Business Analysis of Easyjet

| ✓ Paper Type: Free Assignment | ✓ Study Level: University / Undergraduate |

| ✓ Wordcount: 2087 words | ✓ Published: 12 Oct 2017 |

Business Analysis for Easyjet

Introduction

Since the deregulation of transportation and airline travel throughout Europe, there has been a significant growth in the number of Budget airlines serving the travel consumer. One of the first of these new types of airline carriers was Easyjet. The intention of this report is to provide an independent assessment of this organisation, which will include an evaluation of the business strategy, the strength of its change and risk management procedures and an overview of its investment potential.

Easyjet History

Founded in 1995 Easyjet was the UK’s first “Low Cost” carrier and is currently the second largest to Ryanair in the European market (Nugent 2008). The business currently runs 165 aircraft, which carried over 43 million passengers in 2007 to and from 103 airports (see figure 1).

Figure 1 Easyjet airport network

Existing Corporate Strategy

From its inception, Easyjet focused it corporate strategy upon the “budget-price” model that had been pioneered by US based Southwest Airlines. The core of this strategy is concentrated upon three main factors.

1) No-frills

The first of these factors was the adoption of a “no-frills” pricing strategy (Johnson et al 2007, p.247, Whittington 1993 and Pettigrew et al 2002), which was achieved by eliminating in-flight services, such as entertainment, free meals and reserved seat numbers, as well as external services such as paper-based tickets and brochures and courtesy lounges at airports. In addition, Easyjet’s aircraft operate a single ticket class, which increases the potential for maximising passenger capacity.

2) Low-cost base

The second factor has been the maintenance of a “low-cost” base throughout the organisation’s supply chain, which allows for competitive prices whilst at the same time ensuring the achievement of above average returns (Porter 2004, p.210). The main areas that the corporation has concentrated upon in this respect have been driven by ensuring a lean and cost efficient corporate and operational structure. For example the corporation’s headquarters at Stansted are minimalistic because Easyjet operates a system of remote working and desk-sharing as a part of its cost reduction process (Easyjet 2008 b). Marketing costs have also been reduced by the elimination of commissions to third parties and agents (Johnson et al 2007, p.247). In addition, by its efforts to convert its aircraft fleet to a single type, the company is able to reduce both the cost of maintenance and training for engineering staff.

Another area of the business operations that has helped the business to maintain its “low-cost” base is through its efforts to maximise, or exploit as Lynch (2006, p.217) prefers to define it, the use of the business resources. This is evidenced by the fact that the roles of the business employees are flexible, for example in-flight crew are expected to clean the aircraft between flights and the fact that it aims to turn aircraft around at destinations within a thirty minute window, thus improving productivity and the return on the capital investment (Porter 2004, p.243).

3) Innovative processes

Easyjet’s current market position has also been driven by its use of innovative processes (Faulkner and Campbell 2006, p.388), many of which have contributed directly to the success that the company has achieved during the past thirteen years. Most of these innovations have also helped Easyjet to achieve its current level of success. Much of the innovative processes have been concentrated upon the way in which the corporation has embraced the use of IT and Internet technology. At the point of sale innovation has been used by a) the introduction of paperless tickets, which has resulted in the company achieving around 90% of its bookings online and b) the increasing conversion to automatic booking in procedures at airports, both of which help to reduce corporate costs.

In addition, Easyjet has adopted an innovative approach to its marketing and promotional strategy. In this respect it has created “extremely high levels of awareness with consumers” (Johnson et al 2007, p.247). Furthermore, by using online IT networking facilities the company maintains a regular dialogue with its customers (Easyjet 2008 b, p.80). These processes have enabled the business to react positively and effectively to the changes in consumer demands.

Competitive advantage

It is clear that the corporate strategy of Easyjet outlined above has contributed hugely in terms of providing the business with a competitive advantage in that it has enabled the corporation to achieve a position where it “outperforms [most of] its competitors” (Pettigrew et al 2002, p.55). This is certainly the case in terms creating a significant level of differential between the Easyjet product and those of the national carrier competitors (Porter 2004, p.207 and Kotler et al 2004, p.407).

However, even in relation to competitors within the more focused “budget” airline sector, Easyjet has sought to create a competitive advantage. This endeavour has been focused upon two main areas of the business operations. Firstly, unlike Ryanair, which has concentrated a major element of its low cost strategy upon developing a network of secondary airports, Easyjet has focused its attention on a hub of major airports that serve a large consumer base (see figure 2).

Figure 2 Population coverage comparison

Furthermore, because it travels to and from these major airport, Easyjet is better placed than Ryanair to attract low cost business travellers which, according to a company spokesman, accounts for 20% of their passenger load (Gunnion 2007) and is likely to increase in times of economic downturn.

Strategic results

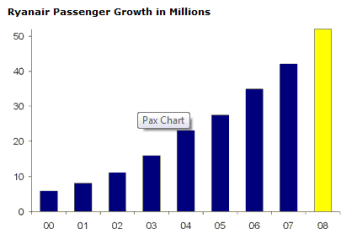

The successes that have resulted from the strategy adopted by Easyjet can best be seen when compared with the performance of its nearest rivals, these being Ryanair and British Airways. For example, in terms of the European market it is clear from the following graphs (figures 3 and 4), that in the past year Easyjet has almost matched Ryanair passenger numbers, which means that the business is now vying for the number one position in the European budget airline sector.

Figure 3 Easyjet passenger growth

Source: Easyjet (2008 b, p.5)

Figure 4 Ryanair passenger growth

Source: http://www.ryanair.com/site/EN/about.php?page=About&sec=story

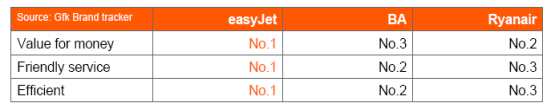

Furthermore, according to independent data, the company is also outperforming its main competitors in terms of customer satisfaction (see figure 5), which is key determinant for future success and business growth (Grant 2005, p.289).

Figure 5 Customer satisfaction

Source: Easyjet (2008 b, p.5)

Challenges

However, despite the success that Easyjet has enjoyed to date, it is not immune from the challenges and risks that are currently facing the global and regional airline industry. These risks can be deemed to apply to the following area of its business operations.

Competition

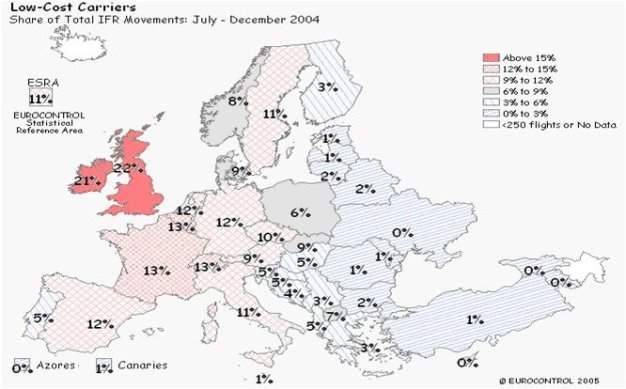

With the expansion of the European Union member states and the continued democratisation of the Eastern European countries, there is no doubt that competition within the European “Low-cost” industry will increase during the coming decade. As can be seen from the following regional map (figure 6), there is still a significant level of market share to be competed for within mainland Europe and airline corporations within many of the emerging European nations are already seeking to achieve market share within these areas.

Figure 6 Low cost airline share of European markets

(IFR = International flight routes)

Source: De Grotte 2005

Further competitive pressures could also be experienced because of the recently agreed “open skies agreement” that has been signed by the US and EU, which will liberalise still further the ability of airlines to expand their international presence (Bremner 2008). This could see US airlines seeking to enter the European airline market.

Taxation

As is the case with other airline operators, Easyjet benefits from the significant tax subsidies provided to the industry, recently identified as being in the region of £6 billion (Bized 2004), which reduce fuel, landing and VAT charges. In the face of increasing concerns regarding the environmental impact of air travel, it is quite likely that the politicians will seek to reduce these benefits within the near future, which will significantly affect operators’ profit margins.

Economic Climate

The UK Prime Minister, Gordon Brown, publicly acknowledged on the 22nd October 2008 that the UK and the world was entering into a recessionary period, which follows on from the recent “credit crunch” crisis, which has been in place for over twelve months. Although Easyjet’s recorded performance to date indicates that these economic problems have had little effect, it is feasible that they will have an adverse effect upon the company’s performance for the years 2009 and 2010 unless action is taken to mitigate these issues.

Environment

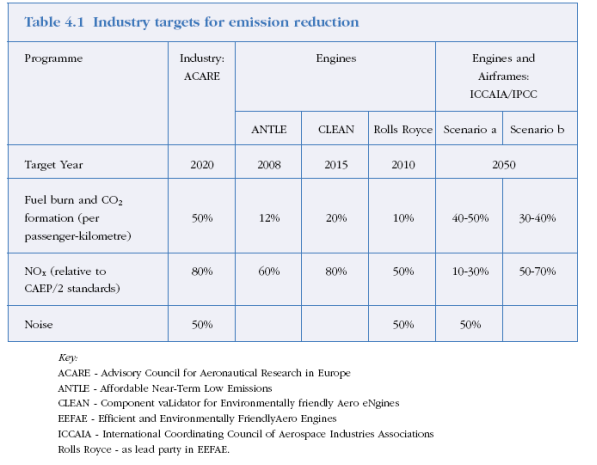

Another challenge and threat facing Easyjet is the introduction of new legislation in relation to reducing the airline industry’s effect upon the environment. As can be seen from the following (see table 1), the regulators are imposing some stringent targets for airline corporations to meet during the course of the next four decades. Despite the fact that in its corporate governance and annual financial reports Easyjet states that its current fleet is 25% cleaner than previously, the company still has some way to go before it can match the future requirements indicated.

Table 1 Airline Industry targets

Source: http://www.rcep.org.uk/avreport.htm,

Risks

All businesses are liable to be subjected to risk, and the airline industry is no exception. In this case, Easyjet would have the risk of mechanical accidents and disasters as well as the risk of other corporate and economic issues to deal with. As Devlin et al (1997, p.12) point out within their study on business continuity “history shows that most companies that suffer a disaster causing an extended disruption to information processing do not survive more than two years after the disaster.” Easyjet has implement to risk identification and management policy to deal with these risks, which is based upon a strategy of continuous investigation and communication through the whole of the business management chain.

Financial strengths and weaknesses

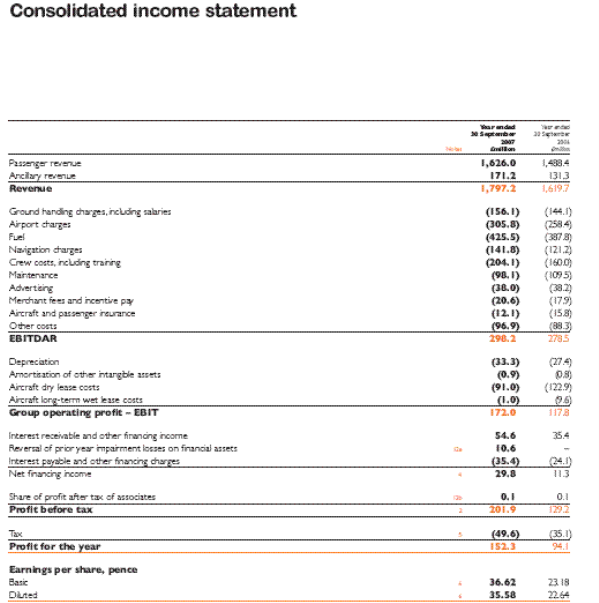

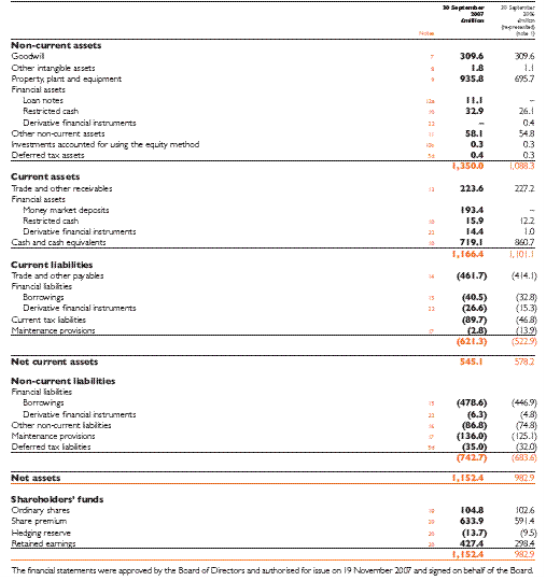

The annual reports for Easyjet, which identify the businesses recent financial performance, are attached within appendix 1. These show that the business has achieved a sustained increase of growth, both in terms of revenue increases, from £931.8 million in 2003 to £1,797.2 million in 2008. Profits have also increased from £32.3 million to £152.3 million for the same period, which compares favourably with those of its competitors (see figure 7).

Figure 7 Profit performance

Source: Easyjet (2008 b, p.6)

However, the underlying return on equity that is most important to an investor and this shows an increased ratio from 4.4% (2003) to 13.6% (2008). This has been reflected within the performance of Easyjet’s share value (see figure 8), which until the end of 2007 had shown a significant level of growth, outperforming the shares of Ryanair and the FTSE 100 for most of the latter part of the five year period indicated. However, like other industries, the current economic climate has seriously reduced this value.

Figure 8 Easyjet share performance

Conclusion

In conclusion, if Easyjet is able to address the challenges that it currently faces and is able to maintain the previous levels of growth and financial performance, it would prove to be a positive investment for the future in the opinion of the author, an opinion that is supported by current market analysts[1].

Bibliography

Bremner, C (2008). Heathrow to get busier after “open skies” agreement. The Times, London, UK (31 March 2008).

Doughty, Ken (ed) (2000). Business Continuity Planning: Protecting Your Organisation’s Life. Auerbach Publishing. Florida, US.

Easyjet (2008 a). Company Overview. Available from: http://www.easyjet.co.uk/EN/About/Information/index.html (Accessed 21 October 2008).

Easyjet (2008 b). Investor Day. Available from: http://www.easyjet.co.uk/common/img/analyst_and_investor_day_2008.pdf (Accessed 21 October 2008).

Faulkner, David and Campbell, Andrew (2006). The Oxford Book of Strategy: A Strategy Overview and Competitive Strategy. New ed. Oxford University Press. Oxford, UK.

Grant. Robert M (2005). Contemporary Strategy Analysis. 5th edition. Blackwell Publishing. Oxford, UK.

Gunnion, S (2007). Budget airlines reach for the skies. Investors Chronicle, London, UK.

Johnson, G., Scholes, K and Whittington, R (2007). Exploring Corporate Strategy. FT Prentice Hall, Harlow, UK.

Kotler, Philip. Wong, Veronica., Saunders John A and Armstrong, Gary (2004). Principles of Marketing, 4th European edition, Pearson Education Ltd. London, UK.

Lynch Richard (2006). Corporate Strategy. 4th edition. Financial Times Prentice Hall. Harlow, UK.

Nugent, H (2008). Ryanair grounds aircraft with winter cuts. The Times, London, UK. (18 July 2008).

Pettigrew, Andrew M. Thomas, Howard and Whittington, Richard (2002). The Handbook of Strategy and Management. Sage Publications Ltd. London, UK.

Porter, Michael E (2004). Competitive Strategy: Techniques for Analysing Industries and Competitors. The Free Press. New ed. The Free Press. New York, US.

Webster, P and James C (2008). Gordon Brown bites bullet and uses “R” word. The Times, London, UK (22 October 2008).

Whittington, G (1993). Corporate Governance and the Regulation of Financial Reporting. Journal of Accounting and Business Research, Vol. 2, Corporate Governance Special Issue, pp311-319

Appendix 1

Figure 9 Easyjet Income statement

Figure 10 Easyjet Balance sheet

Figure 11 Easyjet five year information

1

[1] See FT.com at http://markets.ft.com/tearsheets/analysis.asp?s=EZJ:LSE

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this assignment and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal