Retail Banking in Vietnam

Info: 5089 words (20 pages) Dissertation

Published: 9th Dec 2019

Executive summary

This report was commissioned to examine the role played by retail banking in developing banking services in Vietnam and its outstanding issues.

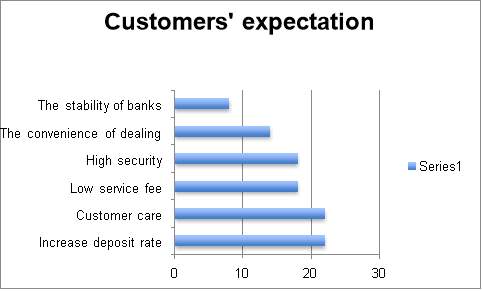

The research draws attention to the fact that retail banking has contributed significantly to the development of the national economy as well as the living condition of citizens is being improved apparently. After that, an online survey was made to identify and analyse customers’ expectation. 50 customers were asked, nearly 50% of respondents answered that they wanted banks to increase deposit rate and enhance the quality of customer care. Meanwhile, 3 other aspects of banks, which customers expect from, are high security, low service fee, and the convenience when dealing, in which their respective interest rates were 36%, 36%, and 28%. Further investigations reveal ethical conflicts faced by both retail banks and their customers. There were many cases of bank fraudulent, which was originated in asymmetric information. Asymmetric information is the situation when there is two parties do transaction with each other, but the volume of information that they know about each other is not balance. The serious consequence of asymmetric information is moral hazard. Another aspect of this report is problems caused by both customers and retail banking that could cause damage to both parties. From the customers’ side, they could be the problem of late payment or fake documents. Meanwhile, the problems caused by the banks are disclosing customers’ information, low security system, or misselling.

The report proposes some recommendations to help banks stop banking fraudulent.

- The government needs to improve the efficiency of the “Credit centre”.

- Banks need to improve the security system.

- Improving the capacity of employee and their professional ethics to prevent moral hazard.

Table of contents

Chapter 1: The role of retail banking within finance sector in Vietnam

1.1 Retail banking development has contributed significantly to the economic growth.

Chapter 2: Customers’ expectation of retail banks in the new era of globalisation

e) The convenience when dealing

Chapter3: Ethical conflict faced by both retail banks in providing services to their customers.

Chapter 4: Problem caused by differing objectives which face both the customers and a retail bank

4.1 Problems caused by the customer:

4.2 Problems caused by the bank:

Introduction

This report discusses the development of retail banking in recent years and demonstrates how it is influencing to the finance sector in Vietnam. The report also shows the expectation of customers from this new banking system and then, it helps to know more about the existed conflicts faced by both retail banks in providing services to their customers, thus the report can give some recommendations to solve the problem. The report is divided into four main parts:

- The role of retail banks within finance sector in Vietnam.

- Customers’ expectation of retail banks in the new era of globalisation.

- Ethical conflicts faced by both retail banks in providing services to their customers.

- Problems caused by both customers and banks.

Retail banking is banking services targeted at individual consumers rather than corporate clients. The main services of retail banking are savings, payment, consumer loans, credit cards, debit cards. In recent years, retail banking has been a key main focus which contributes a big part of the banking sector development. In this process, retail banking has to face many problems caused by both customers and banks such as the fraudulent of borrowing money or the security of customers’ information. Because of that problem, there are many aspects of retail banking need to improve to adapt to customers’ expectation.

Chapter 1: The role of retail banking within finance sector in Vietnam

Developing retail banking helps to accumulate capital for the economy and diversifies capital flows. Due to a considerable mobilisation amount of money from the stable source of idle savings in the population, commercial banks provide to households and small and medium enterprises (SMEs) to invest in the production business. From there, it can boost production and consumption, support economic growth, creates jobs. As a result, forms of capital mobilisation are more diversified and more flexible, such as interest rate savings, deposit savings, flexible principal (Nguyen Thu, 2016).

Taking an example to see how the development of retail banking affects the capital mobilisation: In 2016, according to a report released by the National Financial Supervisory Commission in October, mobilised capital from economic organisations and residents increased by 14.1%, compared with 8% in the same period last year. Another report form the State Bank of Vietnam stated that by the end of September, the mobilisation from the population grew by more than 17% while the economic organisations only grew by 10.65%. In fact, many banks focus on boosting the mobilization from the population (retail) rather than the business (wholesale). For people, this is still a safe and profitable investment channel (Ngoc and Nguyen Phuong, 2016).

- Retail banking helps accelerate the process of cash flow, promotes non-cash payments and saves costs.

The utility of retail banking is to attract individuals and households. Households and SMEs (Small and Medium-sized Enterprises) make payments through the modern banking system, speed up payment process, and increase capital rotation. Which leads to the strengthened circulation of the currency, at the same time reducing the amount of cash in circulation, promoting non-cash payments. As a result, it contributes to reducing social costs such as printing, storage, circulation and destruction (Nguyen Thu, 2016).

- Developed retail banking services can assist the Government and the State Bank of Vietnam (SBV) in avoiding money laundering as well as tax evasion.

Through the balance and transactions on the account, the Government and the SBV can control strictly the tax revenue and the internal resources of the population. Which means if they realise any suspicious transactions of any accounts, it is expected as a signal for the authority to investigate whether it is for a legal purpose or not.

- Retail banking are being a reliable and safe place where the citizens can save their money, their property.

Instead of keeping money at home, which faces a lot of risks, the people can deposit money at the bank, which brings them a lot of benefits such as the gain interest of deposit monthly, not be worried about safety. People also can use “Trust Services” provided by retail banks. Specifically, banks are acting as trustees, managing assets for deceased customers by declaring assets, preserving.

- Developing retail banking helps to improve the quality of life through capital loan activities are more diversified.

Nowadays, forms of loans are very diverse: loan for home and car buying, loans for studying abroad, financial proofs, employee loans and overdrafts. Expanding loans is very meaningful to customers. The demand for consumption of individuals and households is huge but they do not always have the financial resources to meet them. With diversified types of loans, customers are more likely to have access to more capital, access to the facilities, and use of the goods and services they desire before they accumulate enough money. As a result, people’s living condition is much more improved.

Chapter 2: Customers’ expectation of retail banks in the new era of globalisation

In order to do this part, an online survey was made to ask more than fifty people about what do they expect from the banks and other information.

Chart 1: Customers’ expectation

From the result above, we can see that the increases of deposit rate and customer care are the two most expected from the customers to the bank. About 22 respondents choose to increase deposit rate, reach 44% the total answer. To know more about why many respondents want to increase deposit rate, we can see these bar chart and table below.

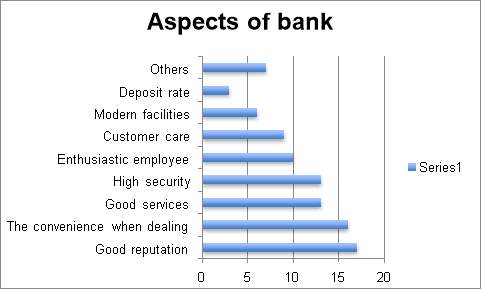

Chart 2: Aspects of bank that make customer choose to use service from that bank

The bar chart above is about which aspects make the customer choose the bank that they want to use. There are seventeen customers choose “good reputation’, followed by “the convenience when dealing” with sixteen chosen. Meanwhile, only 6% of respondents select “deposit rate”. That is the reason why so many people expect to increase the deposit rate. One thing worth noting is that the selection of reputable banks also affects customers’ expectation. This table below will demonstrate it.

Table 1: Banks’ interest rate in period of 6 months (The information is taken from banks’ websites)

| Bank | Number of selection | Interest rate (6 months) | ||||

| Vietcombank | 15 | 5.3% | ||||

| BIDV | 11 | 5.3% | ||||

| Vietinbank | 8 | 5.5% | ||||

| Techcombank | 5 | 5.05% | ||||

| VIB | 5 | 5.6% | ||||

| Military bank | 5 | 5.4% | ||||

| Agribank | 3 | 5.6% | ||||

| SHB | 1 | 6.5% | ||||

| Eximbank | 1 | 5.6% | ||||

| Sacombank | 1 | 6.0% | ||||

As we can see, Vietcombank, BIDV, Vietinbank are three most popular banks in Vietnam recently, which occupies the belief of many customers so that why three of them are most selected. But the interest rate of those banks is not high, even lower than many other banks such as SHB, Sacombank, Eximbank, VIB with the deposit rate are 6.5%, 6.0% and 5.6% respectively.

Besides 22 respondents choose to increase deposit rate as their expectation, there are also 22 respondents choose “customer care” is the aspect they want banks to improve. Customer care is the field that has not been paid much attention by the bank. Meanwhile, the customer always wants to own the highest level of care when they have to pay money to use service at the bank. That means many people still do not have the level of treatment as much as they deserved, so the majority of respondents want banks to improve this aspect.

The next aspect that respondents most want to improve is “low service fee”. When people use service at the bank, they have to pay many kinds of fee such as annual fee, withdraw money fee, transfer fee; which make them feel uncomfortable. According to statistics, an ATM card is subject to dozens of fees, from the issuing fee, annual fee, reissue fee, transfer fee, withdrawal fee, SMS banking. Sometimes their accounts are deducted some unclear amount of money.

After concerns about the “service fee”, customers want the security system of banks to improve. Many cases that the information of customers was stolen by hackers and brought a concern to customers. Their money was withdrawn from their ATM accounts without the control of customer and the banks also. For example, a customer in Hanoi was withdrawn 94 million in one night while he was sleeping. The reason was his information was stolen and the thief used that information with a fake card to withdraw the customer’s money (Nguyen, 2017). The security of customers’ information remains a big concern for the users and also the banks.

It is a very important aspect which banks should focus on enhancing it. The survey investigates the feeling of customers when they use some services from banks such as ATM, using services branches and transaction offices of banks.

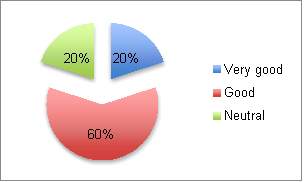

Chart 3: Assessment of convenient branch locations, the bank’s trading room

Chart 3: Assessment of convenient branch locations, the bank’s trading room

From the pie chart above, there are 60% of respondents mark good for this criteria, meanwhile, 27% clients think it is very good and 13% respondents feel neutral. At present, banks have transaction offices in the centre of densely populated areas, easy transportation and many passersby so that customers can save travel expenses. But besides that, the existing situation is that the branches and sub-branches are only concentrated in many places where there are many enterprises and universities due to high demand for payment at the above sites. In order to access branches or sub-branches in other places, people still have some inconveniences such as distance, low-density PGD, difficult to reach.

Chart 4: Assess the speed of transactions through ATM

An observation from the pie chart shows that most ATM customers are satisfied with this service in terms of transaction time. However, many ATMs are still experiencing technical difficulties that lead to time-consuming transaction or ATMs run out of cash, causing customers to remain incompletely satisfied with the transaction.

Chapter3: Ethical conflict faced by both retail banks in providing services to their customers.

There are a lot of bank frauds happening today causing huge damage to the economics. The table below summarises some cases.

| Bank | Case | Year | Amount |

| Ocean Bank | From November 2012, with the responsibility of the chairman of the board OceanBank, Mr Tham solved Pham Cong Danh hundreds of billions of VND even though Mr Danh is not eligible for loans. This act caused OceanBank suffer 350 billion loss. Ha Van Tham also had many fraudulent trading from 2010 to 2014, which lead to bad debts of OceanBank more than 14 billion VND (Hoang, 2016). | 2010-2014 | 1.600 billion VND |

| Vietinbank | In 2007, Huyen Nhu’s loan was over 200 billion VND. Since 2010, due to business losses, unable to pay debts, Huyen Nhu intended to appropriate money from customers, so she took the advantage of the authority of a head at a transaction office to mobilized capital and appropriated money (Hai, 2014). | 03/2010-09/2011 | 4.000 billion VND |

| MHB Bank | In November 2010, Huynh Nam Dung, the former chairman of MHB’s board, directed MHB’s internal audit team to conduct an audit at MHBS and discovered the business results of this unit in consecutive losses. Instead of correcting the business, Mr Dung continued applying wrong polic to steal money from the bank.

The policy of transferring the capital of the defendants caused MHB to lose the principal amount of 272 billion VND (Than, 2017). |

2010 | 300 billion VND |

| Sacombank | Ngan was the head of a transaction office of Sacombank. Taking the advantage of the trust of customers, he has been writing off debt.

On September 18, 2009, he withdrew VND2.8 billion and lied to the customer as the bank did not disburse. At this time, the customer borrowed money from outside to give Ngan with the hope he helps him to borrow 2.8 billion. After appropriating 4 billion, Ngan fled (Thuy and Khanh, 2016) |

2009 | 4 billion VND |

Table 2: Cases of bank fraudulent

We can notice that the forms of fraudulent trading through the bank increasingly sophisticated and almost instigators are the employee of banks. Most of the cases happen because of the main reason, which is “ asymmetric information”. It is the situation of unbalance information when a party has more information than another party in a transaction, which will result in “moral hazard”. When one party have the advantage of deep understanding about other parties, they can do wrong actions that bring benefits to themselves, not for other parties.

(The recommendation part will discuss the solution to solve these problems)

Chapter 4: Problem caused by differing objectives which face both the customers and a retail bank

There are many problems arisen from both customers side and the bank side.

4.1 Problems caused by the customer:

One of the biggest problem caused by customers is they run away from the debt. They borrow money from the bank and after that, they lost the capacity of paying the debt so they ran way or they try to postpone the payment process. It causes a huge damage for the bank, bad debt is usually erased from the payment account of the bank. Bad debt has negative impacts on the economy in general and banking system in particular. For commercial banks, bad debt will cause commercial banks to reduce the efficiency in using capital, reducing profits, risking cash flow, reducing the ability to pay for loans (Nguyen 2017).

Another conflict caused by customers is they may make a fake document to apply for the loan. Specifically, many businesses create some documents like business’ property or financial reports. There are many motivated entrepreneurs to hide the risk and amplify their company’s ability to make a profit. Businesses tend to create vague information to make difficult for banks as banks find out the real economic situation of the business.

4.2 Problems caused by the bank:

The biggest conflict between customers and banks which is caused by the banks is the security of customers’ information. Banks disclose customers’ information to a third party. For instance, when a customer comes to a bank to deposit money, the customer will have to fill in an information form. After that, the saving department will transfer this information to sale department and then, sale department will contact the customer to introduce ask them to buy credit card of the bank. A lot of customers feel annoyed when they receive some phone calls like that. The bank also can sell customers’ information to an estate organisation and contribute a part of making customers feel uncomfortable.

More seriously, the information of customers can be stolen by hackers and it causes many risks to customers. The security system of the bank still has many security holes which hackers can utilise it to steal important information of the customer and then appropriate the customer’s account.

The last problem is misselling. It happens when an employee of a bank, who intentionally misleading and misrepresenting a customer about the characteristics of a product or service (Investopedia, 2017). In an effort to buy a financial product to a potential customer, an employee could leave out a certain step in the process and not mention some favourable information to the customer.

Conclusion

With the continuous increase in the number, competition among commercial banks has become increasingly difficult and fierce. The development of retail banking has also become an indispensable trend, a common trend not only in Vietnam but around the world because retail banking has an influence on different aspects of the finance sector. Furthermore, retail services increasingly account for a significant proportion of the bank’s revenue and therefore the bank needs to capture and build on its strengths in the retail system with hight quality and professional service. It can maximise customer expectation, thereby enabling effective risk management while optimising the distribution channel, thereby optimising business performance.

Recommendation

This part will demonstrate more clear about the solution to avoid the situation of asymmetric information and its consequence.

- The government needs to improve the efficiency of the “Credit centre”, which is the organisation collecting customers’ information of whom has relations to any credit organisation. It can offer huge benefits to banks to know more about customers, it prevents banks from being cheated by customers, especially in term of lending money to customers (Pham et al., 2017).

- Banks need to improve the security system. The modern system should record every access of the employee to control the situation. In case of identifying any suspicious transactions, there will be a need of immediate inspection to stop the worst situation.

- It is necessary to improve the capacity of employee and their professional ethics to prevent moral hazard. Many cases happened because of a huge personal benefit that lures people to do wrong. It reflects the professional ethics of the employee are still low and need to be corrected.

(Word count: 2200)

Appendices

Survey question

Research form for commercial banks

Hello,

To serve for scientific research, we are looking forward to receiving your comments and evaluations on this survey.

| STT | Question | Answer |

| 1 | Do you have a bank account? | A. Yes

B. No |

| 2 | If not, why don’t you use a bank account?

(Can choose more than one answer) |

A. Uneccessary

B. Unconvience C. Unsafety |

| 3 | Which bank are you using service from? | |

| 4 | Which aspects make you choose that bank?

(Can choose more than one answer) |

A.Good reputation

B. Good services C. Safety D. High interest rate E. The convenient dealing F. Modern facilities G. Enthusiastic employee H. Good customer care |

| 5 | What kind of service are you using? | A.Saving money

B.ATM C.Internet Banking D.Credit card E.Debit card |

| 6 | Evaluate your satisfaction when you use the service at the transaction office, at the bank. | 1-5

1.Very unsatisfied 5.Very satisfied |

| 7 | Evaluate the convenience of the location of the branch or transaction office of the bank. | A.Very good

B.Good C.Neutral D.Bad E.Very bad |

| 8 | Assess your satisfaction when you use the service through ATM. | 1-5

1.Very unsatisfied 5.Very satisfied |

| 9 | Evaluate the speed of transactions through ATM. | A.Very good

B.Good C.Neutral D.Bad |

| 10 | Assess the safety of the ATM. | A.Very good

B.Good C.Neutral D.Bad |

| 11 | What is your expectations? (Choose more than one answer). | A. Increase deposit rate

B. The stability of banks C. Better customer service D. The convenience when dealing E. High security F. Low service fee |

Research form for commercial ban

Thanks for your help.

- Hai, D. (2014). Huyền Như nhận án chung thân, Vietinbank không phải bồi thường – VnExpress. [online] Tin nhanh VnExpress. Available at: http://vnexpress.net/tin-tuc/phap-luat/huyen-nhu-nhan-an-chung-than-vietinbank-khong-phai-boi-thuong-2945511.html [Accessed 13 Jun. 2017].

- Hoang, T. (2016). Đề nghị truy tố cựu chủ tịch OceanBank Hà Văn Thắm – Tuổi Trẻ Online. [online] Tuổi Trẻ Online. Available at: http://tuoitre.vn/tin/phap-luat/20161006/de-nghi-truy-to-cuu-chu-tich-oceanbank-ha-van-tham/1183831.html [Accessed 12 Jun. 2017].

- Investopedia. (2017). Misselling. [online] Available at: http://www.investopedia.com/terms/m/misselling.asp [Accessed 27 Jun. 2017].

- Ngoc, H. and Nguyen Phuong, N. (2016). Cuộc đua huy động vốn của các ngân hàng | Tài chính – Ngân hàng. [online] http://enternews.vn/. Available at: http://enternews.vn/cuoc-dua-huy-dong-von-cua-cac-ngan-hang-103929.html [Accessed 6 Jun. 2017].

- Nguyen Thu, G. (2016). Ý nghĩa kinh tế – xã hội của phát triển dịch vụ ngân hàng bán lẻ trong hội nhập. Tài Chính, [online] 1(7). Available at: http://tapchitaichinh.vn/tai-chinh-kinh-doanh/tai-chinh-doanh-nghiep/y-nghia-kinh-te-xa-hoi-cua-phat-trien-dich-vu-ngan-hang-ban-le-trong-hoi-nhap-88492.html [Accessed 6 Jun. 2017].

- Nguyen, H. (2017). Bị rút tiền trong thẻ ATM tại nơi cách cả nghìn cây số. [online] VietNamNet. Available at: http://vietnamnet.vn/vn/kinh-doanh/tai-chinh/bi-rut-tien-trong-the-atm-tai-noi-cach-ca-nghin-cay-so-369947.html [Accessed 8 Jun. 2017].

- Nguyen, H. (2017). Một số giải pháp xử lý nợ xấu trong hệ thống ngân hàng thương mại tại Việt Nam. Tạp chí Dân chủ và Pháp luật, [online] 6(302). Available at: http://tcdcpl.moj.gov.vn/qt/tintuc/Pages/phap-luat-kinh-te.aspx?ItemID=151 [Accessed 18 Jun. 2017].

- Pham, T., Tran, T., Nguyen, T., Nguyen, T., Cao, T. and Phan, T. (2017). Đề tài Thông tin bất cân xứng (asymmetric information) – Luận văn, đồ án, luan van, do an. [online] Doan.edu.vn. Available at: http://doan.edu.vn/do-an/de-tai-thong-tin-bat-can-xung-asymmetric-information-13181/ [Accessed 27 Jun. 2017].

- Than, H. (2017). Nhóm lãnh đạo Ngân hàng MHB gây thiệt hại gần 300 tỉ – Tuổi Trẻ Online. [online] Tuổi Trẻ Online. Available at: http://tuoitre.vn/tin/phap-luat/20170207/nhom-lanh-dao-ngan-hang-mhb-gay-thiet-hai-gan-300-ti/1260805.html [Accessed 13 Jun. 2017].

- Thuy, V. and Khanh, T. (2016). Trưởng phòng ngân hàng làm khống giấy tờ chiếm gần 3 tỷ – Zing. [online] News.zing.vn. Available at: http://news.zing.vn/truong-phong-ngan-hang-lam-khong-giay-to-chiem-gan-3-ty-post684214.html [Accessed 13 Jun. 2017].

- Vietbao.vn. (2017). Lãi suất tiết kiệm ngân hàng. [online] Available at: http://vietbao.vn/vn/lai-suat-tiet-kiem/ [Accessed 27 Jun. 2017].

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Banking"

Banking can be defined as the business of a bank or someone employed in the banking industry. Used in a non-business sense, banking generally means carrying out activities related to the management of one’s bank accounts or finances.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: