Currency Comparison for Apple IPad Air Silver

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 1117 words | ✅ Published: 17 Oct 2017 |

- Sofia

The aim of this paper is to discuss the issue with the currencies and particularly whether they are at their current level. To analyze this problem in this course we should use the Big Mac index, which is used for such evaluations and additionally we have to choose a product and compare its prices in at least 10 countries, where it is available. The product which is going to be used in this coursework to be analyzed whether the currencies are at their current level is Apple iPad Air Silver 128GB. The currencies from the following eleven countries will be used for the analysis: United States (base country of the product), United Kingdom, Japan, Denmark, Germany, Russia, Poland, Australia, Sweden, Hungary and China. Firstly we had to find the prices of the product in all countries and convert the amounts into dollars, because the base country of the product is United States, but before converting all numbers all additional taxes as VAT, goods and services tax, transactions costs and etc. should be deduct from the amounts of the product. The next parts are to evaluate the implied PPP rate and under/over percentage against the dollar, which will show us in which countries the product is under or over valuated.

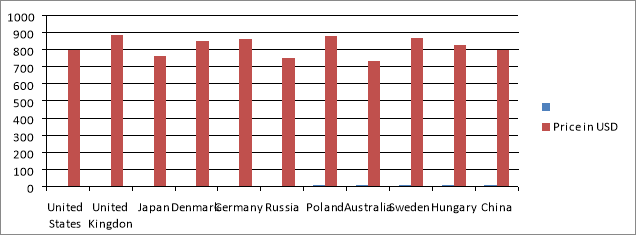

The chosen product for this coursework is Apple iPad Air Silver 128GB, because is a good candidate for the application of the law of one price. Burdett & Kenneth (1983) claimed that a good or services should be sold for a same price in the different countries. The law of one price is a form of purchasing power parity and its main task is as an arbitrage to eliminate the price difference in the different countries. In cases where we can meet substantial distinction of the prices of a product, according to Lamont & Thailer (2003) we can buy the product from the country where is cheaper and sell it in the country, where is more expensive. This will continue due to the moment when purchasing power parity holds and the prices are equalized. In a world of perfect competition “the unique price equals the marginal costs for all suppliers” (Brauer, 2003, p. 13) and the mark-up profit is always equal to all sellers and “goods market arbitrage” tries to regulate the market and mainly not some producers to set higher price. The following table shows us the prices of the product in the chosen countries.

|

Countries: |

Price in USD |

|

United States |

799.00 |

|

United Kingdom |

885.98 |

|

Japan |

764.18 |

|

Denmark |

851.36 |

|

Germany |

861.39 |

|

Russia |

752.04 |

|

Poland |

878.44 |

|

Australia |

734.24 |

|

Sweden |

868.40 |

|

Hungary |

824.55 |

|

China |

799.15 |

Fig. 1. How much costs an Apple iPad Air in different countries, converted to USD.

We can definitely observe some small differences in the prices, but they are minimized to their minimum and are due to several factors, which influence the currencies and the additional taxes for delivery. There are several factors according to Bergen (2010), which can influence the currencies and they are the following:

- “Differentials in inflation

- Differentials in Interest Rates

- Current-Account Deficits

- Public Debt

- Terms of Trade

- Political Stability and Economic Performance”

We can say that Apple iPad Air Silver 128GB can be a candidate for the application of the law of one price, because it satisfy the following criteria, which are important to comply with this rule.

- This product of Apple has identical characteristics (for instance: weight, composition, quality) in the markets, where it is accessible.

- Moreover, this iPad and its components are tradable across the borders and there are no trade barriers (duties, quotas).

- From an economic point of view, this product answer of every criteria for a substitute good and there are so many other goods with which can be substituted. This status of the product will prevent from “pricing to market”.

This coursework and measurements are made according to the Big Mac index conditions. Robert Carbaugh (2002) claimed that this Big Mac index “suggest that the market-exchange rate between the dollar and the yen is in equilibrium when it equates the prices of Big Macs in the United States and Japan”. This means that no matter the exchange rates and currencies, the goods and services should be sold for the same price in the different countries. For instance if a good has no equal prices between the countries, this will definitely break the rule of the law of one price. The Economist every year is publishing such statistics according to the Big Mac index.

The Big Mac index is one of the easiest ways to measure whether the prices are equal and PPP is divided into two groups:

- Absolute

Absolute purchasing power parity backs the theory of the law of one price and according to most of the economists this means that a basket of goods and services should cost equal amount in all countries, where it is offered (Clark et.al., 1994).

- Relative

Relative PPP has definitely some disadvantages in comparison to the Absolute, because this type according to the economists “assumes only that the rate of change in the nominal exchange rate will be equal to the difference the domestic and foreign rates of inflation on equivalent baskets of goods” (Clark et.al., 1994).

|

Countries: |

Under(-)/over(+) valuation against the dollar,% |

|

|

United States |

||

|

United Kingdom |

11% |

|

|

Japan |

-4% |

|

|

Denmark |

7% |

|

|

Germany |

8% |

|

|

Russia |

-6% |

|

|

Poland |

10% |

|

|

Australia |

-8% |

|

|

Sweden |

9% |

|

|

Hungary |

3% |

|

|

China |

0% |

|

Fig. 2 Under/Over valuation against the USD.

In figure 2 we can observe that in most of the countries, which are used for our calculations the prices are over valuated or under valuated, this means that in some countries we can meet higher prices of the Apple iPad Air and in other locations we can find this iPad for a small amount. China is the only country, which has prices, which complies with the law of one price and is equal to the price in United States. But this coincidence can be due to the fact that United States and China has special relation about financial and economic issues. For instance, I mean the giant external debt, which United States owe to China. Or due to the fact that this product Finally, we can`t say that this product answers entirely of the law of one price, because the prices in the different countries are very different.

References

http://books.google.bg/books?id=9e48srCogD4C&printsec=frontcover&hl=bg#v=onepage&q&f=false

http://www.investopedia.com/articles/basics/04/050704.asp

Lamont, O.A. and Thaler, R.H. (2003), “Anomalies: The Law of One Price in Financial Markets”.Journal of Economic Perspectives17 (Fall 2003), pp. 191–202.

^Burdett, Kenneth, and Kenneth Judd (1983), ‘Equilibrium price dispersion’.Econometrica51 (4), pp. 955-69.

http://books.google.bg/books?id=jvkAYmRqEGoC&printsec=frontcover&hl=bg#v=onepage&q&f=false

http://books.google.bg/books?id=slEkqBhYNh0C&printsec=frontcover&hl=bg#v=onepage&q&f=false

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal