Aaron’s Inc. Financial Analysis

| ✅ Paper Type: Free Essay | ✅ Subject: Business |

| ✅ Wordcount: 801 words | ✅ Published: 14 Sep 2017 |

Aaron’s is a is a rent-to-own retailer. The RTO business model was introduced in the late 1960’s in the US by major appliance stores and was offered to customers who could not purchase the goods all at once and who also could not get credit because they had lower incomes and posed a higher risk to traditional lenders. RTO businesses enable customers to acquire goods such as major appliances, household furniture, and electronics by making weekly or monthly payments vs. paying for them outright. Typically, customers make payments for a set number of weeks or months, usually seventy-eight weeks or eighteen months (Anderson and Sanjiv). At the end of their term, they can either return the items or purchase them. Today rent-to-own represents a $4.5 billion industry with about 3.5 million customers (Martin and Nancy). The industry is forecasted to continue growing as the low-income population is increasing and is expected to depend on rent-to-own payment models. This presents a good growth opportunity to invest in.

Aaron’s, Inc. was founded in 1955. The company was formerly known as Aaron Rents, Inc. and changed its name to Aaron’s Inc. in April 2009. It principally operates in the US and Canada with headquarters in Atlanta, Georgia and offers lower to middle- income customers the opportunity to purchase goods with no credit check or credit sources from traditional bank financing. In addition, Aaron’s manufactures its own furniture which allows the company to have control over quality, cost, delivery, design, durability, and quantity of furniture products. Moreover, Aaron’s customizes its furniture based on customer needs which gives it an advantage over its competitors. Aaron’s Standard Industrial Classification (SIC) Code is 7359 assigned by the U.S. government to identify the primary business which it operates. It recorded revenues of $2,725.2 million in the financial year ending December 2014 (FY2014), an increase of 22% over FY2013. The operating profit of the company was $139.8 million in FY2014, a decrease of 25.3% compared to FY2013. The net profit was $78.2 million in FY2014, a decrease of 35.2% compared to FY2013 (market line).

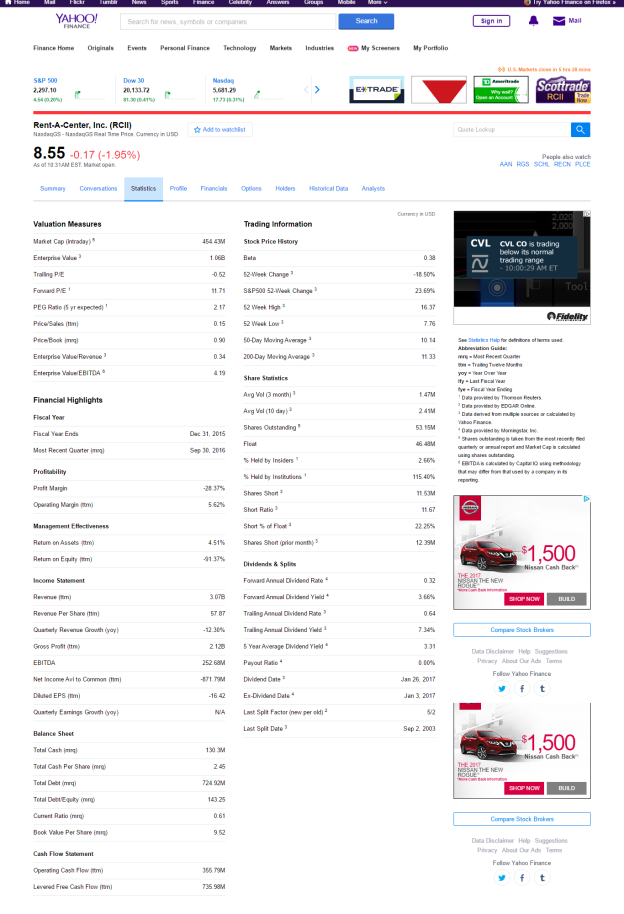

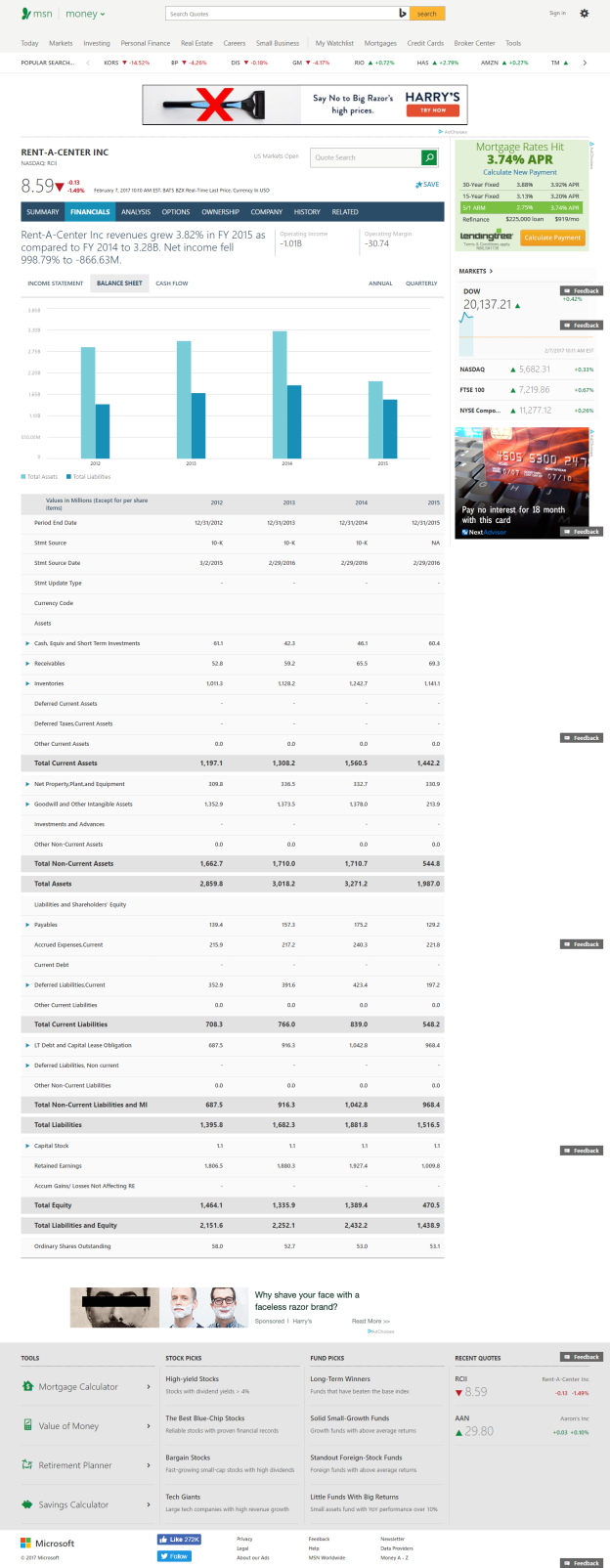

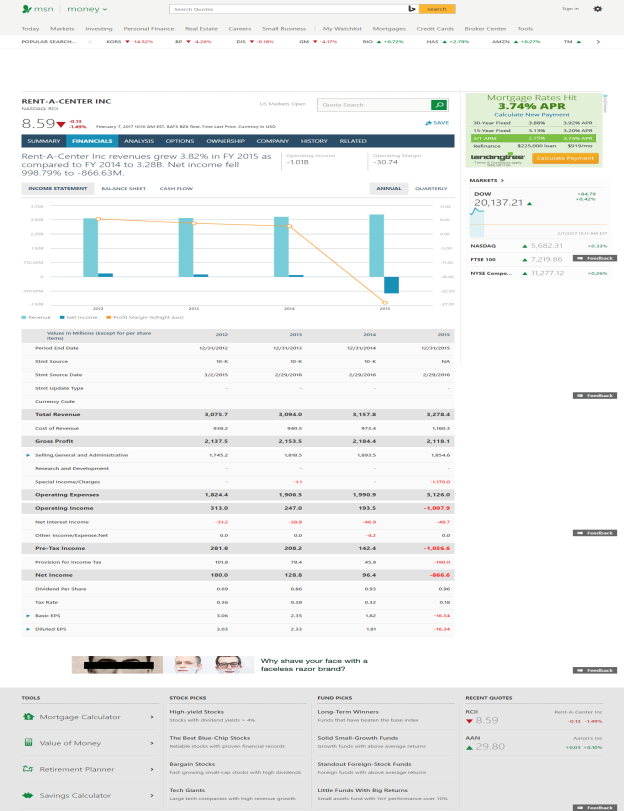

Aaron’s is subject to intense competition from Rent-A-Center, Inc. RAC is based in Texas and offers the same service as Aaron’s but covers a larger geographical area. Its Standard Industrial Classification (SIC) Code is 7359. The company operates 2,672 company-owned stores across the US, Canada, and Puerto Rico. RAC recorded revenues of $3,157.8 million during the financial year ending December 2014 (FY2014), an increase of 2.1% over FY2013. The operating profit of the company was $193.5 million in FY2014, a decrease of 21.7% compared to FY2013.The net profit of the company was $96.4 million in FY2014, a decrease of 25.1% compared to FY2013 (market line).

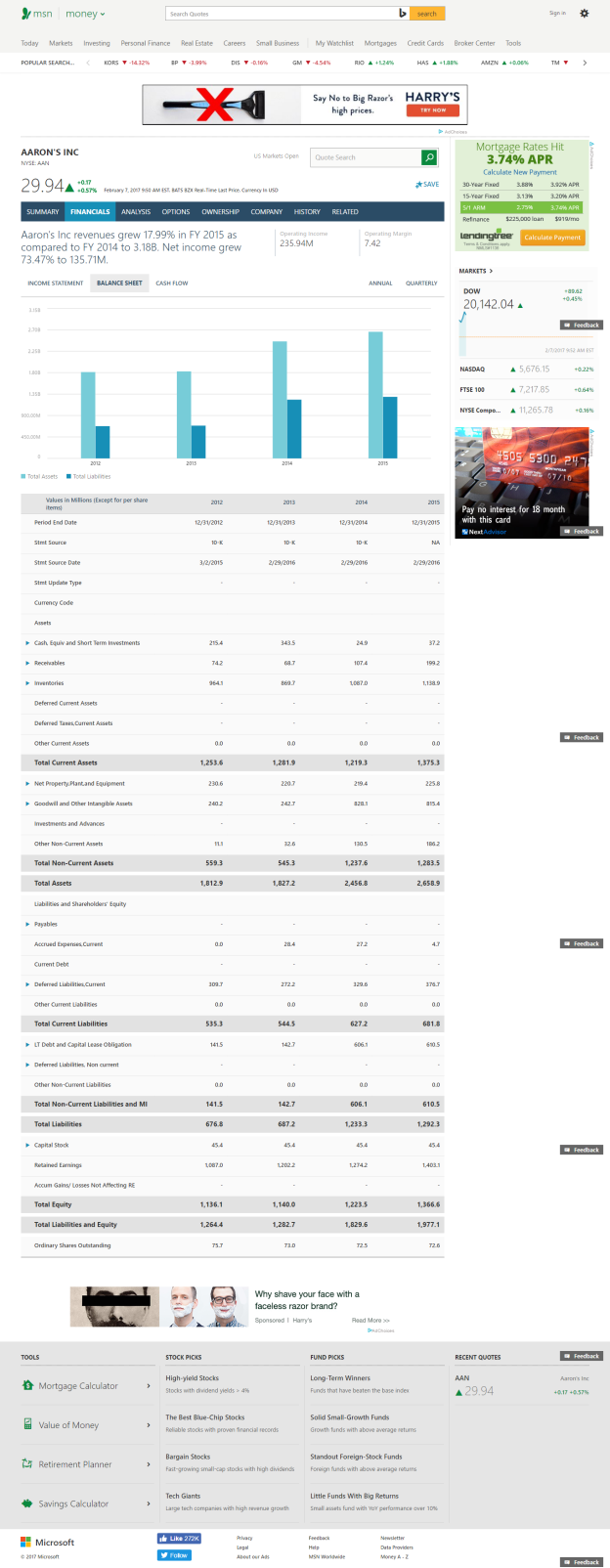

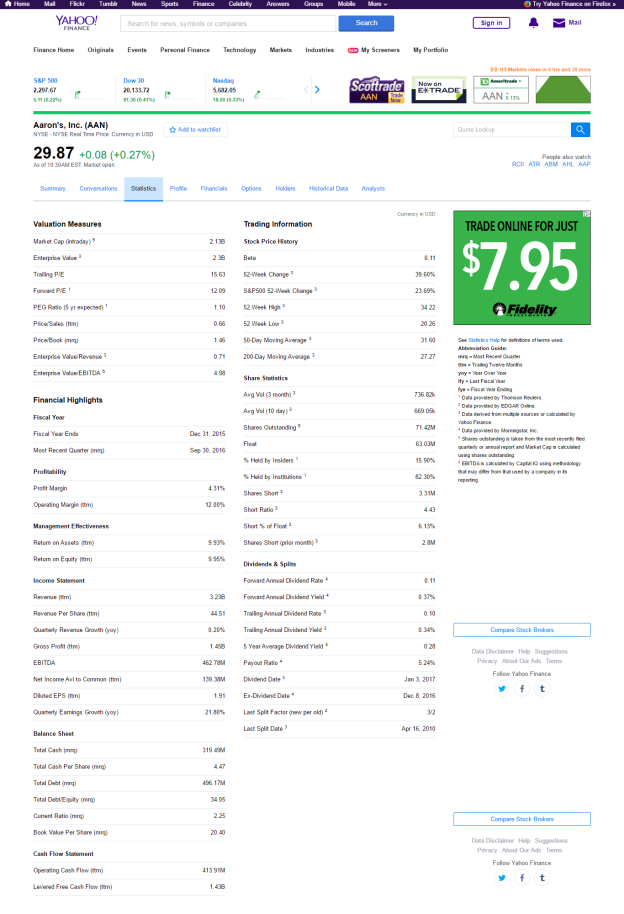

The financial ratios show that RTO companies are doing well financially. Aaron’s and RAC’s current ratio for 2015 are 2.46% and 2.36% respectively. The ratios are a little high, good companies should have ratios below 1% to cover its short-term debt with its current asset without relying on loan money. The debt/equity ratio for Aaron’s and RAC in 2015 are 0.34% and 1.43% respectively, which indicates that both of the companies have taken on relatively little debt and thus have low risk.

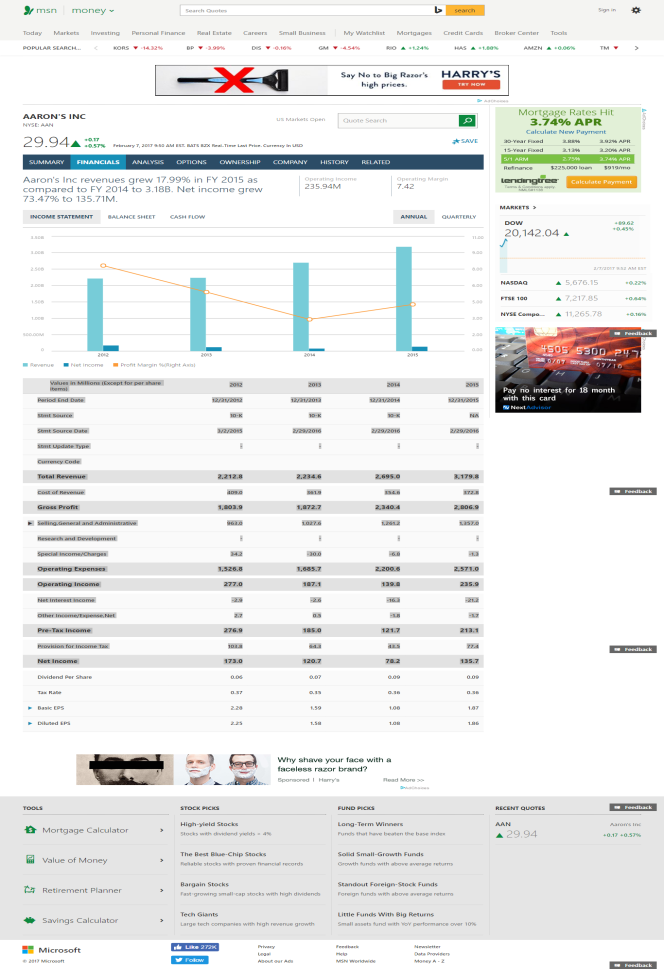

The US rent-to-own market is growing at 3.8 % (market line), with significant growth during the past few years, driven by the downturn in the US economy. In addition, growth in the industry is driven by an increase in US urbanization rates and an increase in the population of low-income households. Geewax the author of the article The Tipping Point stated that the lower- class in the US has grown by 5% in the past 20 years. This shift will mean more customers will opt for rent-to-own payment models since they are less likely to have the necessary cash to purchase big ticket purchases and as banks and credit cards tighten their lending to these higher risk customers. Furthermore, MSN Finance shows that financial ratio of Aaron’s is healthy. Aaron’s revenue grew by 17.99% in FY2015 compared to FY 2014. Therefore, the company is well positioned to extend its business and increase its revenue which makes it a good place to invest ones’ money in.

Work Cited:

Anderson, Michael, and Sanjiv Jaggia. “Return, Purchase, Or Skip? Outcome, Duration, And Consumer Behavior In The Rent-To-Own Market.” Empirical Economics 43.1 (2012): 313-334. Business Source Complete. Web. 28 Jan. 2017

“Rent-A-Center, Inc.” Rent-A-Center, Inc. SWOT Analysis (2015): 1-8. Business Source Complete. Web. 28 Jan. 2017

“Aaron’s, Inc. SWOT Analysis.” Aaron’s, Inc. SWOT Analysis (2015): 1-8. Business Source Complete. Web. 28 Jan. 2017

Gara, Tom. “Computer Rental Company Aaron’s Agrees to Stop ‘Monitoring’ Its Customers.” The Wall Street Journal. Dow Jones & Company, 22 Oct. 2013. Web. 28 Jan. 2017

Martin, Susan Lorde, and Nancy White Huckins. “Consumer Advocates Vs. The Rent-To-Own Industry: Reaching A Reasonable Accommodation.” American Business Law Journal 34.3 (1997): 385. Business Source Complete. Web. 28 Jan. 2017.

Geewax, Marilyn. “The Tipping Point: Most Americans No Longer Are Middle Class.” NPR. NPR, 9 Dec. 2015. Web. 28 Jan. 2017.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal