Causes and Implications of Negative Externalities

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 3032 words | ✅ Published: 17 Oct 2017 |

Course: Economics for Business ECON20023

Lecturer: Ms. Welshi Tupou

Prepared by:

- Shahryar Alvi

Table of Contents (Jump to)

Implications of negative externalities

Methods to correct negative Externality

Other options and their economic reasons

Negative Externalities

Discussion

Externalities whether negative or positive are present within the environment and co-exist simultaneously. Negative externalities take place when the consumption or production causes a harmful or a negative effect to a third party. (Economics.help, n.d.) For instance, like waste, arises from consumption while on the other hand carbon emissions from factories, arise from production. (Anon., n.d.)

As per the economist’s terms, a negative externality is a cost that affects the third partyas a result of an economic transaction. In a transaction, the producer and consumer are the two parties, and third parties may include any individual, organization, property owner, or any resource that is indirectly affected. In a pure economics context, a negative externality is also referred to as anexternal cost. (Anon., n.d.)

Externalities also occur in situations where property rights over assets or resources have not been allocated, or are uncertain and are not predetermined. For example, no one owns the oceans, even the air in which we breathe, they are not the private property of anyone, no ownership and ights have been allocated to them, so ships may pollute the sea without fear of being taken to court, road traffic can pollute the air without being taken into account the harmful effects being emitted for the people breathing the air, leading to prolonged illness (Anon., n.d.)

Implications of negative externalities

If our goods or services or even the environment at large, have negative externalities, then the entire market fails to operate efficiently and effectively. This is because individuals, who incur the costs and their actions impacting others, fail to take into account the costs that they inflict to other people.

Externalities, whether negative or positive are often used for the government’s ownership of industries to prohibit the products and their related activities with negative externalities.

However, there are some of the reasons where the externalities may not even be corrected since the positive and negative externalities are inter related to each other.

For instance, mowing your lawn is a positive externality of grooming the appearance of your household premises however at the same time, mowing your lawn gives a loud nuisance noise to your ears which creates a negative externality. Some research scientists are now beginning to question efforts to prevent global warming since calculating the benefits for people in cold climates outrun the costs and the hazards for people in warm climates. (Caplan, 1990)

When faced with negative environmental externalities, the governments of the states impose and establish regulations that restrict specific business practices. These regulations help make the environmental clean and are much more expensive to abide by as the cost of reducing pollution and varies widely from industry to industry.

A more targeted environment efficient solution by is to issue tradable “pollution permits” that predefines the emissions levels for each category of business. Any business activity that extends beyond the permit should have to be penalized under the Government’s regulations. This will curtail negative externality of the environment pollution, accentuating the selling of the permits to less flexible polluters (Blinder 1987).

However, there are at times when an externality is at low levels of production and diminishes as the quantity increases. As long as the required output is being produced, these externalities are safe to handle with precautionary measures. For example, if during a famine and dry spell in most underdeveloped areas of the world, doubling the food supplycategorically leads to robbery, and other juvenile and serious crimes. However, doubling the food supply during normal times would probably have no impact on crime. (Caplan, 1990)

Methods to correct negative externality

The vast complexity of environments and the limitations of a systematic mechanism typically calls for the efficient regulations. Listed below are some of the solutions that can curtail negative externalities and give way to efficient economic disposition of the community

Solutions to externalities

Social and Cultural Conventions

One tactic to deal with negative externalities is through social conventions, culture and tradition.

The argument here is whether “certain social conventions can be viewed as attempts to force people to take in to account the externalities that they generate and through tradition. Recognition of signals and appropriate responses are instilled as part of the culture.”(Wills, 1995-96)

The example associated with this is impressing on people from a young age that. One has to hold on to the litter until a bin is found. This should reduce the externality that the litter creates.

The question that can be raised as id the social conventions could be used to impose a stricter view of reducing negative externalities on multi-national corporations.

While social convention may seem appealing in dealing with negative and unpleasant externality generating activities. However this method is confined to individuals who can reduce the low cost externalities through their activities, and social attention behavior.

Acquisitions and Mergers

Another possible solution includes the third parties to merge. For example if the profits of the fishing companies are being affected enormously by the water pollution produced by a steel mill within the same city, then the issue can be addressed by merging the fishery and the steel mill to work together towards a common goal and internalize the effects. This suggestion is also seen as having a number of problems in its practical scenario and its implication in its effective implementation.

This method is suitable for corporations but will have to consider how the individuals can merge with these companies to minimize the negative externalities. Thus, even if acquisitions and mergers are a solution to the problem of externalities, in multiple instances, they are still not practical solutions to be implemented for a drastic reduction in negative externalities.

Laws, regulations and fines

The most commonly used method to reduce the problem of externalities, especially pollution, is the enforcement and imposition of regulatory limits and policies on the amount of the externality produced. The imposition of penalty and fines on those parties who create externalities beyond the regulated limit is one of the most effective ways to reduce the externalities and create a sense of responsibility towards the parties. While this approach is a simple and easy to be implemented solution, it does require all the companies to reduce their externality to a certain acceptable level or else the method will not be efficient.

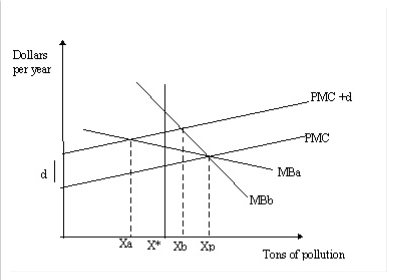

Figure 1 represents the situation of two companies (a and b) with identical costs but different marginal benefit curves (MBa and MBb), explaining their market characteristics

The free market with no government regulation will produce quantity Xp pollution. When the companies account for the damage (d), caused by their production, Xa and Xb are produced which are their externalities. Given different marginal benefit curves, moves by the government to have all companies reduce their pollution to a reasonable amount as regulated i.e X*.

Hence , the use of regulations and fines do appear to be a simple solution , however it may not be as efficient as perceived since it does not cover the scope of monitoring the companies and detection of them breaching the laws and the payment of fines whenever imposed..

Corrective taxes

The imposition of corrective taxes is another practical solution to the dilemma of negative externalities such as pollution. The mechanism of corrective taxes is designed to enforce the producers to limit their production of the goods to a reasonable level of production that can be optimized and capitalized to its fullest capacity.

The amounts to be included as Corrective taxes can be the amount equal to the damage the company inflicts on its environment and the society at large (Katz & Rosen, n.d.)

Figure 2 indicates the effects of a Corrective tax on a company producing a negative externality such as pollution. The figure shows the free market equilibrium occurs where demand (D), becomes equal to the private marginal cost (PMC) of production as that in my home country Pakistan at quantity Xp. However the optimal amount of production which can be capitalized occurs at Q* where social marginal cost (SMC), that takes in to account the damage (d) caused by producing the item , equals D. By implementing the tax m effective supply curve is raised to become its private marginal cost plus the tax. As a result there is a rise in the price of the goods and an increase in demand for it. This efficient level of production is achieved at price P1 and quantity Q*. (Gibson, 1996)

Corrective taxes offer a more effective means of reducing negative externality than regulating laws and displaying social and cultural behavior.

However it outruns its side effects as well since in order to charge tax from the companies producing negative externalities, the government or law enforcing institutions must be able to determine which activities produce externalities, more damage to the third parties and whether the damage produced is harmful and should be able to finally come up with the recommended environmental and damage control policies to put into practice apart from charging the tax levy if any limit is breached (Economics.help, n.d.)

However with improvement in the technology and a greater understanding of environmental cause and effective method of corrective taxes may become increasingly responsive in terms of its results oriented action in taking the industries and manufacturers towards more optimal level of production

Property Rights

Another positive and more practically bound solution is the establishment and enforcement of private property rights that can provide a better framework and solutions a number of problems posed by externalities .

“A private property right is a legally established title to the sole ownership of a scarce resource that is enforceable in the courts.”(McTaggart, n.d.)

At first, the establishment the ownership of private property rights by the legal system would allow victims of negative externalities to pursue the offending party legally for the compensation of the damage caused and suffered.

This solution too has a number of problems attached to it. There are problems for obtaining the ownership documents from the party and assigning and defining property rights. Problems in enforcement of property rights are likely involve a number of significant alterations made to the ownership documentation and even the existing property law governed by the country .Hence, while the property rights offer an innovative solution to the problem of externalities, there is still much practical implication to be explored in this aspect.

Case Study

Negative Externality in Pakistan & its Market Structure

Pakistan has a diversified economy that offer a range of various hybrid market combinations including the perfect competition, monopoly and oligopoly market competitions especially free market. The following diagram illustrates the negative externality in detail with reference to Pakistan.

Diagram Illustration of negative externality with deadweight welfare loss

Diagram Illustration of negative externality with deadweight welfare loss

As shown in Figure 3, in a free market, people ignore the external costs and the cost inflicted to others, therefore output will be at Q1 (where Demand = Supply). This is socially inefficient because at Q1 – Social Cost exceeds the social Benefit, which should not be the case. The best situation is when the social efficiency occurs at Q2 where Social Cost = Social Benefit.

The red triangle is the area of dead weight welfare loss. It indicates the area of overconsumption that acts as a warning to the manufacturers that they are producing wastage that is a negative externality itself. (Economics.help, n.d.)

An external cost, such as the cost of pollution and wastage from industrial production, makes the marginal social cost (MSC) curve higher than the private marginal cost (MPC). (Economics.help, n.d.)

Government measures to address negative externality

Generally, the market-based solutions aim to manipulate market forces to reduce the externality, by utilizing the market price mechanism.

One such market-based solution is to extend and enforce property rights and ensure authenticated documentation is done so that the parties affected by negative externalities and negotiate with those individuals and organizations that cause the externality.

In this context, there are other solutions that the government can ensure to reduce negative externality through direct and strict controls and policies as below:

- Putting heavy or nominal tax levies on the polluting and creators of negative externalities such as carbon taxes, or taxes on plastic bags, road congestion,

- Subsidizing and encouraging the community households, companies and individuals to be non-polluters and energy efficient, such as the government can give grants for home insulation, energy efficient electrical appliances installation improvements and so on. More and more company should be given open access to grants to invest in energy efficient systems that can minimize the negative externality that is being released to the environment.

- Sellingpollution permits that allow a reasonable amount of pollution and emission to be emitted to the environment and are available to a specific number of companies who are trading in such activities.

- Forcing companies polluting the environment to pay for the damage compensation to those who suffer and are victimized such as people residing in the premises of the chemical factory

- Road pricingschemes must be established mot only to regulate the road traffic but also to curb the road congestion, such as the Electronic Road Pricing (ERP) system, which can be a pay-as-you-go, card-based, road-pricing scheme.

- Providing more information to consumers and producers,raising awareness of the negative externalities and the need to be responsible for the damage caused by externality generating activities. Important public messages should be printed on tickets to travel on transport that causes pollution and noise , especially air and even road travel, should contain information on how much CO2pollution and how much fine will it have to pay if the limit is breached for each journey

Other options and their economic reasons

Tradable Pollution Permits & Rights

Another alternate option which has been suggested by Economists a lot many times is the creation, purchase , issuance and monitoring of tradable pollution permits as discussed earlier in the previous heading.

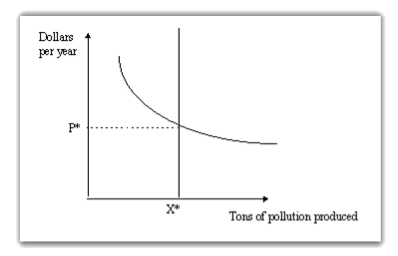

This is illustrated well in Figure 4.

The pollution rights approach to negative externalities requires the government to create market awareness and establish a market for its business in the region. The supply of pollution rights, and hence the quantity of pollution produced, is fixed at quantity X*.

Companies that are not prepared to pay the market price of P* to purchase pollution permit and tradable rights must be able to bring their pollution limit to a reasonably low level or adopt technologies which produce less negative and harmful externalities.

Tradable pollution rights can help achieve and maximize efficiency as the increase or decrease in demand will be reflected in a change in the pricing model of the rights ,but the amount of pollution produced should not exceed the optimal level determined by pollution permits available in Pakistan.

Pollution and tradable rights have posed a number of problems that still need to be catered to. For example in determining the number of pollution rights to be sold, the government must determine the companies eligible to purchase the pollution permits and the point where “the marginal social cost of pollution equals the marginal abatement cost.”(G. Currie, 1992). T

The other problem is the companies willing to pay to purchase the pollution rights in Pakistan since people are not that much aware of it and will find it difficult to spend money on it since they will not know about measures the government has taken to reduce the negative externalities.

Other problem is to list down such companies and to monitor their pollution limit so that the companies can be fined once the limit for the permit is breached. A mechanism can be established making use of technology to track the pollution permit purchasing companies and monitoring their performance.

Subsidies – to encourage positive externalities

So far we have focused on the negative externalities and their impact on the third parties and how government especially in Pakistan can intervene to make the situation better.

The solution to negative externalities is through payment of subsidies, fines for any limit breached or on the purchase of any tradable pollution permits

The cost of collecting and dispensing the subsidy must also be taken in to account as well as monitored as to which company is liable to pay the subsidy and how much the amount is paid. Specific collecting officers must be appointed and its administration should be well managed if the purpose of the companies being able to produce to meet true optimality is to be achieved.

Conclusion

On a concluding note, therefore it can be stated that the existence of externalities and their corresponding decrease in the demand of the market and its failure to meet the new market demands has serious practical implications which need to be dealt if we are to achieve an efficient economic and developed zone. While, we have discussed about a number of methods to correct the negative externality, each of the method discussed earlier has its own pros and cons to offer.

References.

Alan, B., 1987.. Hard Heads, Soft Hearts: Tough-Minded Economics for a Just Society. In: Hard Heads, Soft Hearts: Tough-Minded Economics for a Just Society. New York: Addison-Wesley.

Anon., n.d. Economics Online. [Online] Available at: http://www.economicsonline.co.uk/Market_failures/Externalities.html

Anon., n.d. ibid, p 617..

Anon., n.d. Katz & Rosen, op cit , p.624.. Katz & Rosen.

Caplan, B., 1990. Externalities. The concise encyclopedia of economics, p. 50.

Coase, R. H., 1960. The Problem of Social Cost. The Journal of Law and Economics, .

Economics.help, n.d. Economics.help/micro-economic-essays/. [Online] Available at: http://www.economicshelp.org/micro-economic-essays/marketfailure/negative-externality/ [Accessed 2014].

G. Currie, K. J. &. S. J., 1992. STUDYMATE : HSC 3 Unit Economics,. Sydney: McGraw-Hill.

Gibson, H., 1996. Externalities: Implications for allocative efficiency and suggested solutions.. [Online] Available at: http://users.hunterlink.net.au/~ddhrg/econ/ext1.html

Katz & Rosen, n.d. Katz & Rosen, op cit , p.624.. p. p.624..

McTaggart, M., n.d. Findlay & Parkin ,. Volume II, p. p. 468..

Rosen, K., n.d. Rosen, Katz. Volume II, p. p.618..

Wills, I., 1995-96. Schools Brief : Environmental Problems, Policy. Environmental Problems, Policy, vol. 11 (num. 4).

1

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal