Ford Motors Financial Analysis

| ✅ Paper Type: Free Essay | ✅ Subject: Finance |

| ✅ Wordcount: 3580 words | ✅ Published: 08 Oct 2021 |

Table of contents

Ford Motors background Information page 1

Revenue/financial position of the company page 2

International finance activities manager page 3-4

Capital structure and global subsidiaries page 5-7

Foreign Direct Investment activities page 8

Foreign currency management/policies page 9

Financial strategies and facts page10

Company Background

Ford Motors is a multinational automaker company founded and incorporated by Henry Ford in the early 19th hundreds with its headquarters located in Dearborn, Michigan. Essentially the company produces passenger cars, tractors, trucks, and other automobile spare parts.

In the late 1890’s Henry Ford created his first experimental car in his workshop, in Detroit. Ever since that successful conduct experiment, he was inspired to form his company, Ford Motors company and assembled his first car on July 08,1903 at the Mack avenue. A few years later, the demand for the car increased which led to a new model T to be introduced which also led to a high demand for the car. Because of that Ford had to expand his manufacturing plant so it could produce in mass quantities. Hence after all of the success, Ford established the first U.S branch in Kansas City, Missouri and his first overseas plant in Manchester, England in 1911. He also launched the world’s first moving assembly line for automobiles in 1913 and in 1914 he instituted the five-dollar daily wage for an eight-hour day (instead of the two dollar for nine hours) to boost labor efficiency.

At this rate Ford had sold more than 500,000 cars all over the world with the help of its international sales branches like Paris, South Africa, Australia, etc, at the end of the 1920’s. However, after a few years, the model T as popular as it was, was losing its market share to its competitors due to its utilitarian style. Customers demanded a different style, a more luxuries one fortunately enough for the company, in 1922 it acquired the Lincoln Motors company (1917) which was going through some financial difficulties itself. This helped Ford create luxury cars like the original Lincoln and Continentals as well which were a great hit. By the end of the 19th century, Ford was mainly focused on its service performances with concerns regarding vehicles.

Beginning the 21st century, two automobile manufacturing companies (General Motors and Chrysler LLC) with Ford Motors fell in a financial crunch due to the subprime mortgage crisis followed by the great recession (2007-2009). Therefore, the current president George W. Bush announced an urgent rescue plan for these three struggling automakers. The congress and the government (TARP) funded a $700 billion and a $13 billion loan for those companies until 2009 so they can recuperate by showing financial capability and pay back the loan in full. Allegedly, the loans were first given to the two companies, albeit Ford already had enough money to run its company. In 2009, Ford saw a rise in sales and market share thanks to the government’s plan (“cash for clunkers”) that let customers trade in old cars for new ones with a $4500 budget. With that, Ford implemented a strong branding strategy as well as focusing on the companies high selling brands and also executing a number of cost-cutting steps.

Currently, Ford Motors embodies an approximate of $127 billion-dollar multinational enterprise, making it to be the world’s second largest automobile company. Which besides manufacturing vehicles also operates Ford credit that provides credit lines to Ford motors products at dealerships and helps customers with commercial financing. Generating an income of about $3 billion as well as owning the biggest auto rental company, Hertz corporations. As stated above the company still produces/manufactures luxury cars like the Jaguar, Lincoln, Volvo, Ashton Martin, that he acquired in the early 1990’ through shares. As of today, it is earning a slow income but still pushes to make a difference even in a fluctuating stock market index.

Financial Statement

A financial statement is a recorded document that showcases a company’s financial and operational performance over a specific period of time. For a firm like Ford Motors to help it be financially stable as well as being independent, it needs to look at how its going to create profit, repay debts, pay-back operations costs, etc which is basically reducing the company’s weakness areas and using its strength as an advantage. Usually Investors, creditors and market analyzer look over the financial statement to determine the company’s potential earnings and financial health, which can be done by using the three major types of financial reports which are: The Balance sheet, Income statement and Cash flows.

For Ford Motors and its subsidiaries, we will be using the consolidated income statements form (in millions, except per share amounts):

|

|

2018 |

2019 |

2020 |

|

Total Revenues (Automotive, Ford credit, Mobility) |

160,338 |

155,900 |

127,144 |

|

Total costs and expenses |

157,135 |

155,326 |

131,552 |

|

Income/(Loss) before income taxes |

4,345 |

(640) |

(1,116) |

|

Net income/(loss) |

3,695 |

84 |

1,276 |

|

Net income/(loss) attributable to Ford Motor Company |

3,677 |

47 |

(1,279) |

Explained: As I gathered from the Ford 2019 annual report:

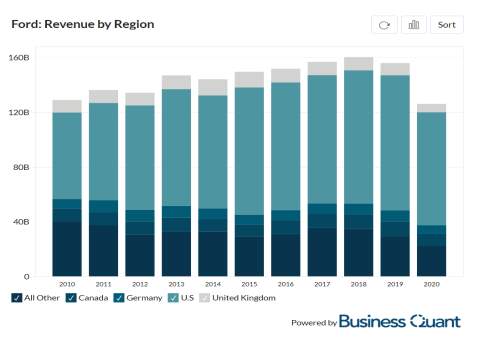

With the help of its first successful launch of branch in Canada and England, Ford Motors has now expanded its locations in over 125 countries all over the world. Here is the overview of its revenues gathered by its international operations/sales from 2010 to 2020:

International financial activities

Ford Motors is a multinational automaker company, which means it runs its operations and manufacturers in more than several countries. As I have stated in page 2 of the financial statement, Ford has over 125 locations around the world, that has helped the company effectively operate the foreign exchange market and have a comparative advantage. Since Ford has many subsidiaries, it has helped it secure the free trade agreement between southern countries like Asia and Mexico and also sustaining world trade relations overall. That has given Ford Motors a bit of a competitive advantage compared to other competitors which in turn, has established a beneficial partnership for the company and the United States. Initially the company was able to expand its foreign trade opportunities as well as compete with other industries in foreign exchange and international trade market by associating with the marketing term “laissez-faire” that is known globally, which means letting things go in course of their own action.

When it comes to managing the financial aspect of the company and its subsidiaries abroad, there are many challenges that a corporation faces. The main one for Ford and any firm that is doing business internationally is the global financial management. It is a window to see how the world’s economy is doing and how that can affect your/their business.

Three critical challenges rise from global financial management:

- risk management,

- foreign exchange rates, and

- regulations of banks.

Risk management happens when the goods you purchased or sold in another country might be exposed to high prices due to the countries in contact having higher inflation rates, but it can luckily be solved with strong fiscal polies as well as a conducted financial statement.

Foreign exchange rates are also one of the hardest things to foresee since it changes every time creating uncertainty for companies. Constant fluctuations of exchange rates in a countries can severely slow down a company’s business abroad and expose them to higher interest rates. When it comes to bank regulations, some countries go hand in hand with banking institutions such as the world bank and the international monetary fund. That can cause a problem for global businesses because those institutes recommend banks to not take risks in markets especially if they are emerging countries.

During the recent times, Ford had faced four financial challenges in an attempt to restructure.

The first one was regarding costs and weak earnings. In 2019, Ford announced that it would be applying an $11 billion reconstructive plan so that the company focuses solely on SUV’s and trucks. This initiative was not planned strategically nor was it financially concise, that it made the company’s net income to decrease by 57% ($423 million), year after years with the aggregate revenue also plunging by 1.8% (about $37 billion).

The second one was because of weak guidance, that didn’t move the adjusted earning but that was supposed to increase if they followed it up. but since its stock is so lowly priced, it doesn’t actually change anything anyways, and the downside is minimal.

The third one is terms of weak sales, like in North America ever since they stopped producing sedans, the whole company market share had decreased while the revenue increased but still the segmented auto revenues heavily weakened. In China as well, the once promising sales land has slipped and fell of about 27% in revenues (0.6% decrease in market share).

The fourth one would be the stocks, even though the auto-industry is known to be cyclical in nature, the F-series of Ford motors have been going strong. But as it is recurring, there will be a possible slowdown that might or not create a recession. After all, one of the man indicators of a high consumer spending scale are auto sales, and Ford will not be getting any more shares with how it is going besides the earning growth. So as of now with the exception of the dividend yield’s sustainability, investors are not advised to invest in auto stocks.

Hence to solve these problems now or in the future, the company’s current key responsible international finance managers: David Webb, John Lawyer and William Clay Ford jr. need to over review their strategies. David Webb is the current treasurer at Ford, he is responsible for managing the financial aspects of the company by making decisions on investments or acquisitions. He also works with executive managements to supervise the company’s global objectives and cash management. Prior to being an official treasurer, Webb served as Ford’s assistant treasurer, directing the company’s global Capital Markets, Capital Strategy, Risk Management, Affiliate Finance, banking, and Treasury Operations functions. Webb was also previously director of financing, where he was in charge of Ford global issuance strategy and credit’s funding programs. When he first started his career in 2003 at Ford Motors, he was able to get the director of risk management position where he developed strategies by analyzing overall performances of the company thus far. At the same time, he was the financial strategy department director, where he supervised liquidity and funding strategy, and the company’s global capital.

Then David reports to John Lawler who is the chief financial officer of Ford Motors. John Lawler as a CFO is mainly responsible for the whole finance functions plus taxes, financial accounting planning, treasury, investor relations, etc. previously he was the chief executive officer of Ford’s LLC Autonomous vehicles and was vice president where he brought the driverless market sector by leading the team. He was also Vice President of Strategy at the time. He led Corporate Strategy, Business Development, and Global Data Insights and Analytics in this position, facilitating the development of Ford’s long-term enterprise strategy and assisting in the delivery of vital partnerships such as those with VW and Mahindra.

From 2016 to 2017, Lawler worked for Global Markets as a vice president, corporate controller, and chief financial officer. He was a vice president/chairman, chief executive officer of Ford China before taking on the position of corporate controller. Lawler was in charge of Ford’s activities and company leadership in China at the time. Ford’s growth had hit record levels before he left in June 2016, with over one million Ford vehicles sold in 2015 and sales up another 14% in the first quarter of 2016. Lawler has extensive international business management experience, especially in the areas of market research, pricing strategy, and product programs. From January 2007 to 2010, he was a key member of the team that led the company’s North American turnaround, serving as controller of U.S. Marketing and Sales before heading to China in 2010. In the United States, he was in charge of core business strategies such as pricing and business planning, as well as leading the company’s attempts to simplify distributor policies and reduce uncertainty. He joined Ford in 1990 and has worked in North America, Europe, and Asia in a number of capacities.

Ultimately Lawyer then finally reports back to the executive chair Mr. William Clay Ford Jr who is the leader of the company for final touches in the international finance activities with all of the financial team’s collective effort put together with the help of these financial institutions that have helped partner up with Ford, such as: Citibank, G-mac, HDFC, etc.

Capital structure and global subsidiaries

For companies like Ford, Debt is an essential part that constantly needs to be reviewed. Debt is for the most part is money borrowed by another party that has to be paid back, sometimes even with interest. For big companies like Ford debt arrangement can help make large purchases that is normally not authorized. It is a big discussion topic amongst investors since it is a key cause in companies facing bankruptcy. If Ford has too much debt and is on the verge of defaulting, the company may need to take drastic measures, such as debt reduction and asset sales. To determine the amount of debt, we use the Debt-to-Equity Ratio, which is measured by diving the long-term debt by the stockholder’s equity to find the company’s financial leverage. First, we see Fords recent total Debt history and as of now Ford Motors debt to equity ratio 5.28%.

According to the graph, we can see that Ford’s total debt increased between 2017 and 2020, reaching $161 billion in the fourth quarter of 2020. Ford’s overall debt was about $150 billion in the years leading up to 2020. Ford’s overall debt rose the most in 2020, reaching a new peak of more than $170 billion in second quarter of 2020, as the firm took on debt to raise liquidity during the outbreak of COVID-19. But we can see that by the fourth quarter its total debt slightly decreased after it paid off its credits. When we compare it to the total breakdown of the company, we can see that most of its debt came from the credit and automotive line. We can see on the graph above and below that the Ford’s credit line made up of 85% of the total debt in the last quarter of 2020 and accounted nearly 140 billion dollars in contrast to the automobile line that accounted $20 billion.

Ford Credit’s debt is expected to decrease in 2020 due to the fact that it operates under a radically different business model than Ford Automotive. As I have mentioned above, Ford credit provides credit lines to Ford motors products at dealerships and helps customers with commercial financing, so it is the company’s captive financial unit, offering services such as lending and leasing to wholesalers and retail customers. Because of the pandemic, its credit line which consists of also vehicles like the Lincoln may have an effect on the amount of originations. In other words, Ford Credit’s debt rises during a strong economic cycle but falls when the automotive market climate deteriorates because less consumers will sign up for Ford Credit’s leasing contracts. Furthermore, Ford Credit’s debt is relatively secure since it is typically backed by cash obtained from Ford’s finance receivables.

The other side of the breakdown is the automobile sector. As seen, its automotive debt grew in by more than 100% in 2020, reaching nearly $40 billion in the second quarter. Prior to 2020, Ford’s automotive debt was around $15 billion, but it began to grow in the first quarter of 2020, to around $25 billion, before peaking at $40 billion in the second quarter. When the recent epidemic hit, in fear of increased debt, Ford took an 8-billion-dollar loan triggering the automotive debt. The extra cash drawn from the credit facilities was supposed to help Ford weather the COVID-19’s negative effects. For your knowledge, the pandemic has forced Ford to shut down most of its assembly plants. Ford would have repaid the majority of the debt drawn from its credit facilities by the fourth quarter of 2020, reducing its automotive debt to $24 billion.

Then finally we see its liquidity assets, the net debt. In order to decide if a corporation is overleveraged or has too much debt in relation to its liquid assets, net debt is used. A business with a negative net debt has little debt and more cash on its balance sheet, while a company with a positive net debt has more debt on its balance sheet than liquid assets.

FDI Activities

Foreign Direct Investment is one of the foreign market entry strategies used by firms to invest in a manufacturing or service sectors. If a company like Ford desires to do an investment abroad it needs to consider a lot of risk factors like; choosing where to invest, low wage rates, government incentives to invest, infrastructure, tax rates, political stability, etc. and what type of FDI to use either a Greenfield or Acquisition investment, which is when a company builds its plant from the start or if it wants to buy another company in that country its investing.

In the United States, foreign investments are highly encouraged and welcomed without a substantial restrictions or control by the federal, state, or local government. The Government even facilitates privatization (selling a state-owned company to private investors). FDI plays an important role in the U.S. economy, it provides prosperity and growth, creates additional jobs, pushes exports and overall is a source of capital and provides higher revenues for a country like the U.S and companies.

Ford has many foreign investments like Mexico, Europe, India, south Africa, etc. Ever since the 19 hundred Ford have been interested in investing in Mexico. It was the first to open an automotive assembly plant in 1925, and other American and Mexican companies followed suit in the following years. Nonetheless, imports supplied 53 percent of domestic passenger car demand by 1960. Its import was getting bigger than its export. A few years ago, it had a couple of downturns because of the former president’s ban, because of that Ford had to abruptly stop an about $1.6 billion dollar car plant which stressed network worth of supplier that were hoping to get a huge number of customers and increase their potential economy.

A number of auto manufacturers had already began expanding in areas where the auto sector was in demand thinking the plantation was going to happen. However, amid former presidents Trump’s pro-American policies, which global automakers have been struggling with since his election, Ford continues to expand its operations in Mexico.

As previously stated, after the company agreed to forego the $1.6 billion investment, it revealed that the Focus operations would be relocated to its Hermosillo facility. By oblige to the president some cars will still be made in Mexico, Ford’s decision to abandon the San Luis Potosi project was a major “win” for him. Ford, on the other hand, announced in February 2017 that, in addition to Hermosillo, it will be going ahead with intends to increase many of its Mexican plantations in Chihuahua and Irapuato.

So, after all these complications in the future Ford may come back to Mexico since it still has other operations there, with the future president’s acceptance it could potentially happen. Another one of its newer investments is in South Africa. It is said that it is estimating to invest about 1.05 billion dollars in operations, manufacturing and to expand productions of its pick ups and range rovers. According to Andrea Cavallaro, operations director of Ford’s International Market Group, the investments would boost Ford’s installed capacity from 168,000 to 200,000 vehicles.

Ford is joining global automakers Volkswagen, Toyota, and Nissan in increasing production in Africa, which is seen as a wide, untouched resource for new car sales by the industry. it is investing about $683 million in the improvements of infrastructure and new facilities at its plant in Silverton, a suburb of Pretoria, and $365 million in tooling upgrades at major supplier factories in South Africa. As part of the Ford-VW partnership, the plant will also produce Volkswagen pickup trucks. Ford would add 1,200 workers in South Africa as a result of the increased development, bringing the total number of employees in the country to 5,500.

Additionally, the carmaker’s supplier network will add an estimated 10,000 new jobs. By 2024, Ford wants the Silverton plant to be fully energy self-sufficient and carbon free, according to Cavallaro. South Africa’s automotive industry has lofty goals, placing it at the center of efforts to resurrect economic development and reduce unemployment by industrialization. South African President Cyril Maphosa said at Ford’s announcement that the company had already assisted in the recruitment of 12 automotive component suppliers to the region.

The government’s program, which is backed by investment and tax incentives, aims to more than double the industry’s annual output to 1.4 million vehicles by 2035 and increase the proportion of auto components produced locally to 60% from 39%. The COVID-19 pandemic, on the other hand, has harmed the targets, with local sales and exports falling by about 30% last year. Another recent investment is of the January 2021 as Ford Motors company has announced to invest $580 million in Argentina so that it manufactures its trucks there.

References

1) Gupta, L. (2020, June 22). Ford’s Revenue by Region (2010–2021). Business Quant. https://businessquant.com/ford-revenue-by-region

2) Butler, D. (2019, October 30). 4 Problems Facing Ford. The Motley Fool. https://www.fool.com/investing/2019/10/30/4-problems-facing-ford.aspx

3) Dave Webb | Ford of Europe | Ford Media Center. (2020). FORD MEDIA CENTER. https://media.ford.com/content/fordmedia/feu/en/people/dave-webb.html

4) Staff, R. (2021, February 2). Ford to invest $1 billion to upgrade South Africa operations. U.S. https://www.reuters.com/article/us-ford-motor-safrica/ford-to-invest-1-billion-to-upgrade-south-africa-operations-idUSKBN2A210U

5) Chan, C. K. (2021, April 21). Is Ford’s $160 Billion Debt A Cause For Concern? Cash Flow Based Dividends Stock Screener. https://stockdividendscreener.com/auto-manufacturers/ford-total-debt-and-leverage-ratio-analysis/

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal