Global Competitive Advantage – Apple Case Study

| ✅ Paper Type: Free Essay | ✅ Subject: Business |

| ✅ Wordcount: 2043 words | ✅ Published: 26 Sep 2017 |

International Business

Global competitive advantage – creating and sustaining: the case of Apple Inc.

The purpose of this essay is to discuss theoretical ideas behind creating and sustaining global competitive advantage; then applying these in an analysis of Apple Inc. Using the star analysis, I will examine how the company achieves global competitive advantage by means of efficiency, flexibility and learning.

Apple Inc. is an American multinational corporation, founded in April 1976, headquartered in Cupertino, California, US (Apple.com, 2014). The company designs, manufactures and retails consumer electronics, online services, personal computers and software. Apple is also thelargest publicly traded corporation in the world by market capitalization, second-largest information technology companyby revenue and theworld’s third-largest mobile phone maker (Forbes.com, 2013).

Globalisation plays a major role in achieving global competitive advantage. The merge of distinct and historically separate national markets into one global market place poses many advantages as well as disadvantages for companies operating world-wide (Hill, 2005).

Home country

Apple states that it differs from other companies within the same sector as it was set up to create value by “seeking innovations and creating an organization that can implement them” (Steve Jobs, 2000). The company is thought to have a very powerful management and corporate culture, which promotes innovation in everything they do, “from their products to marketing and delivery”; which is key in differentiating their brand from the competition (The Harvard Review, 2011).

Porter’s (1980) value chain helps businesses examine additional competitive capabilities hidden in primary and support activities. For the purpose of this assignment, I will concentrate on exploring primary activities that predominately apply to how Apple creates value and thus gains competitive advantage.

Research and development is one of the primary activities, where Apple creates value. The company designs and develops products which are rich in design and user experience. Throughout the years, Apple has created a brand culture, attracting customers who identify with the brands values: innovativeness, simplicity, and coolness (Forbes, 2012).This core competence alone gives the company a distinguished brand image in the market, and a competitive advantage, which succeeds even in the face of multiple competitors (Apple.com, 2014).

Marketing and sales is a very important sector for a company competing within the fast-developing technology sector. Perceived scarcity of Apple’s products makes them seen as luxury goods therefore more desirable and in demand (Forbes, 2011). Apple is also seen as the master of preserving confidentiality during the product development phase. On the other hand, the company is also named the “master of the teaser marketing campaign” (Telegraph, 2013). Each time a new product is due to be launched, leakages feed the media and internet creating speculations months prior to the actual launch. This creates a free marketing momentum prior to paid marketing campaign.

The Apple store is a place where customers are able to sense the Apple experience delivered by the products, but also by the well-trained staff. Employees are trained not to focus on sales but on building relationships and creating loyal customers. This approach makes customers feel like Apple enriches their lives, thus improves brand image and creates value (The Business Review, 2011).

Partner country

Businesses are often unable to sustain continuous high levels of productivity over long periods of time without accessing knowledge from beyond their boundaries – they require external knowledge to develop new innovations (Haeussler et al. 2014). According to Bing-Sheng et al. (1998), increasing formation of strategic alliances can be seen as a response toglobalisationand increasing uncertainty and complexity in the business environment.

A strategic alliance is an agreement between two or more organisations to collaborate on a specific business activity or an on-going project, whilst maintaining their own identity. The main aim of an alliance is for both firms to benefit from achieving economies of scale and greater access to target markets, sharing of knowledge and expertise as well as the reduction of risk and costs thus gaining competitive advantage (Bing-Sheng et al. 1998).

Apple Inc. has recently announced a new partnership with IBM. The main aim of the alliance is to team up “market-leading strengths” of both companies to renovate enterprise mobility with the use of IMB’s data and analytical capabilities and Apple’s hardware and software as well as unique customer experience (Apple, 2014). According to Forbes (2014), IBM will also sell iPhones and iPads to business clients worldwide. This demonstrates that Apple will benefit from greater access to new target markets whilst IBM will advantage from selling Apple’s products to their customers. Furthermore, a strategic alliance with IBM poses a great potential advantage for Apple as IBM holds extensive understanding of enterprise business conditions and demands. Consequently, Apple could act opportunistically and learn from their competitor.

Partner selection is vital to forming a successful strategic alliance (Hill, 2014). IBM will help Apple achieve its strategic goals through greater enterprise market access, gaining access to critical core competencies of IBM and sharing the costs and risks of new product development. On the other hand, according to Hill (2014), the failure rate for strategic alliances seems to be high; this is why an alliance should be structured so that threat of opportunism is minimised. Contractual safeguards have to be written into the alliance agreement to protect core competencies of the company (Hill, 2014). Apple and IBM both agreed to bring together complementary skills and assets that neither company could develop on its own (Forbes, 2014) – this reduces the threat of opportunism from both sides as both companies will benefit from the alliance.

An additional way of successfully managing a strategic alliance is to recognise opportunities ahead of the competition (Haeussler et al. 2014). Critics outline that Apple didn’t realise the importance of a strategic alliance with Microsoft early enough. Consequently, if Apple would have licensed their Mac OS operating system, when it first came out, perhaps Windows would not be as successful (Forbes, 2014). This demonstrates that strategic alliances can pose a great competitive advantage when recognised at the right time and managed correctly.

Supplier country

International businesses often face make-or-buy decisions about whether they should perform a certain activity in-house or outsource elsewhere. Companies usually internalise core competence activities in order to protect proprietary product technology, accumulate dynamic capabilities and improve scheduling. On the other hand, activities seen as peripheral to core competence are usually externalised with the aim of lowering cost and achieving strategic flexibility (Parmigiani, 2007).

As outlined earlier in this essay, Apple Inc. perceives designing and developing its products as the company’s core competence, hence these activities are internalised to avoid opportunism from competing companies. Acquisition of businesses can also help protecting and expanding core competencies of the company. Apple acquires smaller businesses in order to gain skills and intellectual property to work on new projects (Tim Cook, 2013), for instance: in recent years, the company acquired Siri (a voice-recognition system) as well as a series of mapping start-ups that shaped the basis of Apple Maps (Apple.com, 2014). In contrast, critics debate if Apple should become more acquisitive as they are moving from traditional personal computers to smart phones and mobile computing, where competition is much tougher (Forbes, 2014).

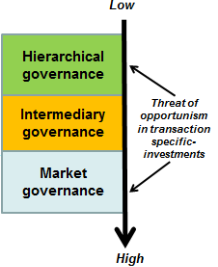

When balancing between internalisation and externalisation, companies have to consider transaction cost analysis of boundary decisions, including the most efficient way of governing it. Internalised design and development of Apple products demonstrates the company’s hierarchical approach to transaction cost analysis of boundary decisions, where costs are high as activities are performed in-house, however: threat of opportunism is kept at its minimum (Hill, 2014).

On the other side of the spectrum, activities such as manufacturing are externalised and performed by other companies such as Foxconn Technology Group, located in China (Apple, 2014). This is also an example of intermediate governance as both firms benefit from the manufacturing contract. Offering a relatively high-skilled, low-priced labour force as well as a good business infrastructure and a stable economy, China is an ideal location for manufacturing Apple’s products (The Economist, 2014). Furthermore most of the products needed for manufacturing are made in China thus lowering the cost of production (Forbes, 2014).

As outlined above, the more complex the governance mechanism, the more effective it will be in reducing the threat of opportunism. On the other hand, market governance – although relatively cheap, will allow competing companies to act opportunistically (Barney, 1999). Bearing in mind the transaction cost economies; Apple balances between internalisation and externalisation efficiently, thus creating a competitive advantage.

Customer country:

Integration– Responsiveness (IR) is vital to achieve global competitive advantage. This framework outlines that companies should balance between pressures for cost reduction and local responsiveness (Hill, 2014). As demonstrated below, the integration-responsiveness framework presents four distinct approaches to IR.

Apple Inc. operates under international strategy: products are designed focusing on domestic customers, whilst international business is sought as a way of replicating its home-market success (Kendall et al. 1990). This means that Apple’s products are standardised: engineering, design and manufacturing is all controlled by one source – this gives the company greater control as well as a competitive advantage as it differentiates from competing businesses (Forbes, 2013). Consequently, differentiation becomes the main competitive strategy as international strategy is not the most cost-efficient. Furthermore, international strategy is well suited for high-end products also allowing greater control over the company (Rothaermel, 2013). Apple has a strong brand image, with products seen as up-market and luxury (Forbes, 2014). This demonstrates that the company does not have to alter its IR as pressure for local responsiveness and cost reduction is relatively low.

On balance, based on application of academic frameworks in research I conducted, I believe that Apple generates and maintains substantial global competitive advantage over its rivals. Activities such as: building efficient global supply chains, flexibility when managing risks and opportunities and learning from international exposure as well as partnership with other companies all help Apple become an innovative company with a strong brand reputation and a sustained global competitive advantage.

References:

Apple (2014) Apple/About. Available from: http://www.apple.com/uk [Accessed: 1 December 2014].

Apple Press Info (2014) Apple and IBM Forge Global Partnership to Transform Enterprise Mobility. Available from: https://www.apple.com/uk/pr/library/2014/07/15Apple-and-IBM-Forge-Global-Partnership-to-Transform-Enterprise-Mobility.html. [Accessed 30 November 2014].

Barney, J.B. (1999) How a Firm’s Capabilities Affect Boundary Decisions. MIT Sloan Management Review, 40 (3) 137-145.

Bing-Sheng, T; Das, T. K (1998) Resource and Risk Management in the Strategic Alliance Making Process. Journal of Management. 24 (1) 21-42

Forbes (2013) Apple Dominates List Of The World’s Most Valuable Brands. Available from: http://www.forbes.com/sites/kurtbadenhausen/2013/11/06/apple-dominates-list-of-the-worlds-most-valuable-brands . [Accessed 28 November 2014].

Forbes (2014) Apple – IBM Partnership: Enough To Solve Enterprise iOS Fears?. Available from: http://www.forbes.com/sites/leoking/2014/07/16/apple-ibm-partnership-enough-to-solve-enterprise-ios-fears/. [Accessed 30 November 2014].

Forbes (2014). This Is Why China Is So Important For Apple. Available from: http://www.forbes.com/sites/chuckjones/2014/09/22/this-is-why-china-is-so-important-for-apple/. [Accessed 25 November 2014].

Forbes (2012) Why Apple Is a Great Marketer. Available from: http://www.forbes.com/sites/christinemoorman/2012/07/10/why-apple-is-a-great-marketer/. [Accessed 26 November 2014].

Forbes (2014) Why Can Apple Make Things But IBM Can’t? Available from: http://www.forbes.com/sites/jonathansalembaskin/2014/10/21/why-can-apple-make-things-but-ibm-cant/. [Accessed 30 November 2014].

Haeussler, C; Higgins, M. (2014) Strategic Alliances: Trading Ownership for Capabilities. Journal of Economic and Management Strategy. 23 (1) 178-203.

Harvard Business Review (2011) Retail Isn’t Broken. Stores Are. Available from: https://hbr.org/2011/12/retail-isnt-broken-stores-are/ .[Accessed 1 December 2014].

Harvard Business Review (2011) What I Learned Building the Apple Store. Available from: https://hbr.org/2011/11/what-i-learned-building-the-ap. [Accessed 30 November 2014].

Hendrix, J. (2014) Apple’s Organizational Structure. Available from: http://www.academia.edu/7937905/Apples_Organizational_Structure. [Accessed 26 November 2014].

Hill, C. (2005) International Business: Competing in the Global Marketplace (5thedn), McGraw-Hill/Irwin.

Hill, C. (2014) International Business: Competing in the Global Marketplace. New York: McGraw-Hill Education (UK).

Hofstede, G. (1983) The Cultural Relativity of Organisational Practices and Theories, Journal of International Business Studies 14 (2) 75-89.

Kendall, R. & Allen J. M. (1990). An Empirical Analysis of the Integration-Responsiveness Framework in Global Industries. International Journal of Business Studies. 21,(4) 541-564.

Moore, A. T; Segal G. F. (2002) Evaluating the Costs and Benefits of Outsourcing Correctional Services. Available from: http://reason.org/files/4ca7ce58f2a7b7a1529a21927459880a.pdf . [Accessed 28 November 2014].

Ohmae, K. (1989) The global logic of strategic alliances. Harvard Business Review. Pp. 143-154.

Parmigiani, P. (2007) “Why do Firms Both Make and Buy?” Strategic management journal. 29 (3) 295-303.

Porter, M (1980). Competitive strategy. The ultimate business library, Wiley. Available from: http://search.credoreference.com.ezproxy.uwe.ac.uk/content/entry/wileyultbuslib/michael_porter_competitive_strategy_1980/0 [Accessed: 26 November 2014].

Rothaermel, F.T. (2013) Strategic Management. The McGraw-Hill Companies, Inc.

The Economist (2014) Chinese Economy. Available from: http://www.economist.com/topics/chinese-economy. [Accessed 1 December 2014].

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal