Business Strategy of Anthem Inc

| ✓ Paper Type: Free Assignment | ✓ Study Level: University / Undergraduate |

| ✓ Wordcount: 2530 words | ✓ Published: 12 Aug 2019 |

About the company

Anthem, Inc. is a leading health insurance company in the country. It was founded in early 1940. Until 2014 the company was known as WellPoint, Inc and it has been the leading health benefits company. The company grew by acquisitions and is headquartered in Indianapolis. It is the largest for-profit managed health care company in the BCBSA, Blue Cross and Blue Shield Association and as well as the second largest health insurance payers, by the marketplace in the country.

Anthem along with its affiliated companies serves over 73 million people in the United States which includes around 40 million people with its Anthem homegrown health plan products. Anthem Inc delivers a number of leading health benefit product solutions through a broad portfolio of health care plans. The health services cover a wide range of specialty products such as life and disability insurance benefits, dental, vision, behavioral health benefit services, as well as long-term care insurance and flexible spending accounts. With several health care regulations in place, Anthem is licensed to serve members in 14 states and specialty plan members in other states. [1]

Anthem Business Strategy

Anthem’s strategy is driven by the focus on achieving the following objectives:

- “Create the best health care value in our industry”

- “Excel at customer experience”

- “Capitalize on new opportunities to drive growth”

The company’s affiliated health and specialty plans are organized around the following customer segments:

- National Accounts Local Group

- Individual

- Medicare Programs

- Medicaid

- Federal Employee Program

- Blue Card

- Specialty Products

Anthem, Inc. affiliated health plans have created a variety of PPOs, HMOs, various hybrid and specialty products, network-based dental products and health plan services that combine the attributes consumers find attractive with effective cost control techniques. Anthem’s vision is to be the most innovative, valuable and inclusive partner.

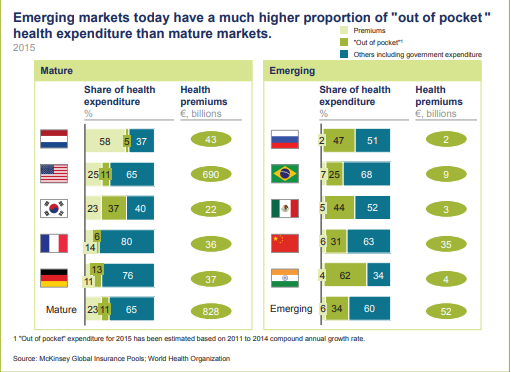

Global Health Insurance Sector

The global health insurance industry is facing a significant increase in competition. This has put significant pressure on companies to become more efficient, alter their business models and enhance their technology-related processes. The global health insurance industry is currently dominated by the United States and it accounted for around 70 percent of the total global health premiums in 2015. There is an increased awareness for the necessity for health insurance in emerging markets. With the rise in income levels, increased awareness and more private health insurers, the annual share of health premiums in emerging markets is expected to increase in the coming years. “Rapidly emerging markets, China and India are balanced to lead this growth and increase the share of the global private health insurance premiums from 4 percent in 2015 to 11 percent in 2020.” [2] While there are a few early entrants in the market, it will be a great opportunity in terms of transforming the quality of life and health care as well as for Anthem, Inc to expand globally in these emerging markets.

Fig 1: Mature Vs Emerging markets – Out of Pocket health expenditure A deep dive into the Asian market on healthcare needs and expenditures reveal that majority of the population in this growing economy are slowly being introduced to healthcare insurance traditions. Medical and life science research industry has also seen significant growth in the last couple of decades especially in India. For every individual in a growing economy like India, China, health insurance has become a necessity. With the medical inflation rates so high and to be without health insurance can prove to be a huge financial risk. With the growing corporate culture and changing lifestyle, there are growing healthcare needs. Buying a health cover does not seem to be an option anymore but an absolute need.

Why Global Entry in the Indian Insurance Sector?

Insurance Regulatory and Development Authority (IRDA) is an autonomous body to regulate and develop the insurance industry in India. In August 2000 IRDA had opened up the market and allowed foreign direct investments up to 26% in the insurance sector. Expanded FDI limit will reinforce the current organizations and also enable the new players to come in. This will enable more individuals to purchase life and health insurance. As more organizations would enter the insurance marketplace, it would lead to higher competition and cheaper insurance premium for the clients. IRDA increased foreign direct investment to 49 percent in 2013. Although with the increased FDI, Government still holds guidelines regarding the management control, which would lie with the Indian counterpart.

A recent study conducted in India shows that only 1.1 billion of the Indian population which is less than 15% of the Indian population is covered through health insurance. According to WHO statistics, 31 % and 47% of the hospital admissions in urban and rural India are either financed through loans or sale of assets. “Additionally, as per statistics, 70% of Indians spend their entire income on healthcare and 3.2% of the population fall below the poverty line owing to high medical bills. The Indian healthcare industry amounted to $160 billion in 2017 and is expected to reach $370 billion by 2022 due to the increased demand for specialized and quality healthcare facilities.” [3] The market is dominated by private players. Indian health insurance industry is growing up rapidly. There are massive investments from existing corporate hospital chains and new entrants backed by personal equity investors. This growth will be driven by hospital facilities, private-public projects, medical diagnostic centers and pathological laboratories, and also the health insurance sector. India currently faces a shortage of healthcare infrastructure and is anticipated to possess a potential demand of 1.75 million new beds by the tip of 2025, particularly in rural areas and Tier II and Tier III cities. [4] This plight of healthcare infrastructure would possibly want overseas organizations to set up hospitals in India through foreign direct investment.

The hospital services market, that represents one among the foremost necessary segments of the Indian healthcare industry, is presently valued at $80 billion and accounts for 71 percent of industry revenues. “The boom in medical tourism in the Indian healthcare sector is urging hospitals and hoteliers to create coalitions. The potentiality of world-class hospitals and experienced medical professionals has bolstered India’s position as a preferred destination for medical tourism. The healthcare industry is now proactively creating norms for the medical tourism industry with the assistance of credit rating agencies, insurance companies,1 and others involved in the self- regulation of the sector.” As per the industry assesses, this market is expected to grow from $3 billion to $7-8 billion by 2020. 4 Health insurance and hospital administration is a key area in which companies like, Anthem corp can make a difference. This opportunity includes introducing and maintaining industry standards and classifying and certifying healthcare centers. Favorable entrant situations in India combined with innovative Anthem strategies will be best recognized for Anthem to make footprints in the emerging Healthcare industry.

Legato Health Technologies

In November 2017, Anthem founded Legato, an independent services provider to the Anthem companies with the purpose of leveraging global scale and execution expertise to transform healthcare as a GIC (Global In-house Center).

- Enrollment and Billing

- Commercial Claims

- Enterprise Benefits Administration

- IT Application and Development

The company is headquartered in Bangalore, India and has staffed about 5000 employees performing customer service, back-office functions and software development and IT support for Anthem Inc. The company has contracted with Apollo Munich Health Insurance Company Limited to provide health insurance benefits to Legato employees.[5]

Global Expansion through a Subsidiary in India

With the health insurance regulatory and political landscape in favor of expanding in the Indian marketplace, Anthem should strategize taking this business line a step forward in the Indian marketplace. Anthem Inc can now expand its health insurance products in India through an Indian subsidiary. Having an existing contract with Apollo Munich Health Insurance company Ltd, Anthem can extend this relation through contractual terms and operate via Apollo Munich Health Insurance in the Indian marketplace. Anthem will form the board of directors with a strategic leader from the subsidiary company to lead the initiative in the Indian marketplace and that also align with the overall Anthem’s strategic pillars. Anthem can have their directors in the board to supervise and advice on the subsidiary operations but it is key to have the strategic leader from the subsidiary company who are closer to the local consumer market and understand the local nuances and be innovative.

The investments that Anthem would make in this subsidiary company would be strategically used in formulating newer health plans and products that would cater to the local population under the supervision and guidance of the strategic leader from the subsidiary company. In this way, there will be encouragement, rewards, recognition and formularized process of innovation encouraging the subsidiary side. The opportunities that are recognized could be a new product that fits into the trend of local market needs. The subsidiary company can bring in higher managers from the headquarters, Anthem Inc to see and review the local consumer health care needs in formulating any newer health plan products. This will encourage personal connections between the subsidiary and the headquarter Anthem Inc. This can be a formal channel for the subsidiary to implement their innovative ideas and at the same time align their innovation and processes with Anthem global strategy.

New Global Products – Travel Insurance

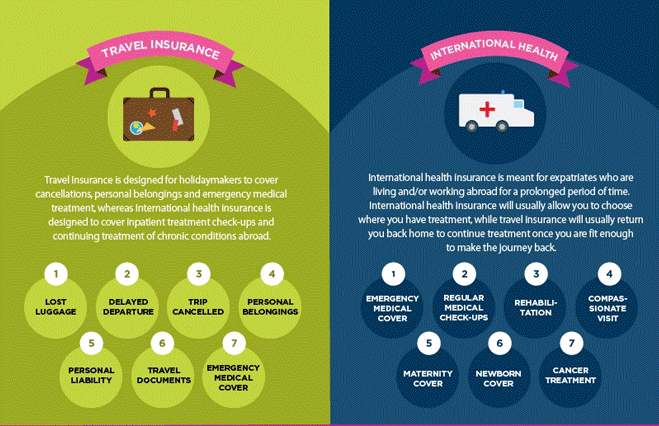

Travelers around the world are increasing every day. The vacation tradition in the United States is defined to be longer, relaxed stays. Especially in recent years, travelling overseas for vacation has taken the charm. Travelling overseas is a wonderful and exciting experience. To be covered with an insurance gives the peace of mind to be protected in the event of the unexpected especially when the travel is outside the country of residence. Travel insurance product will be designed to protect you from both non- medical situations like trip cancellations, lost luggage and personal liability as well as unexpected medical emergency situations.

Some of the health plan products in the marketplace do provide insurance and coverage during travel but defines an invisible line between ‘urgent care’ and emergency care’. Also, any medical emergencies that may arise from the pre-existing condition may not be covered. This could represent a huge financial risk for travelers. Most standard benefits from the insurance policies do not apply while travelling outside of the home country. Travel insurance plan can give the peace of mind to enjoy the trip to the full intent and be able to provide the needed assistance when the unexpected or unfavorable strikes. Travel medical coverage is ideal for:

- International vacationers

- Relatives visiting from overseas

- People going on cruises, safaris or guided tours.

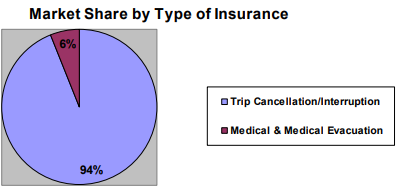

Fig 2: Insurance Coverage – Travel Insurance Vs International Health Insurance. According to statistics available from the web, about 20M US nationals fly overseas each year and an average of approximately 30M inbound visitors into the US. Among these travelers, only about 10% of them have insurance during travel. There is a growing awareness among the travelers for the need of travelers insurance. Travel Insurance industry has grown by 2.7% to reach revenue of $2bn in 2018. The number of international travelers from the US is expected to increase in the coming years, presenting a potential opportunity for the industry.[6] Per below chart, 94% of the travel insurance purchased covers trip cancellation and interruption. Only about 12% of the travel insurance claims are being made. With these statistics, it is evident that there is potential for growth and revenue when Anthem can launch travel insurance product in the market.[7]

Fig 3: Market Share by Type of Insurance. Anthem serving over 70M Americans with its health insurance products today would give additional benefits for its members to buy travel insurance products and also be an opportunity to increase the member base by attracting the market in terms of convenience by keeping both health and travel products with the same company.

Expat Insurance Product

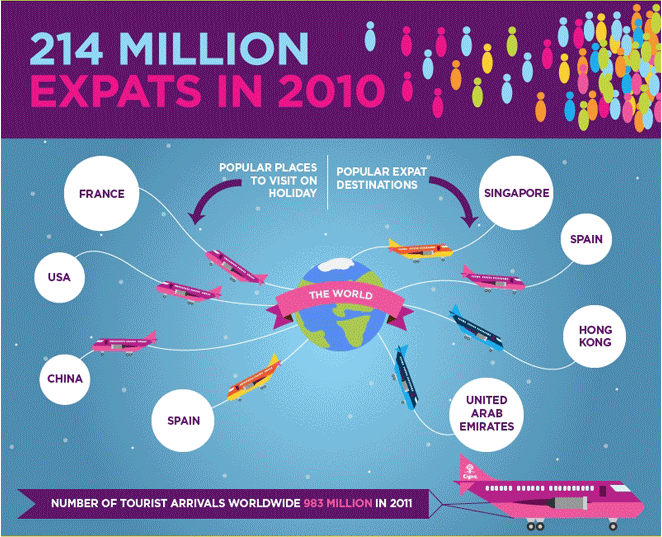

With Anthem’s strategy to expand in India and rest of the global markets in the coming years, there will be a need for Anthem employees to travel onsite for business reasons for an over extended period time, nowhere between a month and one year. There will be then, an in-house need for Anthem to design expat insurance for its employees. Taking this product idea to the marketplace would give an opportunity for Anthem members and the rest of the population an option to benefit from this product. Anthem expat health product will provide health coverage in case of medical emergency, routine physical exam, and care for a pre-existing medical condition that needs ongoing treatment, injury and accident. The product can be designed for any period between 1 month up to 12 months, however, the product will have the flexibility for cancellation if the trip will be shortened. For any medical coverage lesser than a month, travelers insurance will be an alternative to consider. [8]

Fig 4: Expat Population Spread Map 2010 The figure above shows the population of expats in 2010 and these figures have grown gradually in recent years. Anthem strategy will include launching this product in the Indian marketplace through the subsidiary. The product will be carefully reviewed with the health regulations in the rest of the Asian market and product expanded in the Asian market through subsidiaries. This product when launched in the marketplace, it would not only provide our members to take advantage of this product but can also potential big business revenue line for Anthem.

The Road Ahead – Anthem Global Strategy

Health care industry has several restrictive regulations in different countries. But with conditions favorable in India and a great potential marketplace, Anthem should strategize to expand in the Indian market. With a 2-year roadmap in this global expansion strategy beginning with capitalizing Legato Health technologies in India from backend IT office operations to marking footprints in the marketplace. Anthem will expand through its subsidiary Apollo Health in India. In the first year of this roadmap, Anthem will carefully review and form the board with Anthem strategic partners and initiative leaders from the strategic company.

The strategic leader will bring Apollo health competencies in terms of market survey and potential health plan products that will be need and demand for the local population. The global products will be designed and submitted for approval for Insurance regulatory for approval before the end of the ninth month into the roadmap and launch in the marketplace in the first year At around the same time, Anthem travel products will be carefully designed based on the market analysis in the US and India, to begin with, it. Anthem would focus on marking its first global footprints in India for these travel products and slowly expand into the rest of Asian and other global markets through subsidiaries. This global strategy aligns with One Anthem transformation and together we can change lives for the better.

References

- [1] Anthem, Inc., www.antheminc.com/AboutAnthemInc/index.htm.

- [2] McKinsey Insights, https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/global%20insurance%20insights%20an%20overview%20of%20recent%20trends%20in%20life%20p%20and%20c%20and%20health/global-insurance-industry-insights-an-in-depth-perspective-may-2018.ashx

- [3] Indian Insurance impact analysis, https://www.omicsonline.org/open-access/impact-analysis-of-fdi-on-insurance-sector-in-india-2162-6359-1000255.php?aid=54867

- [4] “India –Healthcare.”, www.export.gov/article?id=India-Healthcare-and-Medical-Equipment.

- [5] About Legato https://jobs.legatohealthtech.com/

- [6] National Travel and Tourism Office (NTTO), https://travel.trade.gov/view/m-2017-I-001/index.asp

- [7] Travel Insurance Growth Trend, www.ustia.org/uploads/2/4/8/8/24887869/travel-insurance-sales-show-steady-increase-9-12-11.pdf.

- [8] Travel Medical Insurance, https://www.cafii.com/wp-content/uploads/2018/06/CAFII-Travel-Medical-Insurance-2018-Research-Executive-Summary.pdf

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this assignment and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal