Northrup Grumman Case Study

| ✅ Paper Type: Free Essay | ✅ Subject: Marketing |

| ✅ Wordcount: 1895 words | ✅ Published: 03 Nov 2020 |

Northrup Grumman B-2 Spirit Bomber [4].

1 Describe the organisation, core activities and additional services it provides

Northrup Grumman is an American based global Aerospace and Defense company which is currently one of the largest defense contractors in the world. The firm employs over 90,000 employees and operates in more than 550 facilities in the US and in more than 25 countries globally [8].

The company was formed in 1939 after Jack Northrop left Douglas (known for its conception of the semi-monocoque DC-3 plane), then spent a majority of his resources on developing a flying wing bomber – a feat that met heavy criticism at the time. Over the years, the firm acquired a multitude of high-profile companies including Grumman Aerospace, Xetron corporation and Navia aviation to name a few [1], and has established a large portfolio of products such as ballistic missiles, commercial/military radar, Apollo 16 Lunar Module and fighter/bomber aircraft [4].

Figure 1: Northrup Grumman MQ-4C Triton drone [8].

The firm’s core activities are made up of five main business sectors each with their own respective additional services [4]:

- Missions Systems – Encompasses navigation, electronic warfare, airborne radar and logistics systems.

- Aerospace systems – Development of manned/unmanned aircraft and subsystems with key products including the iconic B-2 Stealth Bomber and the unmanned MQ-4C Triton drone.

- Innovations systems –development of vehicles such as the Cygnus spacecraft and the upcoming Omega space launch vehicle.

- Ship Building– Design and production of battle ships including guided missile interceptors, assault ships, aircraft carriers and submarines.

- Technology services – Provision of network-centric solutions which includes training, maintenance support and communications materials to the military, telecommunications, medical, and other markets.

2 What does the market look like?

For the purpose of focus, the report analysis will revolve solely on the Aerospace & defense sector.

Who is their target customer and what defines them?

Northrup Grumman’s targest customers primarily consist of the US military, followed by other countries’ governments and also private commercial firms. Unlike the commercial sector, the unique attribute of a governmental customer base is that large amounts of capital are available to invest into contractors as defense is typically highly-funded by governments who are keen to keep their sector competitive. The US spends a significantly large amount on defense spending (figure 2) in comparison to other countries, allowing Northrup Grumman to capitalise on this large to spend on research & development of its solutions and also in its other business sectors.

Figure 2: Global defense expenditure in 2019 [10].

What does the market look like and what are its key drivers?

In 2018, the Aerospace and Defense industry experienced a strong year as global military expenditure followed a positive upwards trend and was followed by a booming defense sector in 2019 [6]. The defense sector is expected to robustly continue its growth trajectory in 2020 and beyond, backed by a global defense spending increase of 3% compound annual growth rate between 2019-2023 [7]. This growth in the defense factor is believed to be a consequence of numerous factors:

- Elevated global tensions have continuously been pivotal to Aerospace and Defense spending. NATO countries have been investing largely into defense due to the ever increasing potential threats from Russia, North Korea and the Middle East in the near-term [3]. The recent escalations between the US and Iran are an example of a situational that prompts governments to improve their capability of instigating/preventing conflict.

- The Trump era has allowed the defense sector to flourish. In December 2019, Donald Trump approved a bill that authorised a Defense budget of $738 billion [7]. This was favourable for defense contractors as there will be large demand for massive projects with possibility for further scope due to the larger availability of capital. This demand has been realised with a $3 billion US order for Northrup Grumman’s next-generation B-21 Bomber aircraft [7].

- Higher defense spending by other major regional powers such as China, Saudi Arabia, India, and Japan has continued to increase as the demand for military equipment is on the rise. Northrup Grumman’s presence in other countries that are spending more on defense benefits them greatly. An example was the firm’s award of the $75 million IDIQ contract award to deliver Joint Threat Emitter (JTE) support services to the Kingdom of Saudi Arabia in 2018 [11].

- As seen throughout history, military modernisation is a large factor in government funding in defense and especially in the modern age, there is now an increased focus on cyber-security concerns. The uncertainty and complexity of this international security ecosystem is highly likely to boost global defense spending over the next five years. Northrup Grumman’s wealth of cyber and logistics capabilities provides a firm advantage to this market driver.

- Numerous countries have rapidly been developing their reach into Space in the recent decade. Thus, Aerospace and Defense is becoming an important part of the overall Space industry with growing global tensions potentially posing a threat to space assets such as satellites, which are often relied upon for military operations including communications, reconnaisance and commercial purposes.

What does the competition look like?

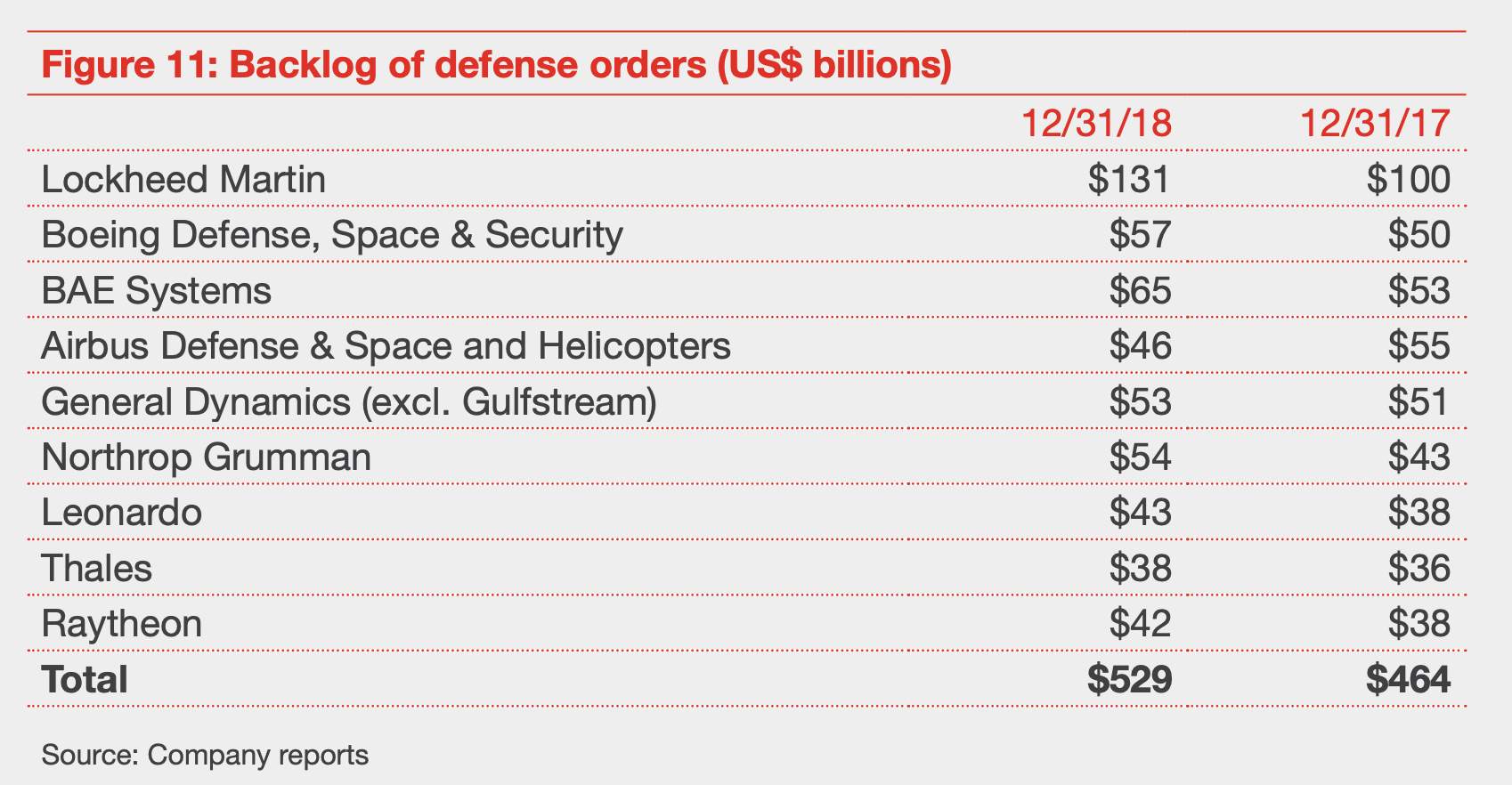

The Aerospace defense contracting market is highly competitive with the main market competitors being Lockheed Martin and Boeing (figure 9). The top competitors are all slightly differentiated in terms of their portfolio which typically may or may not solely focus on Aerospace and Defense. There is also a growing possibility of new low-cost competitors entering the market, including the emergence of possibly strong aerospace manufacturing centres in China and Russia [13].

Figure 3: Backlog of defense orders 2018/2017 [5].

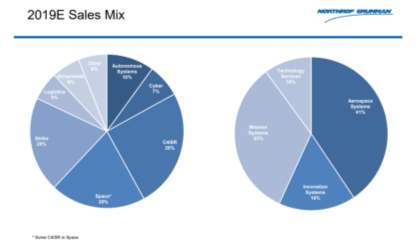

Figure 4: Northrup Grumman 2019 Sales mix [2].

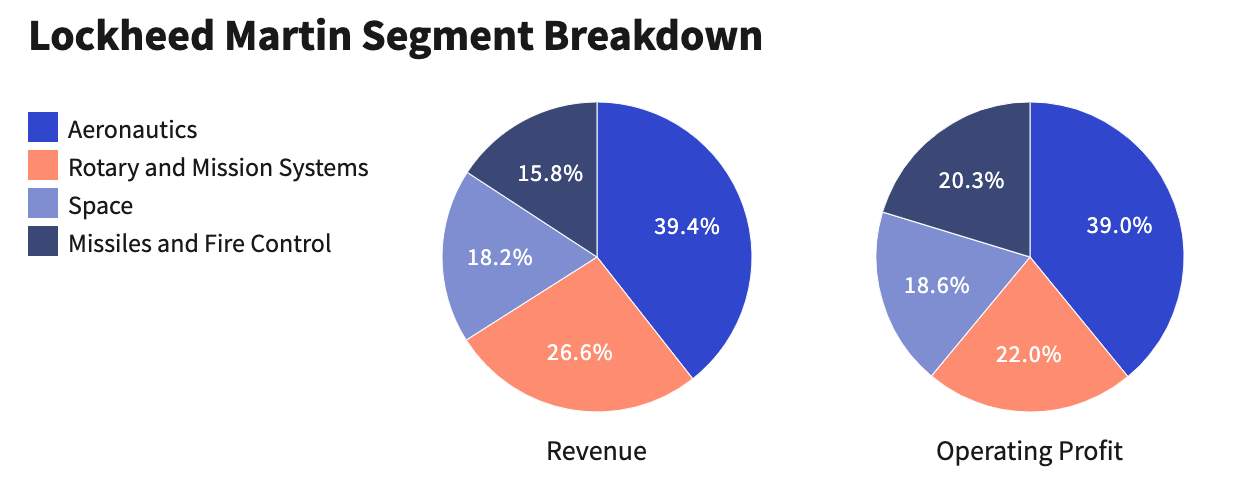

Figure 5: Lockheed Martin 2019 Sales mix [12].

By analysis of its main competitor, Lockheed Martin, it can be seen that its primary income source is also Aeronautics, much like Northrup Grumman. One of the crucial drivers of Lockheed Martin’s current sizable success is the globally-sold F35 Joint-strike fighter, which Northrup Grumman does not have a direct competitor to. In 2018, the F-35 generated 27% of Lockheed’s total consolidated revenue and 68% of its Aeronautics segment’s revenue [12]. The firm has now exceeded its delivery targets for 2019 and has secured global orders for 478 F-35 fighter jets at a cost of $34 billion over the next three years [12].

3 What is the business model?

As seen in figure 3, Northrup Grumman utilises various separate sectors as sources of revenue as opposed to solely one. An advantage of having numerous segments is that reduced revenue streams from one can be compensated for by revenue from other segments. This allows the business to be protected by unforeseen market forces due to the dispersion of business risk and grants a stable liquidity position. Another advantage is their ability to utilise resources and opportunities across multiple industries in which it operates in, allowing for cost reduction and process streamlining.

Figure 4: Northrup Grumman Business model 2018-2019 [2].

Northrup Grumman’s primary customer is the US government and they achieve sales via bidding for contracts meaning that they do not need to spend large sums of money marketing their products to the general market like other companies – this frees up capital that can be diverted to more important cost sources. Northrup Grumman’s most important costs involve: Research and development, manufacturing costs, supply chain and software support. For example, the B-2 Bomber program cost the company $44.75 billion and was sold at $737 million per unit [14]. A downside of having the US government as a primary customer is that this exposes the company to numerous regulations, risk of government disapprovals or sudden contract cancellations. These factors can cause material liability, adversely affecting their potential to bid for other contracts.

4 What is their Strategy?

Northrup Grumman is very successful as it has historically provided innovative products at low costs. The company invests a significant amount of its total revenue into research and development activities to acquire valuable components and develop reusable product lines. Entering a more technology-oriented age, if the firm adopted smart factory initiatives, it could drive a 10–12% gain in factory productivity without need for major capital investment [9]. They have also previously increased its investment prospects and focused on financial sustainability through share repurchases and raising dividends [16].

Industry 4.0 Key components [17].

A recent trend amongst Aerospace and defense companies that Northrup Grumman is following is to only bid on projects that will yield the best financial returns. The firm declined bidding on the US Air force’s new GPS satellites and even the F-35 DAS systems which they were suited for [8], showing that long-term sustained performance is crucial to the firm’s strategy as opposed to short-term gains. This reluctance on bidding has been prompted by past circumstances where even when a bid was won, the government changed the terms of the contract to the point where it was no longer worth the effort. A historical example might have been the Grumman F-14 Tomcat where the firm could not deliver the aircraft at the requested price without risking bankruptcy [1].

A current problem they are facing is the battle for the contract against Lockheed Martin and Boeing for US bomber aircraft. Senator John McCain has previously threatened legislation that would undo the B-21 contract unless the air force replaces it with fixed-price terms, like the Boeing KC-46A programme [15]. The total requirement for 100 stealth bombers to replace the Boeing B-52 and B-1B is worth an estimated $80 billion [15]. The firm recently advertised the bomber aircraft during the highly-watched Super Bowl event in a bid to raise publicity and public favour towards them. This strategy is a first for Northrup Grumman or any defense company, which could potentially be in their favour. Another potential solution to spread risk would be to allow for the B-21 to be sold to other countries and commercially, much like the F-35, providing a potentially massive source of revenue and competitive edge.

*1540 word count excluding Titles, subtitles, figure captions, reference page.

References

[1]Reference for business, ‘’Northrup Grumman Company profile.’’, https://www.referenceforbusiness.com/history2/67/Northrop-Grumman-Corporation.html accessed February 13, 2020.

[2]Northrup Grumman, ‘’FQ4 Conference call’’, January 2020, http://investor.northropgrumman.com/static-files/bc9eadd7-2c4e-4557-83be-2c21042ef4af accessed February 13, 2020.

[3]R. Lineberger, ‘’Deloitte Global A&D sector outlook’’, https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Manufacturing/gx-eri-2019-global-a-and-d-sector-outlook.pdf Accessed February 13, 2020.

[4]Northrup Grumman, https://en.wikipedia.org/wiki/Northrop_Grumman accessed February 13,2020.

[5]PWC, ‘’Aerospace & Defense sector outlook 2019’’, https://www.pwc.com/us/en/industrial-products/publications/assets/pwc-aerospace-defense-2018-review-2019-forecast.pdf accessed February 13, 2020.

[6]IATA, Industry Statistics, June 2018, https://www.iata.org/pressroom/facts_figures/fact_sheets/Documents/fact-sheet-industry-facts.pdf accessed February 13, 2020.

[7]SIPRI, “Trends in world military expenditure, 2019.” accessed February 13, 2020.

[8]Northrup Grumman, https://www.northropgrumman.com/, accessed February 13, 2020.

[9]P. Wellener et al., 2019 Deloitte and MAPI Smart Factory Study: Capturing value through the digital journey, Deloitte Insights, https://www2.deloitte. com/us/en/insights/industry/manufacturing/driving-value-smart-factorytechnologies.html, accessed February 13, 2020.

[10]Stockholm International Peace Institute, ‘’SIPRI Military Expenditure Database, 2019’’. accessed February 13, 2020.

[11]Northrup Grumman, February 2018, https://news.northropgrumman.com/news/releases/northrop-grumman-to-provide-advanced-electronic-warfare-simulation-capability-to-kingdom-of-saudi-arabia, accessed February 13, 2020.

[12]M. Johnston,‘’How Lockheed Martin makes its money’’, January 2020, https://www.investopedia.com/articles/markets/102715/how-lockheed-martin-makes-its-money-lmt.asp

Accessed February 13, 20

[13]R.A Bitzinger and N.Popescu, ‘’Defence industries in Russia and China’’, December 2017, https://www.iss.europa.eu/sites/default/files/EUISSFiles/Report_38_Defence-industries-in-Russia-and-China.pdf Accessed February 13, 2020.

[14]United States General Accounting Office (GAO). “B-2 Bomber: Cost and Operational Issues Letter Report, 14 August 1997, GAO/NSIAD-97-181.”, accessed February 13, 2020.

[15]J.Drew, ‘’Penalty for break Northrup’s B-21 contract’’,March 2016, https://www.flightglobal.com/penalty-for-breaking-northrops-b-21-contract-is-300-million/119961.article, accessed February 13, 2020.

[16]Marketline, ‘’Northrup Grumman Company report’’, August 2017, https://store.marketline.com/report/mlpm0004-005–northrop-grumman-corporation-company-strategy-performance-analysis/, Accessed February 13, 2020

[17]Metasmartfactory, https://metasmartfactory.com/,Accessed February 13, 2020

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal