International Trade Lecture

Learning Outcomes

To be able to:

- Understand the different theories of trade and the causes of trade between countries

- Examine FDI determinants

- Explore the arguments for and against trade

- Understand what a customs union is, preferential trading and the workings of the EU.

1.0 Introduction

International trade functions in much the same way as individual trade, except that the trade normally occurs with firms and, by definition, between different countries. Firms import goods from other countries and sell them for wholesale to retailers or brokers, who in turn sell them to consumers in stores or online. Politicians frequently refer to this trade as if it were national, perhaps even controlled by the government. In fact, governments are not very innovative and infrequently engage in trade. On the contrary, firms undertake international trade, whereas public policy is always the foremost impediment to it.

Trade surpluses or deficits are aggregate measure of individual firms’ exports less imports, either in total or to a specific country. Yet these things arise due to consumer demand. The only thing that politicians or governments have to do with such trade is to distort or limit it, either by tariffs (taxes) or regulation. Government basically cannot expand opportunities for wealth; it can only limit what is found in the marketplace. When politicians speak of creating opportunities, they are merely saying that they will relax some cost or restriction that has already been imposed on firms or consumers.

This chapter is structured as follows. The next section comprises an overview of the arguments for and against trade. There follows an examination of the theories of trade (classical trade theories and firm based theories). Section 4 will look at the theories of foreign direct investment (FDI) in order to understand the determinants of FDI. The penultimate section looks at international trade restrictions and also touching on preferential trading. Finally, we examine the EU.

Need Help With Your Economics Essay?

If you need assistance with writing a economics essay, our professional essay writing service can provide valuable assistance.

See how our Essay Writing Service can help today!

2.0 Arguments for trade and the arguments for restricting trade

Advantages of trade

- The theory of comparative advantage - discussed in the following chapter

- Greater quality in factors prices - For example, the demand for labour will rise in labour-intensive countries like India if they specialize in labour intensive-goods. This will push up wage rates in these low-wage countries, thereby helping close the wage gaps between them and the developed world.

- Increased competition - competition from imports may stimulate greater efficieny at home. It may stimulate greater research and development.

- Decreasing costs - both countries benefit from specializing in industries where economics of scale can be gained.

- Export-led growth - In a growing world economy, the demand for a country’s exports is likely to grow. This stimulates growth in exporting countries.

Exchange is one of the most prominent motifs in economic theory. People trade because they receive what economists call “mutually beneficial gains” from doing so—so long as the transaction is voluntary. That means that each side considers himself richer because of the trade. Both are satisfied.

For example, if Sam has 100 apples but no pears, and Susan has 100 pears but no apples, each can trade 10% of their inventory to the other and as a result have more variety and more opportunities. Those options produce different conditions that make people “feel” (psychologically) wealthier.

All valuations are subjective, since not everyone will be equally satisfied by the same mix of possessions or circumstances that lead to one feeling wealthy. Nevertheless, on a macro level, the more trade that occurs, the wealthier a society becomes, and more merchants and entrepreneurs enter the market with innovative goods and services that make people satisfied, content and with less “uneasiness” (Mises 1966: 13).

Note that wealth is not the same as money, which is a store of value and medium of exchange. Wealth is measured in terms of things that satisfy intensely important human needs: food, safety, shelter, warmth, beauty, sex, romance, friendship, spirituality, peace, happiness, children, family, power, achievement and fulfilment. Wealth is attained through greater opportunities and varieties of goods or services that one has in his life to obtain such ends. Money is, therefore, a means to these ends rather than an end in and of itself, but it is the mechanism, facilitator or means by which trade occurs.

Over time, economists have used different theories to explain international trade, the concept of exchange between entities in different countries. They trade because they expect to benefit from the exchange, and want the goods or services. The theory of international trade is more complicated than individual and often domestic trade because public policy is involved, which leads firms to invoke business strategies to minimize costs or maximize benefits.

Public policy establishing international economic structures varies widely. Some places practice almost complete autarky (e.g., modern North Korea, Spain in the 1940s-1950s, Albania in the 1980s), others complete market openness (e.g., Hong Kong, Chilean major ports 1820-1920). Krasner (1976) argues that the structure of international trade is determined by states acting to maximize their GDPs, social stability and political power.

Most economists have argued that freer trade best promotes state interests, although rent seekers prefer protectionist policies that inhibit true free trade so that they can gain at the expense of others. Nevertheless, since states are comprised of people that act to maximize their aggregate economic utility, global welfare is best achieved by free trade. The following section delineates the development of international trade theory over the last 240 years.

3.0 Theories of trade

Classical Trade Theories

Mercantilism

Dating from the Sixteenth Century, mercantilism states that a country’s wealth is determined by the amount of gold and silver it holds. Therefore, a country should increase its holdings by promoting exports and discouraging imports, thus avoiding trade deficits—a situation where the value of imports is greater than the value of exports. This reasoning is why colonization and control of world trade was so important to European powers like England, Spain, Portugal, France and Holland.

Protectionism is part of mercantilism that still exists today, even though the entire theory has been widely rejected by economists. People and politicians still like the idea of using import tariffs to “protect” domestic industry and jobs, even though consumers and firms are forced to pay more for goods. For this reason, advocates of genuine free-trade argue that it benefits the global community, while protectionist policies benefit only select industries.

Absolute Advantage

Adam Smith, the Scottish father of modern economics, questioned mercantilism in his famous book, An Inquiry into the Nature and Causes of the Wealth of Nations (1776). He instead suggested a new theory: absolute advantage. It highlighted the ability of one country to produce a good more efficiently than another. Moreover, he argued that trade between countries should not be regulated by government intervention, but rather should flow naturally according to market forces.

The basic idea is that if a country can produce a good cheaper and/or faster than another, that country has and absolute advantage and thus can and should specializing in producing that good. Such specialization generates labor efficiencies, too, since workers become more skilled at doing the same tasks in this production. Production itself would experience efficiencies as incentives would automatically arise to foment faster and better production methods. Smith reasoned that increased efficiencies benefit people in all countries by making goods cheaper for all, and thus trade should be encouraged. A country’s wealth must not be judged by how much gold and silver it has, but rather by the standard of living of its inhabitants.

Comparative Advantage

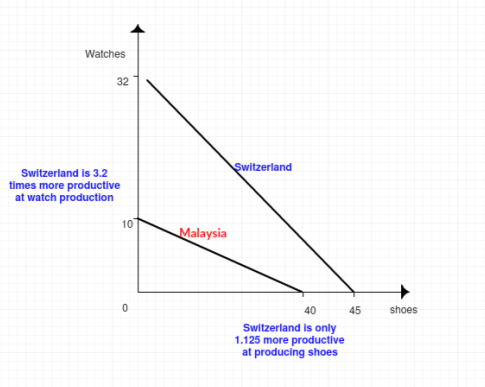

Smith’s theory proved too simplistic and thus gave way to comparative advantage, where some countries may be better than others at producing more than one good and, therefore, have a comparative advantage in many industries. In contrast, some countries may not have any useful absolute advantages. Accordingly, Englishman David Ricardo introduced the theory of comparative advantage in 1817, arguing that trade and specialization between countries could still occur even though one did not have any production advantages over the other, so long as that country can produce a product better and more efficiently than i other goods. Comparative advantage focuses on relative productivity differences, while absolute advantage looks at absolute productivity.

A country (i.e., its firms) will specialize in doing what it does relatively better—the thing that it can make the most profit doing. For example, even if firms in Switzerland can make watches and shoes better than those Malaysia, it makes sense for Switzerland to only make watches—if the profit from doing so is higher than dividing resources and producing both things—and simply buy its shoes from Malaysia.

Heckscher-Ohlin theory of international trade

Elaborating on Ricardo’s theory, two Swedish economists, Eli Heckscher and Bertil Ohlin, showed that countries gain a comparative advantage by producing products that utilize factors that are in abundance within its territory. Their theory stated that countries would produce and export goods that required resources or factors that were in great supply and, therefore, had cheaper production factors. In contrast, countries would import goods that required resources that were in short supply, along with higher demand. For example, it makes sense that countries like Vietnam, Mexico, China and India that have cheap, large labor pools would become optimal locations for labor-intensive industries like shoe, textile and clothing production.

However, this theory has not been completely satisfactory. Russian-born (but American) economist Wassily Leontief studied the 1950s United States economy with relation to international trade and noted that while it was abundant in capital—and should therefore export more capital-intensive goods—the exact opposite was true. His findings were the reverse of what the factor proportions theory would have predicted. In subsequent years, economists found that period of history to be exceptional for the United States, creating the “paradox.” Labor was both readily available and relatively more productive, making exportation of labor-intensive goods sensible.

Others have generated new theories and empirical evidence that minimize the impact of the paradox. Yet, the paradox demonstrates that international trade is complex and is impacted by numerous mutable factors, making it difficult for a single theory to explain everything about it.

Firm-Based Trade Theories

Post-World War II International trade theories have been developed by business school professors as well as economists. These firm-based theories evolved with the emergence and growth of the multinational companies, whose expansion could not be adequately explained by earlier theories. The newer theories incorporate other product and service factors: brand loyalty, customer loyalty, technology, quality and other items subject to consumer whims or preferences into the theory of international trade.

Country Similarity Theory

In 1961, another Swedish economist, Steffan Linder, hypothesized that intra-industry trade resulted because consumers in countries with a similar stage of development would, perhaps, have similar preferences. Accordingly, companies produce for domestic consumption first, then look for markets that look similar to their domestic one, in terms of customer preferences, to begin export operations. Most successful trade in manufactured goods occurs between countries with similar per capita incomes, and is especially useful in understanding trade in goods where brand names and product reputations are important factors for consumers.

Product Life Cycle Theory

American Raymond Vernon, 1960s professor at the Harvard Business School, developed the product life cycle theory, which originated from the field of marketing. The life cycle has three distinct stages: (1) new product, (2) maturing product, and (3) standardized product. Since the theory assumed that production of the line occurred wholly in the country of innovation, it was a useful theory to explain the manufacturing success of the United States—globally dominant after World War II—and later on with the development of personal computer and cell phone technologies.

Nevertheless, the theory has been less successful in explaining more recent trade patterns that feature global innovation and manufacturing. For example, nowadays it makes sense to do research and development (stage 1) in India or China, where highly skilled labor and facilities are usually cheaper. The theory holds that the home country would host stage 1 production.

Global Strategic Rivalry Theory

Strategic rivalry theory was presented in the 1980s by American economists Paul Krugman and Kelvin Lancaster. The focus was on how multinational firms sought to gain a competitive advantage in the global marketplace. When firms encounter global competition, they must quickly develop competitive advantages. The best way to obtain a sustainable competitive advantage is to establish barriers to entry into the industry, obstacles new entrants face, such as research and development, intellectual property rights ownership, economies of scale, unique business processes or methods, extensive industrial experience, and control access to necessary natural resources.

National Competitive Advantage Theory

American professor Michael Porter from Harvard Business School developed the national competitive advantage model in 1990. His theory states competitiveness in an industry depends on its ability to innovate and upgrade, focusing on why some countries are more competitive in certain industries than others. He identified four linked determinants: (1) local market resources and capabilities, (2) local market demand conditions, (3) local suppliers and complementary industries and (4) local firm characteristics.

Porter saw value in the factor proportions theory, which considers a country’s natural resources and skilled labor pool as key factors in determining what products a country will import or export, along investments in education, technology and infrastructure. These factors combined provide a country with a sustainable competitive advantage.

Porter suggested that a sophisticated domestic market is essential for ongoing innovation, and thus creates a sustainable competitive advantage. Domestic markets that are sophisticated, trendsetting, and demanding impel continuous technological innovation and new product development.

Large global firms benefit from the presence of efficient ancillary industries to provide necessary inputs to remain competitive. Not surprisingly, certain industries tend to cluster geographically, providing efficiencies and greater productivity.

Strategy, industry structure and industry rivalry are essential local firm characteristics that affect a firm’s competitiveness, and rivalry between local firms spurs innovation and competitiveness. Porter also viewed public policy and chance playing a part in the national competitiveness. Public policies can increase the competitiveness of firms and, on occasion, entire industries.

Need Help With Your Economics Essay?

If you need assistance with writing a economics essay, our professional essay writing service can provide valuable assistance.

See how our Essay Writing Service can help today!

4.0 Foreign Direct Investment Theories

Definition

FDI is when a firm from one country sets up an operation in another country. It usually involves the transfer of ownership, technology, and movement of labour.

Early Theories

Companies invest in foreign countries as part of their pursuit to maximise profits. Traditionally, theories have emphasized infrastructure, labor costs and property rights as the key determinants of foreign direct investment (Biswas 2002). The earliest models suggested that available interest rates on capital were the prime determining factors, where firms invested in foreign countries simply to obtain higher returns than were possible at home. Later, larger macroeconomic factors (e.g., exchange rates) affecting the strategies of transnational corporations were brought into view. These early theories were based on models of perfect competition.

Addition of Other Factors

A gravity model is used to explain bilateral flows of foreign direct investment and trade between two countries mainly based on the comparison of distance and GDP (Fillippini and Molini, 2003).

In general, theorists have identified a number of “gravity” or “horizontal” reasons for foreign direct investment that seem to fit well with the observed data in many econometric studies: cultural similarity, common language, geographical proximity, relative size of the parent company versus the target country, relative GDP per capita in each country, corruption level, strength of legal institutions, population density, and certain “economic frictions” like the existence of tax treaties and investment treaties, the inflation rate, and availability of domestic credit, were found to be statistically significant factors (Blonigen & Piger 2014).

Domestic firms have a comparative advantage in language, knowing local preferences and culture, understanding the legal system and exchange rate risk. Thus, foreign firms must have very large profit potential or market power to offset these disadvantages (Hymer 1976). Otherwise they will not invest. This model is based on the assumption that markets are imperfect, and follows the field of industrial organisation, coupled with the strategic use of patents, superior management teams and better technology.

Internalization Theory

Furthermore, some market imperfections result in “internalization,” where subsidiary outputs are used as inputs in another arm of the multinational corporation, or where technologies are shared (Buckley & Casson 1976). Accordingly, where ownership of assets in a foreign country is desirable along with its location advantages (e.g., less uncertainty, better company control, and superior ability to negotiate locally without divulging too much information), and internalization is possible, then firms will engage in foreign direct investment and produce abroad (Dunning 1993). Otherwise, without internalization, the firm will be better off just licensing its ownership advantage to foreign firms.

The “vertical” reason for foreign direct investment is lower labor costs for unskilled workers to handle labor-intensive production (Blonigen & Piger 2014), which is a key incentive for any foreign direct investment. This reason remains one of the most important attractions to firms looking to cut production costs and maximize profits.

The OLI/Eclectic Paradigm

Dunning (2000) contended that the existing hypotheses of international production were not satisfactory. The OLI framework can be used to anticipate the production undertaken by MNE's and financed by FDI. As stated by the paradigm, a firm engages in FDI if the following conditions are satisfied:

1) It possesses net Ownership - these are favourable circumstances that emerge from the FDI seeking firms which may arise from entrepreneurship skills, privilege ownership (trademark) of a product, production technique and high returns to scale.

2) The Location advantages - this is the degree to which MNEs choose to locate these value-adding activities outside their own country. These advantages include trade agreements (special tariffs or taxes), low wages and the presence of raw materials.

3) Internationalisation preferences - If it is beneficial to internalise as opposed to utilizing the market to transfer those advantages through a partnership, then a firm will engage in foreign production itself.

Synopsis

The aforementioned theories have helped academics, businessmen and policy makers better understand international trade and to make decisions regarding managing and regulating it, finding better ways to maximize profits and state power. The truth is that countries have very few absolute advantages in production or services. Furthermore, production factors are not clearly distributed between countries, even though some have a disproportionate quantity of certain factors or access to capital. Other theories have better explanatory power than Smith’s, but still lack plenary power.

Consequently, no one theory is general or even dominant in helping understand international trade or foreign direct investment, even though each one sheds significant insight. Governments and firms utilize these theories to interpret trends and develop strategy. In the meantime, academics continue to observe, study and hypothesize about world trade phenomena, in order to improve current theories or find better ones.

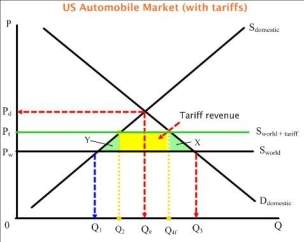

5.0 International Trade restrictions

Artificial but Legal

Trade restrictions are legal, artificial means of inhibiting trade between countries that are enacted by public policy. They are always related to protectionism and are often a result of rent seeking (or other opportunistic behaviour) by firms or industries seeking to quell competition. Examples of such restrictions are putting a 100% tariff on sugar, orange and ice cream imports to protect domestic producers from competition, prohibiting importation of military hardware in order to protect national security (Bovard 1991), and prohibiting used vehicle imports to protect bus companies, new car dealers and spare parts firms.

Of course, public policy is never stated in terms of benefitting private interests, but rather the elusive “public interest” (Simmons 2011). For instance, justifiable rationale includes making citizens secure of having their own food supply in time of war, making sure that no foreign power knows about the design of military hardware or has an opportunity to tamper with it, and eliminating unsightly vehicles that might cause more pollution, congestion and other negative externalities in urban areas.

Astute businessmen who learn to play the game of international business well know that assembling effective lobbyists and special interest groups can be far more profitable—if they can convincingly suggest and secure “public interest” legislation that in reality directly or indirectly benefits specific firms or industries. Competition is fierce and product promotion, publicity and advertising are costly. Therefore, paying salaries and expenses of a team that can legally limit foreign competition or force consumers to buy certain products (e.g., air bags in cars) makes sense for profit-maximizing firms (Cobin 2009: 29-36, 52-82, 163-179).

Arguments favouring trade restrictions:

- Infant industry argument - An infant industry is an industry in its early stages and without protection, it will not survive competition from abroad.

- To prevent dumping and other and unfair trade practices.

- To prevent establishment of a foreign based monopoly.

As a result, trade restrictions reduce general consumer satisfaction and wealth by reducing the variety of available goods and/or pushing up their prices, leaving consumers with less disposable income and, thus, fewer opportunities to purchase other goods. Particular consumers—the relatively few workers and stakeholders in protected industries—experience the opposite effect. They benefit from maintaining higher wages and profits that increase their ability to consume, at the expense of consumers generally.

Free Trade Agreements

In order to combat this social loss, free trade agreements are commonly touted throughout the world. However, such agreements are usually managed trade rather than free trade. Genuine free trade agreements would be quite short; a page with the following statement would do: “All import tariffs between our countries are hereby abolished.” Instead, such agreements usually entail dozens, if not many hundreds of pages of restrictions, conditions and regulations related to specific trade and other unrelated public policy goals. Thus, they are not genuine free trade agreements. Moreover, many free trade organisations like GATT and WTO are inconsistent in offering genuine free trade to developing countries, loading agreements with unpalatable ancillary requirements in order to attain greater trade (Sen 2005: 1026-1027).

There are other political pacts such as the European Union, NAFTA in North America and Mercosur in much of South America that attempt to make free trade possible within certain geographical zones. Nevertheless, the entire zone still has protectionist and other regulated trade policies with countries outside the zone—often including very high tariffs. These blocs sometimes will assail countries that have economic, military or social practices repugnant to the zone’s countries by curtailing trade with the offending country. Thus, regional agreements (political projects) that harm consumer welfare are at times utilized to implement unrelated political agendas.

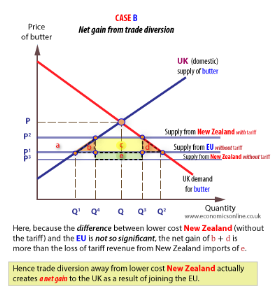

6.0 Preferential Trading

The European Union is the world’s best-known example of a commons market and customs union. Mercosur in South America is another example. Such groups are formed by countries with geographical proximity. The objective is to promote duty free (or close to duty free) trade, free movement of labor, free movement of capital, and eliminate trade barriers to new entrants among and between member countries. The group also imposes a common external tariff on imports from non-member countries.

Preferential international trade pacts provide advantages to firms located within its member states. Typically, tariffs on certain goods are reduced but not always eradicated. The goal is to achieve a higher level of economic integration. Importantly, these programmes are designed to consolidate state power, rather than improve consumer welfare, as a primary objective.

Consumers are always better off with greater opportunities and choices, regardless of whether goods are produced in the territory where they live or abroad. The consumer wants to remove as much “uneasiness” (Mises 1966) as possible, given his household budget constraint. Oftentimes, that situation means that consumers must make trade-offs between opportunities that lead them to maintain unsatisfied needs or wants.

Therefore, by increasing the price of a good through a tariff, consumers have less money to spend on other utility-enhancing items. Overall, preferential trading is a means by which the state gives back a portion of what is being taken from consumers by tariffs, and thus increases their utility, but not as much as genuine free trade. General consumer satisfaction is simply not maximized.

In the case of a common market and customs unions, consumers are better off than they would be living under protectionism in their own country alone because there is still some genuine free trade between certain countries. Obviously, the larger the union, the better-off consumers will be. However, there will always be some loss to consumer welfare since not all desired products will be available in (or produced by) member countries, meaning that consumers will have to pay far more for many sought after important goods.

That is one reason why people in Uruguay and Argentina (Mercosur members) pay two or three times as much for new automobiles than consumers do in nearby Chile. Chile is an associate member of Mercosur, too, but does not participate in the tariff policy. Since ousting communism several decades ago, Chile adopted low tariffs across the board for new goods imported (currently 6%), and also has entered into genuine free trade agreements with other countries, which already provide superior benefits than what Mercosur could do for Chileans.

7.0 The European Union

The Political and Economic Project and its Troubles

The European Union, based in Brussels, has its own unelected parliament that legislates for its twenty-eight member countries, along with its own civil and criminal justice system. The European Union is principally a political and economic integration programme.

Economists have argued that the benefits from currency and customs unions greatly exceed the costs (Breedon & Petursson 2006). Yet they are still popular in the world. Objecting to programmes being foisted upon people by public policy rather than spontaneously emerging in the market process, academics have long questioned whether the European Union can survive (Harris 2001).

As noted earlier, mutually-beneficial gains from trade are only assured when such trade is voluntary, a feature oftentimes absent in top-down, imposed European Union regulation and trade policy designed by bureaucrats rather than elected representatives. Indeed, researchers have found that its nearly-autocratic external trade policy is heavily bureaucratic, complex and almost entirely insulated from public opinion (Reichert & Jungblut 2007).

Since its inception in 1957 (Treaty of Rome), and formal beginnings in 1993 (Maastricht Treaty), the European Union has been a growing political project designed to make the relatively smaller nations of Europe more competitive with larger competitors like the United States and China. The newest addition is Croatia (2013). In many respects, the European Union rapidly and radically changed the institutional arrangements that provided the “rules of the game” (North 1992) for European countries for centuries. Such shocks are usually costly and often laden with difficulties.

One objective has been to create an internal single market, with open borders and free movement of people. This last point was particularly troubling to voters in Great Britain, which elected to leave the European Union by referendum held on 23 June 2016. Moreover, economists have found that intra-national trade is still ten times higher (on average) than international trade—even within the European Union (Nitsch 2000). Thus, the internal single market has certainly experienced incomplete success.

Fiscal, Monetary and Trade Difficulties

The United Kingdom never entered into the currency union by adopting the Euro and, ever since its inception, scholars in other member countries (such as the Netherlands) have been concerned about fiscal negative shock spillovers into their countries—especially output-retarding rising interest rates in larger member countries like Germany or France (Beetsma, Giuliodori & Klaassen 2006). In addition, European Union tax policy has been so uncoordinated with member state policies that it has led to “distortions” in labor markets in those states, to the extent that they may effectively offset the benefits countries receive by reductions in international tax competition (Cnossen 2003).

The European Union’s recent adoption of radical environmental standards has also proven to be disruptive to international trade, especially for now non-compliant countries exporting to the European Union (Burnete & Choompta 2015). Green policy is thus dousing the benefits from international trade. Moreover, the negative impact might expand. Others scholars from the Left are worried that European Union external trade policies are not doing enough to attain gender-sensitive criteria that enhance gender equality with external trading partners (True 2009). Accommodating such social policy would in turn further debilitate international trade. Foisting such policy on trading partners has previously generated outcries from developing countries, too. For instance, Mexican scholars lamented the protectionism of the European Union during the 1990s, which favoured exports to Latin America while favoring imports mainly from (pre-membership) Eastern Europe at the expense of Latin America (Rozo 2001).

European Economic and Monetary Union (EMU)

Another important aspect of the European Union are its policies of economic integration through its common currency, the Euro. Countries that want to participate have to pass a stringent two-year test period where they demonstrate responsible monetary policy action. Not all member countries participate in the monetary union, e.g. Denmark, Sweden and the (soon-to-depart) United Kingdom, but the group that do form a part of the European Union called the Eurozone. This union, too, has been fraught with opportunistic behaviour on a national level, drawing significant criticism from some corners, which often call out Mediterranean countries for being fiscally irresponsible.

In many respects, financing for the Eurozone rests upon the policies and fiscal promises of Germany, and to a lesser extent, France—being the largest and most productive Eurozone states. However, there has been much controversy in those countries, Germany in particular, over the frequent bailouts of less-fiscally-responsible Eurozone members, e.g., Greece, Portugal and Spain. In fact, all of the Mediterranean countries have posed significant strain on the union, leading some to wonder if the Euro can survive at all, or if it would simply be better to have the Euro in Northern Europe and leave the southern countries to manage their own currencies.

Case Study: Trans-Pacific Partnership

Nearly all economists concur that barriers to trade through things like tariffs are not efficient means of maximizing overall consumer utility. In fact, they are a means to assure that relatively small groups are enriched at the expense of the wider population. To avoid this pitfall, many smaller countries have signed “free trade” agreements to eliminate protective tariffs between them and other countries.

Entering such agreements is not always popular, especially when affected industries in larger countries form special interest groups that are able to attain the implementation of protective tariffs that stymie foreign competition. For instance, President Donald Trump has championed the idea of renewed protectionism in the United States, and has declared his intention to abolish the 1994 North American Free Trade Agreement (NAFTA) with Mexico and Canada, as well as to terminate negotiations to become a ratified member of the Trans-Pacific Partnership (TPP), initially started by Brunei, Singapore, New Zealand and Chile in 2005. TPP was entered into by smaller, developed (or mostly-developed) countries in the Pacific side of the Southern Hemisphere, to unite them and to better move forward economically.

The initial agreement was relatively short, and was adequate to eliminate tariffs. Although there were some managed trade elements, TPP’s length was nothing compared to behemoth NAFTA or other agreements that provide for social activism, economic regulation and outright rent seeking. NAFTA, for example, contains over 1,700 pages (741 pages for the treaty itself, 348 pages for annexes, and 619 pages for footnotes and explanations). Thus, while some doubt can be cast upon whether there are true international trade benefits from agreements like NAFTA, it seems that TPP has been far more concise, clear and beneficial to consumers by lowering tariffs without any strings attached.

In 2008, eight countries began negotiations to join the TPP: Australia, Canada, Japan, Mexico, Malaysia, Vietnam, Peru and the United States. In 2016, these countries signed the revised and great expanded TPP agreement (along with the original four countries), but their membership is subject to the approval of the existing members, and final ratification by each country’s legislature. Accordingly, each country must go through its internal legal formalities for the TPP treaty to be established—a requirement which is especially arduous in larger countries like the United States which are infected with protectionist tendencies.

There is a difference between signing and ratifying the TPP, the latter being far more difficult to accomplish where manipulability of democratic process is involved. For instance, the United States is beleaguered by many thousands of special interest groups and political action committees. Accordingly, under the Trump administration in 2017, there is little chance that the United States will finally join the TPP. Trump ran under a seriously-protectionist banner. Moreover, the United States’ revisions to TPP have complicated the process and legal obligations, too.

Nevertheless, between 2010 and 2013, Taiwan, Colombia, Thailand, Laos, Indonesia, the Philippines, Cambodia, Bangladesh, Sri Lanka and India also expressed interest in participating in the deal. Perhaps, in the end, a shorter version can be adopted that excludes the United States but includes the other 17 interested countries. Such an agreement would be worthwhile for each of the remaining twenty-one member countries.

Consider that ever since bantering and negotiating with the United States began, the TPP treaty has grown a lot—with the current revision containing thirty chapters. Consequently, the revised agreement contains much more than genuine free trade provisions. It attempts to “promote economic growth; support the creation and retention of jobs; enhance innovation, productivity and competitiveness; raise living standards; reduce poverty in the signatories' countries; and promote transparency, good governance, and enhanced labor and environmental protections” by lowering both non-tariff and tariff barriers to trade and establishing means to settle investor-state disputes.

By eliminating trade barriers and tariffs, countries would be able to exploit absolute and/or comparative advantages, as well as factor proportions theory. Countries that are producers of natural resources need buyers for the excess they produce, whether It be fruit, animal, dairy, forestry and seafood products (e.g., Chile, New Zealand, Canada, Mexico, Sri Lanka), wine and minerals (e.g., Chile, Australia, Peru), or petroleum products (e.g., Brunei, Canada, Colombia, Mexico), while at the same time needing to buy finished textiles (e.g., from Taiwan, Japan, Malaysia, Vietnam, Laos, Thailand, Indonesia, Bangladesh, the Philippines, Cambodia, Sri Lanka), electronic and plastic goods (e.g., Taiwan, Japan, South Korea, Mexico) and financial and logistical products (e.g., Singapore, Japan, Canada).

In addition, wider application of the principles of modern economic theories of international trade promoted by business schools, like competitive advantage, could be better exploited if trade regulations we abolished or lightened. Therefore, even if the United States refuses to join TPP, the market available with the remaining twenty-one nations would be robust and beneficial for all, so long as social agendas and other distortive policies are not imposed. TPP’s benefits come from truly tariff-free trade, not by managed trade or cross-cultural social impositions.

In the final analysis, one can see how special interest pressures have influenced the TPP agreement—especially seen in the debate in the United States—over thorny political issues surrounding agriculture, intellectual property and investments. Arguably, the United States is the largest rent seeking society in the world. Because of those interest group pressures, other requirements besides economic efficiency and trade are now involved with the TPP. As a result, the TPP has lost much of its appeal to those countries that simply wanted to eliminate tariffs—especially for countries like Chile that already have separate free trade agreements with great importing countries the United States, India, China and Canada. Chile would, of course, clearly benefit from adding Japan and Taiwan to the revised TPP, but not if a mountain of new social exigencies were added to the deal. Those things, erode benefits from simple free trade.

Indeed, from an economics perspective, there is no reason to maintain trade barriers with any country, since consumer surplus and opportunities are reduced. The only net beneficiaries of unfree trade are rent seeking firms or industries looking to limit competition, along with vote-seeking politicians and power-brokers that stand to gain from implementing such exigencies.

References

Beetsma, R., Giuliodori, M. & Klaassen, F., 2006, ‘Trade Spill-overs of Fiscal Policy in the European Union: A Panel Analysis’, Economic Policy 21(48), October, 639-687.

Biswas, R., 2002, ‘Determinants of Foreign Direct Investment’, Review of Development Economics 6(3), October, 492-504.

Blonigen, B.A. & Piger, J., 2014, ‘Determinants of Foreign Direct Investment’, Canadian Journal of Economics 47(3), August, 775-812.

Bovard, J., 1991, The Fair Trade Fraud: How Congress Pillages the Consumer and Decimates America’s Competitiveness, St. Martin’s Press, New York.

Breedon, F. & Petursson, T.G., 2006, ‘Out in the Cold? Iceland’s Trade Performance Outside the European Union and European Monetary Union’, Cambridge Journal of Economics 30(5), 723-736.

Buckley, P.J. & Casson, M., 1976, The Future of the Multinational Enterprises, Macmillan, London.

Burnete, S. & Choompta, P., 2015, ‘The Impact of European Union’s Newly-Adopted Environmental Standards on its Trading Partners’, Studies in Business and Economics 10(3), 5-15.

Carpenter, M. & Dunung, S., 2011, Challenges and Opportunities in International Business in a Flattening World, Flat World Knowledge, Washington.

Choi, J. & Yu, E.S.H., 2002, ‘External Economies in the International Trade Theory: A Survey’, Review of International Economics 10(4), 708-728.

Clift, B., 2013, ‘Economic Patriotism, the Clash of Capitalisms, and State Aid in the European Union’, Journal of Industry, Competition and Trade 13(1), March, 101-117.

Cnossen, S., 2003, ‘How Much Tax Coordination in the European Union?’, International Tax and Public Finance 10(6), November, 625-649.

Cobin, J., 2009, A Primer on Free Market Economics and Policy, Universal Publishers, Boca Raton, Florida.

Dunning, J.H., 1993, The Globalization of Business, Routledge, London.

Eising, R., 2004, ‘Multilevel Governance and Business Interests in the European Union’, Governance 17(2), April, 211-245.

Farrand, B., 2015, ‘Lobbying and Lawmaking in the European Union: The Development of Copyright Law and the Rejection of the Anti-Counterfeiting Trade Agreement’, Oxford Journal of Legal Studies 55(3), 487-514.

Harris, L., 2001, ‘Can European Union Survive?’, Economic Affairs 21(1), March, 43-46.

Hayek, F.A., 1945, ‘The Use of Knowledge in Society’, American Economic Review 35(4), September, 519-530.

Hymer, S.H., 1976, The International Operation of National Firms: A Study of Direct Foreign Investment, MIT Press, Cambridge, Massachusetts.

Gartzke, E. & Hewitt, J.J., 2010, ‘International Crisis and the Capital Peace’, International Interactions 36(2), April, 115-145.

Gleditsch, N.P., 2008, ‘The Liberal Moment Fifteen Years On’, International Studies Quarterly 52(4), 691-712.

Krasner, S.D., 1976, ‘State Power and the Structure of International Trade’, World Politics 28(3), 317-347.

Milner, H.V., 1998, ‘International Political Economy: Beyond Hegemonic Stability’, Foreign Policy 110, 112-123.

Mises, L., 1966/1949, Human Action: A Treatise on Economics, Contemporary Books, Chicago.

Nitsch, V., 2000, ‘National Borders and International Trade: Evidence from the European Union’, Canadian Journal of Economics 33(4), November, 1091-1105.

North, D.C., 1992, ‘Institutions and Economic Theory’, American Economist, Spring, pp. 3-6.

Reichert, M.S. & Jungblut, B.M.E., 2007, ‘European Union External Trade Policy: Multilevel Principal-Agent Relationships’, The Policy Studies Journal 35(3), 395-418.

Rozo, C.A., 2001, ‘Protectionism in the European Union: Implications for Latin America’, Intereconomics 36(3), May/June, 141-152.

Sadeh, T. & Howarth, D., 2008, ‘Economic Interests and the European Union: A Catalyst for European Integration or a Hindrance?’, British Journal of Politics and International Relations 10(1), February, 1-8.

Sen, S., 2005, ‘International Trade Theory and Policy: What is Left of the Free Trade Paradigm?’, Development and Change 36(6), 1011-1029.

Simmons, R.T., 2011, Beyond Politics: The Roots of Government Failure, Independent Institute, Oakland, California.

True, J., 2009, ‘Trading-Off Gender Equality for Global Europe? The European Union and Free Trade Agreements’, European Foreign Affairs Review 14(5), January, 723-742.

Tullock, G., 1993, Rent Seeking, The Shaftesbury Papers, 2, Edward Elgar, Brookfield, Vermont.

Tullock, G., 1988, Wealth, Poverty, and Politics, Basil Blackwell, New York.

Cite This Module

To export a reference to this article please select a referencing style below: