Assessing if Governments in Developing Countries are ‘too small’

| ✅ Paper Type: Free Essay | ✅ Subject: Economics |

| ✅ Wordcount: 4321 words | ✅ Published: 29 Aug 2017 |

Introduction

Assessing if governments in developing countries are ‘too small’ is not a simple task, since many subjective concepts arise from the affirmation. To start with, there are no agreed global criteria to distinguish between a developing and developed country (World Bank 2016). On a second subjective note, to analyse this subject it is necessary to make two ground definitions: how do we measure the size, and based on what it is assessed as too small or large.

The size of government can be calculated differently, it is measured using the levels of expenditure, taxation, and employment as well as the share of the public assets in the economy (Labonte 2010; Alesina 1999). For the sake of simplification most cases studied in this essay will refer to expenditure over GDP, though how expenditures are composed (if calculated only on government consumption or adding government transfers like social security for example) can modify results (OECD 2008). Even sometimes calculations may be misleading since some interventions, for example state enterprises, may be omitted (Labonte 2010). Moreover, to have a full understanding, an assessment can only be arrived if evaluation is focused towards government efficiency; this is done by fulfilling its role of addressing market failure, redistribution and insurance (Stiglitz 1997).

The statements above probably explain why the debate of size of government has been and still is an on-going discussion with several answers. Economists have not yet arrived to a unanimous conclusion (Labonte 2010) nor has been found a unique direct relation between the latter and economic growth (Alesina 1999). This essay will focus in understanding if effectively what is commonly considered as a less developed country has a size of government that is ‘too small’ and its implications in Section 1. Section 2 will review different characteristics and several regional analyses on the matter, to finally arrive to a conclusion.

The role of government and public expenses

Governments usually intervene the economy through the provision of public goods or services that improve social welfare and address market failure. They participate in economic sectors that are not attractive to the private sector through the cost-benefit analysis, but are extremely important to people. Roles of government are synthesised by Stiglitz (1997) in 6 key features: Promoting education, promoting technology, supporting the financial sector, investing in infrastructure, preventing environmental degradation and creating and maintaining social safety nets. By doing this, governments also redistribute wealth, funding those activities through taxation. Generally speaking, public sector will always go to expenditure, since none can be exempted of public goods (such as roads, lights, etc.); the magnitude though, will depend on the level of intervention associated to a market model; for example comparing UK’s public finances with private funding education to Finland’s one with almost 100% public funded education (Lawson 2016).

At the end, the efficiency of the government expenditure is relevant in order to measure its role in the economy and development of a nation. Market failure, because of lack of information, may be addressed by government intervention. The question is though, what if government fails too and better development would have been achieved with smaller government participation. Moreover, adding complexity to the analysis, government may be successful in increasing access to education with one policy, but not in reducing child mortality with another one; then, the assessment of how big or small the government is would depend on the results of the different policies themselves.

Understanding the different ranges of development

To understand how the size of government works in industrialized and the opposite type of countries, it is necessary to know the definition of developing country. There is no consensus on such definition, and different international organizations have their own standards. Generally speaking, it can be referred to the level of GDP per capita, but in the last years some of what were known as developing economies rose in that matter and changed the concept. Even the World Bank has agreed to remove that categorization and introduce a new one depending on the levels of income of a nation (as the International Monetary Fund does), because of the complexity and non-linearity of characteristics that define how developed a country is (World Bank 2016). Additionally non-economic figures, as the Human Development Index (which evaluates the levels of education, health and literacy of a nation) can be measured in combination with the levels of income; this will enable a further or more holistic understanding of the degree of development (UN 2016).

This matter is important specially because depending on the level of development is the how the specific role of government or its priorities are going to be defined; and depending on that role, public interventions with their associated objectives are going to be assessed as efficient or not. For example, comparing Seychelles and Switzerland illustrates the situation. Seychelles has a 65.8 Gini coefficient, 43% of the population living under the USD1.90 per day poverty line and a poor infrastructure and institutions for its high population density. On the contrary, Switzerland has a 31.64 Gini coefficient, unreported poverty by the World Bank and considered to have one of the finest infrastructures and institutions in the world. With such scenarios, policy objectives and role of the state may differ; nevertheless, both countries are under the High-Income economies of the World Bank with more than $12,476 GDP per capita (World Bank 2016).

Having clarified this point, the essay will continue to address the issue referring to developed and developing countries. Nevertheless, understanding that that definition does not mean the same in each particular case will be crucial during the essay to assess if governments are ‘to small’ in developing countries.

Combining theoretical and empirical trends on size of governments

Though referring efficiency of government only to economic growth may be simplistic (since government may pursue different objectives), it is found comparable among countries, plausible for a cost-benefit analysis and easy to measure (Devarajan et al. 1996); moreover, economic growth is statistically significant associated to development (Rodrik 2014). Then, the relationship between government size and economic growth may be interesting to have general understanding of the matter, though some findings may be contradictory.

To start with, Burgess & Stern (1993) argue that government expenditure in industrialized countries tends to be larger than less developed economies, since the latter struggles between public needs and corruption, rent seeking and inefficiency, while in the first taxation (as a main source of financing the spending) tends to grow with industrialization. Because of this, taxation is more associated to indirect taxes in developing countries (such as VAT) and direct ones in developed economies (such as income tax). Moreover, when income taxing, developed economies have more incidence in personal income tax, while developing in corporate ones. Corporate income tax is then expected to reduce investment and increase prices, thus associating it to less economic growth conditions. A vicious cycle occurs: the less growth, the less taxation. Then, in this case government could be seen as ‘too small’ in developing countries.

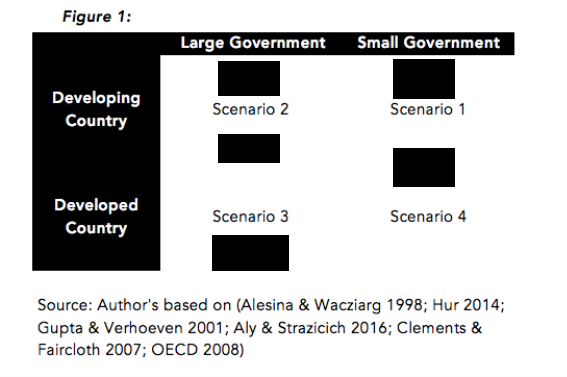

On a supporting note, studies have indeed showed that the public sector tends to be bigger in developed countries than developing ones (Alesina 1999). This may link economic development with greater governments, but also with other associated problems too. The larger public sector is associated to the lack of productivity in public services such as hospitals or schools, generally known as ‘Baume’s cost disease’ (Baumol 1993). For Alesina (1999), the higher expenditures get, the more taxation that will be needed, reducing the disposable income, stimulating people to depend more on transfers and paradoxically slowing, in the end, economic growth too (Scenario 1 in Fig. 1). In contrast, countries with lower GDP per capita struggle with taxation, informal economy and recessions, lacking with capacity to increase state volume. The low expenditure makes the government services not attractive, thus people are not willing to pay more taxes. This trap makes government services even scarcer, with high levels of inefficiency and corruption (Scenario 3 in Fig.1). Despite that the first case indeed shows that developing countries do not have big enough governments, the second case shows that developed ones may have an excessive one. Moreover, though Alesina’s (1999) work does not describe it directly, there is a thirds case where the combination of the costs of being a developing country with a large government merge (Scenario 2 in Fig.1), resulting in the following panorama. Firstly, because of being less developed probably the rent-seeking attitude in addition to misallocation, encourage the assumption the market itself would have done better. Furthermore, as public expenditure is high, state has become a ‘redistributive machine’ with growing transfers and subsidies, resulting in disincentives of investments (because either government has produced already what private sector could have, or because increasing taxation makes workers save less and capitals fly away). Higher state intervention impacts on how competitive and innovative the market is, thus growth of the public sector becomes a problem for development. In this case (for example a country as Argentina, showed by Figure 2) government in a developing country is ‘too large’. Probably it is the case as mentioned above, where income of the country is considered high, but characteristics as institutions are not ones of an industrialized nation.

|

Figure 1: |

||

|

Large Government |

Small Government |

|

|

Developing Country |

Scenario 2 |

Scenario 1 |

|

Developed Country |

Scenario 3 |

Scenario 4 |

|

Source: Author’s based on (Alesina 1999) |

||

On a supporting note, studies suggest that the contradiction that associates government size to positive and negative growth may arise because of time. On one hand there were empirical findings that suggested a positive relationship between government spending and economic growth; those were greater especially in less income economies. This was probably associated to governments genuine social interest and capacity to avoid exploitation (Ram 1986). Contradictory, other statistically significant studies concluded that the relationship was negative, linking it to the effects of crowding out private investment and the impact on competitiveness and innovation (Landau 1986). To bring comprehensiveness, more holistic studies combined both findings, suggesting that in the short term impact of high government intervention (thus high government consumption) could be positive, but in the long run it would have decreasing marginal returns and become negative (Conte & Darrat cited in Guseh 1997).

In order to find balance, a last approach could be explaining the ideal size of government through the production theory. Governments have a production function of public goods and services, and taxation is an income used as a factor of production. The revenue of the government means less disposable income for households. In this sense, the optimal level of public expenditure is when the marginal production of the last dollar is greater than the effect of households’ consumption or investment into the economy with that last dollar. Then, indeed most of the developed countries show higher levels of expenditure and taxation with a low marginal outcome, and most of developing countries show lower levels of expenditure and taxation with high potential but low actual marginal outcome due to inefficiencies (Karras, 1996). In his study, Karras (1996) suggests that ideal government size should be 23% as government expenditure as percentage of GDP globally, varying from 14% in OECD countries and 33% in South America; moreover, he concludes that with a 20% government services are overprovided in Africa (Scenario 2 in Fig.1) and with a 25% underprovided in Asia (Scenario 4 in Fig.1), implying that the difference may rely in the stages of development.

In summary after reviewing the cases, is not unrelated to agree that affirmation “Governments in developing countries are ‘too small’” depends on context. As figure 1 shows, even though less developed countries tend indeed to have smaller governments than industrialized ones some exceptions arise. Moreover, what will actually define if it is ‘too large or small’ will not be the level of spending on its own but a combination of it with its efficiency (World Bank 2016). The further section will review different characteristics that may affect the size of government and growth, regional cases where government was found to be ‘too large or small’ and alternatives on how it could become more optimal (whether it is by increasing or decreasing its size, or by allocating in better ways).

Different features associating to the government size

There are several characteristics that may affect the size of government and its effects, besides the simple distinction between developed and developing country. For example, there is a study that focused on how fiscal decentralization could affect the size of government specifically in Latin America. Stein (1999) found that decentralization could have both increasing and decreasing effects on the size of government, and that the key determination was the level of vertical imbalance (when most revenue comes centrally and expenditure is done decentralized, explained by the low revenue capacity of the regional and local governments). In the end decentralized countries with higher vertical imbalance were found to have larger governments, and those with low imbalance had smaller governments. Though the fiscal imbalance tends to be larger in Latin American countries than in OECD ones, the finding is regardless the level of development. This could be one of the reasons explaining why there were some exceptional cases where developing countries had very large governments for their performance, as seen in section 1.

On a different note, Alesina & Wacziarg (1998) and Rodrik (1998) analysed the impact of the levels of trade of a country in the government size. Alesina & Wacziarg (1998) found that bigger countries (that have a lower per-capita cost of public goods because of higher population) have a smaller share of government consumption over GDP compared to small countries. The reason is assumed because smaller countries are likely to be more open because they are restricted by the size of their domestic markets. Rodrik (1998) find the same relation, though for a non-exclusive different reason. Open economies are more susceptible to external shock, then government needs to be greater to have role of stabilization and assume risk-reducing activities. Both findings apply to developed and developing economies, and though industrialized countries are highly associated to high exports of added-value goods, developing ones have commodities exports too (Rodrik 2014). Then again, these relations may explain other associations like why governments could be ‘too large’ in developed but in developing countries too in some cases.

On a different kind of analysis, government sector size and its effects on growth could be associated to different political and economical models of a country. Guseh (1997) found this aspect relevant, since systems are not constant through time, and he acknowledged that increasing the size of government could be beneficial in the short term but harmful in the long run. In the end a negative relation was found, stating that for every 1% increase in the public expenses there would be a 0,143% decrease in economic growth rate. When studying it in different kind of societies, results agreed that the more free societies were (assessed by the level of political right and civil freedom), the lower the negative effect on growth would be. Additionally, negative effect of government spending was not different between market and mixed economies, but was substantially larger in socialist economies. Negative impact was found to be 3 times greater in socialist and un-free societies and optimal combination was found to be mixed economies that are politically free. Overall, the type of model a country fosters could affect how efficiently are the public expenses achieved.

Supporting the theory that public consumption is positive until a certain point that it starts being unproductive, other studies reviewed the impact of regulation (meaning state intervention in market failures) on growth. Jalilian et al. (2007) analysed the path that regulation systems went through in different countries, with a trend of making it less and less through time in the last decades. Even though the effect of regulation on growth was found negative, the study makes no distinction between developed and developing economies; it questions if developing countries are lessening state intervention as industrialized ones without having gone through the optimal level of regulation yet and leaves it for further research.

Last but not least, in order to find an optimal mix, what is necessary to know is the composition of the expenditure itself, to actually acknowledge which is the most productive spending. Discriminating kind of expenses in this analysis is important because, maybe it is not a matter of overall effect on growth, but the effects of specific interventions compared to others. In this sense, and initial study conducted by Aschauer (1989) arrived to the conclusion that ‘core’ infrastructure (such as roads, water and sanitation interventions, airports, highways, etc.) were found to be the most productive towards economic growth; the study was conducted only in developed countries. Nevertheless, one different study arrived to different conclusions. Devarajan et al. (1996) made a research discriminating between developed and developing economies. When talking about less developed countries, the study stated that current government spending had a positive effect on economic growth, while capital expenditure had negative impact. This effect was potentially associated to already initial higher than necessary proportions of capital costs, suggesting that developing countries have been miss allocating; what is considered efficient could become the opposite if used excessively. Paradoxically when the regression was run for industrialized economies the findings were opposite, supporting Aschauer (1989) conclusions.

All the examples mentioned above give an understanding on the aspects that may affect government size and its efficiency. Even though most characteristics can be associated to developed or developing situations, distinctions are not exclusive and might apply to either case. In this way, the cases above enable light in what should be done in order to converge public spending and become nor too large or small, but optimal, regardless level of development.

Assessing regional realities to converge towards optimal

As previously reviewed, there is no consensus about government spending and its efficiency. Though some expenses can have positive effects in certain situations others may not. Inside all government expenses stand the policies that might have increasing-productivity effects and decreasing-productivity effects. For example, there could be a case were government is big and spends its entire budget in productive policies or the opposite regardless the level of development. To find equilibrium alternatives, it is then necessary to increase or decrease its size, allocate in better ways or a combination of both (Labonte 2010). Referring to Figure 1, situation could tend to optimal by:

- Scenario 1: Increasing productive public spending by altering allocation of existing budget

- Scenario 2: Decreasing public spending and allocate better

- Scenario 3: Decreasing ineffective public spending

- Scenario 4: Maintain

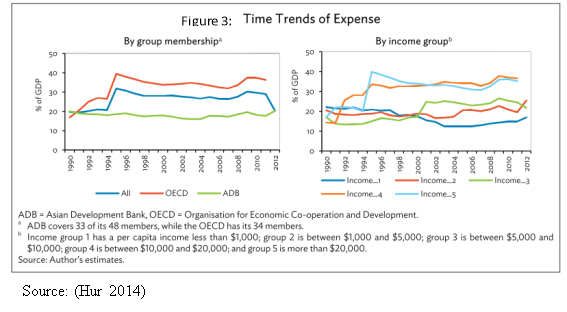

Reviewing different analysis on regional perspectives the picture becomes clearer to the scenarios. To start with, Asia could be in a simple and general way, in between Scenario 1 and 4. The Asian Development Bank conducted a study agreeing that government spending had a positive effect on growth, and that expenses on health and education seemed to reduce income inequality compared to OECD economies (Figure 3), emphasizing the retributive role of state in developing countries. Indeed the study finds that government size is smaller in developing economies in Asia, but effective spending is done either way. In 10 Asian cases, reducing taxation has more constant growth effects than increasing expenses, agreeing that changing expenses’ composition is more plausible than increasing taxation (Hur 2014). On a different case, a study conducted suggests that efficiency in African government spending is on average less efficient than in Asian and Western countries (pure Scenario 1). Though public health and education has improved in the 1980’s and 1990’s, there is room for better allocation still, instead of increasing budgets. Both studies appear to agree with Karras (1996) government productivity assessment.

Analysing Latin America, a study conducted by the CEPAL (United Nations Economical Commission for Latin America), does picture the situation seen in Figure 2, with developing economies such as Brazil, Argentina and Venezuela having governments closer to Nordic countries, without such level of development (Scenario 4). Government intervention has increased in the last 10 years, pushed by current spending, with a higher incidence of social expenses. To start with fiscal incomes increased due to the increase in primary exports, challenging the sustainability of such big government. Moreover, countries where expenses were already high it increased further. The found inefficiencies in infrastructure investment in addition to regressive allocation of social spending in education and health, confirm that in this case government should be reduced and better allocated too (Clements & Faircloth 2007). On a different region but supporting note, a study conducted in the Arab Gulf suggested that size of government was larger than should be (probably because of its high reliance on oil exports) and not as efficient, suggesting again reduction and better allocation was necessary (Aly & Strazicich 2016).

Last but not least, there is a general trend that agrees that government sector continues to grow in developed economies like Europe and North America. This growth mainly comes from transfers and subsidies, generating in the end disincentives to economic growth with increased taxation and fostering unemployment through higher social programs (Feldmann 2010; Alesina 1999; OECD 2008). This situation resembles with Scenario 3, where government needs to be reduced.

After reviewing the different literature regarding government size, several conclusions come to place. To start with, overall government sector is found to be substantially smaller in developing countries than in developed ones. Additionally, there is a trend of poor administration and ineffective results in less developed countries, making it indeed ‘too small’ (Alesina 1999). Nevertheless, in the recent decades this assumption has fade away alongside the concept of developing countries, and exceptions to this categorization become greater through time (for better or for worse). The Asian case is an example that shows a government sector that can be assessed as efficiently small (Hur 2014). On the contrary, Latin America pictures some cases where developing countries continue to have excessive unproductive governments, or ‘too large’ ones. Even ‘too large’ can be becoming the case for developed nations, specially due to current spending (OECD 2008).

Secondly, different characteristics may affect the size of government and its subsequent effects. Fiscal capacity and administration, types of taxes, economical and political model, level of exports are some of those features. All of them independently or combined, could affect not only how big or small the state is but also the effect on economic growth; even through time it may have different effects. Studies have proved contradictory (Devarajan et al. 1996; Alesina 1999; Labonte 2010), do note finding a unique relation. It actually the country contexts and characteristics that will shape the role of government; that role will determine priorities and in a way guide the composition of public expenditures to be more or less efficient towards society needs (Stiglitz 1997; Labonte 2010).

The affirmation that “governments in developing countries are ‘too small’” is true in simplistic and generalized way. As analytical complexity is added, it becomes more challenged by profitable and not so profitable cases. Depending on the circumstances different scenarios will be found, and the only one conclusion that all cases should follow is that: increasing-productivity government expenses should be pursued and decreasing-productivity ones should be cut (Labonte 2010). It is up to government decide which are those, according to the country’s unique set of characteristics (not developed or developing, but a specific combination of many) and the role the public sector should have.

Bibliography

Alesina, A. (1999). Too large and too small governments. Economic Policy and Equity, pp.216-234.

Alesina, A. & Wacziarg, R. (1998). Openness, country size and government. Journal of Public Economics, 69(3), pp.305-321.

Aly, H. & Strazicich, M. (2016). Is Government Size Optimal in the Gulf Countries of the Middle East? An empirical investigation. International Review of Applied Economics, 2171(December).

Aschauer, D.A. (1989). Is public expenditure productive? Journal of Monetary Economics, 23(2), pp.177-200.

Baumol, W.J. (1993). Health care, education and the cost disease: A l o o m i n g crisis for public choice*. , 77(1), pp.17-28.

Burgess, R. & Stern, N. (1993). Taxation and development.pdf. Journal of Economic Literature, 31(2), pp.762-830.

Clements, B. & Faircloth, C. (2007). Gasto público en América Latina: tendencias [Public Expenditure in Latin America: trends]. Revista de la CEPAL, pp.39-62. Available at: http://www.cepal.org/publicaciones/xml/0/31950/Clements.pdf.

Conte, M., and Darrat, A. (1988). “Economic Growth and the Expanding Public Sector.” Review of Economics and Statistics 70 (1988): 322-30.

Devarajan, S., Swaroop, V. & Zou, H. (1996). The composition of public expenditure and economic growth. Journal of Monetary Economics, 37(2), pp.313-344. Available at: http://www.sciencedirect.com/science/article/pii/S0304393296900392.

Feldmann, H. (2010). Government size and unemployment in developing countries. Applied Economics Letters, 17(3), pp.289-292. Available at: http://dx.doi.org/10.1080/13504850701720221.

Guseh, J.S. (1997). Government Size and Economic Growth in Developing Countries: A Political-Economy Framework. , 19(1), pp.175-192.

Hur, S. (2014). Government Spending and Inclusive Growth in Developing Asia. ADB Economics Working Paper Series No. 415, (415).

IMF, 2016. World Economic Outlook Database [Online]. Available at: International Monetary Fund – http://www.imf.org/external/ns/cs.aspx?id=28 (Accessed: 21 December 2016).

Jalilian, H., Kirkpatrick, C. & Parker, D. (2007). The Impact of Regulation on Economic Growth in Developing Countries: A Cross-Country Analysis. World Development, 35(1), pp.87-103.

Karras, G. (1996). the Optimal Government Size: Further International Evidence on the Productivity of Government Services. Economic Inquiry, 34(2), pp.193-203. Available at: http://doi.wiley.com/10.1111/j.1465-7295.1996.tb01372.x.

Labonte, M. (2010). The Size and Role of Government : Economic Issues.

Landau, D. (1986). Government and economic growth in the less developed countries: an empirical study for 1960-1980. Economic Development and Cultural Change, 35(1), pp.35-75.

Lawson, D. (2016). The Public Sector, lecture notes distributed in Economic Analysis of the Public Sector at The University of Manchester on October 2016.

OECD (2008). Government Sectors in the Industrialized Market Economies. Public Sector Economics, pp.2-5.

Ram, R. (1986). Government Size and Economic Growth: A new Framework and Some Evidence from Cross Sectional and Time Series Data. American Economic Review, 76(1), pp.191-203.

Rodrik, D. (2014). The past, present, and future of economic growth. Challenge, 57(3), pp.5-39. Available at: http://www.tandfonline.com/doi/full/10.2753/0577-5132570301.

Rodrik, D. (1998). Why Do More Open Economies Have Bigger Governments? Journal of Political Economy, 106(5), p.997.

Stein, E. (1999). Fiscal Decentralization and Government Size in Latin America. Journal of Applied Economics, II(2), pp.357-391. Available at: http://www.cema.edu.ar/publicaciones/download/volume2/stein.pdf.

Stiglitz, J.E. (1997). The Role of Government in Economic Development. , pp.11-23.

UN (2016). United Nations HDI – December 2016. [Online]. Available at: http://hdr.undp.org/en/content/human-development-index-hdi (Accessed: 20 December 2016).

World Bank (2016). World Development Indicators 2016, Available at: https://openknowledge.worldbank.org/bitstream/handle/10986/23969/9781464806834.pdf?sequence=2&isAllowed=y.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal