Market segmentation and marketing mix of LG and SAMSUNG

| ✅ Paper Type: Free Essay | ✅ Subject: Marketing |

| ✅ Wordcount: 3425 words | ✅ Published: 01 Jan 2015 |

Definitions

Market segmentation

The dividing of all possible customers into groups based on their needs, age, income, education etc. (Cambridge Business Dictionary, n.d.)

Marketing mix

The combination of actions a company uses when selling a product or service. These are often described as the four Ps: Product, price, promotion and place.

(Cambridge Business Dictionary n.d.)

Aims

This piece of work aims to analyse and assess the market segmentation and marketing mix characteristics of and potential for Samsung compared with LG. Due

to the very broad market sectors and product ranges of both companies, this report will concentrate on the relatively new product sector of fitness

monitors when considering both market segmentation and mix. Interest in these products has grown due to the availability of ‘wearable devices’

and the suitability of technology, particularly Smartphone apps, to assist in this pursuit. There has also been increased awareness and concerns about

keeping fit and healthy. According to Vecchione (2012) the market for self-monitoring functions such as high blood pressure and blood glucose levels using

wireless wearable devices is growing faster than Telehealth (the official NHS version of technology to monitor patients remotely in their own homes). The

proportion of wireless devices used to monitor health conditions is predicted to increase from a low level of 5% in 2011 to as high as 80% by 2016 (Ibid),

with the resulting readings being stored and analysed on smart phones.

Company background

An Introduction to Samsung

Samsung was founded in Suwon, Korea in 1969. Its vision 2020 is stated as being “Inspire the world, create the future” (Samsung website, n.d.)

Samsung Electronics is a global leader in semiconductors, telecommunications and digital media technologies with sales of 143.1 billion U.S. dollars in

2011 and 221,730 employees spread across 72 countries (Ibid.) Samsung has been the world’s largest television manufacturer since 2006 and is the world’s

largest producer of LCD panels. The company also has the greatest share of the global market for memory chips. With the introduction of the Samsung Galaxy

S mobile, the company has taken the lead in global sales figures for smart phones as of 2013. Samsung has also established a prominent position in the

tablet computer market with the Android-powered Samsung Galaxy Tab offering strong competition against the iPad from Apple. The headquarters of Samsung

Electronics Co., Ltd. are situated in Suwon, South Korea and this is also the flagship company of the Samsung Group. In 2013 the president of Samsung

Electronics was Boo Keun Yoon; and the goals of the company encompassed both quantitative ($400billion global sales and number one spot in the global IT

industry); and qualitative (design products that enrich people’s lives and contribute to a socially responsible future). This is a real sign of the

times as organizations increasingly have to demonstrate corporate responsibility and contribution to social or shared value, i.e. doing well by doing good;

an approach which can provide additional competitive advantage (Kramer, 2011). Roy (2013) explains this further as being the next stage of business

thinking, embedding contributions to wider society as an integral part of corporate strategy.

Samsung operates in Western Europe, the Far East, and the United States; increasing its share of the mobile phone market in Western Europe over the past

three years at the expense of companies such as Apple and Nokia. In 2011, for example, Samsung had only a 14% market share in Western Europe (compared with

Apple at 21% Nokia at 20%). By 2013, Samsung’s had increased its share of the Western European market to 45%; Apple’s share dropping to 20%,

and Nokia’s market share plummeted to just 5%. Other competitors including Blackberry fared even worse, losing practically its 17% market share to

Samsung and Apple. HTC’s Android smart phones also struggle to compete with the two market giants, especially Samsung, who managed to generate more

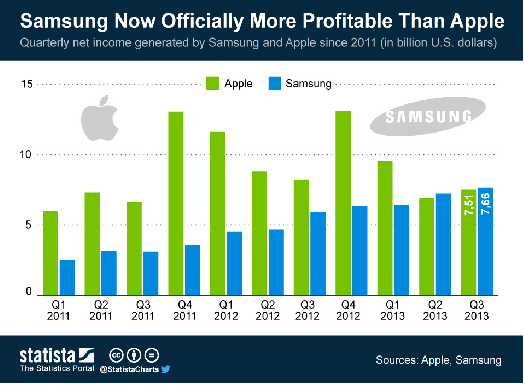

income than Apple in 2013 (please see Figure 1 below).

Figure 1 – Samsung and Apple profits 2011-2013 ($ billion)

Source: Statista

Thirteen Samsung products have held the number one spot for market share including televisions, semi-conductors (the first product which the firm

originally manufactured) and mobile phones (Samsung, n.d.) Samsung is continuing to research and develop new innovative products such as LCDs and

semi-conductors.

An introduction to LG

There is some resonance in the LG story compared with Samsung: LG is also a Korean company and it too was founded about half a century ago in 1958,

originally known as Goldstar. It was founded on the ethos of creating a happier, better life (LG website, n.d.) Since 1958 it has progressed into the

digital age through technological development, originally of home appliances such as washing machines and radios.

Then in 1995 the company was renamed LG Electronics, acquiring the United States based company Zenith (Ibid.), hence opening up the vast American market.

This was followed in 1997 by LG developing the first digital mobile handset and being the first company to be certified for the production of digital

television sets. In 1998 the company developed the 60 inch plasma TV followed by a joint venture with Phillips to create LG Phillips LCD (Ibid.)

2002 sees LG export GPRS1 colour mobile phones to Europe and in 2003 achieve

monthly export volume of 2.5 million units. By 2005 LG had become the fourth largest supplier of mobile handsets worldwide; plus the firm was the pioneer

of notebook computers (LG website, n.d.) 2008 sees the company launch a new global identity: “stylish design and smart technology, in products that

fit our consumers’ lives” (LG website, n.d.). In 2009 LG becomes the third largest supplier of mobile phone handsets worldwide, and 2010 saw

the company launch the world’s first 3D LED TV.

According to their website LG brand identity focuses on self expression and a promise of satisfaction to its customers; using the phrase

“delightfully smart” as its strapline. The LG logo itself is said by the company to represent a circle around the customer epitomising the

corporate value of establishing a lasting relationship with and achieving highest satisfaction for customers. This is the basis of relationship marketing

and is key to attracting and retaining customers in a world where consumers are bombarded with sales messages.

Market segmentation

As Drucker neatly put it, “the purpose of business is to create customers” (Swaim, 2010, p.14) and to do this requires looking from outside the

company from the customer’s point of view and answering questions about market segmentation, including “what does the customer buy” and

“what is value to the customer”?

Samsung and LG market segmentation

Information to guide segmentation can be collected through carefully planned market research; and the analysis of questionnaire surveys. Here are some

market segments that will be most relevant to the fitness monitor market:

Students

tend to be the most technology-literate and represent a well defined segment in terms of the early adoption and use of new

technologies. They also assist in promoting and recommending products through the social media methods; plus can be helpful in co-production and the

development of the product. The importance of the use of social networking sites (SNS) in the consumer buying process must not be underestimated; seeking

opinion from other consumers is now a pre-requisite of the purchase decision-making process. Interbrand (2012) suggests this may always have been the case

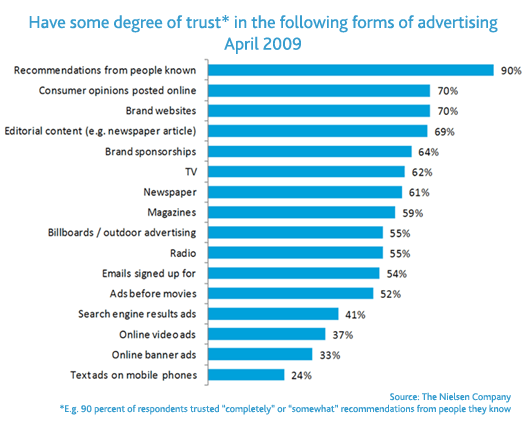

but a feature of the past few years is the increase in the speed with which opinions and consumer influence can be spread. Nielsen (2010) discovered that

most internet users seek out reviews and consider the brand recommendations of fellow consumers before finally deciding on a purchase (Figure 2). The graph

illustrates that recommendations from friends and family are the main source of information most trusted. A key factor to note here, however, is that

official brand websites can be as influential as online consumer opinions but they have to be more than just promotional messages. In comparison,

advertising in newspapers and on radio and TV are less trusted by consumers.

Figure 2 – Percentage of consumers who have trust in different forms of advertising

Source: Nielsen, 2010

Young professionals

are another market segment for these types of products; the main difference with the student sector is the considerably

higher income and hence greater willingness to spend more on the product. This group is arguably carrying on the great tradition of early adopters too; the

UK market has always been at the forefront of adopting new technology, including broadband, digital TV and Smartphone take-up (Ofcom, 2010). Wireless

technologies such as these fitness monitors have been no exception with the digital age being fully embraced by the early adopters in the UK as soon as the

new products have been released by the major manufacturers including Samsung and LG.

There is a third key market segment for fitness monitors revealed by research evidence and that is

young women

who tend to be more

interested in health and using exercise as a way to keep slim as much as keeping fit (Clohessy, 2014). The functionality of the new generation of fitness

monitors includes features such as the number of calories being burnt off as exercise progresses, with different consumption rates depending on the type

and intensity of activity. These last two market segments also have the advantage of containing a greater proportion of working people who are consequently

much less influenced by the absolute price of the product. They are also proactive Twitter and Facebook users and contributors, reading reviews and

providing comment as part of the consumer decision-making process.

Marketing mix

The marketing mix, or four Ps (product, price, promotion and place) is a tool integral to the development of marketing strategy; the specific tactics for

the major parameters of the product or service can be defined. In more recent literature, the marketing mix has been expanded to include the seven Ps

(Kotler, 2012,) encompassing more elements as shown below in Figure 3. The basic four mix elements remain but are joined by the new criteria of

‘people’, ‘physical evidence’ or ‘environment’, and ‘process’; these are considered by some to better

describe the marketplace influences. Kotler (2012.p.31) describes it as: ‘holistic marketing’ which “recognizes and reconciles the scope

and complexities of marketing activities”.

Figure 3 – the seven Ps of the Marketing Mix

Source: Kotler, 2012

However, this report will be concentrating on the four core marketing mix elements of product, price, promotion and place.

Samsung marketing mix

In the case of Samsung, the tactics adopted to satisfy some of the marketing mix elements might be considered to be:

Product

– The Samsung fitness monitor is called ‘Gear Fit’ (Figure 4) and is designed for the wrist; it has a curved display and several apps

including a built-in heart rate monitor and work out management system.

Promotion

– Celebrity endorsement is not a new concept and has a long history dating back to the early 1900s. For example, according to Ketcham (2001), Buffalo

Bill Cody was pictured on a trade card and supplied a testimonial for the back of the card, in which he praised the benefits of Kickapoo Indian Oil.

Another trade card depicted the image and name of Sarah Bernhardt, connecting her with Carters Liver Bitters (Ibid.) Samsung has already successfully used

celebrity endorsement to promote its products, using the sportsmen and women at the Sochi Winter Olympics (Samsung, n.d.) This philosophy can be extended

to engage the younger sports-oriented consumer, with the careful selection of sports stars providing a strong enticement for consumers to try the product.

It might be a footballer or tennis player, perhaps connected with a major sporting event.

Price

– If a premium price is to be charged for the product, Samsung needs to provide a strong competitive advantage for the Gear Fit over the competition,

particularly LG. A good way of securing willingness to pay a higher price for a product is to add value through additional features or extra services.

Samsung is well regarded for its innovative products and is number one in the smart phone market currently. This kudos will most probably rub off onto the

fitness monitor too provided the right approach is adopted in terms of engaging the consumer through the social media focusing on Facebook and Twitter.

Place

– With its domination of the Smartphone and tablet computer markets, Samsung will be able to exploit not only its on-line presence for sales of the

Gear Fit monitors but also capitalize on the goodwill and very strong presence in the high street. All the mobile phone network companies will be keen to

stock the innovative Samsung products including fitness monitors, as will the supermarkets and electronics stores. Samsung already produces medical

monitoring equipment for the hospitals and clinics; this fitness monitor could be added to the product range for healthcare too.

LG marketing mix

The marketing mix tactics adopted by LG could conceivably include:

Product

– In terms of the fitness monitor, LG has developed a couple of complementary products; the Lifeband wristband (Figure 5), with a touch screen; and

the heart rate earphone monitor. The Lifeband plays music, receives calls and texts, has a three axis accelerometer and altimeter for recording exercise

effort, and can track the route of the wearer using a Smartphone app.

Promotion

– aligning a brand with major events to create and maintain an identifiable profile is central to the promotion strand of the marketing mix. The

natural target events for the promotion of the Life band will include the London Marathon and the Great North Run; monitoring the heart rate during a

marathon event assists with pacing and avoids straining the heart (Sinha, 2014).

Price

– maintaining a premium pricing policy would be possible with such an expanding market, but LG needs to ensure the consumer is willing to continue to

pay that premium through constant product enhancements such as the music functionality and GPS capability. These enhancements need to be communicated and

discussed with consumers through engagement through social media hopefully developing that relationship with the customer central to the LG ethos, as

depicted in the encircling logo.

Place

–Apart from the company website there must be considerable scope for collaborating with franchise/nationwide gyms; and exercise equipment companies

to promote the LG Life band. There will also be increasing potential in tendering for Clinical Commissioning Group contracts for Telehealth2 and telecare 3 products; the wearable fitness monitor providing a cost-effective and simple to

use way for patients to monitor their own condition and feel more in control of their health.

Conclusions

* Both Samsung and LG Electronics have identified the fitness monitor market as a potential area for considerable growth over the new few years.

* They have both developed attractive products to promote to the particular market segments highlighted in this report, including students, women

interested in staying fit through calorie counting as well as exercise, and young professionals.

* Pinkse and Slade (2004) remind us that competition is greatest amongst brands that are most similar and it seems that these two large Korean electronics

firms need to distinguish themselves from the other in order to create a unique selling proposition (USP) for their product(s) and to generate a desire for

the product and organisations.

Recommendations

1. It would be beneficial to take a longer term view of demographic trends, particularly in view of the ageing demographic, to predict any change in the

potential market for fitness monitors. Such information is supplied by the Office for National Statistics Census 2011 data and population projections (ONS

2011).

2. Exploiting the potential of social media to promote the brand identity through taking advantage of the buzz around the social side of fitness and

exercise; which exists particularly amongst younger target market segments.

3. Celebrity endorsement is a really effective way to promote products that are the subject of culture and desire, particularly amongst the youth and young

adult market. Samsung used sports men and women at the Sochi Winter Olympics to promote their products (Samsung, n.d.); perhaps they can continue this and

maybe LG could find their own set of celebrity endorsers for their products?

4. However, considering the increasing life expectancy combined with the ageing demographic (a greater percentage of the population being aged over 55, 65

and particularly 75 there is a considerable untapped market for promoting fitness monitors to this group of consumers. The lengthier retirement periods

experienced by many people nowadays provide considerable potential for promoting a regular exercise regime to be built into their daily routine. The

fitness monitor is well suited as an aid to a healthier old age as it is simple to use, portable and wearable, and can be promoted as positively reducing

the likelihood of long term illness or disability. This is backed up by the evidence that highlights regular physical activity as the single most important

lifestyle behaviour change for keeping healthy (Colberg et al, 2010) preventing type 2 diabetes, reducing high blood pressure and vastly reducing the risk

of cardiovascular disease and increased mortality.

5. Pursuing the fitness monitor market and expanding it into the Telehealth sector will have considerable potential too as the NHS and healthcare

professionals are increasingly encouraging people with long term conditions to be more proactive about self-care and management. The Department of Health

(2011) estimates there are around 15 million people in the UK with long term conditions; and that as many as 80% of these people could be supported to

manage their own condition including though the use of effective self-monitoring. Not only will this reduce pressure and costs on NHS services, including

keeping people out of hospital; but there is evidence that outcomes for patients are improved too with people more confident and experiencing a better

quality of life (Challis, 2010).

Word count = 3,093

References

Colberg, S., Sigal, R., Fernhall, B., Regensteiner, J., Blissmer, B., Rubin, R., Chasan-Taber, L., Albright, A. & Braun, B. 2010. Exercise and Type 2

diabetes. Diabetes Care;Dec. 2010; 33(12) pp.147-167.

Cambridge Business Dictionary. N.d. [On-line] Available @ http://dictionary.cambridge.org/dictionary/business-english [Accessed

11/10/2014].

Challis, D., Hughes, J., Berzins, K., Reilly, S., Abell, J., Stewart, K. 2010. Self care and case management in long term conditions: the effective management of critical interfaces. London: HMSO.

Clohessy, K. 2014. The best heart rate monitor for weight loss. [On-line] Available @

http://www.livestrong.com/article/380969-the-best-heart-rate-monitor-for-weight-loss/ [Accessed 13/10/2014.

Department of Health. 2011. Ten things you need to know about long term conditions. London: Department of Health.

Fournier, S. & Avery, J. (2010) The Uninvited Brand. Boston: Boston University.

Interbrand. 2012. Branding in the post-digital world. London: Interbrand.

Ketcham, S. (2001) Celebrity Endorsements are a thing of the past (and Present) [on-line]. Available from: theoldtimes.com. [Accessed 11/10/2014].

Kotler P. et al. 2012. Marketing Management (2nd Ed). Harlow: Pearson Education Limited.

Kramer, M. 2011. Corporate Social Responsibility vs. Corporate Social Value – what’s the difference? [On-line] Available @ http://www.fsg.org/KnowledgeExchange/Blogs/CreatingSharedValue/PostID/66.aspx [Accessed 12/10/2014].

LG website [On-line] Available @ http://www.lg.com/uk/about-lg [Accessed 11/10/2014]

Nielsen. (2009) Global advertising consumers trust real friends and virtual strangers the most. [On-line] Available @ http://www.nielsen.com/us/en/insights/news/2009/global-advertising-consumers-trust-real-friends-and-virtual-strangers-the-most.html [Accessed 11/10/2014].

Ofcom. 2010. UK consumers revealed as early adopters of new technologies. [Online] Available @ http://consumers.ofcom.org.uk/news/uk-consumers-revealed-as-early-adopters-of-new-technologies [Accessed 12/10/2014].

Office for National Statistics (ONS). 2011. 2010-based national population projections. [On-line]. Available through ONS website @ http://www.ons.gov.uk/ons/rel/npp/national-population-projections/2010-based-projections/rep-2010-based-npp-results-summary.html [Accessed 09/10/2014].

Pinkse, J. & Slade, M. (2004). Mergers, brand competition and the price of a pint. European Economic Review: 48 (2004) 617-643.

Roy, S. 2013. Corporate shared value – the new competitive advantage. [On-line] Available @ http://www.triplepundit.com/2013/01/corporate-shared-value-new-competitive-advantage [Accessed 12/10/2014].

Royal College of Nursing website. N.d. Telehealth and telecare. [On-line] Available @ http://www.rcn.org.uk/development/practice/e-health/telehealth_and_telecare [Accessed 11/10/2014].

Samsung. 2013. Samsung Electronics Annual Report. Suwon: Samsung Electronics Co. Ltd.

Samsung website [On-line] Available @ http://www.samsung.com/us/aboutsamsung/samsung_group/history [Accessed

09/10/2014]

Sinha, A. 2014. Heart Monitor Training. [On-line] Available @ http://www.marathonguide.com/training/articles/heartmonitortraining.cfm [Accessed 13/10/2014]

Swaim, R. 2010. The Strategic Drucker: Growth Strategies and Marketing Insights from the works of Peter Drucker. Singapore: John Wiley & Sons.

The King’s Fund. 2013. Transforming our healthcare system: Ten priorities for commissioners. London: The King’s Fund.

Vecchione, A. 2012. Health monitoring devices market outpaces Telehealth. Information Week [On-line] Available @

http://www.informationweek.com/mobile/health-monitoring-devices-market-outpaces-telehealth/d/d-id/1104636? [Accessed 11/10/2014].

1 GPRS (General Packet Radio Service) is a technology enabling phones to transfer data quickly, whilst still allowing telephone calls to be made.

2 Telehealth (or telemedicine) is defined as the remote monitoring of physiological functions including blood pressure, temperature and blood sugar

levels, particularly as an aid to the self-management of long term conditions by patients in their own homes (Source: RCN website, n.d.)

3 Telecare covers a number of systems of sensors and alarms which monitor the safety of the living environment enabling people to remain living at home

who otherwise would require care in a community hospital or care home. Examples of telecare devices include fall detectors, personal alarms, flood

detectors and extreme temperature detectors (Source: RCN website, n.d.)

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal