India’s Retail Market: An Analysis

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 3094 words | ✅ Published: 01 Dec 2017 |

GLOBAL OUTLOOK:-

The global apparel sector consists of covering clothing textiles, footwear, luxury and accessories cover the whole of the market and this resulted to $2,560 trillion in 2010 approximately. The apparel, luxury goods, accessories cover over 55% of the whole market and further is expected to generate $3,180 billion till 2015 which will show a yearly growth of 4%. The global apparel industry is continuing to grow at a healthy phase with the absence of transferring costs for consumers and also with the wide range of different products. The rivalry in the industry is no more than adequate. The whole apparel industry provides benefits like trade and employment opportunities, investment and revenue gain from all over the world. This industry has very short span of product life cycle as the fashion changes at a regular interval of time and the products are many which are characterized by different sections which give a wide range of demand boost for the sector.

The global apparel industry is uneven. There is an opportunity for large numbers of small players in this industry. The increase in the capacity might be costly for the small players in the market as they would have to increase their production and outlets also which would increase their raw material, more staff and finished goods costs too on a flexible basis. There are major players in the market e.g. Wal – Mart which have a strong consistency and has capability to hold its position stable in spite of new entrants in the market. So, overall the small players have a scope to enter and gain profits and probably a ray of sunlight to increase its share in the market with expansions in the outlets.

MARKET SEGMENTS:-

- The Global Children’s Wear Market is likely to reach $186 billion in 2014, showing a 15% growth in five years and this will include 40% share of America’s market.

- The Global Men’s Wear Market is likely to reach $402 billion in 2014, showing more than 14% growth in five years. The leading market’s sub segment which includes more than 58% of the market includes 35% America’s stake in the market.

- The Global Women’s Wear Market is expected to grow more than $621 billion in 2014, which shows more than 12% yearly growth. The market’s leader is its sub segment of retail clothing with 64% of the total market share. The EU holds more than 37% stake in the whole global market which is highly competitive.

INDIAN RETAIL INDUSTRY OVERVIEW:-

If we look at the Indian Apparel sector we can say there is a wide Growth potential in this industry. The Indian Retail Market is expected to reach USD 1.3 trillion by 2020. The raise in the Income levels and awareness towards quality product would prove to be growth drivers for consumption expenditure in India. The biggest benefit of its growth will be the organization of the retail sector which is expected to grow at USD 220 billion by 2020 and it increased to 8% in 2012, and is expected to grow at 20% in 2020. The 60% contributor is food and grocery segment to the Indian retail Market which includes clothing and fashion segment contributing 8% in the whole market. While in the unorganised sector its vice versa as the food and grocery contributes less and the clothing and fashion segment contributes at its highest.

INDIAN APPAREL MARKET OVERVIEW

On calculating on the basis of purchasing power the Indian economy stands at fourth in the world after the United States, The European Union and China. For almost two decades textile and apparel industry has been a major donor to India’s GDP and provides employment to over 45 million people (Source: CII). India’s GDP in the year 2013 was estimated to be US$ 1.823 trillion and 5.2% of this came from the textile and apparel industry. The apparel market, which is split into menswear, womens wear, and kids wear was costing US$ 40 billion in 2013,likely to grow at a CAGR of 13% to reach US$ 124 billion, in 2020. The export market is likely to grow from US$ 36 billion in the year 2013 to US$ 85 billion by the end of 2023. The mens wear leads the market with 42% market share followed by womens wear holding 38% of the market and the kids’ wear which has 20% holding in the market. The India’s Apparel Market is the second largest contributor with a share of 8% in the Indian retail market. Organized market consists of clothing and fashion retailing which is the largest and the most penetrated segment which accounts 1/3rd of the organised retailing market.

Organized market is growing faster than the overall retail market due to various factors such as significant growth in income and change in life styles. The expansion in the upper middle class size and focus on advertisements has enabled awareness to high brand consciousness and increase in luxury product spending. The organized retail in 2010 contributed 17% of the total apparel market and is estimated to contribute 25% of the total apparel market by 2015 and its share is controlled to grow sharply over the coming years contributing approximately 40% share of the total apparel market by 2020.

GROWTH IN APPAREL SECTOR:-

India’s per capita consumption of Apparel is still much lower compared to other countries. India’s per capita consumption of apparel is at $46 compared to US is at $727, European Union at $729 and China at $209. So there is still ample opportunity for growth in Apparel sector in India.

MENSWEAR MARKET:-

Men’s-wear is the principal segment in India and is larger than the women’s-wear segment. Men’s-wear market in India is expected likely to grow at a CAGR of 9% in order to reach US$ 39,575 million in 2023. The main products of this segment are shirts and trousers which dominate the men segment market. The fastest growing categories in this segment are denim, active wear and t-shirts. At a global level, the men’s wardrobe is shifting from traditionally formal towards casual and lifestyle apparel.

With increased spending power and growing exposure to international fashion styles, the men’s-wear wardrobe has expanded substantially and is tending to witness sharper segmenting to include sports/gym wear, occasion specific ethnic wear, casual wear, office wear, night wear and party wear. Men’s denim market is expected to grow at 14% per year. The men’s trousers market comprises both formal and casual trousers. Though the share of formal trousers is high, casual trousers market is expected to grow faster than the formal trousers. The male trousers market is no longer limited to the traditional colours of blue, black, grey and brown. The demand for lightweight casualwear trousers is also increasing. The focus of many brands and retailers is on Menswear and so it has more brand penetration with greater brand awareness.

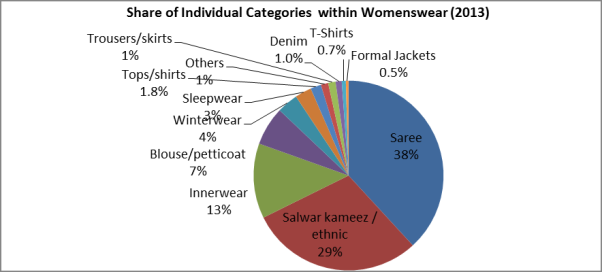

WOMENSWEAR MARKET:- The women’s-wear market of India contributes 38% to the Indian apparel market, largely dominated by unorganized players. However, with increasing preference for branded apparel, regional brands and international 95 brands have expanded their geographical presence. The women’s-wear market is expected to grow from US$ 15,493 million in 2013 at a CAGR of 10% to reach US$ 38,915 million in 2023. The growth in the market captures two essential preference shifts. Firstly, shift from non-branded apparel to branded apparel and secondly, increasing share of western wear to ethnic wears categories. (Source: Technopak Report, 2014). The increasing number of women within the workforce coupled with the keen desire to experiment has driven the growth of contemporary ethnic wear with trendy and fusion elements. An interesting phenomena, amongst women is that traditional ethnic wear tends to be limited to special occasions only. Further, growth of the salwar kameez market is largely driven by the increasing demand for kurtis that tend to be teamed typically with denims.

Women’s denim market is also demonstrating an encouraging growth at a CAGR of 15%. Most of the denim brands traditionally catering to male consumers have realised the growth potential of women denim users in the country. Women’s t-shirts and tops categories are also growing owing to increasing participation of women in workforce and a generic inclination towards western wear categories. The women’s tops and shirts market is currently estimated at US$ 282 million and is expected to range up to US$ 876 million by 2023, grow at a CAGR of 12%. The women’s t-shirts market of US$ 107 million is witnessing growth in tandem with the growth of all other casualwear categories and is likely to grow at a CAGR of 15% in order to reach US$ 436 million by 2023. The womens wear market is not as mens wear market because of the lower brand penetration with a still growth of US $ 15.5 billion and is expected to grow at CAGR of 10% and expected to reach US$ 38.9 billion in 2023 which is as the value of mens wear segment. The segment is growing at a faster pace as compared to the mens wear segment involving the attention of both national and international brands. Many menswear brands and retailers have also tapped into this opportunity and have stretched their presence into this segment as well.

KIDSWEAR MARKET:- The kids apparel market contributes 20% to the total fashion market and is the fastest growing segment in the Indian market. The kids apparel market of US$ 8,222 million in India is likely to grow at a CAGR of 10.50% in order to reach US$ 22,369 million in 2023. Boys segment contributes 52% to the kids apparel market and the remaining by girls segment. The US$ 4,253 million boys’ wear market in 2013 is composed to grow at a CAGR of 10% and expected to reach US$ 11,156 million by 2023. The boys’ wear segment is dominated by school uniforms with a market size of US$ 1,347 million and a projected CAGR of 10%. The next big categories within boys’ wear are t-shirts, shirts and bottom which constitute 46% of the boys’ wear market. Within these categories, knits have a higher growth rate than woven apparel. Denim is the fastest growing category in boys’ wear segment, with an expected CAGR of 15% the boy’s denim market is expected to reach US$ 355 million by 2023 from its current value of US$ 91 million. Extension of denim brands to kids apparel and brand awareness of denim products is contributing to the growth of kids denim. Designer kids apparel is also emerging as a promising opportunity in the premium and luxury categories. The US$ 3,969 million girls’ wear market is graceful to grow at a CAGR of 11% and reach US$ 11,213 million by 2023. Like the boys’ wear segment, girls’ wear segment is also dominated by school uniform with a market size of US$ 1,198 million and a projected CAGR of 11%, a growth rate higher than growth rate of boys school uniform. The factors that drive the kids apparel market are increasing expenditure on kids and improved awareness of kids’ brands. Additionally, due to increased media exposure, kids have also become more fashion conscious today and influence their parents to allow them to experiment with clothing.

Branded kids’ wear retail in itself is a high growth opportunity area as the market is dominated by local and unorganized players. The absence of a significant player in the mid-tier segment presents a huge prospect. There is still a substantial gap in the need for design and quality in kids apparel offering providing ample opportunities for organized players. The kids wear market can be further classified into boys wear and girls wear, each of which would lead to 10 % of the domestic apparel market. The boys wear market was worth US$ 4.3 billion in 2013 and will grow at CAGR of 10 % to reach US$ 11.2 billion within next 10 years whereas the value of the girls wear market is US$ 4 billion which might be smaller than the boys wear segment, but soon higher growth rate would be seen. The girls wear segment is expected to grow at CAGR at 11% which is likely to reach the similar value as the boys wear segment by 2023. Some of the participants of growth in the kids wear segment are the increasing wealth of Indian parents and the consequently increasing expenditure on kids and an increased awareness of kid’s brands.

OPPORTUNITIES FOR THE SECTOR:

- HUGE POTENTIAL FOR INDIA-VIETNAM TEXTILE TRADE: India-Vietnam textile trade has a huge potential, specifically since India accounts for only 2% of all Vietnamese import of garment input materials at present. Presently, Vietnam meets only 50% of its material demand for production of garments which provides a good opportunity for Indian companies to finance in Vietnam’s textile industry. India currently has global market share of 13.52% in these materials. Vietnam is one of the world’s top garment exporters, which relies on import of materials.

- NON-COMPLIANCE OF FACTORIES IN BANGLADESH & CAMBODIA: Cambodia and Bangladesh, which are big manufacturers and exporters of textile, are disreputable for constant strikes and high levels of corruption. Both these factors have a hostile impact on the country’s garment sector. The tragic incidents of Rana Plaza and Tazreen in Bangladesh followed by constant lockouts in Cambodia have put this industry under close scanner in the international arena. Newly, also inspectors hired by group of Western Clothing brands, as part of an invention launched after a building collapse last year, which killed more than 1,100 workers, found safety problems at Bangladesh factories.

- CHANGING DEMOGRAPHICS, RISING INCOMES: India’s growing population has been a key driver of textile consumption potential story in the country. It has been accompanied by a young population, which is in growing phase and is visible to changing tastes and fashion. Further, driving this factor is increasing female work-force participation in the country. Besides this, growing income has been a key factor of domestic demand for the sector, with growth in income in the rural economy as well; the mounting push on demand from the income side is set to continue.

- POSITIVE STEPS BY INDIAN GOVERNMENT:–

Indian government invites proposals for setting up textile parks: Textiles Ministry has invited proposals from Industry Associations/Groups of Entrepreneurs /Special Purpose Vehicles (SPVs) for setting up of Integrated Textile Parks (ITPs) under the Scheme for Integrated Textiles Park (SITP) during the remaining part of the 12th Five Year Plan (April 2012 – March 2017). While, for the ITPs, government funding will be 40% of the project cost with a ceiling of Rs 40 crore, for special category states, the funding will be 90% subject to ceiling of Rs 40 crore.

For this purpose, Government of India has empanelled professional agencies (Project Management Consultants) for evaluation of project, preparation of DPR and project implementation. SITP is being implemented by the Ministry of Textiles with an objective to provide world class infrastructure facilities for setting up textile units. The scheme facilitates textile units to meet international environmental and social standards.

Eligible projects under the scheme would cover common effluent treatment plants, captive power generation on technology preferably renewable/green technology, infrastructure such as storm water management, necessary roads and pipelines for water & wastewater and, facility for testing and R&D centres.

- ‘BUDGET 2014-15’:

Mega Cluster: Finance Minister Arun Jaitley has planned setting up of new textile mega clusters in his maiden Budget in the Parliament. The mega-clusters will be set up at Bareily and Lucknow in Uttar Pradesh, Surat and Kuttch in Gujarat, Bhagalpur in Bihar, Mysore in Karnataka, and one in Tamil Nadu for which he has allotted a sum of Rs 200 crore.

Trade Facilitation Centre: In Budget 2014-15, the Finance Minister also proposed to set up a Trade Facilitation Centre and a Crafts Museum with an outlay of Rs 50 crore in order to develop and promote handloom products and carry forward the rich tradition of handlooms of Varanasi, where a textile mega-cluster would also be supported.

PROBLEMS/CHALLENGES:

- INCREASING WAGE COST IN CHINA: China’s wages are set to increase by at-least 11% in FY2014- 15, driving more low cost textile manufacturers to move production into lower-cost geographies, like Vietnam, Bangladesh and India.China’s ruling Communist Party have been pushing for pay increases to retain public support and to accelerate the nation’s shift away from polluting and capital-intensive manufacturing to a more services-driven economy. In minimum-wage increases so far announced for 2014, workers in Shenzhen in Guangdong province got a 13% boost and the gain for those in Yangzhou, Jiangsu province, was 15.6%. This, situation is definitely positive for India, where the labour cost still remains to be affordable, if not low.

- NON-COMPLIANCE OF FACTORIES IN BANGLADESH & CAMBODIA: Cambodia and Bangladesh, which are big manufacturers and exporters of textile, are infamous for continuous strikes and high levels of corruption. Both these factors have an adverse impact on the country’s garment sector. The tragic incidents of Rana Plaza and Tazreen in Bangladesh followed by continuous lockouts in Cambodia have put this industry under close scanner in the international arena. This situation again offers a big potential for the Indian textile industry. Since, most reputation-conscious buyers only associate with factories with adequate compliance standards. Non-compliances, especially in the area of child labour and health and safety usually lead to immediate and permanent delisting from a retailer’s supply books.

- CHANGING DEMOGRAPHICS, RISING INCOMES: India’s growing population has been a key driver of textile consumption growth story in the country. It has been complemented by a young population, which is growing and at the same time is exposed to changing tastes and fashion. Further, driving this factor is rising female work-force participation in the country. Besides this, rising income has been a key determinant of domestic demand for the sector, with income rising in the rural economy as well; the upward push on demand from the income side is set to continue.

OUTLOOK:-

The outlook for the Indian textile industry for ‘FY14-15’ looks promising, buoyed by both strong domestic consumption as well as export demand. Though last year has been encouraging for the industry, the ongoing fiscal also is expected to fetch good business on hopes of revival of Technology Upgradation Fund Scheme (TUFS), by new government in upcoming budget 2014-15, scheduled to be presented in second week of July.

Further, changing global environment in terms of revival of US economy and depletion of textile inventory in both US and European markets, has put this sector on a higher growth trajectory, while domestically, changing lifestyle, rising incomes and increasing demand for quality products are set to fuel demand for this industry.

However, the industry also faces certain headwinds on account of inflationary conditions, exchange rate fluctuations, import of second hand machinery, policy changes among others. Nevertheless, increasing labour cost in China, non-compliance of large number of factories in Bangladesh among others, provide India a big opportunity in view of its relative advantage. However, to be more competitive and capture the space in market left by China and Bangladesh, the industry has to be competitive in pricing, apart from meeting strict timelines and being quality conscious.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal