Regional Integration Impact: EU’s Single Market Programme

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 937 words | ✅ Published: 28 Nov 2017 |

This assignment looks at the short-run and long-run impact of regional integration (RI), specifically European Union’s Single Market Programme. Regional integration is characterised by the free trade and factor mobility within the member states while leaving the barriers to trade unchanged with the rest of the world. (Walz, 1997).

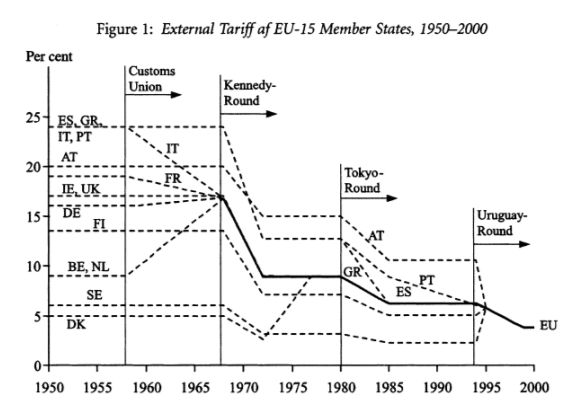

The European Community (EC) was first form of regional integration in Europe; it was the governance of three international organisations by the same set of institutes. In 1993, these communities were incorporated in European Union (EU). The European Union developed a single market which is governed by a set of institution namely European Commission, European Central Bank, European Council etc. The creation of single market did not stop at just free trade and free movement of goods and people, but the EU also introduced the single common currency: Euro. EU also harmonised there external trade policy and all the EU member states have an external tariff of 3.6 per cent in 2000 as shown by Figure 1. (Badinger, 2005).

The European Community (EC) was first form of regional integration in Europe; it was the governance of three international organisations by the same set of institutes. In 1993, these communities were incorporated in European Union (EU). The European Union developed a single market which is governed by a set of institution namely European Commission, European Central Bank, European Council etc. The creation of single market did not stop at just free trade and free movement of goods and people, but the EU also introduced the single common currency: Euro. EU also harmonised there external trade policy and all the EU member states have an external tariff of 3.6 per cent in 2000 as shown by Figure 1. (Badinger, 2005).

Source: Badinger, 2005.

Smith et al. (1998) stated that ‘the aim was that the elimination or reduction in trade barriers would reduce existing structural imperfections in European markets, and hence increase welfare and efficiency.’

Therefore, this assignment progress, the empirical evidence will be provided of the economic growth and will also look at other positive impacts that occurred due to the regional integration of EU. Moreover, as Badinger (2005) argues whether the integration-induced effects on the growth rate are only temporary (neoclassical growth theory, endogenous growth theory without scale effects) or permanent (endogenous growth theory with scale effects) and so we will discuss a few journal articles to see what other economist have found in their studies.

Many journal articles have stated that traditional growth theory predicts no permanent growth effects of regional integration; however, the economists who support regionalisation often claim the opposite. The Cecchini Report (1988) estimated that the EC 1992 Programme would have a once-off effect on EC income but refrained entirely from considering any long-run effects.

Torstensson et al. (1997) confirmed that Baldwin (1989) ‘estimated the long-run growth effect of the EC 1992 Programme by using the Cecchini report’s estimate of a once-off raise in EC output by between 2.5 and 6.5%. This estimate was then plugged into the aggregate growth model of Romer (1987) in which the output elasticity of physical capital is taken to be unity. Using a reasonable calibration of the model parameters, Baldwin estimated that EC 1992 could lead to an increase in the long-run rate of growth of between 0.28 and 0.92 percentage points.’ They also suggest by using the time-series data and co-integration analysis that 0.3 percentage points of the French growth rate in the 1980s was due to the EU membership.

The results found in Henrekson et al. (1997) of a permanent effect on the growth rate were in contracts to the more recently study by Vanhoudt (1999) where he rejected the hypothesis of permanent effects on the growth rate.

However, if we look at the technology flow from abroad, it can be said that integration boosts a country’s opportunities to improve its efficiency by participating in other countries’ technological progress. By following this statement, the hypothesis of permanent growth effects of integration occurs from endogenous growth theory with scale effects. Taking Romer (1990) as the representative model, assuming constant returns to the stock of knowledge, it infers that larger countries grow faster; therefore, integration can be seen as an increase in the size of the economy, leading to a higher steady-state growth rate. (Badinger, 2005).

Badinger (2005) also found an investment-led growth hypothesis can already be found in Balassa (1961), ‘who stresses the role of integration in creating a more favourable environment for entrepreneurial activities, reducing the risk premium for investments (less uncertainty), and lowering the cost of capital as a result of more efficient financial markets.’

The existing evidence suggests that the investment-led growth effects of integration, if any, are only level effects.

References:

Allen, C., Gasiorek, M. and Smith, A. (1998). ‘European Single Market: How the Programme Has Fostered Competition’, Economic Policy, No. 27: 439-69.

Badinger, H. (2005). ‘Growth Effects of Economic Integration: Evidence from the EU Member States’, Review of World Economics, Vol. 141(1): 50-78.

Baldwin, R. (1989). ‘The Growth Effects of 1992’, Economic Policy, No. (9): 247-81.

Baldwin, R. (1992). ‘Measurable Dynamic Gains from Trade’, Journal of Political Economy, vol. 100(1): 162-74.

Baldwin, R. and Wyplosz, C. (2006). The Economics of European Integration, Maidenhead: McGrawHill, chs. 6-7.

Davis, S., Rondi, L. and Sembenelli, A. (2001). ‘European Integration and the Changing Structure of EU Manufacturing, 1987-1993’, Industrial and Corporate Change, Vol. 10(1): 37-75.

Egger, P. and Pfaffermayr, M. (2004). ‘Foreign Direct Investment and European Integration in the 1990s’, World Economy, Vol. 27(1): 99-110.

European Commission (1988). Research on the costs of non-Europe (the Cecchini report).

European Commission (1996). The Impact of the Internal Market by Industrial Sector: The Challenge for Member States, European Economy, Reports and Studies No. 4.

European Commission (2002). European Integration and the Functioning of Product Markets. European Economy. Special Report. No. 2.

Hakura, D. (1998). The Effects of European Economic Integration on the Profitability of Industries. IMF Working Paper No. 98/85.

Head, K. and Mayer, T. (2000). ‘Non-Europe: The Magnitude and Causes of Market Fragmentation in the EU’, Review of World Economics, Vol. 136(2): 284-314.

Henrekson, M., Torstensson, J. and Torstensson, R. (1997). ‘Growth Effects of European Integration’, European Economic Review, Vol. 41(8): 1537-57.

Hoffman, A. (2000). ‘The Gains from the Partial Completion of the Single Market’, Weltwirtschaftliches Archiv, Vol. 136(4): 601-30.

Vanhoudt, P. (1999). ‘Did European Unification Induce Economic Growth? In Search of Scale Effects and Persistence Changes’, Review of World Economics, Vol. 135(1): 191-219.

Walz, U. (1997). ‘Dynamic Effects of Economic Integration: A Survey’, Open Economies Review, Vol. 8(3): 309-326.

Ziltener, P. (2004). ‘The economic effects of the European Single Market Project: projections, simulations – and the reality’, Review of International Political Economy, Vol. 11(5): 953-979.

1

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal