Selecting the Right Local Partner as the Key Success for IJVs in China

Info: 21215 words (85 pages) Dissertation

Published: 11th Dec 2019

Tagged: BusinessEconomicsInternational BusinessBusiness Strategy

ABSTRACT

This paper seeks to understand how choosing the right local partner is important for IJV, established in PR China, and what are the effects on its performance. Since the Chinese market is changing rapidly and competition of each market segment is high, IJV can face some difficulties, especially at the beginning. That is why having the right local partner can be helpful for Joint Venture to encouragemarket expansion, provide country-specific knowledge, mitigate operational risks and obtain insightful information (Luo, 1997).

The data is collected through a survey of middle-level managers working in International Joint Venture in China. Different local partners traits, either strategic or organizational, can affect various aspects of International joint ventures performance. That is the main reason why firms need to know which criteria is important for local partner selection, and also which criteria are crucial for their specific strategic goals. As for the critical factors, the author identified: local partner“s international experience, market experience, product relatedness and organizational form. For joint venture’s performance are used perceptual measures of the foreign partner. Since there is no consensus regarding what is the best way for measuring performance, in previous researches were used a different kind of measures. Author excluded financial indicators, mostly because they are showing only one side of performance and also that kind of data can be unavailable for the author. Having considered all those disadvantages of financial indicators, some researchers have chosen perceptual measures which include social commitments and engagement of partners, and meeting the needs of partners over the long term. According to Geringer and Hebert (1991), international joint ventures which were performing more successfully, stayed longer in operation than those international joint ventures that were estimated as less successful (Pothukuchi, Damanpour, Choi, Chen, Park, 2002).

In this paper, the author got foreign partner’s satisfaction with Joint Venture and efficiency as individual dimensions of JV’s performance. Further, the results are showing how local partner’s market experience, international experience, product relatedness and organizational form could affect satisfaction and efficiency of Joint Venture.

Keywords – International Joint Venture, China, local partner’s characteristics, performance, efficiency, satisfaction

- Table of Contents

2.1. Background of IJVs in China

2.2. The effect of the national culture

2.3. Comparison between West and China

2.5.1. The Equity Joint Venture

2.5.2. Contractual Joint Venture (CJV)

2.6. Choosing the right investment vehicle

2.7. The importance of due diligence

2.9. Government Policies and Regulations

2.10. The need for the adequate local partner

III. Theory and hypothesis development

4.3. Questionnaire development

4.4. Exploratory factor analysis

VI. Conclusion and Implications

6.1. Limitations and future research

I. Introduction

The joint venture (JV) is a combination of two or more legally distinct organizations (the partners) in which all partners are participating in joint venture’s decision-making activities (Geringer 1988). In the case of the international joint venture (IJV), at least one partner is located outside of the jurisdiction of the Joint Venture. Both of these partners, foreign and local have different strategies and interests.

The International joint venture can be an important strategic alternative in today’s highly competitive global environment (Ozorhon et al., 2008). Through joint ventures, firms are acquiring knowledge, resources, and expertise, from other companies and they are becoming more flexible (Harrigan, 1986). Firms usually form a joint venture to protect their own business, share the cost of research and development or to achieve economies of scale.

Some other reasons are local firm’s knowledge about the culture and the market, and the sharing of financial risks (Inkmen and Beamish, 1997). Because of the high instability, propensity for failure, and a complex governance structure, multinational companies continue to engage in IJVs at a rapid pace (Morris and Hergert 1987).

In China, foreign companies are seeking for domestic partners who can offer great benefits like significant knowledge of the local market, well-established distribution channels or government relationships. Joint Ventures are sometimes the only way to register in China if the government still controls a certain business activity, e.g. Restaurants, Bars, Building and Construction, Car Production, Cosmetics, etc. The Chinese authorities encourage foreign investors to use joint venture form of company to obtain access to new management skills and advanced technology. On the other hand, foreign investors can enjoy, low production costs, low labor costs and a potentially significant Chinese market share, etc.

Despite all these advantages, JV can also have some serious obstacles. Cultural difference is one of the most important factors that influence the performance of joint ventures, according to the previous studies.

The cultural differences are not limited to the different cultural backgrounds of the partners, but also can be demonstrated through the concept of cultural distance. Generally, the greater the cultural differences are, the more difficult it is for the group members to communicate and the more unfavorable it is for the organization’s success. Team members with different cultural backgrounds had different ideas about conflicts and solutions to the conflicts, and a heterogeneous group may face strong organizational collusion.

Communication between partners is also important, not only to guide the workplace but at the executive level to avoid mismatch of ambitions between JV partners.

To establish a successful joint venture in China, first step for foreign partner is to find a eligible and corresponding local partner. Also, foreign partner needs to know that Chinese laws sometimes provide qualification requirements for the local partner qualification in a joint venture. That is why it is essential for foreign partner to make sure that local partner will have legal capacity to act as an investor into firm’s contract.

There are several studies conducted regarding the systematic relationship between local partner selection and IJV performance. This question is important because the strategic

and organizational characteristics of local partner influence the degree of resource indivisibility or complementarity, and the extent of strategic and organizational fit, between domestic and foreign partners (Buckley and Casson, 1988). Although IJVs have been considered as a driving force for connecting complementary skills and know/how (Contractor and Lorange 1988) there are some additional costs which come from shared decision making and the need for coordination between partners (Killing 1983). Moreover, IJVs should be established only in the case when additional benefits are bigger than expected extra costs (Geringer 1991).

The specific purpose of this paper is to help define partner selection criteria and to identify their impact on JVs performance. In the following pages, a presentation of the theoretical foundations and hypothesis development will be followed by a brief discussion of methodological issues. Further, the empirical results and the main conclusions will be discussed and summarized. In the end, possible theoretical and practical implications and directions for future research will be suggested.

II. Literature Review

2.1. Background of IJVs in China

The Chinese economy had experienced remarkable growth in the last couple of decades that catapulted the country to become the world’s second-largest economy. Rapid economic growth mainly came from country’s increasing integration into the global economy and the government’s bold support for economic activity. Since 1978, China has create one of the most unique economic reforms in modern history (Raymond P.M. Chow, Oliver H.M. Yau, 2010). It went from centrally planned economy to a market-oriented one. When China started launching its open-door policy in the late 1970s and pursuing the development of a market-driven economy, many foreign companies have entered the market through joint ventures. The first international venture capital firms entered China in the early 1980s (David Ahlstrom & Garry D. Bruton & Kuang S. Yeh, 2007). In the beginning, venture capital was limited primarily to infrastructure and property investments; new hotels and tourist facilities were especially popular (Lau, 1999).

Until 2007, there were almost 122,821 joint ventures in China (Epstein, 2009). The purpose of these joint ventures was to create benefits for both partners, in terms of local knowledge, cost consideration and access to market, in addition to the transfer of technology and skills (Theresa Lau, K.F. Chan, Susan H.C. Tai, David K.C. Ng, 2009).

Since the Chinese economic reform in the late 1970s, foreign investors had permition to create equity joint ventures with either private Chinese companies or state enterprises. Very common form of IJVs was the one made from the multinational firm from developed countries with local firms or state-owned companies.

Usually, local partners are forming joint ventures to obtain capital, managerial skills, technology and access to export markets (Antoniou and Whitman, 1998). Unlike local partners, foreign partners want to remain competitive, gain profits for the home firm and reduce the risks related to entering the Chinese market. Despite all of these benefits that joint venture provides, it is not easy to form one, especially not in China. Chinese and foreign partners often have different interests and objectives.

Chinese main cultural characteristics are the avoidance of uncertainty, collectivism, and acceptance of hierarchy and authority which results in hierarchical decision-making, bureaucratic organizational structure, conservative leadership, static management style and Confucian-Leninism. On the other hand, Western culture, for example, has the main characteristics such as open communication, decentralized decision-making, a flatter organizational structure, flexible management styles and individualism (Theresa Lau K.F. Chan Susan H.C. Tai David K.C. Ng, 2009). The difference in partners cultural background can significantly influence the business behavior and in the case of IJVs can bring a risk of misunderstanding which can end with a failure in cooperation. The smaller the cultural gap between the partners, the easier it is to create the desired cohesion necessary for the efficient performance of an IJV.

Because of the cultural and behavioral differences between Chinese managers and foreign managers, which cannot be avoided, IJVs formed by foreign partners and local Chinese partners may have entirely different organizational and strategic characteristics

2.2. The effect of the national culture

The culture can be defined as „a pattern of beliefs and values that are manifested in practices, behaviors, and various artifacts shared by members of an organization or a nation“ (Hofstede, 1980). The culture is a so-called social glue, which can serve to bind individuals and creates organizational cohesiveness (Cartwright and Cooper, 1993).

When a company is entering a foreign country’s market through the international joint venture, it has several advantages than as wholly owned subsidiary. Through IJV, the firm can use local partner’s knowledge of the domestic market which includes local consumer tastes, local framework, business practices, as well as to share the cost of the risk of foreign entry. Despite these advantages, IJV can also bring some risks, like dealing with problems in cooperating with partners from a different national and organizational culture (Harrigan 1988). The inevitable cultural difference can lead to a conflict or in the worst case to a dissolution of the venture (Shenkar and Zeira 1992).

Organizational culture and history of firms, in this case, joint ventures, are highly influenced by the cultural and environments in which they operate (Oliver, 1997). Also, numerous of empirical studies have shown how significant is the influence of national culture on firms performance. National culture can affect managerial decision-making, leadership style and human resource management practices (House, Hanges et al. 1999). According to Lane and Beamish (1990), the biggest problems in IJVs often come from a strong impact of national culture on management systems and behavior, which at the end usually creates unresolved conflicts.

Many scholars agreed that alliances between culturally similar partners are more likely to have higher performance than alliances between culturally different partners. According to Cartwright and Cooper (1993) in alliances selection, decisions are usually driven by financial and strategic considerations. Despite that, many organizational alliances didnt meet expectations because of the incompatability of partner’s cultures. In Joint venture, different culture types can create different psychological environments and differences in practices can have a negative influence on performance. The cultural gap that exists between partners can affect the success of their cooperation (Cartwright and Cooper, 1993). Main problems in communication, cooperation, commitment, and conflict resolution between IJVs partners are problems caused by partners’ value and behavior differences which can cause interaction problems that can affect JVs performance (Harrigan, 1988).

According to Dunning and Bansal (1997) who studied the effects of societal culture on firms, including JVs, culture might affect many activities of international JVs. Low individualism or high collectivism in a home country can lead to a firm’s preference for JVs rather than other forms of investment. Furthermore, companies from collectivistic cultures are more likely than those from individualistic cultures to select a JV instead of a wholly-owned form of a company (Ji Li, Kevin Lam, Gongming Qian, 2001). Also, cooperation-generating mechanisms can usually differ between individualist and collectivist cultures, mostly because of the differences in their expressive and instrumental motives (Chen et al., 1998). Different cultures have different commitment generating mechanisms, and with all those cultural differences it can be difficult to produce commitment between partners in joint ventures (Cullen, Johnson, and Sakano, 1995).

With their different competitive advantages, firms may adopt different strategies. It has been shown that in their JVs operating in China, many companies from collectivistic cultures seem to prefer more labor-intensive operations, with little investment in equipment or a very low level of technological intensiveness (Li, Khatri, and Lam, 1999). Alterna- lively, many firms from individualistic cultures seem to prefer a technology-intensive approach, with heavy investment in production facilities and equipment (Boulton, 1997).

Several types of research, conducted regarding the influence of culture on companies performance, have suggested that culture can be considered part of business resources, which in turn may affect the behavior and performance of JVs. (Ji Li, Kevin Lam, Gongming Qian, 2001).

2.3. Comparison between West and China

Every firm that is doing business in a foreign country has to be aware of and responsive to that nation’s culture. (Kuntara Pukthuanthong, Thomas Walker, 2007).

Venture capital investments can bring high returns but is often followed by a high level of risk. For foreign company performing in China, those risks are mainly related to cultural differences. Not only in China but different parts of the world have significant cross-country differences in venture capital markets and their internal structures, which makes it difficult for a firm to move from one market to another. (Kuntara Pukthuanthong, Thomas Walker, 2007). However, dissimilarities between Western venture capital market and the venture capital in China are enormous. Foreign firms are operating in unfamiliar surroundings, and usually, do not understand the language and the culture.

Efficiency, public information disclosure and profit maximization, are important factors for investors in the West, while in China personal relationships, networking, and harmony are more valued (Ahlstrom and Bruton, 2001; Chen, 2001).

The cultural differences between western countries tend to be comparatively minor, and employees can typically adjust to another nation’s culture without many difficulties. While setting up in China, Westerners soon become overwhelmed by the cultural differences. With personal adjustments of someone’s lifestyle and the ways of interaction and communication with others, while working abroad, it is necessary to make adjustments in organization level as well because many norms and standards from the western business world cannot operate in China.

One of the critical success factors for IJVs are the need to build and maintain the relationships (e.g. Elashmawi, 1994; Geringer, 1988; Hamill and Hunt, 1993; Hergert and Morris, 1988; Sonnenberg, 1992; Stafford, 1994). In that context, Chinese prefer long-term relationships in business dealings, as they believe relationships will bring continuous success to all parties concerned (Raymond P.M. Chow, Oliver H.M. Yau, 2010).

For Chinese people, working in a harmonious environment is crucial. Also, it is expected from members of the Chinese partner in a joint venture to tend to prefer working as a team, on equal footing, putting interests of the whole organization in front of the individual (Wang, 1994). Moreover, competition or conflict would be discouraged or even avoided.

The key features of the western business culture are profit maximization, shareholder rights protection, and transparency. In contrast, Chinese culture is focused on harmony, networking, and seniority. According to Bruton (1999), Chinese culture can have a high tolerance for information asymmetry between the companies insiders and external investors and for the outside board members as well.

Chinese managers from IJVs are usually older than their foreign partners. Moreover, while elders are respected in traditional Chinese culture, the senior Chinese executives expect to have more power and that their word can have more value than their younger members of the leadership group. (Jan Selmer, 2005). In Western countries, they do not deal with this kind of expectation so it can be strange for them or they can even refuse to accept it.

Foreign and Chinese managers can also have different educational backgrounds. Usually, senior executives in China have good technical training, but they might not have a formal management training.

Despite Chinese managers who expect age and general life experience to have more priority in discussions and decisions, Western managers value experience and expertise specific to the business task at hand.

In China, employees tend to share responsibility within an organization. Instead of individual, there are collective actions at all levels in a firm’s hierarchy (Boisot and Child, 1988; Bruton et al., 2002b). Further, it might be difficult for western people who got used to negotiations on a one-on-one basis, to communicate with several individuals who have the responsibility for the same task. The collectivism is so strong in China that teamwork became a standard in business culture and when individuals want to work alone, their performance will also drop significantly (Earley, 1993).

2.4. The importance of Guanxi

Guanxi is an important part of Chinese culture and represents a form of networking that has some characteristics of a modern Western networking as well. Guanxi existed in Chinese culture for more than two centuries. It usually implies to a networking and interpersonal connections, but it also has a strong impact on the social and economic life of Chinese people.

In the business world, Guanxi is related to all the relationships and networks a business person can maintain within and outside the firm. In the case of the venture capital industry, guanxi refers to relationships and interconnections between venture capitalists and their related network of entrepreneurs ,investors and other venture capitalists (Kuntara Pukthuanthong, Thomas Walker, 2007). Guanxi is social capital because it involves exchanges of social obligations and determines one’s face in society (Hwang, 1987).

Guanxi can be both, resource and liability, which depends on if someone needs a favor or owes it (Tsang, 1998). It can create value for venture capital organization as well as the firm it funds if it is used properly and in the right way. Moreover, it takes time to create guanxi. To build a guanxi with someone, it is necessary to have some benefits from it to build a strong relationship. It also refers to a business world. Moreover, it can be a bit more complicated than any Western interpersonal skills. Guanxi relies on long-term orientation and mutual trust. It is driven by unwritten social rules. For Chinese firms, guanxi can be used as a strategic mechanism to deal with resource disadvantages and competition by exchanging favors and cooperating with government authorities and competitive forces (Seung Ho Park and Yadong Luo, 2001). It is often used as an entrepreneurial tool to bridge gaps in information and resource flows between managers, stakeholders or between firms.

Guanxi also involves obligation, credibility, and understanding, and it can be intention-oriented. It is that kind of relationship that can be used for both, individual or organizational purposes so when persons or organizations want to achieve their goals they first call for their Guanxi networks.

To have a successful firm in China, foreign partner needs to establish robust and wide guanxi network, and it is not enough to have a few top executives or officials from the central government on its network to be successful. That is usually the main reason behind some of the first western capital firms’ failure after entering the Chinese market. The Guanxi is a network that has to be very broad-based to be beneficial. Foreign companies after establishing JV in China need to think about their Guanxi network, that is going to create, and also of their chinese partners as well.

2.5. Types of JV in China

Joint Venture in certain industries can be the only way of registering a business in China, such as telecommunication and information technology services, mining businesses, breeding and seeds developing industries as well as in the medical field. (Spiegeler, 2016).

There are two forms of Joint Venture, the Equity Joint Venture and Contractual Joint Venture. Both EJV and CJV are limited liability companies established by the Chinese laws and regulations. They need to have signed contract between a foreign and Chinese partner with all necessary information including rights, responsibilities, and interests of each partner in details. The main difference is in the division, which in EJV is the ratio of equity and CJV depends on partner’s decision.

2.5.1. The Equity Joint Venture

The Equity Joint Venture (“EJV”) is probably the most common form of foreign investments in China.

EJV is a limited liability company created between foreign and Chinese partner/s in which each partner participates in gains and losses according to the percentage of equity that it has contributed to the EJV. It is an independent legal entity, which has its own financial administration. Its income is subject to corporate income tax law and partners are not allowed to extract the shares out of the EJV.

The foreign partner is required to contribute at least twenty-five percent of the registered capital of the EJV. The capital can be contributed in the form of cash, capital goods, industrial property rights, and other qualified assets. Usually, the local partner will contribute cash, clearance fees and land use rights or land development, and on other hand the foreign partner will contribute cash, technology, construction materials or equipment and machinery (InterChina Consulting, 2011). In EJV, profit is divided in the form of a dividend to the partners in proportion to each partner’s ownership interest.

EJVs have a two-tiered system of management: the Board of the Directors and General Manager. The Board of Directors must contain at least three members. It is the highest decision-making the body of the EJV. The responsibility of partners it to appoint the board members, whose representation needs to be in proportion to each partner’s respective ownership interest. According to the EJV Law, any of partners can choose the Chairman, who will be the Legal Representative of the company. As for the General Manager, it will be responsible for the daily management. The Deputy General Manager System refers to, if one side appoints the post of General Manager, then on the other hand will have the right to appoint the Deputy General Manager. When a joint venture is finally registered, the entity must abide by all Chinese laws. Foreign investors can only recover their capital if they sell their interest to the local partner or a third party, or upon liquidation of the EJV, if the company is solvent. It is not possible to do unilateral termination of the EJV.

2.5.2. Contractual Joint Venture (CJV)

Contractual Joint Venture (also known as Sino-Foreign Cooperative Venture) is more flexible than the equity joint venture, but it also deals with many challenges. Like its name says, it is based on a contract which regulates the whole relationship between foreign and the Chinese partner. Unlike EJV, in CJV liabilities and profits are distributed according to the contract.

The minimum foreign contribution is not required for this form of JV, and the contribution of the investors does not need to be expressed in monetary value, it can also be expressed as labor, resources, and services. CJV can be formed as Limited Liability Company in which CJV owns all contributed assets, and investor’s liabilities are limited to the contributions made to the Registered Capital of the CJV. Also, it is not necessary from CJV to be an independent structure. It can be a contractual arrangement between partners. Regardless the CJV type, partners are free to create their rights, obligations, risks and liabilities in this contract. The tricky thing about contractual joint venture can be that nobody is holding the final word on disputes, except if it is written down in the agreement. So disputes can easily get out of hand, which is usually not very good for the business; this may explain why this kind of JV is still rather unused.”

If CJV is created as Limited Liability Company, then it would be based on a two-tiered system of management: The Board of Directors and General Manager.

The Board of Directors needs to consist at least three members, and it has authority to make all the major decisions concerning CJV. The members of the Board are chosen by CJVs partners, and the Chairman of the Board of Directors is a Legal Representative of the CJV. Representation does not need to be based on the proportion of contribution made by each party. Moreover, for the daily management is responsible General Manager.

If CJV is not established as an independent legal entity, then instead of Board of Directors it needs to have a Joint Management Committee and The Head of the Joint Management Committee will be the Legal Representative of the CJV. It would be better for CJV to regulate the responsibility of the Head of the Management Committee for representing CJV’s partners.

Both of these types of CJV are formed after partners negotiations regarding the CJV Contract terms, and it needs to be approved by the relevant authority.

2.6. Choosing the right investment vehicle

This is one of the most crucial decisions that one company has to make while entering the Chinese market. Several factors can affect the entry mode, such as, size and scope of the market, industry landscape, government regulations, costs of setting up a local entity, etc. Therefore, for choosing the right entry form is important to take into consideration all of these factors. Even though the number of foreign companies that are forming wholly foreign-owned enterprise (WFOE) is growing fast, JV is still more used investment vehicle.

JV can have some advantages and disadvantages that also need to be taken into consideration.

The main advantage of JV, and having a Chinese partner is the support for foreign companies without experience in doing business in China. Further, Chinese partner can be helpful in obtaining access to marketing and distribution channels, labor recruitment, acquiring land and production facilities, sourcing raw materials, and obtaining government approvals (InterChina Consulting, 2011). Sometimes well-experienced staff in a WFOE can be as much supportive as Chinese partner in JV, but there are some situations where having a Chinese partner can be more useful. Particularly in the case when domestic sales are the top priority, Chinese partners can offer access to established marketing and distributions channels. JV can be preferred by a foreign investor who is looking to share the burden of capital investment. Especially, foreign investors in capital-intensive industries may need a local partner to share the investment load, but also cash-short investors in technology and other industries may appreciate the JV as an investment vehicle (Ross, 2010).

As it was mentioned before, JV can have some disadvantages as well (see Table 1). The main disadvantages can come from the difference in national and organizational culture between partners, and form different objectives and expectation for the project. Doing business in China is based on relationships, so-called Guanxi. That is why being just a friend with a business partner it is not enough. Partners need to trust to each other and share the same long-term strategy. However, these goals are not easy to accomplish since Chinese and Westerns usually have different objectives, mostly because they come from different cultures, different environments and have entirely different life history. Moreover, thanks to foreign partner’s fresh cash and technology, the local partner will be more oriented on quick profits and expansion. As for the foreign partner, the main goals will be a low-risk and safe investment, also to ensure a long-term presence in China and steady growth. That is why partners need to negotiate about the JV’s long-term strategy and objectives at the beginning of their relationship. Also, they need to decide what is and what is not likely to be accomplished. Differences in their long term goals can be fatal for JV. It is common for a local partner with minority equity who cannot achieve its plans, to start doing some hidden activities with the JV. Especially when it owns the effective control discussed before.

Table 1. Advantages and disadvantages of WFOE, JV and REP office

| Advantages | Disadvantages | |

| WFOE |

|

|

| Joint Venture (JV) |

|

|

| Rep Office |

|

|

Source: B2B International, “Entering Chinese Business-to-Business Markets: The Challenges & Opportunities.”

As it was mentioned before, JV can have some disadvantages as well. The main disadvantages can come from the difference in national and organizational culture between partners, and from different objectives and expectation for the project.

Once, when a foreign partner decides to go with JV, needs to find an adequate local partner.

Also, the balance between the advantages and disadvantages of JV can often be affected by the level of control.

2.7. The importance of due diligence

Due diligence is imperative for the both partners to examine and confirm all the information that the other partner had provided. Once when a local partner is found, the foreign partner should check the validity of provided information. The critical areas can be regarding not reporting tax, security arrangements, and incomplete evidence of title to land and buildings and complicated debt (InterChina Consulting, 2011). It is critical to have due diligence even before establishing JV so the foreign partner can stop the negotiations on time and not make a terrible mistake if the local partner is incompetent and have been hiding it. Problems that can occur during due diligence are inadequate documentation and poor transparency. It can be expensive for a foreign partner to choose a wrong local partner for business. Moreover, to discover is the chosen local partner the right partner for the firm, foreign partner needs to find the answer to some questions:

– What is the background of the company? What is its domestic market reputation? The type of a company (SOE, SME…)? What is the main product/ service? Who are the customers? What is the main business and how is it regulated?

– Who are his suppliers and employees? How strong connections does it have in the business life?

– What is the main financial source and validity of provided financial statements?

This information can be divided into three groups: legal, financial and reputational.

Table 2. Legal, financial and reputational criteria of local partner

| Legal | Financial | Reputational |

| Business license | Origin of cash flow | Key managers backgrounds |

| Business scope | Transparency | Relationship with business partners, suppliers, clients |

| Titles of property | Fraudulent cash movements | Links with officials |

| Authorizations… | Reality assets | Corruption |

Source: S.J. Grand, “Joint ventures in China: How to make your partnership successful,” September 2014.

It is crucial to cover all these aspects at the beginning of the alliance to prevent some potential threats that can be fatal for JVs success in the future. Foreign partner needs to get familiar with Chinese partner’s organizational culture, vision, mission, philosophies. In China, the financial and legal part can be a problem. As for the reputation and connections in the business world, they can be checked by interviewing distributors, competitors, business clients and former business partners. These are the core aspects that need to be covered before building a stronger relationship with a JV’s partner. It is not an easy job to get all these information since Chinese partner cannot be asked directly. Further, foreign partner needs to do a proper investigation either by interviewing employees, clients or by visiting its factories to understand better Chinese partner’s strengths and weaknesses. With this information, a foreign partner can decide to proceed with negotiation with a Chinese company or not. It can have a clearer picture with whom are they dealing.

This can be the right way for a foreign partner to find out is the chosen local partner adequate to do business with. However, in the end, because not so perfect China’s corporate governance a certain level of risk needs to be taken while establishing JV.

2.8. Maintaining control

The control over JV is the second important thing that foreign partner needs to take care with. Even if foreign partner has more than 51 % of shares and full legal rights over JV, it does not mean that it controls it, especially not in Chinese culture where this rule seems unfair. It is not easy to establish control over JV, despite equity share or arrangements made in the contract. It is mostly because Chinese partners are controlling staff of JV, who are usually being transferred from its company and who is keeping the goals, objectives, etc., from the original firm. That is why it is important to deal with this problem while setting the Joint Venture. Even if Chinese partner has minority equity share, it still has rights to veto a decision made by foreign majority partner.

In EJV who is holding the majority, can ensure a high level of control by choosing a majority of the board members. Moreover, control over the board can mean control over JV. Since the board is not actually in charge of daily operations, Chinese partner as minority shareholder who has rights to appoint either the Representative Director or the General Manager still can have the actual control over JV.

Also, the company seals (chops) can be a certain way of control. The employees who monitor seals can do many things like rising salary, transfer money on his account or some other irregular things. Control the seals is just another way of controlling JV. When maintaining the majority equity is not enough to keep the control there can be some other solutions: The first one can be to change the structure of JV into a wholly owned subsidiary of an offshore vehicle with the foreign investor and minority Chinese investor holding shares (InterChina Consulting, 2011). This practice is not that usual because of difficulties that Chinese investors may face while investing in offshore vehicles. The other option is to change FIE, which 67% is owned by a foreign investor into Foreign Invested Company Limited by Shared. In that situation, a foreign partner can have more efficient control of the highest governing body of the FICLS, the Shareholder’s General Meeting. Which can be very important for decisions as adissolution or amendment of the FIE’s constitutional documents, merger, division.

When a foreign partner has a minority in equity share the best way it will be to establish CJV as limited liability company where is possible to have a majority control over the Board of Directors. If JV is set as EJV, a foreign partner can negotiate for an extension of the list of matters which require unanimous board approval for some crucial business decisions.

2.9. Government Policies and Regulations

The Chinese government is trying to encourage foreign companies to invest in China since its open-door policy. That is why, it has set up a legal and foreign investment policy system, which mostly contains regional policies, tax policies, industrial policies, and financial policies. With the development of Chinese economy, there is a rising number of regulations and standards, which apply for both, domestic and foreign companies. The impact of government regulations can be adamant on costs and timeline of market entry, and that is why companies need to take into consideration these implications while entering the Chinese market. Also, sometimes when a product or a service is approved in the USA or Europe, it is not necessary to happen the in China. There is no guarantee for that.

It is neccessary for a foreign company to do a research about regulations environment before deciding to enter the Chinese market. Once where the company is on the market, it needs to continue with monitoring the regulation changes and to understand what the consequences for the business are. Sometimes it can be even difficult to anticipate those changes, or they can be difficult for interpretation. This is a problem especially for companies who are used to more transparent regulations. Many companies are hiring market research specialists and legal consultants to understand Chinese laws and regulations better.

To succeed in the Chinese market, foreign partner needs to understand government policy and regulations. Even though, China is a part of WTO, since 2001, which was helpful regarding liberalization of trade environment to an extent, many industries stayed strongly regulated. Even today, there are various industries that still are not allowed for foreign companies, or that have many limitations. Those kind of industries is restricting foreign companies’ involvement in the field of telecommunications, energy and petrochemicals sectors. First thing for a foreign company, who is looking to establish a JV in China, is to check the China foreign investment catalog, which contains the list of categories for foreign investment projects, named as prohibited, restricted and encouraged. JV needs to promote the development of Chinese economy, science, and technology. Establishment of JV will not be approved if it will violate Chinese law, detriment China’s sovereignty or if it is going to bring environmental pollution. Each partner is allowed to contribute in forms of, cash, buildings, premises, equipment or other materials, industry property, know-how, right to use of a site as an investment. The highest authority has Board of Directors which needs to have no less than three members. The chairman of the board is the legal representative of the joint venture. The joint venture also needs to establish managerial office who will be in charge of daily operations.

Investment in the joint venture is a capital required to establish a business till it can support itself. That investment contains two parts: registered and non-registered capital. Registered capital is the JV’s equity investment, and it is a fixed amount. The non-registered capital can be explained as the amount of debt financing which JV is allowed to obtain. 15% of registered capital needs to be paid in first three months after obtaining the business license, and the balance is supposed to be for the first two years. If the joint venture is established by two or more foreign investors, the minimum legal requirement is 30,000 RMB and 100,000RMB for JV with only one foreign partner. Besides these minimum requirements, the decision about the amount of registered capital will be based on each case separately, depending on business activities, joint venture’s location and scale of operation. Further, the amount will be written in the articles of association. For the different types of a joint venture, there are different rules. In equity joint venture

foreign partner needs to contribute with no less than 25% of total investment. EJV is

limited liability company, with an independent legal identity. It must contain two-tiered management structure with a Board of Directors and management team which is responsible for daily management. The structure of equity joint venture is way more rigid than in the case of the contractual joint venture. As for the CJV, it also requires the same two-tiered management as EJVs.

2.10. The need for the adequate local partner

The main advantage of choosing to do business with a local partner is the support that the partner is providing, especially for the foreign companies without experience doing business in China. A partner can be helpful with labor recruitment, acquiring land and production facilities, obtaining government approvals, sourcing raw materials, etc.

Even though having experienced Chinese staff can be very helpful, there are some aspects where Chinese partner can provide bigger support. One of them can be access to well-established marketing and distributions channels. This can save time and money for foreign companies, especially in B2B which is based on multiple personal relationships that require time for establishment and development. There can be some disadvantages as well, of having a local partner. They are mostly coming from differences in national and business culture. Also, it can happen that partners follow different goals, objectives or have different expectations. All of these things can be critical for Joint venture success, even fatal in some point. To have a good relationship with a partner and to have a good start up, foreign partner needs to find someone who can feel its requirements. Moreover, it needs to spend the time to find an adequate local partner. Since Chinese market is very dynamic and diverse, there can be either large number of candidates, or finding the right local partner can be tough.

Foreign partner needs to find the balance between advantages and disadvantages which can usually depend on the level of control. That is why the foreign partner first task is to find a company who can meet all the necessary criteria.

Some of the criteria can be from the aspect of local partner’s organizational form: state-owned or private-owned companies; Production Capacity: designed and actual capacity,

exports revenue and total revenue; Production Parameters: technology, land area, low cost production capacity, fixed infrastructures; Location: proximity to raw materials, proximity to export ports, access to convenient facilities such as gas, electricity, etc., proximity to district ; Profitability: profitable or not profitable; Brand: brand equity( national, regional, provincial) and brand names; Management: preferred export experience and background, professional management with proven successful experience in this industry, sound practices in accounting, English capacity, HR management, administration, etc.; Permits: all fiscal and operational permits need to be egal and available in accordance with Chinese regulations, as well a in Land Use Right etc. (InterChina Consulting, 2011).

The basic determinants of partner’s selection are JV’S skills, resources, knowledge, operating policies, procedures, and the level of sensitivity to institutional changes, indigenous conditions, and structures (Harrigan 1986). Having the right local partner is of particular importance because it can stimulate the adaptability of JV. Also, it can reduce operational uncertainty and improve the strategy-environment configuration (Zeira and Shenkar 1990). Before establishing the joint venture, foreign partner needs to define what the major criteria for choosing the adequate partner are and what the relative importance of each criterion is. Different firms can have different standards, but according to Geringer (1991.), they can be classified into two main categories: operational or project related and cooperation related. Further, operation-related criteria are usually related to local partner’s strategic traits, and cooperation-related criteria are related to organizational traits. Strategic traits usually include the market position of a local partner, product relatedness, industrial experience, absorptive capacity, etc. As for the organizational traits, they mostly include organizational form and size, international experience, previous inter-partner collaborations, etc. Strategic traits can affect JV’s operational skills and resources and for the other hand organizational traits can influence effectiveness and efficiency of cooperation between partners. Moreover, both of these types of local partner’s traits can have a strong influence on joint venture’s performance.

For example, if partner has strong strategic traits but has a lack of organizational traits it can lead to instability of joint venture, or if partner has strong organizational but no strategic traits, it can make joint venture unprofitable.

According to previous studies, strategic and organizational traits can have a strong influence not only on performance but individual aspects of performance like export growth, risk reduction, financial return, local market expansion, etc. Each criterion can have a different effect on a different aspect of performance. For example, organizational traits are found to have a strong influence on overall performance, profitability and uncertainty reduction. Strategic traits are found to be more important for joint venture’s financial return and sales growth (Luo 1997). Also, the organizational form is connected with some specific dimensions of joint venture’s performance as well. That is why foreign partners who are focused on market expansion need to look for local partners with rich market experience, related product or service, high absorptive capacity and superior market position. Moreover, if foreign partner is more focused on profitability and stability than local partner with long international experience, organizational collaboration, and great market power will be more suitable. That is why foreign partner needs to define what are the critical organizational or strategic factors for local partner’s selection. On the other hand, local partner and the government should try to make these factors/traits more available to attract profitable and stable foreign companies.

.

III. Theory and hypothesis development

Since the Chinese market is very complex, it is not easy for foreign investors to succeed on their own. Many differences in language, culture, legal environment, business practices can become potential threats, especially for the foreign companies with limited or with no experience working in China.

From the beginning of Chinese open-door policy implementation, JV was the most used investment vehicle for foreign investors while entering the Chinese market. The main purpose of IJV for Chinese government was a transfer of advanced technology and management techniques from foreign companies to state-owned enterprises. However, foreign investors were also benefiting from access to markets and suppliers, as well as lower investment and operational costs. For some industries, JV can be the only way to register a business, or foreign partner needs to have minority ownership. Because of all those reasons, JV stayed very common in China. Even though their failure rate is very high, and they can be very difficult to manage. There are several reasons why some companies succeed, and many of them fail, including different expectations, various organizational types, different organizational cultures, conflicting management styles or overestimation of the Chinese partner’s market position.

That is why foreign companies need to take care while choosing the local partner for a JV. The best why is to create a list of criteria that local partner must meet, such as guanxi, good market experience, long international experience, quality, expertise, suitable facilities. Further, foreign partner needs to do much more than just doing the research of the market. It needs to build a strong relationship with potential candidates for a local partner.

Since, the Chinese market is changing constantly and it is evolving more quickly than in the other parts of the world, there is no one-size-fits-all approach for foreign companies while entering into the Chinese market. Their strategies can depend on so many different factors, from company size and culture, industry sector, product type, to long-term business aims and global corporate vision.

3.1. Research Objective

Help foreign companies with choosing an adequate domestic partner for the Joint Venture by providing some guidelines through identifying critical factors of domestic partner for JVs success.

1. 3.2. Research question

What are the crucial factors in the selection of JV’s local partner in China?

3.3. Research Framework

Firms strategy

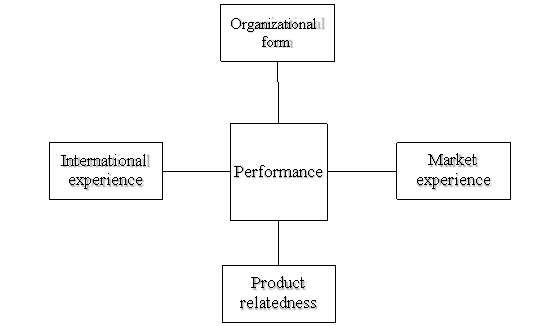

Figure 1: Conceptual Framework

In this research, literature review and numerous previous studies support the above research model. Several studies have proven the significant relationship between local partner’s traits and JV”s performance. The originality of this research is based on perceptually measured performance and the effect of local partners’ traits on performance.

3.4. Hypothesis development

Market experience

When a foreign company is entering a complex market, like it is the case with Chinese, it can be really difficult at the beginning, especially for a foreign partner who has limited or no experience of doing business there. That it is why it needs a partner, who can help to adapt to the market quickly, and to grow fast. To accomplish that, foreign companies need someone with a solid supply relationship, large buyer networks, and an excellent organizational image (Luo 1996). Many foreign companies failed after entering the Chinese market because they have not done their job in a right way. The Chinese market is complex, and besides doing a research of it, foreign investors need an experienced partner with strong industrial knowledge. Domestic partner with a strong background in the market can bring good reputation or high credibility in the industry (Luo, 1997). The longer is domestic partner experience in the market the better is for JVs market growth in China. It will have enough knowledge of potential threats and how to deal with them. Also, it can have strong business connections, especially with influential persons in China. In that case, JVs will have an exciting business network and enough of knowledge to start gaining revenue.

Therefore:

H₁. In the IJV established in China, the longer the domestic partner’s market experience is, the better is JV’s performance.

Organizational form

Nowadays there are different types of organizational forms that company can have. The most important for China can be from the aspect of ownership, which creates private and state-owned companies. From the beginning of Chinese economy transition, state-owned companies had more advantages than private owned, mainly because the market was weakly structured, with poorly specified property rights and the strong influence of government. State-owned companies had better access to resources, materials, capital, information and capital structure (Perkins 1994). They enjoyed many privileges from the government and had a special treatment in certain market segments, and they still are. State-owned companies have access to state-instituted distribution channels as well and with all those privileges have higher market power than private owned ones. They already know the market, have enough information about the customer(s), and they are monetizing the value, engaging with their needs and delivering satisfaction. What they can have a lack of are the technology and innovation.

Private-owned companies are mostly managed and owned by entrepreneurs. Since Chinese market is huge and there are many unfulfilled products and market niches, private-owned companies have more chance for survival and growth. Private-owned companies can react more quickly to opportunities in the market because of their simple structure and because they can out- maneuver more established firms (Tan and Litschert 1994). Private companies are more innovative and flexible than state-owned, and they are more capable of transforming their R&D investments into productivity gains. Both of these organizational forms have some advantages and disadvantages.

Business models are tightly linked with technological innovation, and yet it can be essentially separable from technology. Mostly partners are focused on one of those two things. Further, if foreign partner is more focused on a business model, than it needs someone who is more oriented on innovation and technology. In this case privately owned companies rather than state-owned. Also, we can say that state-owned companies can fit better with a foreign partner who is more focused on technology and innovation. Therefore:

H₂.The relationship between JV performance and type of local partner is moderated by firm’s strategy.

H₂a. When in JV foreign partner is focused on technology and innovation, the state-owned local partner will enhance JV performance.

H₂b. When in JV foreign partner is focused on business model, private owned local partner will enhance JV performance

International experience

International experience of a local partner can be crucial, especially in early stages of joint venture because it can influence the relationship, communication, and cooperation between partners. Since doing business in China cannot be compared to doing business in other develop countries, it is very important for both partners to have an international background. National and organizational cultural dissimilarities among partners are the biggest obstacles for partners to overcome.

The most common way for Chinese partners to gain international experience is through import and export businesses or cooperative projects (Luo, 1997). By doing business with foreign firms, Chinese partner is learning more about international operations, marketing strategies, technology, product innovation. Since foreign experience is followed by exposure to foreign values, it can also affect the local firm’s ability to communicate more efficiently with its foreign partner (Shenkar and Zeira, 1990). Further, it can stimulate the trust and collaboration between partners. International experience and knowledge about different national cultures can be effective in overcoming mistrust and opportunism. Since in China, business culture and practices differ from those in other countries, having a Chinese partner with considerable international experience will be seen as culturally knowledgeable and cooperative by a foreign partner. Therefore:

H₃In the IJV, established in China, the longer the domestic partner’s international experience is, the better performance will JV have.

Product relatedness

If local partner’s main product/service is different from the JV’s main product/service, it can affect JV’s performance, the economy of scale and scope, etc. The main problem that can come up with that diversity is the inability for JV to utilize existing distribution channels, product image, industrial experience, and production facilities already established by the local partner (Geringer et al. 1989). Further, having a new product/ service means starting from the beginning. It can be time-consuming to establish a new customer base, distribution channels, which can cost JV a lot of money.

Even though there are many advantages of having local partner, such as, connections with the significant people from the government, administrative efficiency, access to scarce production factors and reduction of financial and operational risks, there are some unique advantages of product relatedness between local partner and JV that probably won’t happen in the situation when products/services are not related. Those advantages can come from the economies of scale and local partner’s existing distribution channels, marketing skills, customer loyalty, and production facilities (Luo,1997). Since in the complex Chinese market, interaction with buyers, suppliers, competitors and governmental representatives can be complicated, a local partner who has already established those relationships can be more helpful for JV to build stable relationships with, buyers, suppliers, local government, etc. Therefore:

H₄ In the Chinese market, JV with product/service related to product/service of its local partner, will have higher performance than if it is not related.

IV. Research Methodology

4.1. Data and Sampling

Data was obtained from 50 IJV in China, in the period from January till April 2017. Data was collected through self-completed questionnaires. Self-completed questionnaires were in online form, and Survey Monkey is used as an online survey tool because it was the most convenient way to collect data. In order to test survey questions, pilot interviews were conducted among five managers working in the international joint ventures, who were not included in the main study.

The final target respondents were identified as managers, of mid-level and above, working in an International Joint Venture in China.

To avoid the confounding effect of having multiple partners (>2), this study focuses on single local-single foreign partnerships.

Foreign partners are from different countries: USA, Germany, Turkey, Mexico, Bulgaria, Russia, South Korea, etc.

All questionnaires and interviews were conducted in English. In this paper, a convenience sampling method is used for a respondent gathering since the author had limited channels of connecting to all parts of the population. After done research about International Joint Ventures in China and obtained enough information, the questionnaire was delivered through emails, social medias such as LinkedIn, where target group is likely to be present. These limited channels of finding respondents could cause a lack of variety from the population. Moreover, that is why this method has to be regarded as convenience sampling.

4.2. Variable Measurement

Independent Variables

Product Relatedness was measured by a dummy variable: 1 if it is related, 0 if it is not related. International experience was measured by the number of years local partner had cooperated with a foreign company.

For the market experience, the author used the number of years local partner has been operating in the market before creating this IJV. Moreover, for the last variable, the organizational form was also used a dummy variable, 1 if the local partner is state- owned, and 0 if it is privately owned.

Depended variable

For JV’s performance are used perceptual measures of the foreign partner. Since there is no consensus regarding what is the best way for measuring performance, in previous researches were used a different kind of measures. Author excluded financial indicators, mostly because they are showing only one side of performance and also that kind of data can be unavailable for the author. Having considered all those disadvantages of financial indicators, some researchers have chosen perceptual measures which include social commitments and engagement of partners, and meeting the needs of partners over the long term. According to Geringer and Hebert (1991), international joint ventures as performing more successfully were more likely to remain in operation than those international joint ventures that were evaluated as being less successful (Pothukuchi, Damanpour, Choi, Chen, Park, 2002).

That is why the author used subjective measures from studies by Parkhe (1989) and Geringer and Hebert (1991). Further, questions for measuring foreign parent’s satisfaction with the IJV’s overall performance were based on using a 5-point Likert-type scale. To measure JV’s performance, two factors were identified as the most important (Table 5).

First factor measures satisfaction with joint ventures and it hasnine items: commitment of the partners towards each other, cooperation between partners, overall satisfaction of the foreign partner with the joint venture, commitment of the partners towards the joint venture, conflict resolution between partners, adequacy of interaction between partners, communication between partners, fixed cost reduction, lower average cost from larger volume. Respondents had to answer to questions, regarding the first factor, from 1 (Very dissatisfied) to 5 (Very satisfied). The second factor measures the efficiency of the joint venture, and it hasthree items: sourcing and access to capital, aggressive joint venture to increase costs or to lower market share for a third company and defensive joint venture to reduce competition. For the second factor was also used the Likert scale. Respondents had to answer from 1 (Very low) to 5 (Very high).

Moderated variable

Firm’s strategy was measured with 1 if it foreign partner is focused on technology and innovation, 2 if foreign partner is focused on the business model and 3 if it is focused on both. To better understand results of the effect of mediating variable on performance, we divided it into two new variables. The new variables were named as IFB and IFT. IFB is a dummy variable measured with 1 if foreign partner is focused on the business model or both, and 0 if it is focused on technology and innovation. Moreover, IFT is also a dummy variable, measured with 1 if foreign partner is focused on technology and innovation or both, and 0 if it is focused on the business model.

Control Variables

In this paper venture’s age and size were considered as controlled variables. Age and size were controlled because of their potential effect on JV’s performance.

Age was measured as a number of years the venture has been in existence.

The size was measured as a number of full-time employees of the venture.

4.3. Questionnaire development

The questionnaire is a general term for all methods of data collection in which each person is asked to respond the same set of questions in a predetermined order (deVaus, 2002). Further, it can include structured interviews, telephone questionnaires and also questionnaires in which questions are answered without the presence of an interviewer, such as Auchentoshan distillery’s online questionnaire. From all the methods used for data collection, the questionnaire is one of the most used. Moreover, each respondent is asked to answer the same set of questions, and because of that questionnaire is providing an efficient way for collecting responses from the sample prior to quantitative analysis (Saunders, Lewis, Thornhill, 2012). Compared to other methods, questionnaires have many advantages and disadvantages. As for the advantages, the questionnaire is very practical and significant amount of information can be collected from a larger sample in a relatively cost effective way and in a short period. It allows respondents to take time for considering their responses carefully without interference from, for example, an interviewer. The results of the questionnaires can usually be easily and quickly summarized by either a researcher or through the use of a software package. It can provide anonymity and can be carried out by the researcher or by any number of people with limited effect on its validity and reliability. Can be analyzed more ‘scientifically’ and objectively than other forms of research.

As for the disadvantages, it can be difficult to get a good response rate because sometimes there is no strong motivation for respondents to give a valid response. Also, respondents may read each question differently and because of that their answers are based on their own interpretation of the question. Therefore, there is going to be a certain level of subjectivity that it might not be acknowledged. Questionnaires are complex instruments and sometimes can be misled if they are not designed properly.

However, in general, questionnaires are effective mechanisms for efficient collection of certain kinds of information, and that is why the author chose this method as the way to collecting data.

In this research self- completed questionnaires were used, which are usually completed by respondents. The questionnaire is designed with Survey Monkey online survey tool. There are in total thirteen questions. The questions cover information about respondent such as position within Joint Venture and years of working. On the first question, respondent could choose between various answers and this question was relevant in terms of ensuring that respondents will be from the sample- middle-level managers and above working in a JV. Questions are made in the way to cover all eight variables.

For classification of quantitative data into data types is used a hierarchy of measurement, often in ascending order of mathematical precision (Berman, Brown and Saunders 2008).

Quantitative data is usually divided into two different groups: categorical and numerical (Saunders, Lewis, Thornhill, 2012). Categorical data mostly includes values which cannot be measured in a numerical way, but can be classified into categories according to the characteristics of variables or placed in rank order. They are known as nominal (descriptive) and ordinal (ranked) data (Berman Brown and Saunders 2008).

In this questionnaire, nominal variables are used for the questions which have two or more categories, but these categories cannot be compared, such as nationality of the foreign partner, respondent’s working position, etc. The questionnaire covers these questions to ensure that respondents are from the requested sample. All posts were from the mid-level management and above. As for the variables that need to be analyzed, nominal variables were also covering questions about the organizational form, product relatedness, and firm’s strategy. In the question about the organizational form of local partner, respondent had to choose the answer between private-owned and state-owned form since only these two types are relevant for the research. To test hypothesis number two (H2), respondents had to answer about foreign partner’s firm strategy as well. Moreover, is the foreign partner more focused on the business model or technology and innovation or maybe on both? All these data only count the number of occurrences in each category of a variable, and that is why they are shown as nominal (Saunders, Lewis, Thornhill, 2012).

Most of the questions from the questionnaire are with ordinal variables since ordinal data are known as being more precise categorical data form. Further, the relative position of each case in data set is known. Therefore, ordinal variables are used in questions that have a Likert scale with answers 1 (very dissatisfied) 5 (very satisfied) and 1 (very low) 5 (very high). Since values are organized from lowest to highest, there are clearly categorical variables. What can distinguish them from being interval variable, is the fact that the space between these values it is not the same across the levels of variables. All questions that measure performance as dependent variable are with ordinal variables. Performance is measured by two factors: satisfaction and efficiency. For the satisfaction are used nine different values, and they are measured with a Likert scale, 1 (very dissatisfied) 5 (very satisfied). Respondent had to show the level of satisfaction of commitment of the partners towards each other, cooperation between partners, the commitment of the partners towards the joint venture, conflict resolution between partners, adequacy of interaction between partners, communication between partners, fixed cost reduction, average cost lowering from a larger volume. The difference between satisfaction levels cannot be measured because it is different among different people. For the efficiency is also used a Likert scale , but with another answers, from 1 (very low) to 5 (very high). This factor is covered with question number thirteen where the respondent is rating items such as sourcing and access to capital, aggressiveness of the joint venture to increase costs or to lower market share for a third company and the level of defense of joint venture to reduce competition, from very low to very high.

Another type of data whose values are measured or counted numerically as quantities is called numerical (Berman Brown and Saunders 2008). Numerical data are more precise than categorical because in numerical data each data can be assigned a value of a position on a numerical scale. Further, numerical data can be divided into interval and ratio data. In this research author used interval data stating the difference or‘interval’between any two data values for a particular variable. Unlike ordinal variables, the interval has the same amount of space between each measure. This type is chosen to describe control variables such as a number of full-time employees in joint venture and years of joint venture establishment in China. Also, the interval is used for questions which cover years of local partner experience in China and years of local partner international experience before Joint Venture.

4.4. Exploratory factor analysis

Exploratory Factor Analysis (EFA) is a statistical approach for determining the correlation among the variables in a dataset.[1] Further, the main goal of factor analysis can be to reduce “the dimensionality of the original space and to give an interpretation to the new space, spanned by a reduced number of new dimensions which are supposed to underlie the old ones” (Rietveld & Van Hout, 1993), or to show the meaning of the variance in the observed variables in terms of underlying latent factors (Habing 2003). Exploratory Factor Analysis is preparing the variables for cleaner structural equation modeling. However, EFA is only adequate for non-nominal items which theoretically belong to reflective latent factors.

For the purpose of conducting EFA, Principal Component extraction analysis is used, with Varimax rotation. Also, all the items with a loading value less than 0,4% on any factors will be deleted. The results of the data are explained in the following table:

Table 4. KMO and Bartlett’s Test

| KMO and Bartlett’s Test | ||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | .815 | |

| Bartlett’s Test of Sphericity | Approx. Chi-Square | 443.113 |

| df | 66 | |

| Sig. | .000 | |

The Table 4. shows the results of KMO and Bartlett’s Test of Sphericity of the exploratory factors which are affecting Joint Venture performance. The KMO statistic is varying between 0 and 1. According to Kaiser (1974, all values greater than 0.5 as acceptable (all values below this need to lead researcher to either rethink which variables to include or collect more data). Moreover, values between 0.5 and 0.7 are mediocre, and values between 0.7 and 0.8 are good, values between 0.8 and 0.9 are great, and values above 0.9 are superb. As for the data in this paper, the value is 0.815, which falls into the range of being great, so we should know that factor analysis is appropriate for these data.

The purpose of Bartlett’s test is to test the null hypothesis that the original correlation matrix is an identity matrix. In order to work with factor analysis, we need some relationships between variables, and if the R-matrix was an identity matrix, then all correlation coefficients would be zero. In conclusion, the main goal is to get this test as significant, in other words to have a significance value less than 0.5. The Bartlett’s test of sphericity is calculated through the Approximate Chi-Square test, and shows the value at 443.113 df=66, and significance= 0,000, which indicates that the correlation matrix is significantly different from an identity matrix, in which correlations between variables are all zero, therefore, there are some relationships between the variables we hope to include in the analysis. For these data, Bartlett’s test is highly significant (p>0.001), and that is why factor analysis is appropriate.

Table 5. Communalities

| Initial | Extraction | |

| Commitment between partners in JV | 1.000 | .550 |

| Cooperation between partners in JV | 1.000 | .592 |

| Overall satisfaction of the joint venture | 1.000 | .485 |

| Commitment of both partners towards Joint venture | 1.000 | .566 |

| Conflict resolution between partners | 1.000 | .583 |

| Adequacy of interaction between partners | 1.000 | .718 |

| Communication between partners | 1.000 | .712 |

| Fixed cost reduction | 1.000 | .496 |

| Lower average cost from larger volume | 1.000 | .617 |

| Sourcing and access to capital | 1.000 | .657 |

| The level of JV’s aggressiveness to increase costs or to lower market share for a third company | 1.000 | .875 |

| The level of JV’s defense in order to reduce competition | 1.000 | .863 |

| Extraction Method: Principal Component Analysis. | ||

The table of communalities shows data before and after extraction. Principal component analysis works on the initial assumption that all variance is common; therefore, before extraction, the communalities are all 1. The communalities after extraction are representing the amount of variance in each variable that can be explained by the retained factors. The extraction values, for statistical significance, have to be higher than 0.4%. The results are found between 0.485 and 0.875, which all the values are well represented in the common factor space.

Table 6. Total variance explained

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | Rotation Sums of Squared Loadings | ||||||

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 6.532 | 54.429 | 54.429 | 6.532 | 54.429 | 54.429 | 4.580 | 38.166 | 38.166 |

| 2 | 1.183 | 9.856 | 64.285 | 1.183 | 9.856 | 64.285 | 3.134 | 26.119 | 64.285 |

| 3 | .945 | 7.873 | 72.158 | ||||||

| 4 | .879 | 7.323 | 79.481 | ||||||

| 5 | .668 | 5.565 | 85.045 | ||||||

| 6 | .533 | 4.443 | 89.489 | ||||||

| 7 | .451 | 3.759 | 93.248 | ||||||

| 8 | .267 | 2.224 | 95.472 | ||||||

| 9 | .235 | 1.957 | 97.429 | ||||||

| 10 | .163 | 1.361 | 98.790 | ||||||

| 11 | .106 | .882 | 99.672 | ||||||

| 12 | .039 | .328 | 100.000 | ||||||

| Extraction Method: Principal Component Analysis. | |||||||||

Table 6. lists all the eigenvalues associated with each linear component (factor) before extraction, after extraction, and after rotation. It should be clear that first two factors explain relatively large amounts of variance (especially factor 1) whereas following factors explain only small amounts of variance. Furthermore, three factors are extracted because they had eigenvalues greater than 1, which leaves us with two factors.

Above table also shows the Rotation Sum of Squared Loadings of all observed factors. Each number components, represent each factor: Satisfaction with Joint Venture and Efficiency.

Table 7. Rotated Component Matrix

| Component | ||

| 1 | 2 | |

| Adequacy of interaction between partners | .789 | |

| Communication between partners | .778 | |

| Cooperation between partners in JV | .760 | |

| Commitment between partners in JV | .720 | |

| Conflict resolution between partners | .687 | |

| Overall satisfaction of the joint venture | .663 | |

| Lower average cost from larger volume | .658 | .429 |

| Commitment of both partners towards Joint venture | .612 | .438 |

| Fixed cost reduction | .554 | .436 |

| The level of JV’s aggressiveness to increase costs or to lower market share for a third company | .880 | |

| The level of JV’s defense to reduce competition | .880 | |

| Sourcing and access to capital | .786 | |

| Extraction Method: Principal Component Analysis.

Rotation Method: Varimax with Kaiser Normalization. |

||

| a. Rotation converged in 3 iterations. | ||

The rotation of the factors structure has clarified things considerably: there are two factors. The suppression of loadings less than 0.4 and ordering variables by loading size also makes interpretation considerably easier. Nine questions are loading highly on factor 1. We will call this factor satisfaction with Joint Venture. As for the second factor, three questions are loading highly, and we will call this factor efficiency.

V. Quantitative analysis