Proposal: Causes of corporate failures

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 1944 words | ✅ Published: 30 Jan 2018 |

- Introduction

The issue of corporate failures (CF) became prominent yet again, following the financial crisis of 2007-2008, caused primarily by risky-investments made in the belief of a continuous appreciation in home-values, due to decades of low-interest rates & the era of light-touch regulation[1] [Deregulation & free-markets]. Furthermore, the collapse of Lehman-Brothers; a large investment bank, brought the issue of corporate failures to the fore and hence sparked the researcher’s interest in the subject.

The collapse of Lehman’s has been described as the largest bankruptcy in the world, it was a bankruptcy ten times bigger than that of Enron and it rattled the global and domestic markets in the midst of an economic recession (M. A. Johnson & A. Mamun 2012)[2]. Consequently it is included in the literature-review when looking at the causes of failure in an attempt to answer the research question.

- The Research Question

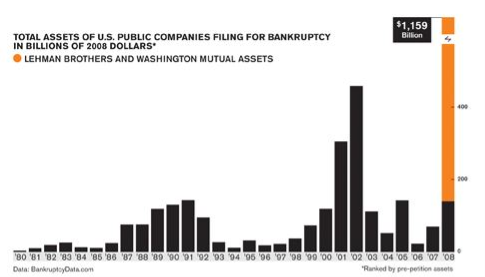

The research question is focused on why corporations fail, particularly the recurring themes from failures. This question is important as the total-assets of companies filing for bankruptcy in the U.S was at $1.159billion in 2008 (Kalwarski T, 2009)[3]. In addition big-businesses in Ireland that went burst in 2010 were five times greater than was seen at the peak of the Celtic-Tiger[4] (O’Carroll L, 2011)[5], with a huge-amount of failures concentrated in the construction-sector. Furthermore, in Lithuania alone the slowdown of the economy amplified the rate of bankruptcies to about 34% in the first half of 2008 (Silvanaviciûtè, S 2008)[6].

Figure 1- Total assets of U.S Public Companies filing for bankruptcy.

Source: Business week, chart by Laurel Daunis-Allen [7]

Therefore, given the financial-crisis of 2008, the globalization of the world economies and the ripple effect of corporate-failures on economies & the society, the need to investigate the recurring themes is vital. (Azkunaga J, San-Jose L, Urionabarrenetxea S, 2013)[8].

This research will prescribe in its recommendations the use of bankruptcy prediction models (BPM) as a way to predict and mitigate the occurrence of future failures. This is important due to the fact that corporations who experience complete failure usually file for bankruptcy under their various national bankruptcy codes.

1.2 Aim & rationale for this research

The aim of this research is to collect data on the causes of/themes in corporate-failures, exploring the recurring themes & the link between the independent-variables [greed, corporate-culture, economic-cycles, corporate-governance, incentive-schemes etc.] and the dependent-variable [Corporate-Failure]. In addition the impact of the economic cycles (a slowdown in the economy/a recession) in failures will be investigated. Furthermore the research will explore briefly the literature on bankruptcy prediction models, so as to make a valid argument for its continued use in the prediction & prevention of failures.

The rationale for this research stems from the researcher’s interest in the issues that led to the recent financial crisis, the collapse of Lehman-Brothers, the need to curb future corporate failures and a will to contribute to reducing the prevalence of corporate failures.

1.3 New & Relevant Research

As at 1988 an integrated theory of corporate-failures was non-existent. Hambrick & D’Aveni noted that the focus was on small business failures and public sector failures, with the existing literature being mainly qualitative (Daughen and Binzen, 1971; Richards, 1973; Starbuck, Greve, and Hedberg, 1978 cited in Hambrick). The quantitative aspects focused only on financial-ratios (Altman 1968) [9], with the only work carried to contrast the above being that of Miller and Friesen’s (1977) to point out the characteristics of large unsuccessful and the more successful firms. The shortcoming of Miller et al 1977 was that their project did not consist of firms who experienced complete failures[10]. (Hambrick, D, & D’Aveni, R 1988)

This research aims to pull together the origins of failures, the relevant themes on corporate failures, the impact of an economic recession on corporate-failures and the use of prediction models in predicting failures/distress. The relevance of this, will be to update the existing literature and put the different aspects together under one piece of work. Something of this magnitude has not yet being done by previous researchers based on the literature-review. Consequently, this research will would be of practical benefit to academics and students seeking to further explore the subject matters of CF and BPM.

1.4 Approach to the research

A top-down approach was followed in in the literature-review and this assisted in the identification of the relevant themes in corporate-failures and assisted in developing a framework which enabled question asking via semi-structured interviews. The research was approached using both primary and secondary research methods. The interview process provided a primary qualitative insight into the viewpoints/experience of professionals/experts in the bankruptcy, insolvency and liquidation industry as to the key themes in corporate failures. Secondary research-methods enabled data collection through a look at the previous cases of failures, newspaper articles, case-studies, reports, peer-reviewed journals etc. The justification for the research approach adopted will be discussed in greater depth in the research methodology [See Chapter 3]. The final objective will be to identify the implications of this research for literature & practice (Williams K, Pg. 68 2013)[11].

1.5 Learning Style & Suitability of the Researcher

The learning style of the researcher follows a methodical & logical approach, going through a step by step process. It is theoretical, involving reading and gathering information from various sources in order to get a broad view of a subject matter. This learning style is appropriate as this research requires sufficient knowledge of the various themes, models & theories pertaining to CF and BPM, generalizations about complex issues, including making necessary inductions.

The researcher is a Master’s in Accounting & Finance student who has completed all taught components of his degree with distinction. He holds an undergraduate degree [BA. (Hons) in Accounting & Finance] from Dublin City University with a significant specialism in accounting. The researcher has studied Corporate-Governance (CG), Quantitative-Methods and attended qualitative and quantitative analysis workshops during his studies, including the use of Nvivo; a qualitative analysis software and SPSS; a statistical software for quantitative data analysis. This would enable the researcher to understand the quantitative or qualitative aspects of this research.

Furthermore, the researcher has conducted literature reviews and attended full year lectures on research methodology, including the use of the fine foundation’s criteria to critique articles and journals. This backs up the researcher’s capacity to understand the various themes and the ability to carry out a reliable analysis and critique of data for research purposes. The researcher’s academic experience and knowledge of working on individual/group projects, word-papers and essays on related themes such as the impact of the financial crisis on banks, the Goldman-Sachs Abacus transaction, regulatory capital requirements and a proposal fantasy-budget sent to the Irish Institute of Taxation, financial & investment analysis of UK & Irish corporations have all laid a foundation to handle the cognitive and challenging aspects of this research.

The need to gather qualitative data through semi-structured & open-ended interviews will benefit from the researcher’s open and engaging approach to formal/semi-formal situations and the experience obtained from previous interviews conducted with the managers of major multi-national companies. The ability of the researcher to listen attentively and ask insightful questions would aid in the collection of good and reliable data.

1.6 Outline of the Dissertation

Title page

Declaration

Table of Contents

List of Tables & Figures

List of Abbreviations

Acknowledgements:

This section thanks & acknowledges those have helped the researcher in completing this research

Abstract:

This serves as a brief synopsis of the research. It includes the aim of the research, how it was carried out, the findings from the literature & primary research and finally the conclusion & recommendations from the research.

This dissertation is divided into seven chapters, which includes sub-headings. The contents of each chapter are discussed below;

Chapter 1: Introduction

This chapter acts as a background to the topic, it goes through the rationale for the research, explaining why the research is new & relevant and the approach to be followed when carrying out the research. The learning style and suitability of the research as pertains to this research. An outline of the dissertation and finally the scope and limitations of the research.

Chapter 2: Literature Review

This chapter explores the literature; origins of failures, the causes & the themes in CF. Therefore it raises awareness of the themes in the area and justifies the research question

Chapter 3: Research Methodology & Methods

This chapter examines the research methodology using the ‘research onion’. It justifies by critical evaluation, the selection of an appropriate research philosophy & approach etc. It explores the options for data collection. It describes the ethical issues that guide the research, the population sample and how data collection, coding and analysis will be accomplished.

Chapter 4: Data Analysis & Research Findings

Data collected using the research methods outlined in chapter 3 will be critically analysed here and the findings will be presented.

Chapter 5: Discussion & Conclusion

This chapter discusses how this research contributed to the area of CF. It draws awareness to the research limitations. It reviews and interprets the research result, consequently drawing a general conclusion by summarising the research findings.

Chapter 6: Recommendations & Future Dimensions

This chapter recommends based on the research findings what could be done to stem the continued menace of corporate failures and prescribes dimensions for future research.

Chapter 7: Self Reflection & Performance

This is the final chapter and it appraises the researchers learning and engagement, looking at the impact this process has had on the researcher personally and academically.

Bibliography

This references the original works and literature used to back-up each chapter of this dissertation.

Appendices

This contains supporting documents: charts, interview transcripts, interview questions, tables, figures etc.

1.7 Scope & Limitations of the Research

This research focuses only on the failure of big-corporations. Therefore it doesn’t take into account why small-business entities fail. The period required to complete this dissertation is a factor that restricted the sample size which was used in the analysis of the recurring themes in failures. A purposive sample-size was used, which permitted for a critical analysis appropriate for the time frame and word count required for this research.

1.8 Contributions of this Research

This issue of corporate failures is not a new topic but this research will update and contribute to literature by highlighting the recurring issues in corporate failures based on the collection of primary data from practitioners in the field of insolvencies, bankruptcy and hence give an updated view on any change in corporate failures themes pre and post the 2007-2008 financial crisis.

[1] Financial regulation: Light touch no more Britain’s financial regulators are getting much tougher http://www.economist.com/news/21567399-britains-financial-regulators-are-getting-much-tougher-light-touch-no-more. Accessed 21st May 2014.

[2] Johnson, M, & Mamun, A 2012, ‘The failure of Lehman Brothers and its impact on other financial institutions’,Applied Financial Economics, 22, 5, pp. 375-385, Business Source Complete, EBSCOhost, viewed 21 May 2014

[3](Kalwarski Tara, 2009) Corporate Failure: The worst may be yet to come. Tara Kalwarski and Laurel Dauni-Allen, Business Week. http://images.businessweek.com/ss/09/01/0129_numbers/index.htm Accessed 12th April 2014.

[4] Metaphor for the Irish economic growth.

[5] Lisa O’Carroll: The Guardian Business failures rising in Ireland http://www.theguardian.com/business/ireland-business-blog-with-lisa-ocarroll/2011/jan/07/ireland .Accessed 2nd June 2014.

[6] Simona Silvanaviciûtè 2008, ‘Estimating the Negative Impact of Business Failures on Lithuania’, Socialiniai Tyrimai, 2008, 4, pp. 113-120, SocINDEX with Full Text, EBSCOhost, viewed 12 April 2014.

[7] Business week, chart by Laurel Daunis-Allen: Total assets of U.S Public Companies filing for bankruptcy http://images.businessweek.com/ss/09/01/0129_numbers/4.htm Accessed 2nd June 2014.

[8] Juan Antonio Azkunaga, Leire San-Jose, Sara Urionabarrenetxea (2013): The impact of financial globalization and financialization on the economy in the current crisis through banking corporate governance. Accessed 12th April 2014.

[9] Altman, EI 1968, ‘Financial Ratios, Discriminant Analysis and the prediction of Corporate Bankruptcy’, Journal of Finance, 23, 4, pp. 589-609, Business Source Complete, EBSCOhost, viewed 12 April 2014.

[10] Hambrick, D, & D’Aveni, R 1988, ‘Large Corporate Failures as Downward Spirals’, Administrative Science Quarterly, 33, 1, pp. 1-23, Business Source Complete, EBSCOhost, viewed 12 April 2014.

[11] Kate Williams 2013: Planning your Dissertation. Pg. 68. Oxford Brookes University, Palgrave Macmillan, Hampshire England.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal