International Financial Analysis of Burberry

| ✅ Paper Type: Free Essay | ✅ Subject: Finance |

| ✅ Wordcount: 2426 words | ✅ Published: 03 Nov 2020 |

Introduction

This report is meant to financially analyse Burberry PLC over the course of the past three years in order to determine whether or not it is a good company to invest in. The global and British economies will be analysed to comprehend the type of market Burberry is operating in. The finances and retail industry will be assessed to see the possible non-monetary, external factors involved in the profitability, efficiency, and liquidity of the company. Finally, a ratio analysis of the entire Burberry PLC company will be performed in order to assess the profitability of the investment.

Burberry PLC

The Burberry brand was founded by Thomas Burberry in 1856 but the first London store opened its doors in in 1891. Burberry is known for being innovative, starting off with the invention of gabardine – a cotton weatherproof fabric that gave Burberry’s its reputation. Today, the company is still as innovative, Burberry is an industry leading investor in artificial technology to improve the customer experience not only within their boutiques, but through the use of social media to its full potential (Burberry PLC, 2017).

Earlier in 2017, Burberry’s Chief Executive Officer and Chief Creative Officer, Christopher Bailey stepped down and Burberry hired “luxury retail veteran” Marco Gobetti in hopes of steading Burberry’s shares (McClean, 2016). During Mr. Gobetti’s first few months in charge, he has set a plan in motion to gradually start saving £120m a year, increase revenues, and lodge itself “firmly in luxury” by improving customer experiences (Vandevelde, 2017).

Economic Outlook

The economic outlook will contain a brief analysation of the global economy and the British economy to determine stability and risk.

Global Economy

The global economy is expected to stabilize by the end of 2017, because global trade has risen and so has the emerging markets. Not only will a stronger global economy be present in developed nations, but it will also be present in developing nations. Although there are some risks present, such as the “possibility of financial market disruptions,” there is more evidence of a stable global economy (Global Outlook a Financial Recovery, 2017).

British Economy

The United Kingdom’s economy is the third largest in Europe and it is a leading financial centre. The gross domestic product has increased an average of 1.5% over the past year and it increases by 0.4% quarterly (Ons.gov.uk, 2017). This means that the gross domestic product has not been sharply decreasing or increasing which is a sign of economic stability. The unemployment rate is at a steady 4.9%, which compared to the American market the unemployment rate is at parity and at a healthy point. Even though the British economy is one of the fastest growing economies, Brexit has put London’s title as the European financial centre in jeopardy and there is a vast amount of uncertainty surrounding the overall position of the British economy amongst and with members of the single market (Cia.gov, 2017). Overall, the British economy is steady regardless of the uncertainty of the future and consequences of Brexit.

Retail Industry Outlook

Burberry operates under the wide umbrella of the retail industry, but finds itself within the luxury fashion market niche. The luxury fashion market in Britain is projected to be worth £54bn within the next two years and the sector is valued at 2.2pc worth of the UK gross domestic product (Armstrong, 2015). In order for luxury fashion brands to succeed, companies are now targeting generations Y and Z to keep in business in the long-term future. Generations Y and Z spurred the 85% growth in luxury sales in 2017 (Agnew and Rutter Pooley, 2017). Therefore, luxury fashion brands need to market towards millennials and the younger generations to succeed in the changing world.

Ratio Analysis

The analysation of Burberry’s financial statements through the use of ratios is essential in determining the company’s profitability, liquidity, efficiency, and capital structure. Burberry’s financial ratios will be compared to industry standards and to Jimmy Choo PLC’s in order to fully comprehend whether Burberry’s finances are up to, above, or below industry standard.

Profitability Ratios

The profitability ratios will not only measure and demonstrates Burberry’s efficiency in producing profits, but it will also shed a light towards the company’s efficiency in managing its costs and investments.

Gross Profit Margin

From the year ending in March 2015 until the year ending in March 2017, the gross profit margin ratio has remained within 0.50%. This signifies that Burberry’s profitability in manufacturing and selling goods has stagnated over the past three years. A stagnant gross profit margin means that, while the management of the cost of sales has not deteriorated, it has not improved either. It can also indicate stability in the company’s prices and stability of overall costs. To further support the previous statements, the retail industry median is 43.9% and Jimmy Choo PLC’s gross profit margin is 64.01% (Benchmark Breakdown: Key Metrics On 25 Industries, 2017). Burberry has a much higher ratio than the industry standard and a slightly better ratio than its competitor. Therefore, even though the ratio has decreased by 0.21% over the past year, Burberry is still more efficient in producing a profit above the cost of sales than expected which can be due to the high prices that the luxury fashion market lends itself to and high demand.

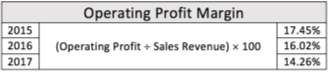

Operating Profit Margin

The operating profit margin has been decreasing since March 2015 from 17.45% to 14.26% in March 2017. The decreasing ratio indicates a decrease in Burberry’s profitability in its trading operations and a decrease in the company’s control of fixed costs. This may be due to an increase in overheads while operating profits slightly decrease as shown on page 127 and 123 of Burberry’s Financial Statements of 16/17 and 15/16 respectably. Even though Burberry has a decreasing operating profit margin it is still nearly three percentage points higher than its competitor Jimmy Choo, whom has a ratio of 11.81%.

Net Profit Margin

Burberry’s net profit margin has decreased from having a 13.52% net profit in 2015 to a 10.40% net profit in 2017. This indicates that management has not been successfully creating profit, which is due to increasing overheads as revenue has only increased according to the statement of cash flows. However, compared with the industry standard, which stands at 3.6%, and Jimmy Choo, which stands at 4.12%, Burberry is more successful at generating profits than the industry norm and its competitor.

Return on Assets (ROA)

The increase in the return of assets ratio demonstrates that the efficiency of which Burberry management have handled and used their resources has been profitable. The ratio’s increase could be due to profitable investments in total assets made by management.

Return on Equity (ROE)

Return on equity lowered nearly seven percentage points from 2015 to 2017. This indicates that the capital invested by ordinary shareholders has been decreasing in profitability over the past three years. After analysing the statement of cash flows for all three years, the return on equity has decreased due to a slight increase in dividends and a decrease in investing activities. Even though Burberry’s return on equity is decreasing, the ratio at which it stands still gives the company a high advantage compared to the industry standard of 9%. Since Burberry is nearly twice as efficient in the return of equity, the company can still afford it.

Return on Capital Employed (ROCE)

The return on capital employed is yet another ratio that has decreased over the time being studied. The decreasing ratios demonstrates that Burberry is investing more capital by year than the profit being generated. As previously shown, the operating profit margins, net profit margins, and gross profit margins have all decreased over the three-year period

Liquidity Ratios

The liquidity of a company is equivalent with the ability of a business to pay for short-term liabilities.

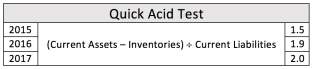

Quick Acid Test

In the retail industry, liquidity ratios are non-essential because of the lack of debtors (Chatzivgeri, 2017). However, it is important to note that Burberry has the liquidity to cover twice the amount of their current payments. This is due to high equity and many current assets which is caused by good company investments.

Efficiency Ratios

The efficiency ratios measure the way a company deals with its assets concerning inventory, receivables, and payables.

Average Inventories Turnover Period

Burberry’s average inventory turnover period is very high and has only increased over the past three years. From 2016 to 2017, the average did decrease from 236 days to 221 days, yet the number is still alarmingly high. Typically, high average inventories turnover periods are caused by the overproduction of goods or poor sales achievement. Poor sales achievement might be caused by the brand’s high prices and its reputation for being exclusive.

Average Settlement Period for Receivables

The average settlement period for receivables has retained an average of 47 days, which indicates that Burberry has high efficiency in collecting credit sales.

Financing Ratios

The relationship between a company’s debt and its equity can be demonstrated through the use of capital structure ratios.

Gearing

The term gearing in a financial analysist context means the mix of debt and equity in a company’s finance (Atrill and McLaney, 2017). Thus, the decreasing gearing ratios in Burberry’s financial statements indicate that most of their funding comes from equity rather than debt. This indicates a low risk level for investors and shareholders, because the capital being used to finance its operations comes from the company itself.

Interest Cover

The interest cover ratio has only drastically risen since 2017, which indicates an increase in profits. Burberry’s ability to pay 263 times its interest demonstrates that Burberry has high liquidity as well.

Investment Ratios

An investment ratio is for the company’s investors and potential investors see how much profit they will gain from their investment.

Price/Earnings (P/E)

Burberry’s price per earnings ratio is quite low, for the past three years the ratio been below one, meaning that Burberry’s earnings are high but market price is low. This could be an indicator that the company is expanding or growing. The low market price can also be a repercussion of Burberry’s Chief Creative Officer and Chief Executive Officer, Christopher Bailey left Burberry PLC in July 2017 (Vandevelde, 2017). The change in management and management styles may have led to the low market price.

Dividend per Share

Burberry’s dividend per share has been steadily increasing since 2015. This means investors have been getting a larger part of the company’s profits as the years go by. This could be caused by an overall increase in profits, which would mean a higher dividend to distribute amongst the investors. Overall, the ratio for the dividend per share is quite low, but it has been increasing.

Conclusion and Recommendations

The economic portion of this analysis demonstrated that the global economy is stable and will not greatly interfere with Burberry’s financial performance. While there is reason to worry about Brexit’s effect on the single market and Burberry, it is not distressing enough to cause drastic drops in profitability or efficiency. Analysing the retail industry demonstrated that to expand or even maintain a luxury fashion business profitable and operational, the fashion house must appeal to the younger generations. Burberry’s dedication to innovation, whether technological or product wise, will give the company a competitive advantage over its competitors. As for the financial analysis, the profitability ratios demonstrate that even though the company’s costs are not being effectively managed, Burberry is still producing profits. The quick acid test and financing ratios showed that the company is highly liquid and the efficiency ratios demonstrated a need to improve on efficient methods when dealing with inventory. Analysing the investment ratios revealed that Burberry is very generous in the distribution of dividends. Overall, compared to other companies like Jimmy Choo PLC and based on the retail industry standard, Burberry’s finances are profitable for investment. Therefore, Burberry PLC is a company worth investing in.

References

- Aerts, W. and Walton, P. (2017). Global financial accounting and reporting. 4th ed. Hampshire, United Kingdom: Annabel Ainscow.

- Agnew, H. and Rutter Pooley, C. (2017). Generations Y and Z drive growth in luxury market. Financial Times. [online] Available at: https://www.ft.com/content/8386fd06-b95e-11e7-8c12-5661783e5589#myft:saved-articles:page [Accessed 16 Nov. 2017].

- Armstrong, A. (2015). Luxury Industry in britain is Worth up to 54bn. The Telegraph. [online] Available at: http://www.telegraph.co.uk/finance/newsbysector/retailandconsumer/11829702/Luxury-industry-in-Britain-is-worth-up-to-54bn.html [Accessed 16 Nov. 2017].

- Atrill, P. and McLaney, E. (2017). Accounting and finance for non-specialists. 10th ed. London: Pearson Education Limited, pp.195-246.

- Benchmark Breakdown: Key Metrics On 25 Industries. (2017). Forbes Magazine. [online] Available at: https://www.forbes.com/2010/06/29/best-in-class-financial-metrics-entrepreneurs-finance-sageworks_slide/#635f5c96be51 [Accessed 15 Nov. 2017].

- Bloomberg.com. (2017). BRBY:London Stock Quote – Burberry Group PLC. [online] Available at: https://www.bloomberg.com/quote/BRBY:LN [Accessed 16 Nov. 2017].

- Burberry Annual Report 15/16. (2017). [ebook] London: Burberry PLC. Available at: https://www.burberryplc.com/content/dam/burberry/corporate/Investors/Results_Reports/2016/5-annual_report_2015_16/Report_burberry_annual_report_2015-16.pdf [Accessed 14 Nov. 2017].

- Burberry Annual Report 16/17. (2017). [ebook] London: Burberry PLC. Available at: https://www.burberryplc.com/content/dam/burberry/corporate/Investors/Results_Reports/2017/AnnualReport/Burberry_AR_2016-17.pdf [Accessed 14 Nov. 2017].

- Burberry PLC. (2017). Company. [online] Available at: https://www.burberryplc.com/en/company.html [Accessed 13 Nov. 2017].

- Chatzivgeri, E. (2017). Analysis and Interpretation of Financial Statements (II).

- Chatzivgeri, E. (2017). Analysis and Interpretation of Financial Statements (I).

- Cia.gov. (2017). The World Factbook — Central Intelligence Agency. [online] Available at: https://www.cia.gov/library/publications/resources/the-world-factbook/geos/uk.html [Accessed 16 Nov. 2017].

- Global Outlook A Financial Recovery. (2017). 1st ed. [ebook] Available at: http://pubdocs.worldbank.org/en/216941493655495719/Global-Economic-Prospects-June-2017-Global-Outlook.pdf [Accessed 16 Nov. 2017].

- McClean, P. (2016). Burberry’s new chief executive Marco Gobbetti is a luxury veteran. My Financial Times. [online] Available at: https://www.ft.com/content/0b6c44ac-4777-11e6-8d68-72e9211e86ab#myft:saved-articles:page [Accessed 16 Nov. 2017].

- Ons.gov.uk. (2017). Gross Domestic Product (GDP) – Office for National Statistics. [online] Available at: https://www.ons.gov.uk/economy/grossdomesticproductgdp [Accessed 16 Nov. 2017].

- Uk.finance.yahoo.com. (2017). CHOO.L Income statement | JIMMY CHOO PLC ORD 100P stock – Yahoo Finance. [online] Available at: https://uk.finance.yahoo.com/quote/CHOO.L/financials?p=CHOO.L [Accessed 15 Nov. 2017].

- Vandevelde, M. (2017). Burberry plans to move more upmarket to be ‘firmly in luxury’. My Financial Times. [online] Available at: https://www.ft.com/content/91af77d8-c529-11e7-a1d2-6786f39ef675#myft:saved-articles:page [Accessed 16 Nov. 2017].

- Vandevelde, M. (2017). Burberry sales rise as Bailey bows out as chief executive. [online] Ft.com. Available at: https://www.ft.com/content/aa989b84-3ba0-11e7-821a-6027b8a20f23#myft:saved-articles:page [Accessed 16 Nov. 2017].

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal