Analysis of Dividend Policy

| ✅ Paper Type: Free Essay | ✅ Subject: Finance |

| ✅ Wordcount: 2550 words | ✅ Published: 23 Sep 2019 |

DIVIDEND POLICY

Introduction

The goal of corporate finance is to maximize the wealth of the shareholders. Companies pursue this goal through their capital budgeting, financing and dividend decisions. Dividends occur when the companies are generating profit, and that is when they should decide whether to distribute dividends to their shareholders, or to reinvest the profit into the business. The process of distributing dividends starts on the declaration date, which is when the board of directors announce a dividend distribution. The statement includes the size, date of record and payment date, and when the dividends are declared it becomes a debt to the company. Consequently, after the record date has been determined, the ex-dividend date is set, which means if an investor purchases the stock on or after the ex-dividend date, they will not be eligible to receive the dividend. These dates are usually important because many studies have shown that it has an effect on stock prices. Furthermore, realising over time the importance of dividends in satisfying shareholders expectations, managers believe that dividend policy has an effect on share prices. The impact of dividend policy has been a primary argument among researchers, especially following the dividend irrelevance hypothesis of Miller and Modigliani (1961) which argued that, in perfect capital markets, the value of a firm is independent of its dividend policy. However, several market imperfections may exist, including taxes, transaction cost, information asymmetry, and agency cost. The examination of dividend policy has produced mixed and inconclusive reviews, “The harder we look at the dividend picture, the more it seems like a puzzle, with pieces that just do not fit together” (Black, 1976).

Dividends versus Share Repurchases

Companies reward shareholders by providing dividends or share buy backs. Dividends are share of the regular profits after successful quarters that are equally distributed to shareholders based per share. Buy backs provide an avenue to return excess capital to shareholders by reducing the number of outstanding shares in the market.

Furthermore, buy backs are pro-cyclical which means that they are more versatile and increase firms’ financial flexibility (Allen & Michaely, 2005). This shows an increase in temporary earnings rather than permanent earnings, that of dividends. Buy backs are used by management when they want to leverage their position in the company or to reduce their stock declining during recession to portray stability to the public. When a company repurchases shares, it shows a signal that they believe the share is undervalued or overlooked by analysts (Brav et al., 2005). Companies must be able to repay their liabilities and produce a free cash flow prior to any buy backs, meaning that they are mainly debt free. To put it simply, buy backs are a productive way of returning surplus capital to shareholders (Grullon & Ikenberry, 2005).

Unlike buy backs, using dividends as a way of indicating growth and profitability can be extremely costly for the company and its future. Moreover, dividends require a huge sum of cash and are required to be steady in nature. Companies pay out dividends from their after-tax profits which are then taxed again when investors receive it, which significantly reduces its primary value (Fama & French, 2001). In countries like India, companies pay corporation tax and then distribution tax on payment of dividend before the investors pay tax on it as an income. This shows the dividend being taxed thrice before actually receiving it. Hence institutional investors in India filter out such companies.

Without taking taxes into account, the duo have similar concepts with both providing cash flow. However with taxes, a general buy back proves to be more preferable for shareholders. As buy backs increase the EPS by reducing the number of outstanding shares in the market, it consequently increases the P/E ratio and in the long run raising the ROE. Generally, buy backs are taxed at a capital gains tax rate whereas dividends are subject to ordinary income tax (Masulis, 1980).

Other investors, such as technology investors prefer excess capital gains, hence they would look at the maturity and the business operations of it. In addition, growth investors that prefer company reinvestments would generally opt for non-dividend paying companies. On the other hand, high dividend paying stocks have a clientele of those investors looking for a particular dividend payout ratio on a comparable income level or tax considerations. Lastly, young shareholders may wish for a free cash flow business to reinvest profits and fund its own growth.

Theories of Dividend Policy

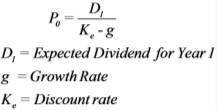

There are several prominent theories and schools of thought that have shaped corporate finance today and what companies view as the optimal distribution of dividend payments. Myron Gordon’s view on the matter in 1959 is a classical school of thought regarded as the ‘bird in the hand’ argument, and is shared with other renowned researchers in the field in the early 1960’s, namely James Walter as well as Graham & Dodd (Cozorici, 2015). They state that dividends are always preferred over capital gains through retained earnings, as investors see cash dividend payments as reduced uncertainty about future cash flows. This means that a firm’s dividend policy does have an impact on the firm’s value. Gordon’s theory revolves around his Dividend Discount Model, which is used even today to value firms. With the reduced uncertainty that comes with higher dividends, this would lead to lower required return, which in turn will decrease the denominator [Ke-g] and increase the firm value [P0] (Saravanakumar). Walter’s theory is also based on Gordon’s Growth Model but also takes the firm’s retention ratio into account, not just growth rate. According to Graham and Dodd, a dollar of dividend causes a much greater increase in firm value than a dollar in retained earnings, by around four times. (Tanushev, 2016)

There are several prominent theories and schools of thought that have shaped corporate finance today and what companies view as the optimal distribution of dividend payments. Myron Gordon’s view on the matter in 1959 is a classical school of thought regarded as the ‘bird in the hand’ argument, and is shared with other renowned researchers in the field in the early 1960’s, namely James Walter as well as Graham & Dodd (Cozorici, 2015). They state that dividends are always preferred over capital gains through retained earnings, as investors see cash dividend payments as reduced uncertainty about future cash flows. This means that a firm’s dividend policy does have an impact on the firm’s value. Gordon’s theory revolves around his Dividend Discount Model, which is used even today to value firms. With the reduced uncertainty that comes with higher dividends, this would lead to lower required return, which in turn will decrease the denominator [Ke-g] and increase the firm value [P0] (Saravanakumar). Walter’s theory is also based on Gordon’s Growth Model but also takes the firm’s retention ratio into account, not just growth rate. According to Graham and Dodd, a dollar of dividend causes a much greater increase in firm value than a dollar in retained earnings, by around four times. (Tanushev, 2016)

In 1961, Miller and Modigliani rebutted this theory as they believed that a firm’s risk, and therefore its value, was based on the riskiness of the firm’s cash flows and the quality of their earnings, not how these earnings were distributed. This idea brought about their Dividend Irrelevance Theory, which stems from and shares the same assumptions as their fundamental theory that capital structure, in terms of debt-to-equity ratio, does not affect firm value. (Miller & Modigliani, 1961) Their school of thought of dividend policy states that the value of a firm’s stock should be the same no matter what dividend payout they offer, ceteris paribus. This means that shareholders should be indifferent between receiving gains from cash dividend payments or from additional proceeds from the sale of a stock due to capital appreciation. This assumes that the shares are very liquid, meaning they can be converted to cash instantaneously, which is not always the case. Another significant flaw that this theory has is that it assumes there are no taxes for corporations and for investors, which neglects a major difference between dividends and share repurchases as previously mentioned in this paper. It is also implied that there is no information asymmetry between the firm and the investors which is a notion that in fact does affect investors’ preference because if investors knew the outcome of the firm’s reinvestment, they might be indifferent between capital gain and dividend gain, or possibly prefer capital gain. However, in the practical sense information asymmetry does exist, and therefore the uncertainty embedded in reinvesting earnings persists, reinforcing the ‘bird in the hand’ argument. Later in 1985, Merton Miller discussed dividend policy with the assumption that information is in fact asymmetric, and discussed how dividend announcements affect share price and act as a signal to the public. (Miller & Rock, 1985)

Dividend Signalling

Dividend signalling theory developed to explain the relationship between the change in the firm’s dividend policy and the signal the investors receive about the future of the firm’s performance. An increase in dividend payouts can cause a positive abnormal return in the stock price, while a decrease in dividend payouts will result in a decrease in the stock price (Bernhardt, Douglas & Robertson, 2005). The manager of a company has private information related to the firm’s performance and future that is not available to investors, who only receive the public information. Therefore, increasing the dividend is a way for a company to send a positive message to the public investors about the company’s future cash flow. Another reason for a positive abnormal return is that the company will have less cash in hand, which will signal a reduction in the risk of agency costs (Officer, 2011).

All public companies disclose their financials and other information about risk, performance and future outlook. Firms can deliver information to the public through financial analysts and financial press. The role of disclosure in capital markets is a very important role because it is the main source of information for outsiders and investors; however, not all companies deliver the same level of information or the same level of analyst coverage and press coverage (Healy & Palepu, 2001).

Miller and Rock (1985) developed a model that links the relationship between a firm’s level of asymmetric information and its dividends. A firm that has a high level of asymmetric information will pay a higher dividend than a firm with more public information because it will try to signal to investors that the firm has a higher current earning, which will in turn signal high future earnings. A company with full information delivered by public disclosure or by their financial analysts, however, will not pay as much dividends as a firm with a higher level of asymmetric information to convince its investors about its current and future performance (Deshmukh, 2005). By increasing dividends, a firm will close the gap between insiders (managers and directors) and outsiders (shareholders).

Signalling is very expensive; a firm usually maintains a sustainable level of dividends and only increases the amounts if they are confident about their current and future performance. Miller and Modigliani (1961) claimed that stock price may be affected by the change in dividends in an imperfect market, which developed what is known as the signalling hypothesis. In contrast, Ang (1987) and Koch and Shenoy (1999) argued that a firm with weak and bad future expectations will not be able to signal a positive message to investors. For example, Florida Power & Light Company announced a 32 percent reduction in its quarter dividend, and the market reacted negatively to the news (Soter, Brigham & Evanson, 1996). The reason for the decrease, however, was to finance a new project that would benefit shareholders in future. The stock price later recovered after shareholders realized the reason behind the dividend reduction (Al-Malkawi, 2010).

Empirical evidence

Empirical observations have been an important area in the discussion of dividend policy. There have been many studies on this subject, such as how dividends affect the stock prices, how companies pay a significant percentage of their earnings as dividends, and the questions of dividends versus share repurchases and corporate smooth dividends.

Firms tend to increase dividends when they believe that earnings are increasing in the long run, so that they can maintain dividend payments. Therefore, this implies that dividend increases indicate sustainable earnings. This prediction is also consistent with the dividend smoothing hypothesis. Companies will attempt to smooth dividends over time and not increase their dividend unless they can maintain it in the future. Lintner (1956) observed that firms are mainly concerned with the stability of dividends.

Baker, Powell and Veit (2002) surveyed the financial managers of NASDAQ firms to assess their views about dividend policy issues including the bird-in-the-hand hypothesis. Their questionnaire contains one statement about the hypothesis, stating ‘investors generally prefer cash dividends today to uncertain future price appreciation’. Based on 186 responses, only 17.2% agree with the statement, 28% no opinion, and 54.9 % disagree.

In 1982, Rozeff generated an empirical model to find the optimal level of dividend payout called the ‘Cost Minimization Model’ by taking agency costs and transactions costs into account. He surveyed 1000 firms as a sample for his study from over 60 industries, and found that high dividend is preferred for larger investors that have a high stake in the firm’s stock, but not for investors with less ownership. (Mohanasundari & Priya, 2016)

Conclusion

The decision of whether to pay dividends and how much to distribute is a vital consideration a publicly listed company must make, and is a highly-disputed issue in corporate finance. In this paper, we have discussed the advantages and disadvantages to an investor and firm of dividends versus share repurchases. We also discussed some theories of dividend policy, and whether it is even relevant in determining a firm’s value, and therefore its share price. Lastly, we interpreted the effects of a firm changing its dividend policy, and how that can signal a firm’s performance to the public in a realistic imperfect market, where information is asymmetric.

Works Cited

- Saravanakumar, A., Dividend decision theories are using Modigliani-Miller, Gordon, Radical and Walter’s models.

- Tanushev, C. (2016) ‘Theoretical Models of Dividend Policy’, Economic Alternatives (1312-7562), (3), p. 299.

- Merton H. Miller and Franco Modigliani (1961) ‘Dividend Policy, Growth, and the Valuation of Shares’, The Journal of Business, 34(4), p. 411.

- Merton H. Miller and Kevin Rock (1985) ‘Dividend Policy under Asymmetric Information’, The Journal of Finance, 40(4), p. 1031. Doi: 10.2307/2328393.

- Cozorici, A. N. (2015) ‘Dividend Policy, Signal Information for the Capital Market’, USV Annals of Economics & Public Administration, pp. 87-94.

- Al-Malkawi, H.-A.N., 2010. Dividend policy: A review of theories and empirical evidence. Euro Journals, Inc., (9), pp.171–200.

- Bernhardt, D., Douglas, A. & Robertson, F., 2005. Testing dividend signaling models. Journal of Empirical Finance, 12(1), pp.77–98.

- Deshmukh, S., 2005. The effect of asymmetric information on dividend policy. Quarterly Journal of Business & Economics, 44(1/2), pp.107–127

- Healy, P.M. & Palepu, K.G., 2001. Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics, 31(1–3), pp.405–440

- Officer, M.S., 2011. Overinvestment, corporate governance, and dividend initiations. Journal of Corporate Finance, 17(3), pp.710–724.

- Andres, C. and Hofbaur, U. (2017). Do what you did four quarters ago: Trends and implications of quarterly dividends. Journal of Corporate Finance, 43, pp.139-158.

- Baker, H., Powell, G. and Veit, E. (2002). Revisiting the dividend puzzle. Review of Financial Economics, 11(4), pp.241-261.

- Black, F. (1976). The Dividend Puzzle. The Journal of Portfolio Management, 2(2), pp.5-8.Chen, C. and Wu, C. (1999). The dynamics of dividends, earnings and prices: evidence and implications for dividend smoothing and signaling. Journal of Empirical Finance, 6(1), pp.29-58.

- Deangelo, H. and Deangelo, L. (2006). The irrelevance of the MM dividend irrelevance theorem. Journal of Financial Economics, 79(2), pp.293-315.

- Lintner, J. (1956). Distribution of Incomes of Corporations Among Dividends, Retained Earnings, and Taxes. The American Economic Review.

- Priya, D. (2016). Dividend Policy and Its Impact on Firm Value: A Review of Theories and Empirical Evidence. Journal of Management Sciences and Technology, 3(2347-5005), pp.59-63.

- Brav, A., Graham, J.R., Harvey, C.R. and Michaely, R., 2005. Payout policy in the 21st century. Journal of financial economics, 77(3), pp.483-52

- Grullon, G. and Ikenberry, D.L., 2000. What do we Know About Stock Repurchases?. Journal of Applied Corporate Finance, 13(1), pp.31-51

- Grinstein, Y. and Michaely, R., 2005. Institutional holdings and payout policy. The Journal of Finance, 60(3), pp.1389-1426.

- Masulis, R.W., 1980. Stock Repurchase by Tender Offer: An Analysis of the Causes of Common Stock Price Changes. The Journal of Finance, 35(2), pp.305-319.

- Fama, E.F. and French, K.R., 2001. Disappearing Dividends: Changing Firm Characteristics or Lower Propensity to Pay?. Journal of Financial Economics, 60(1), pp.3-43.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal