Retirement Planning Case Study

Info: 10291 words (41 pages) Dissertation

Published: 9th Dec 2019

Tagged: Finance

Disclaimer

This presentation gives a general audit of your very own couple parts budgetary position. It is created to give informational and/or general information and is not proposed to give specific legal, accounting, endeavor, charge or other master direction. For specific direction on these parts of your general cash related course of action, advice with your master guides. Asset or portfolio benefit and/or returns showed up, or used as a part of the presentation, are not anticipated that would envision nor guarantee the genuine delayed consequences of any endeavor things or particular theory style.

Important: The projections or other information made by Singh Financial Services as for the likelihood of various theory results are hypothetical in nature, don’t reflect genuine endeavor comes to fruition and are not protections of future results. Besides, observe that information in this report is built upon cash related figures data in light of the date above; results gave may vary ensuing usages and after some time.

Introduction

Dear Mr. & Mrs. Williams:

It has been a wonderful opportunity for me to prepare financial plan for you. I appreciate your concern and the importance that you give to begin financial planning at a young stage of your life. This document is in continuation to the process of financial planning for your future based on your priorities and available means.

An individual can, today, hope to carry on with a solid life very much into his or her seventies or eighties, which implies that retirement life is nearly the length of working life. Monetarily, it infers that investment funds ought to be sufficient, not simply to keep up the same way of life for just about 25-30 years, with no new pay, additionally to deal with restorative costs, which are typically high the more seasoned a man gets. Making arrangements for this is a difficult request for anybody. That is the reason it’s basic for everybody to arrange their funds from an early age.

As you are planning to have kids and considering to buy family business, pay loans and purchase a new car, it is particularly important for you to manage your incomes and expenses. Financial security and protection against risks are the key concerns in your case.

The process of financial planning of your case is based on following assumptions:

- Life expectancy is assumed to be 90 years.

- 2.25% annual indexation rate for expected incomes and expenses over the future.

- 7% average annual rate of return on investments.

You are planning to pay-off all the debts before retirement and maintain your current lifestyle after retiring. In order to achieve this, I am happy that you both agreed to save half of the extra money. Your current assets amounts to be $ 19,626. With sound understanding of investing options and willingness to take higher than average risk, there is a sound potential of growth on the invested funds.

Goals & Objectives

It is vital to comprehend what your objectives are, and over what time period you need to accomplish your objectives. A few objectives are transient objectives those that you need to accomplish inside the year. For such objectives it’s essential to be preservationist in one’s methodology and not assume a lot of danger. For long haul objectives, nonetheless, one can stand to assume more hazard and utilize time further bolstering one’s good fortune. It was simple for us to continue with this budgetary arrangement as you have clear comprehension of your objectives. The key short-, mid- and long term objectives based on our last meeting are listed below:

- Long term objectives:

- To plan finance for fulfilling childcare expenses and their education.

- Pay-off the mortgage within 12 years.

- Plan for retirement at the age of 55.

- Replace Natalie car with a used car in 6 years that needs $15,000.

- Mid-term objectives:

- Purchase of family business in 2 years.

- To plan funds for home repair within 3 years.

- Short-term Objectives:

- Pay-off Natalie’s student loan

- Buy a scooter for Natalie’s mother.

Current Financial Position of Chris and Natalie

In order to develop a financial plan that will cater to the achievement of above mentioned goals and objectives, I have analyzed below statements to develop better understanding of your current financial position:

- Statement of net worth

- Cash Flow statement ending December 2015.

- RRSP Statements

It’s worth mentioning here that you own significant net worth of $281,519 with equity ratio of 69% at this young age which is a remarkable achievement and will help you considerably to meet your retirement plans.

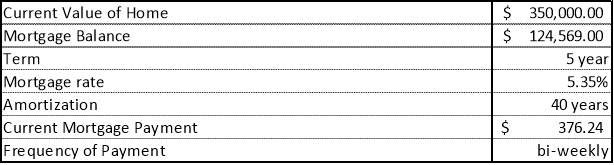

The market value of your home is $350,000 with $124,694 to pay in mortgage. There is a regular source of employment income which will help to fund various expenses that will arise during the course. I am happy that you both are aware of investment instruments like TFSA, RRSP though I find contribution to them quite below the appropriate amount. There is an unused RRSP contribution room of $ 18,712 for Chris and $ 15,970 for Natalie. At present mortgage of $ 124,569 is your major liability followed by Natalie’s student loan of $19,881. Apart from this, the repayment of loan of $ 20,000 taken under Home Buyers Plan from RRSP will begin from this March will add pressure to your cash flows.

Each individual ought to comprehend what their ability to go for broke is. A few ventures can be more unsafe than others. These won’t be suitable for somebody of an okay profile, or for objectives that oblige you to be traditionalist. Essentially, one’s danger profile will change over life’s stages. As a youngster without any wards or budgetary liabilities, one may have the capacity to assume bunches of danger. Be that as it may, on the off chance that this youngster gets hitched and has a tyke, he/she will have wards and higher financial obligations. His/her way to deal with danger and accounts can’t be the same as it was the point at which he/she was single.

At the point when do you require the cash to meet your objective and how rapidly would you be able to get to this cash. On the off chance that you put resources into an advantage for and hope to offer the advantage for supply you subsidizes to meet an objective, then please see how effortlessly you can offer the benefit. More often than not, currency market and securities exchange related resources are anything but difficult to sell. Then again, something like land may take you quite a while to offer.

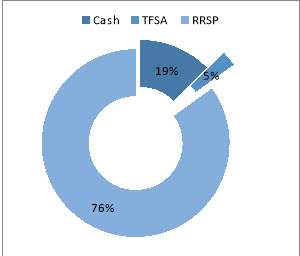

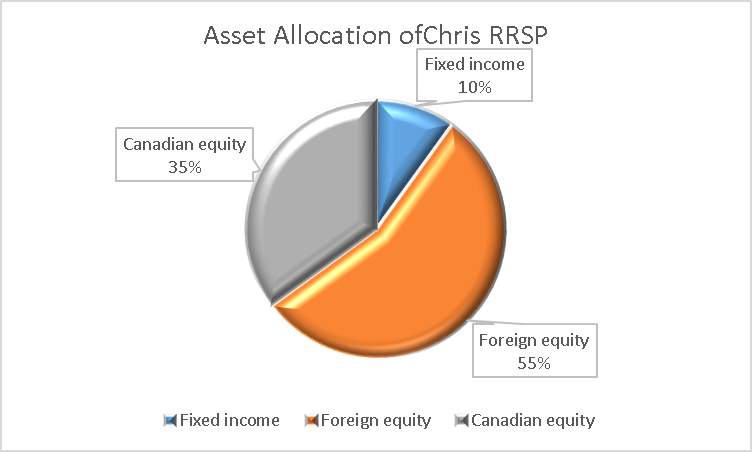

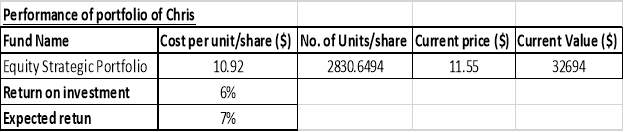

The Current Asset of Chris are mainly into RRSP followed by Cash and TFSA. The RRSP allocation is in equity Strategic Fund for Chris is as shown below:

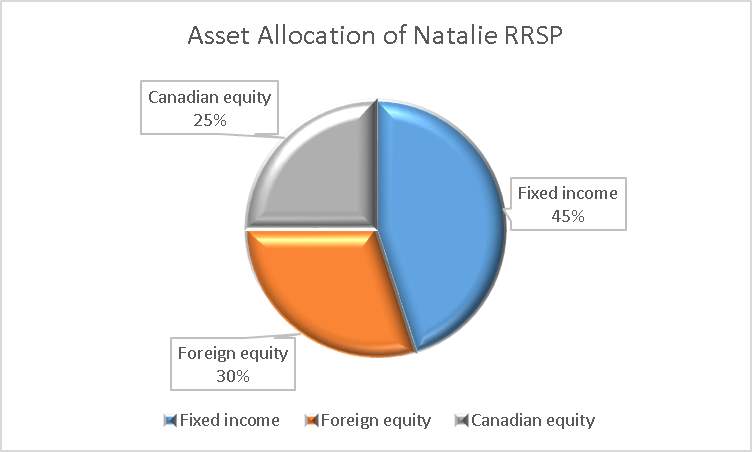

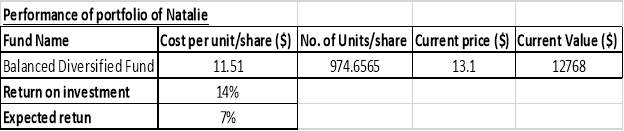

The current assets of Natalie are less as well as little diversified. She had $ 14,813 in her two chequing accounts and $12,768 in RRSP.

Financial Management

Planning to pay-off Mortgage

Mortgage planning is an important part of financial planning. Since it is the major liability in your case, it is essential you plan to deal best with it. It is necessary to plan the frequency and the amount of payment over the period of time such that it is repaid in time and doesn’t come in way of accomplishing your financial goals and life events. It needs to be designed in a way that suit your needs and make sure that your debt load and monthly payment does not conflict with your other financial objectives.

This is the second major objective in your case to pay-off your mortgage by the age of 40. In order to achieve this it is necessary to understand the available options in mortgage and evaluate your mortgage vis-à-vis these available options.

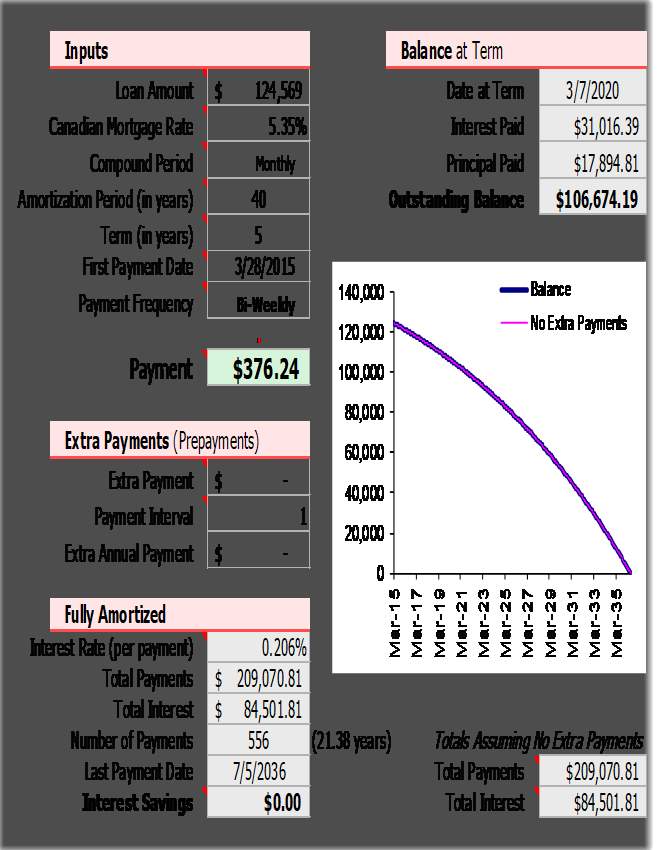

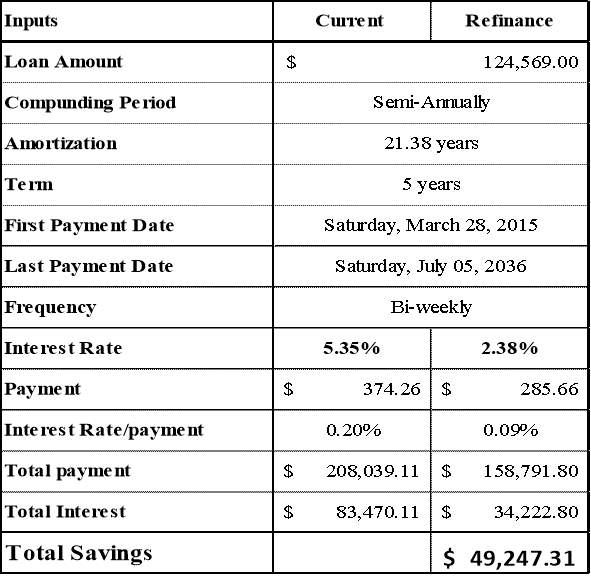

You have taken a long term (5-years) lock and roll type of mortgage which is charging you a very high rate of 5.35% per annum to avoid risk of change in interest rates during 5years period. If accelerated biweekly payment of $376.24 are maintained the loan amount will be repaid by 2036 i.e. in 21.38 years (considering you started paying on March 28, 2015). The fully amortized loan of $209,071 will bear 0.206% of interest rate (per payment) and you will be paying interest amount of $84,502 over the principal amount. The amortization chart for your mortgage under present scenario is as shown below:

Under current scenario we have two options:

- Renewal of current mortgage at the end of 5year term,

- Refinancing the current mortgage with a cheaper one.

Renewal of current mortgage at the end of 5year term:It is expected from the lender of mortgage to provide you with a statement with instruction to renew or not to renew the existing mortgage at least 21 days before the end of term. It is recommended to look around for a cheaper mortgage lender a couple of months before the end of term. Since, mortgage payment is the major expense in your cash flow, it is imperative to look for a cheaper lender or to negotiate with current lender if you could save some money over next term.

In case you choose to stick with existing lender you may choose to increase or decrease the amount of mortgage payment, frequency of payment, making any additional prepayments. Also, there is a chance to negotiate the rate of interest. In case you opt to change your lender you may need to pay switching fee.

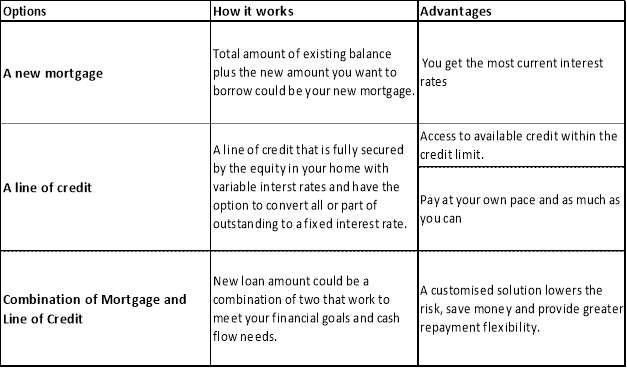

Refinancing the current mortgage with a cheaper one:Since your home will be building equity with increase in its value, you can use it borrow money than taking out a traditional loan. You can also consolidate your high interest loans and refinance your mortgage with that amount. It will help you to save money and clubbing whole debt into one. It is generally considered a good strategy to refinance the mortgage and in case of huge loan amount, to consolidate them and refinance them as mortgage loan because it has a lasting effects on finances and lifestyle. You will benefit from low interest rates.

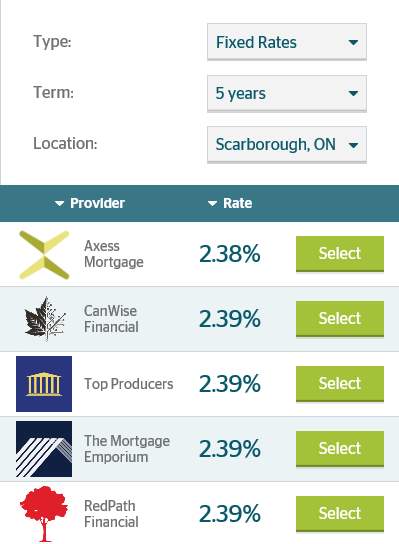

Considering the current scenario of your mortgage it is recommended for you to refinance your mortgage at the end of the term of 5 years, since you are bearing a very high rate of interest of 5.35% on this mortgage. For instance the other available mortgages with similar term to maturity are shown below:

It’s imperative to make use of low cost mortgage loan in order to save money to be paid in the form of interest. In case of refinance the mortgage, the impact on savings is shown in below table:

You will be saving $ 49,247 in above scenario if you refinance your mortgage from the loan provider at 2.38%. Here, to draw the comparison I have taken same amortization period, term and frequency of payment.

Recommendations

In order tohave an efficient mortgage planning, you should take steps as mentioned below:

- Consider Refinancing the mortgage: Refinancing your mortgage seems to be an attractive option in your case. It will help you to save the extra money that you might have to pay if you continue with your present mortgage. The rate for present mortgage is quite high i.e. 5% vis-à-vis market rate that has options from 2.38%. This will help you to consolidate your all kind of loans that you may need to fund future expenses to meet your financial needs. The low rate on refinancing the mortgage is an attractive feature that you can benefit from. If you consider this strategy and wish to payoff current value of mortgage by 40 years of age, you can save $49,247 of interest amount that you might have to pay otherwise.

- Reducing the payment for next 10 Years and Extra payments / prepayment of mortgage: Extra payment or lowering the payment of mortgage is an attractive feature that will help you plan your funds and expenses over the period of time. You may lower the mortgage payment during next few years when you will be paying for buying your family business, and childcare expenses. You may consider to reduce your mortgage payment for next 10 years and then start making extra contributions to pay it off by the age you turn 40.

- Considering a few more years to pay-off mortgage: The goal to pay-off mortgage by the age of 40 is quite realistic but considering the fact that you want to maintain your present lifestyle, you may have to cut all of your leisure and entertainment expenses. This seems to be hard to consider in practical life, so my submission will be that you should consider the age of 50 to be the age when you have paid off your mortgage and loans and successfully sail through the costs associated with child care and their education.

Planning for Child care and education expenses

You are planning to start your family in three years from now and planning to raise two kids at the age of 31 years and 34 years. Since Natalie has to go back to work and cannot spend full time with her child, you have to bear child care costs. With the birth of child there are so many costs that need to be born. So, it is essential to let you make aware of the costs associated with child care and then costs associated with their school and college studies. The following topics cover the above mentioned two scenarios. Firstly, we will discuss the present situation of childcare cost in Ontario which comprises of daycare services, food, clothing, toys, medicine, transportation etc. Secondly, we discuss the various options available to save for the college education of the child.

- Child Care Costs:

Savings required for expenses that come with the birth of child:

Apart from daycare costs there are several other coats that need to be paid when a child is born. These costs are for diapering, feeding, clothing, medicines, toys, books and media.

| Costs | Amount/month | Amount/year |

| Diapering | 75 | 900 |

| Feeding | 80 | 960 |

| Clothing | 60 | 720 |

| Medicine | 25 | 300 |

| Toys/books | 30 | 360 |

| Misc. Costs | 20 | 240 |

| Total | $ 290.00 | $ 3,480.00 |

Savings required for daycare services of both children:

As you are going to start a family, it is imperative to plan for the savings required to bear the expenses of child care and the education of kids. Since, you are planning to have your first child by 2019 and second child by 2022 we have to be considerate for savings devoted to the growing up of children and meeting their educational expenses.

As both of you will be working parents, you have to take services of nanny or daycare centers. Almost half of parents in Canada uses various options of child care like nannies, home daycares, daycare centers, kindergarten and before and after school services. It is critical for parents to find a balance between quality, convenience, availability and cost of child care. Child care arrangements are mostly used for children in the age group of 1 to 5 years. Since Natalie will have to return to work after her maternity leave, you might need these services during 1st year of child age which will continue till they start going to school.

Most parents use child care services on a daily basis and it is found to be maximum till 4th year of child and it start decreasing afterwards. As per facts stated by Statistics Canada on type of child care arrangement among parents using child care, in Ontario 36 percent uses daycare centers, 32 percent used private centers and 19 percent used home daycares.

As discussed in our meeting, we estimated the cost of daycare to be approximately CAD$ 1,200/ month for each child. In view of high demand of these services, I assume a 2% increase in cost per year. Although there are child care subsidy provided by Ontario government which is CAD$ 71 in your case yet it is insignificant to fund child care expenses.

The various cost associated with child care comprises of cost of day care, food, clothes, other costs which includes buying items of hygiene, toys and use of transport for sending them to daycare/school. As per latest figure released by Canadian living, it cost $ 243,660 to raise a child to age of 18. This cost is before sending them to university.

The saving required to raise both children to the age of 13 are calculated below:

| Required Saving | Start date | End Date | Assumed rate of growth | Saving reqd. per month |

| $ 334,100 | March 2016 | March 2035 | 1.00% | $950 |

There are many financial instruments like steeped Guaranteed Income Certificates (GIC), Registered Retirement Saving Account(RRSP), Tax free Savings Account (TFSA) which could be used to ensure growth and liquidity of the funds. Most of these instrument provide the assumed rate of growth and tax benefit as well.

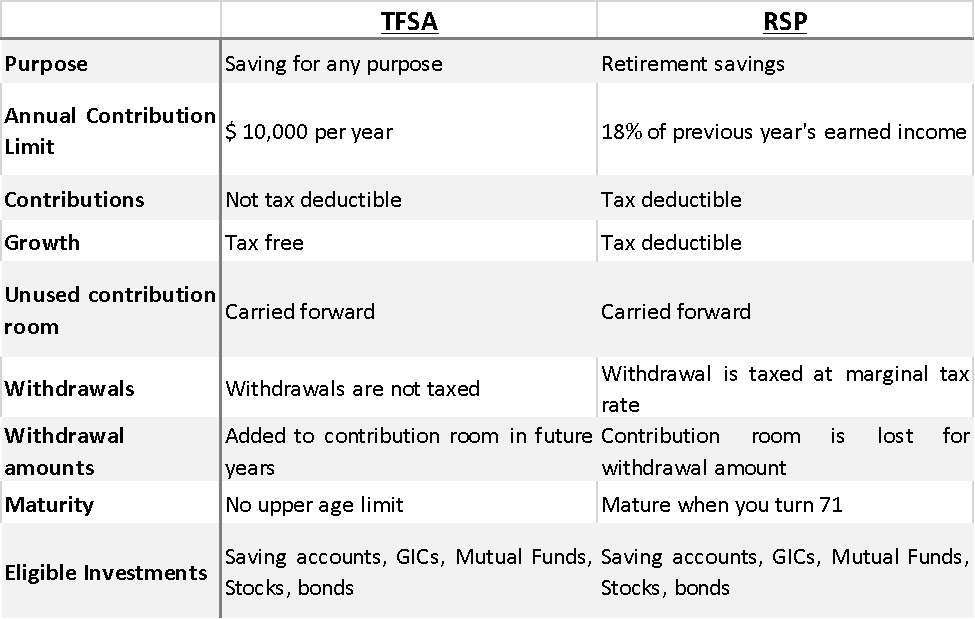

Key differences between TFSA and RSP:

Option 1:Using Tax Free Savings Account: You can save $10,000 every year and can also contribute the maximum permissible amount for past five years which is $10,000 in 2015, $5,500 for 2013 and 2014 and $5,000 for 2012 to 2010. Since contributions are not tax deductible, using only TFSA as a saving option is not a recommended. You can withdraw amount and can re-contribute that amount later. The growth is tax free.

Since you will needs funds periodically to fund the expenses of child care, you can set up TFSA GIC Account with laddered maturity.

Option 2: You can contribute to Registered Retirement Savings Plan (RRSP). The primary purpose of RRSP is to save for retirement. Although the annual contribution amount can help reduce your annual tax liability but it cannot be considered a better choice to fund short-term needs. Withdrawals from RSP are taxable so it cannot be considered a good option for saving for Child care expenses.

Savings required for post-secondary education of both children:

| Child 1 | Child 2 | ||||

| Year | Cost of Living | University expenses | Cost of Living | University expenses | Total Cost |

| 2037 | $ 12,000.00 | $ 5,000.00 | $ 19,037.00 | ||

| 2038 | $ 12,060.00 | $ 5,000.00 | $ 17,060.00 | ||

| 2039 | $ 12,120.30 | $ 5,000.00 | $ 17,120.30 | ||

| 2040 | $ 12,180.90 | $ 5,000.00 | $ 12,250.00 | $ 5,500.00 | $ 34,930.90 |

| 2041 | $ 12,241.81 | $ 5,000.00 | $ 12,311.25 | $ 5,500.00 | $ 35,053.06 |

| 2042 | $ 12,372.81 | $ 5,500.00 | $ 17,872.81 | ||

| 2043 | $ 12,434.67 | $ 5,500.00 | $ 17,934.67 | ||

| 2044 | $ 12,496.84 | $ 5,500.00 | $ 17,996.84 | ||

| Total required funds for University education of Both children | $ 177,005.58 | ||||

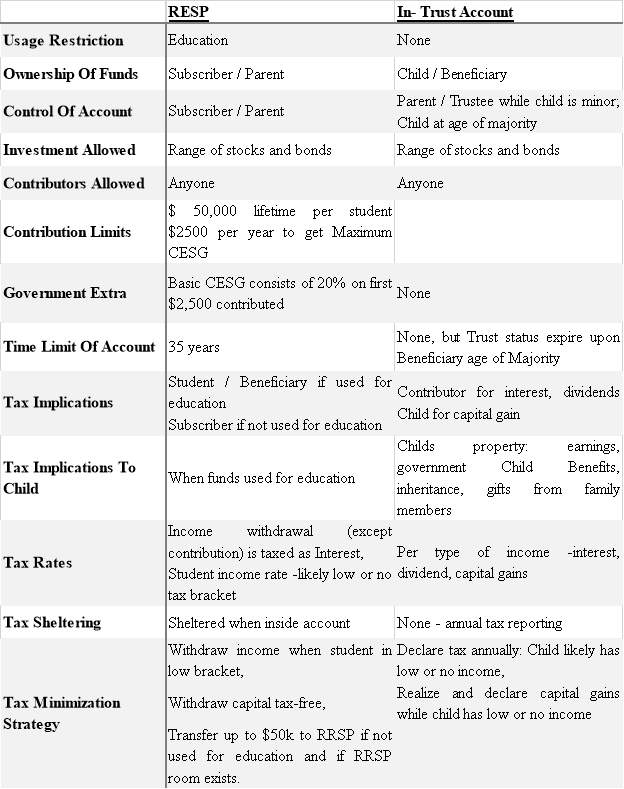

The current cost of education is around $4,200/year of study. Assuming the cost of living and education increase by 0.05%, we calculated that funds of $177,000 will required to pay for the post-secondary education of both children. You can use non-registered option to save for education of children but it is not tax effective means. In order to accumulate these funds, you can use RESP and in-trust accounts; both are the two most tax efficient options.

Option 1: Setting Up of RESP: You can set up RESP account after the birth of child and to a maximum of $50,000 per child. In order to get maximum CEGS benefit you should plan your payment accordingly as per your income criteria that could be found at CRA website.

Option 2: In trust account could be used to grow money and save for child education. You can invest in instruments that generates capital gains and tax on the realized capital gains needs to be paid when they are realized. Of the total capital gain only 50% is taxable as per current tax rules. Since your child will be attending college there income will be low so there will be minimum impact of tax on the realized capital gains.

You can also invest in interest generating or dividend paying instruments but interest or dividend income will be taxable each year and it will continue throughout the life of in-trust account.

Apart from this, capital gains from in-trust accounts will be taxed in hands of child vis-à-vis in case of investments generating interest/dividend income can’t be taxed to minor and will be attributable to one or both of you. So it is recommended to invest in capital gain generating instruments rather than interest paying in order to reduce tax liability.

Though in-trust account is comparatively not that tax efficient to RESP but could be used to save for extra expenses and extra cost that your child will incur and that can’t be funded if you use only RESP.

Recommendations

Saving for Child care Expenses:Liquidity of investment instrument is key in deciding which option to choose for saving money for bearing child care expenses. Child care expenses could be saved by setting up a Tax Free Savings Account (TFSA). Since, Chris has sound understanding of Equity market, you should consider buying some bonds, index-linked GIC. These instruments offers return in the range of 2 to 10% and interest is compounded annually.

Saving for child education:You should set up RESP account for each child after they are born. The contribution to RESP should be so made that you could get maximum CEGS benefit. The maximum limit per child is $50,000 for lifetime. In order to cover extra expenses you should set up in-trust account. The exact amount to be invested for saving can be evaluated in later stage of financial planning.

Buying the Family business

Chris is planning to buy his fathers’ hauling company at its current value of $100,000. You have convinced Chris’s father to pay for the business in installments of $10,000/ year for the period of 10 years. Here it is important for you to understand the scenario associated with buying the family business and its succession.

Family business succession is the process of transitioning the management and the ownership of the business to the next generation of family members. All things considered, the compelling reconciliation and administration of the family segment will have a deciding impact on the achievement of the progression process. Administration progression and the need to formalize administration procedures is a vital stage in the move of a privately-owned company. The family part will have a deciding effect on the capacity of the privately-run company to move its administration and formalize its administration forms and, in that capacity, privately-owned companies must join this element into the progression process.

As it were, one can’t hope to just transplant demonstrated business best practices into the family business operations without altering or tweaking them to represent the family component. Coordinating the relatives into the proprietorship progression handle and building up the privately-run company principles to direct the possession progression will give a significant part of the solace required for an effective progression. By tending to the family segment in each of the key ranges, adequate solace will be given to each of the gatherings included to permit the move to happen in a convenient and precise design. The level of subtle element required to arrange a successful move may on occasion appear to be overpowering. Nonetheless, if the privately-owned company focuses on applying a considerable lot of the privately-run company best practices laid out in the book, they won’t just discover the exercises enlightening and remunerating, however will have in all likelihood beaten the privately-run company progression chances.

Sole proprietorship: With sole proprietorship you will be the owner of your business. You will be able to keep all the profits earned from the business. Since you are buying it from your family its start-up costs are low compared to the scenario if you set up such a business today on your own. There will be maximum privacy and independency for Chris to work as a sole proprietor. It will be easy to establish and operate the business. It is easy to change the legal structure later if circumstances demand any change in case of sole proprietorship and you can easily wind up your business.

At the same time, there will be unlimited liability for debts on you as there will be no legal distinction between private and business assets. Your capacity to raise capital will be limited. All the responsibility for making day-to-day business decisions would be yours. The sole proprietor is taxed as a single person and the life of the business will be limited to you.

Incorporating the business:A corporation is an extraordinary lawful substance and it is partitioned from the general population who possess its shares. Its advantages are:

1.Limited individual risk. The best point of interest of consolidation is the restricted risk that it consults on shareholders concerning obligations, commitments and liabilities of the enterprise.

2.Number of Owners. Joined organizations can possibly have a boundless number of various proprietors. In the event that the business has or is anticipating having various proprietors, fuse is ideal. To begin with, it is less demanding to move proprietorship in the business, as every one of the proprietors need to do is secure or offer their shares in the organization. Likewise, proprietors/shareholders are just subject to the degree of their shareholdings. They are not at risk for some other proprietor’s close to home obligation or to their loan bosses as might be the situation in an association.

3. Government Grants. Some administration gives and projects are just offered to consolidated organizations.

4. Capacity to raise capital. The capacity to issue different classes of shares with inclinations as to profits, recovery or convertibility and to use securities or debentures enormously improves a company’s capacity to acquire stores for extension or advancement.

5. Workers. Organizations can offer shares to their representatives as a type of benefit sharing motivator along these lines partaking in the benefits and execution of that enterprise without influencing control. The execution of the organization subsequently influences all and is a motivating force for workers to enhance execution and in this way enhance the estimation of their shares and the benefits the organization produces.

6. Conceivable expense favorable circumstances. Little Canadian controlled private partnerships are exhausted at around a large portion of the customary rate on the primary $500.000 of dynamic business wage in every year. A company likewise has extra duty arranging and pay part courses of action accessible.

7. Constant presence and proprietorship is transferable. The passing or withdrawal of a shareholder does not influence the presence of the partnership, which appreciates never-ending progression.

8. Capacity to hold title to land and go into contracts. A partnership can possess land and sign contracts under corporate name.

Available Options to buy family business:

When you are planning for business succession it is imperative to consider the various options available to you:

- Direct transfer of business to you that we are considering so far in your case.

- Selling it to partner who might be interested in buying your business. In this case we need to contact some realtor and then make arrangements to sell the business to that partners. You may consider any friend, family member or employee of your business, who might be interested in your business.

- Selling it to a third party.

- Incorporating the business.

Method of transitioning the business:

- Build up clear however adaptable timetables to keep you on track.

- Set points of reference for accomplishing objectives and targets.

- Keep the progression arrangement up and coming to mirror any progressions or choices.

- Review and alter your arrangement in any event once per year as things can change rapidly in the business world.

- Prepare a correspondence arrangement for telling your successor, representatives, suppliers and clients of your progression arranges.

Savings required to buy business:

The value of business is $100,000 which you have to pay over 10 years by paying $10,000 every year. You have the option to extend its payment for further more years. Since buying the company will help you own 100 percent of profits, it will help you with extra money coming out of business.

| Value of business | $ 100,000.00 |

| Agreed payment option | If extended |

| $10,000 for 10 years | $6,667 for 15 years |

| Freed up funds | $3,333/years |

Recommendation

Incorporating the business in Canada will help you get a heightened protection of the name of your company. If you incorporate at federal level you will be able to carry on business anywhere in the country. There will be limited liability to the amount you invest in it. It will have perpetual existence. If you wish to expand your business you can raise capital by issuing shares in the market. It will help you save tax as you and the incorporated business will be taxed individually. It is recommended that you should consider to extend the payment for family business over 15 years with $6,667 yearly payment. This will help you to save $3,333 every year which you could use for other financial needs.

Buying Scooter for Natalie’s mother

Natalia mentioned that she might have to help her mother to buy a scooter. There are no many options to choose from. The most prevalent price for scooter is in the range of $ 800 to $ 1,500. So it is not a major expense and need not require any additional savings. You can compare various options available online. It will be recommended for you to pay in cash for the scooter as it will be in lines with your way of spending and avoiding any payment of interest.

Paying off Natalia student loan

There is a student loan of $ 19,881 on Natalia for which you are making payment of $600/ month. You are incurring a very high rate of 8% on this loan. So it should be your prime concern pay off this loan at first. Since you don’t have any immediate expenses you should consider making extra payments to get rid of it as soon as possible. This will help you to save a couple of dollars which you could use for some other purpose.

| Comparisonof student loan payment under existing and recommended payment amount | ||

| Amount | $ 19,881.00 | |

| Rate | 8% | |

| Existing | Recommended | |

| Payment | $ 600.00 | $ 1,500.00 |

| Term(months) | 37 | 14 |

| Interest | $ 2,660.00 | $ 1,005.00 |

| Net saving (Interest) | $ 1,655.00 | |

Because you have $ 1,040 of monthly current surplus as per your current cash flow. So, you can use this surplus to get rid of this loan amount. If you opt to pay $1,500 dollar every month for 14 month period, you can get rid of this loan. This will help you save $1,655 which you could use to buy scooter for Natalie’s mother or any other purpose.

Risk Management

Importance of Analyzing the Risk

In the process of Risk analyzingwe attempt to define and analyze the various risks or dangers to you posed by potential natural and human-caused adverse events. It helps in identifying and minimizing impact of uncertain problems or eventson your life that could undermine your present lifestyle and meet financial goals and objectives. Hazard examination is helpful in reckoning and invalidating the conceivable issues. It is vital to enhance wellbeing and overseeing potential dangers in the working environment. In this process, we recognized the dangers that you may confront and then we figure out the probability of these dangers to occur, and their conceivable effect on your life. Once the conceivable estimation of danger is distinguished, we have to begin taking a gander at methods for overseeing them.

Current Risk coverage of Natalie and Chris

You both are living very safe lifestyle. As you shared that you like to spend your vacation by visiting your friends and family and spend most time working on projects around your house. So there is low probablitity of getting in a risky or adventurous activities.

Risk Coverage of Natalie: Natalie has a group life and disability coverage sponsored by her employer. You have life coverage of 100 percent of your gross salary. You have short term and long term disability insurance coverage of 100 percent of your gross salary for first 90 days of disability and then 70 percent of your gross salary till 65 years of age. The insurance provides you with disability coverage under own occupation for 2 years of disability and then covers any occupation.

Risk coverage of Chris: You have health coverage sponsored by Natalie’s employer. You do not have life insurance or disability insurance.

Required coverage

Natalie is totally covered for all kinds risk in the event of any uncertain happening in her life. While Chris is under insured and should consider to cover for the life and disability. Since Chris is a truck driver, there is always a high degree of risk of disability if he unfortunately get into an accident.

| Probability | ||||

| High | Medium | Low | ||

|

Severity |

Critical | Chris –Death or Disability due to accident with 100 percent loss of income. | ||

| Material | Chris –Disability due to accident with partial loss of income. | |||

| Minor | Chris –Loss of income due to short term disability. | |||

Assumption for calculating required value of coverage are:

- In event of death of one spouse, 90 percent of current living expenses will continue.

- 90 years of life expectancy

Chris is earning $38,000 per annum so, he should consider buy a life and disability insurance up to the amount of 100 percent of lost income.

Available options

Term Life insurance:Term life insurance is well-suited to meet high, short-term protection needs for the lowest initial cost. It is the great option to be considered by a couple with young children and a mortgage because it is an affordable way to get the full coverage they need today. It providesextra security that gives scope at a settled rate of installments for a constrained timeframe for a fixed term that vary from 5 years to 30 years. Once the period of term insurance lapse, the annuitant has to pay higher rate of premiums compared to the earlier rate. The coverage under it can do a good job of meeting immediate needs and may provide the opportunity to later move or convert to permanent life insurance without providing proof of health.The protection does not assemble any money esteem. On the off chance that you live past the term of the protection, the scope closes and by and large neither you nor your recipient gets anything from the organization. Be that as it may, you may reestablish the term of the protection, yet your premiums will probably be much more prominent because of your expanded age. The measure of unadulterated protection scope, or passing advantage, continues as before over the term of the strategy. The benefits of Term life insurance comprises of:

- Amid the early years of a term arrangement, the premium will as a rule be essentially lower than for money esteem protection.

- It’s easy to get it and one of the simplest form of life insurance.

- It will be clear how much you’ll be paying and how much your beneficiary can expect. Also, its premiums are fixed and guaranteed not to change over time.

- It might be obtained to meet a particular money related commitment, for example, reimbursement of a credit.

- Numerous term arrangements can be changed over to money esteem life coverage if your protection needs change.

- It easy to claim the money advantage. Your assigned beneficiary will get an assessment free, single amount demise advantage. Furthermore, there are no premiums for your recipients to pay after your demise.

Whole Life insurance: The choice to buy Whole life insurance as opposed to Term life is an individual decision and relies on upon your accounts, age, and scope objectives. The main part of the basic leadership process with regards to picking between whole life and term is expense. Whole life strategies cost altogether more than term approaches for the same measure of scope. In spite of the fact that that cost is ensured to stay level, your principle concern ought to be with having satisfactory scope when you require it.

Similarity between Whole life and term life are as shown below:

- Just like term life coverage, recipients exist in an entire disaster protection strategy. They get the demise advantage upon the agreement holder’s passing.

- The most evident contrast, at any rate externally, is expense. Now and again, entire life coverage premiums are three to five times as much as term life premiums, at any rate at the onset. In any case, term disaster protection keeps going a “term”: a predefined period, typically 10 or 20 years, before the strategy lapses. The more youthful you are and the better wellbeing you are in, the lower the expense. At the point when the term is up, you can recharge the arrangement, for the most part at a much higher premium, and relying upon your age and wellbeing. The strategy is organized to last your whole life, and the length of you continue paying the premiums, the approach will be in power paying little heed to age and wellbeing.

- The premiums in entire life strategies go towards a money esteem and also a passing advantage – term life has only a demise advantage.

The key differences between the two are:

| Whole life policies | Term Life Policy | |

| Benefit | Living benefit, tax-sheltered cash account | No such benefit |

| Longevity | Level premium | Premium rises with period |

| Dividend | Dividends are paid | No dividends |

| Renewal | Needs to be renewed | For whole life |

| Income | Income can be used for retirement | Nothing |

Available options in market:

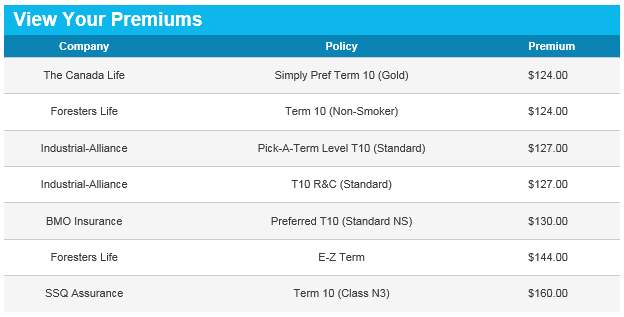

Based on your age, there are several insurance companies among which you can choose from. The amount of insurance is considered $100,000 for a term policy of 10 years. A comparison of premium offered by various companies is shown below:

Recommendation

The premium of the term policy will be lower in your case, but it needs to be renewed at the end of term. Since Chris is young, so it is better for him to get a term of 5 or 10 years and then consider whole life at the later stage of life.Term life insurance is well-suited to meet high, short-term protection needs for the lowest initial cost. It is the great option to be considered by a couple with young children and a mortgage because it is an affordable way to get the full coverage they need today

Investment Planning

Analyzing your current portfolio

An investment analysis is a glance back at past venture choices and the point of view of settling on the venture choice. Speculation objectives ought to dependably be considered while breaking down a venture; one size does not generally fit all, and most elevated returns paying little respect to hazard are not generally the objective. We have to pick a financing blend that minimizes the obstacle rate and matches the benefits being financed. Since our budgetary assets are limited, there is an obstacle that it meets your set money related objectives before being considered adequate.

It’s ideal to go out on a limb than excessively. The harm done by a solitary offer everything-at-a-business sector low event can far exceed the additional returns that a higher stock assignment ought to ordinarily accomplish.

In your case you have risk tolerance is more than average risk taking tendency. Your investment objective is to grow their portfolio so that they can meet their long-term financial goals. Key strength of Chris is his knowledge of the various investing option and their benefits is really an asset to administer your portfolio. Here is a quick look up how your portfolio is allocated:

Natalie’s portfolio is out-performing and is yielding a 14% return which is higher than expected.

The portfolio of Chris is not performing as required at the moment. His portfolio needs to be reviewed and regularly so as to ensure it meets the set target of 7%. Though, he has invested in equity portfolio there are significant chance of it to grow and yield a higher return.

Recommendation

Being a youthful financial specialist has its own arrangement of difficulties. On the off chance that you think about your venture choices as learning open doors, even misfortunes can be considered interests in your money related instruction. In the first place, figuring out how to profit is more imperative than really making it. Thus, to put a budgetary turn on a well-known axiom, show yourself to angle for the right stocks and you’ll encourage your financial balance until the end of time. There is an extensive variety of more hazardous interests in the share trading system, incorporating little organizations with high development potential or organizations amidst a turnaround. Taking a risk on one of these organizations can significantly enhance the profits you can win in the business sector.

Retirement Planning

Retirement Planning

Canadians are living longer and confronting a more prominent obligation today to support their retirement. Sparing and constructing a “retirement savings” for what’s to come is turning out to be more imperative. Notwithstanding, numerous Canadians are not sufficiently sparing to keep up their wanted way of life all through their retirement.

In retirement, numerous Canadians have a diminished wage since they are no more working. It’s vital to consider the amount you should resign serenely, whether you will be depending on a lessened salary, and whether that will be sufficient.

Since we’re living longer and our futures keep on increasing, our retirement reserve funds will be extended further. To help yourself get ready for an agreeable and practical retirement, you should arrange your retirement deliberately, and see how Canada’s retirement salary framework functions. It is vital to consider your alternatives. The prior you begin arranging, the more alternatives you will have.

With legitimate arranging, you can sufficiently spare for the way of life or way of life you need in retirement. As retirement arranging might be an entangled procedure, you might need to counsel a money related proficient who represents considerable authority in retirement arranging.

It is essential to investigate and get ready inquiries that you need replied before meeting. Record your budgetary objectives and ask how your monetary expert can help you accomplish them. To help you pick the privilege budgetary expert, see Working with a money related proficient.

Remember that while making arrangements for your retirement is a long haul duty, arrangements can change. For instance, you may wish to resign at a prior age than you initially arranged, or you may have changed employments and now acquire an alternate salary. Audit your retirement arrange yearly and after each huge occasion in your life to perceive how well you’re doing and consider whether you have to roll out any improvements

Retirement Goals

- Retire by the age of 55

- Maintain present lifestyle after retirement

- Save $60,000 for retirement (present value)

Analyzing RRSP investments

RRSP is a retirement investment funds arrange for that you set up, that we enroll, and to which you or your life partner or basic law accomplice contribute. Deductible RRSP commitments can be utilized to decrease your expense. Any pay you gain in the RRSP is normally excluded from expense the length of the assets stay in the arrangement; you for the most part need to pay charge when you get installments from the arrangement.

You can add to your RRSP until December 31st of the year you turn 71 years old or when you have accessible RRSP contribution room. You can add to your life partner’s RRSP until December 31st of the year that he or she turns 71 years old.

In the event that you are close retirement, you might be contemplating getting consistent wage from your RRSP. You for the most part have a specific measure of adaptability on the sorts of salary you can get. Contact your RRSP guarantor to discover what your alternatives are. At any age up to the end of the year you turn 71, you can pick one of the accompanying alternatives for your RRSPs. For more data, see RRSP alternatives when you turn 71. You can exchange your RRSP assets to an enrolled retirement salary reserve (RRIF). Beginning in the year after you build up a RRIF, you get a base sum every year utilizing a foreordained equation taking into account the estimation of the RRIF and your age. You may need to pay charge on the wage when you begin getting installments from the RRIF. Enter these installments as wage on your pay assessment and advantage return for the year you get them. For more data, see Transferring. You can utilize your RRSP assets to buy an annuity. You may have gotten recompense installments from a RRSP. A recompense installment is a settled or single amount installment from your RRSP annuity that is equivalent to the present estimation of all or a portion of your future annuity installments from the arrangement. Passing of a RRSP annuitant or a PRPP/SPP Member

In case of death, an individual may have a RRSP. The sum you incorporate into pay of the perished annuitant can differ contingent upon regardless of whether the RRSP has developed.

Available Contribution room:

| Income | *18% | Carry forward | P/A | Room | |

| Chris | $ 38,000.00 | $ 6,840.00 | $ 18,712.00 | – | $ 25,552.00 |

| Natalie | $ 64,000.00 | $ 11,520.00 | $ 15,970.00 | $ 8,837.00 | $ 18,653.00 |

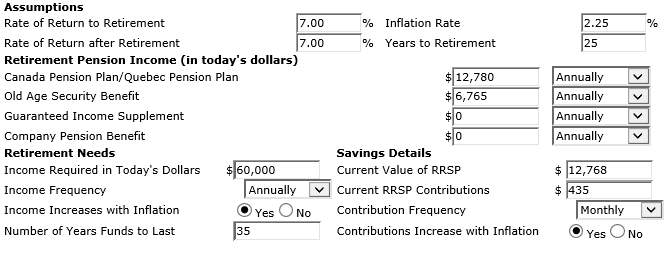

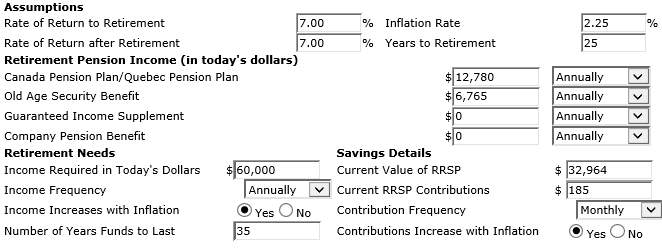

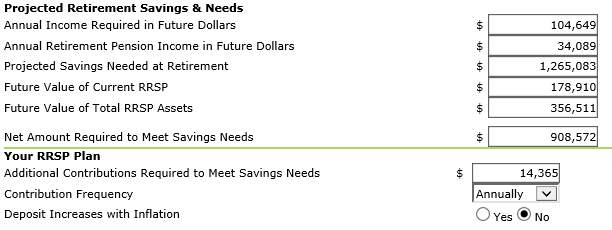

Natalie’s required RRSP:

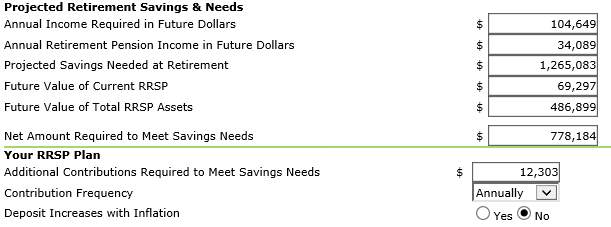

Chris RRSP contribution requirements:

Recommendation on RRSP

Using unused contribution room: There is an unused contribution room of $ 25,552 for Chris and $18,653 for Natalie. This room is a potential opportunity which will help you to save for your retirement and as save tax. You can deduct your RRSP contribution on your tax return in the year you make the contribution.

Natalie contribution to Spousal RRSP: RRSP contribution room for Chris is $25,552 which is enough where they can potentially save for retirement. Since earned income of Chris is in lower tax bracket, Natalie should make spousal RRSP contribution. This will help her save in the form of taxes because if she contribute for spousal RRSP she could claim deduction under spousal RRSP deduction.

Increase RRSP Contribution: In order to meet your retirement goal of maintaining current lifestyle you and ensure you have required funds at the time you require your need to increase your contribution to RRSP. In case of Natalie, she need to make additional contribution of $12,303 and Chris should consider addition contribution of $14,365 annually.

Consider to retire by 60: Since you had major financial expenses to bear, it will be recommended if you retire by 60 years of age. This help you to accumulate more funds for your retirement. You will could save majority of money earned during these years because by that time you would have paid of mortgage, you will not have any expenses to pay for your children or any other event. This extra fund will help you spend your retirement with leisure and keep you financial secure.

Estate Planning

Estate Planning offers various advantages to verging on each person, including control over how your property will be dispersed at death, naming gatekeepers for minor kids, assigning an individual delegate to direct your domain, naming specialists to settle on budgetary and social insurance choices for you in the occasion of your inadequacy and lessening or dispensing with home assessments forced at death.

You ought to decide how they expect to possess resources amid their marriage. In Canada, resources are attempted to be possessed similarly between wedded life partners paying little heed to the title, with constrained exemptions. Clearing up this issue while both life partners are living can maintain a strategic distance from unintended outcomes after the passing of a mate.

Recommendations

Naming Guardians for Minor Children if both you met an uncertain death. Having this issue determined by naming a guardian in their Wills can keep away from a battle among the perished couples’ families for care of surviving minor youngsters.

Passing on of Life coverage and retirement benefits might be the most profitable resources that numerous youthful couples own. Be that as it may, such resources pass consequently to the recipients who are named on the records. Such resources are not controlled by the expired companion’s Will. Subsequently, companions must audit the recipient assignments on such resources for ensure they go at death as proposed.

Making trusts for Young Children instead of leaving resources straightforwardly to their youngsters, youthful couples ought to consider leaving resources in trust for the advantage of their kids until a proper age. Life coverage and retirement arrangements ought to likewise name the trust for kids as recipient instead of minor kids. Youthful couples will likewise need to name a trustee to deal with the trust resources and make circulations to the kids for their requirements until the age set in the trust is come to by the youngsters. Youthful couples ought to be careful about naming a relative as trustee who has no experience taking care of monetary matters or who can’t say “no” to demands for cash made by the youngsters or their watchmen.

Incorporate Financial and Health Care Power of Attorney. A thorough home arrangement ought to likewise incorporate budgetary and social insurance forces of lawyer in which life partners name each other to settle on choices in the occasion one of them is alive yet crippled coincidentally or harm. Numerous wedded couples have the misinterpretation that they have legitimate power to settle on money related and restorative choices for each other. This is not valid. Indeed, even life partners need money related and human services forces of lawyer to maintain a strategic distance from court guardianship in the occasion of inadequacy.

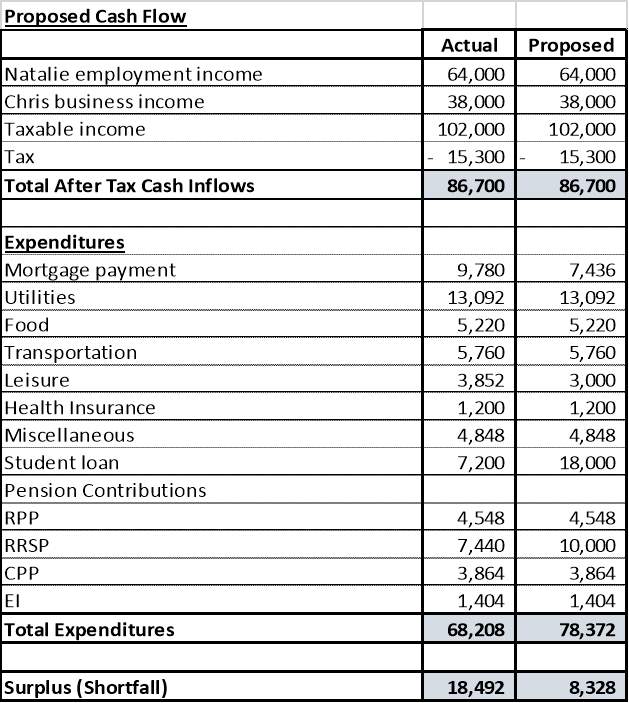

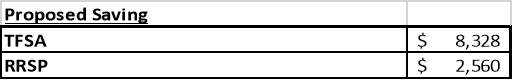

Budgeted cash flow for Natalie and Chris

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Finance"

Finance is a field of study involving matters of the management, and creation, of money and investments including the dynamics of assets and liabilities, under conditions of uncertainty and risk.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: