Primark International Expansion Opportunity Analysis

Info: 7634 words (31 pages) Dissertation

Published: 20th Aug 2021

Tagged: International BusinessPESTLE

Summary

The purpose of this project is to analyse the opportunity and limitations of an already recognised company such as Primark to establish their business in a brand new market in Eastern Europe, Poland.

The project is organised in three main sections; first an introduction to the focused company is performed followed by a PESTLE analysis of the evaluated market. Secondly, we assess the current fashion retail market in Poland using the five forces framework. Finally a set of conclusions are drawn to define a market entry strategy.

By the end of this assessment, the reader will be able to understand the sort of challenges and analysis companies have to perform when evaluating to do business in a foreign country within an international and globalised world.

Introduction

Primark opened its first fashion retail store in Dublin in 1969 under the name Penneys and today operates in over 350 stores in eleven countries across Europe and America. Primark is widely established as the destination store for keeping up with the latest fashion looks without breaking the bank. Primark’s mission is to offer a diverse range of products, stocking everything from baby and kids, to women’s and men’s clothing, homeware, accessories, beauty products and confectionery. Primark is owned by its parent company Associated British Foods plc. For further information about the company please refer to

According to GlobalData, “Primark has grown faster than any of the top 10 clothing companies in the past five years. The fashion division is growing at a respectable rate, and the strong performance is all the more impressive when you take into account how its competitors are doing. Next described 2017 as the ‘toughest in 25 years’ after it posted a second consecutive annual loss. H&M went down the route of deep discounts in order to entice shoppers, and it resulted in a 44% drop in first-quarter profit. Zara owner, Inditex, saw profits rise, but at a slower pace. British consumers are being squeezed as inflation continues to outpace the earnings growth rate, but Primark is holding up well”.

The core business strategy is to continually increase and maximise its retail space across all stores this is achieved through upgrading existing stores and through the opening of new stores in new markets, as Primark extends its global presence it results in increased profit volumes. Currently Primark are considering entry to the Polish market

Primark’s adjusted operating profit

As a result of its business strategy Primark’s adjusted operating profit is on an upward trend, analysing the data from the financial year ending September 2008 to the financial year ending September 2017 adjusted operating profit was calculated to be 735 million British pounds. Over this ten year period Primark has increased its operating profit year on year from GBP 233 million to GBP 735 million an increase of 68%.

Primark within the Global Market Context

Globalisation in markets is a highly disruptive force driven in the main by international economies becoming more integrated with a shift towards a single market and global economic system. In their book Richard Dobbs et al state that the “the world economy’s operating system is being rewritten, its authors explain the trends reshaping the world and why leaders must adjust to a new reality”.

To harness the power of these market trends business leaders must formulate appropriate strategies to both counter the negative effects and to also take advantage of the opportunities which these “distributive” forces offer. There are three keys to entering and competing successfully in a global market context. 1. Start with a strategy, 2.Understand the Culture and 3. Identify its Competitive edge.

According to KPMG “Consumer demand for richer experiences and greater convenience means that retailers need to rethink their strategy, both online and in stores. Having the right product mix is no longer sufficient to attract the new wave of consumers including Millennials, who are entirely focused on one transaction.

Primark operates in a highly competitive and global “Fast Retail Fashion industry”, this term refers to the concept where retail operators produce inexpensive designs and which move rapidly from design stage to store availability. This fast fashion trend is challenging the old order where retailers only needed to have new product lines in store on a seasonal basis. Fast fashion retailers now bring multiple designs into their stores each week to ensure that they stay on trend and where possible be a ahead of the competitive product offerings

Primark’s competitors in this space include Spanish chain Zara, H&M of Sweden, GAP and Forever 21 of the United States and Topshop of England.

As Gasper et al put it “Emerging market economies are implementing more open trade and free market policies to compete with everyone from everywhere for everything” – Gasper, Bierman & Kolari: Introduction to Global Business 2014.

For Primark there are two specific global market contexts which need to be considered:

1-Technological Advances – e-commerce and online shopping

E-commerce and technological development has emerged as the single biggest globalisation factor, Baldwin advises that “ because the third and most disruptive phase is still to come. Technology will bring globalization to the people-centric service sector, upending far more jobs in rich countries than the decline in manufacturing has in recent decades”. (The great Convergence Information Technology and the new globalisation Richard Baldwin).

E-commerce poses a considerable threat to established high street retail businesses. Consumers now have access to multiple handheld devices and technology and they can shop 24/7 without the need to leave their homes or offices, this is in contrast to bricks and mortar stores whose trading availability is limited to between 9am and 5pm.

The entry of Amazon and Alibaba and their evolution as giant e-tailers has had a disruptive effect across all business sectors and in particular the retail sector. The term “Amazon Effect” has been given to describe the effect Amazon are having on established traditional high street retail business models.

In the US the Amazon affect is having both a positive and a negative effect on the jobs market, for March 2018 jobs data showed an increase in the number of jobs created. For warehousing and storage jobs there was an increase of 2,500 jobs and for the non-store retail it added 4,300 positions. On the negative side the retail sector continues to hemorrhage positions — department stores slashed 7,900 jobs, and clothing stores cut 7,300 jobs.

As fashion retail selling is a people based and experiential transaction, in this regard the single biggest challenge for bricks and mortar retailers is to align its product offerings with its customers’ requirements. The challenge for Primark is to create great positive experiences in both their online and offline market presence.

Primark engage with their customers using elements of omni channel marketing, this method of marketing offers a seamless customer experience through whatever channel the customer engages with the retailer, it is the mix of customer experiences gained through the companies physical stores, the corporate website, mobile phone apps, or through social media platform.

Primark currently delivers a successful customer engagement strategy blending both the online and offline customer experiences. The two key elements of this strategy include Social Media Fashion Blogging, and also the customer experience which Primark delivers in its stores. It is the physical store layout which includes the store garment displays, the audio/visual/Wi-Fi interaction, its cafes and the in store customer service.

Proof of Primark’s offline success can be found in its UK operation which has bucked the trend in clothing and footwear sales growth. It has been growing its offline sales volumes by winning market share from its competition e.g. New Look and H&M. This success is being attributed to two factors – Primark produces a better product range and it is also capitalising on the general trend for ‘trading down’ amongst UK shoppers.

Primark’s e-commerce Challenge

To counter the competitive threat posed by Amazon, (and others) Primark need to consider implementing a fully online e-tailing customer experience. This would combine and fit well with its existing and successful social media customer engagement strategy. The key decision for its near future business planning is for Primark to review its plans to continue with the expansion of its bricks and mortar stores at the current rate or to blend this strategy with a fully online e-tailing operation.

The Boston Consulting Group in its annual study of total shareholder return 2017 issued a number of guidelines for retail businesses, the message for retail leadership teams was clear: “they will need to up their game if they are to continue attracting capital. This is particularly true for retailers in segments facing renewed attack from Amazon: grocery, drugstores, and office products, to name a few. To compete against the online giant, they will need to improve their value proposition, the customer experience, and their internal operations”. For further details of this study please refer to the following link.

2-Logistics and the retail supply chain

How consumers behave and what they demand has changed. The willingness to wait to be satisfied or served has reduced and we as consumers expect instant product availability. For this reason it is crucial that Primark implements and continually reviews its logistics operations to ensure that they are optimised and that its products arrive at the right place and at the right time to satisfy its customers’ demands.

Primark leverages its supplier and logistics relationships using lean business, and logistics models. The average lead time from the design of a garment to in shop and “on the rail” is six weeks. Buying and merchandising team’s source and buy fashion items that best reflect each season’s key fashion trends. Primark’s range includes womenswear, lingerie, childrenswear, menswear, footwear, accessories, hosiery, beauty and homeware. Primark sources its garments from suppliers in Asia and the Far East placing high volume orders which result in economies of scale.

Primark has full control of its logistics operation and it has opened a number of hub logistics centres across Europe, the management of these hubs has been outsourced to DHL. Primark’s German hub located at Monchengladbach is 40,000 sq. meters and has 37,000 pallet spaces, it is designed to transport 16 million shipments annually.

Primark Logistics challenge

As Primark deploy its business strategy of opening new stores across Europe this places additional demand on its existing logistics operations. Primark/DHL have designed its logistics hubs so that they the can support this increased demand. For the new stores opening in the Polish market and to optimise its logistics costs Primark can successfully scale up the operation of the Mönchengladbach logistics hub in Germany.

PESTLE ANALYSIS

Political Factors

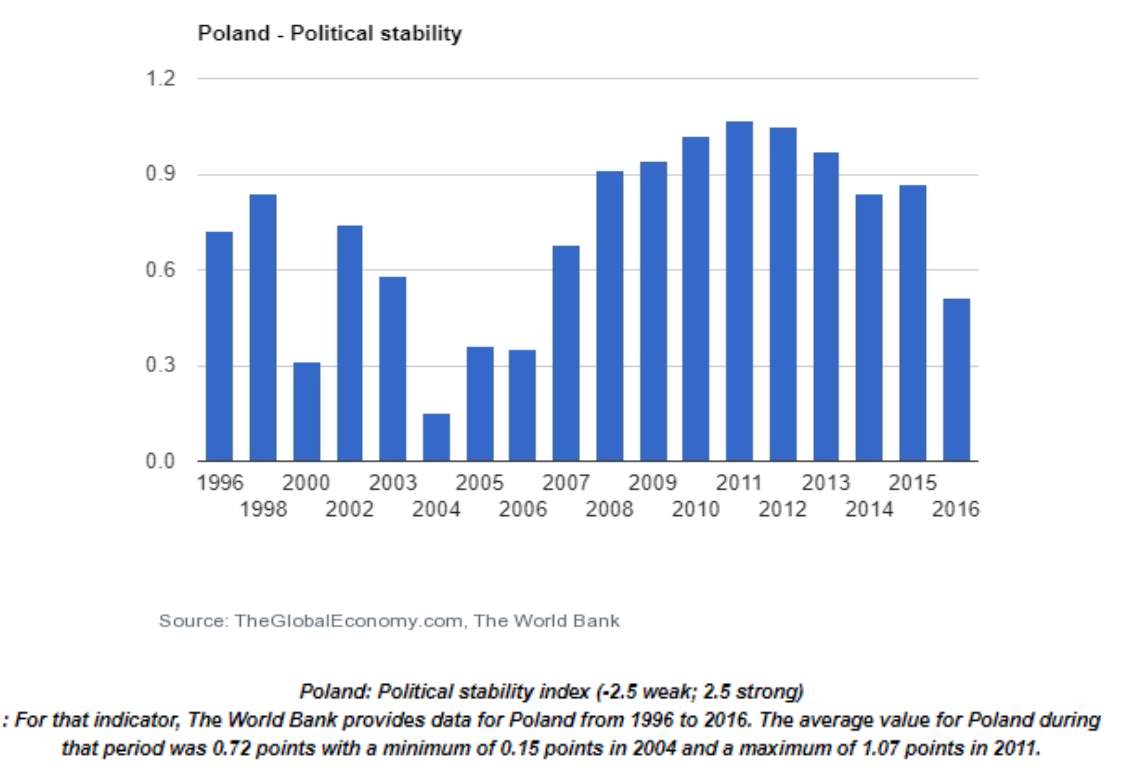

In the political landscape, Poland has become a stable democracy since the fall of communism in the country and has made significant progress in terms of safeguarding human rights and protecting minorities. Following this political transformation, Poland adopted a new constitution and established a mixed presidential-parliamentary system of government similar to France. This brought political stability to the country that increased their GDP significantly over the last decade. Below you will find a graph depicting the political stability in the country for the 20 year period of time between 1996 and 2016:

Poland is a representative democracy, with the president as the Head of State with the government centered on the cabinet.

The current political party governing the country, Law and Justice (Pis) (Prawo i Sprawiedliwość) is a fairly new political party established in 2001 with skeptik ideals about liberal economy. After the last elections in 2015, the conservative Law and Justice (PiS) party has managed to control the two Houses of Parliament for the first time since the fall of communism. This opens the possibility to pass their laws and establish their policies in a seamless manner without having to negotiate much on their position.

Their focuses are mainly on domestic problems that Poland has, such as reducing the retirement age, supporting the national industries, in increasing social freedoms.

Most recently, Law and Justice has received criticism for wanting to undermine democracy by trying to weaken the judiciary and by trying to silence the media. Ideals and policies of this kind contributed to a decrease in political stability and uncertainty for foreign companies to make business in Poland.

In regards to social issues this party is conservative. However their economic policies have turned to the left creating some barriers to market entry. Poland is currently not keen to join the Eurozone and prefers to hold to their currency as it has proved its value after the recession.

Economic factors

Economic Growth

Over the last 27 years, Poland’s economy has grown so fast that it was able to catch up with the economic prosperity of other European countries. This growth allowed that the gap between Poland and the richest countries to be reduced significantly.

Additionally, Poland’s membership to the EU helped in providing employment and structural funds to boost this growth significantly.

Poland was one of the few EU countries that managed to avoid recession in 2009, with the economy registering growth of 1.60% due to strong economic policies, robust domestic demand, and a flexible currency.

The annual GDP growth rate in Poland averaged 4.13% from 1995 to 2017. The strongest expansion of the last six years was in 2017 with an annual GDP growth of 4.6%. According to The European Commission it is expected that the GDP growth is forecast to remain strong at 4.2% in 2018 and 3.6% in 2019.

Finally, Poland was the first ex-communist country to quickly adopt privatisation and liberalization of their economy. The government has successfully privatised most of the small to medium deficitiary state-owned companies and promoted direct investment from foreign countries.

Amongst Poland’s main export partners you will find Germany, UK, Czech Republic, France, Italy, the Netherlands and Russia. Their main exports are machinery and transportation equipment, semi-elaborated goods, food and livestock.

GDP composition

The services sector is the largest sector in Polish economy. Generating 64% of the GDP is followed by manufacturing and agriculture with 33.3% and 3.6% contribution respectively.

Machine building, iron and steel, coal mining, shipbuilding, food processing and textile manufacturing are amongst the biggest industries in the country.

Being a member of the EU, NATO and the OECD, Poland becomes a reliable and solid partner for international business. The large influence of direct foreign capital demonstrates the economic attractiveness of the country. Its location makes it very convenient for investments, located in the center of Europe, at the intersection of main communication routes it is really a bridge between the Western and Eastern Europe. Poland creates a friendly climate for investors and offers clear tax and legal rules. This is confirmed by the World Bank Group in the “Doing Business 2018” report, in which Poland was classified at the 27. Position when it comes to “Ease of doing business”.

Inflation rate

The inflation Rate in Poland averaged 8.61% from 1992 until 2018, reaching an all time high of 46.50% in April of 1992 and a record low of -1.60% in February of 2015.

During 2017 inflation was 1.9% and although it is believed that it will remain stable by the end of 2018, a moderate rise is expected in the next few years.

Currency and Exchange rates

Poland is not part of the Eurozone. Their national currency is the Polish zloty (PNL), which curiously translates as ‘gold’. According to Narodowy Bank Polski at 2018-03-15 the exchange rate is 1 EUR = 4.21627PLN.

Interest Rates

The interest rate reference have been set at 1.5% in March 7th of 2018 – same as for the last three years – by the National Bank of Poland. This was a widely expected outcome along with the stability of the Lombard rate and the deposit rate at 2.5% and 0.5%, respectively. Lastly, the rediscount rate remained unchanged at 1.75%.

The interest rate in Poland averages 7.04% from 1998 to current time. It’s maximum historic was 24% back in March 1998 and the minimum historic happened in March 2015 at 1.5%, a prosperous year for Polish economy.

Interest rates remain unchanged. The Monetary Policy Council does not predict any increases in the following months.

Tax and duties

Poland is an attractive option for business in the region, thanks to its location, its market size and to its openness towards foreign investments regardless the most recent political changes.

The country offers foreign investors the same treatment as domestic investors except for a few exceptions. Various activities and businesses can benefit from special financing and incentives such as the EU financing.

Additionally, Special Economic Zones have been created where business activities can benefit for preferential treatments if they decide to establish in the zone.

The value of the Corporate Income Tax in Poland is 19% however companies established in any designated Special Economic Zone are exempt from this tax.

Unemployment Trends

Back in 2013 the unemployment rate in Poland was 10.3%, and has fallen to 5.1% in 2017 being the lowest level in 26 years

Minimum wage

It is expected that by 2018 the minimum wage in Poland will reach PLN 2,100 (EUR 493) gross per month. According to the Polish Central Bureau of Statistics, 1.4 million people earn the minimum wage.

Poland Retail Market

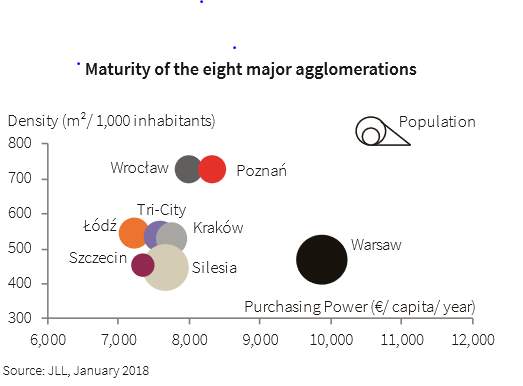

In recent years there has been great growth in the retail sector in Poland, the construction of the largest shopping centers in the country to be able to house domestic and foreign retails companies has grown so much that at this time in Poland there are 408 shopping centers, which account for nearly 9.8 million m². The cities of Wroclaw and Poznan are the most saturated retail cities of the main Polish agglomerations, with shopping center densities of 729 m² and 727 m² per 1,000 inhabitants, respectively. Warsaw residents have the highest purchases power: € 10,929 per capita per year.

Figure 1.1 Poland Retail Market JJL 2017

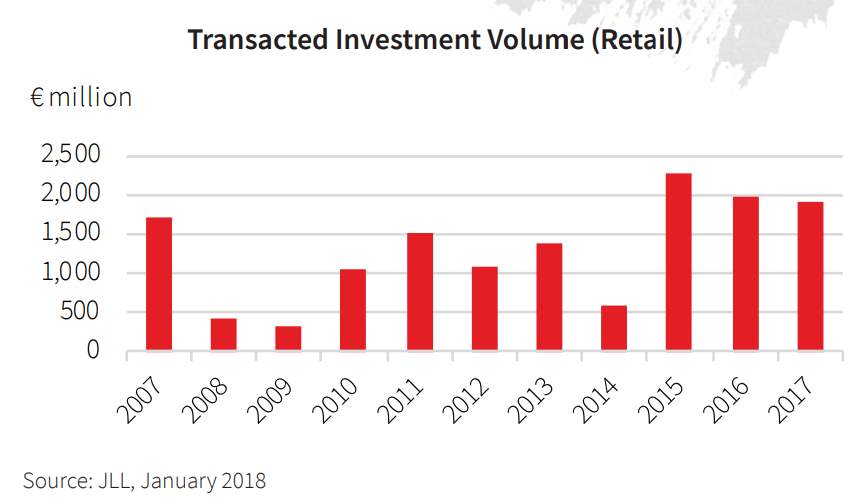

In 2017 there have been transactions for more than € 1.93 billion in deals completed in this sector, and it is expected that by 2018 these investments will remain active.

Social Factor

Socio-cultural environment

Poland has a rich history that can be traced for hundreds of years, its culture is unique and diverse. Because of its location, in the center of Europe sharing borders with Germany, Czech Republic, Slovakia, Ukraine, Lithuania, Russia and Belarus, it has always been found in conflictive situations that have marked in some way the Polish culture.

At 38.123 million in 2018, the population of Poland is one of the largest in Europe. However, in recent years population growth has stagnated and the country has been affected by the fall in the birth rate.

When it comes to the social structure, for the Poles the family is at the center of everything and family obligations will always be ahead. Poles tend to make a clear difference between people who belong to their family circle and those who do not belong.

With regard to the culture of business in Poland is formal. Poles are usually reserved but their style of communication is always direct; the eye contact must be maintained all the time, the Poles see it as a sign of respect and trust. They usually say what they think and address the issues directly. Trust and honesty are highly valued by this culture, and for them the rules and regulations must be respected. They have a good hard working ethic.

The official language in Poland is Polish, 98% of Poles speak the official language, the remaining 2% speak languages including German, Ukrainian and Belarusian. English is the most common foreign language spoken in Poland.

When it comes to religion, it plays a very important role in society and a bigger part in Polish culture. In the last census that occurred in 2011, 92.2% of the population was Roman Catholic.

Although great progress has been made in recent years with respect to the diversity of the workforce, much remains to be improved in these aspects. For instance, Polish women have made great strides in recent years and can be found in any area of commerce and industry, but most of the managerial positions in the polish industry are occupied by men.

Consumer Profile

Some discrepancies are observed for salaries based on the region and sector of employment in Poland. These discrepancies are the largest present in the EU.

Consumer behaviour depends directly on the income level which is lower in rural areas.

During the last decade, the middle class increased in numbers with their income levels closer to the European average salary. This contributed to consumer spending and it expected to continue growing in the next few years.

| Household expenditure by purpose in the EU, 2015 | Poland | EU Average |

| Food | 15,3 % | 11,1 % |

| Alcoholic beverages and tobacco | 6 % | 3,9 % |

| Clothing and footwear | 5 % | 4,9 % |

| Housing costs | 21,5 % | 24,7 % |

| Furnishing and household | 5,3 % | 5,4 % |

| Purchase of Vehicles | 3,4 % | 3,6 % |

| Fuel and maintenance of personal Transport | 7,3% | 6,4 % |

| Transport services | 1,6% | 2,8 % |

| Communications | 2,4% | 2,5 % |

| Restaurants and cafes | 2,4% | 6,8 % |

| Hotels | 0,7% | 1,6 % |

| Insurance | 1,6% | 2,5 % |

Fashion Industry in Poland

Until the fall of communism, Poland was closed for any development in the fashion sector, which led to low activity in this field and only wealthy people had access to western trends in fashion.

In the 90s, Polish people began to have more contact with their neighboring countries, and from that point in onwards the fashion industry and consume has grown exponentially.

In the past 30 years, many fashion brands have been created in Poland, and many of them manufacture in the country.

The Polish clothes and footwear market has years of growth ahead and the Revenue is expected to show an annual growth rate of 9.1 % between 2018-2022 resulting in a market volume of € 3,230 million in 2022.

With a population of almost 40 million people, Poland is a highly attractive market. Foreign fashion groups like the Spanish based INDITEX and the Swedish based H&M are very successful in this market.

Porter’s five forces analysis

Competitive Rivalry

In the sector of fast fashion and low cost, Primark will face up heavy-weight competitors already installed in Poland for many years. These are INDITEX with their subsidiary brands (Zara, Bershka, Stradivarius, etc.), C&A, Forever 21, H&M, and also against the major Polish retailer, Reserve being these last two, the biggest retailers in Poland.

Primark’s main competitors are internationally recognized brands with no barriers to market their products. Currently these competitors have large surfaces, equal to Primark or even larger.

Although Primark has competitive prices, it will have to compete not only in quality and design of its products but also in prices that it is already currently doing in other European markets.

The first store opened by H&M in Poland was in 2003. Today this brand has 177 stores in the country.

Reserve is the local competitor being the oldest company, flagship brand of LPP, with the first stores opened in 1999. Since 2002, Reserve clothing has been available in countries of Central and Eastern Europe. Since 2014 also in Germany and Croatia, and starting in 2015, the Middle East.

The brand offers clothing for women, men and children with the latest models being delivered to the stores every day. Currently there are more than 700 Reserve stores in Poland.

Strengths and Weaknesses of the two major competitors:

- Strengths: their major strength is that all of their products can be purchased online and their market target is much wider in range than Primark’s which market target is usually less than 35 years old.

- Weaknesses: their prices are slightly higher than those from Primark.

Threat of new entry

The most significant barriers or limitations for entering the Polish market are:

- large capital investment,

- Economies of scale.

- Primark should have an effective distribution of products, identify locations strategically for the opening of stores, and get information about the tastes of consumers in time to give answer to them.

Threat of Substitutes Products

As we have already mentioned, Primark will have many competitors in their market, and this brings a very high threat when finding substitute products. In this sector, brands compete mainly to improve quality and focusing in prices and not in the differentiation of their products. As a result of this, we can conclude that the substitution threat is high.

Buyer Power

The offer is sufficient to satisfy the consumer demands. Customers will not doubt in changing to a competitor because of price difference. They are usually not ‘loyal’ in this type of market where the best price is mostly sought.

It must be borne in mind that the average wage in Poland is still low compared to other countries of the European Union, therefore prices should be kept as low as possible as consumers cannot afford spending too much on fashion.

Supplier Power

There is a large number of suppliers. Currently, Primark works with more than 700 different suppliers, most of them come from underdeveloped countries such as Morocco, Bangladesh and India. Most of the factories that produce their products also work for other retailers, most of them are competitors. Therefore, the negotiation’s power of suppliers in the fast fashion sector is low due to the large number existing.

Cultural (Individual) Profile of Poland

The cultural dimensions of the Polish target market has been analysed using the Hofstede six dimensional framework model, developed by Professor Geert Hofstede it applies a six-dimensional measure of cultural values and it is used to define a countries culture – as Hofstead explains it is “the collective programming of the mind distinguishing the members of one group (country) or category of people from others”.

For an overview and description of the Hofstede model please refer to this web link.

Having gathered and analysed the relevant data we ac advise the following characteristics of the cultural drivers of the Polish population,

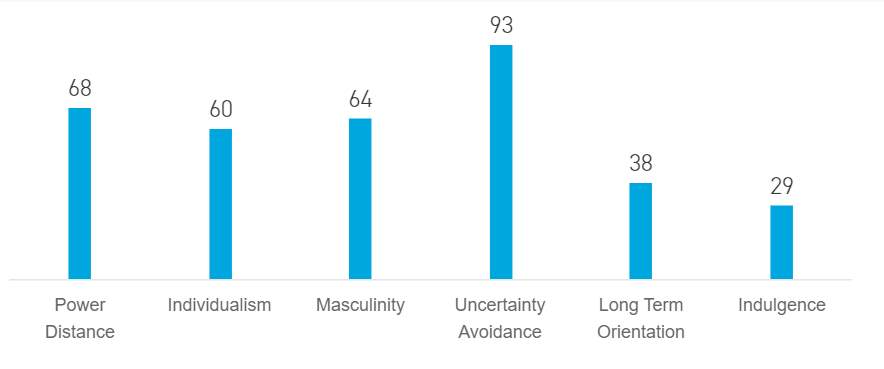

Fig: 1 Hofstede’s Polish culture table through the lens of the 6-D Model©.

Source Hofstede Poland

Applying the Hofstede theory and framework to the Polish market the above table and the following are the findings of the research, rated from 1-100% for each of the six dimensional indicators.

Power Distance: At a score of 68, Poland is a hierarchical society.

Individualism: Poland, with a score of 60 is an Individualist society. This means there is a high preference for a loosely-knit social framework in which individuals are expected to take care of themselves and their immediate families only.

Masculinity: Poland scores 64 on this dimension and is thus a Masculine society. In Masculine countries people “live in order to work”, managers are expected to be decisive and assertive, the emphasis is on equity, competition and performance and conflicts are resolved by fighting them out.

Uncertainty: Poland scores 93 on this dimension and thus has a very high preference for avoiding uncertainty. Countries exhibiting high Uncertainty Avoidance maintain rigid codes of belief and behaviour and are intolerant of unorthodox behaviour and ideas.

Long Term Orientation: Poland’s low score of 38 in this dimension means that it is more normative than pragmatic. People in such societies have a strong concern with establishing the absolute Truth; they are normative in their thinking. They exhibit great respect for traditions, a relatively small propensity to save for the future, and a focus on achieving quick results.

Indulgence: With a low score of 29, Polish culture is one of Restraint. Societies with a low score on this dimension have a tendency to cynicism and pessimism. Also, in contrast to Indulgent societies, restrained societies do not put much emphasis on leisure time and control the gratification of their desires. People with this orientation have the perception that their actions are restrained by social norms and feel that indulging themselves is somewhat wrong.

The above data has been referenced from Hofstead Country Insights, for a detailed breakdown of the individual analysis please refer to this web link Hofstede Poland It should be noted that additional cultural dimensional research can be carried out using al Trompenaars methodology this uses a seven dimensional comparative model see below web link for detail.

Cultural Customer and Employee Relationships

Analysing the Polish target market to determine the cultural drivers underpinning customer relationships we note that on Hofstede’s Uncertainty Avoidance Index, Poland scores a very high 93 on this dimension.

Because Poland scores high on this dimension retailers operating in the Polish market need to place a high focus on the clarity of the information which they present to their customers as “the quality of information presented to the customer may be critical to perceptions of usefulness, satisfaction, and ultimately consumer loyalty” (Karahanna et al. 2013).

Interpreting these results and applying it in the context of Primark’s entry to this market they will need to create customer communications strategy which is clear in its message and which touches on the above needs of the Polish consumer.

The British council have issued guidelines for Polish “Intercultural Fluency” and they advise five factors to achieve good employee and customer relationships. As this information has been compiled by the British Council’s own intercultural professionals who themselves are Polish nationals and who are based in Poland they give a good insight to the key cultural drivers of Polish citizens.

- Expect people to highlight what’s going wrong

rather than what’s going well - Build rapport by taking time and not being too friendly, too quickly

- Be prepared for a society with traditional but changing values

- Earn trust by having achievable visions rather than unrealistic ones

- Be prepared for hierarchical ways of working

Business Culture

Every culture has its own unique ways of doing business and in this regard Poland is no different. Business is predominantly carried out through personal interaction and to establish effective business activities there are some key points which should be understood about Polish business culture. The following should be incorporated into Primark’s executive cultural integration training for its non-Polish employees.

Relationship Oriented: In most cases the Polish preference in business transactions is to build personal relationships and to get to know the other person’s personality. There is a formality to the way they operate, they like to have a professional closeness

Business: Hierarchy Polish workplaces tend to be hierarchical, there is a gap between those who are in positions of authority and their subordinates.

Business Meetings: Listen respectfully to anything managers have to say as the preference is to have the actual evidence and data to back up the facts it is even better still to have worked out business projections as these will have more appeal than to use unproven claims.

The Polish – a view of themselves

The OECD’s Better Life Index gives an additional insight into how the Polish population see themselves, the key findings for Poland are that it performs well in some measures of well-being in the Better Life Index, Poland ranks above the average in personal security, as well as education and skills, but below average in health status, income and wealth, social connections, civic engagement, subjective well-being, jobs and earnings, environmental quality, work-life balance and housing, the ‘highlights are as follows:

- The average household net-adjusted disposable income per capita is USD 18 906, much lower than the OECD average of USD 30 563 a year.

- In terms of employment, around 65% of people aged 15 to 64 in Poland have a paid job, below the OECD employment average of 67%.

- Good education and skills is an important requisite for finding a job. In Poland, 91% of adults aged 25-64 have completed upper secondary education, higher than the OECD average of 74%,

- In terms of health, life expectancy at birth in Poland is 78 years, two years below the OECD av

- Concerning the public sphere, there is a strong sense of community and a moderate level of civic participation in Poland, where 89% of people believe that they know someone they could rely on in time of need, i

- Voter turnout, a measure of citizens’ participation in the political process, was 55% during recent elections; lower than the OECD average of 69%.

In general, Poles are less satisfied with their lives than the OECD average. When asked to rate their general satisfaction with life on a scale from 0 to 10, Poles gave it a 6.0 grade on average, lower than the OECD average of 6.5.

Entry strategy to the market

After covering most aspects of Primark’s Business and the Polish market we are able to design a market entry strategy.

It is known that there are a lot of Polish customers in the stores of Primark all over Europe and that the brand is recognized in Poland. However, this is not sufficient as an analysis must be performed to understand what styles and fashion are seductive to the general public in Poland. For this purpose, the creation of a dedicated team to cover these aspects/needs is required.

As Poland is a member of the European Union, Primark will not encounter major difficulties to enter the market in terms of market regulations. Therefore, the same entry strategies that have already been used in other markets of the European Union can be used in this occasion as well.

Initially, it is convenient to locate the first store in the capital of Poland as it is the most populated city in the country. Warsaw has more than 3 million inhabitants, and can be used as learning pattern or trend to study the Polish market. Depending on the data that is obtained, it will be possible to decide, whether to establish new stores in other less populated cities and locations or to keep the minor number of stores distributed around the capital. This strategy was already applied in 2016 in Italy where the initial store was established in Milano, expanding in the market to other cities nearby until finally having a significant presence across the country.

Although a large capital investment is needed, Primark could be installed in shopping centers that do not have large affluences of sufficient consumers. It is a known phenomenon that Primark’s presence in shopping malls attract consumers and benefits all shops present in the mall. This way, Primark could have a very high rental bargaining power as a result, and its price could be further reduced.

Additionally, Primark could also provide free Wi-Fi and a “relaxing area” in the store, where customers can sit and take a break during their shopping trip. This proved to be an effective tactic to keep consumers in the store and attract more people to the shop.

As for warehousing, the distribution centers must be installed in the Special Economic Zones defined in Poland where tax deductions are offered.

Despite not having an online store, Primark makes intensive use of social networks to generate the ‘word of mouth’ and rumor spreading amongst customers and potential consumers. Therefore, mainly focusing on social networks will be one of the main strategies that Primark must use at an early stage or even shortly before opening stores in the market to generate customer expectations. As an example, we can mention, the opening of one of the largest stores of Primark in Madrid in 2015.

Key management issues that the company must address to implement its market entry strategy

For all decisions in relation to market entry and store expansion the first crucial step for Primark is to carry out research and gather authoritative data on the key commercial aspects of doing business in the target market. The overarching objective is to gain a detailed knowledge of the business sector, its growth potential and the expected competitive activity within the market.

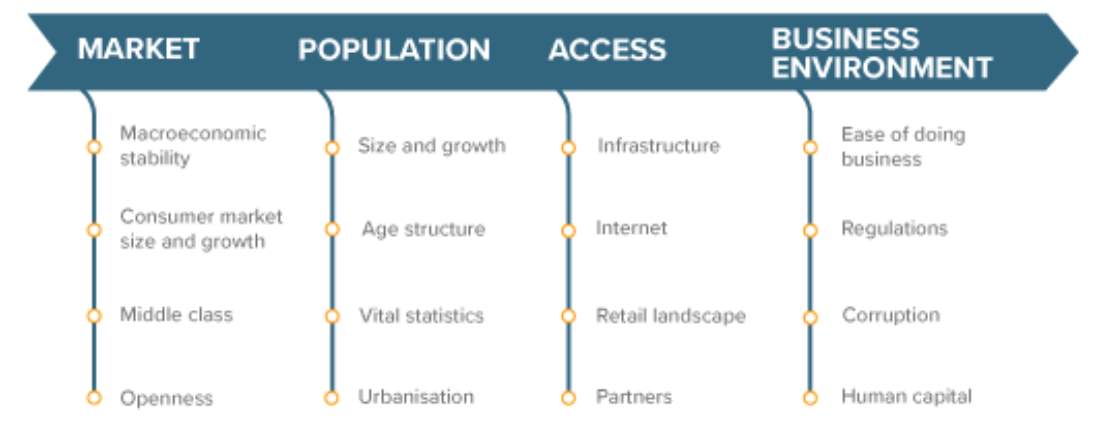

In relation to entering the Polish market, Primark must complete all due diligence checks and analyse the data across a number of key market characteristics before making the final decision to enter the market, the company must be 100% ready. The market entry challenges and any potential risks which Primark may face can only be identified when an in depth data gathering phase is undertaken. Euromonitor International provides a useful starting point framework to evaluate the characteristics of a given market, they refer to this as the “four pillar model for market selection” it breaks down the market entry criteria under four headings, Market, Population, Access and Business Environment.

Fig FACTORS AFFECTING MARKET SELECTION

Primark’s business model is operating successfully in a number of large cities across the European Union, it has successfully opened and continues to trade in these locations, it has entered these markets using a “Greenfield – 100% ownership” market entry strategy, where the parent company retains complete control over the business. Although this strategy requires a high amount of “front end” investment and represents a long term commitment, it does however provide complete control over the Primark brand and in so doing brings with it the opportunity for Primark to get the highest return on its investment.

There are also a number of key risk areas to focus on and in their book “International Business: Theory and Practice” Ehud and Amit Menipaz outline four key areas of risk which all organisations should consider before entering an international market , they are “Cross Cultural Risks , Country Risk, Currency Fluctuation Risks and Commercial Risk”.

Following are the two key management issues which Primark need to address as part of its market entry strategy to the Polish market.

Management Issue No.1

Is Primark’s standard product offering a strategic fit for the Polish Market, and can the existing business model which has successfully been deployed in other countries fit the Polish market?

No one market profile (country or consumers) are the same, each has specific and individual requirements to fit its unique cultural profile. In Primark’s case while it will trade in every market under its strong brand image, it also needs to adopt its market strategy to fit the specific needs of the market. Most companies of this size who operate in global markets should have a global marketing strategy (GMS) as it is a must have marketing tool. In the context of entering the Polish market one key issue to get right would be the pricing point of its products so that it appeals to polish consumers based on these levels of disposable income. Evaluate your pricing model—consumers in less developed countries are very price conscious and your product may not fit the local economic environment.

Management Issue No.2

Due to the increased demand for products which is driven by the globalized market the demand for company products is growing at a rapid rate, one of the key challenges for Primark will be to ensure constancy and supply of its product range, in a recent Ernst and Young Retail Sector Report they advise that “in a less globalized world in which all retailers in a market tended to source their products from the same country, sudden location-specific risks had little impact on the relative competitiveness of market players. However, in a globally diverse market where retailers tap into different geographical locations, sourcing risks can have large impacts on costs, profitability and market position.

As Primark expands its store network and increases its sales volumes this places greater demands on its supplier it needs to take steps to mitigate the risk of supply shortages and interruption, this should include sourcing from multiple suppliers in diverse locations.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "PESTLE"

PESTLE, or PESTEL, is a framework used in strategic analysis to analyse the impact of external factors on a business in terms of market growth or decline, potential, and operational direction. An extension of the PEST analysis (political, economic, sociological, and technological) model, it adds legal and environmental.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: