Understanding Foreign Direct Investment Decisions: A Managerial Level Analysis

Info: 12264 words (49 pages) Dissertation

Published: 9th Mar 2021

Understanding foreign direct investment decisions: a managerial level analysis

Contents

2 Different types of “decision”

2.2 From simple decisions to strategic decisions

3 Factors influencing FDI decisions: Managers Matter (?)

3.1 Cognitive capabilities (belief)

4 Internal firm characteristics

5 External corporate environment

6 FDI decision: the influence of the team

1 Introduction

Organisations are made up by individuals: this may sound quite trivial. However, the strategic literature has generally shown a lack of focus on individuals, their motivations and their interaction (Felin and Foss, 2005; Foss and Pedersen, 2014; Felin et al., 2015). This gap characterises also international business (IB) literature. Yet a thorough analysis of the cognitional and motivational factors that lead managers to make certain decisions seems of fundamental importance to understand internationalisation patterns. IB research has “paid far more attention to the incremental, gradual, experience- and knowledge-based aspects of internationalization than to the role of managerial intentionality affecting internationalization” (Hutzschenreuter et al., 2007, p.1056). Thus, the lack of an integrative framework shows an inconsistency between managerial level studies and firm level studies. This is particularly apparent in the case of decisions concerning foreign direct investment (FDI). While mainstream theories in International Business rely on the assumption that managers are risk averse, different studies at individual level show that managers have an idiosyncratic tendency to take risk (Aggarwal and Samwick, 2003; Amihud and Baruch, 1981; Baulkaran, 2014; May, 1995).

Traditional theories seem to be insufficient to capture the role played by the managers (Foss and Lindenberg, 2013). FDI decisions have been considered as either the outcome of managers’ rational-optimal behaviour (as in the case of Internalisation Theory) or the result of a psychological learning process (as in the case of Process Theory). In both cases FDI decisions have been rooted at the organisational level, with no (or little) reference to the individuals who are actually making the decisions. This looks problematic as in the real world it is not the firm which makes decisions. It is the managers who “make choices – either as a group or individually – nested in the environment and organizations in which they operate” (Devinney, 2011, p. 64-65). As far as the 1966, Aharoni defined the FDI decision as “a dynamic social process of mutual influences among various members of an organisation, constrained by organization strategy, its resources and limited capacity, goals and need of its members, throughout which choices emerge” (Aharoni, 1966, p.15). However, both Internalisation Theory and Process Theory have overlooked the importance of a managers’ decision-making model (Buckley et al., 2007; Devinney, 2011).

In recent years, a Microfoundation approach has been promoted by IB scholars in order to reconcile studies at individual and organizational levels and to reduce the degree of firm heterogeneity (Buckley et al., 2016; Devinney, 2011; Maitland and Sammartino, 2015b; Aharoni, 2010). The main strength of this approach is that the focus on the “micro-level” allows the researcher to avoid “explanatory black boxes”, while leading to a more rigorous work at the firm- or macro-level (Felin et al., 2015). In addition, micro-level explanations are usually more stable, fundamental, and general than macro-level explanations (Coleman, 1990). However, Microfounded empirical research faces unique challenges because processes take place at different levels of analysis and must be considered simultaneously (Aguinis and Molina-Azorín, 2015). Microfounded empirical research involves sampled data sets that “must be longitudinal, they must feature some mobility […] and encompass sufficient variance at both micro and macro levels” (Felin et al., 2015, p.611). The complexity is due to the fact that individuals (micro-level) influence each other, and their interaction may lead to aggregate outcomes (macro-level) that can be unforeseen, surprising, and emergent (Barney and Felin, 2013).

My research would potentially contribute to the theory by microfounding the existing FDI theories with behavioural aspects. The omission of the decision maker and the assumption of perfect rationality can lead to a misspecified model of firm internationalisation (Aharoni et al., 2011). Opening the black box of how decisions are made allows to understand the role of managerial intentionality. In other words, the possibility of managers making deliberate strategic choices that may not follow rational rules. The first two research questions aim at looking at the aspects that influence managers in making decisions about internationalisation and specifically about FDI. Papadakis et al. (1998) showed that every strategic decision is influenced by a number of factors that can be grouped in 3 main dimensions: the nature of the decision itself, the top management characteristics and contextual factors connected to external corporate environment and internal firm characteristics.

RQ1: Does the nature of the FDI decision influences the decision method?

(1a) Do managers rely on intuitions when it comes to FDI decisions?

(1b) Do managers rely or on systematic search of information when it comes to FDI decisions?

RQ2: What are the main factor(s) influencing FDI decision?

(2a) Do the manager’s individual and demographic characteristics have an impact on FDI?

(2b) Do the internal firm’s characteristics have an impact on FDI?

(2c) Do the uncertainty of the external environment have an impact on FDI?

(2d) Do the same factors works at the same way for every firm? What are the conditions under which the same factor may have a different impact?

The third research question aims at understanding how managers influence each other and jointly come to a common decision. Wallach et al. (1962) demonstrated that individual judgement can be different whether the decision is made individually or collectively. In fact, due to a phenomenon called polarization (Sunstein, 2002), individuals in a group decision can choose options that are more extreme than their personal preferences. The level of trust of and consensus among the group members (Wu and Chiclana, 2014) may also have a critical importance in group decisions.

RQ3: Does the interaction with the other board members influence the individual manager’s judgement?

(3a) How does manager risk perception change when it comes to group decisions?

(3b) Does the level of trust, consensus or shared orientation among the members change the individual ability of judgment?

The remainder of the essay is set out as follows: in the second section the peculiarities of different types of decisions are outlined. In the third section managers’ characteristics and contextual factors potentially affecting the decision-making are respectively examined. In the fourth section the dynamics of group decision are described. The fifth section is about the methodology of investigation. In the sixth section, a chapter plan for the final dissertation is presented. In the final chapter conclusions are drawn.

2 Different types of “decision”

“Imagine that atoms and molecules failed to follow the laws supposed to describe their behavior. Few would call such behavior irrational or suboptimal. However, if people violate expected utility axioms or do not revise probabilities in accord with Bayes’ theorem, such behavior is considered suboptimal and perhaps irrational. What is the difference, if any, between the two situations?”

(Einhorn and Hogarth, 1981, p.53)

2.1 Everyday decisions

People are required to make decisions every day. Normally to make every decision one needs to assess the frequencies or the classes of the likelihood events connected to the decision. For example, the decision about taking the umbrella is based on the judgement of the chances of raining. Judgement is a cognitive ability that allows the decision maker to assess the risk before making any decision. According to the Rational Choice Theory a decision can be defined as good when leads to maximise the utility of the decision-maker. As summarised by Edwards (1954), to define a decision as rational one should have a complete set of information, should be infinitely sensitive (the decision-maker can choose from a set of alternatives that are infinitely divisible) and must always be able to express a preference between two or more options.

Simon (1957) has observed that the individual judgment is actually bounded in its rationality, because in the reality people do not have a set of complete information nor possess a set of infinitely divisible alternatives. A good decision for Simon (1957) leads to an outcome that satisfice. A decision-maker is satisfied when, rather than examining all the alternatives, he/she finds a satisfactory solution that matches his/her aspirational level. A satisfactory alternative is made by “dynamic mechanisms that adjust the aspiration levels to reality on the basis of information about the environment” (Simon, 1972, p.168). Simon’s work revolutionised the traditional way to think about decisions simply by describing how a decision is made instead of focussing on how a decision should be.

More recent findings have extended the concept of bounded rationality. Thaler (2000) shows that individual willpower is also bounded. In fact, human beings sometimes make decision that are conflicting with their long-term interests (for example avoiding to enter in a retirement investment plan or not quitting to smoke). In addition, Thaler (2000) suggests that, differently from stereotypes, people’s self-interest is also bounded. Individuals do care – or act as they care – about the others and are often willing to sacrifice their own interests to help others (for example people want to be treated fairly and want to treat others fairly, if they behave appropriately). In the same stream of research Bounded ethicality (Chugh et al., 2005) and bounded awareness (Chugh and Bazerman, 2007) have been also identified as cognitive biases. Bounded ethicality refers to the different perception about ethical behaviour that people show in different contexts. Bounded awareness represents the inattentional blindness that makes humans regularly fail to see and use information easily available to them.

Kahneman and Tversky (1979), pioneers of the Prospect Theory, continued the work begun by Herbert A. Simon and contributed to enrich the psychology literature with a long list of cognitive biases. Their work laid the foundation of the modern understanding of how people make decisions (Bazerman and Moore, 2008). Specifically, they found that, rather than engage themselves in time-consuming decisions, people tend to use heuristic as a shortcut. The aim is to reduce the time of making decisions or to minimise the complexity that generates a large number of alternatives. Here is just a short list of the most prominent heuristic biases identified by the authors. The first is available heuristic. It means that people assess the probability of an event by the degree to which instances and events are readily available in their memory (Tversky and Kahneman, 1973). In addition to the available heuristic people may use the representativeness heuristic (Kahneman and Tversky, 1974) when their judgement is influenced by previously formed stereotypes. Decisions can also be biased by confirmation heuristic, when people seek or interpret the evidence in ways that are partial to existing beliefs, expectations, or a hypothesis in hand (Nickerson, 1998). People may also rely on affect heuristic. Their judgements is influenced by personal feelings and emotions before any reasoning takes place (Slovic et al., 2007).

What is then a rational decision? Are humans “hopelessly lost in the face of real world complexity, given their supposed inability to reason according to the canon of classical rationality”? (Gigerenzer and Goldstein, 1996, p.2). If human mind is inextricably biased, can automata make a perfectly rational decision? The dichotomous view between models of pure rationality and the heuristic-and-biased view, that infers the human mind is systematically biased and error prone, has been challenged by Gigerenzer and Goldstein (1996). They use an ecological approach to demonstrate that limited time, knowledge or computational abilities do not necessarily lead to a poor decision. In many real-world situations, not only humans, but also animals can make fast and frugal rational decisions because their minds have learnt how to do it.

Gigerenzer and Goldstein (1996) have shown that an unsystematic decision is not necessarily a poor decision. This is because humans are adapted to the environment and can learn how to make quick and effective decisions. Originally Simon’s concept of bounded rationality had two sides, one cognitive and one ecological. He stated that the “human rational behaviour is shaped by a scissors whose two blades are the structure of task environments and the computational capabilities of the actor” (Simon, 1990, p.7). The proponents of the Prospect Theory (Kahneman and Tversky, 1979) have usually focused on the cognitive aspect, while the proponent of the Fast and Frugal Theory (Gigerenzer and Goldstein, 1996) have traditionally focused on the environmental aspect. In recent years, a dualistic view has become prominent in decision-making research (Basel and Brühl, 2013). They propose a holistic approach in which intuitive and deliberate processes are analysed and, more importantly, observed in their interaction (Gilovich et al., 2002; Kahneman and Frederick, 2002). Research in managerial decision-making may benefit from this dual approach because the two decision methods discussed are not mutually exclusive. To be a successful manager one has to be competent both in an intuitive and deliberate way of making decisions.

2.2 From simple decisions to strategic decisions

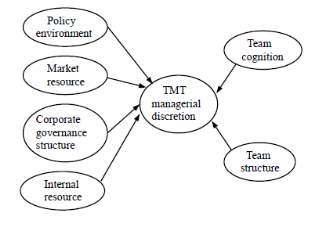

When moving from a simple decision to a more structured decision cognitive limitations and biases should not affect the decisions at the same way. Simple decisions (such as taking the umbrella) and strategic decisions are at the opposite side of a continuum. Simple decisions have a short and limited influence only on the decision-maker. While a strategic decision has a long-term impact not only on the person who made the decision, but also on third people. Managers, or those in charge for making strategic decisions, determine “the direction and scope of an organisation over the long term, which achieves advantage in a changing environment through its configuration of resources and competences with the aim of fulfilling stakeholder expectations” (Johnson et al., 2009, p.3). The complexity of a strategic decision lies in the fact that managers (or strategic decision-makers) are influenced by a larger range of factors in making a decision. An et al. (2013) assert that external factors (Policy environment, Market resources), internal factors (Corporate governance structure, Internal resources) and team factors (Team cognition and team structure) are all input to the manager’s brain in the form of information, that are analysed by personal cognition and affected by the demographic characteristics (see Figure 1).

Figure 1: Factors influencing Strategic decisions

Source: (An et al., 2013, p.1382)

Such a complexity should have an impact on the way managers (or strategic decision-makers) approach to the decision. It has been found that, generally, people tend to behave differently according to the type of the decision that they are require to handle. Financial incentive, for example, may affect people’s behaviour making their decisions less prone to heuristic biases (Grether, 1980). Stanovich and West (2000) have clarified that there are two systems of making a decision: System 1 and System 2. System 1 is characterised by an automatic, unconscious and relatively undemanding thinking. Typically, this system is used when people are busy or under time constraints because it is faster, effortless, implicit and emotional. System 2 is much more structured and involves the process of analytic intelligence. Normally, System 2 is slower, conscious, effortful, explicit and logical. It aims at decontextualizing and depersonalizing problems and it is not dominated by the goal of attributing intentionality (Stanovich and West, 2000). The two systems are not mutually exclusive, they may also work together in a way that System 2 monitors and controls the activities of System 1 by confirming or denying intuitive decisions (Trevis Certo et al., 2008). Usually, people rely on System 1 for everyday decisions while key decision-makers (politicians or managers, for example) should force themselves to move to a more structured System 2 when it comes to strategic decisions. Strategic decisions should ideally be assisted by a decision aid that helps the decision maker to define the problem, identify and weight the criteria, generate and rate the alternative according to careful assessment, and finally compute the optimal decision (see Table 1).

Table 1: Rational decision-making process

|

|

|

|

|

|

Source: adapted from Bazerman and Moore (2008) p.2-3

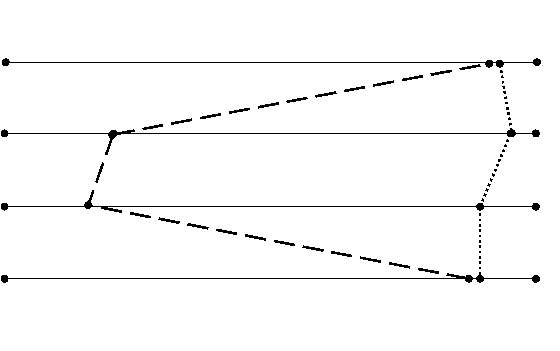

A strategic decision is usually associated to a systematic and slow method to make a decision. A large body of literature (Nutt, 1999; Hickson et al., 2003) has demonstrated that the decision-making is very much like the Decision 2 in Figure 2. More specifically, a strategic decision is associated to a systematic, rational, slow and unbiased method that is expected to drive to a higher quality-outcome of the decisions. However, it has been argued that while a systematic decision method improve the quality of the decisions, it contributes to increase managerial incompetency against using alternative planning tools or no planning tools (de Villiers et al., 2016). This suggests that managers stuck in systematic procedures may lose their judgment and intuition abilities.

Another body of literature has come to a totally different conclusion. It has been shown that managerial decisions look more like the Decision 1 in Figure 2 challenging the trade-off accuracy/speed documented by classic decision theorists. Cognitive biases and fast decision-making are not necessarily connected to a poor decision outcome. In a study on senior decision-makers of an inexperienced multinational company, Maitland and Sammartino (2015a) found that heuristics may provide a powerful cognitive tool that enable, rather than limit, decision-making in dynamic and uncertain environments (i.e. Decision 1 in Figure 2). In the same stream, another group of authors argue that executives should rely more on intuition and less on the systematic analysis because fast decision makers end up using more, and not less, information than slow decision makers (Eisenhardt, 1989; Perlow et al., 2002).

It has been said that a strategic decision differs from a simple everyday decision as it has a higher complexity. The complexity is due to a larger decision impact and a bigger number of factors influencing the decision itself. This difference should affect the method of making decisions. A strategic decision should be processed by a more systematic and slower decision method to allow decisions to be free from biases and heuristic. However, the literature shows conflicting findings about the role of heuristic and intuition. A systematic and rational method does not necessarily lead to a satisfactory outcome. At the same time, the outcome of an intuitive or emotional decision is not necessarily irrational. A descriptive approach to conduct an investigation on decision-making has to account for such contradictions and flaws, because decision-making is based on several individual characteristics including personal experience, culture, knowledge, tolerance for uncertainty and risk that makes it difficult to outline or even predict a general behaviour (Aharoni et al., 2011).

2.3 FDI decisions

FDI decisions are a sub-set of strategic decisions. With strategic decisions they share the complexity and the magnitude of their impact. FDI decisions are at the core of International Business. Due to the discipline’s foundational arguments, the impact of cultural differences and high levels of uncertainty and risk on FDI decisions is higher than on other types of decisions. FDI decisions are “the more strategic and risky end of the capital investment spectrum due to the complex political, cultural, economic and legislative considerations” (Sykianakis and Bellas, 2005, p.955). In an evolutionary perspective, managers play an active role in determining both the evolutionary path and the internationalization position of the firm through FDI decisions (Hutzschenreuter et al., 2007).

Since the inception of the IB discipline, FDI has been generally studied with a specific reference to a firm level. Stephen Hymer (1976)’s seminal work was the first to introduce the firm as a unit of analysis when explaining the process of internationalisation. Doing so he laid the foundation of International Business as a discipline. His main contribution was the identification of the factor that allows multinational companies to succeed given the initial disadvantage of the liability of foreignness. He argued that: “Certain firms have considerable advantages in particular activities [and] the possession of these advantages may cause them to have extensive international operations” (p. 41). The main argument for internationalisation has been nested at firm level as the result of an overarching firm-specific advantage. The role of the decision maker in Hymer’s theory has an implicit nature and the factors influencing managerial choices have been always explained by using assumptions.

Similarly, Internalisation theory (Buckley and Casson, 1976) relies on the assumption that FDI decisions are about setting the boundaries of a firm “where the benefits of further internalisation of markets are just offset by the costs” (Buckley and Casson, 2009, p.1564). Decisions are made by rational (or quasi-rational) managers aiming at maximising firm’s profit. The assumption of rationality has been used to explain why managers make certain choices. Certainly managers can make mistakes, this is because rationality is bounded: due to search costs, a decision-maker only gathers a sufficient amount of information to deal with uncertainty with an acceptable level of risk (Simon, 1972).

Within the framework of the Process theory (Johanson and Vahlne, 1977) FDI decisions are related to the concept of psychic distance. Psychic distance is a measure of the cultural diversity between two different countries. The lower the level psychic distance the higher is the possibility to enter a new market. The level of psychic distance also influences the level of commitment that a firm is willing to assume. Export and licencing entail a low level of risk while FDI entails higher risk for a firm. Managers make repeated decisions under a condition of uncertainty and use their learning abilities to increase their international knowledge and so reducing the level of psychic distance.

Traditional theories in International Business rely on the assumption that managers are rational and risk averse. Using a descriptive approach consisting on observing how manager make their decisions, Buckley et al. (2007) have drastically challenged the traditional theory. They found that in the choice of investment location managers fairly follow rational rules. The number of cognitive biases affecting managers’ judgement is so large that the rationality (or quasi-rationality) assumption is no longer coherent and may foreclose a deeper understanding of the decision-making (North, 2005; Kuhn, 1962). New findings in decision-making “have led to a paradigm shift in economics and organization science, with important consequences for the field of international business” (Aharoni et al., 2011). In recent years, the number of studies demonstrating that the success of multinational enterprises (MNEs) is as much as a function of managerial discretion, industry characteristics and environmental factors is increasing. The specific issue raised by microfoundations research is that to fully understand firm’s choices “one must fundamentally begin with and understand the individuals that compose the whole” (Felin and Foss, 2005, p.441). Basically, researchers should pay greater attention to individual abilities, propensities, heterogeneity, purposes, expectations and motivations. The firm’s internationalisation path embodies managerial decisions about when, how, where and why internationalise. In this sense, each firm is the unique result of a specific sequence of managerial choices.

Figure 3: Diagram representing FDI decision-making process

Source: my elaboration from (Aharoni, 1966)

Notes: the present decision-making model best fits with a pro-active FDI decision. For example, in a reactive FDI decisions, such as an opportunity arisen in a foreign country, some of the steps may be redundant or placed in a different order.

The choice to undertake FDI is the most critical decision for a firm because it is the mean to initiates the internationalisation process that will determine the evolutionary path of the firm itself. The research focus is on the core stage of FDI decision which is the stage that entail the highest level of complexity. Aharoni (1966) identified three major stages in the FDI decision-making: (1) initial idea generation, (2) investigation and development, and (3) final decision. If the decision to undertake FDI has been made, another set of further decisions is required. These decisions are about how the project will be implemented. It concerns the location, the entry mode, the time and the speed of the international investment. The first block of decisions generally concerns the top management level, while the second block of decision is an executive managers’ competence. Figure 3 shows the entire set of FDI decisions. The decision to “look abroad” is a key-decision for a firm (see the grey box in Figure 3) and entails the maximum level of managerial discretion. It has been said that in most cases the decision appears less than rational, invariably triggered by any number of initiating forces and may exhibit aspects of serendipity (Devinney, 2011).

Hypothesis 1: The complex nature of the FDI decision do not necessarily push managers to adopt a systematic decision method

3 Factors influencing FDI decisions: Managers Matter (?)

“Elections are emotional. Investing is emotional. And investing in the midst of an election? Well that’s a recipe for a storm of emotions – and some rather irrational decision-making”.

(McGrath, 2016)

It is normally assumed that actions and choices of a firm are results of firm decisions. The majority of the theories in management do not account for the role of managers. Macro facts (firm’s facts) appear sufficient to explain firm actions. Several theories (such as Internalisation Theory) have incorporated the concept of bounded rationality, but individual level phenomena have been treated as redundant. In most of the cases, managers are considered as “type” rather than as individuals. As exceptions, Top Management Team (TMT) literature and the Agency Theory recognise the role of managers in making decisions. Research on TMT explores the managers’ cognitive capabilities, whereas Agency theory focuses on the individual managers’ motivations.

TMT literature is built on the Upper Echelon Theory (Hambrick and Mason, 1984). The theory states that the organisational outcome is partially predicted by managers background characteristics. In other words, organizations are considered as the reflection of their TMTs. This means that firm-level choices, including FDI decisions, depend on the team’ cognitive processes. Empirical research in this area uses demographic variables (such age, experience, education) as proxies of managerial cognition. For example Wiersema and Bantel (1992) found that firms shows more flexibility in corporate strategy when have a TMT characterised by lower average age, shorter organizational tenure, higher team tenure, higher educational level, higher educational specialization heterogeneity and higher academic training. The conclusions of the TMT literature about managers’ cognition and behaviour are quite controversial. Kilduff et al. (2000) assert that “demography research rarely examines the black box within which the cognitive diversity of the top management team is assumed to affect firm performance” (p.21). Researchers should incorporate constructs that are more complex than simple demographic variables and integrate qualitative with quantitative methods in order to draw more informed conclusions (Priem et al., 1999).

Alternatively, Agency Theory offers a different perspective on managers’ decision-making. Agency Theory mainly aims to explain why a manager “will choose a set of activities for the firm such that the total value of the firm is less than it would be if he were the sole owner” (Jensen and Meckling, 1976, p.306). Agency theory points out the substantial divergence of interests between owners and managers. While capital remuneration is the main shareholders’ goal, the managers’ action can also be driven by personal benefit. Usually managers’ controlled firms are: a) more likely to maximise sales than profit; b) more diversified; and c) more likely to make decisions that smoothes income (Oesterle et al., 2013). Shareholders’ interests need to be safeguarded by implementing an appropriate governance structures. Usually the conflict of interests is corrected by offering managers with company equity shares. Ownership should give managers the deterrent from resources misallocation and pursuing private interest. Agency theory relies on very strong assumptions by depicting managers motivated only by their own interests. Different studies from the Stewardship literature have challenged the Agency theory demonstrating that fairness collectivism, pro-organizational behaviour, and trustworthiness are also important motivators (Davis et al., 1997; Donaldson and Davis, 1991).

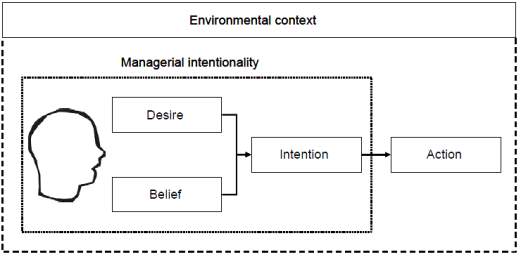

Both Upper Echelon Theory (Nielsen and Nielsen, 2011) and Agency Theory (Oesterle et al., 2013) have been used in IB to account for the role of managers in making decisions about internationalisation. However, a recent new perspective in IB has provided a more persuasive explanation of the role of managers in FDI decisions. The new stream of literature has adopted the concept of Managerial Intentionality (MI) to emphasise that managers do have the ability and the intention to influence the evolutionary paths of the firm (Hutzschenreuter et al., 2007; Hutzschenreuter et al., 2010; Dasi et al., 2015). It is argued that once path dependency has been considered, significant unexplained variance remains. The unexplained variance “may capture the role of luck, but it may also capture important unobserved and under-researched effects of managerial intentionality” (Hutzschenreuter et al., 2007, p.1058). MI is based on three different mental states: desire, belief and intention (see Figure 4). Manager’s actions are explained by the interaction of these three elements. Belief represents the cognitive aspect, the facts that the manager believes are true. Desire describe the motivational dimension. Intention is the result of the combination of the first two elements and is the main predictor of managers’ actions.

Hypothesis 2: FDI decisions are directly influenced by managerial intentions.

Figure 4:Managerial Intentionality

Source: (Hutzschenreuter et al., 2010, p.125)

3.1 Cognitive capabilities (belief)

Belief or Managerial cognitive capability is considered one of the two legs of MI. In management research cognitive capabilities have traditionally been used to describe firm characteristics. Dynamic capabilities have been described as “the firm’s ability to integrate, build, and reconfigure internal and external competences to address rapidly changing environments” (Teece et al., 1997, p.516). However, following the psychoneural identity hypothesis “knowledge does not exist in and of itself without a knowing subject” (Reihlen and Ringberg, 2013, p.707). Recent works have attempted to microfound cognitive capabilities (Reihlen and Ringberg, 2013; Helfat and Peteraf, 2015) recognising that the concept of cognition has at least two meanings. The first includes mental activities responsible for acquiring and processing information. While the second includes mental structures responsible for the function of representation. Individuals’ cognition provide the firm with a source of heterogeneity as they differ in the capability to process information.

Building upon Teece (2007), Helfat and Peteraf (2015) identify three dimensions of managerial cognitive capabilities: sensing, seizing and reconfiguring. The first dimension is sensing opportunities which is based on the managerial ability of perception and attention. Perception refers to the ability to recognise and interpret relevant data from the external environment. Heuristic and biases can influence managers in processing the information. For example, Baack et al. (2015) found that confirmation biases may alter the perception of psychic distance twisting the ability of judgement and risk assessing. The level of attention is also critical to determine what a relevant opportunity is. Ridge et al. (2014) found that both temporal myopia (focussing only on the short term) and spatial myopia (focussing only on the internal market) influence the firm’s strategy. Temporal myopia discourages long-term investment, while spatial myopia leads the managers to conform to industry tendencies with no emphasis on originality.

The second dimension of managerial cognitive capabilities is seizing opportunities. It refers to manager’s abilities of problem-solving and reasoning. These abilities are directed at finding a solution to problems by applying a range of different methods based on the individual cognitive style. Cognitive style has been defined as “consistent individual differences in ways of organising and processing information and experience” (Messick, 1984, p.61). Managerial cognitive styles are different one another and are associated to different types of decision-making. For example, Forbes (2005) find that firms made faster decisions when they are managed by older entrepreneurs with prior entrepreneurial experience (age has been considered as a source of superior cognitive styles). Similarly, Mitchell et al. (2011) point out that managers with greater metacognitive experience make less erratic strategic decisions. Another critical ability that defines the managerial cognitive style is intuition. In general, intuition can be defined as the extraction or creation of knowledge without reflection upon its epistemological status (Reihlen and Ringberg, 2013). Intuition has been also defined as a mean to manage the classic trade-off between decision accuracy and decision speed (Dane and Pratt, 2007). In a simulated strategic decision making environment, intuitive thinking managers have been found to use their intuitions to make higher quality decisions than other managers (Hough and Ogilvie, 2005). In the reality managers do not have the luxury of choosing between a “systematic” or an “intuitive” approach to the problem. A manager should master the whole range of skills and use them as they become appropriate (Simon, 1987).

The third dimension of managerial cognitive capabilities is reconfiguring. A firm’s reconfiguration is needed when external conditions change and strategic assets need to be changed consequently. Different firms, such as IBM or Apple, have successfully reshaped their organisations, while other firms, such as Kodak or Polaroid, have failed to adapt to external changes. A firm may decide to reconfigure its assets more effectively than others when managers have superior language and communication skills and social cognitive capabilities (Helfat and Peteraf, 2015). Language and communications skills lie at the heart of IB activities. They are a “necessary constituent of ongoing sequences of decisions and resource commitments that characterize day-to-day organizational life” (Brannen et al., 2014, p.495). Along the same perspective it has been shown that language barriers may create a cognitive reaction that affect the formation of trust among the members of an organisation (Tenzer et al., 2013). The effect of the lack of trust can in turn affect the decision-making. Reconfiguring also includes social cognition. It is a complex construct that embraces different types of mental activities – such as memory, attention, emotions and affective system – that are related to the social aspects of an individual external environment. Sheng et al. (2015) find that social cognitive capabilities can enhance the firm ability to exploit tacit knowledge and innovation by enhancing the communication between headquarter and subsidiaries. Other social cognitive capabilities such as emotion, affect and group interaction will be further explored in the next paragraphs.

To sum up, cognitive capabilities represent the individual knowledge within an organizations. According to the Knowledge-based theory (Spender, 1996) a firm can be understood as a system of knowledge where intuition shaped by shared cultural practices is a superior source of managerial knowledge (Reihlen and Ringberg, 2013). Cognitive capabilities are simplified representations of objects, persons, actions, and events. They fill the potential information gaps and represent the basis for consequent decision-making (Wrona et al., 2013).

Hypothesis 3: Managerial cognitive capabilities (sensing, seizing and reconfiguring) affect mangers’ judgement in making FDI decision.

3.2 Emotions and Affects

The role of emotion and affects deserves a special mention because the influence of these feelings on decision-making has been largely ignored or misunderstood (Bechara, 2004). Traditionally emotional decisions are generally associated to System 1 thinking as they appear to be quicker and irrational. In addition, there is also evidence that emotional choices can lead people to make decisions they later regret (Milkman et al., 2009). However, a popular experiment in the neuroscience field has revolutionised what generally people think of emotions. The experiment showed the role of the absence of emotions in making decisions. Damasio et al. (1990) studied a group of patients with a specific brain damage that make them incapable of experience any feelings. The absence of emotional biases may suggest that the judgment of these patients would be more objective. Instead, they found that the inability of feeling emotions induces a form of sociopathy that destroys any ability to make rational decisions. Emotions can be considered as both an idiosyncratic factor leading to a rational choice and a bias affecting the ability to make a decision. Certainly, emotions have a role in the decision making, but their effect remains controversial. Most of the controversies about emotions would be solved by defining the concept of rational decision. What does it mean rational decision? When talking about decisions different dimensions (such as complexity, method, speed, and outcome) have to be considered (see Figure 2). It is believed that rationality is a concept related to the method of making a decision rather than describing the outcome. It has been said that a good decision leads to an outcome that satisfice (Simon, 1957). In other words, an outcome that matches the intention and the aspiration of the decision maker. From a managerial perspective, emotions should be considered as a factor leading to make decisions that satisfice the decision maker from an individual point of view. Decisions under the effect of emotions can be considered both rational and irrational, if assessed with the canon of classical rationality.

In IB, the role of emotions has been mainly studied in the context of international negotiations (Lee et al., 2006; Hinds et al., 2014). Van de Laar and De Neubourg (2006) find that the presence of positive emotions increased the chance for a firm to engage in FDI. Typically, the concepts of emotion and individual motivation are sometimes overlapping making difficult to understand the real impact of emotions on FDI. In a more recent paper, emotions have been studied as an important factor affecting the decision to offshore business activities. Emotions such as patriotism can either directly affect the choice of offshoring activities or make the decision making process more conflicted (Musteen, 2016). The emotional attachment to one’s country may lead the manager to avoid FDI or offshoring activities and, consequently, prefer national investment solutions. Understanding the role played by emotions, such as patriotism, in FDI decisions can be really interesting, especially nowadays. The recent results of American election and the rising anti-European Union wave may emphasise the role of home-country investments, rather than international investments. The study of managerial emotion can provide an explanation of decisions like domestic labour force preference and/or FDI avoidance.

Hypothesis 4: FDI decisions are affected by managerial emotions. Particularly, emotions such as patriotism can lead the managers to avoid FDI and prefer home-country investments and labour force.

3.3 Personality traits

The greater the CEO’s emotional stability, the higher his or her discretion. In particular, over time a CEO’s emotional stability enhances his or her discretion through the development of improved sensing capabilities. (Hutzschenreuter and Kleindienst, 2013)

3.4 Motivation (desire)

The other leg of MI is represented by the motivational aspect or the desire of the manager-individual decision maker. Cognitive and motivational aspects are intertwined

processes to such a degree that they must be considered simultaneously and in close interaction with each other.

4 Internal firm characteristics

Hypothesis 5: Internal firm’s characteristics have an influence on managerial FDI decision

MI is not unanimously considered as a valid option to explain firm’s decisions. It is argued that path dependency and complexity of the firm’s decision model make negligible the role of managers (Devinney, 2011; Greve, 2013). Basically researchers are split in two groups. Those who believe that the reasons of a firm behaviour can be found at individual level (Buckley et al., 2016; Maitland and Sammartino, 2015b) and those who consider macro-facts (firm-facts) as sufficient to explain the firm’s decision to internationalise (Devinney, 2011; Greve, 2013). It is certainly true that managers are constrained by environmental, organisational and institutional givens. However, the level of heterogeneity among firms in terms of multinationality and the difference in their internationalisation strategies suggest that managerial intentionality may have an influence on FDI decision. The breadth of the managerial discretion may vary according to the firm specific routines, the type of firm and/or the size of the firm. As mentioned by Hutzschenreuter et al. (2007) Honda (Japanese manufacturer) and Würth (German Manufacturer) corporate strategies encourage managers and employees to think individually and to come up with personal initiatives. Dasi et al. (2015) assert that managers in the context of small and medium enterprises have more discretion as they are less limited by firm’s routines and path dependencies.

Hypothesis 6: Managerial intention has a greater influence on FDI decisions when (1) firm’s dimension is smaller, (2) firm’s routines encourage managerial discretion, and (3) firm’s routines are less structured.

In some firms, where the organisational structure is less systematic, mangers may hold more discretion. In other firms managerial intentionality may be less visible.

5 External corporate environment

Besides the type of decision and the cognitive limitations, uncertainty has been identified as another main factor influencing strategic decisions (Liesch et al., 2011; Rivoli and Salorio, 1996; Sahaym et al., 2012; Sanchez-Peinado and Pla-Barber, 2006). Uncertainty refers to the “difficulty or inability to predict the environmental and organisational conditions” (Sanchez-Peinado and Pla-Barber, 2006, p.219). Uncertainty put the decision-maker under the spotlight: issues such as experience, risk propensity, affect, and other cognitive abilities become essential in making good decisions.

6 FDI decision: the influence of the team

In addition, making a decision often involves the interaction with other individuals. Understanding how these individuals act or react to the others’ behaviour is important to make a decision.

The processing of socially relevant information takes place in specific areas of the brain, suggesting that social cognitive capabilities perform a distinctive cognitive function (Helfat and Martin, 2015).

First, these capabilities may help managers to foster cooperation. Cooperation is often associated with trust among organization members; trust also may serve to lower the costs of coordination (Gulati, 1995; Zaheer and Venkatraman, 1995). The capacity of top executives to trust and foster trust is likely to depend in part on their social cognitive capabilities, since trust requires mutual understandings. Second, Top executives may also utilize social cognitive capabilities when seeking to overcome organizational resistance to change.

“Is there a special kind of motivation that is particularly geared to the fact that organizational members need to engage in collaborative activities such that organizations that tap into it would gain a performance advantage—what may be termed joint production motivation? (Lindenberg and Foss, 2011)

7 Method

Define different levels: need for differentiate levels organizational/individual, appropriate methodology and current issues.

8 Research plan

8.1 First empirical chapter

Does the nature of the FDI decision influences the decision method

8.2 Second empirical chapter

Managerial and contextual factors influencing FDI decision

8.3 Third empirical chapter

How the group interaction affect managerial decision

9 Conclusion

Managers, the object of this research, do not work in an island but they are influenced by a number of different elements within and outside the firm. Managers make most of their decisions, including FDI decisions, in a world characterised by uncertainty, influenced by: inter-managers interactions, network and value-chain position of the firm, industry peculiarities and market condition. Cognitive and motivational biases and their individual characteristics will affect the rationality of their decision-making process by shaping their level of risk perception. A good decision rely on manager’s ability to get as closer as possible to the actual level of risk.

Based on our findings, we argue internationalization theory’s intellectual framework is sound, but its explanatory power can be enhanced by more granular specification of the drivers of MNE behaviour (Maitland and Sammartino, 2015b, p.754).

References

Aggarwal, R.K. and Samwick, A.A. 2003. Why Do Managers Diversify Their Firms? Agency Reconsidered. The Journal of Finance. 58(1), pp.71-118.

Aguinis, H. and Molina-Azorín, J.F. 2015. Using multilevel modeling and mixed methods to make theoretical progress in microfoundations for strategy research. Strategic Organization. 13(4), pp.353-364.

Aharoni, Y. 1966. The foreign investment decision process. MA: Harvard University Press.

Aharoni, Y. 2010. Behavioral elements in foreign direct investment. In: Devinney, T.M., et al. eds. The past, present and future of international business and management. Bingley: Emerald Group Publishing, pp.73-111.

Aharoni, Y., Tihanyi, L. and Connelly, B.L. 2011. Managerial decision-making in international business: A forty-five-year retrospective. Journal of World Business. 46(2), pp.135-142.

Amihud, Y. and Baruch, L. 1981. Risk Reduction as a Managerial Motive for Conglomerate Mergers. The Bell Journal of Economics. 12(2), pp.605-617.

An, Y.H., Liu, B. and Li, Y. 2013. Mechanism of Action of TMT Managerial Discretion to Strategic Decision. In: Hua, L.A.N. ed. International Conference on Management Science and Engineering. New York: Ieee, pp.1379-1384.

Baack, D.W., Dow, D., Parente, R. and Bacon, D.R. 2015. Confirmation bias in individual-level perceptions of psychic distance: An experimental investigation. Journal of International Business Studies. 46(8), pp.938-959.

Barney, J. and Felin, T. 2013. What Are Microfoundations? Academy of Management Perspectives. 27(2), pp.138-155.

Basel, J.S. and Brühl, R. 2013. Rationality and dual process models of reasoning in managerial cognition and decision making. European Management Journal. 31(6), pp.745-754.

Baulkaran, V. 2014. Management entrenchment and the valuation discount of dual class firms. The Quarterly Review of Economics and Finance. 54(1), pp.70-81.

Bazerman, M.H. and Moore, D.A. 2008. Judgment in managerial decision making. Danvers, MA: Wiley Global Education.

Bechara, A. 2004. The role of emotion in decision-making: evidence from neurological patients with orbitofrontal damage. Brain Cogn. 55(1), pp.30-40.

Brannen, M.Y., Piekkari, R. and Tietze, S. 2014. The multifaceted role of language in international business: Unpacking the forms, functions and features of a critical challenge to MNC theory and performance. Journal of International Business Studies. 45(5), pp.495-507.

Buckley, J.P. and Casson, C.M. 2009. The internalisation theory of the multinational enterprise: A review of the progress of a research agenda after 30 years. Journal of International Business Studies. 40(9), pp.1563-1580.

Buckley, P.J., Chen, L., Clegg, L.J. and Voss, H. 2016. Experience and FDI Risk-taking: A Microfoundational Reconceptualization. Journal of International Management. 22(2), pp.131-146.

Buckley, P.J., Devinney, T.M. and Louviere, J.J. 2007. Do managers behave the way theory suggests? A choice-theoretic examination of foreign direct investment location decision-making. Journal of International Business Studies. 38(7), pp.1069-1094.

Chugh, D. and Bazerman, M.H. 2007. Bounded awareness: what you fail to see can hurt you. Mind & Society. 6(1), pp.1-18.

Chugh, D., Bazerman, M.H. and Banaji, M.R. 2005. Bounded ethicality as a psychological barrier to recognizing conflicts of interest. Conflicts of interest: Challenges and solutions in business, law, medicine, and public policy. pp.74-95.

Coleman, J. 1990. Foundations of social theory. MA: Harvard university press.

Damasio, A.R., Tranel, D. and Damasio, H. 1990. Individuals with sociopathic behavior caused by frontal damage fail to respond autonomically to social stimuli. Behavioural brain research. 41(2), pp.81-94.

Dane, E. and Pratt, M.G. 2007. Exploring intuition and its role in managerial decision making. Academy of management review. 32(1), pp.33-54.

Dasi, A., Iborra, M. and Safon, V. 2015. Beyond path dependence: Explorative orientation, slack resources, and managerial intentionality to internationalize in SMEs. International Business Review. 24(1), pp.77-88.

Davis, J.H., Schoorman, F.D. and Donaldson, L. 1997. Toward a stewardship theory of management. Academy of Management review. 22(1), pp.20-47.

de Villiers, R., Woodside, A.G. and Marshall, R. 2016. Making tough decisions competently: Assessing the value of product portfolio planning methods, devil’s advocacy, group discussion, weighting priorities, and evidenced-based information. Journal of Business Research. 69(8), pp.2849-2862.

Devinney, T.M. 2011. Bringing managers’ decision models into FDI research. In: Ramamurti, R. and Hashai, N. eds. The future of foreign direct investment and the multinational enterprise. Bingley, UK: Emerald Group Publishing, pp.61-83.

Donaldson, L. and Davis, J.H. 1991. Stewardship theory or agency theory: CEO governance and shareholder returns. Australian Journal of management. 16(1), pp.49-64.

Edwards, W. 1954. The theory of decision making. Psychological Bulletin. 51(4), pp.380-417.

Einhorn, H.J. and Hogarth, R.M. 1981. Behavioral decision theory: Processes of judgement and choice. Annual review of psychology. 32(1), pp.53-88.

Eisenhardt, K.M. 1989. Making fast strategic decisions in high-velocity environments. Academy of Management journal. 32(3), pp.543-576.

Felin, T. and Foss, N.J. 2005. Strategic organization: a field in search of micro-foundations. Strategic Organization. 3(4), pp.441-455.

Felin, T., Foss, N.J. and Ployhart, R.E. 2015. The Microfoundations Movement in Strategy and Organization Theory. The Academy of Management Annals. 9(1), pp.575-632.

Forbes, D.P. 2005. Managerial Determinants of Decision Speed in New Ventures. Strategic Management Journal. 26(4), pp.355-366.

Foss, N.J. and Lindenberg, S. 2013. Microfoundations for Strategy: A Goal-Framing Perspective on the Drivers of Value Creation. Academy of Management Perspectives. 27(2), pp.85-102.

Foss, N.J. and Pedersen, T. 2014. Microfoundations in strategy research. Strategic Management Journal. 37(13), pp.E22-E34.

Gigerenzer, G. and Goldstein, D.G. 1996. Reasoning the fast and frugal way: models of bounded rationality. Psychological review. 103(4), p650.

Gilovich, T., Griffin, D. and Kahneman, D. 2002. Heuristics and biases: The psychology of intuitive judgment. Cambridge university press.

Grether, D.M. 1980. Bayes rule as a descriptive model: The representativeness heuristic. The Quarterly Journal of Economics. 95(3), pp.537-557.

Greve, H.R. 2013. Microfoundations of management: Behavioral strategies and levels of rationality in organizational action. The Academy of Management Perspectives. 27(2), pp.103-119.

Hambrick, D.C. and Mason, P.A. 1984. Upper echelons: The organization as a reflection of its top managers. Academy of management review. 9(2), pp.193-206.

Helfat, C.E. and Martin, J.A. 2015. Dynamic Managerial Capabilities: Review and Assessment of Managerial Impact on Strategic Change. Journal of Management. 41(5), pp.1281-1312.

Helfat, C.E. and Peteraf, M.A. 2015. Managerial cognitive capabilities and the microfoundations of dynamic capabilities. Strategic Management Journal. 36(6), pp.831-850.

Hickson, D.J., Miller, S.J. and Wilson, D.C. 2003. Planned or prioritized? Two options in managing the implementation of strategic decisions. Journal of Management Studies. 40(7), pp.1803-1836.

Hinds, P.J., Neeley, T.B. and Cramton, C.D. 2014. Language as a lightning rod: Power contests, emotion regulation, and subgroup dynamics in global teams. Journal of International Business Studies. 45(5), pp.536-561.

Hough, J.R. and Ogilvie, D. 2005. An empirical test of cognitive style and strategic decision outcomes. Journal of Management Studies. 42(2), pp.417-448.

Hutzschenreuter, T., Han, U.-S. and Kleindienst, I. 2010. Exploring the role of Managerial Intentionality in International Business. In: Devinney, T.M., et al. eds. The past, present and future of international business and management. Bingley: Emerald Group Publishing, pp.113-135.

Hutzschenreuter, T. and Kleindienst, I. 2013. (How) Does discretion change over time? A contribution toward a dynamic view of managerial discretion. Scandinavian Journal of Management. 29(3), pp.264-281.

Hutzschenreuter, T., Pedersen, T. and Volberda, H.W. 2007. The role of path dependency and managerial intentionality: a perspective on international business research. Journal of International Business Studies. 38(7), pp.1055-1068.

Hymer, S. 1976. The international operations of national firms: A study of direct foreign investment. Cambridge: MIT press.

Jensen, M.C. and Meckling, W.H. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of financial economics. 3(4), pp.305-360.

Johnson, G., Scholes, K. and Whittington, R. 2009. Fundamentals of strategy. Pearson Education.

Kahneman, D. and Frederick, S. 2002. Representativeness revisited: Attribute substitution in intuitive judgment. Heuristics and biases: The psychology of intuitive judgment. 49.

Kahneman, D. and Tversky, A. 1974. Subjective probability: A judgment of representativeness. In: von Holstein, C.A.S.S. ed. The concept of probability in psychological experiments. Boston: Reidel Publishing Company, pp.25-48.

Kahneman, D. and Tversky, A. 1979. Prospect theory: An analysis of decision under risk. Econometrica: Journal of the Econometric Society. 47(2), pp.263-291.

Kilduff, M., Angelmar, R. and Mehra, A. 2000. Top management-team diversity and firm performance: Examining the role of cognitions. Organization science. 11(1), pp.21-34.

Kuhn, T.S. 1962. The structure of scientific revolutions. Chicago: University of Chicago Press.

Lee, K.-h., Yang, G. and Graham, J.L. 2006. Tension and trust in international business negotiations: American executives negotiating with Chinese executives. Journal of International Business Studies. 37(5), pp.623-641.

Liesch, P.W., Welch, L.S. and Buckley, P.J. 2011. Risk and Uncertainty in Internationalisation and International Entrepreneurship Studies Review and Conceptual Development. Management International Review. 51(6), pp.851-873.

Lindenberg, S. and Foss, N.J. 2011. Managing joint production motivation: The role of goal framing and governance mechanisms. Academy of Management Review. 36(3), pp.500-525.

Maitland, E. and Sammartino, A. 2015a. Decision making and uncertainty: The role of heuristics and experience in assessing a politically hazardous environment. Strategic Management Journal. 36(10), pp.1554-1578.

Maitland, E. and Sammartino, A. 2015b. Managerial cognition and internationalization. Journal of International Business Studies. 46(7), pp.733-760.

May, D.O. 1995. Do Managerial Motives Influence Firm Risk Reduction Strategies? The Journal of Finance. 50(4), pp.1291-1308.

McGrath, M. 2016. Indexing Innovator Rob Arnott Likes Emerging Markets, But Be Wary Of A Trump Trade War. [Online]. [Accessed 22 April 2017]. Available from: https://www.forbes.com/sites/maggiemcgrath/2016/06/15/indexing-innovator-rob-arnott-likes-emerging-markets-but-be-wary-of-a-trump-trade-war/#3afafa9cbb66

Messick, S. 1984. The nature of cognitive styles: Problems and promise in educational practice. Educational psychologist. 19(2), pp.59-74.

Milkman, K.L., Chugh, D. and Bazerman, M.H. 2009. How can decision making be improved? Perspectives on psychological science. 4(4), pp.379-383.

Mitchell, J.R., Shepherd, D.A. and Sharfman, M.P. 2011. Erratic strategic decisions: when and why managers are inconsistent in strategic decision making. Strategic Management Journal. 32(7), pp.683-704.

Musteen, M. 2016. Behavioral factors in offshoring decisions: A qualitative analysis. Journal of Business Research. 69(9), pp.3439-3446.

Nickerson, R.S. 1998. Confirmation bias: A ubiquitous phenomenon in many guises. Review of general psychology. 2(2), p175.

Nielsen, B.B. and Nielsen, S. 2011. The role of top management team international orientation in international strategic decision-making: The choice of foreign entry mode. Journal of World Business. 46(2), pp.185-193.

North, D.C. 2005. Understanding the process of economic change. Princeton: Princeton University Press.

Nutt, P.C. 1999. Surprising but True: Half the Decisions in Organizations Fail. The Academy of Management Executive (1993-2005). 13(4), pp.75-90.

Oesterle, M.-J., Richta, H.N. and Fisch, J.H. 2013. The influence of ownership structure on internationalization. International Business Review. 22(1), pp.187-201.

Papadakis, V.M., Lioukas, S. and Chambers, D. 1998. Strategic decision‐making processes: the role of management and context. Strategic Management Journal. 19(2), pp.115-147.

Perlow, L.A., Okhuysen, G.A. and Repenning, N.P. 2002. The speed trap: Exploring the relationship between decision making and temporal context. Academy of Management journal. 45(5), pp.931-955.

Priem, R.L., Lyon, D.W. and Dess, G.G. 1999. Inherent limitations of demographic proxies in top management team heterogeneity research. Journal of Management. 25(6), pp.935-953.

Reihlen, M. and Ringberg, T. 2013. Uncertainty, pluralism, and the knowledge-based theory of the firm: From J.-C. Spender’s contribution to a socio-cognitive approach. European Management Journal. 31(6), pp.706-716.

Ridge, J.W., Kern, D. and White, M.A. 2014. The influence of managerial myopia on firm strategy. Management Decision. 52(3), pp.602-623.

Rivoli, P. and Salorio, E. 1996. Foreign direct investment and investment under uncertainty. Journal of International Business Studies. 27(2), pp.335-357.

Sahaym, A., Trevino, L.J. and Steensma, H.K. 2012. The influence of managerial discretion, innovation and uncertainty on export intensity: A real options perspective. International Business Review. 21(6), pp.1131-1147.

Sanchez-Peinado, E. and Pla-Barber, J. 2006. A multidimensional concept of uncertainty and its influence on the entry mode choice: An empirical analysis in the service sector. International Business Review. 15(3), pp.215-232.

Sheng, M.L., Hartmann, N.N., Chen, Q. and Chen, I. 2015. The synergetic effect of multinational corporation management’s social cognitive capability on tacit-knowledge management: product innovation ability insights from Asia. Journal of International Marketing. 23(2), pp.94-110.

Simon, H.A. 1957. Models of man: social and rational; mathematical essays on rational human behavior in society setting. Wiley.

Simon, H.A. 1972. Theories of bounded rationality. In: Marschak, J., et al. eds. Decision and organization: A volume in honor of Jacob Marschak. North-Holland Publishing Companies, pp.161-176.

Simon, H.A. 1987. Making management decisions: The role of intuition and emotion. The Academy of Management Executive (1987-1989). 1(1), pp.57-64.

Simon, H.A. 1990. Invariants of human behavior. Annual review of psychology. 41(1), pp.1-20.

Slovic, P., Finucane, M.L., Peters, E. and MacGregor, D.G. 2007. The affect heuristic. European Journal of Operational Research. 177(3), pp.1333-1352.

Spender, J.C. 1996. Making knowledge the basis of a dynamic theory of the firm. Strategic management journal. 17(S2), pp.45-62.

Stanovich, K.E. and West, R.F. 2000. Individual differences in reasoning: Implications for the rationality debate? Behavioral and Brain Sciences. 23(5), pp.645-726.

Sunstein, C.R. 2002. The Law of Group Polarization. The Journal of Political Philosophy. 10(2), pp.175-195.

Sykianakis, N. and Bellas, A. 2005. The foreign direct investment decision‐making process. Managerial Auditing Journal. 20(9), pp.954-969.

Teece, D.J. 2007. Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance. Strategic management journal. 28(13), pp.1319-1350.

Teece, D.J., Pisano, G. and Shuen, A. 1997. Dynamic capabilities and strategic management. Strategic Management Journal. 18(7), pp.509-533.

Tenzer, H., Pudelko, M. and Harzing, A.-W. 2013. The impact of language barriers on trust formation in multinational teams. Journal of International Business Studies. 45(5), pp.508-535.

Thaler, R.H. 2000. From homo economicus to homo sapiens. The Journal of Economic Perspectives. 14(1), pp.133-141.

Trevis Certo, S., Connelly, B.L. and Tihanyi, L. 2008. Managers and their not-so rational decisions. Business Horizons. 51(2), pp.113-119.

Tversky, A. and Kahneman, D. 1973. Availability: A heuristic for judging frequency and probability. Cognitive psychology. 5(2), pp.207-232.

Van de Laar, M. and De Neubourg, C. 2006. Emotions and foreign direct investment: a theoretical and empirical exploration. Management International Review. 46(2), pp.207-233.

Wallach, M.A., Kogan, N. and Bem, D.J. 1962. Group influence on individual risk taking. ETS Research Report Series. 1962(1), pp.i-39.

Wiersema, M.F. and Bantel, K.A. 1992. Top management team demography and corporate strategic change. Academy of Management journal. 35(1), pp.91-121.

Wrona, T., Ladwig, T. and Gunnesch, M. 2013. Socio-cognitive processes in strategy formation – A conceptual framework. European Management Journal. 31(6), pp.697-705.

Wu, J. and Chiclana, F. 2014. A social network analysis trust–consensus based approach to group decision-making problems with interval-valued fuzzy reciprocal preference relations. Knowledge-Based Systems. 59, pp.97-107.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business Analysis"

Business Analysis is a research discipline that looks to identify business needs and recommend solutions to problems within a business. Providing solutions to identified problems enables change management and may include changes to things such as systems, process, organisational structure etc.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: