Increasing Auto Adjudication – A Claim Submission Avenue Study

Info: 10311 words (41 pages) Dissertation

Published: 11th Dec 2019

Tagged: Finance

Abstract

Relationships exist between claim submission avenue and claim auto adjudication rates. Automating the processing of simple, high volume claims prevents the need for manual processing and labor costs. Industry standards characterize companies with an auto adjudication rate of 80% or higher as optimally efficient. Metlife Dental Claims currently has an overall auto adjudication rate of 78% and in order to achieve the industry standard of 80%, methods of increasing auto adjudication rates without increasing costs must be identified.

Objectives

The purpose of this study is to determine the claim submission avenue drivers of decreased auto adjudication rates within claims processing operations. Claims fail auto adjudication due to the Claim Level or Charge Line Edit which presents within the Unified Claims System (UCS). Many of these edits are linked to submission avenue which depend on a provider’s preferred method of claims submission. Based on the correlation between claim submission avenue and auto adjudication rate established by this study, a recommendation to reduce the number of paper claims submitted to increase overall auto adjudication rates will be proposed as a result of this study.

Auto adjudication is driven by two forces: system logic and claim submission avenue. System logic determines if the claim needs manual intervention based on processing edits or if the claim can be processed automatically (auto adjudicated) within the Unified Claim System (UCS). Claim submission avenue is determined by the method of claim receipt (paper fax or mail, electronic clearing house, VRU, website and mobile application) and is tied closely to system logic as electronic claims present with different processing edits than paper claims. Electronic claims are received digitally and as a result, it is possible to manipulate them within the system through automated programming in order to resolve processing edits without human intervention. Processing edits in paper claims cannot be manipulated through automated programming because they are manually keyed into the system by a claim approver after the image of the paper document has been scanned. Paper documents often contain handwriting which cannot be digitally transposed into the system via scan, thus, creating the need for manual processing intervention. Further complicating the processing scenarios surrounding paper claims is the fact that possible system logic enhancements which could allow some paper claims to be scanned more effectively are costly. Because system logic changes are costly and the organization currently has stringent cost measures in place for IT, this study will examine the relationship between claim submission avenue and auto adjudication rates to determine if changes to submission avenue can be manipulated to increase auto adjudication. Because changing claim submission avenue has no associated costs, identifying patterns between claim submission avenue and auto adjudication rates will prevent claims from failing automated processing, thereby increasing auto adjudication rates. The intent of this study is to propose a preferred claim submission avenue which will maximize auto adjudication without incurring additional costs to the organization, providers or customers. In light of new health care reform and changing business needs, reducing costs and streamlining processes to achieve maximum efficiency will make the company more competitive and keep rates low for beneficiaries which will attract more customers and increase profits. Once the claim submission avenue drivers of decreased auto adjudication rates are identified, a plan can be created to increase auto adjudication through claim submission avenue manipulation.

Literature Review

Auto adjudication rates can be increased by enhanced pre-adjudication edits (Neumann, 2010, p.9), Activity Based Costing analysis of inefficient processes (Shoemaker, 2006, p.36) and the utilization of Application Service Providers (Bell, 2000, p.23). These methods of increasing auto adjudication are effective but costly, which presents budgetary challenges for insurance companies in light of recent health care reform. Another less explored option for increasing auto adjudication is driving and incentivizing electronic claims submission which has a significantly higher rate of auto adjudication than paper claims. Increasing electronic claims submission is relatively cost free but incenting providers to discontinue paper claim submission can be challenging when practices are hesitant to utilize new technology. Generational patterns exist within aversion to technology and older generations tend to be “more cynical and less receptive to new ideas” (Sawers, 2013, p.1) making electronic claims submission a difficult tool to promote among tenured providers. To mitigate this challenge, research must be performed to determine the root cause of providers’ aversion to technology and electronic claims submission and a culture shift will be needed in these providers’ practices in order to ensure that electronic claim submission is successful. An integral part of the solution developed to increase electronic claim submission within the top 10% of paper claim submitting providers will be a detailed implementation plan to address the culture shift. In order for change to be implemented successfully:

“A group must have stability, shared experience, and history to form a culture. Over time, especially if the organization competes successfully, a set of persistent norms and values develop. The greater the success of the organization, the greater the reinforcement of its norms and the more enduring the culture” (Boan, 2006, p.51).

Ensuring the success of providers’ switch to electronic claim submission will create the necessary culture change which will positively impact claims auto adjudication.

To effectively shift provider culture toward electronic claims submission, the appropriate data will need to be collected to determine the root cause of providers’ aversion to technology. Since “how data are collected has a sizeable impact on how data are managed, and ultimately how the research is performed” (Wilcox, Gallagher, Boden-Albala & Bakken, 2012, p.1); our data collection will need to be detailed in order to determine why paper claim submission preference exists. To obtain the level of detail needed, data analysis of historical and current auto adjudication rates and claim submission avenues will be utilized to acquire information regarding paper claim submission. While a distinct advantage of utilizing interviews and surveys is that “they are relatively inexpensive to administer” (Trochim, 2006, p.1), similar information can be obtained from analyzing auto adjudication and claim submission avenue data at no expense to the organization. Additionally, detailed data analysis will enable us to “ask questions that elicit ideas and behaviors, preferences, traits, attitudes and facts” (Sincero, 2012, p.1) which will lead us to the root cause of providers’ reluctance to utilize electronic claim submission.

Because incorrectly submitted claims result in failed auto adjudication, the implementation of pre-adjudication edits enables claims to be submitted more accurately (Neumann, 2010, p.10). Additionally, pre-adjudication edits increase audit transparency as changes to claims can be viewed real-time (Plexis Healthcare Systems, 2014, p.1). The company’s leadership team believes that the majority of incorrectly submitted claims are received via paper and postal mail. Utilizing electronic claim submission will enable providers to make real-time changes based on pre-adjudication edits resulting in expedited claim payment. In order to ensure the maximum effectiveness of suggested claim submission avenues, providers should be praised, recognized, and possibly incentivized when using appropriate submission avenues. Praising and creating positive reinforcement when the provider gives an adequate response will increase engagement as praise has been shown to positively impact participation (D’Zurilla, 1966, p.374).

Factors decreasing auto adjudication can be difficult and time consuming to identify. To effectively identify drivers causing decreased auto adjudication to strategically manage costs, Activity Based Costing can be utilized (Shoemaker, 2006, p.37). “Strategic Cost Management means aligning costs with the goals and strategic direction of the organization” (Santana & Afonso, 2015, p.136) and by assigning a cost to each claims processing function, expensive and inefficient processes can be streamlined (Shoemaker, 2006, p.36) resulting in potentially higher auto adjudication rates. In the case of paper claim submission, Activity Based Costing has indicated that paper claims have a higher cost than electronically submitted claims due to the postage, imaging, maintenance, handling and manual processing associated with that claim submission avenue.

When factors are identified which reduce auto-adjudication rates, system and software implementation must be implemented quickly in some cases. Some vendors specialize in implementing unique payer platforms within tight turnaround times (Aldera, 2014, p.1) which can increase customer satisfaction and expedite cost savings. Other vendors focus on specialty software able to handle unique plan specifications such as medical vs. dental (Electronic Health Plans Inc., 2015, p.1), Medicare Part B (CMS, 2003, p.1), healthcare reform based requirements (JavelinaTM, 2012, p.1) or rule-based system logic to meet service levels (Oracle, 2012, p.1). Since our vendors perform all of these functions, they have the ability to directly impact our auto adjudication rates. Our vendor’s main opportunity for improvement involves the quality of their imaging and queue routing work. In order to serve effectively as our vendor, our business partners must “accept and continually establish ownership” and be “resilient to handle the high pressure, demanding environment of a major project” (Kendig, 2015, p.46) such as reducing the amount of imaging work from paper claims. The company’s Leadership Team will carefully review the results of this study to identify opportunities for vendor improvement such as faster imagining turnaround time and system delays for electronic claims.

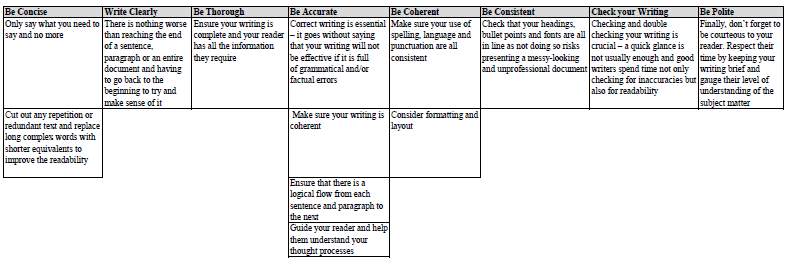

Auto adjudication is higher when system logic is technologically advanced (Bell, 2000, p.23) and the use of Application Service Providers can offer many benefits. In addition to decreased costs due to the lack of system and software maintenance, Application Service Providers also offer HIPAA compliant data integrity (Bell, 2000, p.23). In order to achieve the most effective system logic, some companies utilize Application Service Providers to create their own high-end software and systems to meet their specific processing needs (Guidewire Software, 2014, p.1). This can be costly in some cases and even the best system logic and software can be vulnerable if outdated legacy core systems are utilized at any point in the claims processing workflow (McKendrick, 2008, p.32). This is the case in our organization as even newer systems operate off of core legacy systems. “One other alternative is to enable noncore application programming interfaces — known as APIs — outside of the base core” (Boskovich, 2016, p.1) but this is unlikely to be approved until at least 2018 as “the high risk of a core replacement project is well documented. Industry skepticism about the return on such an investment is also high” (Boskovich, 2016, p.1). To mitigate the risks presented by legacy systems, other companies choose to combine their systems with vendor systems which can result in reduced claim rejection (Information Technology, 2005, p.1). Due to the fact that our organization services military contracts, it is not possible to combine our onshore systems housing military insurance policies with offshore vendor systems because of security concerns. One possibility which may be explored based on the results of this study is that of onshore vendors. Because our organization has been awarded several large contracts recently, it is possible that the need for vendor services may increase and “continued focus on cost effectiveness will drive growth in the new business process outsourcing (BPO) areas. However, the barriers to offshore outsourcing are likely to affect these new operational services” (Outsourcing, 2003, p.17) meaning that work could potentially be routed to an onshore vendor. Aside from the budgetary challenges surrounding costs of paper claim handling, vendor management, APIs and the transition of work to onshore vendors, our main challenge will be creating a culture of change among providers who are reluctant to submit claims electronically. Change management will be crucial to the transition of paper claim submission to electronic claim submission, particularly among experienced providers. Because “ongoing interactions among different individuals, between individuals and organizations, and between multiple levels across organizations and contexts permeate and orient change processes” (Langley, Smallman, Tsoukas & Van De Ven, 2013, p.9); it may be helpful to set up a provider community on the electronic claim submission website where questions can be posted and experiences shared. “Information from virtual communities” encourages a sense of shared experience and “exerts a powerful influence” which “can be rapidly and extensively communicated” (Lim, 2013, p.270). Creating a virtual provider community may also decrease calls to our Provider Unit and providers will have the ability to answer each other’s questions rather than contacting our organization directly. Other ways to assist with change management among providers and overcome resistance to change is to promote self-efficacy, emotional intelligence and organizational commitment among providers (Sasikala & Anthonyraj, 2015, p.30) as these traits have been shown to directly impact the ability to navigate change successfully. In particular, additional soft skill training for Provider Unit Call Center employees may be beneficial. “Training is receiving more attention by call center managers because of increased pressure for productivity and a wider remit of tasks handled in the call center” (Call centers: focus on soft skills, 2003, p.179) and our organization is no different. Our Provider Unit handles a wide variety of tasks in a production based environment and this can reduce the amount of attention paid to soft skills such as promoting self-efficacy and brand loyalty among providers. Through enhanced customer service training in the call center, change management may be facilitated more effectively within the provider community. Aside from the customer-facing component of change management, our organization must take careful steps behind the scenes to develop an effective change management strategy. “Developing a change management strategy provides direction and purpose for change management plans” and “a ‘one-size-fits-all’ approach is not effective for change management” (The Why and How of a Change Management Strategy, 2017, p.1). During this study, it was discovered that “change management strategies define the approach needed to manage change given the unique situation of the project or initiative” and “every change management strategy must include an understanding of the unique characteristics of the change, a supporting structure to implement the strategy, and analysis of the risks of the change and potential resistance to the change” (The Why and How of a Change Management Strategy, 2017, p.1). Past initiatives similar to the one described in this study have failed at our organization and this may have been due in part to failure to formulate the appropriate change management plan. “Formulating the change management strategy is the first critical step in implementing a change management methodology. The strategy provides direction and results in informed decision making throughout the change process. A well-formulated strategy brings the project or change to life, describing who and how it will impact the organization” (The Why and How of a Change Management Strategy, 2017, p.1). Lastly, a key component of change management when transitioning paper claim submitting providers to an electronic environment will be the clarity of written communications sent to providers. Steps that will be taken to guarantee effective provider mailings will include suggesting claim submission avenues that apply to the provider’s business needs and only providing necessary information that is concise and free of technical jargon (Tartell, 2015, p.14). Additionally, the following steps outlined by Mulkeen will be utilized to ensure effective communication with providers:

(Mulkeen, 2016, p.1).

Through effective data collection, analysis and communication, we can begin exploring which of the above listed actions will manage change among our providers and create a smooth transition to a fully electronic claim submission environment. (The Why and How of a Change Management Strategy, 2017, p.1). The review of literature indicates that our biggest challenge with adopting the best practices of other organizations is our stringent cost measures which are currently in place. Without being able to afford legacy system enhancements, expensive vendor services or large changes to our system logic; we are left only with the option to strategically reduce the number of claims failing auto adjudication. To do this, we need to determine which claim submission avenue generates the greatest need for manual processing.

Methodology

A detailed comparison of claim submission avenue and auto adjudication rate data must take place to establish a relationship between these two elements. Both auto adjudication rate and claim submission avenue data is automatically generated via Microsoft Excel by our Unified Claim System (UCS) on a daily basis. This data will be categorized, reviewed and compared from the beginning of 2016 to present. A comprehensive review will be compiled showing the correlation between claim submission avenue and auto adjudication rates to determine which submission avenue produces the highest auto adjudication rate. Once it is determined which submission avenue produces the highest auto adjudication rate, a recommendation can be made regarding our preferred claim submission avenue and a plan can be created and implemented to incent providers to utilize that claim submission avenue.

Context

This study took place in a corporate office setting where the majority of claims are automatically processed via system logic. Manual claim processing is handled by front line associates with access to imaging systems and our master system called Unified Claims System (UCS). Our claims processing team is comprised of about fifty associates, each of who specialize in different work types but all handle a combination of paper, electronic and web claims. Because paper claims are manually scanned and keyed into the system, auto processing logic cannot be manipulated to read fields containing handwriting. System logic for electronic, phone and web claims can be manipulated to handle different claim processing edits as all claim information is digital and can be read by the system. Paper claims are different because they are simply scanned images of actual documents which must be keyed by a processor into the system. As a result, these claims cannot be digitally manipulated. The inability to increase the paper claim auto adjudication rate through technology limits the organization in terms of options to create a cost savings through increasing paper claim auto adjudication. The industry standard for claim auto adjudication is currently 80% or better and in order to remain competitive in a rapidly changing environment which has been impacted by recent health care reform; it is imperative that the auto adjudication rate be increased by 1.86% as quickly as possible. This increase must be achieved without IT costs due to a budget freeze. As a result of the manual processes taking place in the system daily, reports are generated to management detailing auto adjudication rates and claim submission avenue. These reports will be used to determine what, if any, relationship exists between auto adjudication rates and claim submission avenue so that a recommendation can be created to increase auto adjudication rates through the manipulation of claim submission avenue. This will reduce the need for manual handling therefore reducing staffing need and workforce expenses.

Data Collection

Claim submission avenue and auto adjudication data were compiled for each business day in 2016 through November 3rd, 2016. This information is tracked within the Unified Claims System (UCS) and was produced through system generated ABP reporting. System logic enhancements which were made in the first three quarters of 2016 prior to the budget freeze were reflected in this data set. The two reports reflecting 2016’s auto adjudication rates and claim submission avenue volumes were then compared for each day individually. These results were automatically generated by UCS’s ABP reporting and exported in Microsoft Excel.

Data Analysis

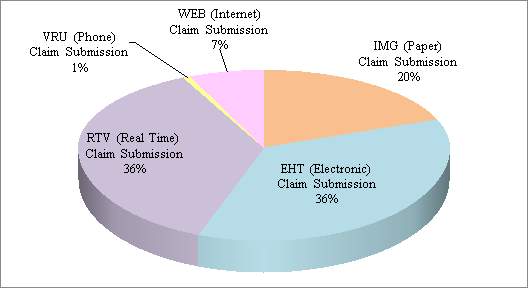

The data revealed that a total of 28,790,542 claims were received through November 3rd, 2016.

| 2016 Claim Receipts | PAPER (Paper) Claim Submission | EHT (Electronic) Claim Submission | RTV (Real Time) Claim Submission | VRU (Phone) Claim Submission | WEB (Internet) Claim Submission |

| 28790542 | 5774976 | 10280115 | 10341098 | 207627 | 2186726 |

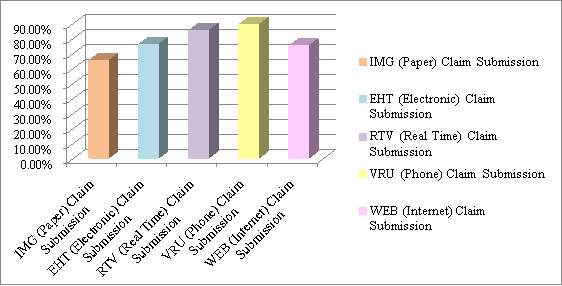

Approximately 72% of all claim receipts were via electronic submission avenues. The highest auto adjudication rates were observed in the VRU phone submission avenue (89.30%) and the lowest auto adjudication rates were observed in paper submission avenues (65.20%).

| 2016 Overall Auto Adjudication Rate | PAPER (Paper) Claim Submission | EHT (Electronic) Claim Submission | RTV (Real Time) Claim Submission | VRU (Phone) Claim Submission | WEB (Internet) Claim Submission |

| 78.14% | 65.20% | 76.10% | 85.20% | 89.30% | 74.90% |

An overall increase of 5.71% in auto adjudication was observed from January 4th 2016 to November 3rd 2016. Electronic claim submission experienced a 5.1% increase in auto adjudication during the above timeframe. Similarly, real time claim, VRU phone, and web claim submission avenues experienced auto adjudication increases of 2.1%, 2.9% and 2.5% respectively. In contrast, paper claim submission saw a decrease in auto adjudication of -0.2%. While variances in auto adjudication rates of up to 70% were observed in electronic, phone and web claims based on deployments of system logic enhancements; a maximum variance of just 16.3% was observed in the auto adjudication rate for paper claims.

An analysis of mean, median and mode auto adjudication rates indicated that VRU and RTV claim submission avenues had the highest auto adjudication rates while paper had the lowest.

An analysis of the Standard Deviation and Variance showed that all claim Submission avenues with the exception of Web Claims showed the desired level of Standard Deviation and Variance which indicates little fluctuation in the data set lending credibility to the data’s accuracy. Similarly, a Normal Distribution analysis was used to identify a Bell Curve within the data set and determine the probability of claim auto adjudication rates being at or below the desired value of 80%. The results shown were expected as most of 2016 was well below the goal. Additionally, an analysis of the Binomial Distribution indicated that 203 of the 214 days examined in 2016 were below the overall auto adjudication goal which prompted a Correlational Analysis indicating that a correlation of 0.24 exists between overall claim auto adjudication rate and paper auto adjudication rates. Lastly, a Regression Analysis was used to estimate the relationships among variables, in this case; the relationship between paper auto adjudication and overall auto adjudication. Paper auto adjudication is the independent variable in this case which is acting upon the overall auto adjudication rate. All of these analyses confirm that paper claim submission is a driver of decreased auto adjudication. Establishing this connection between paper claim submission and decreased auto adjudication will enable us to create a Plan of Action to achieve our goal of increasing auto adjudication.

Findings

Because the data analysis shows that paper claim submission is associated with lower auto adjudication rates and because system logic cannot be manipulated to increase these rates due to the image scanning limitations associated with paper claims; it appears that paper claim submission should be reduced in order to increase the overall auto adjudication rate without increasing IT expenses. Paper claim submission accounted for 20% of all 2016 claim receipts which is equivalent to 5,774,976 claims total.

Because only 65.20% of paper claims auto adjudicate, this means that 3,765,284 claims in 2016 required manual processing. The average rate of pay for a claims approver is $16 hourly and the average rate of production for claims approvers is 17 claims per hour. Based on this data, each claim manually processed costs the organization $0.94 meaning that paper claim processing cost the organization about $3,539,366.96 in 2016. Decreasing the number of paper claim submissions by just 10% or 577,498 claims would decrease manual processing spending to $3,185,430.32 to create a cost savings of $353,936.34 or roughly 10 FTE staffing headcount. If a more aggressive decrease in paper claim submission were pursued, this would only increase this cost savings thereby reducing FTE need and staffing headcount. These findings combined with the review of literature which examined 11 articles regarding strategic change management, effective communication and soft skills indicate that a cultural shift to electronic claims submission will need to be change managed and clearly communicated to providers in order to successfully decrease the number of paper claim submissions to drive down workforce expenses.

Plan of Action

Based on the best practices of other organizations to increase automation and manage change which were identified in the literature review and the data analysis performed in this study, it appears that five actions items must take place in order to reduce the number of paper claims submitted by providers and increase auto adjudication rates: 1.) Providers driving paper claim submission must be identified by the Management Team. 2.) A Provider Education Campaign advising providers of the incentives to switch to electronic claim submission must be carried out by the Provider Unit. 3.) A Provider Portal must be created by the IT Team by January 1st, 2018 to offer education and self-service to providers in an online, web-based environment. 4.) A contractual stipulation must be drafted by the Legal Department and placed in preferred provider contracts effective January 1st, 2018 to ensure that going forward; all preferred providers agree to submit claims electronically. 5.) The Management Team must utilize ten specific change management practices in order to ensure that the provider cultural shift to electronic claim submission receives proper buy-in from both MetLife providers as well as the Provider Unit assisting them.

To reduce paper claim submission by 10%, the top 10% of paper claim submitting providers must be identified. ABP Reporting from UCS can be utilized to determine which provider Tax Identification Numbers (TINs) submit the largest volumes of initial paper claims. Using the TIN to locate the providers’ phone numbers, these providers should be contacted directly by members of the Provider Unit who have received advanced training in customer service techniques. It will then be the responsibility of the Provider Unit associates to coax these paper claim submitting providers into switching to an electronic claim submission avenue. In order to do this effectively, an incentive will need to be offered for providers to switch their claim submission avenue. The natural incentive in this case is expedited claim handling time or turnaround time (TAT) as the postal mail component of the process will be eliminated. Additionally, Provider Unit associates attempting to switch paper claim submitting providers to electronic submission should also educate providers on the accuracy benefits of electronic claim submission as most of these claims are auto adjudicated which removes the component of human error during processing. If necessary, steps should be taken by the Provider Unit associates to help providers set up electronic claim submission while on the phone. Using behavior techniques such as praise, positive reinforcement and “What’s In It For Me” (WIIFM) language; Provider Unit associates will guide providers to the correct solution of enrolling in electronic claim submission. In order to manage this change in claim submission and shift the culture from paper-based to electronic, a Provider Portal website will be created which house FAQs, electronic forms, chat forums to interact with the provider community as well as self-service options to update information electronically reducing the need for phone calls and paper submissions. Additionally, effective January 1st, 2018; all new providers joining the MetLife network must agree to submit all claims electronically or lose their preferred status.

The most crucial aspect of this Plan of Action will be the management of change within the provider culture. MetLife providers have become accustomed to a paper submission environment while other companies have either forced providers to switch to electronic claim submission or have begun operations in the last decade when paper submission has been obsolete. Jones, Aguirre and Calderone (2004) describe ten characteristics of successful change management:

“Address the ‘human side’ systematically, start at the top, involve every layer, make the formal case, create ownership, communicate the message, assess the cultural landscape, address culture explicitly, prepare for the unexpected and speak to the individual” (Jones, Aguirre & Calderone, 2004, p.1). To “address the ‘human side’ systematically”, “a formal approach for managing change — beginning with the leadership team and then engaging key stakeholders and leaders — should be developed early, and adapted often as change moves through the organization. This demands as much data collection and analysis, planning, and implementation discipline as does a redesign of strategy, systems, or processes. The change-management approach should be fully integrated into program design and decision making, both informing and enabling strategic direction. It should be based on a realistic assessment of the organization’s history, readiness, and capacity to change”.

In terms of our organization’s action plan, this means obtaining buy-in from senior leadership which starts with the presentation of this Action Research Project. Jones et al. recommends that to “start at the top”:

“The leaders themselves must embrace the new approaches first, both to challenge and to motivate the rest of the institution. They must speak with one voice and model the desired behaviors. The executive team also needs to understand that, although its public face may be one of unity, it, too, is composed of individuals who are going through stressful times and need to be supported. Executive teams that work well together are best positioned for success. They are aligned and committed to the direction of change, understand the culture and behaviors the changes intend to introduce, and can model those changes themselves. At one large transportation company, the senior team rolled out an initiative to improve the efficiency and performance of its corporate and field staff before addressing change issues at the officer level. The initiative realized initial cost savings but stalled as employees began to question the leadership team’s vision and commitment. Only after the leadership team went through the process of aligning and committing to the change initiative was the work force able to deliver downstream results”.

Like the transportation company, our organization will need senior management to be involved in the planning of the Provider Education Campaign in order ensure the company’s overall vision and strategy is captured. Jones et al. details that to “involve every layer”:

“Change efforts must include plans for identifying leaders throughout the company and pushing responsibility for design and implementation down, so that change ‘cascades’ through the organization. At each layer of the organization, the leaders who are identified and trained must be aligned to the company’s vision, equipped to execute their specific mission, and motivated to make change happen. A major multiline insurer with consistently flat earnings decided to change performance and behavior in preparation for going public. The company followed this ‘cascading leadership’ methodology, training and supporting teams at each stage. First, 10 officers set the strategy, vision, and targets. Next, more than 60 senior executives and managers designed the core of the change initiative. Then 500 leaders from the field drove implementation. The structure remained in place throughout the change program, which doubled the company’s earnings far ahead of schedule. This approach is also a superb way for a company to identify its next generation of leadership”.

Like the insurer described above, our organization will need to ensure that middle management as well as frontline staff with leadership abilities are identified and selected to assist with the Provider Education Campaign to ensure that this effort continues on well after senior management switches roles or retires. Jones et al. states that to “make the formal case”:

“The articulation of a formal case for change and the creation of a written vision statement are invaluable opportunities to create or compel leadership-team alignment. Three steps should be followed in developing the case: First, confront reality and articulate a convincing need for change. Second, demonstrate faith that the company has a viable future and the leadership to get there. Finally, provide a road map to guide behavior and decision making. Leaders must then customize this message for various internal audiences, describing the pending change in terms that matter to the individuals. A consumer packaged-goods company experiencing years of steadily declining earnings determined that it needed to significantly restructure its operations — instituting, among other things, a 30 percent work force reduction — to remain competitive. In a series of offsite meetings, the executive team built a brutally honest business case that downsizing was the only way to keep the business viable, and drew on the company’s proud heritage to craft a compelling vision to lead the company forward. By confronting reality and helping employees understand the necessity for change, leaders were able to motivate the organization to follow the new direction in the midst of the largest downsizing in the company’s history. Instead of being shell-shocked and demoralized, those who stayed felt a renewed resolve to help the enterprise advance”.

The creation of a vision statement to characterize the Provider Education Campaign will not only inspire associates to convert as many paper claim submitting providers to electronic submission as possible but like the consumer packaged goods company described above, it will help our associates understand the value of the change we are implementing. Jones et al. explains that to “create ownership”:

“Requires more than mere buy-in or passive agreement that the direction of change is acceptable. It demands ownership by leaders willing to accept responsibility for making change happen in all of the areas they influence or control. Ownership is often best created by involving people in identifying problems and crafting solutions. It is reinforced by incentives and rewards. These can be tangible (for example, financial compensation) or psychological (for example, camaraderie and a sense of shared destiny). At a large health-care organization that was moving to a shared-services model for administrative support, the first department to create detailed designs for the new organization was human resources. Its personnel worked with advisors in cross-functional teams for more than six months. But as the designs were being finalized, top departmental executives began to resist the move to implementation. While agreeing that the work was top-notch, the executives realized they hadn’t invested enough individual time in the design process to feel the ownership required to begin implementation. On the basis of their feedback, the process was modified to include a ‘deep dive.’ The departmental executives worked with the design teams to learn more, and get further exposure to changes that would occur. This was the turning point; the transition then happened quickly. It also created a forum for top executives to work as a team, creating a sense of alignment and unity that the group hadn’t felt before”.

Like the health care organization described above, opening the Provider Education Campaign to other areas of the business such as Claims Operations may create the cross-functional leverage needed to shift the provider culture. Jones et al. goes on to describe how to “communicate the message”:

“The best change programs reinforce core messages through regular, timely advice that is both inspirational and practicable. Communications flow in from the bottom and out from the top, and are targeted to provide employees the right information at the right time and to solicit their input and feedback. Often this will require over communication through multiple, redundant channels. In the late 1990s, the commissioner of the Internal Revenue Service, Charles O. Rossetti, had a vision: The IRS could treat taxpayers as customers and turn a feared bureaucracy into a world-class service organization. Getting more than 100,000 employees to think and act differently required more than just systems redesign and process change. IRS leadership designed and executed an ambitious communications program including daily voice mails from the commissioner and his top staff, training sessions, videotapes, newsletters, and town hall meetings that continued through the transformation. Timely, constant, practical communication was at the heart of the program, which brought the IRS’s customer ratings from the lowest in various surveys to its current ranking above the likes of McDonald’s and most airlines”.

Like Rossetti’s efforts to manage change within the IRS, our efforts to manage the change associated with the Provider Education Campaign cannot simply rely on a phone call to change the culture. Our communications must extend to website advertising, mailings and media messages. Even simple details such as advertisements showing customers submitting electronic claims can be helpful in managing the provider culture change. Jones et al. states that to “assess the cultural landscape”:

“Successful change programs pick up speed and intensity as they cascade down, making it critically important that leaders understand and account for culture and behaviors at each level of the organization. Companies often make the mistake of assessing culture either too late or not at all. Thorough cultural diagnostics can assess organizational readiness to change, bring major problems to the surface, identify conflicts, and define factors that can recognize and influence sources of leadership and resistance. These diagnostics identify the core values, beliefs, behaviors, and perceptions that must be taken into account for successful change to occur. They serve as the common baseline for designing essential change elements, such as the new corporate vision, and building the infrastructure and programs needed to drive change”.

In order to assess the effectiveness of our provider culture change, Customer Satisfaction, NPS and TNPS data must be regularly monitored. This will also be helpful in determining our Return on Investment (ROI) as we believe electronic claim submission will boost providers’ satisfaction with our company. It is possible that our review of data may show that our change management strategy has been ineffective. If this is the case, our strategy will need to be quickly redefined:

“The process of changing a corporate strategy can be broken down into four distinct steps: planning, implementation, monitoring and review. In the planning stage, managers form their strategic vision into concrete, time-bound goals and objectives. Research and testing are vital in the planning stage, as managers attempt to gain as much information as possible about the viability of the change. The implementation phase sees the change put into action according to the plan. Monitoring is a less of a phase and more of a continual activity that helps managers to gain insight into how well their plans are working and pinpoint potential problems. In the review stage, managers analyze information gained from monitoring activities and decide whether the strategy needs to be altered yet again” (Ingram, 2017, p1).

To ensure our success, we will assign regular data reviews to the Management Team as part of our Plan of Action. Jones et al. describes how to “address culture explicitly”:

“Leaders should be explicit about the culture and underlying behaviors that will best support the new way of doing business, and find opportunities to model and reward those behaviors. This requires developing a baseline, defining an explicit end-state or desired culture, and devising detailed plans to make the transition. Company culture is an amalgam of shared history, explicit values and beliefs, and common attitudes and behaviors. Change programs can involve creating a culture (in new companies or those built through multiple acquisitions), combining cultures (in mergers or acquisitions of large companies), or reinforcing cultures (in, say, long-established consumer goods or manufacturing companies). Understanding that all companies have a cultural center — the locus of thought, activity, influence, or personal identification — is often an effective way to jump-start culture change. A consumer goods company with a suite of premium brands determined that business realities demanded a greater focus on profitability and bottom-line accountability. In addition to redesigning metrics and incentives, it developed a plan to systematically change the company’s culture, beginning with marketing, the company’s historical center. It brought the marketing staff into the process early to create enthusiasts for the new philosophy who adapted marketing campaigns, spending plans, and incentive programs to be more accountable. Seeing these culture leaders grab onto the new program, the rest of the company quickly fell in line”.

The consumer goods manufacturer described above essentially utilized Change Agents to promote the transformation of the company. Change Agents should be identified among both Provider Unit associates and providers alike and their stories of successful change implementation should be shared on the Provider Portal to reinforce the benefits of electronic claim submission. Jones et al. advises organizations to “prepare for the unexpected”:

“Effectively managing change requires continual reassessment of its impact and the organization’s willingness and ability to adopt the next wave of transformation. Fed by real data from the field and supported by information and solid decision-making processes, change leaders can then make the adjustments necessary to maintain momentum and drive results. A leading U.S. health-care company was facing competitive and financial pressures from its inability to react to changes in the marketplace. A diagnosis revealed shortcomings in its organizational structure and governance, and the company decided to implement a new operating model. In the midst of detailed design, a new CEO and leadership team took over. The new team was initially skeptical, but was ultimately convinced that a solid case for change, grounded in facts and supported by the organization at large, existed. Some adjustments were made to the speed and sequence of implementation, but the fundamentals of the new operating model remained unchanged”.

Like the health-care company described above, our organization can use our advanced reporting capabilities to determine if our change implementation has been successful. If our changes do not go according to plan and paper claim receipts or overall auto adjudication rates do not decrease, we can correct our path and determine our next steps correctly. Lastly, Jones et al. details how to “speak to the individual”:

“Change is both an institutional journey and a very personal one. People spend many hours each week at work; many think of their colleagues as a second family. Individuals (or teams of individuals) need to know how their work will change, what is expected of them during and after the change program, how they will be measured, and what success or failure will mean for them and those around them. Team leaders should be as honest and explicit as possible. People will react to what they see and hear around them, and need to be involved in the change process. Highly visible rewards, such as promotion, recognition, and bonuses, should be provided as dramatic reinforcement for embracing change. Sanction or removal of people standing in the way of change will reinforce the institution’s commitment”.

To this point, providers who are not willing to switch to electronic claim submission should have their preferred status removed without exception. Although this is a risky move for the organization, it drives home the point that the cultural shift is both necessary and permanent.

Outcomes

This study revealed that paper claim submission decreases auto adjudication as paper documents often contain handwriting which cannot be digitally transposed into the system via scanning which creates the need for manual processing intervention. Since our company utilizes a legacy system and there is no way to resolve processing edits on paper claims without human intervention, this work is manually keyed into the system by a claim approver after the image of the paper document has been scanned, which drives labor costs. The data analysis portion of this study established the statistical correlation between paper claim submission and overall auto adjudication rate which led to the conclusion that paper claim submission must be decreased through change management efforts within the paper claim submitting provider community. This study has led to the conclusion that the most cost effective way to do this is through a one-time, Provider Education Campaign which targets the top 10% of paper claim submitting providers. In conjunction with the Provider Education Campaign, a Provider Portal website will also be created to promote self-service among providers. These two initiatives combined with strategic change management, follow up data analysis and contract changes are expected to reduce paper claim submission by 10% as of December 31st, 2018. Difficulties encountered during this study included financial constraints and limited IT funding. The cost of the Provider Portal will only be approved if the ROI of $353,936.34 or roughly 10 FTE listed in the Findings section of this study is sufficient to cover the IT costs of creating the website. A price quote for the Provider Portal will not be obtained from our IT Team until June of 2017.

Implications

In summation, the research question of “does claim submission avenue drive overall auto adjudication rates?” has been answered. The relationship between paper claim submission and decreased auto adjudication rates has been quantified and the solutions to correct this without violating stringent cost measures at our organization have been identified. Based on the best practices of other organizations to increase automation and manage change which were identified in the literature review of this study, the author recommends that the five following actions items must take place in order to reduce the number of paper claims submitted by providers and increase auto adjudication rates:

1.) Providers driving paper claim submission must be identified.

2.) A Provider Education Campaign incenting providers to switch to electronic claim submission must be carried out by the Provider Unit.

3.) A Provider Portal must be created by the IT Team by January 1st, 2018 to offer education and self-service to providers in an online, web-based environment.

4.) A contractual stipulation must be drafted by the Legal Department and placed in preferred provider contracts effective January 1st, 2018 to ensure that going forward; all preferred providers agree to submit claims electronically.

5.) The Management Team must utilize the ten specific change management practices identified by Jones et al. to ensure that the cultural shift to electronic claim submission receives proper buy-in from both MetLife providers as well as the Provider Unit assisting them.

Limitations of this study include data set as only a partial year’s data was available for analysis and provider perspective as surveys to gain insight into why provider submit paper claims were banned by the organization. Recommendations for future studies would include obtaining a larger data set as well as survey data. Additionally, carrying out a change management initiative of this magnitude may be more fruitful during a time where budgetary concerns did not limit funding.

References

Aldera Implements Claims Processing, Auto-Adjudication Solution for Unified Life Insurance in Under Six Months. (2014). India Insurance News. Retrieved from http://www.lexisnexis.com.library.keuka.edu/hottopics/lnacademic/

Bell, Zane (2000). Goals for 2000: Auto–Adjudication, Web-enabled Technology and HIPAA Compliance. Health Management Technology, 21(4). 23-23. Retrieved from http://web.b.ebscohost.com.library.keuka.edu

Boan, David M. (2006). Cognitive-Behavior Modification and Organizational Culture.

Consulting Psychology Journal: Practice and Research,58(1). Retrieved from

http://web.b.ebscohost.com.library.keuka.edu/ehost/detail/detail?vid=5&sid=

4f915ebd-0643-4cc8-808c-47d600dc0944%40sessionmgr103&hid=107&

bdata=JnNpdGU9ZWhvc3QtbGl2ZQ%3d%3d#AN=2006-04784-005&db=pdh

Boskovich, Ghela. (2016). An Improved Legacy System Is Still a Legacy System. American

Banker. Vol. 180 Issue 209, p1. 1p. Retrieved from http://web.b.ebscohost

.com.library.keuka.edu/ehost/detail/detail?vid=22&sid=34b7d2bd-770f

-4a2e-af7b-7bb13947a1f8%40sessionmgr106&hid=123&bdata=JnNpdGU

9ZWhvc3QtbGl2ZQ%3d%3d#AN=112241394&db=buh

Callcenters: focus on softskills. MarketWatch: Global Round-up. June 2003, Vol. 2

Issue 6, p179-179. 1p. Retrieved from http://web.b.ebscohost.com. library.keuka.edu/ehost/pdfviewer/pdfviewer?sid=34b7d2bd-770f-4a2e-af7b-7bb13947a1f8%40sessionmgr106&vid=38&hid=123

CMS Extends Major Medicare Contract to ViPS While Expanding Its Use of ViPS’ Auto-Adjudication Software. (2003). PR Newswire. Retrieved from http://search.proquest.com.library.keuka.edu/printviewfile?accountid=27791.

D’Zurilla, Thomas J. (1966). Persuasion and praise as techniques for modifying verbal behavior

in a ‘real-life’ group setting. Journal of Abnormal Psychology, Vol 71(5), Oct,

1966. pp. 369-376.

Electronic Health Plans Inc. (2015). Zoom Company Information. Retrieved from http://www.lexisnexis.com.library.keuka.edu/hottopics/lnacademic/.

Guidewire Software: Mitsui Direct Deploys Guidewire System for Claims Management. (2014). India Insurance News. Retrieved from http://www.lexisnexis.com.library.keuka.edu/hottopics/lnacademic/.

Information Technology; Partnership formed to increase managed care organizations’ auto-adjudication rates. (2005). Healthcare Mergers, Acquisitions & Ventures Week. Retrieved from http://search.proquest.com.library.keuka.edu/printviewfile?accountid=27791

Ingram, D. (2017). What Happens When an Organization Changes Its Strategy? Retrieved from

http://smallbusiness.chron.com/happens-organization-changes-its-strategy-2690.html

JavelinaTM Client Reports Significant Increase in Auto-Adjudication Rates after First Year of Implementation. (2012). Business Wire. Retrieved from http://search.proquest.com.library.keuka.edu/printviewfile?accountid=27791

Jones, J., Aguirre, D. & Calderone, M. (2004). 10 Principles of Change Management. Retrieved

from https://www.strategy-business.com/article/rr00006?gko=643d0

Kendig, Bryan. (2015). Vendor partnerships key to optimizing supply chain management.

SBM Offshore. Dec2015, Vol. 75 Issue 12, p44-46. 3p. Retrieved from

http://web.b.ebscohost.com.library.keuka.edu/ehost/pdfviewer/pdfviewer

?vid=24&sid=34b7d2bd-770f-4a2e-af7b-7bb13947a1f8%40session

mgr106&hid=123

Langley, Ann., Smallman, Clive., Tsoukas, Hardimos & Van De Ven, Andrew H. (2013).

Process Studies of Change in Organization and Management:

Unveiling Temporality, Activity, and Flow.

Academy of Management Journal. Feb2013, Vol. 56 Issue 1, p1-

13. 13p. 1 Chart. Retrieved from http://web.b.ebscohost.com.library.

keuka.edu/ehost/pdfviewer/pdfviewer?sid=34b7d2bd-770f-4a2e-af7b-

7bb13947a1f8%40sessionmgr106&vid=28&hid=123

Lim, Weng Marc (2014). Sense of virtual community and perceived critical mass in

online group buying. Journal of Strategic Marketing. Jun2014, Vol. 22.

Issue 3, p268-283. 16p. Retrieved from http://web.b.ebscohost.com.

library.keuka.edu/ehost/pdfviewer/pdfviewer?sid=34b7d2bd-770f-4a2e-

af7b-7bb13947a1f8%40sessionmgr106&vid=32&hid=123

Linnaeus and HealthCare Information Management Form Strategic Partnership to Increase Managed Care Organizations’ Auto-adjudication Rates. (2005). PR Newswire. Retrieved from http://search.proquest.com.library.keuka.edu/printviewfile?accountid=27791

McKendrick, Joe. (2008). Health Claims Processing Gets Automation Boost: By investing in new systems, health insurers are handling claims in near real-time- even at the providers office. Insurance Networking News. Retrieved from http://www.lexisnexis.com.library.keuka.edu/hottopics/lnacademic/.

Mulkeen, D. (2016). 8 Top Tips For Effective Business Writing. Retrieved from https://www.communicaid.com/communication-skills/blog/communication-skills/top-tips-for-effective-business-writing-2/

Neumann III, John R. (2010). Claims Editing: How to Turn a Dirty Phrase into an Understood Function of the Adjudication Process. Managed Care Outlook, 23(9). 9-10. Retrieved from http://web.a.ebscohost.com.library.keuka.edu.

Oracle. (2012) Oracle launches Oracle insurance claims adjudication for health. Retrieved from http://www.oracle.com/us/corporate/press/1485595?printOnly=1

Outsourcing: onshore could sideline offshore vendors. MarketWatch: Financial Services. August

2003, Vol. 2 Issue 8, p16-17. 2p. Retrieved from http://web.b.ebscohost.com

.library.keuka.edu/ehost/pdfviewer/pdfviewer?sid=34b7d2bd-770f-4a2e-

af7b-7bb13947a1f8%40sessionmgr106&vid=20&hid=123

Plexis Healthcare Systems and Context4 Healthcare, Inc. Announce Expanded Partnership for FirstPass Real Time Claim Editing Solution. (2014). India Pharma News. Retrieved from

http://www.prweb.com/releases/2014/03/prweb11633773.htm

Santana, Alex & Afonso, Paulo. (2015). Analysis Of Studies on Time-Driven

ActivityBasedCosting (TDABC). International Journal of Management

Science & Technology Information Special Issue, Issue 15, p134-158. 25p.

Retrieved from http://web.a.ebscohost.com.library.keuka.edu/ehost/detail

/detail?vid=5&sid=deb3a312-0820-494c-9c83-8622e353e659%40sessionmgr

4004&hid=4107&bdata=JnNpdGU9ZWhvc3QtbGl2ZQ%3d%3d# AN=

113484072&db=buh

Sasikala, S. & Victor Anthonyraj, S. (2015). Self-Efficacy, Emotional Intelligence And

Organizational Commitment In Relation To Resistance To ChangeAmong

Employees. Annamalai International Journal of Business Studies &

Research. 2015 Special Issue, p30-35. 6p. 1 Chart. Retrieved from

http://web.b.ebscohost.com.library.keuka.edu/ehost/pdfviewer/pdfviewer

/pdfviewer?sid=34b7d2bd-770f-4a2e-af7b-7bb13947a1f8%40sessionmgr

106&vid=35&hid=123

Sawers, Paul (2013). Hardwired humans: Why our aversion to technological advances is about

to change. Retrieved from http://thenextweb.com/socialmedia/2012/07/08

hardwired-humans-why-our-aversion-to-technological-advances-is-about

-to-change/#gref.

Shoemaker, Jim (2006). The Benefits of Costing. Business Performance Management, 4(2). 36-37. Retrieved from http://web.b.ebscohost.com.library.keuka.edu

Sincero, Sarah M. (Jul 10, 2012). Surveys and Questionnaires – Guide. Retrieved from

https://explorable.com/surveys-and-questionnaires

Tartell, Ross. Write an EffectiveSurvey Question. Training. Jul/Aug2015, Vol.

52 Issue 4, p14-14. 1p. Retrieved from http://web.b.ebscohost.com.

library.keuka.edu/ehost/pdfviewer/pdfviewer?sid=34b7d2bd-770f-4a2e-

af7b-7bb13947a1f8%40sessionmgr106&vid=41&hid=123

The Why and How of a Change Management Strategy (2017). Retrieved from

https://www.prosci.com/change-management/thought-leadership-library/change-

management-strategy

Trochim, William M.K. (2006). Types of Surveys. Retrieved from

http://www.socialresearchmethods.net/kb/survtype.php

Wilcox, Adam B., Gallagher, Kathleen D., Boden-Albala, Bernadette & Bakken, Suzanne R.

(2012). Research Data Collection Methods: From Paper to Tablet Computers.

Informatics. Paper 1. Retrieved from http://repository.edm- forum.org/cgi/view

content.cgi?article=1003&context=informatics_resources

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Finance"

Finance is a field of study involving matters of the management, and creation, of money and investments including the dynamics of assets and liabilities, under conditions of uncertainty and risk.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: