Proposal to Address the Obesity Crisis in the UK

| ✅ Paper Type: Free Essay | ✅ Subject: Health |

| ✅ Wordcount: 2331 words | ✅ Published: 23 Sep 2019 |

Table of Contents

What does the UK obesity crisis stand for?

Obesity facts in the context of life insurance business

Proposal to address the obesity risk in our business

4. Risk brings opportunities if managed properly

5. Not all business lines will be affected by obesity risk

6. BMI is not a perfect measure

8. Full protection is not achieved with the proposal

9. Linked contracts as a risk management tool

EXECUTIVE SUMMARY

The United Kingdom (UK) is currently facing an obesity crisis. According to official health surveys, almost two thirds of adults are either overweight or obese and slightly higher than a quarter of adults are obese. This problem puts a high strain on the UK economy and it is a menace to the profitability of our business if no risk management actions are taken.

In this context, a proposal to only write policies with customers who are within a healthy weight range (i.e. a Body Mass Index between 18.5 and 24.9) seems to be a possible solution to fully protect our business; however, this approach neither will wholly cover the office from the poor experience arising from obesity, nor will allow our company to embrace the opportunities every risk brings so as to create value and optimise our outcomes for shareholders.

In that vein, this paper starts depicting the weight problem threatening the UK. Then, a discussion regarding the proposal outlined in the previous paragraph is presented, emphasizing in its effectiveness to provide obesity risk protection as well as its side effects. Finally, the author’s conclusions and the suggested path our Office should follow are stated.

THE UK OBESITY CRISIS

Obesity is a big problem in the UK, but before describing the UK weight problem, let’s put into context what is meant by obesity.

WHAT IS OBESITY?[1],[2]

The term obese describes a person who’s very overweight, with a lot of body fat. The most widely used measure of obesity is the Body Mass Index (BMI), defined as weight divided by the square of height (kg/m²). A person is classified as obese if their BMI is 30 or higher. A BMI of 40 or more is often known as ‘morbid obesity’. The full range of classifications is as follows.

|

Classification |

BMI |

|

Underweight |

< 18.5 |

|

Normal weight |

18.5 – 24.9 |

|

Overweight |

25.0 – 29.9 |

|

Obese: Class I |

30.0 – 34.9 |

|

Obese: Class II |

35.0 – 39.9 |

|

Obese: Class III |

40.0+ |

TABLE 1: BMI Classification

WHAT DOES THE UK OBESITY CRISIS STAND FOR?

The UK Obesity crisis refers mainly to:

(i) The steady increase in the levels of overweight or obese people in the UK; coupled with,

(ii) The financial and non-financial burden derived from it.

In respect to the upward tendency in the proportion of overweight or obese people; according to official health surveys conducted in 2016[1], roughly 61% of adults (16 years or above) are either overweight or obese – with 27% accounting only for the obese. The following table shows the proportion of overweight and obese people by country in the UK.

|

Adults (16+) |

England |

Wales |

Scotland |

Northern Ireland |

|

Overweight |

35% |

36% |

36% |

36% |

|

Obese |

26% |

23% |

29% |

27% |

|

Total |

61% |

59% |

65% |

63% |

TABLE 2: Percentage of overweight and obese people per country in the UK (2016)

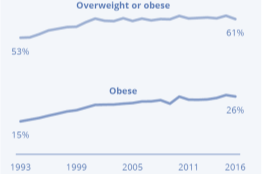

In the same year (2016), the OECD stated the UK has the highest proportion of obese people in Western Europe (nearly 27%) and has showed a 92% increase since 1996[3]. Past statistics confirm that there has been a clear increase in obesity levels in England since 1993 (see FIGURE 1), from 15% to 26%. Correspondingly, the percentage of adults who are either overweight or obese has risen from 53% to 61%. Researchers predict that if the current trend continues, up to 48% of men and 43% of women in the UK could be obese by 2030[5].

FIGURE 1: Obesity levels have increased from 15% to 26% since 1993 in England (similar results apply for the rest of UK).

With relation to the obesity-linked costs, it is clear that excess weight and obesity impact significantly on lifespan, disability, quality of life, and work productivity, with subsequent burdens on population health and healthcare systems. Likewise, obesity is known to be associated with various chronic diseases, which impose considerable costs, from the use of healthcare services and medical treatments to the loss of productivity[5].

It is estimated that the NHS spent £6.1 billion on overweight and obesity-related ill-health in 2014 to 2015. However, that is only the direct cost of obesity; the overall cost of obesity to wider society is estimated at £27 billion. Besides, the UK-wide NHS costs attributable to overweight and obesity are projected to reach £9.7 billion by 2050, with wider costs to society estimated to reach £49.9 billion per year[6].

Finally, in the international arena, according to a 2017 OECD report, the UK has the sixth highest rates of obesity[1] among countries reporting measured data and belonging to the OECD area.

OBESITY FACTS IN THE CONTEXT OF LIFE INSURANCE BUSINESS

In the context of the life insurance business, in order to properly deal with obesity risk there are some important statistical facts[1],[6] that need to be taken into account. They are:

|

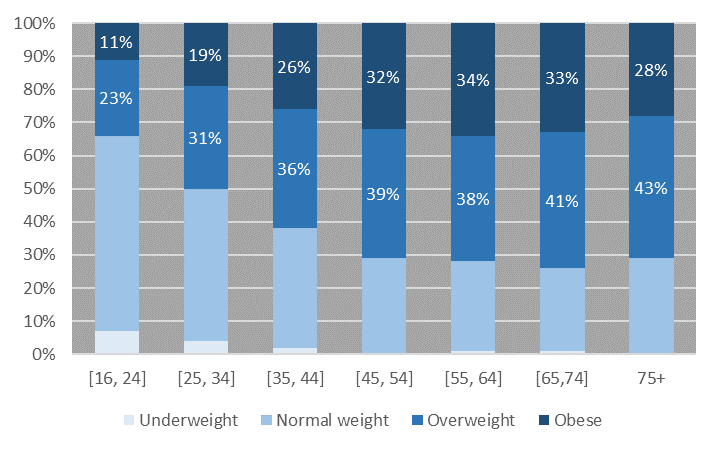

1. OBESITY TENDS TO INCREASE WITH AGE[1]

FIGURE 2: Obesity levels among ages (England, 2016) |

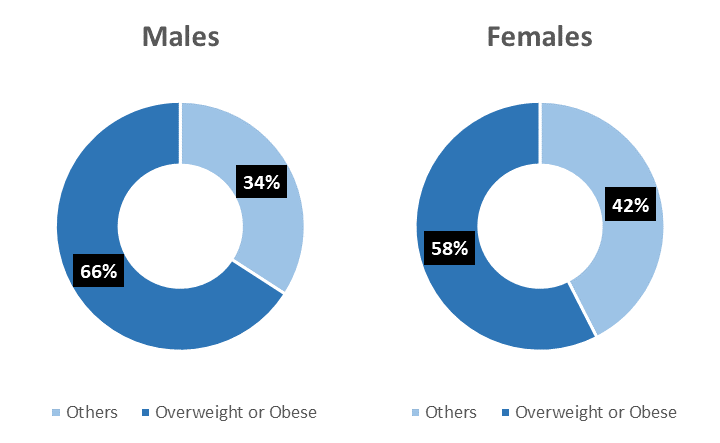

2. MEN ARE MORE LIKELY TO BE OVERWEIGHT[1]

FIGURE 3: Overweight/Obesity levels by sex (UK, 2016) |

|

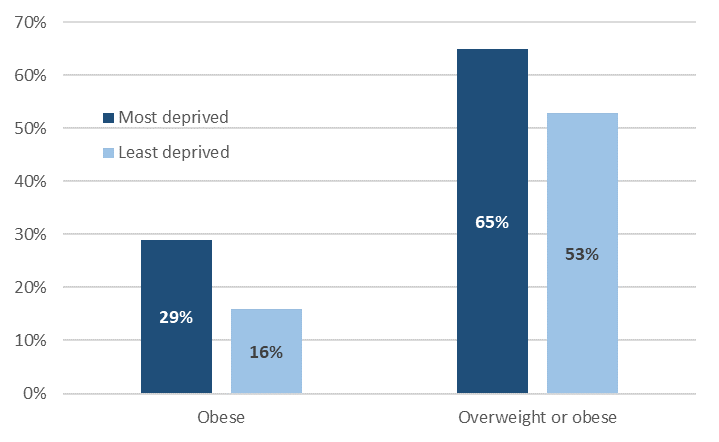

3. HOUSEHOLDS WITH LOWEST INCOMES HAVE HIGHER OBESITY RATES[1]

FIGURE 4: Obesity levels vs. Deprivation (Wales, 2016) |

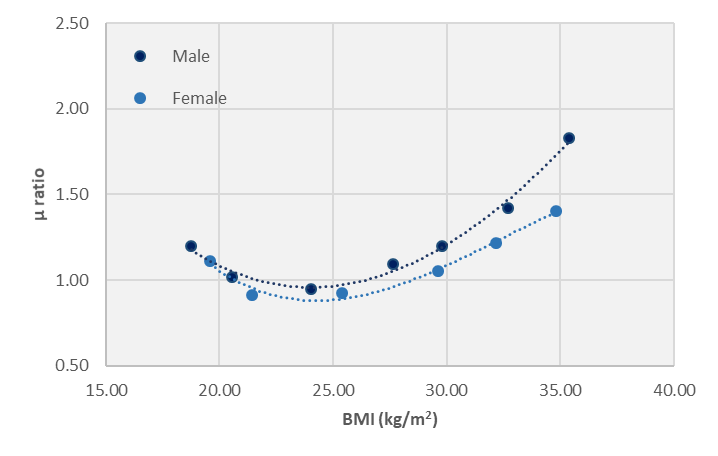

4. J-SHAPED ASSOCIATION BETWEEN BMI AND THE RISK OF DEATH[6]

FIGURE 5: Impact of BMI on mortality rate |

PROPOSAL TO ADDRESS THE OBESITY RISK IN OUR BUSINESS

It has been suggested that our Office should only accept new business from customers who have a BMI between 18.5 and 24.9 (i.e. normal weight). By doing so, proposers argue that the company will be fully protected from poor experience as a consequence of the UK obesity crisis.

Implementing that proposal will certainly reduce the risk arising from obesity; however, that is only the tip of the iceberg, and a comprehensive and long-term approach should be taken. Next, a list of things to consider:

1. EMERGING RISKS

Ruling out overweight/obese people might carry additional risks, which would be even more dangerous than accepting them.

Only 37% of the UK adult population belongs to the healthy BMI range, i.e. our potential market will be shrunk. New businesses – as well as future renewals – will be reduced, bringing increased volatility and random fluctuation risk. Likewise, fixed costs per policy might soar, reducing further our competitiveness.

2. ACTIONS OF COMPETITORS

If competitors accept applicants we reject, they can create long term bonds with them and at the same time still make profit, if priced properly.

Overweight/obese people certainly have higher mortality rates, but increasing obesity is less likely to be a problem if the extra risks can be rated more accurately.

3. REPUTATIONAL RISK

Our reputation will suffer if our business model is not competitive. By only accepting applicants who are in the healthy BMI range, our actions will probably not be aligned with the ones of our competitors. It is known that significant performance gaps vis-à-vis competitors can diminish reputation if not addressed properly[8].

Furthermore, rejecting overweight/obese people could put our business under severe criticism from the public and customers, leading to a reduction in sales.

4. RISK BRINGS OPPORTUNITIES IF MANAGED PROPERLY

Managing the risk arising from obesity can be achieved by: (i) Pricing those customers in line with their increased risk, (ii) Offering shorter term products that allow us, at renewal, to adjust premiums if necessary, (iii) Creating incentives, like premiums reductions, if they lose weight, (iv) Establishing limits to risk and benefit levels, (v) Requiring stricter medical underwriting for overweight/obese people, etcetera.

Moreover, by reinsuring its portfolio of business, the Office not only reduces its risk, but also benefits from the larger expertise in underwriting and pricing reinsurers have.

5. NOT ALL BUSINESS LINES WILL BE AFFECTED BY OBESITY RISK

Obesity is linked to an increased mortality; therefore, if not managed properly it might negatively impact our book of term assurance policies, income protection, long term care contracts and non-profit endowments.

Nonetheless, our annuity business could benefit from an increased mortality. Consequently, there is no reason to stop writing contracts in this particular product line.

On the other hand, the loading contained in the premiums of our with-profits endowment business acts as a cushion against future adverse experience. Hence, by advertising this product especially for the applicants outside the healthy BMI range, the Office can make profit while managing its risk.

Nevertheless, consideration has to be given to policyholders’ reasonable expectations.

6. BMI IS NOT A PERFECT MEASURE

BMI does not show the difference between excess fat and muscle. As a result, a very muscular body may show high BMI with no adverse effects of overweight. Thence, focusing only on BMI could lead to reject profitable business.

Thus, it is required to use other metrics (e.g. waist circumference, waist-hip ratio, visceral fat assessment, subcutaneous fat thickness, and liver fat content) in conjunction with BMI, so as to separate overweight/obese people and consolidate them as a distinct group for insurance purposes.

7. GOING BACK IN OUR STEPS

If today, the majority of applicants are rejected (63% of the UK adult population is not in the healthy BMI range), but later we want to come back to our original sales criteria, there is a high chance refused customers will prefer to insure somewhere else, putting our sustainability at risk.

This claim is supported by research; overweight/obese people are more sensitive to rejection[9]. Hence, accepting them (with the corresponding loading factor) will allow us to create long-term links and possibly new business opportunities.

8. FULL PROTECTION IS NOT ACHIEVED WITH THE PROPOSAL

Even if only individuals in the healthy BMI range are accepted, there is always a chance that policyholders will become overweight/obese in the future, exposing us to obesity risk.

However, if the Office accepts them (accounting for their increased risk) setting risk mitigants – such as shorter term contracts or reinsurance treaties – it will get expertise in that market niche. This expertise can be turned into profits.

9. LINKED CONTRACTS AS A RISK MANAGEMENT TOOL

Currently, only conventional business are offered; however, by selling linked contracts the Office can substantially reduce the increased mortality risk arising from obesity.

This can be achieved by:

(i) Offering a linked product without mortality benefit. However, this can be impractical if the market practice is the opposite.

(ii) Including a mortality benefit and charging for it. Since mortality charges are reviewable, the Office – based on its experience – can allow for increased risk if necessary.

Again, by not rejecting overweight/obese people we can engage in profitable business opportunities while controlling risk.

CONCLUSION & RECOMMENDATION

The Office will not be fully protected from obesity risk by only accepting individuals in the healthy BMI range. As it was outlined, the potential benefits of continuing to offer products to a wider range of customers outweigh the ones from selling only products to normal-weight applicants.

Conversely, by rejecting applicants outside the healthy BMI range, new risks may emerge, our reputation will be damaged and our sustainability would be at risk.

In that sense, the Office should continue offering life insurance products to clients outside the healthy BMI range, in an amount commensurate with the shareholders’ risk appetite. However, in order to control the risk arising from obesity and avoid losing profitable business, we should:

(i) Price the contracts in line with their increased risk.

(ii) Define risk limits (for overweight/obese applicants) in regard to sum assured, term or BMI, e.g. do not accept customers with BMI higher than 40 (morbidly obese).

(iii) Advertise mainly our annuity and with-profits endowment business to applicants outside the healthy BMI range.

(iv) Tighten underwriting. Ask for personal medical attendant report or conduct a medical exam in order to detect pre-existence conditions in overweight/obese people.

(v) Reinsure our portfolio in order to reduce our risk and take advantage of the larger expertise in underwriting and pricing reinsurers have.

(vi) Possibly, launch a linked product. This will give us flexibility to adjust mortality charges if needed.

Implementing these measures successfully, while taking heed of policyholders’ reasonable expectations, will allow us to manage properly our risks and engage in sustainable profitable businesses.

REFERENCES

- Baker, C. (2018). Obesity Statistics. [online] Researchbriefings.parliament.uk. Available at: https://researchbriefings.parliament.uk/ResearchBriefing/Summary/SN03336 [Accessed 13 Feb. 2019].

- National Health Service (2016). Obesity. [online] Available at: https://www.nhs.uk/conditions/obesity/ [Accessed 13 Feb. 2019].

- Higgins, E. (2019). What is the obesity crisis, how does alcohol affect your weight and how can childhood obesity be prevented?. [online] The Sun. Available at: https://www.thesun.co.uk/news/6134434/uk-obesity-crisis-clinically-obese-definition/ [Accessed 13 Feb. 2019].

- BBC News. (2012). What caused the obesity crisis?. [online] Available at: https://www.bbc.co.uk/news/health-18393391 [Accessed 13 Feb. 2019].

- NHS Website. (2011). ‘Half of UK obese by 2030’. [online] Available at: https://www.nhs.uk/news/obesity/half-of-uk-obese-by-2030/ [Accessed 13 Feb. 2019].

- GOV.UK. (2017). Health matters: obesity and the food environment. [online] Available at: https://www.gov.uk/government/publications/health-matters-obesity-and-the-food-environment/health-matters-obesity-and-the-food-environment–2 [Accessed 14 Feb. 2019].

- Peeters, A. (2003). Obesity in Adulthood and Its Consequences for Life Expectancy: A Life-Table Analysis. Annals of Internal Medicine, Vol. 138(1).

- DeLoach, J. (2017). 10 Keys for Executives to Manage Reputation Risk – Corporate Compliance Insights. [online] Corporate Compliance Insights. Available at: https://www.corporatecomplianceinsights.com/managing-reputation-risk/ [Accessed 16 Feb. 2019].

- McClure Brenchley, Kimberly and Quinn, Diane M. (2016). “Weight-based rejection sensitivity: Scale development and implications for well-being.” Body Image 16, 79-92.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal