Fairness under Transaction Costs

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 2191 words | ✅ Published: 29 Aug 2017 |

- Introduction

While the Pareto efficiency criterion can be used to rule out inefficient allocations, it allows for very unequal distribution of welfare among the  individuals. To the extent that extreme forms of inequality are seen as undesirable, this suggest a need to complement the Pareto efficiency criterion with some welfare distribution criterion. We do this below by introducing fairness in the analysis.

individuals. To the extent that extreme forms of inequality are seen as undesirable, this suggest a need to complement the Pareto efficiency criterion with some welfare distribution criterion. We do this below by introducing fairness in the analysis.

Note that fairness holds under ordinal preferences and does not involve any intertemporal comparison of utility (as envy by the  -th consumer is evaluated using her own preferences).

-th consumer is evaluated using her own preferences).

- Motivations

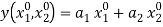

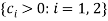

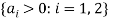

We want to answer two related questions: First, when is fairness consistent with Pareto efficiency? And when it is not, what is the welfare cost associated with introducing fairness in economic analysis? To motivate the answers to these questions, this section considers a simple case of an economy composed of two individuals making production and consumption decisions. Having  units of total time available, the

units of total time available, the  -th individual chooses leisure time

-th individual chooses leisure time  and consumption

and consumption  . The

. The  -th individual has preferences represented by the utility function

-th individual has preferences represented by the utility function  , where

, where  denotes work time, and

denotes work time, and  ,

,  .

.

We first consider situations where there are no transaction costs. Labor times  are used in the production of output

are used in the production of output  according to the production function

according to the production function  ) satisfying

) satisfying  . This allows for heterogeneity in labor/leisure preferences as well as heterogeneity in labor productivity across individuals. The output

. This allows for heterogeneity in labor/leisure preferences as well as heterogeneity in labor productivity across individuals. The output  is a consumer good redistributed to the two individuals to satisfy

is a consumer good redistributed to the two individuals to satisfy  .

.

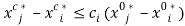

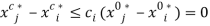

As discussed in the introduction, fairness is defined as the absence of envy: under fair allocations, no individual prefers someone else’s bundle. In the absence of transaction costs, this implies that  for

for  . Note that

. Note that  and

and  ,

,  , corresponds to an location that is both feasible and fair (although not efficient). Thus, a fair allocation always exists.

, corresponds to an location that is both feasible and fair (although not efficient). Thus, a fair allocation always exists.

In this section, we illustrate the linkages between fairness and efficiency in the context of a particular example. The example is as follows: Let  ,

,  , and

, and  , where the parameters

, where the parameters  reflect the demand for leisure and the parameters

reflect the demand for leisure and the parameters  reflect the productivity of labor for the two individuals. Normalizing prices so that the price of

reflect the productivity of labor for the two individuals. Normalizing prices so that the price of  is equal to 1, the shadow cost of time is

is equal to 1, the shadow cost of time is  for the

for the  -th individual. In the absence of transaction costs, with

-th individual. In the absence of transaction costs, with  being the marginal value product of labor for the

being the marginal value product of labor for the  -th individual, the efficient labor supply is

-th individual, the efficient labor supply is  when

when  ,

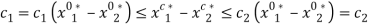

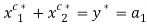

,  . In this context, an allocation that is both efficient and fair would satisfy:

. In this context, an allocation that is both efficient and fair would satisfy:  , or

, or  for

for  . We consider several scenarios, all illustrated in Figure 1.

. We consider several scenarios, all illustrated in Figure 1.

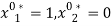

Scenario S1:  and

and  . Under scenario S1, the marginal value product of labor is at least as high as its shadow cost for both individuals. Then, efficient labor is

. Under scenario S1, the marginal value product of labor is at least as high as its shadow cost for both individuals. Then, efficient labor is  and

and  and efficient production is

and efficient production is  . And under zero transaction costs, an allocation that is both efficient and fair under Scenario S1 satisfies

. And under zero transaction costs, an allocation that is both efficient and fair under Scenario S1 satisfies  for

for  . This implies that

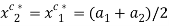

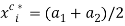

. This implies that  . In this case, there exists a unique allocation that is both fair and efficient: it is the egalitarian allocation where each individual receives the same bundle:

. In this case, there exists a unique allocation that is both fair and efficient: it is the egalitarian allocation where each individual receives the same bundle:  and

and  ,

,  . This allocation generates utilities

. This allocation generates utilities  ,

,  , which is a unique point on the Pareto utility frontier. Figure 1 shows that, under scenario S1, fairness and efficiency can be consistent with each other. Figure 1 illustrates two results. First, under zero transaction costs, fairness excludes many “unfair” allocations located on the Pareto utility frontier. Second, under Scenario S1, fairness can be introduced in the analysis without generating an efficiency loss.

, which is a unique point on the Pareto utility frontier. Figure 1 shows that, under scenario S1, fairness and efficiency can be consistent with each other. Figure 1 illustrates two results. First, under zero transaction costs, fairness excludes many “unfair” allocations located on the Pareto utility frontier. Second, under Scenario S1, fairness can be introduced in the analysis without generating an efficiency loss.

Scenario S2:  and

and  . Under scenario S2, the marginal value product of labor is at least as high as its shadow cost but only for individual 1. Then, efficient labor is

. Under scenario S2, the marginal value product of labor is at least as high as its shadow cost but only for individual 1. Then, efficient labor is  and

and  and efficient production is

and efficient production is  . Under Scenario S2, individual 2 has strong preferences for leisure, implying that it is efficient for this individual to work less (compared to Scenario S1), thus lowering the quantity produced of the good

. Under Scenario S2, individual 2 has strong preferences for leisure, implying that it is efficient for this individual to work less (compared to Scenario S1), thus lowering the quantity produced of the good  . In the absence of transaction costs, an allocation that is both efficient and fair under Scenario S2 would satisfy

. In the absence of transaction costs, an allocation that is both efficient and fair under Scenario S2 would satisfy for

for  , implying that

, implying that  . This inequality can be satisfied only if

. This inequality can be satisfied only if  . This generates two possible sub-scenarios: Scenario S2a where

. This generates two possible sub-scenarios: Scenario S2a where  , and Scenario S2b where

, and Scenario S2b where  .

.

Under Scenario S2a,  means that individual 2 (who chooses not to work) has a cost of time at least as high as individual 1 (who chooses to work). In this case, there exist allocations that are both fair and efficient. They are the allocations satisfying

means that individual 2 (who chooses not to work) has a cost of time at least as high as individual 1 (who chooses to work). In this case, there exist allocations that are both fair and efficient. They are the allocations satisfying  ,

,  ,

, and

and  . Given

. Given  , note that this last inequality restricts the difference in consumption

, note that this last inequality restricts the difference in consumption  to be positive and bounded between

to be positive and bounded between  and

and  . It means that, under scenario S2a, in the absence of transaction costs and under both fairness and efficiency, individual 1 (who chooses to work) must consume more good

. It means that, under scenario S2a, in the absence of transaction costs and under both fairness and efficiency, individual 1 (who chooses to work) must consume more good  than individual 2 (who chooses not to work). This shows that, being both fair and efficient, the allocations just discussed would correspond to utilities located on the Pareto utility frontier (see Figure 1). Thus, under zero transaction costs, Scenario S2a is an example where fairness can be introduced in the analysis without generating an efficiency loss. In addition, such fair allocations are clearly not egalitarian (as each individual consumes different consumption bundles). Thus, in contrast with Scenario S1, Scenario S2a is an example where egalitarian allocations would not be efficient (see Figure 1).

than individual 2 (who chooses not to work). This shows that, being both fair and efficient, the allocations just discussed would correspond to utilities located on the Pareto utility frontier (see Figure 1). Thus, under zero transaction costs, Scenario S2a is an example where fairness can be introduced in the analysis without generating an efficiency loss. In addition, such fair allocations are clearly not egalitarian (as each individual consumes different consumption bundles). Thus, in contrast with Scenario S1, Scenario S2a is an example where egalitarian allocations would not be efficient (see Figure 1).

Under Scenario S2b,  means that individual 2 (who chooses not to work) has a lower cost of time than individual 1 (who chooses to work). In this case, in the absence of transaction costs, fairness and efficiency are inconsistent with each other.[1] Note that this does not imply that fairness cannot be achieved. As noted above, egalitarian allocations exist; and they are always fair. But under Scenario S2b in the absence of transaction costs, such fair allocations cannot be efficient (see Figure 1). In such situations, in contrast with scenarios S1 and S2a, introducing fairness in the analysis cannot be done without generating an efficiency loss. Note that Scenario Sc2 corresponds to

means that individual 2 (who chooses not to work) has a lower cost of time than individual 1 (who chooses to work). In this case, in the absence of transaction costs, fairness and efficiency are inconsistent with each other.[1] Note that this does not imply that fairness cannot be achieved. As noted above, egalitarian allocations exist; and they are always fair. But under Scenario S2b in the absence of transaction costs, such fair allocations cannot be efficient (see Figure 1). In such situations, in contrast with scenarios S1 and S2a, introducing fairness in the analysis cannot be done without generating an efficiency loss. Note that Scenario Sc2 corresponds to  , implying that the individual who has a strong preference for leisure (individual 2) is also less productive (with

, implying that the individual who has a strong preference for leisure (individual 2) is also less productive (with  . This shows that the conflict between efficiency and fairness arises from the heterogeneity in both time preferences and productivity across individuals. Under such a scenario, there is necessarily a tradeoff between efficiency and fairness. This raises the question: What is the cost of this tradeoff? We answer this question in section 3 below.

. This shows that the conflict between efficiency and fairness arises from the heterogeneity in both time preferences and productivity across individuals. Under such a scenario, there is necessarily a tradeoff between efficiency and fairness. This raises the question: What is the cost of this tradeoff? We answer this question in section 3 below.

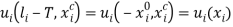

The above analysis was presented in the absence of transaction costs. What happens to the relationships between efficiency and fairness in the presence of transaction costs? To address this issue, we consider the case where labor exchange is costly and distinguish between “actual labor”  and “effective labor”

and “effective labor”  , the difference

, the difference  being the amount of labor “wasted” in labor exchange (e.g., due to commuting time). In this context, let

being the amount of labor “wasted” in labor exchange (e.g., due to commuting time). In this context, let  , with

, with  ,

,  measuring the proportion of labor time wasted by the

measuring the proportion of labor time wasted by the  -th individual,

-th individual,  . Then, the production function for

. Then, the production function for  becomes

becomes  , where

, where  . In this case, transaction costs in the labor market imply a decline in labor productivity, with

. In this case, transaction costs in the labor market imply a decline in labor productivity, with  . But note that, conditional on the new parameters

. But note that, conditional on the new parameters  , the analysis of efficiency presented above remains valid.

, the analysis of efficiency presented above remains valid.

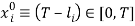

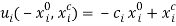

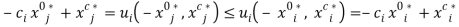

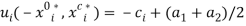

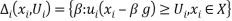

Next, consider envy under transaction costs. Let  be the cost accrued when the

be the cost accrued when the  -th individual considers switching place with the

-th individual considers switching place with the  -th individual,

-th individual,  . The switching costs include information cost, relocation cost and retraining cost. Consider the case where prices are normalized such that the price of

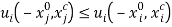

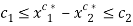

. The switching costs include information cost, relocation cost and retraining cost. Consider the case where prices are normalized such that the price of  is 1. Then, the absence of envy under transaction costs means that no individual feels that they would be better off switching with others, implying that

is 1. Then, the absence of envy under transaction costs means that no individual feels that they would be better off switching with others, implying that  for all

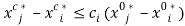

for all  . In the above example, this gives the fairness constraints:

. In the above example, this gives the fairness constraints:  . First, when the transaction costs

. First, when the transaction costs  are small (with

are small (with  ), then the fairness constraints would generate the results discussed above: fair allocations can be efficient under some situations (i.e., under Scenarios S1 and S2a); but fair allocations are inconsistent with efficiency under other situations (i.e., under Scenario S2b). Second, note the above fairness constraints are always satisfied when the transaction costs

), then the fairness constraints would generate the results discussed above: fair allocations can be efficient under some situations (i.e., under Scenarios S1 and S2a); but fair allocations are inconsistent with efficiency under other situations (i.e., under Scenario S2b). Second, note the above fairness constraints are always satisfied when the transaction costs  are sufficiently large. Thus, when transaction costs are large, fairness and efficiency would always be consistent with each other. This result holds under any leisure preference parameters

are sufficiently large. Thus, when transaction costs are large, fairness and efficiency would always be consistent with each other. This result holds under any leisure preference parameters  and any labor productivity parameters

and any labor productivity parameters  . This shows that the presence of transaction costs can affect fairness in two significant ways: 1/ it increases the odds that any allocation would be seen as fair; and 2/ it makes it easier for efficiency and fairness to be fully consistent with each other. These insights are formally developed in the next section.

. This shows that the presence of transaction costs can affect fairness in two significant ways: 1/ it increases the odds that any allocation would be seen as fair; and 2/ it makes it easier for efficiency and fairness to be fully consistent with each other. These insights are formally developed in the next section.

- Efficiency and Fairness

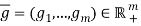

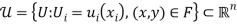

This section presents an analysis of fairness under general conditions. Going beyond the simple case discussed in section 2, we consider an economy involving  consumer goods and

consumer goods and  individuals under general preferences and technology. Each individual makes consumption and time allocation decisions. Let

individuals under general preferences and technology. Each individual makes consumption and time allocation decisions. Let  . As in section 2, denote the leisure time of the

. As in section 2, denote the leisure time of the  -th individual by

-th individual by  , with corresponding labor time being

, with corresponding labor time being  ,

,  . Denoting consumer goods by

. Denoting consumer goods by  , the

, the  -th individual has preferences represented by the utility function

-th individual has preferences represented by the utility function  , where

, where  ,

,  . For welfare analysis, we define a reference bundle

. For welfare analysis, we define a reference bundle  , where

, where  satisfies

satisfies  .

.

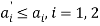

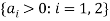

We make the following assumptions:

As1: The utility function  is continuous and quasi-concave on

is continuous and quasi-concave on  ,

,  .

.

As2: The function  is strictly increasing in

is strictly increasing in  for all

for all  ,

,  .

.

Assumption As1 is standard in consumer theory. And given  , assumption As2 implies that preferences are non-satiated in the consumer goods

, assumption As2 implies that preferences are non-satiated in the consumer goods  .

.

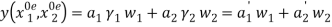

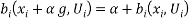

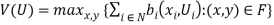

For the  -th individual, define the benefit function

-th individual, define the benefit function

if

if  (1)

(1)

otherwise,

otherwise,

where  ,

,  . The benefit function

. The benefit function  in (1) measures the number of units of the reference bundle

in (1) measures the number of units of the reference bundle  that the

that the  -th individual facing utility

-th individual facing utility  is willing to give up to obtain the bundle

is willing to give up to obtain the bundle  (Luenberger, 1992b). When the reference bundle

(Luenberger, 1992b). When the reference bundle  is chosen such that one unit of

is chosen such that one unit of  is worth

is worth  , the benefit function

, the benefit function  is a monetary welfare measure of willingness-to-pay. Some key properties of the benefit functions will prove useful. First, the benefit function satisfies the translation property

is a monetary welfare measure of willingness-to-pay. Some key properties of the benefit functions will prove useful. First, the benefit function satisfies the translation property  for any

for any  and any finite

and any finite  . Second, under As1 (i.e., under the quasi-concavity of

. Second, under As1 (i.e., under the quasi-concavity of  ),

),  is concave in

is concave in  (Luenberger, 1992b, p. 466).

(Luenberger, 1992b, p. 466).

In a production economy, labor is used to produce  consumer goods. Denote by

consumer goods. Denote by  the

the  goods produced. Denote labor inputs by

goods produced. Denote labor inputs by  , where

, where  is the quantity of the

is the quantity of the  -th individual’s labor used in the production process,

-th individual’s labor used in the production process,  . We use the netput notation (where outputs are positive and labor inputs are negative). Denoting netputs by

. We use the netput notation (where outputs are positive and labor inputs are negative). Denoting netputs by  , the production technology is represented by the feasible set be

, the production technology is represented by the feasible set be  , where

, where  means that outputs

means that outputs  can be produced using labor inputs

can be produced using labor inputs  . Note that having

. Note that having  allows for heterogeneity in labor productivity across individuals.

allows for heterogeneity in labor productivity across individuals.

As3: The set  is closed and convex and satisfies

is closed and convex and satisfies  .

.

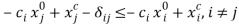

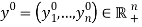

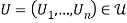

Next, letting  , we define a feasible allocation

, we define a feasible allocation  as an allocation which satisfies

as an allocation which satisfies  , where

, where  . Accordingly, feasibility requires four conditions: 1/ household decisions are feasible:

. Accordingly, feasibility requires four conditions: 1/ household decisions are feasible:  ; 2/ labor use cannot exceed labor supply:

; 2/ labor use cannot exceed labor supply:  ; 3/ netputs

; 3/ netputs  are feasible as outputs

are feasible as outputs  can be produced using labor inputs

can be produced using labor inputs  :

:  ; and 4/ aggregate consumption cannot exceed production:

; and 4/ aggregate consumption cannot exceed production:  . Let

. Let  . From As3, note that

. From As3, note that  implies that

implies that  .

.

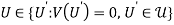

We start our analysis with the characterization of efficiency. We rely on the standard Pareto efficiency criterion: an allocation  is Pareto efficient if it is feasible and there is no other feasible allocation that can make one individual better off without making someone else worse off. Consider the following optimization problem

is Pareto efficient if it is feasible and there is no other feasible allocation that can make one individual better off without making someone else worse off. Consider the following optimization problem

, (2)

, (2)

where  .

.

Definition 1: An allocation  is maximal if it solves equation (2). And it is zero-maximal if, in addition to being maximal, it satisfies

is maximal if it solves equation (2). And it is zero-maximal if, in addition to being maximal, it satisfies  .

.

Zero-maximal allocations are of interest given their close relationship with Pareto optimality. Luenberger (1992a, p. 230-232; 1995, p. 189-192) obtained two key results: 1/ under assumption As2, a Pareto efficient allocation is zero-maximal; and 2/ under assumptions As1-As3, a zero-maximal allocation  is Pareto efficient with respect to all feasible allocations

is Pareto efficient with respect to all feasible allocations  where

where  for all

for all . This has several useful implications. First, except for boundary points, a Pareto efficient allocation is equivalent to a zero-maximal allocation. Second, Pareto efficiency corresponds to maximizing aggregate benefit

. This has several useful implications. First, except for boundary points, a Pareto efficient allocation is equivalent to a zero-maximal allocation. Second, Pareto efficiency corresponds to maximizing aggregate benefit  and then redistributing the maximized aggregate benefit

and then redistributing the maximized aggregate benefit  among the

among the  individuals. Third, the set of points

individuals. Third, the set of points  traces out the Pareto utility frontier.

traces out the Pareto utility frontier.

Next, we introduce fairness considerations in the analysis. As motivated in section 2, we explore when are fairness and efficiency consistent with each other. In a way consistent with previous research, we identify fairness as the absence of envy. But we conduct the analysis of fairness allowing for the presence of transaction costs.

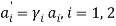

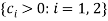

Definition 2: An allocation ( is fair if it satisfies

is fair if it satisfies  and

and  for each

for each  , where

, where  is the number of unit of the reference bundle

is the number of unit of the reference bundle  that would be dissipated by the

that would be dissipated by the  -th individual if the

-th individual if the  -th individual were to switch place with the

-th individual were to switch place with the  -th individual,

-th individual,  .

.

In our definition of fairness, the condition  } involves the term (

} involves the term ( . When the reference bundle

. When the reference bundle  is defined such that one unit of

is defined such that one unit of  is worth

is worth  , it follows that

, it follows that  can be interpreted as the cost involved when the

can be interpreted as the cost involved when the  -th individual considers switching place with the

-th individual considers switching place with the  -th individual,

-th individual,  . In this context, the parameters

. In this context, the parameters  represent transactions costs involved in the fairness evaluation made by individual

represent transactions costs involved in the fairness evaluation made by individual  . Note that the absence of switching costs is obtained as a special case when

. Note that the absence of switching costs is obtained as a special case when  for all

for all  . This the case commonly examined in previous research (e.g., Feldman and Kirman, 1974). But having individuals switching places is expected to be costly: it would typically involve information cost, relocation cost and retraining cost. This suggests that neglecting the transaction costs of switching places is rather unrealistic in fairness analysis.

. This the case commonly examined in previous research (e.g., Feldman and Kirman, 1974). But having individuals switching places is expected to be costly: it would typically involve information cost, relocation cost and retraining cost. This suggests that neglecting the transaction costs of switching places is rather unrealistic in fairness analysis.

In Definition 2, fairness corresponds to the absence of envy under transaction costs. Indeed, the absence of envy means that no individual prefers someone else’s consumption bundle taking into consideration the switching costs  . Letting

. Letting  }, define

}, define  . From assumptions As2 and As3, for any

. From assumptions As2 and As3, for any  , note that

, note that  is a feasible as well as a fair allocation. This gives the following result.

is a feasible as well as a fair allocation. This gives the following result.

Le

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal