Debt Predictions Using Data Mining Techniques

| ✅ Paper Type: Free Essay | ✅ Subject: Computer Science |

| ✅ Wordcount: 2763 words | ✅ Published: 18 Aug 2017 |

Data Mining Project

Introduction

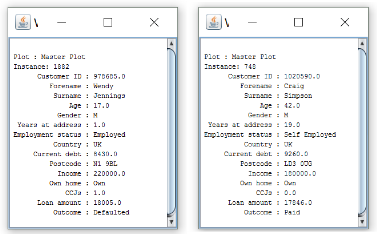

This report is set out to address the issue in which banks are facing. The project brief describes; the banks are finding it difficult to tackle debt and have leant out money to many people who promise to pay the loan back but never do. The banks says that they want to stop this happening. The banks have given some data of 2000 customers who have previously loaned money from them. Using this data, predictions will be made by using exploring different datamining techniques. This techniques will show predictions and differentiation between different types of loan customers, to outline how likely they will repay the loan. This will intern help predict in future how likely the customers will repay the loan. These are define on the attributes and results of each individual customer in the dataset given.

There are 2000 instances (customers) each within 15 attributes of this data set. Each customer is identified by a unique 6 digit customer ID.

Terminology Used

Standard division (StdDev) – a measure of quantity of how spread out numbers are and how much they differ from the mean.

A high standard deviation indicates that the data points are spread out over a wider range of values and are not close to the mean.

Outliers – Observations where noisy data occurs. It is not in correlation with the reset but could prove noteworthy.

Noise – modification of original values, an error or irrelevant data which should be removed.

Attribute – a property or characteristic of an object. Also known as a variable, field or characteristic.

Record – each row of the data set contains data variables.

Mean – the most common measure of the location of a set of points or the average of a set of numbers.

Instances – refers to the individual, custom or person that are identified by the unique ID. An instance has a set of values of 15 attributes.

Attributes

Customer ID, Forename, Surname, Age, Gender, Years at address, Employment status, Country, Current debt, Postcode, Income, Own home, CCJs, Loan amount, Outcome.

Data Summary

|

Attribute name |

Datatype |

Min |

Max |

Mean |

Standard division |

Values |

|

Customer ID |

Numeric |

555574 |

1110985 |

837077.517 |

160763.319 |

Discrete |

|

Forename |

Nominal |

Discrete |

||||

|

Surname |

Nominal |

Discrete |

||||

|

Age |

Numeric |

17 |

89 |

52.912 |

20.991 |

Continuous |

|

Gender |

Nominal |

Discrete |

||||

|

Years at address |

Numeric |

1 |

560 |

18.526 |

23.202 |

Continuous |

|

Employment status |

Nominal |

Discrete |

||||

|

Country |

Nominal |

Discrete |

||||

|

Current debt |

Numeric |

0 |

9980 |

3309.325 |

2980.629 |

Continuous |

|

Postcode |

Nominal |

Discrete |

||||

|

Income |

Numeric |

3000 |

220000 |

38319 |

12786.506 |

Continuous |

|

Own home |

Nominal |

Discrete |

||||

|

CCJs |

Numeric |

0 |

100 |

1.052 |

2.469 |

Continuous |

|

Loan amount |

Numeric |

13 |

54455 |

18929.628 |

12853.189 |

Continuous |

|

Outcome |

Nominal |

Discrete |

Customer ID – used to uniquely identify their customer. After looking at the data it is evident that there are duplicating values. This data set indicates that the unique rate is 99%, therefor 14 values are duplicated or entered incorrectly. Deducting the Distinct value from the unique shows that 7 customers are duplicated in the system. Looking through the dataset, indicated that these customers have the same ID but different names, which is likely down to a mistake.

Customers need to remain unique, if not this will affect other attributes which can contribute to the solution of repaying a loan problem as it will not reference the right customer data.

Customers need to remain unique, if not this will affect other attributes which can contribute to the solution of repaying a loan problem as it will not reference the right customer data.

Forename Surname – these attributes cannot be used to give any sort of statistical material. They are not significant to giving any results of probability in terms of paying back loans in the future.

Filtering through the data set displays varying displays of data, which should not be allowed. This makes data filtering confusing and cluttered i.e. ‘E Spencer’. Some values also contain punctuation such as commas instead of apostrophe’s i.e. Dea,th. Also some of the genders for customers have been mixed up. Also an attribute for the gender has been mismatched i.e. Fewson has been assigned an F for female.

Age – there are no mistakes for customers within this attribute named age in this data set. The ages range from 1 7 ascending up to 89. 53 rounded up is the average age. The statistical information gives a good understanding of data provided. The StdDev of 20.991 shows a good spaced out data which is not clustered and unpredictable, surrounding the mean value.

The age group of 17 – 21; young age group in which a probable distribution can be used here. Or could use a different subset to give reliable data such as deviations in intervals of 10 years in difference.

This attribute Age can give statistical information on the accuracy of the age groups used with no external factors effecting their circumstances. If combining external factures attribute data such as ‘Debt Amount’ would give a very good and valuable probability statistics of these customers repaying loans in the future.

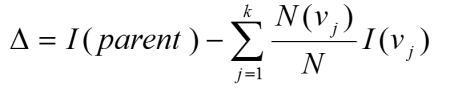

Gender – the dataset shows total of 9 variation of discrete values all of which represent male and female. Most of the data uses M and F for gender identification but H, D, and N are not known and be defined as ‘noise’. By looking at the forename, it is easy to identify the gender, therefore these error values can be changed accordingly.

‘Male’ and ‘Female’ attributed can be changed to ‘F’ and ‘M’ simply, as this is what they represent. Filtering through the datasheet shows that some forenames have been mismatched with the gender. These are assumed to have been entered in error and the genders have been altered correctly. There are four fields that have the value ‘Female’ but have male names i.e. Stuart, Dan, David, Simon these have therefore been changed to ‘M’. This may have occurred due to a misconfiguration issue.

After altering the data to the correct values the M and F gender percentage are very similar, with female = 48.45% and male = 51.55%, there is a 3.1% differentiation. This attribute can be used to give statistics accurately for predicting repayment of repayment of future loans. But although this could be true, discrimination based on gender will be obvious, therefore making the gender attribute inappropriate. This gender data will remain, though not all genders attributes can be accrue or 100% clear. The gender attribute can be said to be equal both ways and the usefulness of this is very low.

Again gender attributes usefulness is small. As stated above, the data can be entered inaccurately such as a forename which is presumed to be female is actually a male.

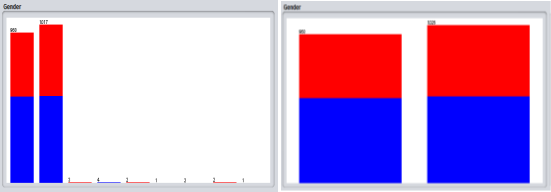

Years at address – There are 74 distinct values. Four anomalies appear to be in this attribute when scanning the dataset; Simon Wallace, Brian Humpreys, Steve Hughes, Chris Greenbank. These are showing an unlikely number of years living at an address for the customers. It is unclear as to whether the data was entered erroneously or if this number is indicative of months or days.

These values are shown as noise on the visualising screen for x: age y: years at address. As the dots lie outside the normal number of years range these are seen as not valid data.

If comparing the age and number of years at address, these four do not correlate therefore are deemed to be invalid data.

These customers should be removed from the data as they are unreliable sources of data. Removing these four would not affect anything as the figure is small and the remaining customers would provide reliable data.

It is believed that years at address would prove effective of the end result of probability of customer repaying a loan. And changing figures is not a good idea as it not clear what these figures are for.

If the data entered for these four is assumed to incorrect then, 71 would be the maximum years at address. To aid a solution to the problem, use a ten year interval subset for the Years at address attribute. It would give a reliable probability for the paying pack a loan, subject to the years living at the current address.

Employment status – the majority of the values in the employment status are dominated by self-employed. 1013 of 2000 people are self-employed which is 50.65%, 642 32.1% are unemployed, 340 17% are employed and 5 are retired 0.25%. It is not possible to prove the figures in the employment status attribute.

The retirement age is 65 but looking at the five people that are retired in this dataset, none of them are over this age. These customers that form the five retired customers are detached from the main body of customers and will be relevant in this dataset in determining the percentage of people which owe date and who have paid it back that are retired. This portion of the data set is very small therefore it is questionable of the reliability.

County – the county attribute contains 4 district values which are UK, Spain, Germany and France. The UK has most of the values (1994) and the rest of the six values are to the remaining countries.

There is not enough data to get an accurate or reliable result for Spain, Germany and France as the large portion of the data goes to the UK. With this, it would be possible to find a pattern in the UK customers but the usefulness is small in this therefore not suitable to building in the solution to the issue.

Current debt – 788 distinct values are contained within this attribute. There are 294 unique values (15%). A person cannot have a finite sum of debt, therefore it is continuous and the larger debt a person accumulates the harder it becomes for one to loan again or repay an outstanding loan.

In theory it is thought that a person with a large amount of debt and an income lower than their owed debt then they are less likely to make the repayment. This however is unproven.

Current debt attribute shows statistical facts of a person’s past debt and can be used to make a good prediction of the probability on whether a customer will pay back loans in future. When a person need to borrow money indicates they are struggling financially in which a loan was required to begin with can inferred the meaning of debt.

Post code – this attribute contains a total of 19171 attributes. It has no values missing (0%) therefore showing how there are more than one customer living in with one another or same area. These areas may form a pattern. As there aren’t enough subjects to form an accurate pattern and perception based on location cannot be allowed, likewise to gender.

This attribute cannot therefore hold any validity and cannot contribute to the solution of predicting loan repayment.

Income – this attribute contains 100 distinct and 0% at seven unique values. These values are continuous as income has no set amount and can salaries can vary i.e. with bonuses or overtime.

Income attribute is significant when evaluating alongside Current Debt. By predicting – a person on little income in whom has debt that they owe of the same figure, will not pay back future loans. By combining several attributes, trends can be seen i.e. those with less debt have a higher income. There are two outliers when viewing loan amount (y) and income (x) on the scatter graph. One has paid back loan and one has defaulted. As there are only two they may not affect the prediction in evaluating.

Own Home – contains three distinct values. There is no noise as there can be only three possible states for ownership of home and 0% missing values.

A prediction in people that are home owners in conjunction with having a high income will probable pay pack a loan. Therefore this attribute may contribute to providing data which can help predict repayment of future loans. From the evidence of the scatter graph in the income attribute a theory can be made; customers can repay a loan back whilst comfortable paying for a mortgage if they have a good wage and those that pay rent have out going expenses therefore find it difficult to repay loan.

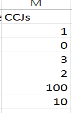

CCJs – has six distinct values which range from 0 to 100. If a person has a customer has a CCJ then this indicates that the person is unreliable with repaying owed money back. The higher the number the higher risk the individual is in repaying a loan making this a vital factor within this dataset and would prove valuable in providing a probability result for repaying loans in future customers.

CCJs – has six distinct values which range from 0 to 100. If a person has a customer has a CCJ then this indicates that the person is unreliable with repaying owed money back. The higher the number the higher risk the individual is in repaying a loan making this a vital factor within this dataset and would prove valuable in providing a probability result for repaying loans in future customers.

There are six distinct values 0, 1, 2, 3, 10 and 100. It can be assumed that 100 CCJs for this customer aged 27 is error data as this is highly unlikely, therefore would be regarded as noise. As the real value for this customer is unknown, this field can should be removed from the set and should assume it to be 1 or 10. As the other values 0, 1, 2 and 3 have numerous instances we could say the same for the person with 10 as there is a large gap between 3 and 10. 10 and 100 are unique out of 2000 customers.

Loan Amount – A loan amount can change continuously, no one person can have a set number of loans.

The lowest loan amount is 13 in the dataset. The lowest of the amount can be seen as input error values (noise) as the bank normally would not lend out such a low odd amount of £13. It is unsure what the real amount would be. It could be 1300

Outcome – contains distinct values of two; Paid and Defaulted attributes. This can be used to predict repayments of future loans of that customers.

Data Mining Algorithm Selection

Naïve Bayes

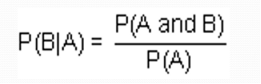

The first data mining algorithm selected is Naïve Bayes. It works on the Bayes theorem of probability named after Reverend Thomas Bayes in 1702-1761 to predict the class of an unknown dataset. It makes assumptions between features. The value of a particular feature is independent to the feature of another feature.

This classifier assumes that the presence of a particular feature in a class is unrelated to the presence of any other feature. [1]

Naïve Bayes has been used in real life scenarios where methods used for modelling in the area of diagnosing of diseases (Mycin). The method was applied to predict late onset Alzheimer’s disease in 1411 individuals whom each had 312318 SNP measurements available as genome-wide predictive features. This dealt with nonlinear dependant data and was proven to be powerful and affective in providing useful patterns in the large dataset [2].

The aim of this datamining technique is to determine whether a set of values of the attributes can be assigned to a particular class. It is worked out by finding the objects probability of its attributes values being a part of a particular class. The classifier is then determined as the most frequent possibility.

This annotation shows us the conditional probability. The probability that event B occurs so long as event A has already occurred is the conditional probability of event B in relation to event A.

The notation for conditional probability is P(B|A), read as the probability of B given A.

Zero frequency problem

One of the disadvantage with Naive-Bayes is that if you have no occurrences of a class label and a certain attribute value together then the frequency-based probability estimate will be zero. When all the probabilities are multiplied, it will give zero. Solution is to shift your zero frequency

Advantages & Disadvantages

Naive Bayes classifier makes a very strong assumption on the shape of your data distribution. The result of this can be bad. This is not all terrible as the Naive Bayes can be optimal even if the assumption is violated. If there are no occurrences of a class label and a certain attribute value together, then the frequency based probability estimate will be zero. Given Naive-Bayes’ conditional independence assumption, when all the probabilities are multiplied you will get zero and this will affect the posterior probability estimate.

Calculating probabilities is mostly overlooked, often trying to discretize the feature or fit a normal curve.

Naive Bayes gives useful outcomes with the algorithm being a robust method it can detect noise and unrelated attributes but Naive Bayes classification need big data set in order to make reliable estimations of the probability of each class. You can use Naïve Bayes classification algorithm with a small data set but precision and recall will keep very low.

to slightly higher. So, if you have counts of some occurrence in your data use Laplacian smoothing.

Decision tree

Decision trees are a representation for classification. It is a set of conditions, organized hierarchically in a way that the final decision can be determined following the conditions fulfilled from the root of the tree to one of its leaves. They are based on the strategy “divide and conquer”.

There are two phases for possible types of divisions. The first type is Nominal partition. Where an attribute may lead to a split with as many branches as vales there are for the attribute.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal

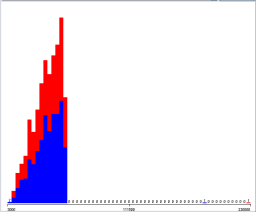

The attribute ‘Gender’ has been updated to rectify the default values of the gender. The changes that were made was to change any full word ‘Male’ and ‘Female’ to F and M. the changes are represented in the histogram.

The attribute ‘Gender’ has been updated to rectify the default values of the gender. The changes that were made was to change any full word ‘Male’ and ‘Female’ to F and M. the changes are represented in the histogram.

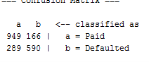

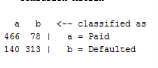

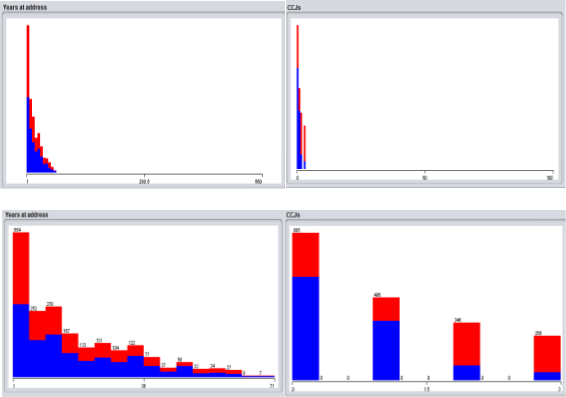

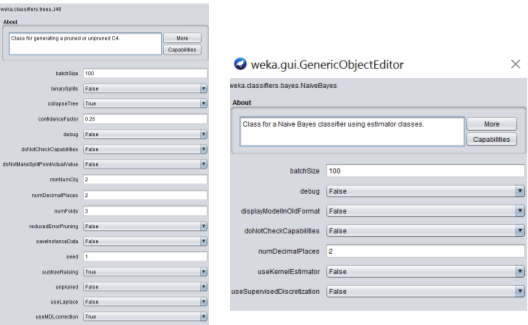

For the initial testing, both Naïve Bayes and J48 parameters will remain at their default and unchanged as set in Weka, pictured below.

For the initial testing, both Naïve Bayes and J48 parameters will remain at their default and unchanged as set in Weka, pictured below.