Tourism Management of Halifax, Nova Scotia, Canada

Info: 9273 words (37 pages) Dissertation

Published: 9th Dec 2019

Tagged: Leisure ManagementTourism

Marketing Management:

City Branding

Halifax, Nova Scotia, Canada

Table Of Contents

2.4.1. Boston, Massachusetts (US)

2.4.3. Toronto, Ontario (Canada)

2.4.4. Montreal, Quebec (Canada)

3. Conclusions & Recommendations

5.1. General Introduction To What Halifax Has To Offer

5.1.2. Family Tourism (Budget Friendly)

5.1.3. Outdoor Adventure Enthusiasts

5.1.4. Concerts, Festivals, Events (Young Adult Visitors)

5.1.5. Halifax Rainbow (LGBT Community)

5.1.6. Business Conventions, Conferences & Offices

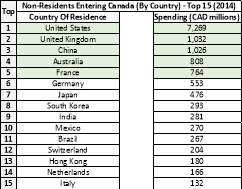

5.2. Tourist Statistics Summary – International Tourists (Exc. US) 2015

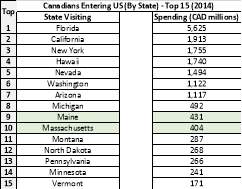

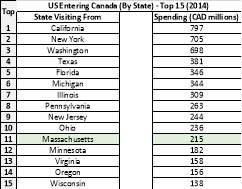

5.3. Tourist Statistics Summary – International, US & Canada Tourists 2014

Table Of Figures

Figure 1: Geographic Location Of The City Of Halifax, Nova Scotia, Canada (MSVU, 2016)

Figure 2: Destination Halifax Branding Logo (Destination Halifax, 2015)

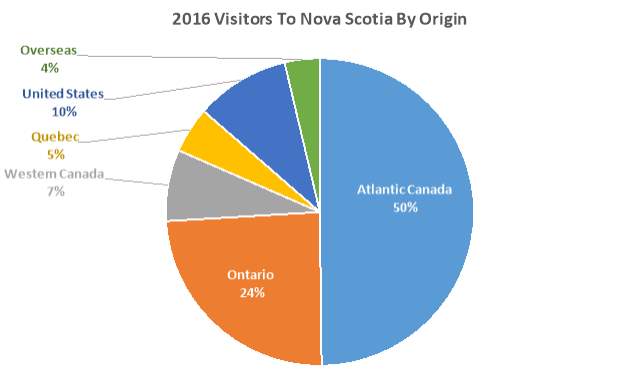

Figure 4: 2016 Visitors To Nova Scotia By Origin Country, (Tourismns.ca, 2017b)

Figure 5: Halifax City Logos – Before (Left) & After (Right), (Brand New, 2014)

Figure 6: Halifax City Logos – Customisable, (Brand New, 2014)

Figure 7: Niagara Original Regional Brand Logos – Customisable, (Halifax.ca, 2014)

Figure 8: Halifax City Geometric Logo – Customisable, (Brand New, 2014)

Figure 9: City Of Melbourne Geometric Logo – Customisable, (Design Ninjaz, 2016)

Figure 10: The “Be Bold” Brand Promise Adopted By Halifax, (Brand New, 2014)

Figure 11: The “Be Bold” Branding Campaign Adopted By Blackberry In 2012, (Blogcdn, 2017)

Figure 12: Canadian Tourist Statistics Summary – International Tourists (Exc. US) 2015

1. Introduction

Halifax is the regional municipality and capital of the province of Nova Scotia, located on the Eastern seaboard of Canada approximately 1.5hrs flight East of Ottawa and 4.5hrs flight North East of Washington D.C.

Figure 1: Geographic Location Of The City Of Halifax, Nova Scotia, Canada (MSVU, 2016)

It has a metropolitan population of 417,800, (Statistics Canada, 2017a), about 44% of the total population of Nova Scotia, (Statistics Canada, 2017b), but is responsible for approximately 50% of its GDP, (Statistics Canada, 2016a) (Halifax Partnership, 2016a). This is driven by strong performances in key market segments, including tourism, education and life sciences, finance and insurance, aerospace and defence, and health services, which have been the focus of the Halifax 2011-2016 and 2016-2021 economic strategies for growth, (Halifax Partnership, 2016b). In 2014, a re-branding exercise was performed that included the renaming of Halifax Regional Municipality (HRM) to Halifax, the introduction of a new logo as well as a branded geometric shape for marketing, and a new slogan “Be Bold”, (Brand New, 2014).

The following report will explore the ways in which Halifax is promoting, positioning, and branding itself as a tourist destination for local, national, and international visitors. Techniques such as STP analysis shall be used to evaluate the current strategies to determine; what has been implemented, what is working and what is not, the challenges being faced and what progress has been made. Recommendations shall be provided to enhance the existing strategies, with a view to aiding the achievement or exceedance of the goals.

2. Current Strategy

2.1. Promoting

The tourism industry of Halifax is administered by Destination Halifax; a Destination Marketing Organisation (DMO) formed through the merger of several government agencies, in partnership with local private businesses. They target a wide range of tourists in a variety of market segments, and in doing so, aims to foster economic development through the marketing of the destination brand and its associated products and services. A multitude of activities and options are promoted at different times of the year to supplement the year-round offerings, to ensure as much as possible that the tourism is non-seasonal. Care has been taken to be as inclusive as possible regarding the target demographics, providing a “something-for-everyone” proposition. Supporting the activities of Destination Halifax are the Tourism Sector Organisations (TSO’s) of Nova Scotia that represent constituent groups like B&B’s, Hotels, Restaurants & Bars, Wine & Food Associations, and the Tourism Human Resource Council, which are critical in supporting tourism in the region.

Figure 2: Destination Halifax Branding Logo (Destination Halifax, 2015)

The branding and marketing campaign is not restricted to the efforts of Destination Halifax; there is substantial support through other Canadian agencies and businesses at the local, national, and international levels. The Halifax region receives significant on-flow of tourism from Tourism Nova Scotia who have been heavily promoting their own brand recently. They received praise for their marketing efforts, particularly their social media presence, that included a YouTube video campaign, ‘If You Only Knew’, targeting first-time visitors to the province. This campaign alone delivered “190 million impressions (88 per cent higher than 2015), and 11.1 million video views (61 per cent more than 2015). Our organic search demand hit a 10-year record high and we delivered 40 per cent more referrals to operator web sites than last year”, (The Chronicle Herald, 2016).

It was supplemented with the widespread umbrella campaign, ‘Take Yourself There’, which has been established with a set of guidelines to ensure consistency of the intended message and a uniform application of branded materials. The guidelines are quite specific; detailing “the aim of the campaign (positioning, brand pillars, core experiences, personality), the design of the message (campaign overview, tone of voice, logo treatment, photography, colour palette, taglines, backgrounds & icons, advert visual vocabulary and web elements), and the key elements or unique selling points”, (Tourismns.ca, 2015).

Figure 3: Tourism Nova Scotia National (Top – English & French) & International Branding Logos, (Tourismns.ca, 2015)

The Atlantic Canadian Tourism Partnership (ACTP) acts on behalf of its nine (9) Atlantic Canadian members, including Halifax, to grow the tourism industry across the member provinces. The partnership works like a managed fund, taking smaller contributions from each of the members and investing it collectively in international marketing campaigns targeting the U.S and U.K customer base. It also conducts research and market intelligence to better target specific markets or tourist demographics. The current 3-year partnership is spending around $20 million in marketing activities, and since inception “ACTP has produced significant positive impact on tourism visitation and revenue in Atlantic Canada, generating an average $14.71 return on investment for every dollar spent in direct to consumer campaigns”, (Tourismns.ca, 2017a).

The Tourism Industry Of Canada (TIAC) supports the wider needs of all Canadian tourism organisations, operators, and service providers to promote steady growth in the industry that benefits all regions and interests. For Halifax, this is performed by the Tourism Industry Association Of Nova Scotia (TIANS), focusing specifically on the coastal province. Destination Canada also supports national tourism efforts, providing a landing page for all Canadian tourism searches with links to regional tourism websites, including Nova Scotia and Halifax. This aids in directing web-based traffic directly to the regional websites, providing location specific information, products, and services.

2.2. Positioning

The use of social media platforms has been vital in the rollout and growth of the Halifax tourism brand. Destination Halifax launched a sister site, Halifax Sociable, to boost its social media presence, which utilises over 200 independent social media networks from the AddThis platform, including high-traffic sites like; Facebook, Twitter, YouTube, Pinterest, Instagram, TripAdvisor and Snapchat. Halifax Sociable engages bloggers and fans of Halifax to be brand ambassadors, promoting Halifax through the social media platform or digital medium of their choice. Early metrics have shown “15,000 pageviews in first 6 months of launch, with new unique visits coming from 60 different countries. The fully integrated marketing of Halifax Sociable! means Destination Halifax is able to leverage the over 20,000 Facebook fans and over 1500 Twitter followers…The Facebook community is extremely active and is within the top 5 sources of traffic to the main Destination Halifax website…Specifically, year over year social media communities like Facebook – under the core campaign of Halifax Sociable! – have increased unique new user visitation to the primary web asset by 1,020%”, (Halifax Sociable, 2011).

Halifax Sociable uses social media specific competitions to build interest in the brand, and activities associated with the brand, by encouraging people to spread the word about upcoming or recently held events for a chance to win prizes. An example is the “Pin & Win”, (Destination Halifax, 2012), Best Of Halifax competition targeting Canadians to select what they believe to be the best Halifax has to offer from a selection of activities and events on Pinterest. The prize is an all-expenses paid holiday (including flights) to Halifax tailored to what they would most like to do in Halifax. The Pinterest competition generated much interest “by continuing to create and share content inspired by the Halifax region and telling the Halifax story through engaging visuals; the Destination Halifax’s Pinterest account has grown to 22 boards, over 565 pins, and close to 1300 followers”, (Destination Halifax, 2013). The combined social media campaigns have been very successful, receiving several commendations, including; two social media awards in 2013 and a gold service award in 2014.

Although the digital branding and marketing campaigns are the primary channel for promoting Halifax, it’s supplemented with traditional forms of media and promotion including travel fairs, promotional flyers, billboards, radio and television advertisements, travel magazines and other printed media. Public relations pop-up events are held in key locations such as Toronto, Ottawa and Montreal displaying prominent local attractions, entertainment, and cuisine. Tourism promotion is just as, if not more, important in the Canadian home market, given the origins of tourists visiting Nova Scotia (86% of all tourist traffic). Of those visiting Nova Scotia, Halifax receives 53% on-flow of that tourism traffic. These figures highlight the need to penetrate further into the international market with a focused effort to boost U.S (10%) and overseas (4%) visitor numbers, particularly if Halifax wants to attain the title of ‘Global City’, as its latest campaign suggests.

Figure 4: 2016 Visitors To Nova Scotia By Origin Country, (Tourismns.ca, 2017b)

2.3. Branding

In 2014 Halifax launched its major re-branding campaign ‘Be Bold’, the first since the Halifax Regional Municipality campaign was launched in 1996 to bring together the municipalities of Halifax, Dartmouth, Bedford & Halifax County. The former city branding failed to develop Halifax as a destination of choice in the region, with poor adoption even within the council itself, “It was never created on a true brand platform…with no brand management framework, the logo didn’t extend into other government activities…we had departments making their own logos for themselves, and while the old logo featured a stylized lighthouse, it was not exactly a beacon to attract business and tourism from outside the city. There was no meaning behind it. We had a fragmented municipal identity, there was no master brand platform externally and nothing strong enough for agency partners to adapt”, (Marketing Mag, 2014). The new campaign was the culmination of 4 months work, surveying, collating and analyzing the inputs of 20,000 people to ensure comprehensive engagement of stakeholders throughout the community. This aimed to reduce the ‘resistance to change’, foster participation, gain traction and facilitate the transition to the new ‘Halifax’ brand.

It began with the unveiling of the new city logo:

Figure 5: Halifax City Logos – Before (Left) & After (Right), (Brand New, 2014)

The new logo omitted the ‘regional municipality’ component, which was viewed to be unnecessary as “an overwhelming number of people have a strong opinion that the name of our region is Halifax”, (Halifax.ca, 2016). However some felt it took too much away from the previous logo citing that “this ignores key communities like Dartmouth and the municipality’s suburbs and outlying areas”, (Herald News, 2014). The new design allows for customisation to suit varying themes, departments, or activities:

Figure 6: Halifax City Logos – Customisable, (Brand New, 2014)

This customisable design encourages engagement and acceptance allowing agencies and businesses some freedoms in design flair or differentiation, whilst promoting a singular message or brand to the customers. Other cities have successfully employed similar concepts such as the Niagara region, who struggled with “many brand messages with varying purposes, mandates and messages and needed to develop one cohesive brand image for the region”, (Halifax.ca, 2014):

Figure 7: Niagara Original Regional Brand Logos – Customisable, (Halifax.ca, 2014)

A readily identifiable geometric shape that people can associate with Halifax was also designed and features a similarly customisable design:

Figure 8: Halifax City Geometric Logo – Customisable, (Brand New, 2014)

The use of the geometric shape to associate with the Halifax brand is a tool used well by other cities looking at creating a memorable brand.

Recently some of the top 10 city destinations in the world have elected to adopt similar brand association, like Melbourne:

Figure 9: City Of Melbourne Geometric Logo – Customisable, (Design Ninjaz, 2016)

A brand promise was released with the tagline “Be Bold”, aimed to capture the essence of the city of Halifax. The message aimed to inspire locals, businesses, and the wider community to be proud of their city and embolden them to actively and publicly promote it:

Figure 10: The “Be Bold” Brand Promise Adopted By Halifax, (Brand New, 2014)

A degree of care should be taken when opting for such slogans or taglines to ensure there is no confusion regarding the product or brand being sold. A local artist in Halifax already sells her products under her own ‘Be Bold Halifax’ brand, whilst ‘Be Bold’ is “the trademark of a skin care company, financial services firm and an anti-bullying campaign”, (The Chronicle Herald, 2014). It was also a former marketing campaign launched by Blackberry in 2012 to promote its new smartphones.

Figure 11: The “Be Bold” Branding Campaign Adopted By Blackberry In 2012, (Blogcdn, 2017)

2.4. Competing Cities

Given the size of Halifax and its prominent position in Nova Scotia, it’s difficult to see any real threats coming from local islands or other coastal villages within Nova Scotia, when it comes to attracting more tourists. It’s more likely that the real threats come from the larger populous cities which are the typical entry point into Canada; Toronto, Montreal, Vancouver. Similarly, competing coastal towns on a similar scale to Halifax are more likely to be from their North American counterparts.

2.4.1. Boston, Massachusetts (US)

Boston is a coastal town in the US state of Massachusetts that boasts several similar selling points to Halifax such as being the hub of the area, great transport links, urban / coastal landscape and gasto-tourism. Boston’s population is approximately 50% larger than Halifax and it sees around 1.6 million international tourists each year. The is greatly assisted by the cruise port, which ranks in the top 15 ports in the US for tourist arrivals, “114 ships & 309,027 passengers”, (Massport, 2016a), 3 times more than Halifax and Boston-Logan International airport which sees “36 million passengers a year”, (Massport, 2016b), 10 times more than Halifax. These figures include 684,000 tourists visiting from Canada, (Statistics Canada, 2016b).

2.4.2. Portland, Maine (US)

Portland, another coastal town in the US, attracts predominantly the US based market segment for its tourist numbers, although does get some Canadian tourists from “Ontario (6%), Quebec (3%), New Brunswick (3%), and Nova Scotia (1%)”, (Visit Maine, 2016). As New Brunswick is the adjoining province to Nova Scotia, a targeted marketing campaign could persuade these travellers to holiday much closer home. The US has had a strong national and international marketing campaign called ‘DiscoverUS’, which filters down through the various local organisations. Portland led a very successful social media and digital marketing campaign recently that received very high commendations. Portland’s offerings are similar to Halifax, although smaller in scale.

2.4.3. Toronto, Ontario (Canada)

Toronto is a big and bustling city; it doesn’t compete directly with Halifax or Nova Scotia, but it receives the lion’s share drawing the highest number of foreign tourists to Canada. The city makes a good deal of effort to provide landscapes, activities, products, and services that suit the tastes of everyone, but the very urban vibe is difficult to shake and is sometimes referred to as the New York of Canada. Whilst Toronto has a variety of activities and tourist attractions, like Niagara Falls nearby, it lacks the rural / coastal and outdoor scenes that Halifax can offer. Toronto obviously offers more fine dining, hotels, business and conference facilities and other modern conveniences. It also has its fair share of large scale events, typical of metropolitan cities.

2.4.4. Montreal, Quebec (Canada)

Quebec draws the 3rd highest number of foreign tourists to Canada, with the majority being French (French-Canadian province). Montreal is known as the Paris of Canada, with the same laid back style synonymous with the French capital. Renowned city landscapes rich with history and architectural delights, it gives a European feel to it. The closest large city and tourist conduit into Canada to Halifax it provides a key access point for tourists coming to Halifax – provided they continue to Halifax. Like Toronto, it offers the modern conveniences found in many large cities.

2.4.5. Findings

Halifax won’t be able to compete head on with the likes of Montreal or Toronto, however, can leverage their current position in the tourism game to bolster Halifax. Portland is a reasonable equal for comparison to Halifax and with the right targeted campaign, should be able to boost its tourists by luring more Canadians away from Portland (particularly from Ontario, Quebec and New Brunswick). Boston is more complicated as it has a larger tourist base, however it offers very similar selling points to Halifax. Again, with the right strategy, it may be possible to sway more Canadians away from the US market.

2.5. Segmentation

For Halifax, the most readily identifiable segmentation would be the geographic locations of its customers. Per Figure 4, a significant proportion of tourists coming to Halifax and Nova Scotia are from Canada. Figure 12 in Appendix 5.2 and Figures 13-15 in Appendix 5.3 also show some interesting insights:

- Comparing the countries of origin for international tourists across all Canadian provinces, it can be seen that there are many Top 5 countries for other Canadian provinces that have very few tourists going to Halifax / Nova Scotia. Some of these market segments are huge and in several cases the tourist numbers are larger than any tourist segment that Halifax / Nova Scotia has (South Korea, Japan, China, India, Switzerland and Belgium). Growing middle classes in India, China and South Korea looking to travel should prompt an increased focus towards these market segments (Note: UK, Japan, China and South Korea are the biggest tourist segments to US, other than Canadians (#1) and Mexicans (#2), so stiff competition can be expected).

- Many of the market segments Halifax / Nova Scotia are currently attracting could be improved or increased by leveraging the current tourist numbers going to major Canadian cities and converting them into on-flow tourists, such as the Chinese, Japanese and Indian tourists. The highest foreign tourist locations to Canada (non-US) are Ontario & Quebec (East), BC & Alberta (West). Significant numbers of French tourists arriving in Quebec, could be lured to join the numbers arriving from St. Pierre & Miquelon (also French). Australian tourist numbers could also be bolstered from on-flow via Ontario. Additional tourist advertising in these cities at key locations, such as the airports and transport hubs would be advantageous – including increasing the number of multi-lingual advertisements and promoting dual language services in Halifax.

- The biggest foreign spenders in Canada (Top 5) are the US, UK, China, Australia & France.

- Canadians spend billions in the US, including Maine & Massachusetts (9th & 10th biggest spends) which include cities Boston and Portland. Increased emphasis should be to promote Halifax over these locations that seem to offer the same value proposition.

- US tourists spend big in Canada. A push to get more of these tourists coming to Halifax should be proposed (they’re already coming to Canada). Targeted campaigns for states like New York, that already see high tourist numbers migrating North and a look at Texas & Florida would be worthwhile, as these tourists are already likely to be flying given their geographic location in relation to Canada.

Halifax includes activities for its customers based on age, gender and sexual orientation. The arts and cultural offerings are suited to all age brackets, including special activities to keep the kids entertained. Halifax holds a variety of festivals and events for all ages and tastes, has an established food and wine tourist trade, is well known for its abundance of ocean based and outdoor activities and caters for the LGBT community (Halifax Rainbow). With the largest grouping of education facilities in the region, it draws crowds for end of term breaks and terminal education ages. It also offers conference and convention facilities to accommodate business tourism. A variety of accommodation and dining options ensures all budgets are catered for and transport options are plentiful; by car, train, plane, and ferry / cruise liners. With its mix of coastal, rural, and urban settings, the lifestyle of Halifax has all demographics covered with year-round activities.

2.6. Targeting

Halifax has modernised its marketing and branding campaigns to reach its targeted audiences more effectively, through a greater understanding of key market segments and tailored campaigns through a variety of mediums and channels. Senior tourists from the home market can access more traditional mediums like TV, radio, and printed materials with the option of booking online, by phone or through travel agencies. Younger tourist segments and internationalists are more likely to use digital platforms as their first point of call and millennials will access it instantly via the many social media platforms available. Growth markets like the UK, US and China requires additional on the ground presence at travel & tradeshows and tourism conferences. Using the combined efforts of local, national, and international tourism agencies, working together to promote a uniform message, and achieve common goals, the costs are distributed and thus reduced, but the benefits enhanced for all constituents. The potential returns from these investments and initiatives is significant; they are established growth markets with proven returns in both the US and Canadian markets.

2.7. Positioning

Halifax has a great opportunity to play to its strengths in how it markets itself to potential customers. The province of Nova Scotia offers tourists a little bit of everything, and Halifax is the perfect base for this journey. The ‘Atlantic Gateway’ is an apt name for Halifax, who acts like a hub to the Eastern Seaboard. There’s potential to position itself as a transit destination, offering an air transit layover location on route to other destinations for the nearly “4 million passengers it processes every year at Halifax International Airport”, (Halifax Stanfield, 2017). It’s the first port of call for larger cruise ships moving along the coastline and should look to capitalize further on this market that brings “136 cruise liners a year to Halifax with over 238,000 passengers annually”, (Cruise Halifax, 2017).

The right mix of tourist attractions, activities, natural beauty, urban, rural and coastal landscapes gives Halifax its unique selling point. Whilst many other destinations in Canada and nearby US have a few of these selling points, Halifax offers ‘something for all’. The ‘Be Bold’ campaign is the perfect delivery mechanism that prompts Halifaxns to be proud of their city and promote it to the world, tying in perfectly with the Destination Halifax concept. The new logo that has now been rolled out across the municipality provides a common brand to promote.

3. Conclusions & Recommendations

Halifax is making positive progress with its current city branding and marketing campaigns. Awareness of the Halifax brand is spreading to more countries, the digital media platforms are seeing record traffic volumes and tourist numbers are increasing year-on-year. The focus for Halifax should be the expansion of its International customer base. Numbers are very strong for the Canadian market and they should look to build on this through further expansion of the US and UK markets, as well as an active push into developing Asian markets such as China, India, Japan and South Korea. The European market could also prove popular in coming years, with Brexit and the Trump administration making international travel that much harder. Halifax should look at the following:

- Increase Transit Throughput & Associated ‘Layover Tourism’

- Increase flights to international destinations offering a layover at Halifax.

- Additional layover related products and services in close proximity to the airport & ferry terminals and free transport service between key hub locations.

- Increase frequency of flights and engage more international carriers that serve high volumes from target segments like the US, UK, China, India. A budget carrier may also encourage increased tourists with cheaper flights. This may engage more “first-time visitors”

- Partnership with hotels to offer deals for overnight / short stays. Offering weekend or getaway packages may add to local tourism numbers.

- Increase visibility of diversified accommodation offerings and pricing points through popular digital platforms like booking.com, TripAdvisor, Airbnb, etc…

- Refined Collaboration Between Tourism Organisations

- Adopt Destination Halifax as the umbrella brand for all Halifax related tourism linking all city related marketing from other agencies to this website. Destination Halifax should take the lead role of brand curator, refining the core Halifax brand value.

- Establish branding guidelines for the standardised implementation and use of the Halifax branding and marketing materials. Future themes and campaigns can then be developed in accordance with the guidelines, accounting for available budget, evolving collaborations and partnership opportunities. A consistency of delivery across all tourism platforms ensures the message is clear and well received.

- Leverage the tourist volumes of major cities to create on-flow tourism with package deals that include short Halifax stays tacked onto the end of longer major city stays.

- Actively Target Those US & Canadian Tourists Choosing Boston & Portland Over Halifax

- Survey the target demographics to determine where their preferred location is and why.

- Produce promotional material specifically tailored to lure tourists away from the US markets and into Halifax.

- Include seasonal discounts to raise the profile of Halifax outside the peak season periods as a pre-cursor to the main tourist season.

- Add a summer festival / concert inviting popular international artists that will be the headline event for the summer season.

4. References

Air Canada, 2014. Air Canada – Canada’s Best New Restaurants. [Online]

Available at: http://enroute.aircanada.com/canadas-best-new-restaurants-2014/edna/

[Accessed 08 03 2017].

Blogcdn, 2017. Blogcdn – Blackberry, Be Bold. [Online]

Available at: https://www.blogcdn.com/www.engadget.com/media/2012/02/bbbold1-22.jpg

[Accessed 08 03 2017].

Brand New, 2014. Brand New – Be Bold Or At Least Semibold. [Online]

Available at: http://www.underconsideration.com/brandnew/archives/new_logo_and_identity_for_halifax_by_revolve.php

[Accessed 08 03 2017].

Cruise Halifax, 2017. Cruise Halifax – Visitor Satistics. [Online]

Available at: http://cruisehalifax.ca/our-visitors/statistics/

[Accessed 08 03 2017].

Design Ninjaz, 2016. Design Ninjaz – Geometric Patterns In Logo Design. [Online]

Available at: http://designninjaz.com/geometric-patterns-in-logo-design/

[Accessed 08 03 2017].

Destination Halifax, 2012. Destination Halifax – Pin & Win The Best Of Halifax On Pinterest With Destination Halifax. [Online]

Available at: http://legacy.pitchengine.com/destinationhalifax/pin-and-win-the-best-of-halifax-on-pinterest-with-destination-halifax

[Accessed 08 03 2017].

Destination Halifax, 2013. Destination Halifax – Destination Halifax Wins Two Social Media Awards. [Online]

Available at: http://www.destinationhalifax.com/about-dh/travel-media/press-releases/destination-halifax-wins-two-social-media-awards

[Accessed 08 03 2017].

Destination Halifax, 2015. Destination Halifax – Home Page. [Online]

Available at: http://www.destinationhalifax.com/

[Accessed 08 03 2017].

Gibbons Whistler, 2016. Gibbons Whistler – Guide To Great Canadian Beer Festivals. [Online]

Available at: https://gibbonswhistler.com/great-canadian-beer-festivals-guide/

[Accessed 08 03 2017].

Halifax Partnership, 2016a. Halifax Partnership – Economic Data & Reports. [Online]

Available at: http://www.halifaxpartnership.com/en/home/economic-data-reports/default.aspx

[Accessed 08 03 2017].

Halifax Partnership, 2016b. Halifax Partnership – Halifax Economic Growth Plan 2016 – 2021. [Online]

Available at: http://www.halifaxpartnership.com/site/media/Parent/11×8,5_HP_GrowthPlan_PRINT.pdf

[Accessed 08 03 2017].

Halifax Sociable, 2011. Halifax Sociable – Destination Halifax Is On The Social Media Bandwagon, Are You?. [Online]

Available at: http://www.halifaxsociable.ca/destination-halifax-is-on-the-social-media-bandwagon-are-you/

[Accessed 08 03 2017].

Halifax Stanfield, 2017. Halifax Stanfield – Airport Facts & Stats. [Online]

Available at: https://halifaxstanfield.ca/airport-authority/media-centre/airport-facts-and-stats/airport-statistics/

[Accessed 08 03 2017].

Halifax.ca, 2014. Halifax.ca – HRM Branding Strategy. [Online]

Available at: https://www.halifax.ca/municipalclerk/documents/140415ca1153.pdf

[Accessed 08 03 2017].

Halifax.ca, 2016. Halifax.ca – Application Of The HΛLIFΛX Logo & Brand On All Community Signs, And Landmarks. [Online]

Available at: http://www.halifax.ca/council/agendasc/documents/160726cai01.pdf

[Accessed 08 03 2017].

Herald News, 2014. Herald News – Halifax Mayor, Council Approve City’s New Brand. [Online]

Available at: http://thechronicleherald.ca/metro/1200762-halifax-mayor-council-approve-city-s-new-brand

[Accessed 08 03 2017].

Marketing Mag, 2014. Marketing Mag – Rebranding Halifax. [Online]

Available at: http://www.marketingmag.ca/brands/rebranding-halifax-121803

[Accessed 08 03 2017].

Massport, 2016a. Massport – Passenger Volumes. [Online]

Available at: https://www.massport.com/media/418604/Passenger-Volumes.pdf

[Accessed 08 03 2017].

Massport, 2016b. Boston-Logan International Airport (Massport). [Online]

Available at: https://www.massport.com/media/419503/1216-avstats-airport-traffic-summary.pdf

[Accessed 08 03 2017].

MSVU, 2016. Mount Saint Vincent University (MSVU) – Halifax, Nova Scotia. [Online]

Available at: http://www.msvu.ca/en/home/beamountstudent/internationaleducationcentre/halifax.aspx

[Accessed 08 03 2017].

Statistics Canada, 2016a. Statistics Canada – Real Gross Domestic Product, Expenditure Based, By Province & Territory. [Online]

Available at: http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/econ50-eng.htm

[Accessed 08 03 2017].

Statistics Canada, 2016b. Statistics Canada – Travel By Canadians To The United States, Top 15 States Visited. [Online]

Available at: http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/arts39a-eng.htm

[Accessed 08 03 2017].

Statistics Canada, 2017a. Statistics Canada – Population Of Census Metropolitan Areas. [Online]

Available at: http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/demo05a-eng.htm

[Accessed 08 03 2017].

Statistics Canada, 2017b. Statistics Canada – Population By Year, By Province & Territory. [Online]

Available at: http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/demo02a-eng.htm

[Accessed 08 03 2017].

The Chronicle Herald, 2014. The Chronicle Herald – Halifax’s Proposed ‘Be Bold’ Theme Not New Yo Business. [Online]

Available at: http://thechronicleherald.ca/metro/1195799-halifax-s-proposed-be-bold-theme-not-new-to-business

[Accessed 08 03 2017].

The Chronicle Herald, 2016. The Chronicle Herald – NowNS: Social Media Spots Your Next Destination. [Online]

Available at: http://thechronicleherald.ca/business/1421829-nowns-social-media-spots-your-next-destination

[Accessed 08 03 2017].

Tourismns.ca, 2015. Tourismns.ca – 2015 Tourism Brand Guidelines. [Online]

Available at: https://tourismns.ca/sites/default/files/tourism_ns_2015_brand_guidelines.pdf

[Accessed 08 03 2017].

Tourismns.ca, 2017a. Tourismns.ca – Atlantic Canadian Tourism Partnership (ACTP). [Online]

Available at: https://tourismns.ca/atlantic-canadian-tourism-partnership-actp

[Accessed 08 03 2017].

Tourismns.ca, 2017b. Tourismns.ca – Nova Scotia Visitor Origin (Dec 2016). [Online]

Available at: https://tourismns.ca/sites/default/files/visits2016_allentrypts_dec_2017jan31final.pdf

[Accessed 08 03 2017].

Visit Maine, 2016. Visit Maine – 2015 Annual Report. [Online]

Available at: https://visitmaine.com/assets/downloads/2015AnnualReport.pdf

[Accessed 08 03 2017].

5. Appendices

5.1. General Introduction To What Halifax Has To Offer

5.1.1. Gastro-Tourism

Having a long coastline, the city boasts of its seafood culinary experience. To attract gastro-tourists, the city offers food tours like ‘Local Tasting Tour’, ‘Taste Halifax Food Tour’, ‘Nova Scotia Chowder Trail’, etc. It promotes itself as a city with more pubs and clubs per capita than almost any city in Canada. They also arrange tours for wine lovers to the Annapolis Valley – Napa of the North. It appears that Halifax has successfully positioned itself in this segment. Its target market is clear; it offers restaurants both high-end and economic, with good ratings on TripAdvisor and positions itself as a culinary hub of Nova Scotia. It is also promoted by Air Canada as “the city for best restaurant experience”, (Air Canada, 2014).

5.1.2. Family Tourism (Budget Friendly)

Halifax offers budget friendly indoor and outdoor options for families visiting the city. Destination Halifax lets families share their stories on the main webpage along with the information on different sights to keep the visitors more involved and promote itself as a very family-centric destination. Families get to share their experiences visiting “Fisherman’s Cove”; a village that offers activities for children like whale watching cruise, and they promote their restaurants that offer economic deals for families. Indoor visits include Halifax Central Library and Clay Café that offer activities and games designed for families. The webpage also has a section that lets you know about the “Top 10 places with Free admission” targeting big families looking for low cost holidays. One of the positioning challenges is the cold weather, which can cause travel inconvenience for families with young children.

5.1.3. Outdoor Adventure Enthusiasts

This segment of the city targets those visitors who are adventure fanatics, enjoy exploring and participating in outdoor activities. The city offers several options like The Oval, outdoor skating rink, many trails like Duncan’s Cove, The Halifax Ghost Walk trail for strolling, running and cycling (the use of catchy names adds to the level of interest). Visitors coming during winter can go to snowy hills for tobogganing. They can also do kayaking, winter surfing, sailing tours and visit Hartfield Farm (horseback riding and sleigh rides). A visit McNabs Island gives an insight into what the area was like pre-development and offers many adventurous attractions only a short distance from the city centre.

The positioning challenge here is that although the city offers several options for outdoor activities, its cold weather is a challenge to attract adventure-seekers to sample these activities, for example, surfing in cold waters. Many of these sights, like McNabs island, are relatively unknown and the target market of the ‘winter outdoor activities enthusiast’, who typically spends winter holidays skiing in resorts like Windsor, Wentworth Valley, etc… is somewhat difficult to attract.

5.1.4. Concerts, Festivals, Events (Young Adult Visitors)

Destination Halifax for 2017 is promoting its events and festivals as seasonal events:

Winter: February

Nova Scotia Ice-Wine Festival

Challenger: when it comes to Ice-wine in Canada, the Niagara Ice-wine Festival that features the famous ice-wine from Ontario and taking place also in in the same time, tends to attract more visitors and media coverage. They have a stronger marketing campaign and are first to appear on Google when searched for Ice-Wine.

Spring: March – May

NLC Festival Of Whiskey

Promoted by NLC (Nova Scotia Liquor Corporation), the target market is locals and internationals and it has a good digital marketing campaign associated with the event

Smart Phone Film Festival

Target market is mainly locals and it has competition from Toronto, with the TSFF, although their target market is more international.

Atlantic Film Festival For Youth

Run since 2001, its target market is young people and families – there is traditionally a good response or turn-out for this event.

March Break 2017

The target market is children and young adults (mainly locals). Various activities for spring break like the Discovery Centre, Innovation Lab, art classes, etc.

St. Patricks Day Parade in Canada

This takes place across all states; for Nova Scotia, it is held in Halifax as it’s the capital. Special events are organized in the city to attract locals and visitors alike.

AUS Sports Events

Arranged by Atlantic University, Halifax and targets locals (typically students)

Music Concerts & Dance Festivals

A platform for local and national talent, organized by the city, it sees several music festivals held throughout the year of different genres including pop, rock, jazz, Celtic, etc…

Burger Week

Is sponsored by Feed Nova Scotia (a non-profit organization) and is targeted towards the local consumers.

Summer: June-August

Street Hockey Tournament

It’s promoted as the world’s largest street sports tournament, and is endorsed by PlayOn in Canada. Halifax is participating as one of several host cities for 2017 and the marketing campaign involves a trending hashtag #PlayOnHalifax. The event invites a large number of spectators and teams from around the world.

Rendez-Vous 2017 Tall Ships Regatta

A famous transatlantic sailing race involving tall ships will include six countries. Halifax, along with Quebec, will be representing Canada. The ships will stop at more than 30 Canadian ports. Other countries are the US, Portugal, France, UK and Bermuda. Halifax promises to showcase the best of Nova Scotia through its music, food, historical sights and family friendly experiences.

Halifax International Busker Festival

The festival offers acrobatic, visual and fire displays performed by the world’s top street performance artists and attracts a good number of spectators each year. The challenge is the poor marketing campaign and average website.

Halifax-Dartmouth Natal Day Festival

Celebrates the city’s birth on August 4th. This year the city will be celebrating its 122nd Natal Day (1895 – 2017). The festivities will include fireworks, food and entertainment with the parade being endorsed by Pepsi. It is expected to be a big event as Canada is also celebrating its 150 years anniversary.

Halifax Seaport Beer Festival

Although Halifax promotes its festival and manages to be “one of the top ten in Canada”, (Gibbons Whistler, 2016), it’s main challenge is drawing enough visitors to the event as Canada hosts several beer festivals around the country, in the main cities, throughout the year.

Lebanese & Greek Food Festivals

Popular events amongst locals in Halifax.

Fall: September-November

Hal-Con Sci-Fi Convention

Since 2010, it has been Nova Scotia’s own Comic-Con and positions itself as Atlantic Canada’s biggest sci-fi, fantasy and gaming convention. Its main challenge is garnering sufficient support for the event, as Comic-Con traditionally targets and attracts the tech geeks, Hal-Con struggles to draw the crowd’s attention to its events through its digital marketing efforts (it currently has around 6,000 followers on Twitter).

5.1.5. Halifax Rainbow (LGBT Community)

Destination Halifax has a special section named Rainbow Halifax who’s target market is the global LGBT travelers. The city organizes special focused events to attract them to visit the city like the Halifax Pride Festival, positioning itself as one of Canada’s premier pride festivals. Destination Halifax created a sister website, named Halifax Pride and sponsored by the Halifax Pride Society (a non-profit organization working for the LGBT community, has been set up specifically to cater for the traffic flow surrounding the event and has a list of other upcoming events. Destination Halifax also offers a special section on their website that specifically caters for the gay community (under TGC, Travel Gay Canada) and offers “Rainbow Halifax Hotels, Activities & Attractions “. The positioning challenge is the difficulty to stand-out against other major cities as the ultimate LGBT destination (currently only attracting around 4,000 followers on Twitter). Although it has been successful locally in positioning itself in this segment, its major competitor cities in Canada include Vancouver, Montreal and Toronto.

TGC tends to be the first search results that appear when searching on Google, which does cover all the LGBT friendly destinations in Canada, the Halifax and Nova Scotia offerings occupy a very limited presence on that website.

5.1.6. Business Conventions, Conferences & Offices

Destination Halifax also offers itself as the venue of choice for business conferences, conventions and the like. Halifax promotes itself as Atlantic Canada’s best seminar & convention destination. The website offers free services if the booking is done through them, such as arranging for supplier listings, etc… Several convenient accommodation and venue facilities for business are also offered, including ALT Hotel that is directly connected via an indoor concourse to Halifax International Airport. Many hotels offer special packages for meetings and stays. The challenges include the fact that CVENT (the Online Event Planning Platform) does not list Halifax in its global list of best destinations for business meetings. Other Canadian cities did make the list, including Vancouver, Toronto and Montreal. When searching for meetings destinations in Canada on their website, http://www.cvent.com/rfp/canada-meeting-event-planning.aspx, the search offers filters by regions, offers and promotions. When searching for promotions on venues, Halifax was either not offering any deals or promotions or omitted. When searching for places in Nova Scotia, the two suggested cities were Halifax and Cape Breton. Although the average room rate in Halifax is slightly higher than that of Cape Breton, it offers more flexibility in options for conferences and meetings, making it more attractive for such events.

5.2. Tourist Statistics Summary – International Tourists (Exc. US) 2015

Figure 12: Canadian Tourist Statistics Summary – International Tourists (Exc. US) 2015

This table shows the Top 20 international countries, by tourist numbers, entering Canada in 2015 for each of its provinces. Nova Scotia (in green) shows the Top 5 countries (other than the US or Canadians themselves) to be the UK, Germany, St. Pierre & Miquelon, Australia, and France. For all other Canadian provinces, the Top 20 (in grey) and Top 5 (in yellow) are highlighted for reference. The countries listed in red under Nova Scotia are those countries that were recognised as a Top 5 country for at least 1 other province in Canada.

5.3. Tourist Statistics Summary – International, US & Canada Tourists 2014

Figure 13: Non-Residents Entering Canada 2014 Figure 14: Canadians Entering (By State) US 2014 Figure 15: US Entering Canada (By State) 2014

The above tables show the Top 5 International countries of origin, the most popular US states with Canadian tourists and most popular US states where tourists to Canada come from.

Mr. Daniel Lewis Mr. Karthik Thiruvidaimarudur Sukumaran

Analyst – Halifax Executive City Branding Team Analyst – Halifax Executive City Branding Team

Mobile – +44 7729 313 855 Mobile – +44 7466 951 391

Email – Daniel.Lewis.2016@uni.strath.ac.uk Email – kaarthikts.88@gmail.com

Ms. Huda Abdul Ghaffar Ms. Jing Zhao

Analyst – Halifax Executive City Branding Team Analyst – Halifax Executive City Branding Team

Mobile – +44 7460 750 485 Mobile – +44 7743 906 584

Email – Huda.Abdul-Ghaffar.2016@uni.strath.ac.uk Email – Jing.zhao.2016@uni.strath.ac.uk

Ms. Prabhjot Kaur Alkrra

Analyst – Halifax Executive City Branding Team

Mobile – +44 7454 496 575

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Tourism"

Tourism is where people travel to visit places, typically as part of a holiday or trip. People will often travel to places of interest and beauty for leisure purposes, whilst travel for business can also be classed as tourism.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: