Poverty and Inequality Lecture

The following chapter will consider the economics behind poverty and income inequality. In this chapter, you will learn about:

- Drawing the Poverty Line

- The Poverty Trap

- The Safety Net

- Income Inequality: Measurement and Causes

- Government Policies to Reduce Income Inequality

- Sustainable Growth

- Sustainability and Environment

Before we begin the chapter, it is vital that we mention the difference between poverty and inequality. To provide a definition, poverty could be described as a state of being poor; having an insufficient amount of a good etc., in this case being income. Inequality relates to a difference in circumstances, so again being income. Inequality is the difference between the incomes of the richest, compared with the poorest. However, inequality in itself does not suggest poverty, it just suggests that equality doesn’t exist to a specific degree.

1.0 Inequality

When it comes to social issues in economics, poverty and inequality remain a ‘topical’ issue, both in the developing and the developed world. When it comes to economic inequality, the main metric would be the disparity of wealth among the economy, looking at those with the lowest percentile of wealth compared with those with the highest. A widely-used metric in equality is known as the Gini Coefficient, which is a measure of the statistical dispersion intended to show the distribution of wealth between a country’s residents.

Discussing the causes of inequality, there are many factors which could be considered. Firstly, there is the factor of employment, and wage rate. For instance, a worker in the financial services may command a much higher wage rate than those in the service sector; be it shops, restaurants etc. Economically, this does make sense as the idea would be those working in the financial services will be more productive for the business, generating a greater income level which could then support a higher wage rate. However, there is also this consideration of the supply/ demand of labour, which in turn would also link into globalisation. See the discussion below:

Example

Consider two jobs roles in the UK, one a low-cost manufacturing role, and the second a skilled financial role in the City of London. As globalisation opens up new emerging economies into the global market, there are now more opportunities for businesses to trade internationally, but also to expand their production internationally. So, with emerging economies now opening up, the supply of low-skilled labour is increasing, which in turn pressurises wages. Moving back to the manufacturing roles in the UK, the business may be reluctant to increase them too much in the future. If they do increase, then it may be more cost effective to move production to a lower-cost country; i.e. China. On the other hand, the expansion of skilled labour may be less pronounced, which means that wages for financial roles may continue to increase.

In this example, we are seeing an expanding pay gap between those in low-skilled jobs, and those in highly-skilled jobs, creating this inequality.

Another driver of inequality in recent years has been increases in the value of assets, mainly in housing which has increased the wealth of those lucky enough to own them. So, there is now a situation whereby a small % of the population of a country owes more than their fair share of assets. Consider those who own business, or who own multiple properties which they rent out.

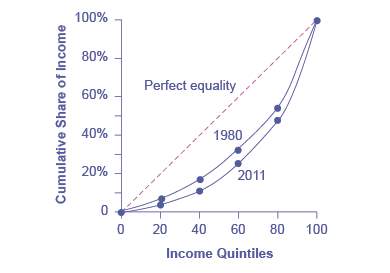

When it comes to showcasing income equality, you could draw a bar graph that showed the share of income going to each fifth of the income distribution. However, another method is the Lorenz Curve. Lorenz curve shows the cumulative share of population on the horizontal axis and the cumulative percentage of total income received on the vertical axis (see below).

Figure 1 - Lorenz Curve.

So, in the graph above, the scale of inequality is denoted by the sloping of the curve. For instance, considering the graph above it could be said that the lowest 20% of the population in 2011 only had a 5% share of total income. If the country was equal, then the lowest 20% would receive 20% of the income.

Need Help With Your Economics Essay?

If you need assistance with writing a economics essay, our professional essay writing service can provide valuable assistance.

See how our Essay Writing Service can help today!

1.1 Poverty

The idea of poverty could be quite subjective depending on the person asked; with the official definitions seeing poverty as the state of being extremely poor. According to the World Bank, the most obvious way to consider poverty is through income, with the World Bank at the time considering the $1.90 per day barrier as a definition of poverty; revised from $1 per day in 1990. However, this level will differ by country dependant on the cost of living associated with that country and the rate of inflation. For instance, some developing countries may experience high levels of inflation supported by increasing GDP growth. If wages are unable to upkeep with these price increases in the economy, then the living standards of workers may decrease, even with the economy growing.

With this, we can mention two types of poverty, namely relative and absolute. Relative poverty can be seen when the average income is below a certain amount; so, for instance we can say that anyone in the UK who earns 50% less than the average income in the UK is deemed in relative poverty. With this in mind, it could be mentioned that an increase in economic growth works both ways. On one hand, it could decrease relative poverty by providing the conditions for greater employment and higher wages. However, it could also increase relative poverty if growth is unequal causing average wages to rise faster than those on the lowest 10%. Absolute poverty is what has been mentioned above with the World Bank; when the income is below a level which would be deemed necessary to maintain a basic standard of living. So, when we talk about absolute poverty, we talk about people who cannot afford to eat, shelter or heat. Therefore, economic growth should decrease absolute poverty by providing more people with the income needed to have this basic standard of living. In China, increased urbanisation has brought millions of people out of absolute poverty, moving them into the city where they could find employment and increase their incomes. However, it must be remembered that while the person may exit absolute poverty, they may remain in relative poverty.

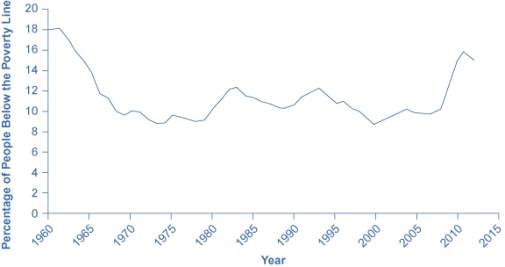

With the above in mind, we can consider how to draw a poverty line. The poverty line can denote the number of people who fall below a designated poverty line, and so with this will change country-to-country, and through time. For instance, the poverty line shown below is from the U.S., showing how poverty has changed over time for the whole population:

Figure 2 - Example of the poverty line - U.S. Census Report (2016) - however it is worth noting on this that per U.S. statistics, poverty for a family with 2 adults, and 2 children is defined when the combined income is below $24,339.

An interesting article can be considered from Totaro & Salzano (2017), published in Bloomberg. The article discussed the rise of poverty in Italy, noting how the number of Italians living below ‘Absolute Poverty’ had almost tripled as the country moved through a double dip recession. The article cited that those described as absolute poor, unable to purchase a basket of necessary goods/ services rose to 4.7Million, which represented 7.9% of the total population. The graphic below shows the rise in poverty in Italy, a country which is also a member of the G-20:

Figure 3 - Growing issue of poverty in Italy - Obtained from Totaro & Salzano (2017: 1)

The interesting point here is that poverty is not constrained to the developing world; there can be poverty in some of the world’s richest countries.

To overcome this, development must be sustainable (discussed more below), being that the development allows for the long-term development of the economy and workers income, allowing them to come out of poverty, and remain out of poverty. With this, the country needs to (1) ensure that growth is focused into long-term industries, and (2) the focus is placed on increasing productivity. For instance, if the country focuses development too much into one sector then there could be issues with economic shocks. For instance, when considering Africa, some have commented how countries have become too dependent on commodity demand, particularly from China, putting them under economic risks. Some African nations, such as Guinea have already come under pressure as the commodity ‘boom’ has ended, leading to mining projects being cancelled/ closed.

Secondly, there is the consideration that productivity needs to increase to ensure that wages can continue to increase. Essentially, increased productivity would see the worker earn more for the business, in turn allowing the business to pay them more. It can be mentioned that in some countries, recent productivity gains have been constrained, in turn impacting on recent wage rises. There are many reasons which could be discussed here, however some of the main reasons behind stagnant productivity may be training, education, participation rates in the labour force, and discrimination etc. In the developed world it could be mentioned that some countries have been impacted by the transformation of their economies, especially as the manufacturing sector is reduced, leading to unemployment. The main issue here is around training, and ensuring those who have lost their job in manufacturing are able to re-train for burgeoning industries, be it technology, engineering etc.

With this, we can now ask the question into whether economic growth does reduce poverty and income inequality, which in turn may lead to greater relative poverty:

Economic Growth may reduce poverty and income inequality if:

- In terms of absolute poverty, economic growth can have positive impacts if it provides accessible employment opportunities. As mentioned in the case of China, the initial development of the economy was supported by growing in the manufacturing sector. However, the growth was also supported by increased urbanisation which allowed more people to move from the countryside to the burgeoning cities, giving them access to higher incomes.

- The wages of the lowest paid rise faster than those of the highest paid.

- Increased minimum wage.

- Government support in the form of unemployment benefits, sickness pay and pensions. These social security payments are designed to support the income of the poorest.

- Economic growth creates the right job opportunities for the lowest paid workers. Initially, it could be considered that many developing economies need the development of low-skilled jobs to fit with the current training/ education levels in the economy. It may be noted that while some countries have boomed on the back of natural resources; i.e. Nigeria; the benefit to the overall economy may be low given that the jobs of offer from the sector are highly-skilled, potentially requiring expats with specific knowledge that the local communities do not have.

Economic Growth may not reduce poverty and income inequality if:

- The best opportunities are created for those who are highly-skilled and educated, meaning that the poorest do not benefit. Increased inequality could come from the fact that many advanced economies have seen wage growth rise faster for those highly skilled jobs as opposed to the low skilled roles.

- There is an increased number of part-time/ flexible roles in the economy. This could be noted in the case of modern economies such as the UK where the rise of the GIG economy has created a boom in flexible roles; with the main issue being that these job roles do not provide the security needed for workers to be guaranteed a set wage.

- ‘Welfare State’ benefits may be indexed linked; so, in the UK payments such as unemployment benefits are index-linked to inflation. If the growth in wages is higher than this index, then inequality will continue to grow.

Economic Growth will not necessarily solve unemployment. For example, growth cannot solve structural and frictional unemployment; this is unemployment caused by lack of skills and geographical immobility’s.

1.1.1 Poverty Trap

Here it is important that we consider the idea of the poverty trap. A poverty trap occurs when poverty persists from generation to generation; ultimately the trap reinforces itself if steps are not taken to break it. Examples of this can be seen in many Sub-Saharan Economies where the level of poverty in rural villages continues to persist given little policy/ support from the government to increase education/ or attract employment and/or investment. A ‘poverty trap’ is thus created when an economic system requires a significant amount of various forms of capital to earn enough to escape poverty. When individuals lack this capital, they may also find it difficult to acquire it, creating a self-reinforcing cycle of poverty.

1.1.2 Safety Net

To overcome poverty, many countries have put in place policies designed to be a safety net, which in the UK we know as the ‘Welfare State’. For instance, the UK offers unemployment benefits to those out of work, a pension for the older generation, and disability/ sickness payments for those who cannot work. Along with these payments, the UK government, as well as other governments offer programs designed to provide income to support children (Child Tax Credit) as well as policies to ensure those who are on a low income can get housing support etc.

1.2 Sustainable Growth

As touched upon, a vital component of poverty reduction plans is sustainable economic growth, providing the country with more jobs, and higher incomes for workers. This has been the case in China, where the expansion of businesses supported urbanisation, moving millions of workers from the countryside into the burgeoning cities. Similar can also be seen in India, and many other cities in Asia/ Africa.

However, the focus is on sustainable development, providing workers with long-term increases in income coupled with job security. In some cases, cracks may appear in the model. Take China; while the country has benefitted enormously through its export-orientated growth model, however recently the government has come under pressure to focus more on the domestic economy, transitioning the economy away from export demand into demand from home. At the same time, the government is also seeking to increase productivity, and introduction more high-value production, which in turn should increase wage growth in the economy.

This then links in with productivity. The Solow Growth Model was put forward to consider sustainable growth, noting that long-term economic growth can only be supported by either (1) an expansion of the labour force, and/or (2) increased productivity from workers. As mentioned above, China was able to lift millions of its citizens out of poverty by moving them into the urban areas, giving them access to employment opportunities in manufacturing. However, as the urbanisation rate slows, China must now focus its attention on increasing productivity to ensure long-term economic growth. This can be achieved through several avenues; be it increasing education, training or the development of high-value industries. However, even with this, relative poverty in the economy may increase.

This is because we have barriers to consider which may restrict all workers benefitting from increase training/ education. Above we mentioned that productivity is linked with wage growth. The expectation here is that if a worker becomes more productive, then they earn more for the business, which in turn will allow the business to pay the worker more. Also, if the worker is more productive then their importance to the business is higher, and so the business may need to increase the wage rate to remain competitive and ensure the worker does not leave. However, the ability to increase productivity will be dependent on the industry in which the worker is in. For instance, greater automation and capital investment into the manufacturing sector has increased productivity, however this has come with the need for fewer workers, creating unemployment. Furthermore, it could also be noted that many of these workers may have moved into the service sector has it becomes the dominant sector in many advanced economies. However, the potential for productivity gains in this sector may be limited; greater automation could again come at the expense of workers; i.e. self-service checkouts at retail stores.

1.3 Sustainability and Environment

When sustainable development is considered, discussion must also be paid towards externalities and potential issues with the environment. The link here with inequality/ poverty is that the development is that the actions of one actor in the economy can damage/ deplete/ spoil it for all other parties. To visualise this, consider the development of the Nigerian oil sector in the Niger Delta. The development of pipelines, rigs in the Niger Delta has provided great wealth to the businesses which have invested, as well as the government, however it could be considered that the development has severely damaged the eco-system of the Niger Delta (see below). The image below is just one which can be used to show the effects of the investment onto the local community, showing how an oil spill damaged the local environment:

Figure 4 - Showing the environmental damaged caused by the oil industry in the Niger Delta.

The main issue here is that this environmental damage has impacted on the livelihood of local communities, especially those that are involved within farming, fishing industries. The environmental damage has destroyed the ability of some to farm/ fish in the local area and so in turn has created poverty. This is known as the ‘Tragedy of the Commons’, an economic theory which considers how one actor in the economy acting on their own self-interests can deplete/ spoil the resource for all other actors. The idea behind the theory has initially come from the book published in 1833 by economist William Forster Lloyd, who at the time considered the impact that unregulated grazing was having on the farming community.

This is where the idea of externalities come into question, which is defined as a cost/ or benefit that affects a party who did not choose to incur this. So, looking at the example of Nigeria above, the local communities did not choose to incur the costs associated with pollution from the oil industry. So, this is a negative externality. Other examples could include noise pollution, traffic, poor air quality etc. For instance, it could be mentioned that in China a large proportion of the urban population are suffering from the negative externality of poor air quality caused by development of the manufacturing sector. It would be hoped that sustainable development would be able to overcome this by promoting long-term economic growth.

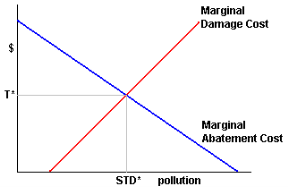

In some cases, the Marginal Abatement Cost (hereafter MAC) needs to be considered. In general, the MAC refers to the cost of reducing one unit of pollution. For instance, the Nigerian government could consider the MAC of reducing the level of pollution in the Niger Delta. An example is shown below:

1.3.1 MAC - Pollution Tax

This example will consider the development of a pollution tax in Nigeria. The graph below shows how we can graphically show the benefit of a pollution tax. Assume that currently businesses, without regulation and emitting pollution beyond the point where MAC=0. If the government then decided to impose a tax on pollution to overcome the damage caused by pollution, and so the Marginal Damage Cost, then the equilibrium would be reached at point T-STD.

Figure 5 - Visualisation of MAC - Pollution Tax

Ultimately, these taxes would rise the cost of polluting for businesses, which in turn would lead them to emit less in a bid to reduce their costs and remain competitive. This has already been noted in many advanced economies with their ‘carbon prices’; whereby businesses have to pay for a permit to emit CO2. Several benefits could be mentioned here, including:

- Taxes generate revenue which could be used to overcome the negative impacts of the pollution.

- The fairness of a uniform pollution tax is evident as each business is levied with the same cost per unit of pollution.

- Taxes give businesses incentives to operate, and maintain their pollution controls.

- Taxes will stimulate R&D in reducing pollution further.

However, there are several negatives to be mentioned. To start, there is the issue that taxes are generally unpopular, difficult to establish and potentially costly to oversee and collect. Furthermore, there is also the consideration over how the tax will evolve; for instance, will the threshold for the tax be lowered as businesses reduce their pollution levels. Finally, as new firms add more emissions to the pollution aggregate, the tax rate may need to be raised to maintain stable aggregate pollution levels.

1.4 Coase Theorem

The Coase Theorem works on the assumption that under perfectly competitive markets with zero transaction costs, an efficient set of inputs/ outputs are selected regardless of how property rights are divided. When property rights are involved in the process, then the theorem suggests that parties will move towards a mutually beneficial and efficient outcome. The basis of this theory came from Ronald Coarse, who built up the theory when mentioning radio frequencies. He argued that regulating frequencies would not be needed because the stations which had the most to benefit from broadcasting on a certain frequency would have the incentive to pay other broadcasters not to interfere; creating a situation whereby all parties involved would benefit.

So, in this case, one party may offer funds to another party to compensate for activities. However, in some cases this may not hold and could depend on the local rules/ regulations. For instance, in some markets likes the UK, the legal system may be focused on the ensuring all parties agree; with barriers such as planning permission ensuring that all parties can resolve difference before a specific project is started. In the end this could involve the payment of compensation; for instance, a business paying the local community/ local residents compensation to approve the construction of a local manufacturing plant. While the plant may come with a number of benefits already, including providing local employment opportunities; there are also negative externalities to consider. For instance, the plant could create noise, traffic issues, pollution, all seen as negative externalities to the local community which may support the need for compensation.

However, in some countries the regulation may be lax, providing loopholes for businesses to develop without compensating other parties involved. For instance, consider the industrialisation of China and the issues that many urban residents now suffer from poor air quality, polluted rivers and potentially contaminated food. However, while these residents will suffer from the long-term urbanisation of China in the way it was done, there are those who have benefitted, and dramatically increased their living standards from the increase in business. The have benefitted from the expansion of their business, being offered higher wages etc., however at the same time have not compensated those who have been affected, in turn creating income equality.

1.5 Labour Market Interventions

As touched upon in the last section, there are some ways in which parties can intervene within the labour market to overcome inequality/ poverty. As mentioned in the example above, the government can put in place regulation which ensures that all parties are involved within the decision making process, i.e. planning permission, which in turn may allow for compensation to be discussed and distributed. However, the government is also able to intervene much more directly into the market and impact on inequality directly with wages. This can be seen in the UK for example, where the introduction of the National Living Wage was designed to increase the income of the lowest paid workers in the UK. Recent increases in the rate have been above inflation, allowing the lowest paid to take home a greater increase in pay, potentially reducing the pay gap with higher paid roles. Furthermore, there has also been talk in the UK of a potential pay-cap on management pay, particularly CEO pay; although such regulation would be hard to enforce as it is essentially direct involvement into private businesses. Although, there are still methods which the government can adopt. For instance, while the government may not put a specific limit on; so ‘CEO pay must not exceed 10x the lowest paid worker’, they can demand that businesses report their statistics to the public. This then puts pressure on the businesses from other stakeholders, including their workers, customers, suppliers etc.

For instance, one way in which the government has intervened in this way in the past has been with new regulation designed to increase transparency and reporting within the business world. For instance, the FTSE has recently started requiring listed businesses to report on their CO2 emissions; while they cannot directly intervene in the private businesses, making them publically report the information may put pressure on them from other stakeholders in the business, be it shareholders, employees, and customers etc. Similarly, the UK has plans to introduce reporting into CEO pay, whereby the business would have to report on the multiple between the lowest paid worker and the highest, ultimately showing the inequality within the business. While there are no set targets to meet, it would be hoped that by putting this information in the public domain for all to see, then pressure may build for the businesses themselves to make changes.

Another way in which the government could intervene would be to try and overcome barriers/ inefficiencies in the labour market which may be driving this income inequality/ poverty. For instance, the government may look to increase the training/ education available to unemployment workers in a bid to retrain them for the jobs which are available.

1.6 Migration

When it comes to reducing global inequality and poverty, one solution could come through migration. A good example of migration could be seen in the EU, whereby the newest member states have in some cases been able to migrate their unemployment problems away. For instance, when Poland joined the EU in 2004, a large number of workers emigrated into other EU members such as the UK. Workers left Poland in search of higher wages offered in the UK, allowing them in many cases to increase their living standards. Similar occurrences could also be noted between the U.S. - Mexico, with the general idea being that workers in poorer countries may search for employment in advanced economies to increase their living standards. However, in the EU we also see migration driven by skills, with the free movement of labour allowing for doctors in France to seek employment in the UK, and bankers from Spain to head to Germany etc.

The benefit behind this migration is that businesses can benefit from the larger pool of labour, in turn increasing their competitiveness. There is the concept that having better access to labour could increase productivity, which may come from the creation of a business cluster. To provide a definition, a business cluster can be defined as:

‘A business cluster is a geographical concentration of interconnected businesses, be it producers, suppliers and institutions’

The main idea being that a business cluster can increase productivity. A great example to note here will the financial sector in London. Banks have clustered into London to take advantage of the access to labour, infrastructure and environment created by there being such a concentration of businesses. At the same time, London is also home to institutions such as the Financial Services Authority, as well as suppliers such as those businesses involved in Fintech. Migration does play a part in this development, as the banks which are developing their business in London, be it European/ U.S./ Asian banks have access to global talent.

Although, migration can also cause issues. For instance, the recent Brexit vote in the UK highlighted the growing problems with high levels of migration into the UK economy. While it has benefitted industries such as finance by bringing in skilled labour, there was concern that the situation in the EU was causing an influx of low-skilled labour into the UK, who in turn where increasing the supply of labour and keeping wages low. For UK, workers this could have caused a stagnation in wage growth at a time when inflation was increasing, ultimately causing their living standards to fall. It must be mentioned though that in some part the government has intervene with the introduction of the National Living Wage, seeking to increase the wage rate for the poorest workers. However, even with this it appears that the increased competition for jobs caused by high levels of migration from Eastern European countries has caused anger in the UK, which in turn may also be directed at the inequality within the economy.

Need Help With Your Economics Essay?

If you need assistance with writing a economics essay, our professional essay writing service can provide valuable assistance.

See how our Essay Writing Service can help today!

1.7 Summary

This section will now summarise the chapter.

- When it comes to poverty we can talk about absolute or relative poverty. As suggested by the name, relative poverty while change depending on the country; and is focused on displaying the level of people which may fall below a specific income level; so, earning 50% than the national average. Absolute poverty is when a person is unable to afford the minimum living standard; be it shelter, heat, food.

- In some countries, a ‘poverty trap’ may develop; when an economic system requires a significant amount of various forms of capital to earn enough to escape poverty

- Economic growth can be successful at reducing absolute poverty; for example, consider the development of the Chinese economy, however questions can be raised over its success of reducing relative poverty, which in turn would be linked with income inequality.

- To reduce relative poverty, the wages of the lowest earnings need to increase faster than the average; reducing this gap.

- The government can intervene in the market to improve this; be it through setting a minimum wage, or increasing its welfare payments; i.e. pensions/ unemployment payments etc. When it comes to government welfare, we can refer to this as a safety net.

- However, when it comes to wage growth, the focus may be on productivity; so, a more productive worker will be able to gain a higher wage. The government can intervene here in regards to education/ training, however increasing productivity will also require other factors such as capital investment and market access.

- Here, the chapter focus on migration and noted how migration benefits access to workers, which raises productivity through the creation of business clusters. We used the example of the EU and noted how London had benefitted from the expansion of its financial services cluster; supported not only by the underlying infrastructure in London, but also the ability of businesses there to attract global talent. However, the downsides of migration have also been noted, with the chapter focusing on low-skilled migration into the UK and how this was a focal point when it came to the recent Brexit result.

- Overcoming income inequality may be harder than poverty given the control that a small proportion of the country has over a larger proportion of assets in that country. The coarse theorem works on the assumption that under perfectly competitive markets with zero transaction costs, and efficient set of inputs/ outputs are selected regardless of how property rights are divided. So, in this case, one party may offer funds to another party to compensate for activities; i.e. pollution.

- However, the above is not always the case which means that one group may suffer given the actions of another. The example considered here was Nigeria where the development of the local oil & gas industry has created pollution issues in the Niger Delta, which in turn has impacted on local communities who rely on traditional industries such as farming/ fishing. Poverty is being created given the environment damage which is being done to create wealth for others.

- Taxes, and other policies could be implemented here - i.e. pollution taxes/ business transparency; however, these may be hard to introduce/ monitor and collect.

1.7.1 Questions

- What is the difference between poverty and income inequality?

- What is the poverty line?

- What goods and services would you include in an estimate of the basic necessities for a family of four? How will this impact on the poverty line?

- In country A, the population is 300 million and 50 million people are living below the poverty line. What is the poverty rate?

- How can the effect of the poverty trap be reduced?

- What are the main reasons economists give for the increase in inequality of incomes?

- Identify some public policies that can reduce the level of economic inequality.

- What is the Marginal Abatement Cost?

- What is the Lorenz Curve?

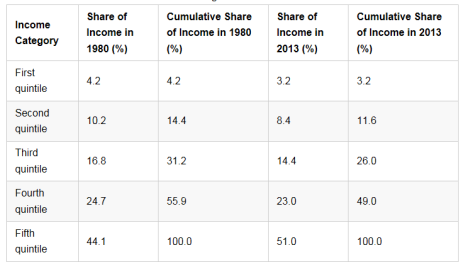

- Using the data presented in the table below, draw a Lorenz Curve doe both 1980 and 2013. What does the curve show above the change in equality between the two dates?

(Please note that the ‘First Quartile’ represents the lowest 20% of the population, ‘Second Quartile’ is 20-40% and so on)

Practical Chapter

When it comes to inequality and poverty, the first task is to define each. To provide a definition, poverty could be described as a state of being poor; having an insufficient amount of a good etc., in this case being income. Inequality relates to a difference in circumstances, so again being income. Inequality is the difference between the incomes of the richest, compared with the poorest. However, inequality in itself does not suggest poverty, it just suggests that equality doesn’t exist to a specific degree.

Focusing on poverty, there are two types to note, namely absolute and relative. Absolute poverty is where the incomes is unable to support the minimum standard of living, be it for shelter, food, heat. As mentioned by the World Bank, living on less than $1.90 per day is considered as a definition of poverty. Relative poverty is poverty which is considered relative to other earnings in that country, and so a level which will change from country-to-country. For instance, one could say that all those whose income is less than 50% of the country’s average live in relative poverty; essentially their living standards will be low when compared with the national average. Economic growth could be the main driver to overcome this. As seen in China, economy growth can be a powerful tool to reduce poverty. China was able to do this through urbanisation, brining millions of workers into the burgeoning cities from the countryside, finding greater employment opportunities and increasing their own incomes, fostering this rise in living standards. However, this does not come without challenges. For instance, the Chinese story has involved huge amounts of capital investment into infrastructure, while the government has also intervened in the market with state-owned businesses. Other countries may not be able to replicate this. However, there is the notion that government intervention could be used to help overcome poverty. For instance, there is the idea of a ‘safety net’ which covers what we see in the UK as the welfare system. For example, the government offer pensions, unemployment/ disability benefits as well as housing support etc., all to protect vulnerable groups in society and stop them from entering poverty.

However, when it comes to relative poverty, which links in with inequality, this can be harder to reduce. The government can intervene; for instance, many governments have brought in a minimum wage to increase the wages of the lowest earners. Other governments have put policies in place to support education/ training which can help increase worker productivity and increase wages. Although, in many economies, a large % of the assets are held by a few individuals; be it businesses/ housing etc. If the economy did well then all would benefit; any reduction in inequality would only be seen if the income of the lowest rose at a faster pace than the wealthiest which may be hard to achieve when it is the lowest earners who may be renting homes off the richest, or buying products from the businesses they own. When it comes to showcasing income equality, you could draw a bar graph that showed the share of income going to each fifth of the income distribution. However, another method is the Lorenz Curve. Lorenz curve shows the cumulative share of population on the horizontal axis and the cumulative percentage of total income received on the vertical axis.

Linking with this is the coarse theorem, which works on the assumption that under perfectly competitive markets with zero transaction costs, and efficient set of inputs/ outputs are selected regardless of how property rights are divided. When property rights are involved in the process, then the theorem suggests that parties will move towards a mutually beneficial and efficient outcome. However, this does not always happen. For instance, consider the idea of a business pollution the local environment in China. The coarse theorem would suggest that the business would then compensate local communities, potentially those who have suffered from the pollution; be it lower crop yields or health issues. However, this may not happen, and so poverty may be created by the actions of one. Some governments have looked to reduce this by intervention. For example, the government could force the business to pay compensation, make them publicly declare their information on pollution, or could simply tax them for a negative externality[1].

References

Totaro, L., and Salzano, G. (2017) [Online]. Italy's Poor Almost Triple in a Decade Amid Economic Slumps, Available at https://www.bloomberg.com/news/articles/2017-07-13/italy-s-poor-almost-tripled-in-a-decade-amid-economic-slumps, Accessed 14.07.2017.

U.S. Census Bureau. (2016) [Online]. Poverty Data, Available at https://www.census.gov/topics/income-poverty/poverty.html, Accessed 09.08.2017.

Recommended Reading List

Atkinson, A. B., & Bourguignon, F. (Eds.). (2014). Handbook of income distribution. Elsevier.

Fosu, A. K. (2010). Inequality, income, and poverty: Comparative global evidence. Social Science Quarterly, 91(5), 1432-1446.

Li, S., Sato, H., & Sicular, T. (Eds.). (2013). Rising inequality in China: Challenges to a harmonious society. Cambridge University Press.

Milanovic, B. (2013). Global income inequality in numbers: In history and now. Global policy, 4(2), 198-208.

Silber, J. (Ed.). (2012). Handbook of income inequality measurement (Vol. 71). Springer Science & Business Media.

[1] A negative externality can be defined as an activity which imposes a negative effect on an unrelated party.

Cite This Module

To export a reference to this article please select a referencing style below: