Evaluation of Markets for TSA Business Expansion

| ✅ Paper Type: Free Essay | ✅ Subject: International Business |

| ✅ Wordcount: 2913 words | ✅ Published: 18 May 2020 |

INTRODUCTION

This report will outline the potential markets with respect to countries where TSA will be able to expand their business in food packaging and processing industry by conducting preliminary analysis. This analysis will determine the best two countries as it will highlight the advantages and disadvantages of TSA’s profit potential in the market that will assist the company is the best way possible to reach their goals by providing turnkey solutions. TSA is growing by providing innovative packaging equipment. In addition to this, the main possible risks that the company might face with respect to financial, political and environment relating to the two markets will also be included.

Unfortunate scenarios like cancellation of business in the country, the losses that might occur, small issues, etc will be spoken about. The differences between two potential markets with respect to various risks that might affect the business of TSA will be discussed. A clear recommendation will be shown for the TSA’s growth with respect to the countries.

PRELIMINARY ANALYSIS OF POTENTIAL MARKETS

INDIA

The economy in India is among the fastest growing ranked at the second position among other developing nations. As a result, there is a large scope of potential which is rising in terms of market and business in this respective country. India also provides a wide range of selection in terms of revenues for any business growth.[1] This country with the huge population of 1.37 billion offers a large customer base which is another advantage for a company to grow their business. The Australian Government also made a strategy in 2018 to prioritise India as their main economic partner.

India is also positioned in the 4th place as Australia’s trading partner with an export of around A$21.1 billion. India has invested A$15.5 billion in Australia and Australia has invested A$13.9 billion in India.[2] With an increase in the overall conditional features, India witnessed $31.7 billion in the packaging industry alone in the year 2015 and is said to reach $72.6 billion by the year 2021 with the extensive growth rate.[3] The reason for this growth in business can be assigned to the rapidly growing population and the per capita income of the crowd in the country. With such a rise, India attained the 5th position in the world with respect to the packaging industries.[4]

ADVANTAGES

- Fast growth for sustainable business: with the growing population, the fastest growth in business will be witnessed by India with a total of 5.9%.[5] India will also sense a moderation in inflation

- Availability of workforce: the average age in India is 25 years and this being a major part, the innovations and youthful aspirations will be in large.

- Business favourable rules: bills like Goods and Service Tax, Direct Taxes Code, Companies Bill and the Land Acquisition bill will be beneficial for the business that are erupting in India.[5] These laws will enable efficient movement of goods within the country.

DISADVANTAGES

- Payment of taxes: businesses in India need to make up to 33 payments of tax per year which can get worked up for an organization.[6] The corporation tax rate for a business to align itself with will be around 30% including taxes like VAT, tax on property, CST, etc.

- Increase in competition: the rise in all genres of business in India is growing tremendously and with respect to the packaging industry, India has about 700 manufactures and this can be a possible threat for TSA.[6]

- Trading: in India, trading across the borders of the country is still a hectic role due to the number of obstructions that a company can encounter when exporting and importing. The bureaucracy adds up to this and makes the job even more hard for the companies.

JAPAN

This country has a population of 126.9 million and is also in the 3rd position with the largest economy worldwide.[7] Japan mainly produces transport equipment, food items and also beverages and this might be a good setup for a packaging industry to start their business. In the year 2018, Japan witnessed a boom in their employment rate, their GDP and also an increase in the tax revenue and profits.

In the year 2017, Japan was at the 2nd position as Australia’s trading partner with an estimate of $71.8 billion trading both ways.[8] The Japan-Australia Economic Partnership Agreement (JAEPA) allows Australia to have a healthy business relationship with Japan in goods, services and investment. This country has invested approximately $219.2 billion in Australia making it the 4th biggest investor globally. Likewise, Australia has also invested a total amount of $125.1 billion in Japan at the end of year 2017.[8] The packaging industry in Japan has an annual value of US$50 billion and this country is known for their unique style of packing products using indigenous materials like wood, bamboo, etc.[9]

ADVANTAGES

- Acts as a gateway: with the wide customer population in Japan, the country offers a stable investment ground for setting up a business which open up to trade and foreign relations. This also acts as a route to spread their way into the Asian market.

- Educated workforce: the country has a good literacy and this assists in finding educated and skilled staff for the business to grow. With this background, the level of expertise found is Japan is not to be questioned with an added advantage of a knowledge base.[10]

- Work ethics: the people of Japan abide by clear work rules and regulations. Every individual has a sense of responsibility towards their work and dedicates the required for the action to be settled.[10] They have good leadership qualities, dedication, hard working qualities among them. This makes it reliable for a business to be established.

DISADVANTAGES

- Payment in terms of taxes: the country’s tax system acts as a barrier for major business considerations. Up to 30% of corporate tax is lined out for organizations with an annual of 14 payments to be made.[11] This also consumes a lot of time and in the year 2019, some factors might be an obstacle which might slow the economy of Japan. There are ricks with respect to the banking domain and an ascend in the usage of taxes.

- Culture: the main language is not English, and this can act as an hinderance for any business to be set up.[12] There is also issues regarding gender equality, which can be pointed out.

- Transporting goods: the geography of this country can be challenging for domestic movement of goods and also in terms of services. Japan has 6,800 islands and this makes it even harder for the companies to deliver their goods to the destinations.[12]

RISKS ASSOCIATED WITH THE POTENTIAL MARKETS

INDIA: ECONOMICAL RISKS

The main economic risk of doing business in India is the inflation factor. The inflation rate in India increased to 2.9% in the year 2019. Another major factor in the economic domain is the deficiency of discipline and rules at the central government level. There is an increased level of transfer of revenue to the rural parts of India, unequal pay rise for the staffs of the regional states and also food subsidiaries with fuel subsidiaries as well.[13] TSA must be aware of the rates of interest and rates of exchange in India which could be a major threat to them. TSA must take into consideration their location and the competition that they might face in the states which could be a risk they might encounter.

POLITICAL RISKS

India being a democratic country does not show any major political risks to the businesses that need a start in this country. Well-established rules and regulations tend to keep the continuation of the organisation since liberalisation exists. The major political risk TSA might encounter is the dispute that prevails between India and Pakistan and also China, and this might grow to a level higher than the existing one.[13] Hence, the conflicts in the borders might be a legit risk for TSA.

SOCIAL ENVIRONMENTAL RISKS

The heavy bureaucracy that exists in India will act as a major threat to TSA to open up their business in this country. The politics in any organization in India is dominated by castes and religion rather than talent and capabilities. This might be a major risk to TSA as riots and outbreaks are usually seen when religion and caste in involved.[14] The discrimination by sex prevails in large in India and this could hamper any international companies’ businesses. This increase the physical risks for TSA to face in this environment.

JAPAN

ECONOMIC RISKS

The economical growth of Japan has become frail when compared to other peers and there has been barely a 1% growth over the past 20 years.[16] There has been introduction of a well-structured budget plan, liberal monetary schemes and structural reforms but still the economic growth has not seen a major change but has been weak. The inflation rate can be a risk to the business of TSA as the public debt continues to be of a higher rate in Japan.

Another major threat to TSA is the budget pressure the country will face ahead of the Olympic Games 2020 that is scheduled to take place in Tokyo.[15][17] There has been a rise of 2% in Value added tax from 8%, and this might rise to a higher level 2020 onwards.[15] Looking at the future of Japan, the country is bound to face issues with controlling the debt levels and this adversely will affect the budget of the nation.

POLITICAL RISKS

Japan has a monarchy rule and an independent judiciary. The laws applied do not distinguish foreign companies from the regional ones. Policies are made in Japan by taking into consideration the beneficial advantages for the political leaders. The policy is executed by not considering the public view and this can be a major threat for TSA’s business. These policies are majorly affected by the bureaucracy that exists in this country and are built by the members and leaders of the Liberal Democratic Party (LDP).[15] In Japan, the political opposition to LDP has remained weak and have not been able to have a stand for themselves.

SOCIAL ENVIRONMENTAL RISKS

The system of hierarchy still exists in Japan and most of the businesses in this country are based on the same. The people of Japan are more reliant towards hierarchy by respect than being confronted. The gender discrimination also exists in large in this country though it has been descending with time. The generic language of communication in Japan is not English and this can be a major risk for TSA to establish their territory in this country. TSA needs to identify the culture and work ethics of the people of Japan and then continue to consider the Asian country for further business relations.

The major environmental threat to starting a business in Japan is how prone the country is to natural disasters.[18] For example, the earthquakes that occur in Japan are of a large magnitude and this can be a major risk for TSA as this might collapse the entire infrastructure of the organization and cause a major loss for the company and their business journey.

COMPARISON BETWEEN THE POTENTIAL MARKETS

The table below gives the basic comparison between India and Japan in terms of economic factors:

| FACTORS | INDIA | JAPAN |

| Population | 1.36 billion | 126.9 million |

| GDP | $1.84 trillion | $5.96 trillion |

| Exports | $301.9 billion | $776.6 billion |

| Imports | $503.5 billion | $830.1 billion |

| Gross national income | $477 billion | $4.52 trillion |

| Inflation rate | 9.7% with 25th rank overall | 0.1% with 196th rank overall |

| Unemployment rate | 8.5% with 46th rank overall | 4.4% with 94th rank overall |

| Tax rate | 30% | 50% |

| Public debt | 51.7% of GDP | 219.1% of GDP |

| Economic growth | 6.22, ranked in the 8th position | -5.12, ranked in the 133th position |

Figure 1: Table showing comparison of various features between India and Japan.[19]

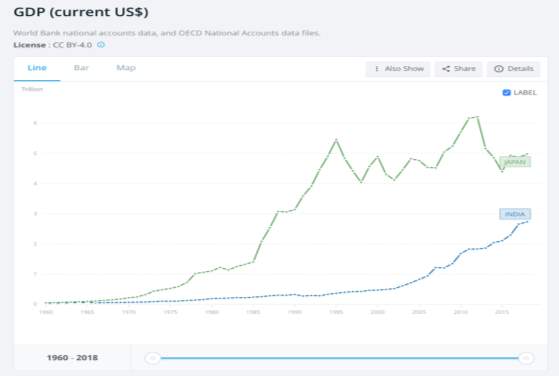

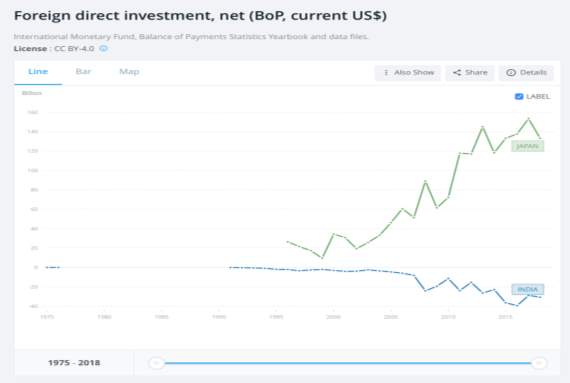

The above table shows us the basic differentiations between the countries, India and Japan. This chart highlights facts like population, GDP, inflation rate, etc. When analysed, though Japan is smaller than India in size, it is seen that Japan is far more developed than India. Features like unemployment rate, the foreign investment in Japan seems to be far more than the gradings in India. This makes it a better platform for a business to kickstart.

Another major feature that can be observed from the above table is the economic growth rate of both the countries. India has a faster economic growth compared to Japan, and this brings in a state of doubt, but considering the other factors Japan seems to be of a better option.

Figure 2: shows the GDP of India and Japan between the year 1960 and 2018.[23]

Figure 3: shows the Foreign Direct Investment of India and Japan between 1975 and 2018.[24]

Figure 4: shows the rankings of various factors required to start a business in Japan.[22]

Figure 5: shows the ranking of various factors required to start a business in India.[21]

Figure 6: Cultural distance comparison between India and Japan.[20]

Figure 7: the above graph shows the trade in services of Japan between 2011 and 2017

Figure 8: shows the levels of various risk factors of doing business in India

Figure 9: shows the levels of various risk factors of doing business in Japan

CONCLUSION

After the investigations and analysis that has been done on both the potential markets, that is India and Japan, it is seen that Japan seems to be a better potential market when compared to India for TSA to open up their business in food packaging. The financial risks, political risks and socio environmental risks have been analysed individually for both India and Japan and after the analysis, it seems that Japan is a better market for TSA to start their business in food packaging than in India where the risks for a small obstruction like getting electricity can be hectic and treacherous for TSA’s business.

The risk table shown in the above discussion compares the political risks, economic risks, legal risks, tax risks, operational risks, security risks, individual risks and transport risks for both India and Japan over a scale ranging from low to extreme. This comparison shows us that the overall risks in India is elevated and high when compared to Japan which is low and moderate. Hence, this table tells us that TSA will be on a safer side of the business if they expand their production line in Japan rather than India.

Hence to conclude, Japan is a more optimal option for TSA to expand their food packaging and processing unit when all the risks, pros and cons have been looked into and analysed.

REFERENCES

- Investinindia.com. (2019). India’s Business Potential | Invest in India. [online] Available at: https://www.investinindia.com/indias-business-potential [Accessed 23 Sep. 2019].

- Australian Trade and Investment Commission. (2019). Austrade’s export opportunities to India. [online] Available at: https://www.austrade.gov.au/Australian/Export/Export-markets/Countries/India/Market-profile [Accessed 23 Sep. 2019].

- The Economic Times. (2019). India’s packaging industry to touch $72.6 billion by FY20: ASSOCHAM-EY study. [online] Available at: https://economictimes.indiatimes.com/industry/indl-goods/svs/packaging/indias-packaging-industry-to-touch-72-6-billion-by-fy20-assocham-ey-study/articleshow/68032848.cms [Accessed 23 Sep. 2019].

- WEDC. (2019). India: the world’s fifth-largest packaging industry – WEDC. [online] Available at: https://wedc.org/export/market-intelligence/posts/india-worlds-fifth-largest-packaging-industry/ [Accessed 23 Sep. 2019].

- Inc.com. (2019). 7 Reasons to Do Business in India. [online] Available at: https://www.inc.com/gautam-chikermane/7-reasons-to-do-business-in-india.html [Accessed 23 Sep. 2019].

- Tmf-group.com. (2019). Top 10 challenges of doing business in India. [online] Available at: https://www.tmf-group.com/en/news-insights/business-culture/top-challenges-india/ [Accessed 23 Sep. 2019].

- Australian Trade and Investment Commission. (2019). Austrade’s export opportunities to Japan. [online] Available at: https://www.austrade.gov.au/Australian/Export/Export-markets/Countries/Japan/Market-profile [Accessed 23 Sep. 2019].

- Anon, (2019). [online] Available at: https://dfat.gov.au/geo/japan/Pages/australia-japan-bilateral-relationship.aspx https://www.tandfonline.com/doi/abs/10.1300/J047v06n04_03?journalCode=wifa20 [Accessed 23 Sep. 2019].

- Taylor & Francis. (2019). Food Packaging in Japan. [online] Available at: https://www.tandfonline.com/doi/abs/10.1300/J047v06n04_03?journalCode=wifa20 [Accessed 23 Sep. 2019].

- Limited, C. (2019). Benefits of Doing Business in Japan. [online] Communicaid.com. Available at: https://www.communicaid.com/cross-cultural-training/blog/benefits-of-doing-business-in-japan/ [Accessed 23 Sep. 2019].

- Tmf-group.com. (2019). Top 10 challenges of doing business in Japan. [online] Available at: https://www.tmf-group.com/en/news-insights/business-culture/top-challenges-japan/ [Accessed 23 Sep. 2019].

- Gaille, B. (2019). 20 Pros and Cons of Doing Business in Japan. [online] BrandonGaille.com. Available at: https://brandongaille.com/20-pros-and-cons-of-doing-business-in-japan/ [Accessed 23 Sep. 2019].

- Amritt, Inc. (2019). Common Risks of Doing Business in India | Amritt, Inc. [online] Available at: https://amritt.com/services/india-business-training-workshop-and-education/common-risks-of-doing-business-in-india/ [Accessed 23 Sep. 2019].

- Sonia Jaspal’s RiskBoard. (2019). Risks of Doing Business in India. [online] Available at: https://soniajaspal.wordpress.com/2011/09/04/risks-of-doing-business-in-india/ [Accessed 23 Sep. 2019].

- Aig.com. (2019). Japan: Business Environment & Risk Analysis – Insurance from AIG in the US. [online] Available at: https://www.aig.com/knowledge-and-insights/k-and-i-article-japan-business-environment-risk-analysis [Accessed 23 Sep. 2019].

- Exportfinance.gov.au. (2019). The economic environment for doing business in Japan. [online] Available at: https://www.exportfinance.gov.au/resources-news/ebooks-and-reports/exporting-to-japan/the-economic-environment-for-doing-business-in-japan/ [Accessed 23 Sep. 2019].

- Import-export.societegenerale.fr. (2019). Country risk of Japan : Economy. [online] Available at: https://import-export.societegenerale.fr/en/country/japan/economy-country-risk [Accessed 23 Sep. 2019].

- Brink – The Edge of Risk. (2019). Prioritizing Business Risks in Japan. [online] Available at: https://www.brinknews.com/dealing-with-business-risks-in-japan/ [Accessed 23 Sep. 2019].

- Nationmaster.com. (2019). India vs Japan: Economy Facts and Stats. [online] Available at: https://www.nationmaster.com/country-info/compare/India/Japan/Economy [Accessed 23 Sep. 2019].

- Hofstede Insights. (2019). Country Comparison – Hofstede Insights. [online] Available at: https://www.hofstede-insights.com/country-comparison/india,japan/ [Accessed 23 Sep. 2019].

- World Bank. (2019). Explore Economies. [online] Available at: https://www.doingbusiness.org/en/data/exploreeconomies/india [Accessed 23 Sep. 2019].

- World Bank. (2019). Explore Economies. [online] Available at: https://www.doingbusiness.org/en/data/exploreeconomies/japan [Accessed 23 Sep. 2019].

- Data.worldbank.org. (2019). GDP (current US$) | Data. [online] Available at: https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=IN-JP [Accessed 24 Sep. 2019].

- Data.worldbank.org. (2019). Foreign direct investment, net (BoP, current US$) | Data. [online] Available at: https://data.worldbank.org/indicator/BN.KLT.DINV.CD?locations=IN-JP [Accessed 24 Sep. 2019].

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal