How Job Anxiety affects Executive Decision Making in Gain and Loss Context

| ✓ Paper Type: Free Assignment | ✓ Study Level: University / Undergraduate |

| ✓ Wordcount: 3014 words | ✓ Published: 12 Aug 2019 |

Introduction

In a short introduction, the idea of the essay is to study the effects of job anxiety in on social buffering and strategic risk taking moderated by role of decision context on senior executives.

Anxiety is a feeling of worry, nervousness, or unease about something with an uncertain outcome (retrieved from: https://en.oxforddictionaries.com/definition/anxiety). It is known to influence how people think and act (Eysenck, 1992; Maner etal., 2007; Raghunathan and Pham, 1999), it is quite evident that CEOs suffer from anxiety due to their job. It can be easily assumed that anxiety will affect how executives perceive, make sense of, and behave while taking strategic decision.

The goal of this study is find out the direct relation between job anxieties experienced by executives and their risk strategies as well their social buffering techniques. In the study, researchers are postulating that job anxiety will cause executives to –

- Create a social buffer against threats by surrounding themselves with supportive decision-making teams.

- Pursue lower-risk firm strategies.

Research gap is identified that in previous years job anxiety has been shown to influence a variety of outcomes among lower level employees (c.f., Abdel-Halim, 1978; Griffith and Hebl, 2002; Muschalla, Linden, and Olbrich, 2010) but, no studies were conducted to study the impact of job anxiety on CEOs and top executives. To narrow this gap the researcher’s aim to study the impact of job anxiety on senior executives and CEOs of an organization.

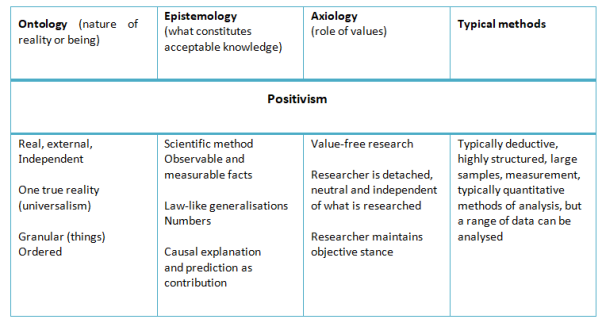

To signify direct relationship between job anxiety and strategic risk taking and social buffering, the researchers have established paradigm of objectivism. Ontologically, objectivism embraces realism which considers social entities to be like physical entities of the natural world, in so far as they exist independently of how we think of them (Saunders ,2016). A researcher using positivist philosophy use existing theory to develop hypotheses. These hypotheses would be tested and confirmed, in whole or part, or refuted, leading to the further development of theory which then may be tested by further research. Epistemologically it focuses on discovering observable and measurable facts and regularities, and only phenomena that can be observed and measured would lead to the production of credible and meaningful data (Crotty 1998). It also looks for causal relationships in the data to create law-like generalisations like those produced by scientists (Gill and Johnson 2010).

(Mark Saunders et al, 2009, p-136)

Literature Review

Using literature on the research topic is a means of developing an argument about the significance of your research and where it leads. It is used to identify what is already known about area we intend to study (Bryman,2012). The paper starts with discussion about anxiety in general. The American Psychological Association (APA) defines anxiety as “an emotion characterized by feelings of tension, worried thoughts and physical changes like increased blood pressure.” The study conducted by the authors is mainly based on two previous theories namely upper echelon’s theory and behaviour decision theory.

The upper echelons theory states that organizational outcomes—strategic choices and performance levels—are partially predicted by managerial background characteristics. Propositions and methodological suggestions are included (Donald C. Hambrick and Phyllis A. Mason, 1984)

The central premise of upper echelons theory is that top executives view their situations – opportunities, threats, alternatives and likelihoods of various outcomes – through their own highly personalized lenses. These individualized interpretations of strategic situations arise because of executives’ experiences, values, personalities and other human factors. Thus, according to the theory, organizations become reflections of their top executives (Mie Augier and David J. Teece ,2018)

The behavioural decision theory consists of two facets, normative and descriptive. Normative decision theory is concerned with identifying the best decision to make, modelling an ideal decision maker who is able to compute with perfect accuracy and is fully rational. The practical application of this prescriptive approach (how people ought to make decisions) is called decision analysis, and is aimed at finding tools, methodologies and software (decision support systems) to help people make better decisions. In contrast, descriptive decision theory is concerned with describing observed behaviours under the assumption that the decision-making agents are behaving under some consistent rules. (Retrieved from: http://www.en.wikipedia.org/wiki/Decision_theory)

Based on the previous studies, authors argue that many individuals experience anxiety in connection with their jobs. Authors argue that prior scholars of the past have also focused extensively in studying the effects of job anxiety in lower level employees (e.g., Abdel-Halim, 1978; Doby and Caplan, 1995; Griffith and Hebl, 2002). The study conducted by authors was the first to focus on job anxiety in top management executives and to demonstrate how job anxiety affects their job related decision and strategic decision making.

The authors also take into account the principles of buffering hypothesis while deducing their hypothesis about social buffering. The buffering hypothesis is a theory holds that the presence of a social support system helps buffer, or shield, an individual from the negative impact of stressful events. The buffering hypothesis has been researched in terms of whether or not social support systems lengthen a person’s longevity, health, and wellness (Cassel and Cobb, 1976)

Based on the fundamentals of upper echelons, behaviour research theory and buffering hypotheses, authors postulated that job anxiety will cause executives to –

- Create a social buffer against threats by surrounding themselves with supportive decision-making teams.

- Pursue lower-risk firm strategies.

Social buffering is an act of creating a social support network around you to protect from awkward situations or adverse consequences of stress. According to social buffering model, persons with more social support are less affected (or unaffected) by negative life events.

Upper echelon’s theory presents the evidence that senior executives’ decision making strategies can be affected by as work experience, age, tenure, and education can affect an executive’s decisions and actions (for review, see Finkelstein, Hambrick, and Cannella, 2009). The preferences of the top executive (e.g. the CEO), who tends to have the strongest input into the selection, evaluation, and dismissal of team members affect the composition of top management team affect the composition of TMTs (Finkelstein, 1992).

Top management executives influence the selection process of decision making team and try to incorporate their own personal preferences. Hence, the authors proposed the idea that top executives with high levels of job anxiety aim to lower their exposure to risk by engaging in a social buffering process. The researchers have applied this concept in their study to propose that anxious top executives will engage in social buffering by relying upon trusted advisors when facing difficult strategic decisions.

The scholars who have studied behaviour decision theory have presented the evidence that situational characteristics affect how executives make decisions (e.g., Larraza-Kintana etal., 2007; Souder and Bromiley, 2012), particularly in the domain of risk (e.g., Chattopadhyay, Glick, and Huber, 2001; Matta and Beamish, 2008; Wiseman and Gomez-Mejia, 1998).Based on these studies, authors argue that the effects of job anxiety will differ depending on whether an executive is operating in a gain context versus a loss context.

Methods and Analysis

In this paper, four hypotheses were proposed by the authors. Based on the previous studies, authors proposed that top executives with high levels of job anxiety aim to lower their exposure to risk by engaging in a social buffering process.

Hypothesis 1: Job anxiety will induce top executives to choose decision-making teams that provide a higher level of social buffering

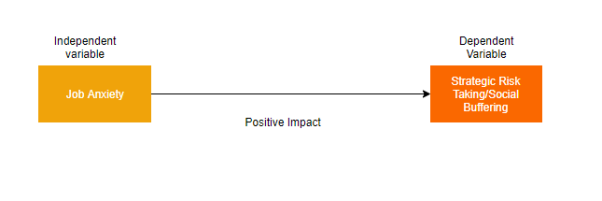

In the Second Hypothesis, researchers assert that job anxiety will have positive effect on executives’ assessments of risk, as well as their preference for safer (as opposed to higher-riskier) courses of action. Job anxiety will motivate executives to pursue risk-averse strategies and opt for less risky courses of actions when making any decision.

Hypothesis 2: Job anxiety will induce top executives to pursue lower-risk strategies.

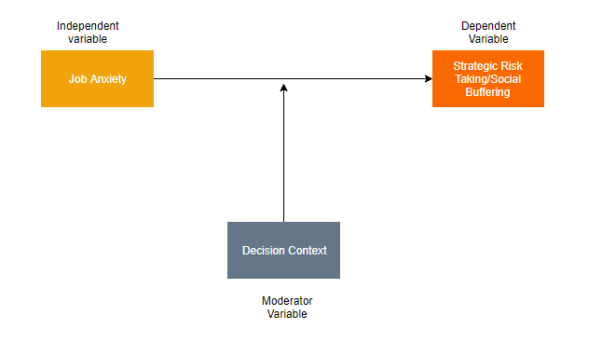

While proposing third hypothesis, the researchers highlight the moderating influence of decision context. Based on the behavioural decision theory, authors defined decision context as a continuum reflecting the extent to which an executive frames his or her overall situation at a given time as generally favourable (i.e., gain context) or unfavourable (i.e., loss context) relative to a reference point. Deriving their third hypothesis from the first one, the authors argue that loss context will strengthen the relationship between executive job anxiety and social buffering. The authors also believed that gain contexts will weaken the influence of job anxiety on social buffering

Hypothesis 3: The influence of top executive job anxiety on social buffering will be stronger (morepositive)inperceivedlosscontextsthanin perceived gaincontexts.

Previous researches also exhibit that decision context will also affect executives’ strategic risk taking techniques. Studies in the past show that CEOs are more inclined to take risks when facing losses such as performance below aspirations (Wiseman and Bromiley, 1996). Gain contexts, on the other hand, exacerbate executive risk aversion. Therefore Decision context is also acting as a moderating influence in the relationship between job anxiety and strategic risk taking.

Hypothesis 4: The influence of top executive job anxiety on strategic risk taking will be stronger (more negative) in perceived gain contexts than in perceived loss contexts.

Scholars used a multisource, multi-method data collection approach to test their ideas. This involved gathering data from a wide variety of sources, including recorded in-person structured interviews with every top executive in our sample; online surveys administered to the executives’ decision-making teams. Job anxiety, an independent variable was assessed by surveying the spouses, families, and friends of the top executives in our sample. Dependent variable, social buffering, was measured similar to Cruz et al.’s (2010) measure of TMT benevolence,5 which focuses on the degree to which the leader believes that his or her team wishes the leader more good than harm (Mayer and Davis, 1999). Another dependent variable, strategic risk taking was measured by gathering data from both the focal top executive leading the team as well as the subordinate members of the team. To assess the moderator variable psycholinguistic approach (Pennebaker, Francis, and Booth, 2001) was employed which aimed at measuring perceived gain/loss context based on the language executives used during our in-person interviews. The researchers also included control variables which were held constant during the research. Researchers have utilized age, prior performance; profit vs. Non-profit status and family status.

Reflecting on the method employed, the paper employs quantitative method. All the variables are converted into numerical values and hierarchical linear regression model is used to test the hypotheses.

Figure 1

Figure 2

Conclusion

Based on the results, it was concluded that the research model did not support hypothesis 1 and job anxiety was not found to be the predictor of social buffering. H 2, H3 and H4 were verified by the paper. Based on the results of hypothesis 3, it was also concluded that job anxiety has nosignificant effect in gain contextsThe substantial variance in job anxiety observed in the samples collected for study stresses on the fact that executives worry about making mistakes in their jobs, and results also indicate that anxious top executives take steps to reduce exposure to risk as well as their organizations’ strategic risk taking. Anxiety’s effects depend on whether decisions occur in gain or loss contexts.

Contributions and Suggestions

In an interview conducted after the journal was published, the authors of the journal suggested some strategies to reduce the job anxiety in CEOs and senior executives. According to the authors, when a board of directors appoints a CEO, rather than assuming that they will always make level-headed decisions on their own, the board might take steps to provide social support but also accountability. Board should ask CEO to present multiple options when considering a big strategic decision, instead of CEO’s final solution, as this might make their avoidance of smart risks more transparent. Also, employees working under anxious CEO should consider more on presenting ideas related to risk mitigation. (States News Service, Oct 19, 2015)

Although authors could not find the effect of job anxiety on social buffering, but did not find support for the main effect of executive job anxiety on social buffering, the negative interaction found between anxiety and perceived gain/loss context suggests that anxious executives do take steps to buffer themselves from perceived threats — but only when facing a loss context. Hence, in my opinion social buffering could be used as a control variable when measuring effects of job anxiety on strategic risk taking. Also, the study also suggests job anxiety could have significant effect on executive performance. Hence to extend the study further, job performance could be used as a dependent variable.

The results of the journal stresses on the fact that executives worry about making mistakes in their jobs, and results also indicate that anxious top executives take steps to reduce exposure to risk as well as their organizations’ strategic risk taking. The studies of this journal can be extended by quoting that Job anxiety can be directly related to the higher wages given to CEOs. A study was conducted by Alex Bryson, Erlin Barth and Harald Dale-Olsen which showed that higher wages are associated with higher job satisfaction and higher job anxiety (Barth, Bryson & Dale-Olsen, 2010). This study was based on the framework by (Smith, 1776)

A worker is given higher wages to compensate for higher effort or more challenges that come with the job, and job anxiety induces higher wages. The second idea, brought into economics by (Akerlof 1982) Higher wages induce more stress if the worker feels he has to reciprocate and perform better as a result of higher pay. In this case higher wages lead to more job anxiety.

The theory of equalizing differences refers to observed wage differentials required to equalize the total monetary and nonmonetary advantages or disadvantages among work activities and among workers themselves. Measurable job attributes on which compensating wage differentials have been shown to arise empirically include

(1) Onerous working conditions, such as risks to life and health, exposure to pollution, and so forth;

(2) Intercity and interregional wage differences associated with differences in climate, crime, pollution, and crowding;

(3) special work-time scheduling and related requirements, including shift work, inflexible work schedules, and possible risks of layoff and subsequent unemployment .(Rosen, Sherwin, 1986)

Another study conducted by Annamária Kubovcikova, Jakob Lauring and Tine Koehler demonstrated that people who speak a foreign language at work suffer from job anxiety more than the ones who speak native language at work. However, as predicted by the job demands-resource model this effect is reduced by team leader inclusive language management. It was also exhibited in the study that to reduce job anxiety in the employees, inclusive language management is more important than language proficiency.

References

A. Smith The wealth of nations. Penguin Classics, London (1776)

Abdel-Halim AA. 1978. Employee affective responses to organizational stress: moderating effects of job characteristics. Personnel Psychology 31(3): 561 – 579.

Bryman, Alan. 2012 Social Research Methods 4: p 97-128

Larraza-Kintana M, Wiseman RM, Gomez-Mejia LR, Welbourne TM. 2007. Disentangling compensation and employment risks using the behavioural agency model. Strategic Management Journal 28(10): 1001 – 1019.

Crotty, M. (1998) The Foundations of Social Research.London:sage

Cruz CC, Gomez-Mejia LR, Becerra M. 2010. Perceptions of benevolence and the design of agency contracts: CEO-TMT relationships in family firms. Academy of Management Journal 53(1): 69 – 89.

Doby VJ, Caplan RD. 1995. Organizational stress as threat to reputation: effects on anxiety at work and at home. Academy of Management Journal 38(4): 1105 – 1123.

Erling Barth & Alex Bryson & Harald Dale-Olsen, 2010. “Do Higher Wages Come at a Price?,” CEP Discussion Papers dp1011, Centre for Economic Performance, LSE.

Eysenck MW. 1992. Anxiety: The Cognitive Perspective. Lawrence Erlbaum Associates: Hove, UK.

Finkelstein S. 1992. Power in top management teams: dimensions, measurement, and validation. Academy of Management Journal 35(3): 505 – 538.

Folkman S, Lazarus RS. 1985. If it changes it must be a process: study of emotion and coping during three stages of a college examination. Journal of Personality andSocialPsychology48(1): 150 – 170.

G.A. Akerlof 1982. Labor contracts as partial gift exchange

Gill, J. and Johnson, P. (2010) Research Methods for Managers(4th edn). London: Sage

Griffith KH, Hebl MR. 2002. The disclosure dilemma for gay men and lesbians: ‘Coming out’ at work. Journal ofAppliedPsychology87(6): 1191 – 1199.

Hambrick DC, Mason PA. 1984. Upper echelons: the organization as a reflection of its top managers. Academy of Management Review 9(2): 193 – 206.

Kubovcikova, Annamária,Lauring, Jakob and Koehler, Tine, 2016.Language and job anxiety in multicultural teams: The role of inclusive language management

Academy of Management Annual Meeting Proceedings., Vol. 2016 Issue 1, p1-1. 1p.

Larraza-Kintana M, Wiseman RM, Gomez-Mejia LR, Welbourne TM. 2007. Disentangling compensation and employment risks using the behavioural agency model. Strategic Management Journal 28(10): 1001 – 1019.

Maner JK, Richey JA, Cromer K, Mallott M, Lejuez CW, Joiner TE, Schmidt NB. 2007. Dispositional anxiety and risk-avoidant decision-making. Personality and IndividualDifferences42(4): 665 – 675.

Maner JK, Schmidt NB. 2006. The role of risk avoidance in anxiety. Behavior Therapy 37(2): 181 – 189.

Mark Saunders, P. Lewis and A. Thornhill. January 2009. Understanding research philosophies and approaches

Matta E, Beamish PW. 2008. The accentuated CEO career horizon problem: evidence from international acquisitions. Strategic Management Journal 29(7): 683 – 700.

Mayer RC, Davis JH. 1999. The effect of the performance appraisal system on trust for management: a field quasi-experiment. Journal of Applied Psychology 84(1): 123 – 136.

Mie Augier and David J. Teece ,2018, the Palgrave Encyclopaedia of Strategic Management

Muschalla B, Linden M, Olbrich D. 2010. The relationship between job-anxiety and trait-anxiety— A differential diagnostic investigation with the Job-Anxiety-Scale and the State-Trait-Anxiety-Inventory. Journal of Anxiety Disorders24(3): 366 – 371.

Pennebaker JW, Francis ME, Booth RJ. 2001. Linguistic Inquiry and Word Count: LIWC2001. Erlbaum: Mah wah, NJ.

States News Service, Oct 19, 2015. CEO JOB ANXIETY STRONGLY IMPACTS JUDGMENT AND DECISION-MAKING, RESEARCHERS FIND

Raghunathan R, Pham MT. 1999. All negative moods are not equal: motivational influences of anxiety and sadness on decision making. Organizational Behavior and Human Decision Processes 79(1): 56 – 77.

Rosen, Sherwin, 1986. Chapter 12 the theory of equalizing differences. Handbook of Labor Economics, 1986, Vol.1, pp.641-692

Wiseman RM, Bromiley P. 1996. Toward a model of risk in declining organizations: an empirical examination

Wiseman RM, Gomez-Mejia LR. 1998. A behavioral agency model of managerial risk taking. Academy of Management Review 23(1): 133 – 153.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this assignment and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal