Labor Intensive and Capital Intensive Country Comparison

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 2583 words | ✅ Published: 20 Nov 2017 |

Surname: KAREKLA

Name: MARIA

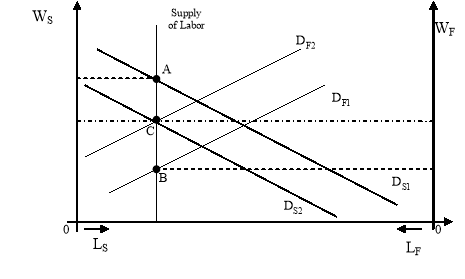

Subject_1.a) Freedonia, being a labor abundant country and Sylvania Being a capital one, have differences in the supply of labor relative to capital, which as explained by Agiomirgianakis and Vlassis (2005)(1) leads to lower wages in Freedonia. As shown in the diagram below the line of supply of labor is fixed for both countries, where A is the equilibrium point for Sylvania’s supply-demand for labor and B is the equilibrium point for labor for Freedonia. Sylvania having a lower labor supply with a shortage of labor relative to capital has a high equilibrium with high wages and Freedonia having a higher supply of labor relative to capital has a lower equilibrium with lower wages. These conditions create the incentive for labor to migrate from Freedonia to Sylvania to obtain higher wages. With no differences in technology and country size, free trade could eliminate the incentive for labor to migrate. Specifically, if Freedonia, being a labor abundant country, exported to Sylvania the labor intensive product, the demand for it would increase, its price would rise and consequently there would be an increase in the demand for labor. The line of the demand for labor would move from its initial position DF1 to DF2. The opposite would happen in Sylvania, where the demand for labor would decrease due to the fall of the price of the labor incentive good and the reduced production of it, since it is now imported. The Sylvania’s demand line for labor would move from its initial position DS1 to DS2. The new equilibrium point for the supply-demand of labor in both countries in now C, where wages are the same for both(1).

1.b) According to the Stopler-Samuelson theory as provided by Wikipedia…. “a rise in the relative price of a good will lead to a rise in the return to that factor which is used most intensively in the production of the good, and conversely, to a fall in the return to the other factor”(2). By this it can be derived that a fall in the price of a good would cause a fall in the return to the factor which is used the most in producing it and a rise in the return of the other factor.

In our case there are two factors, labor and capital, and two goods, a labor intensive and a capital intensive. Sylvania being a capital abundant country, imports the labor intensive good from Freelandia. A subsidize in imports by Sylvania’s government would lead to a fall in Sylvania’s price of the labor intensive good, causing a fall in its production in Sylvania, a fall to the return to the labor factor and a rise to the production of the capital intensive good, a rise to the return to its capital factor. With less demand for labor, wages will fall. Most of the Sylvania’s demand for the labor intensive good would be covered by imports, which would cause an increase in its production in Freedonia, from where it is imported, which creates an increase in Freedonia’s demand for labor, since it’s a labor intensive good, causing an increase in Freedonia’s wages. If imports are issued for the first time to a closed country, trade would actually lead the wages of the two countries to a balance, as it is thoroughly analyzed in the 1a answer, since the demand for labor would rise in Freedonia and fall in Sylvania (fall of the return of labor factor) and the new equilibrium point of the supply-demand of labor in both countries could be as showed in the figure of answer 1a, where wages are the same for both countries and there would be no labor migration. But if the Sylvanias imports subsidize is imposed while in the 1a equilibrium, where wages are similar, the increase in Freedonia’s wages caused as explained above by Sylvania’s imports subsidize, will create a difference in the wages between the two countries. The line of the demand for labor in Fredonia will move from position DF2 to DF3 and point B will be the new equilibrium where Freedonia’s wages are higher than Sylvania’s, causing labor to migrate from Sylvania to Freedonia to obtain higher wages.

Subject_2.a)As the twin deficits hypothesis is explained by Wikipedia, there is a connection between the budget deficit of a country and its current account balance(3). The table and the graph below present the evolution of Greece’s budget deficit (its governments general net lending/borrowing as percent of GDP) and current account balance (% of GDP) using data provided by IMF for the years 1981-2014.

As it can be seen Greece’s governments general net lending/borrowing (%of GDP) is constantly negative (deficit). The same observation is also derived for Greece’s current account balance (%of GDP) with the exception of the last two years (2013-2014) for which, after a long period of decades there is a positive result.

More specifically, as shown in the graph, starting from year 1981, Greece starts with an almost stable budget deficit/GDP of around -5.5% to -7.5%, which deepens for almost a decade from 1985 to 1995, with lowest point that of 1990 where there is a budget deficit/GDP of -14.506%. Continuing, Greece seems to improve it from 1997 to 2003 to levels from -3.098% (1999) up to -5.715% (2003), after which the budget deficit starts to gradually deepen until it reaches -15.647% on 2009, after which an improvement can be observed again that reaches -2.685 on 2014, the best since 1981. In the same time, Greece’s current account balance (%of GDP) being -4.865 on 1981 after a slight fall on 1985 (-7.259), diminishes, reaching a rather high point on 1994 (-0.133), after which it keeps gradually deepening until 2008 when it reaches the lowest point of -15.022. Finally, from 2011 it starts diminishing, overpassing for the first time since 1981 the 0 level, showing a positive balance of 0.731 and 0.697 for the last two years (2013-2014 respectively).

|

Year |

General Government Net Lending/Borrowing (% of GDP) |

Current Account Balance (% of GDP |

|

1981 |

-7.578 |

-4.865 |

|

1982 |

-5.571 |

-3.663 |

|

1983 |

-6.503 |

-4.021 |

|

1984 |

-7.638 |

-4.687 |

|

1985 |

-10.311 |

-7.259 |

|

1986 |

-9.240 |

-3.156 |

|

1987 |

-8.628 |

-1.979 |

|

1988 |

-10.394 |

-1.331 |

|

1989 |

-12.981 |

-3.435 |

|

1990 |

-14.506 |

-3.836 |

|

1991 |

-10.369 |

-1.583 |

|

1992 |

-11.504 |

-1.953 |

|

1993 |

-12.397 |

-0.728 |

|

1994 |

-9.016 |

-0.133 |

|

1995 |

-9.065 |

-2.439 |

|

1996 |

-6.642 |

-3.657 |

|

1997 |

-5.894 |

-5.204 |

|

1998 |

-3.822 |

-4.349 |

|

1999 |

-3.098 |

-5.428 |

|

2000 |

-3.735 |

-7.821 |

|

2001 |

-4.459 |

-7.174 |

|

2002 |

-4.885 |

-6.501 |

|

2003 |

-5.715 |

-6.579 |

|

2004 |

-7.427 |

-5.858 |

|

2005 |

-5.638 |

-7.595 |

|

2006 |

-6.242 |

-11.297 |

|

2007 |

-6.808 |

-14.598 |

|

2008 |

-9.934 |

-15.022 |

|

2009 |

-15.647 |

-11.187 |

|

2010 |

-11.006 |

-10.289 |

|

2011 |

-9.635 |

-9.860 |

|

2012 |

-6.367 |

-2.484 |

|

2013 |

-3.168 |

0.731 |

|

2014 |

-2.685 |

0.697 |

2b) As it can be seen in the table and the graph of 2a subject above, in the first years after 1981 the budget deficit of Greece is really high and it worsens gradually at least until 1995. while in the same time the current account balance, even though its continuously negative, it’s preserved in a relatively law balance reaching even -0.133% of GDP on 1994. The years after 1997 though, where budget and current account deficit are almost the same, their picture is almost reserved and the current account deficit starts deepening while in the same time the budget deficit shows signs of improvement. Finally, after Greece’s accession in the European Economic Community and the entrance of Euro as its currency, the one generally follows the others route. They both start worsening reaching their lowest levels on 2009 for the budget deficit (-15.647% of GDP) and on 2008 for the current account balance (-15.022% of GDP), after which they both improve in fast rates due to the strict measures of the last governments, reaching last year (2014) their best levels since 1981, with a rate of -2.685 for the budget deficit and a positive current account balance (%of GDP) of 0.697.

2c) The entrance of Greece on the European Economic Community took place on 01/01/1981. Since then, Greece came through the different stages of the economic convergence to the European Union with various effects on its economic policy. Even though Greece’s particularity was acknowledged and certain actions were made for her to follow European countries economic programs, Greece couldn’t reach their rates of growth, ending with two devaluations of her currency, drachma, the first on 1983 (15%) with which the government aimed, as its Economy Minister pointed: “to narrow a gaping trade deficit and bolster the economy”(4), taking “measures to control imports”(4) and the second on 1985 (15%) with a parallel restriction of imports and a two years stabilization program.

On 1991 the Maastricht Treaty was signed which resulted to a more strict economic policy from Greek Governments of the following years to obtain an economic growth, through various stabilization programs. Their basic target was to fulfill the conditions for Greece’s accession in the European Economic and Monetary Union. The budget deficit reduces progressively to fulfill the necessary levels. On 1998 Greece’s central bank announced the devaluation of drachma over ECU (12%), to entry the EU’s exchange rate mechanism since there was Maastricht Treaty’s condition for Greece to maintain stable the exchange rate for two years prior to her accession in the European Monetary Union(5).

Finally, on 2000 after reaching Maastricht Treaty’s condition of an inflation below 2%, Greece achieved an appreciation of drachma(6) and the new exchange rate was fixed on 304.750 drachmas/euro. Greece applies for her full entrance on the EMU and Eurozone and is accepted starting from 1/1/2001. 2001 is the last year of drachma as Greece’s currency, since from 1/1/2002 Euro is the new currency used.

The strict fiscal policy that was followed due to Maastricht Treaty lasted until 2004, when the Olympic Games resulted in an increase of the budget deficit, which worsened during the following years. 2009 Greece reached a budget deficit of -15.647% of GDP, which led to severe fiscal discipline, huge loans from other European countries, IMF, ECB, memorandums with strict measures on every economic aspect and a strict surveillance of the troika. Certain changes were made and Greek Governments tried to comply with the agreements and the measures required, which lead to serious reduce of the Greek budget deficit to -2.685% of GDP on 2014 and a positive current account balance from 2013 for the first time during the last decades.

Subject_3. It is thoroughly known that wages are closely connected with productivity. As indicated by Mankiw (2006) “the wage a worker earns, measured in units of output, equals the amount of output the worker can produce”(7). In other words if a country’s productivity raised, it would simultaneously lead to a rise in wages. Also, a Krugman (1997) argues the creation of a modern enterprise/factory in a less developed country with money/technology from the advanced nations would lead to high productivity of that enterprise/factory, but it wouldn’t affect much the productivity of the hole country, since it’s average productivity would stay almost the same(8). So, money and technology from advanced countries wouldn’t be able to raise a less developed country’s average productivity much and that is why wages would stay low.

Continuing, as explained by Cristopoulos et al. (2015) the current account balance equals exports minus imports, which also equals savings minus investment (S-I=X-M)(9). A trade surplus is actually a positive current account balance and means that the country is exporting capital. It’s not logical according to the above equation for a country, as the less developed ones of our subject, to have a trade surplus when it has an inflow of capital from the advanced nations. As explained by Krugman (1997) it’s impossible for a country to have a positive result on the one part of the equation (S-I=X-M), with more exports that imports, and a negative one on the other part when inflows of capitals exceed savings(8).

Subject_4.a)As Christopoulos et al. (2015) notes, purchasing power parity exchange rate can be calculated by the type e=P/P*, where e is “the nominal exchange rate expressed as units of domestic currency per unit of foreign currency, P is the domestic price level and P* is the foreign price level(10). So, the PPP of our subject is e=100€/80£=1.25€/£.

4b)We use the Uncovered Interest Rate Parity, the type of which as Christopoulos et al. (2015) note is i-i*=[E(et+1)-et]/et where i,i* are the domestic and foreing interest rate, et the current exchange rate and E the expected exchange rate(10). Solving for the asked current exchange rate:

i-i*=[E(et+1)-et]/et

et·(i-i*)=E(et+1)-et

(et·i)-(et·i*)+et=E(et+1)

et·(i-i*+1)=E(et+1)

et=E(et+1)/·(i-i*+1)

with PPP=expected exchange rate=E(et+1), £annual interest rate=6.11%=0.0611=i, €annual interest rate=4.69%=0.0469=i*

et=1.25/(0.0469-0.0611+1)=1.25/0.9868=1.27 the current exchange rate

4c) The real exchange rate as Christopoulos et al. (2015) notes is calculated q=eP*/P, where e is the nominal exchange rate, and P*,P as above(10). With e=1.27 current nominal exchange rate:

q=(1.27×80)/100=1.016

since the real exchange rate of Europe is greater than 1 (q=1.27>1) there will be a depreciation of Euro and Europe’s competitiveness will increase, since its goods get more competitive and a reduction of UK’s competitiveness(10). According to the law of one price in the long run the demand in Europe for the basket of goods will increase and the demand in UK will decrease, causing prices to rise in Europe and fall in UK, until the long run equilibrium q=1. So UK’s competitiveness will be reduced by:

(1.25€/£-1.27€/£)/1.27€/£= -0.0157=-1.57%

4d)In the short-run, where prices, wages etc. are stable, if the domestic interest rate increases there will be an inflow of capitals from investors who want to gain more. This capital inflow means an increase on the demand of the domestic currency, which causes an appreciation of the domestic currency(11). As Cunningham (2005) notes an increase of the domestic interest rates provoque a depreciation of the current spot exchange rate of domestic currency relative to the foreign, the e variable of the Uncovered Interest Parity decreases and the domestic currency appreciates(12). Since the real exchange rate is as Cristopoulos et al. (2015) state: “the nominal exchange rate adjusted to the ratio of the foreign price level to the domestic price level”(13), (q=e·P*/P) and since in short-run prices don’t change, the ratio P*/P wouldn’t change, it doesn’t matter of we talk in nominal or real terms. So the argument of the subject is incorrect.

BIBLIOGRAPHY:

(1)Agiomirgianakis, G.M., Vlassis, M. (2005) Economics for Managers –International Economic Environment Patras: HOU pg.141-144

(2) WIKIPEDIA (2014) Stolper-Samuelson Theorem [Online] Available from: http://en.wikipedia.org/wiki/Stolper%E2%80%93Samuelson_theorem [Accessed:28 February 2015]

(3) WIKIPEDIA (2015) Twin Deficits Ypothesis [Online] Available from: http://en.wikipedia.org/wiki/Twin_deficits_hypothesis [Accessed: 28 February 2015]

(4) Reuters (1983) Greece Devaluating Drachma 15% [Online] The New York Times. Available from: http://www.nytimes.com/1983/01/10/business/greece-devaluing-drachma-15.html [Accessed: 28 February 2015]

(5) OECD (1999) OECD Economic Surveys 1997-1998 Greece. France: OECD Publication. Pg.46

(6) OECD (1999) OECD Economic Outlook. Volume1999. France: OECD Publication. Pg.86

(7) Mankiw, G. (2006) Greg Mankiw’s Blog – How are wages and productivity related? [Online] Available from: http://gregmankiw.blogspot.gr/2006/08/how-are-wages-and-productivity-related.html [Accessed: 28 February 2015]

(8) Krugman, P.R. (1997) Pop Internationalism. MIT Press. Pg.75-77.

(9) Christopoulos D. et al. (2015) MBA50: Economics for Managers 3rd Tutorial Meeting January 31, 2015. H.O.U. pg.19-22

(10)Christopoulos D. et al. (2015) MBA50: Economics for Managers 3rd Tutorial Meeting January 31, 2015. H.O.U. pg.59

(11) UOC.GR Open Economy in the Short-Run [Online] Available from: ftp://ftp.soc.uoc.gr/incoming/stamatakis/%CC%C1%CA%D1%CF%202/ANOIKTH%20OIKONOMIA%20BRAXYXRONIA.pdf [Accessed:1 March 2015]

(12)CUNNINGHAM. S, (2005) Lecture 4 International Finance ECON 243 University of Connecticut [Online] Available from:

http://web.uconn.edu/cunningham/econ243/lecture04.ppt

(13)Christopoulos D. et al. (2015) MBA50: Economics for Managers 3rd Tutorial Meeting January 31, 2015. H.O.U. pg.61

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal