Field Development Plan Report

Info: 3973 words (16 pages) Dissertation

Published: 16th Dec 2019

Tagged: Environmental Science

Executive Summary

This report for Field Development Plan for Lismore field located in the North Sea, UK. The project required a holistic and integrated approach to analyse the challenges in the technical and commercial parts that were encountered during the exploration and appraisal of the field, as well as a review of geological and geophysical (static) reservoir models of the field provided by the operator. As a representative of LENS Company, the tasks that were carried out were evaluating the data, devising and recommending an optional development plan for the field.

The gross rock volume of the reservoir was estimated to be 670 MMm3 using area vs depth method which assumed average reservoir properties. Other petro physical properties such as porosity, oil saturation, Net to gross ratio was estimated from the log data. STOIIP was calculated to using Crystal ball, base reference case, MBAL and Monte Carlo and estimated to be 201MMstb. Two main controlling factors which effect on oil recovery factor. Although this was generated and interpreted an expected Production Profile history for next 20 years using fluid parameters.

Analytical models where build for gas solution drive and water drive and compared using recovery factor to determine which drive mechanism would produce higher recoverable oil. The recovery factor for both Devonian and Zechstein were found for each drive mechanism. The average values were taken because the reservoir was assumed to be homogenous. Ultimately recoverable oil of 87.48 million bbl compared to 60.8 million bbl for solution gas drive.

To save cost and to keep simultaneous production from both formation it is decided to use dual tubing completion. This type of completion design will allow to avoid cross flow related problems, which will occur due to pressure difference in Devonian and Zechstein formations.

The concept selected after economic analysis is drilling facilities supported by a jack up rig followed by subsea completion with FPSO as a production facility and tanker as export route. The CAPEX is expected to be $624million with cost of capital 8% and initial return of 42.1%. The expected NPV of the project with $519 million dollars with payback time in the first years once the project commences in January 2018.

Traffic light system is constructed from the challenges faced and possible risk using references from real field development plans. Mitigations and contingency plans are included if any of these accidents does occur because it can act final line of defence to save workers lives. Furthermore, it is our company’s policies to ensure that all workers receive proper training before going to the fields. In addition, all HSE regulations will be included in our field development plans because safety is our upmost priority.

Decommissioning cost is expected to be US $128.2 million. However, it’s impossible to have precise predictions for 17 years ahead and we are expecting decommissioning costs to go down due to decommissioning technology boost.

Contents

Chapter 1. Framing the Lismore Field

1.1 Outline of the exploration history of the Block 29/13 area

1.2 Location and Infrastructure

1.2.2 Important Business Metrics

1.3 Summary of the business case for drilling the Lismore prospect

1.5 Results of the discovery well 29/13-1 and Summary of the field volumetric.

1.5 Outline the appraisal well drilling campaign, well results and their impact on planning

Chapter 2. Mapping the Gross Rock Volumes

Chapter 3. Petrophysical Properties

Chapter 4. Well Production Rates and Profiling

4.1.1 Geological Factors controlling recovery

4.1.2 Physical Factors controlling recovery

4.2 Lismore Production Profile

5.3 Natural Aquifer Water Drive

5.3.1 Microscopic Displacement Efficiency

5.3.2 Recovery Efficiency for Devonian and Zechstein

Chapter 8. Development Concept Economic Evaluation

Chapter 9. Risk and Uncertainties

Chapter 11. Decommissioning Plan

11.1 Well Plugging and Abandonment

11.2 Topside and structure removal

Chapter 1. Framing the Lismore Field

1.1 Outline of the exploration history of the Block 29/13 area

The Lismore prospect was mostly based on a Tertiary play with the potential secondary target at Cretaceous interval. The play was thought to be a trap created by tilted fault blocks, with Palaeocene sandstone or Upper Cretaceous chalk reservoir, sealed by Palaeocene shales. The Kimmeridge Clay Formation, which was located stratigraphically deeper, was assumed to be free of oil and acted as a source.

With significant oil discovery in Permian age Zechstein and Rotliegendes intervals close to the Lismore exploration well, it was likely that these sequences were going to be present below the shallower Tertiary and Cretaceous target horizons at Lismore prospect. Thus Block 29/13-1 went under further investigation for a similar play type potential, while still exploring the shallower targets.

The subsequent discovery well 29/13-1 successfully encountered oil bearing Zechstein, but found oil in underlying Devonian sandstones with the entire Rotliegendes sandstone interval missing from the prognosed stratigraphic sequence. Well testing was carried out and indicated that both reservoir intervals were productive, with the highest rates from the Zechstein carbonates. Although there was some ambiguity in the collected data, the oil appeared to be superior quality (~38˚ API) and was highly under-saturated.

Early estimates of STOIIP suggested a several hundred-million-barrel field size, but there was considerable uncertainty in delineating the true areal extent of the closure due to poor seismic definition and contradictory evidence regarding fluid contact levels in the structure. A campaign of further appraisal drilling was undertaken to address these issues.

Four appraisal wells were drilled across the structure with the objective of defining the field GRV and investigating reservoir property variation across the structure to more accurately calculate the field STOIIP and ultimate recoverable resource.

1.2 Location and Infrastructure

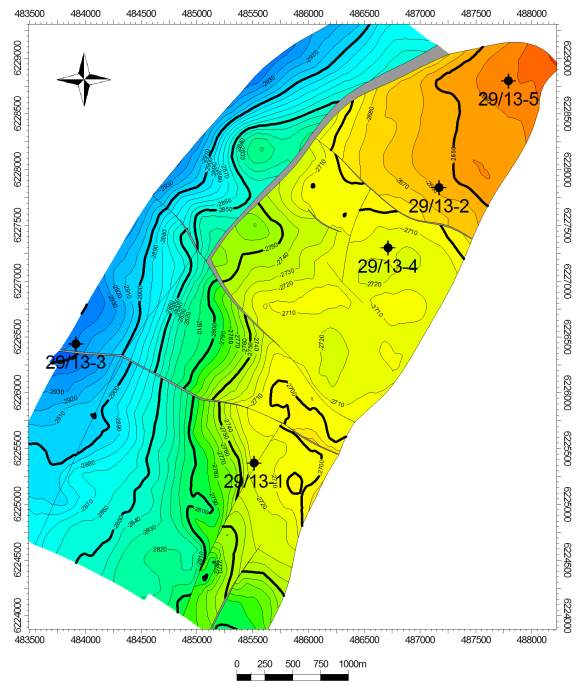

The project is based in Lismore field located in the North Sea. Below figure shows the five wells that were investigated. Four of them were appraised which are wells 29/13-1, -2, -4, -5. The company has no existing infrastructure or production in the basin, however because this is a mature basin with numerous active operators, the infrastructure can be shared.

1.2.1 Fiscal Regime

Currently, the oil and gas in the UK and UKCS the fiscal regime for production and exploration comprises of three taxes, which are Ring Fence Corporation Tax (RFCT), Supplementary Charge, and Petroleum Revenue Tax (PRT). [1]

The Ring Fence Corporation Tax can be calculated like the mainstream corporation tax that is applicable for all companies however, with ‘ring fence’ added. The ring fence is what prevents the taxable profits from extracting oil and gas in UK from being reduced by losses from other activities or by excessive interest payments. The current rate of tax set for mainstream corporation is 30%. [1]

Supplementary charge, which is an additional charge is 32% currently with no deduction for finance costs on a company’s profits. [1]

Petroleum Revenue Tax (PRT) is a field based tax that is charged on profits that arises from production of oil and gas, which the development consent was given before March 1993. The current rate is 50% and is deductible as an expense in computing profits that can be charged to RFCT and the supplementary charge. [1]

UK’s Royalty Fiscal System is calculated as a percentage of gross revenue and payable in cash or in kind, from the start of production.

1.2.2 Important Business Metrics

The financial indicators and energy production and resources measures are the most commonly used industry metrics. They can be divided into the cash flow, daily production and reserve life index (RLI).

One of the most important metrics in the industry is the enterprise value (EV) to debt-adjusted cash flow (DACF). It focuses on the cash flow that is modified for the capital structure. Because the oil and gas tend to have large amount of debt, the traditional cash flow evaluation metrics does not accurately display the E&P’s free cash flow picture. EV separates the cash flows from the operating activities and its finance charges. [1]

EV per day, also known as enterprise value to daily production companies’ valuations relative to their current production levels. Production is reported in BOE (barrels of oil equivalent per day) in oil and gas companies. This compares the trading such as premium or discount to the industry for which companies. [1]

RLI can be expressed as RLI=1/ (production to reserves ratio). This compares how much is being produced compared to how much is still in the reserve. It measures how long the current reserves will last at the current production rate. [1]

The ratios discussed above are a sample of the many data points, metrics and ratios analysts use to understand complicated and unique companies such as oil and gas E&Ps.

1.3 Summary of the business case for drilling the Lismore prospect, illustrating the regional structure and defining the reservoir(s), seal and trap for hydrocarbons being tested

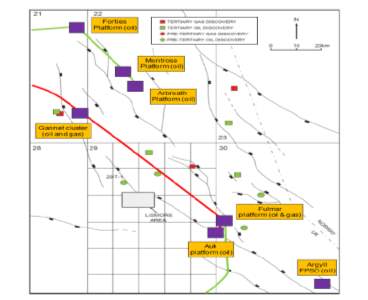

The Lismore field is in a south west area and was not explored before the recent explorations. Kimmeridge Clay was believed to be immature and the area to south west from Viking Graben was overlooked in a past. After the decline in production have started less potential areas begin to be explored and the Lismore field was one of them. As this region was not known before for a potential in hydrocarbons existence no infrastructure was installed there yet, however there are a range of nearby field with a connection to a major North Sea pipeline systems, such as Gannet Cluster or Forties as shown in Figure 1.2.

Figure 0.2 Nearby North Sea fields and infrastructure (Lismore data pack 1)

The best option for a Lens Energy is to agree a contract with an existing infrastructure holder companies from the Auk and Fulmer platforms particularly and get the full access to their infrastructure for a reasonable price. Both these platforms are around 32 km away to the south-east from the Lismore field. As the alternative Gannet Cluster infrastructure can be used, which is 40 km away to the North-West (figure 1.2).

Ideally would be to use nearby platform for all production operations (using subsea design) with a constant renting price for their service, however this option can be considered as an optimistic and likely will lead to an additional decommissioning costs as current platform holder wold not be ready to rent their platform for 17 years without shearing the decommissioning responsibilities afterward.

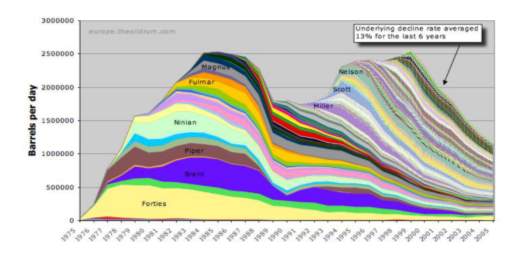

As the most realistic option usage of FPSO will be considered as our company is trying not to invest additional costs into infrastructure for two main reasons: company is limited in finance; the trend of production decline in a North Sea have started in 2000 and keep declining since then (figure 1.3). We are not expecting production rise due to the current relatively low oil prices

Figure 1.3 North Sea Production History (Lismore data pack 1)

1.5 Results of the discovery well 29/13-1 and Summary of the field volumetric.

A single exploration well 29/13-1 was drilled in the south-east part of the Lismore field, which was targeting production zones of the nearby Auk field reservoir formations. The prime goal of this well was to encounter hydrocarbons of the Devonian and Zechstein layers. The Zechstein zone showed much higher oil rates than the Devonian (almost twice higher).

From the well test, we can assume that the reservoir hydrocarbons are mostly represented by a light crude oil with an API of 38° which is equivalent of a Brent crude according to Petroleum UK 2017. [1] And the Brent crude price for 25.03.2017 is $52.00/bbl according to the NASDAQ.com quotation. [2]

At the same time, farther oil quality investigation need to be proceed as there is certain uncertainties in the results that were collected from samples. In future Lismore field will need water or steam injection to keep oil in saturated conditions.

1.5 Outline the appraisal well drilling campaign

Initial calculations suggest that Lismore field contain STOIIP value around 200 million barrels, however this value can be considered as reliable due to lack of accurate data and additional evidence. However, after the first appraisal well (29/13-1) was drilled it was decided to drill another four appraisal and exploration wells across this area to gain more information and more accurate data, which will help to get better reservoir description for a future Gross Reservoir Volume calculations.

Well 29/13-3 was drilled on the west side of the field, which give us information about the water interaction and maximum oil depth. We the farther studies within the field oil water contact can be determined for each reservoir section using the appraisal well data.

Well 29/13-4 and 29/13-2 were drilled from the either side of a major reservoir fault. More investigation and testing in this area can provide better understanding of fault localization and its conductivity.

Fluid samples were taken from a Zechstein and Devonian zone well 29/13-3 from the wellhead and separator respectively and Devonian section separator sample from well 29/13-4. Fluid samples indicate the presents of hydrocarbons and help to determine oil chemical composition in different reservoir sections and layers.

Chapter 2. Mapping the Gross Rock Volumes

Quantifying how much oil and gas exists in an accumulation is called Volumetric Estimation. This estimate is supposed to change throughout the well life [1]. The initial estimate of the volume of hydrocarbons enabled the company to check the feasibility of the project for further development. Therefore, the volumetric estimate is a current estimate calculated using the well log data for the appraisal and discovery wells in the block.

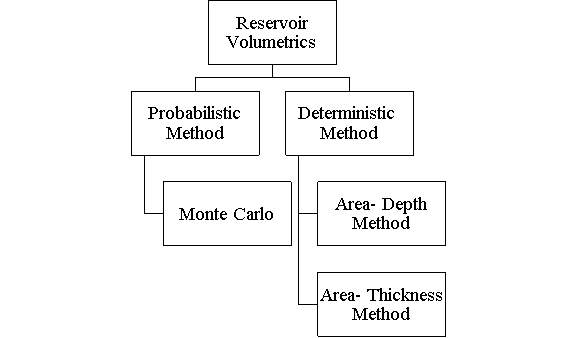

There are various methods used to estimate volumetrics which can be classified into two: deterministic and probabilistic [1]. This helps to reduce the uncertainty of the process. The hierarchy diagram (Figure 2.1) shows various methods we adopted.

Figure 2.2 Methods used to calculate Volumetrics

Deterministic methods average the data gathered at various points in the reservoir from the appraisal well log data, cores and seismic to describe the field wide properties. Whereas, probabilistic methods use statistics, predictive tools, analogue field data and input regarding the geological model to predict trends in reservoir properties away from the sample points [1].

The reservoir volume of the field along with the anticipated recovery factors (RF) control the field reserves- which is equivalent to the hydrocarbons that will be produced in the future life of the field. Hydrocarbon reserves helps to rank oil companies to attract shareholders and investors, which indicates the strength of the company. A reliable estimate of the reserves for a company is therefore of significant importance to the current and future value.

2.1 Deterministic Method

Estimating the volumetrics is important at all stages of the field life cycle. The first estimate gives ‘how big’ the accumulation is. The formulae to calculate the volume of oil or gas are given by

[6] Guidelines for the suspension and abandonment of wells. [online] Available at: http://www.frackfreewrexham.org.uk/wp-content/uploads/2015/02/8-PLN-Supporting-Docs-Web.pdf [Accessed 25 Feb. 2017].[7] Haddon-Cave, C. (2009). The Nimrod Review. 1st ed. [ebook] London, UK: The Stationery Office Limited. Available at: http://www.google.co.uk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=5&ved=0ahUKEwjG_L6Mr4DTAhVpCsAKHWLfDi0QFgg5MAQ&url=http%3A%2F%2Fwww.hse.gov.uk%2Foffshore%2Fageing%2Fkp4-nimrod.pdf&usg=AFQjCNHRtKqaW1B2v0HAXrREors4CTK7pQ [Accessed 5 Mar. 2017].

[8] Health & Safety Executive. (2001). Decommissioning topic strategy. [online] Available at: http://www.hse.gov.uk/research/otopdf/2001/oto01032.pdf [Accessed 12 Feb. 2017].

[9] Hub.globalccsinstitute.com. (2017). Well plugging and abandonment techniques. Global CCS Institute. [online] Available at: https://hub.globalccsinstitute.com/publications/long-term-integrity-co2-storage-–-well-abandonment/2-well-plugging-and-abandonment [Accessed 24 Mar. 2017].

[10] John L. Gidley, (2016), Hydraulic Fracturing [online]. Available at: http://wiki.aapg.org/Stimulation [Accessed 11 Feb 2017].

[11] Leveson, N. (1993). Safeware. 1st ed. [ebook] Addison-Wesley. Available at: http://www.google.co.uk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&ved=0ahUKEwj52pKnsIDTAhXoC8AKHXiUDjwQFggjMAA&url=http%3A%2F%2Focw.alfaisal.edu%2FNR%2Frdonlyres%2FAeronautics-and-Astronautics%2F16-358JSpring-2005%2FDD631F49-C42B-4804-8536-2EA6D67DC3FC%2F0%2Fbook_1_2.pdf&usg=AFQjCNEXsKSIRWTcjc72jmRkMef8P195YQ [Accessed 25 Feb. 2017].

[12] Leveson, N. (2011). Engineering a Safer World. 1st ed. [ebook] MIT Press. Available at: http://www.google.co.uk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&ved=0ahUKEwjgluSGsYDTAhWEL8AKHUCDBjwQFggjMAA&url=http%3A%2F%2Fsunnyday.mit.edu%2Fsafer-world.pdf&usg=AFQjCNGaow_-wHyTxC1kPKQaHFXolNbfBA [Accessed 3 Mar. 2017].

[13] Martin, M. and Schinzinger, R. (1989). Ethics in Engineering. 2nd ed. [ebook] McGraw-Hill Higher Education. Available at: http://www.google.co.uk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=3&ved=0ahUKEwi9y4zNsoDTAhXDDsAKHXIwB4cQFggtMAI&url=http%3A%2F%2Fcourse.sdu.edu.cn%2FG2S%2FeWebEditor%2Fuploadfile%2F20131018102149728.pdf&usg=AFQjCNGCjDnz2Io3mYUdM4-nontxMx_nYg [Accessed 16 Feb. 2017].

[14] Norman J. Hyne, (2007), A Dual Completion [online]. Available at: http://www.mosburgoil-gas.com/html/hyne_10_99_2a.html [Accessed 3 May 2017].

[15] Oil & Gas UK. (2016). Decommissioning Insight 2015. [online] Available at: http://oilandgasuk.co.uk/wp-content/uploads/2015/11/Decommissioning-Insight-2015-updated.pdf [Accessed 01 Mar. 2017].

[16] Oilfield Directory Publications, (2012), Acidizing Operations [online]. Available at: http://oilfielddirectory.com/oilfield/acidize.htm [Accessed 23 Feb 2017].

[17] Petroleumsolutions.co.uk. (2017). Waterdrive Help. [Online] Available at: https://www.petroleumsolutions.co.uk/WaterdriveHTML/index.html?segregated_flow_condition.htm. [Accessed 10 Mar. 2017].

[18] Sandaband. (n.d.). Sandaband material. [online] Available at: http://www.sandaband.com/files/93bafb43-7a6d-4828-90a4-efe8fee065de.pdf [Accessed 19 March. 2017].

[19] Shepard, M. (2009). Oil Field Production Geology. 1st ed. American Association of Petroleum Geologists, pp.37-46.

[20] The Maritime Executive. (2016). Pioneering Spirit Could Save Decom Industry $12 Billion. [online] Available at: http://www.maritime-executive.com/article/pioneering-spirit-could-save-decom-industry-12-billion [Accessed 25 Feb. 2017].

[21] Wilby, B. (2016). Decommissioning Market to boom from 2016 to 2040. [online] Oil and Gas Facilities. Available at: https://www.spe.org/ogf/print/subscribers/2016/04/05_GlobalMarket_April16.pdf [Accessed 25 Feb. 2017].

[22] www.rmspumptools.com. (2017). Completion Systems & Mechanical Products. [online] Available at: http://www.rmspumptools.com/perch/resources/brochures/completion-systems-1.pdf [Accessed 21 Mar. 2017].

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Environmental Science"

Environmental science is an interdisciplinary field focused on the study of the physical, chemical, and biological conditions of the environment and environmental effects on organisms, and solutions to environmental issues.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: