Money Multiplier Mechanism

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 2321 words | ✅ Published: 04 Oct 2017 |

The money multiplier of the money supply was originally developed by Brunner (1961) and Brunner and Meltzer (1964). It’s been used in empirical analyses of money stock control and the impact of monetary policy actions on other economic variables. One important feature of this model is that it decomposes movements in the money supply into the part that is due directly to Federal Reserve policy actions (the adjusted monetary base) and the part that is due to changes in technology and the tastes and preferences of depository institutions and the public (the money multiplier). The behaviour of the money multiplier has changed considerably over time. From 1870 to 1970, it was relatively stable, fluctuating within narrow limits. Since the 70s it has more than doubled in magnitude. During the last ten years the demand for cash by the public has fallen and the demand for bank deposits has increased considerably. The private sector has made greater use of the banks because they have offered interest rates on deposits in order to attract business. As intermediaries, banks have expanded their assets, and bank lending has increased because of shifts in supply rather than in demand. At the same time, banks have been able to lower their cash reserves and expand their lending. This essay will carefully derive the money multiplier mechanism and it will also explain how monetary authorises can influence its size and the money supply in the economy given the recent financial crisis.

Mishkin (2010) stated that high-powered money or the monetary base is the sum of the central’s monetary liabilities (currency in circulation and reserves) and the Treasury’s monetary liabilities (treasury currency in circulation like bank notes and coins) and whereas money supply is the quantity of money. According to Mishkin (2010), the money multiplier tells us how much the money supply changes for a given change in the monetary base. . The money multiplier currently circulating in the economy (Ms) influences the money supply – it can be manipulated through high-powered money (Hm) in the open market operations.

In the first round (Thomas 2010), high-powered money is held either in currency or deposits at commercial banks by the public and this is represented by, where changes in money supply are equal to changes in high-powered money. If individuals hold a fraction in the form of currency, then [1] This will then effect the bank deposits, where changes in bank deposits will be the remainder where [2]

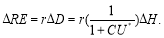

[1] This will then effect the bank deposits, where changes in bank deposits will be the remainder where [2]  Banks would then keep a fraction of its increase as reserves which is represented by r, which is represented by [3]

Banks would then keep a fraction of its increase as reserves which is represented by r, which is represented by [3]  Substituting equation [2] into equation [3] would give

Substituting equation [2] into equation [3] would give  [4] (1-r) is then available to commercial banks to extend credit either by loans or purchase securities and this is represented as follows: [5]

[4] (1-r) is then available to commercial banks to extend credit either by loans or purchase securities and this is represented as follows: [5]  The second round begins with individuals receiving loans of from banks. The individuals hold a portion of the increased money holdings as currency, and the remaining fraction of as deposits. The change in deposits is [6]

The second round begins with individuals receiving loans of from banks. The individuals hold a portion of the increased money holdings as currency, and the remaining fraction of as deposits. The change in deposits is [6]  where the Individuals then deposit them back into the banks, not who will hold some of the increase as reserves and extend credit with what is left, which is [7]

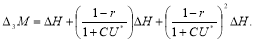

where the Individuals then deposit them back into the banks, not who will hold some of the increase as reserves and extend credit with what is left, which is [7] The third and final round, the expression is written as:

The third and final round, the expression is written as:

[8] , This process continues to infinity and it is in the form of a geometric series as follows: [9]

, This process continues to infinity and it is in the form of a geometric series as follows: [9]

The subtraction of the two geometric series then results in:

[10]  And the expression can be rewritten as: [11]

And the expression can be rewritten as: [11]

We can now derive the money multiplier as (1+CU*/CU*+r), where CU* is the currency deposit ratio, r is the reserves –deposit ratio and H is high-powered or monetary base in other terms. If CU* is 0.2 and r is 0.1, and monetary base was £200m, then the money multiplier would be calculated as follows (1+0.3/0.3+0.1) X £200m = £650m [11] So, this means that the value of the money multiplier is 6.5, meaning that money has circulated 6.5 times around the economy.

Through the differentiation of the multiplier,

And using the quotient rule,

With respect to Cu* and res,  and

and  are acquired. Here, both Cu* and res show a negative relation to Ms.

are acquired. Here, both Cu* and res show a negative relation to Ms.

Since 0 ≤ res ≤ 1, the value of res will be subtracted from 1. Therefore, the result will always be negative. The inverse relationship that Cu* and res have, in accordance to Ms, implies that if more reserves are held at the bank, this will lead to less being loaned out to the public, thus resulting in a lower Ms. Similarly, as more money is held by individuals as Cu*, less is held as De, thus creating less money for the commercial banks to loan out.

There are three main individuals who influence the money supply (Mishkin 2009). The central bank, Bank of England, oversees the banking system in the UK and it is also responsible for Monetary Policy, commercial banks also play a major role. They accept deposits from individuals and other commercial banks as well as businesses. And the third major players are depositors such as individuals and institutions who deposit their money into commercial banks. Bonds are long term financial assets with a maturity of one to thirty years (Pilbeam 2010). They are issued at current prices and the holder is entitled to a steam of coupon payments, which for example, the Treasury will pay them £10 a year for the duration they hold the bond for. Holders may opt to trade their bonds in markets and prices may vary according to market conditions. The Bank of England affects the money supply through three methods; Control by open market operations, the discount rate, where this operation emphasises the Bank of England’s role as lender of last resort and the alteration of the reserve ratio(r).

The origins of the global financial crisis can be rooted to the USA during the period of 2006 to 2008. Excessive lending to high-risk borrowers who were unable to pay back their loans resulted in the banks accumulating vast amounts of toxic loans (Lapavitsas, 2009). As these loans were bundled and sold to investors worldwide, the risks involved were spread globally and so infected many. The lack of confidence resulted in lending ceasing between banks to customers, and between banks themselves (LIBOR Rate). Simultaneously, house prices fell dramatically as homeowners defaulted on their debt. The lack of confidence also lead to mass unemployment and reduced spending. Banks inevitably lost extreme amounts of money and so an illiquid market remained, causing the money supply to drop. A bank run soon followed and resulted in large numbers of people withdrawing money from banks due to speculation and uncertainty over their deposits (Cable, 2009). The people who withdrew all their money increased the “Cu*” and so, “res” increased too. As there was a widespread of toxic loans, banks maintained their stance on no longer lending and so the banks experiencing bank runs were left unable to replace the money withdrawn from their reserves. The likelihood of bankruptcy to various banks became a reality and government intervention was necessary to maintain confidence in the economy. By 2009, the government had provided an estimated £456.33bn in financial support for banks (Rogers, 2011).

These monetary policies targeted potential borrowers by encouraging them to borrow more money from commercial banks. In doing so, they would have more disposable income available to spend in the economy and result in a multiplier effect leading to further GDP growth. From this, there would be increases in “De” and “Hm” due to more money being spent and so, more money circulating in the economy. Individuals and investors will save some of their income as deposits in the bank that would then seemingly use the deposit to loan out to others. However, the actual positive effects from this monetary policy were limited due to the continuous reluctance from commercial banks to continue lending to the public, a consequence of low confidence and high-risk involvement. Therefore, “Cu*” and “res” both remained high whilst “De” continued to be low.

Raising the central bank lending rate is also another way to affect the money supply. The Bank of England lending rate is the interest rate that they charge banks who wish to borrow money. Commercial banks have to hold a prudent level of reserves against unexpected withdrawals, if they find themselves short of cash, then they may have to maintain the minimum ratio by borrowing from the Bank of England. A higher lending rate from the Bank of England will have two effects. Firstly, it will encourage commercial banks to hold more cash reserves than they would otherwise for fear of finding themselves short of cash. Secondly, banks are more likely to raise their own interest rates in line with the Bank of England’s lending rate, which will discourage private sector borrowing. But Randall (2010), a business and political editor, claimed that commercial banks have been charging high interest and approving small amount or even no loans to small and medium business and individuals. While the Bank of England’s base lending rate is 0.5 %( Figure 1) to counteract these increases in “Cu*” and “res” (Bank of England 2010), commercial banks have been charging high interest to lend, some as high as 20%. With the high interest and the refusing for many commercial banks to lend to small and medium business and individuals, many have felt the burden of limited capital and many have collapsed and closed down. This charge is too high as some small and medium firms may not be able to afford the repayments and so run out of currency.

This policy hopes to encourage the purchase of new homes, and further lending from commercial banks due to the reduced risk involved as a smaller sum of money is being loaned out. Likewise, for individuals, the attraction of borrowing increases thanks to the reduced deposit requirements and the lower interest rates. In doing so, money supply should increase through the money multiplier. When the individual has the money and uses it for the purchase of a new property, the person who sells the house will now have the money and will deposit it at a commercial bank until they decide to spend it. This increases deposits in the banks and allows them to loan out – De increases, Cu* and res fall.

As banks are recovering from financial crisis, they need to rebuild their balance sheets just like households do. In addition, thy are very cautious of returning to excessive lending again, not to mention the fact that with unemployment rising and households net wealth fallen, there are very few eligible borrowers who they could lend to (Williams.J, 2014). As a result of all this, most of the extra reserves the Federal Reserve creates are used to replace the toxic assets from the subprime era and held as excess reserves instead of lending them out. This increases the ration of excess reserves to deposits € which reduces the money multiplier, so even if the Fed increases the monetary base, the money supply will fail to follow suit as banks hoard the extra reserves (The Economist, 2009). The monetary transmission mechanism breaks down. This however, provides an explanation for the failure of the Quantitative Easing to increase the money supply through the purchase of assets using the newly created money.

The policies implemented by the monetary authorities aim to increase money supply in the economy, however, each policy has experienced various degrees of success. The use of Quantitative Easing, Funding for Lending and the Help to Buy scheme were key to encouraging lending from banks, with the overall benefits still yet to be fully appreciated. However, lowering interest rates to 0.5% offered little in terms of increased borrowing and lending. Essentially, it is difficult to isolate the individual impact of each policy but, thanks to the policies collectively, the UK economy is no longer in a recession and so it is possible to commend the monetary authorities for their responses.

In conclusion, the essay has shown the ways in which central banks, such as the Bank of England can control the money supply through changes in the rates of interest, open market operations via treasury bills and bonds and the alteration of the reserve ratio. It has also shown that commercial banks play a major part in the money supply, where at recent times, they have been charging well above the Bank of England’s base lending rate of 0.5%. New regulations would need to be put in place to stop this abuse of charging high rates of interest which allows them to make the billions of profits each year. But on the other hand, the government would gain from these huge profits and banking bonus as they would receive increased corporation and income tax.

Word count: 2100 (excluding references and title)

REFERENCES

Bank of England (2010) Available at: http://www.bankofengland.co.uk/ [Accessed 14th December 2014]

BBC (2007) Available at: http://news.bbc.co.uk/1/hi/business/6997765.stm [Accessed: 12th December 2014]

Elliot, L. 2012. Britain’s richest 5% gained most from quantitative easing – Bank of England. [online] Available at: http://www.theguardian.com/business/2012/aug/23/britains-richest-gained-quantative-easing-bank [Accessed: 10 Dec 2013].

IFC – Editorial board. (2014). Journal of International Financial Markets, Institutions and Money, 29, p.CO2.

Labonte, M. (2014). Specialist in Macroeconomic Policy. [online] Available at: http://www.fas.org/sgp/crs/misc/RL30354.pdf [Accessed 12 Dec. 2014].

Lapavitsas, C. 2009. The Roots of the Global Financial Crisis. [online] Available at: http://eprints.soas.ac.uk/7325/1/TheRootsOfTheGlobalFinancialCrisis.pdf [Accessed: 9 Dec 2013].

Mishkin, F.S (2010) The Economics of Money, Banking and Financial Markets 9th edn Pearson Boston

Pilbeam, K. (2010) Finance and Financial Markets 3rd edn Palgrave Macmillan Hampshire

Randall, J (2010) Interviews with leaders in business and finance. Sky News. 14th December 2014

Thomas, G. (2010) Money Supply & The Money Multiplier, the Adjustment Process and the Money Supply in an Open Economy Lecture Notes 2 & 3 [6BUS0341]. University of Hertfordshire 12th December, 2014.

Williams, J. (2014). Federal Reserve Bank San Francisco | Research, Economic Research, Monetary Policy, Money, John Williams, Inflation, Monetary Theory |. [online] Frbsf.org. Available at: http://www.frbsf.org/economic-research/publications/economic-letter/2012/july/monetary-policy-money-inflation/ [Accessed 12 Dec. 2014].

APPENDIX

Figure 1: UK Interest Rates

Source: BBC News. 2009. UK Interest Rates. [image online] Available at: http://news.bbc.co.uk/1/hi/business/7871932.stm [Accessed: 10 Dec 2014]

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal