Effects of Gearing on the Cost of Capital of the firm

| ✅ Paper Type: Free Essay | ✅ Subject: Finance |

| ✅ Wordcount: 3376 words | ✅ Published: 23 Sep 2019 |

COPORATE FINANCIAL MANAGEMENT

“A Report on Critical Research on Effects of Gearing on the Cost of Capital of the firm: A Case Study from NYSE CHEMICAL COMPANIES”.

INTRODUCTION

We are an established boutique client investment firm based in the Irish Financial Services Centre. Our Company Fire Investments Inc. was established in 1988 and has continued in being successful in acting as a personal investment manager for number of a high net-worth individuals based throughout the world.

We are working in the research wing of the firm. We are a team of 4: – Chhavi, Divya, Niraj and Shrenik. Recently we were approached by the Managing director of the firm to work on a new project based on analysing the effects of gearing on the overall cost of capital of the firm. He furthered requested the MD to submit our report based on real life examples.

To begin this research, we as team started from the very scratch dissecting each component and then coming to the final conclusion.

Capital structure of any firm is made up of Equity, Long Debt and Preference shares. A firm may choose to use the mix of these, in the manner most suitable as per their financing and investment needs. According to Saurabh Chadha (2015, pp.295) “capital structure aims at two important concerns, first to maximize the value of the firm and the second is to minimize the overall cost of capital”.

EQUITY: This is the investment made by the owners in the firm in form of common stocks. They have the highest risk as their return in form of the dividend or the principal investment is not guaranteed. They will get the dividend only when earnings are available for distribution after repayment to the lenders and payment of the dividend to the preference shareholders. (Peter Artill, 2017, pp.249) As the owners take more risk, their return expectation is also more. This makes this source of finance relatively less risky but costlier.

DEBT: Debt consists of Short-term debt like bank overdraft, debt factoring, invoice discounting and Long-term debt like finance leases, securitization of assets higher purchase agreements, bonds and debentures.

Debt has long term commitment to pay to the lender the principal amount along with the interest in a timely manner. The interest payable is tax deductible expense. As a result, it is less costly then equity. As the component of the financial distress is associated with the debt, it increases the risk for the firms.

PREFERENCE SHARES: They offer a lower risk to the investors in comparisons to equity as they are paid dividend at a fixed rate and before equity shareholder. But the dividend Paid is not tax deductible and as a result it is costlier then debt.

NOTE: Many companies consider preference shares as a part of Long-term Borrowings and the cost incurred by companies by issue of preference shares is included in Cost of Debt (Kd).

If a firm uses debt in its capital structure, then it is a levered firm. Firms with no debt and only equity in their capital stature are un-levered firms.

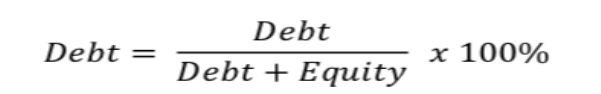

Gearing ratio is the ratio of debt and equity which states the relation between the owner’s funds and the lender funds (Saurabh Chadha etc., (2015, pp.295). Gearing ratio is the percentage of debt in the total capital of the company. For our purpose we have use the formula

For computing the cost of capital or the total cost for using various long-term sources of finance available to the firm, we calculate WACC (Weighted Average cost of capital). This is derived by multiply the cost associated with each source of finance with its corresponding portion in the capital structure and then adding them to get the overall cost.

The client that approached us wants to know in what way debt affects the cost of capital

(PIC: FIRST INSTITUTION PP.12)

(PIC: FIRST INSTITUTION PP.12)

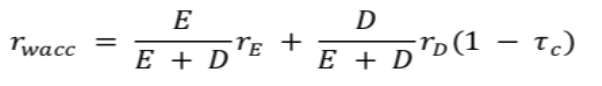

TRADITIONAL VIEW ON GEARING AND ITS IMPACT ON THE COST OF CAPITAL OF THE COMPANY:

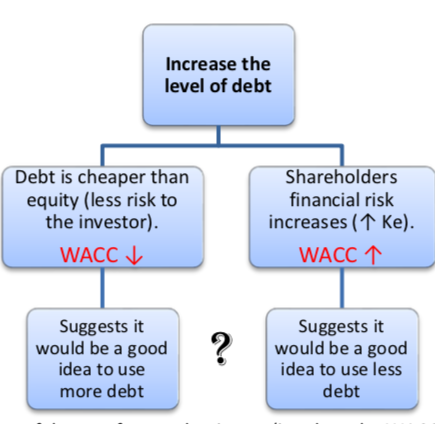

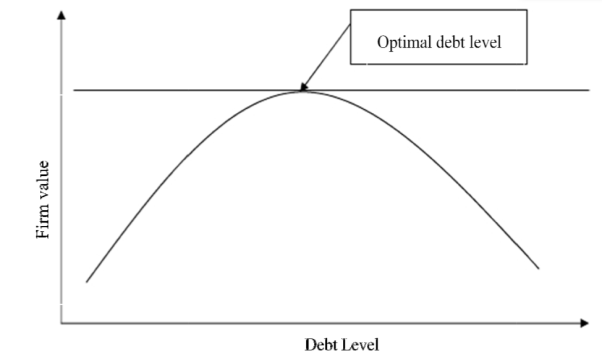

According to the Traditional Theory of Capital Structure an optimal capital structure is one in which debt and equity are in the proportion that; The Weighted Average Cost of Capital is minimized, and the market value (MV) of the firm which is the total of MV of debt + MV of equity, is maximized (FIRST INSTITUTION PP.9)

According to this theory, initially the market value of the firm increases till a certain point as we increase the debt in the overall capital structure of the firm. This is because increasing debt initially doesn’t significantly increase the financial risk for the equity shareholders. Debt is a cheaper source of finance in comparison to equity because of the tax shield, as a result the overall cost of capital (WACC) decreases. FIRST INSTITUTION PP.9)

The decrease in the WACC is more than the increase in cost to the equity shareholders, as a result the Market value of the firm increases because of the optimal mix of the debt and equity in the capital structure. (FIRST INSTITUTION PP.9)

After the threshold level, further increasing more debt results in firm being highly geared in a way that its profits or Earning Before Interests and Taxes (EBIT) are insufficient to service its Interest obligations arising because of excessive debt. There is a significant decrease in the “Value of the Firm” due to firm’s over-leveraging.

https://efinancemanagement.com/financial-leverage/capital-structure-theory-traditional-approach accessed on 14th December 2018.

THE OPTIMAL DEBT LEVEL: MAXIMUM VALUE OF THE FIRM

PIC (Hashemi Tilehnouei, 2014, pp. 116)

ANAYLISE THE ALTERNIVE VIEW OF WHAT CONSTITTUES THE CAPITAL STRUCURE

Capital Structure Irrelevancy theory by MODIGLINI-MILLER IN 1958.

PROPOSITION 1

According to this theory, value of the firm is not affected by the capital structure or the financing decisions. For calculating the value for the firm, they considered the real value of the assets. According to them the excess cash flows, discounted at their present value, after meeting the need to fund all the projects having positive net present value is the value of the firm. (Hashemi Tilehnouei, 2014, pp. 114).

According to this theory the value of a leveraged firm is equal to the value of unleveraged firm.

M&M based this theory on certain assumptions which are (Hashemi Tilehnouei, 2014, pp. 114):

1) Capital market operate in an Ideal environment where there are no bankruptcy costs, Transaction costs and no floatation costs like underwriting commotion etc.

2) Individual and corporates can borrow at the same rate of interest

3)There are no taxes

4) Insiders and outsiders have the same access to information as result there is no information asymmetry.

5) Homogenous expectations of returns.

6) All firms have same class of risk.

Based on these assumptions M&M argues that investors can easily indulge in Arbitrage, which is buying the shares of a company which is undervalued and selling the shares of a company which is overvalued. As a result, the value of the shares which are being purchased will increase and the value of the equity shares which are being sold in the market will tend to decline. (http://www.accountingnotes.net/financial-management/capital-structure/modigliani-miller-m-m-approach/6772)

“They demonstrate that arbitrage profits could arise for individuals able to use leverage. Since in equilibrium arbitrage profits a not allowed; leveraged and unleveraged firms should have the same value and therefore the debt-equity ratio is irrelevant.” B.D. Craven, 2013, pp.433).

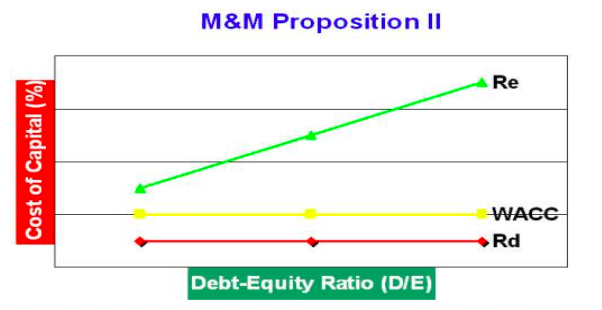

PROPOSITION 2

M&M argue that as the borrowing in the firm increases, so does the financial risk for the shareholders. According to them, the shareholder’s returns expectations increases in the direct proportion to the increase in debt. This results in the cost of capital being constant. Thus, the benefits due to increase in debt, being a cheaper source then equity are offset by the increase in cost to equity. (Peter Artill, 2017, pp.368)

CRITICISM OF M&M

1) Corporate and induvial investors can borrow at different rates as corporate have higher credit ratings.

2) Personal leverage cannot be a substituted for corporate leverage as corporates have limited liability whereas individual investors can go bankrupt.

3) In the real world, transaction and flotation costs do exists. This assumption was theoretically and empirically (Morin and Jarrell, 2001, Leauter,2007) questioned by many authors as cited by B.D. Craven (2013, pp.432).

4) In real world corporate tax exists which further provide a tax shield to the companies.

M&M WITH TAX (1963)

PROPOSITION 1 with TAX

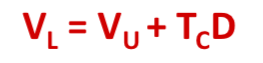

After incorporating the tax benefit due to debt, the value of geared company (VL) is equal to the value of ungeared company (VU) plus the tax benefit (TC) i.e. (1-tax-rate) *interest, D=value of debt

PROPOSITION 2 with TAX

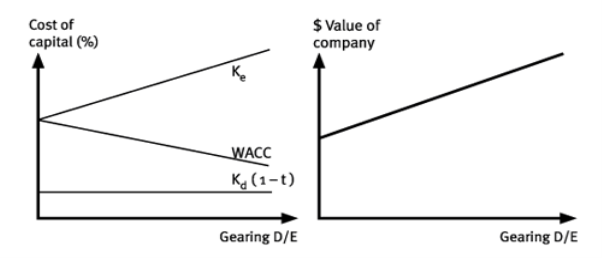

Due to increase in debt the WACC falls and value of the firm  . The benefit of introducing more debt is the tax shield, as it is more than the cost i.e. financial distress, bankruptcy cost and the agency cost or the cost of equity (Ke).

. The benefit of introducing more debt is the tax shield, as it is more than the cost i.e. financial distress, bankruptcy cost and the agency cost or the cost of equity (Ke).

The company should use as much debt as possible.

This is demonstrated in the following diagrams:

http://kfknowledgebank.kaplan.co.uk/KFKB/Wiki%20Pages/Theories%20of%20Gearing.aspx

It is important to consider, that after a certain point there the directors who are acting as the agents for the shareholder, try to maximise their value by taking more loans and investing in lower yielding projects and distributing dividends as a result, the firm is not able to borrow when the actual need for investments is there. This results in loss of investment opportunity, overall low returns for shareholder and ultimately bankruptcy. (Hashemi Tilehnouei, 2014, pp. 114)

ANALYSIS:

According to Traditional Theory, optimum capital structure is one where the Weighted Average Cost of Capital is minimised, and Market value of debt and equity is maximized. We have taken Six Chemical Sector Companies namely:

- QUAKER CHEMICAL CORPORATION (KWR) – Low Gearing Company

- POLYONE CORPORATION (POL) – High Gearing Company

- ASHLAND GLOBAL HOLDINGS INC. (ASH) – Low Gearing Company

- FMC CORPORATION (FMC) – High Gearing Company

- CAVCO INDUSTRIES (CVCO) – Low Gearing Company

- LYONDELLBASELL INDUSTRIES (LYB) – High Gearing Company

Quaker Chemical Corporation:

Quaker Chemical Corporation is a company finalizing its financial statements on 31st December every year. We have attached an Excel Sheet for brief description. Given below is an Extract and Summary:

|

PARTICULARS |

31-Dec-17 |

31-Dec-16 |

31-Dec-15 |

|

GEARING RATIO |

21.64% |

20.15% |

24.95% |

|

COST OF EQUITY (Ke) (M.V) |

4.63% |

4.79% |

4.75% |

|

COST OF DEBT (Kd) (B.V) |

1.08% |

2.06% |

1.56% |

|

WACC (Ko) (Market Value Basis) |

4.45% |

4.63% |

4.83% |

Polyone Corporation:

Polyone Corporation is a company finalizing its financial statements on 31st December every year. We have attached an Excel Sheet for brief description. Given below is an Extract and Summary:

|

PARTICULARS |

31-Dec-17 |

31-Dec-16 |

31-Dec-15 |

|

GEARING RATIO |

70.53% |

65.57% |

64.49% |

|

COST OF EQUITY (Ke) (M.V) |

9.98% |

11.12% |

10.69% |

|

COST OF DEBT (Kd) (B.V) |

3.47% |

3.17% |

4.27% |

|

WACC (Ko) (Market Value basis) |

3.7% |

3.38% |

4.45% |

Ashland Global Holdings Inc:

Ashland Global Holdings Inc is a company finalizing its financial statements on 30th September every year. We have attached an Excel Sheet for brief description. Given below is an Extract and Summary:

|

PARTICULARS |

30-SEPT-2017 |

30-SEPT-16 |

30-SEPT-15 |

|

GEARING RATIO |

46.7% |

44.52% |

55.27% |

|

COST OF EQUITY (Ke) (M.V) |

3.69% |

3.77% |

3.86% |

|

COST OF DEBT (Kd) (B.V) |

5.79% |

6.16% |

3.63% |

|

WACC (Ko) (Market Value basis) |

5.75% |

6.11% |

3.63% |

FMC Corporation:

FMC Corporation is an Agricultural Chemical Speciality company finalizing its financial statement on 31st December every year. We have attached an Excel Sheet for brief description. Given below is an Extract and Summary:

|

PARTICULARS |

31-Dec-17 |

31-Dec-16 |

31-Dec-15 |

|

GEARING RATIO |

61.78% |

58.51% |

61.62% |

|

COST OF EQUITY (Ke) (M.V.) |

0.54% |

0.76% |

1.01% |

|

COST OF DEBT (Kd) (B.V) |

3.50% |

5.33% |

18.27% |

|

WACC (Ko) (Market Value Basis) |

0.99% |

1.63% |

1.78% |

CAVCO Industries:

Cavco Industries is a Chemical Trading Company finalizing its financial statement on 31st March every year. We have attached an Excel Sheet for brief description. Given below is an Extract and Summary:

|

PARTICULARS |

31-March-18 |

1-April-17 |

2-April-16 |

|

GEARING RATIO |

8.29% |

15.56% |

17.61% |

|

COST OF EQUITY (Ke) (M.V) |

20.35% |

16.45% |

21.63% |

|

COST OF DEBT (Kd) (B.V) |

17.32% |

12.23% |

10.34% |

|

WACC (Ko) (Market Value Basis) |

20.35% |

16.45% |

21.64% |

LYONDELLBASELL INDUSTRIES:

Lyondellbasell Industries is a Speciality Chemical manufacturing and trading company finalizing its financial statements on 31st December every year. We have attached an Excel Sheet for brief description. Given below is an Extract and Summary:

|

PARTICULARS |

31-Dec-17 |

31-Dec-16 |

31-Dec-15 |

|

GEARING RATIO |

54.74% |

63.45% |

46.33% |

|

COST OF EQUITY (Ke) (M.V) |

3.14% |

3.16% |

3.23% |

|

COST OF DEBT (Kd) (B.V) |

4.02% |

2.13% |

4.56% |

|

WACC (Ko) (Market Value Basis) |

3.41% |

2.67% |

3.63% |

EFFECTS OF GEARING RATIO:

Every Business, irrespective of its industry or sector majorly finances its operations with combination of suitable proportion of Owner’s Fund (Equity) or Outsider’s/ Borrowed Fund (Debt).

This demonstration is regarded as gearing ratio which indicates the extent of financial risk borne by long term debt holders and equity holders and expressed as the relationship between fixed interest capital and ordinary share capital. (Siyanbola, Olaoye, Olurin (2015))

Financial risks are those risks created by having debt in a company’s capital structure. This is the risk of a company not being able to meet other obligations as a result of the need to make huge interest payments.

Dangers of High Level of Gearing:

At times, due to high gearing ratio company may not be able to settle business Trade Payables within the time limit which may hamper further growth and expansion of the company.

Due to commitments of paying higher fixed cost in form of Interest, companies at times tend to Increase Sales Price which may drive the company’s customers towards their competitors resulting in Risk of Losing Revenues of the company.

Due to high financial liability, the credit ratings of the company may fall down which results in Insolvency of the company or if the company has adequate profits, the financial institutions may lend loans to highly geared company at higher rate of Interest as there is lot of risk involved, which will result in Increase in Cost of Debt and also Increase in Overall Cost of Capital of the Company.

High level of Gearing would make all shareholders unsatisfied as primary objective of every company is to maximise the wealth of the shareholders. Since heavy amount of Interest Liability would decrease Profits of the company resulting into Low Dividend Pay-out to the Shareholders.

EVALUATION OF PERCIEVED EFFECT ON SIX CHEMICAL SECTOR COMPANIES.

Quaker Chemical Corporation is a relatively low gearing company, borrowing lower amount of debt at cheaper rate of Interest forming lower Cost of Equity. The company is able to borrow outsiders fund mainly due to less risk and good profit margins and also due goodwill of the company. On the contrary, equity funds where proved to be expensive as compared to debt funds of the company. But overall weighted average cost of capital of the company reduced over the years, from being 4.83% in the year 2015 to 4.63% and 4.45% in the year 2016 and 2017 respectively. Hence, it can be inferred that this company being low gearing and less risky is capable to manage to obtain cheap source of debt and equity finance.

Polyone Corporation is relatively high gearing company, reliably majorly on the outsider’s funds as a source of its finance. Although being a high gearing company, due to adequate and consistency in its profit margins is able to obtain Debt at a cheaper rate. Every year pre-tax cost of debt to the company is around 5-7%. The overall cost of debt has reduced over years for the company, from being 4.27% in 2015 to 3.17% in 2016 and 3.47% in 2017. On the other hand, Cost of equity being relatively expensive means of finance over debt is 10.69% in 2015, 11.12% in 2016 and 9.98% in 2017. The cost of equity has initially increase and then slightly declined as per the expected market return of the shareholders and earnings of the company. Being a Highly Geared Company and earning stable profits, the company has managed to maintained its Weighted Average Cost of Capital between 3 to 4.5 % in three years by using more debt costing cheaper to the company between 3 to 4%.

Ash Global Holdings Inc. is relatively low gearing company having its Gearing Ratios as 55.25% in 2015, 44.52% in 2016 and 46.7% in 2017. But over the years, due to fluctuations in effective tax rate (Interest is Tax Deductible Expense) the cost of Debt has increased from 3.63% in 2015 to 6.16% and 5.79% in 2016 and 2017 respectively. On the other hand, cost of equity is too low as company is low gearing and hence, less risky. The cost of equity has reduced slowly over the years from 3.86% in 2015 to 3.77% and 3.69% in 2016 and 2017 respectively. So, over the years the overall weighted average cost of capital to the company has increased from 3.63% in 2015 to 6.16% and 5.79% in 2016 and 2017 respectively. So, it can be inferred that by taking market value of equity for computing WACC, the cost of equity and WACC is also more or less similar due to high weight of market value of equity as compared to weights of book value of debt.

FMC Corporation is highly geared company having a higher market value of its shares. The overall cost of capital of the company has reduced over the years from 1.78% in 2015 to 1.63% and 1% in 2016 and 2017 respectively due to higher weights of market value of equity as compared to book value of equity.

Cavco Industries is a relatively low gearing company having its Gearing Ratios at 17.61% as on 02-04-2016; 15.56% as on 01/04/2017 and 8.29% as on 31/3/2018. Over the time, Cavco Industries has witnessed Increase in its Cost of Debt Capital from 10.34% in 2016 to 12.23% and 17.32% respectively in 2017 and 2018. So, for the company debt has traded to be expensive over couple of years. On the other hand, Cost of Equity (Ke) was 21.64% in 2016, then declined to 16.45% in 2017 and raised up to 20.35% in 2018.

Lyondellbasell Industries is a High Gearing Chemical Sector Company having its cheaper cost of debt; cheaper cost of equity and cheaper Weighted Average Cost of Capital. The WACC of the company was 3.41% as on 31/12/2017; 2.67% as on 31/12/2016 and 3.63% as on 31/12/2015.

Conclusion:

The cost of capital of the company’s can be used as HURDLE RATE (Discount Rate) to evaluate and appraise the potential projects for the companies using NPV.

As the primary financial objective of every company is to maximise shareholder’s wealth, then companies should seek to minimise their WACC. In the real world, this can be attained by having some proportion of debt in the overall capital structure, as debt is a cheaper source of finance and cost of debt is a tax-deductible expense, while avoiding the extremes of too little gearing (WACC can be decreased further) or too much gearing (the company suffers from bankruptcy costs, agency costs and tax exhaustion). Companies should pursue sensible levels of gearing keeping in mind earning capacity of the company.

Companies should be aware of the pecking order theory which takes a totally different approach, and ignores the need for an optimal capital structure in the company. It suggests that when a company wants to raise finance it does so in the following pecking order: first is retained earnings, then debt and finally equity as a last resort as retained earnings and debt are considered cheaper than equity in the sense that Interest paid on debt is comparatively lower than dividends on equity and use of retained earnings saves floatation cost of issuing fresh equity and thereby diluting existing stake of the shareholders.

The WACC is used by the Companies and Investors to ascertain and evaluate the financial stability and ability of the company to pay its finance provider (Internal -Equity Shareholders and External – Debenture Holders; Banks; Preference Shareholders) out of the Revenue generated by the company. Only WACC will depict the overall cost to the company and not the profitability in the practical world as M and M theory takes some assumptions which are not in-line with real world.

BIBILIOGRAPHY AND CITATIONS:

- Peter Atrill (2014), “Financial Management for Decision Makers”, 7th Edition

- Obaidullah Jan (2018), “Gearing Ratios” available at https://xplaind.com/908989/gearing-ratio accessed on 11th December 2018.

- Myers, S. C., & Majiluf, N. S. (1984, July). “Corporate Financing and Investment Decisions” – When Firms Have Information That Investors Do Not Have: National Bureau of Economic Research accessed on 14th December 2018.

- Chen and Jung (2011), “How the Pecking-Order Theory Explains Capital Structure”; accessed on 14th December 2018.

- Sibandi and Athenia (2016); “Determinants of Capital Structure” accessed on 15th December 2018.

- Miller (2009;) The weighted average cost of capital is not quite right: reply to M. Pierru. Q Rev Econ Finance 49:1213–1218 accessed on 15th December 2018.

- Siyanbola, Olaoye, Olurin (2015); “Impact of Gearing on Performance of Company”, Arabian Journal of Business and Management Review; Vol. 3, No. 1

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal