Amazon Case Report

| ✓ Paper Type: Free Assignment | ✓ Study Level: University / Undergraduate |

| ✓ Wordcount: 2980 words | ✓ Published: 12 Aug 2019 |

As competition continues to intensify, how should Amazon continue to grow while reaching more customers quicker without having profit close to break-even point?

Analysis:

Amazon being the world’s leading online retailer with extensive selection faces an increase in competition in many aspects. The online retail market is dynamic and is creating new challenges for Amazon over time. Using PEST Analysis model will identify opportunities and threats based on external factors. Recent issues of government criticism towards e-retailers like Amazon had triggered a 6% fall in the share price. However, this does not stop Amazon as they continue with investment and retaining their competitive advantage in technology. Following to Porter’s Five Forces, Amazon shows an overall high attractiveness to the market due to their competitive driving forces including low cost and customer focus. The main threat would be the large high-funded competitors such as Walmart and Google. The threat of substitute is high, but Amazon’s low cost retains customer’s attractiveness. As the leading e-commerce in the world, threats intensifies as their aggressive pricing strategy triggered major competitors to step up. In recent years, Walmart enters their store online, which allows them to focus on customer in-person and online.

Decision Criteria:

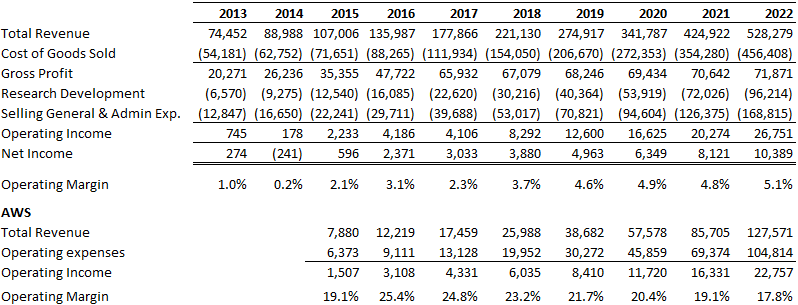

Consideration is needed in Amazon’s current market share rather diversifying its focus. There is potential in each product mix that can expand and grow higher profit than investing in new segments. Although reaching to new products is a competitive advantage, Amazon’s profitability is near break-even point. Profit is not their focus, but investing more on current market share can reach more customers and profitability at the same time. It would be more efficient to focus on growth and profit at the same time. I also created a pro forma income statement from 2013-2022 with a growth rate of 24% based on CAGR. From 2017 to 2022, the graph predicts a 29% rise in profit. This will be achieved by using their competitive strategy. Amazon’s e-book has the highest margin of sales because it is their core focus. Using a similar idea, Amazon should focus on their current market shares rather investing in new areas.

Alternatives:

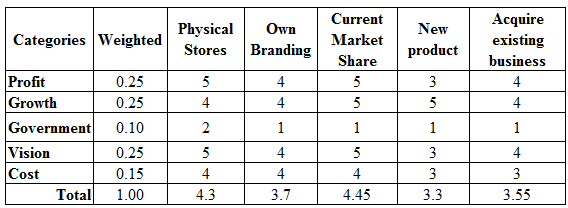

Amazon has numerous alternatives that they can choose from. Using a decision matrix, the top 3 alternatives would be building a physical store, branding their own products, or focus on their current market share. The alternatives are based on the weighting of profit, growth, government, vision, and cost.

Recommendations:

The most highly likable alternative to solve Amazon’s problem in profitability is focusing on their current market share, particularly in Amazon Web Services (AWS). The reason is the Internet continues to show value and cloud computing is less costly than building physical stores. There is also an increase in the start-up business that will require data storage at a low cost. Not only they will attract start-up business, but also big companies that need cloud data storage. Their pay-as-you-go pricing model is very flexible and adaptable. Furthermore, Amazon’s low-cost service will ensure to attract more clients. This will create profitability to soar in the long run.

Implementation:

AWS is a cash cow for Amazon. AWS should continue adding hundreds of new service features every year and cut prices aggressively. This alternative also creates innovation as Amazon requires to keep up-to-date with the latest technology. This will provide all the tools needed for companies to start up in cloud computing. Another approach is partnership internationally to provide more servers and a build long-term relationship. Moreover, this strategy can reach more international customers. Big competitors such as Microsoft and Google are considered. However, Amazon’s dominant market position, size, and sale keep them competitive. This approach will allow higher profitability and will continue on with Amazon’s vision.

Problem

In 2018, Jeff Bezos became the richest man in the world prioritize growth and investment over profit. He continues to strive for innovation, most customer-centric company and being the biggest in the world. While being an established player in the industry, how should Amazon grow to reach more customers quicker without profit being near the break-even point? They should reconsider stepping back from new ventures and retain to their current market share as there is a vast potential for growth and profit.

External Analysis

PEST

In the political side, the government’s attitude towards internet retailers are in question, especially to tax collection from customers. (See Exhibit 1). Amazon has been increasing its lobbying budget to have lobbyist expert deal with their tax battles and other political issues. In 2017, Whole Foods Market was acquired from Amazon creates uncertainty to the stock market and changes in level economic activity to many traditional retailers in the U.S. Their plan for HQ2 will provide more job opportunities. The change in currency exchange rate is risky as Amazon accounted 30.52% of net sales from international sales in 2017 (Amazon, 2017). In the social view, Amazon can be shown as an encouragement to a non-active lifestyle which pressurize the government to encourage a healthy, active lifestyle. This may be a concern as Amazon plans for HQ2 and another physical grocery store. In terms of logistics, Amazon continues to develop high levels of technology to stay competitive and reach customers quicker. The heavy investment in HQ2, R&D, and future expansion will expand the workforce and retain their competitive advantage in technology (Foss and Saebi, 2017).

Amazon Porter’s Five Forces

(See Exhibit 2). Amazon keeps the threat of new entrants low by focusing on heavy logistic, R&D investment, and the proliferation of digital technology infrastructure. It would be extremely difficult for new entrants to raise enough economies of scale or cost advantages to compete with Amazon on a lower level. The threat of substitutes is high, as there is a wide array of substitutes available to buy from other competitors. Substitution like Wal-mart provides both physical and online stores in many countries. Substitute services like Google Drive which offers a value proposition that is uniquely different from Amazon. However, Prime, low-cost and convenience keeps them competitive. Amazon offers a diversified market share, which leads to an immense competition from traditional retail brands to small brands. This intense rivalry among existing players will drive down prices and decrease profitability. However, in the case Exhibit 4c to 4d, Amazon remains as one of the highest in the industry as of 2017. Amazon could also collaborate/partner with competitors to increase the market size and minimize rivalry threat. The bargaining power of buyers is medium. Amazon’s vision focuses a lot on customer satisfaction and product quality. Amazon’s electronic devices such as Kindle and Echo have substantial bargaining powers and absence of switching cost. Also, Amazon’s high customer loyalty through their low-cost structure and Prime has brought more customers over the years. The bargaining power of suppliers is medium. The suppliers have to do business according to the code of conduct set by Amazon. For example, authors with Kindle Direct Publishing are not in the position to bargain the amount of their royalty. There is heavy dependence on collaboration with online sellers and business partnerships, such as technology (AWS) and health (Berkshire Hathaway and JPMorgan Chase). Without the expertise from the partnership, Amazon wouldn’t be able to launch successfully. Intense competition from rivals and substitutes will cause pressure on the margin. Amazon continuous innovation keeps new entry low and buyer’s attracted. The high volume of traffic on Amazon sites attracts suppliers to work with them. The overall attractiveness for Amazon is high with their competitive driving forces.

Internal Analysis

Financial

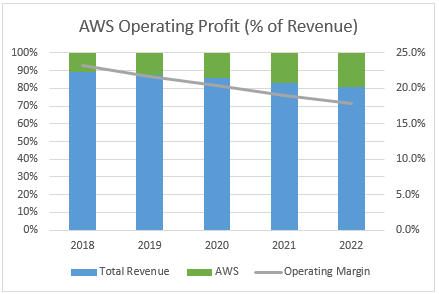

In the next 5 years, we’ll see a growth rate of 24% in sales based on CAGR. Although expense will increase over the years, profit will rise by 29% from 2017. This is due to less investment in new segments and more focus on the current market share. (See Exhibits 3a and 3b). The rise of shares will keep the shareholders satisfy. Additionally, I have included a separate income statement for AWS. They increase from 8.2% of sales in 2017 and a forecast of 24% of sales in 2022. Operating margin falls due to the rise in operating expense, however AWS sales will continue to increase.

Amazon SWOT Analysis

As the leading e-commerce and exceeding the 100 million mark in Prime members globally, Amazon have opportunities to expand its global footprints, open more sites in the emerging markets and achieve faster growth. (See Exhibit 4). Careful consideration must be taken as Amazon aggressive pricing strategy has led major competitors to invest aggressively to prevent market share from going bankrupt. The threat intensifies as physical retail brands like Walmart enters into e-retail. Amazon is also one of the leading players in the cloud industry and brings on innovation to modern technology (Dignan, 2018). Online aspect has brought a vast amount of customers to Amazon, with high margin Amazon has continued to invest in R&D to move its e-commerce experience to the next level. In recent years, Amazon’s diversification has waver the focus from its core competence of retailing books online and venture into newer focus cores. While this might be a good strategy to stay competitive, Amazon has cognizant of losing strategic advantages from its core competence and profitability. There is also an issue of counterfeit items which decreases customer’s experience. Improving technological measures through customer reports and product review could help reduce the number of counterfeit items sold on the website. Amazon has the necessary strengths to continue its e-commerce dominance. The key take away from this SWOT analysis is Amazon has to focus on profitability and not growth alone if it wants to continue to stay competitive in the future and add value to its stocks. Overall, Amazon should focus on its core competence as the current market share has a large potential of profitability.

Competitive Strategy

Amazon’s core strategy is a combination of extraordinary convenience, wide selection, customer focus, and low cost. Although Amazon is well-established, the profit margin is low and is slowly rising. They need to focus more on their current market share because only e-books are accounted the most in sales. Rather focusing on new segments, Amazon competitive strategy should focus on their current market share particularly in internet retailing. Amazon Web Service (AWS) cloud computing accounts for 8.2% Amazon shares in 2016. The increase of start-up businesses who will need data storage shows a high growth in usage. Although there are high competitors like Microsoft and Google, Amazon has a long history in e-commerce. Using Amazon’s core strategy, low cost and continuous adding of new service features to AWS will keep Amazon competitive and leading in place. This approach is appropriate because Amazon does not prioritize in profitability, so low-cost and variation will look attractive. This is similar to when the Internet was first out in 1997, where anything associated with the Internet had value. In 2018, the Internet continues to show value. If Amazon takes advantage of investing in AWS, there will be a higher revenue and profitability to the company.

Recommendations/Alternatives

Top 3 alternatives are based from external and internal factors and decision matrix. (See Exhibit 4).

- Focus on building more physical stores can help the brand achieve faster growth and bring customers closer. As Walmart is rank 1 in overall retailing, with its starts-up on e-retail will show threats of a potential rise in internet retailing. Aside from HQ2, focus on building a new store will increase capital and operating cost. This would be risky as Amazon is near break-even in profit margin, but will decrease in order and shipping costs.

- Focus on selling products under their own brand as third-party sellers earn a higher profit margin than Amazon; there’s an opportunity to more profit. However, they would need to focus first on the international market. Since a majority of Amazon’s earning in 2017 came from the North America markets. Amazon’s branding recognition would be low. At first, it’ll be costly to establish and maintain. Operations will not be profitable, but there is a strategic entry into the international market.

- Retain on current market share, particularly in AWS. There is a high increase in the demographics of start-up business, they will require data storage at a low cost. Amazon’s server and computing space for a much lower price will look attractive to clients. This will require heavy investment in logistics and R&D. The internet continues to show value, so it has the most potential in increasing profit.

I recommend Alternative 3 as it shows a high potential for solving Amazon’s problem with profitability. Unlike physical stores, cloud computing is implemented and flexible. Their pricing model pay-as-you-go is flexible and easily adapt for clients. Also this segment doesn’t require capital cost. AWS can also attract large clients and possible collaboration with them.

Suggestion

The easiest way to progress Alternative 3 is investing in new features and keep a close relationship with their partnership. Using the market penetration, Amazon has numerous product lines that can be implemented into AWS. They would require to keep up with the latest technology which is not a problem as their focus is innovation. Amazon core focus is the customer, by receiving frequent feedbacks helps ensure customers are getting what they need. Another suggestion is partnership internationally to provide more servers and build a long-term relationship. This will also allow AWS to provide even more features and brand recognition. A suggestion is a partnership with China as they are the next rising ventures. This will go head on with Alibaba and their consumers. Although AWS is competing with Microsoft and Google, Amazon has a dominant market position, size, and sale. After steady profitability, within the 5 years, they can expand their data center infrastructure to more regions. This strategy will allow higher profitability and continues towards Amazon’s vision.

Appendix

Exhibit 1 – External Analysis PEST

Political:

- Threat to enforce an internet tax to e-commerce retailers

- Possible subject to additional income tax liabilities

- Amazon’s shares fell 6% from Trump’s announcement

- Relies heavily on political stability in all countries

- Employees are impose with labor tax in Seattle

Economic:

- Changes in level of economic activity impacts many traditional retailers in U.S to go bankrupt

- Changes in currency exchange rates creates risk to Amazon’s international sales

- Changes in foreign currency exchanges rates negatively impacts net sales and operating expense

- Amazon expansion will provide higher employment opportunities

- Increase cost of labour in Amazon’s HQ2 impacts profit

Social:

- Online service changes public’s health and pressures the government to improve non-active lifestyles

- Variety of products can be bought online and deliver to your doorstep

- Shifting attitudes towards increase of obesity, change in work/life style and more leisure time

Technology:

- Amazon relies heavily on changes in technology

- Major impact to connect with customers

- Allows new methods of shipping such as Prime Air and their drone delivery system

- New and enhanced technologies can help Amazon stay competitive

Source: Based on Amazon Annual Report 2017.

Exhibit 2 – External Analysis Porter’s Five Forces

Threat of new entrants – Low

- Amazon Go requires adept in logistic and computer analytics to implement it to perfection

- Whole Foods Market infrastructure requires technology and speed

- Amazon Web Services (AWS) adds hundreds of new services features every year and aggressive pricing

- Difficult to build a brand like Amazon that requires many expenses and dedication which Jeff Bezos had done

- Amazon is a dynamic industry that discourage new players to enter

Competition from substitutes – High

- Amazon’s product can be substituted fairly easy

- Physical grocery/retail stores due to seeing the products first-hand

- Substitutes to cloud computing: physical hardware and on-site or local servers

Rivalry among established competitors/firms – High

- Walmart has greater resources,longer histories, more customers, and greater brand recognition

- Particularly impacts Amazon’s newly-launched products and services and in their newer geographic regions

- Alibaba has new development of business models and well-funded may reduce Amazon’s sales and profits

Buyer power – Medium

- Amazon’s vision is to focus on customer satisfaction and product quality

- Switching cost is low

- Buyers are well informed

- Buyer’s bargaining power is high

Supplier power – Medium

- Suppliers follows Amazon’s set rules

- Collaboration with online sellers such as third parties

- Business partnership such as AWS partnership to build wind farm

Source: Based on Amazon Annual Report 2017. Exhibit 3a

Pro forma income statement for 2013 – 2022 (in millions of dollars)

Source: Based on Amazon Annual Report 2017, MarketWatch, Yahoo! Finance, accessed October 18, 2018.

Exhibit 3b – Amazon Overall Sales and AWS for 2018 – 2022

Exhibit 4 – SWOT Analysis

| Strength | Weakness |

|

|

| Opportunities | Threat |

|

|

Source: Based on Amazon Annual Report 2017.

Exhibit 5 – Decision Matrix

References

- Amazon. (2017). Form 10-K 2017. Retrieved from SEC EDGAR website http://www.sec.gov/edgar.shtml

- Dignan, L (2018, February). Top cloud providers 2018: How AWS, Microsoft, Google Cloud Platform, IBM Cloud, Oracle, Alibaba stack up. ZDNet. Retrieved from https://www.zdnet.com/article/cloud-providers-ranking-2018-how-aws-microsoft-google-cloud-platform-ibm-cloud-oracle-alibaba-stack/

- Foss, N. J. and Saebi, T. (2017) ‘Fifteen years of research on business model innovation: How far have we come, and where should we go?’ Journal of Management, 43(1), pp. 200-227.

- Amazon.com Inc. (AMZN). (2018). Annual financial statements for Amazon.com Inc. MarketWatch. Retrieved October 18, 2018, from https://www.marketwatch.com/investing/stock/amzn/financials

- Amazon.com, Inc. (AMZN). (2018). Income statement. Yahoo! Finance. Retrieved October 18, 2018, from https://finance.yahoo.com/quote/AMZN/financials?p=AMZN

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this assignment and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal