Investing in Brazil: PESTEL and SWOT Analysis

Info: 5943 words (24 pages) Dissertation

Published: 30th Nov 2021

Table of contents

Click to expand Contents

I. INTRODUCTION

II. IMPACT OF THE GLOBALIZATION IN BRAZIL

1) The globalization

2) PESTEL

2.1 Political

2.2 Economic

2.3 Social

2.4 Technological

2.5 Environment

2.6 Legal

3) BRAZIL SWOT Analysis

III. INDUSTRIES OPPORTUNITIES

1) Industries in Brazil

2.1 Economic sectors

2.1 FDI restrictions

2) Foreign Investor Opportunities in Brazil

2.1 Commodities

2.2 Technology

IV. INVESTMENT RECOMMENDATION: FOREIGN INVESTOR

1) Commodities

1.1 Assessment

1.2 Recommendations

2) Technology

2.1 Assessment

2.2 Recommendations

V. REFERENCES

I. INTRODUCTION

Brazil (Republica Federativa do Brasil) is the fifth largest country in the world and the first largest in South America (8.515 million sq km). Brazil shares borders with ten countries: Argentina, Bolivia, Colombia, French Guiana, Guyana, Paraguay, Peru, Suriname, Uruguay, Venezuela and has a direct ocean access to the North and South Atlantic Ocean (“Brazil Map, Map of Brazil,” 2013). The current popuIation of Brazil is 207.681 million people according to the CIA (“The World Factbook — Central Intelligence Agency,” 2017). Since the last three decades, Brazil has been through many changes politically and economically. Politically, the country was under two military dictatorships during more than 20 years (1964 to 1985). Military dictatorship stepped down in 1985 to a new democratic government mostly because of the economic situation. Economically, even if Brazil managed the oil shock of 1973, Brazil had serious problem with its foreign lending in 1982. Following by years of hyperinflation rising up to 2,950 % in 1990. The government leading by Henrique Cardoso has introduced a new plan (Plano Real) in 1994 to restructure public spending, devaluate the currency (new currency: "Real" without US Dollar fixed exchange rate), maintain local product prices and reduce inflation. These reforms reduced the inflation down to 9.5% in 1996 according to Herwin Loman (“Brazil’s macro economy, past and present,” n.d.) and helped the country to be economically more stable. During the financial crisis of 2007/2008, brazil policies could respond and counter the crisis that directly impacted their commodities price. This ability to react during the crisis show the world that Brazil has become a strong and trust economical actor. Brazil intends to use the globalization as a great opportunity to develop the country.

II. IMPACT OF THE GLOBALIZATION IN BRAZIL

1) The globalization

"The globalization" is a term often used to explain economical and/or socio-cultural changes. According to Oxford Reference (“Globalization - Oxford Reference,” n.d.), the globalisation is "the increasing worldwide integration of economic, cultural, political, religious and social systems". The Economic Globalization refers to the development of a single worldwide market where all goods, services, labour, capital and information are traded without barriers (free trade) between countries. The globalization can play an important role in the development of countries. It can create many opportunities as new technologies, heath, foreign direct investments. The increase of growth, productivity, political influences are considered seriously by countries. It also increases risks as interdependence, national sovereignty, environmental, inequity between countries or individuals and generate international conflicts according to (Kuepper, n.d.). Countries having the same dynamic of development and mutual interests are forming association to improve their cooperation. For example, the BRICS is an association regrouping the five major emerging economies: Brazil, Russia, India, China and South Africa.

Globalization Impacts |

|

| Positive | Negative |

| Economy Growth | Interdependence |

| Foreign Direct Investment | National Sovereignty |

| Technological Innovation | Equity Distribution |

| Economies of Scale | Environmental |

| Political Influence | Sociocultural Identity |

Many countries are directly or indirectly impacted by the globalization according to their economic development. Economic development is a process of transformation in which a country or a region improve the economic and social conditions of its residents according to Oxford Reference (“Economic Development - Oxford Reference,” n.d.). An analysis of the macro-economic environment will help to understand Brazil economic development.

2) PESTEL

Pestel is a method often used to analyse the macro-environment (Political, Economic, Social, Technological, Environmental and Legal).

2.1 Political

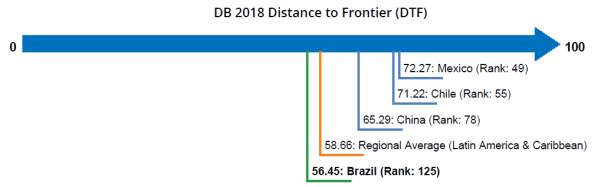

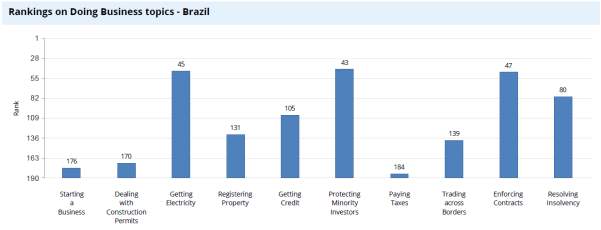

Brazil is a democratic country since 1985. Executive presidents are elected by popular mandate for a period of four year. The chamber of Deputies and The Federal Senate with respectively 513 and 81 members are also elected for a period of four years. President Dilma Rousseff has been elected twice (2011 and 2015) but was removed in August 2016 by impeachment. The reason of the impeachment was a corruption scandal (Petrobas: nation oil company) involving politician and an estimate loss of US$ 2.1billion. Since 2016, Michel Miguel Elias TEMER is the temporary chief of state and head of government. The corruption remains in Brazil but the impeachment of the president show that no-one is untouchable. Brazil needs to reform fiscal position and reduce government debt but there is no clarity about the political route of 2018 according to Standard & Poor(“Standard & Poor’s | Americas,” n.d.). The WorldBank explained (“Overview,” n.d.) that reform program are difficult and face congress opposition. Public spending (70% of GDP in 2016) can hardly be reduce because of the legislation and only 15% of the expenditure are discretionary. Public spending was at 50% of GDP in 2012 according to the CIA (“Limitation of Foreign Participation in Brazilian Companies,” n.d.). In term of bureaucracy, doing business in brazil is a challenging task and the world bank rank (“Doing Business in Brazil - World Bank Group,” n.d.) the Brazil at the 125 position, see below:

The difficulties to run business are mainly due during the process of creation, expansion and the management of taxes. Brazil is implementing new business reforms in order to improve the situation, (for example: electronic data system has been deployed to reduce time documentation for import and export). In Brazil, the army has a crucial role in term of security. They are performing missions outside the country and supporting the police. Brazilian army is neutral outside the country, they are currently leading a peaceful mission in Haiti since 2004 because of the lack of public safety according to Dialogo (“Brazil Assumes Control of Chilean, Uruguayan, and Peruvian Bases in Haiti,” n.d.). It is regular that the government is deploying soldiers on the street in order to reduce crimes and drug trafficking, 10,000 soldiers and police officers were targeting five favelas in July 2017 according to BBC(“Troops raid Rio slums in crime crackdown,” 2017). The Brazil is politically risky because of political scandal and the difficulties to reform economically the country. The bureaucracy needs proper improvement to compete with the other emerging countries.

2.2 Economic

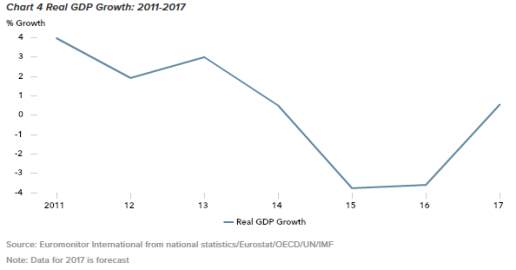

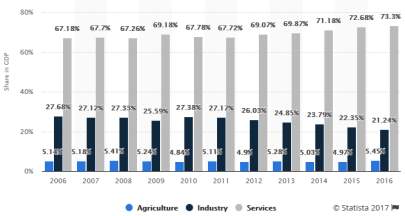

Brazil is one of the largest soya beans, beef, sugar and iron exporter in the world. The agriculture has employed 14% of the workforce in Brazil according to Passport(“Euromonitor International - Analysis,” 2017). Manufacturing represents 10% of the GDP (US$ 1,795 billion) and employed 12% of the workforce. Service sector is the main sector of activity in Brazil and represents 73.3 % of the GDP in Brazil according to CIA. Brazil economy has been able to growth rapidly because It was a commodity exporters and the demand from Asia was very high. The current demand has slowdown and brazil has been struggling for the last three years. Brazil economy is recovering after two years of recession. Between 2015 until 2016, the country had a GDP at -3.8 and -3.6. Economist expect Brazil growth between 0.5% and 0.7% end of 2017 according to PWC (PricewaterhouseCoopers, n.d.) and IMF (“Brazil and the IMF,” n.d.). The inflation rate is expecting to decline from 8.8 % to 3.7%.

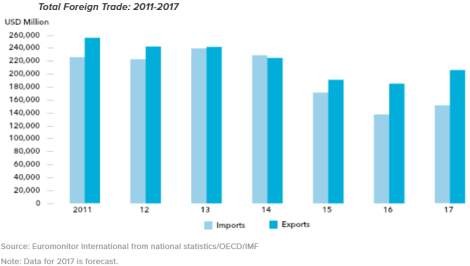

In term of Foreign Trade, Brazil had imported US$ 137.5 billion and exported US$ 185.2 billion of goods around the world in 2016. Brazil generate a trade surplus of US$ 47.7 billion. Trade surplus strength Brazil in the control of their currency. Since 2011, the balance has been negative only once. It was 2014 and the balance was negative by US$ 4 billion, it represented only 1.8% of total exports.

Total import has drastically decreased the last 3 years, -25,2% between 2014 to 2015 and -19.77% between 2015 to 2016. The total export has slowly decreased during the same period, - 15% between 2014 to 2015 and -3% between 2015 to 2016. Brazil has been able to keep exports relatively high when they reduce drastically imports.

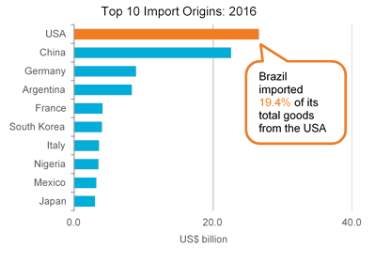

Brazil imports represent 7.7% of the GDP, most of the imported goods are coming from USA and China with more than US$ 20 Billion each. Following by Germany and Argentina with around US$ 5 Billion each. Argentina is the only country from south America in the top ten. Top ten imports countries based in Asia, Europe, America and Africa. Businesses are willing to export goods in Brazil from everywhere. It shows that it is logistically possible to deal with Brazil.

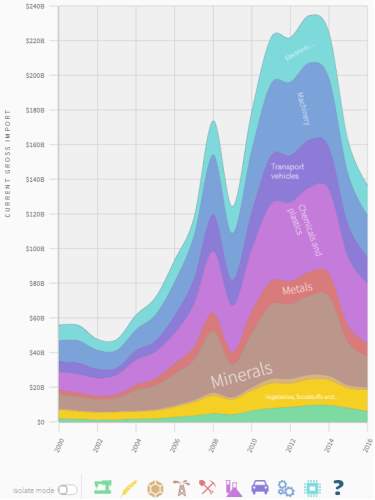

According to Harvard University (“The Atlas of Economic Complexity by @HarvardCID,” n.d.), Chemical and plastics represent US$ 34.7 billion (25.2%), following by Machinery US$ 24.1 billion (17.5%) , Mineral US$ 18 billion (13.1%) and Electronic US$ 17 billion (12.4%). Every sectors has been impact during the recession. Import in Machinery, Minerals, Chemicals and plastics was reduce drastically. Other imports as the food and textile remain stable. Brazil is trying to make new free trade agreement (FTA) in order to increase exports. In january 2017, MERCASUR (trading group of countries from South America) and the European Free Trade Association (EFTA) has started new negotiation. They are also planning negotiation with United kingdom after the Brexit.

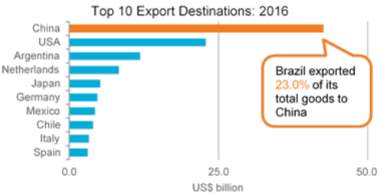

Brazil exports represent 10.3% of the GBP, most of the exported goods are with the China and USA. Brazil export US$ 42.6 billion in China (23%) and almost US$ 25 billion in USA. Argentina and Netherland are receiving around US$ 10 billion and US$ 7 billion. Argentina and Chile, country bases in South America are also part of the top ten of export.

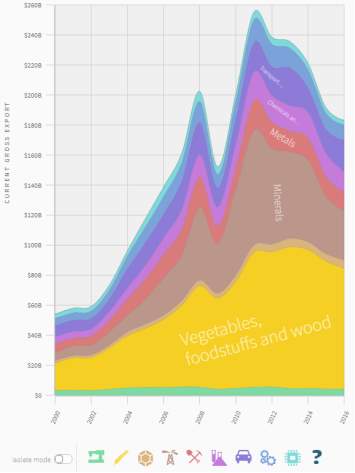

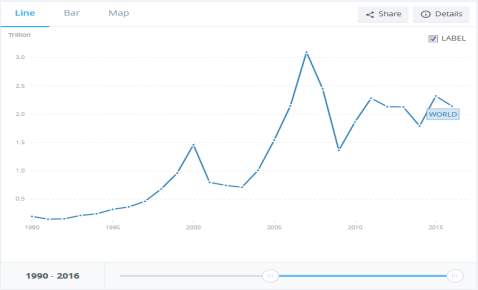

According to Harvard University (“The Atlas of Economic Complexity by @HarvardCID,” n.d.), US$ 80.5 billion (43.5%) of Vegetal Products and foodstuffs were exported in 2016, following by Mineral with US$ 33.1 billion (17.9%) and US$ 20.8 (11.2%) billion of transport vehicles. Most of the exportation of Goods decreased slowly during the recession except Mineral than went down from US$ 76.2B in 2011 to US$ 33.1 in 2016 (-56.6%). The decrease of demand impact seriously minerals commodities. In term of balance by product according to IMF, Brazil had a negative balance of US$18 billion for oils and gases ($8.7B), phone system devises ($3.4B), automobiles parts ($3B), integrate circuit($2.8B), and positive one of US$ 56 billion for Soya beans ($19.2B), Iron ores ($13.3B), Sugar ($10.4B), Crude oil ($7.2B) and poultry meat ($6.1B). Brazil balance by product show Brazil imports some specific commodities as oil and gases with a lot of technology and exports multiples commodities. Combined, USA and China represent 1/3 of foreign trade in Brazil. They are both key partners countries in the development of the Brazil. There are many ways to develop a country, it can be done by the state and or private investors. Investors can be local or from aboard, according to oxford reference (“Foreign direct investment - Oxford Reference,” n.d.), a foreign direct investment is "the acquisition by a resident of a country of real asset abroad". In Brazil, Foreign Direct Investment (FDI) has increases since 1990 from US$ 196 billion to US$ 2.144 Trillion in 2016 according the World bank(“Foreign direct investment, net inflows (BoP, current US$) | Data,” n.d.). Foreign Direct Investment are correlate with worldwide event as financial crisis (2000 and 2008). It is the reason why investment can dramatically decrease.

In the last pass six years, the Foreign Direct Investment has been stable at around 2 Trillion in Brazil. FDI decrease in 2016 by 178 Billion, the corruption scandal had increase the instability of the country and scare investors. Public debt has reached 70% of GBP in 2016, the state of Brazil is depending of financial institutions. This dependency increases the instability of the country and can reduce FDI.

2.3 Social

There are 207 million people living in Brazil, the official language is the Portuguese. According to the CIA(“The World Factbook — Central Intelligence Agency,” n.d.) 64.6 % of the population is Roman Catholic, 22.2% Protestant, 8% none and 5.2% others. In 2017 86.2% of the population is living in city, the major urban areas are Sao Paulo with 21 million, Rio de Janeiro with 13 million, Belo Horizonte with 5.7 million and Brasilia the capital with 4.2 million. Most of the population in Brazil live along the coast. The unemployment was estimated at 11.3% in 2016, Brazil unemployment worldwide rank is 150 countries. The level of adult literacy was at 92.8% in 2016, it has increased by only 1.4 point of % since 2011. There is an economic inequality in Brazil where almost 20% of the population is living in poverty and 4% in extreme poverty.

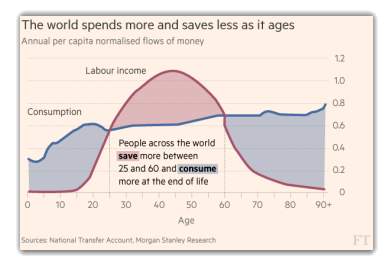

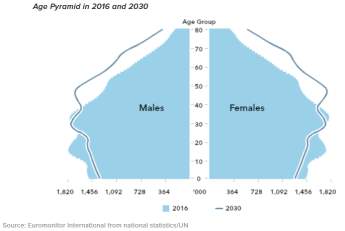

Brazil population is currently young (see above), most of the population is between 15 to 35 years old. It is a phenomenon very important to manage for a state and businesses. According to (Authers, 2016), age has a direct impact in the consumption and saving. In general, if a large proportion of the population are workers, wages, inflation and interest rates trend to go down. The evolution of demography is key element in the development of Brazil society.

2.4 Technological

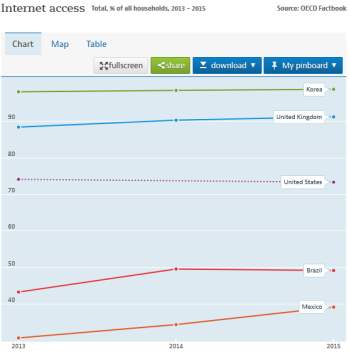

Brazil has a weak technological infrastructure and the internet access indicators show that only 49.2% of household had access to the internet in 2015 according to OECD(“Information and communication technology (ICT) - Access to computers from home - OECD Data,” n.d.). It is low comparing Korea (98.8%), United Kingdom (91.3%), USA (73.4%) but still higher than Mexico (39.2%). It is possible to learn from this indicator the level of access to the new technology for the Brazilian population. Internet is key in the development of technology and communication. To improve the situation, a national broadband plan was launch in 2015 to increase the number of the poor population to have access of technology by declining prices.

2.5 Environment

Brazil is a country with a very rich diversify landscape and has the largest forest in the World, more than 7000Km of beaches, mountains and desert. Brazil also face many environmental problems with the deforestations and the increase of greenhouse gases (12th world emitter), pollutions and rainfall changes in the Amazon are also problematic. Drinking water is also problematic in Brazil because water source is accessible at 87% of the rural population according to the CIA, 51% of the rural and 88% of urban population have sanitation facility. The pollution is a real problem and infrastructure need to be built to accommodate growth. Brazil is facing the most devastating environmental catastrophe with collapse of two mining dams. Sediment which contain chemicals is destroying the all ecosystem along the river across nearly 500 km. It is more than 60 million cubic meters of waste in the river according to Reuters (“Brazil mining flood could devastate environment for years,” 2015). The previous president Dilma Roussef compared it at the BP PLC oil slick in Gulf of Mexico. Environment is more and more important in the society, people or businesses are very careful because they don't want to be associated with organisation or country that don't respect environment.

2.6 Legal

Brazil is a country where running a business is very hard because of its bureaucracy, taxation, corruption and FDI restrictions for some sectors as telecommunication, media, heath care or transportation. Brazil has been rank as an Economic Freedom country 123th in 2017 according to the World Bank(“Euromonitor International - Analysis,” n.d.). As explained in the political part, Brazil is one of the worst country to start a business (ranked 176th in 2017). It can take more than 100 days to start a business according to the Worldbank (“Doing Business in Brazil - World Bank Group,” n.d.). Tax burden is very high. For example, the corporate income tax is going up to 34% according to Deloitte (“Corporate taxation | Deloitte Brazil | Doing Business in Brazil,” n.d.). 9% of social contribution, 15% of tax profit and a surtax 10% if income exceed BRL 240,000 (US$ 72K). This level of tax impact investment in Brazil. According to Egil Fujikawa Nes from The Brazil Business(“Corporate taxation | Deloitte Brazil | Doing Business in Brazil,” n.d.), the main reason of this high level of tax is the underground economy and the fact that Brazil needs to pay for improving the quality of the lower classes. Brazil control import and regulate the flow by adding tax. The protectionism helps to develop industries but also impact the exportation. Brazil can't easily negotiate free trade and had to adjust taxes.

3) BRAZIL SWOT Analysis

SWOT is a method developed by Albert Humphrey to evaluate the Strengths, Weaknesses, Opportunities, and Threats according to the economist (“SWOT analysis,” 2009). See below the SWOT Analysis of the Brazil.

| Strengths: Commodities: mineral & agricultural resources Active population increasing FDI Investment stable | Weaknesses: High burden tax Corruption Public Spending: 70% Weak technological Infrastructure Doing Business |

| Opportunities: Commodities demand increasing New free trade deal Developing infrastructure | Threats: Decrease of price commodities Slowdown of China and USA |

III. INDUSTRIES OPPORTUNITIES

1) Industries in Brazil

2.1 Economic sectors

The GDP in Brazil is shared in three economic sectors: Agriculture, Industry and Services. Services sector is dominant in Brazil and represent 73.3% of the GDP in 2016 according to Statista (Statista, 2017), following by the Industry at 21.24% and the Agriculture at 5.45%. Since 2006, the trend shows that Agriculture has been stable at around 5% when the Services had growth by 6 points of percentage from 67% to 73% and the Industry has decreased by as well 6 points of percentage from 27% to 21%. During the recession, Industries have suffered, mineral commodities went down because of the decrease of demand. At the same time, technology is a sector where Brazilian government is pushing to develop. It can be hard for investors to decide in which economic sectors to invest. Furthermore, even if some industries are attractive because of their potentials, it is not always possible for a Foreign investor to develop business in Brazil. Brazilian government implement restrictions.

2.1 FDI restrictions

In Brazil, foreign companies are limited in term of investment according to Karolina Puin (“Limitation of Foreign Participation in Brazilian Companies,” n.d.). Some economic sectors are forbidden like Medias, Heath care, Air transportation, Nuclear energy, and Security services. Foreign companies cannot manage airports. The main reason is the protection of Brazilian culture, the researches and the safety/security. Other sectors allow partially FDI like Cable television, Road Transportation and Fishing under conditions. In the Cable Television sector, 51% of the voting capital must be owned by a local. In the Road Transportation, a FDI can only have a maximum of 20% of the voting capital. Fishing allow only Brazilian or naturalized people but it is possible under prerequisites to invest in this sector. Sectors without any barriers for FDI are telecommunications license and real estate property. With these restrictions, some foreign investors are not able to participate in the Brazil economy. Others adapt themselves and develop their business plan by taking in consideration current restrictions and futures changes. The Brazil is an emerging economy and its market is opening to the world with opportunities for domestic or foreign investors.

2) Foreign Investor Opportunities in Brazil

2.1 Commodities

Vegetal Products and Mineral commodities are what Brazil export the most (US$ 29.4 billion and US$ 27.5 billion in 2016). Investing in Food and Mineral commodities are a long terms investment. The industry is dependent of the world demand but these commodities are needed because of the population growth and the increasing of consumptions. In brazil, the growth in 2017 is expecting to be at around 0.5% after two years of recessions. It is the best moment to invest because investors are coming back step by step on this market. According to THE BRICSPOST (“Emerging markets to be hot commodity in 2018?,” n.d.), emerging market with commodities are going to perform well. Since last year in November, the BOVESPA (stock exchange in Sao Paulo) is up by 24.2 per cent. Furthermore, the future in commodities should be good as Brazil negotiate trade agreement. Brazil recently signed a double tax treaty with Russia according KPMG(“The Brazil – Russia Double Tax Treaty | KPMG | BR,” 2017) and is currently negotiating with Mexico, EU, UK free trade in order to export more. These agreements haven't been signed yet but It is a sign that businesses are going be able to increase transactions, sales and profits.

2.2 Technology

Brazilians need technology to boost the all country infrastructure, to gain in productivity and to worldwide compete. Brazilian government is willing to facilitate company to achieve technology improvement. Brazil has a huge potential with technology, the increase of people in the middle class is going to help the growth of the all technological environment. Currently, less than 50% of households have access to internet, increasing this number will significantly open door for business growth and new opportunities. Technology implementation goes step by step but with more than 200 million possible users, the Brazil offer incredible promises. Technology investment are expecting to growth in Brazil by 6.7% in the coming year according to BRAZIL TECH (Mari, 2017). Investors will keep investing in technology as long as they reach saturation point.

IV. INVESTMENT RECOMMENDATION - FOREIGN INVESTOR

There are two forms of foreign investments in Brazil, the foreign direct investment (FDI) of foreign indirect investment. The foreign indirect investment can be done through the financial market or by the acquisition of participation from a Brazilian company. For the FDI, most of organisation type in Brazil are Limited liability company (Sociedade limitada / Ltda.) or Corporation (Sociedade anônima / S.A.). They can be Joint ventures for a FDI that invest in a regulated sector. The entry strategy for each industry depend of the restrictions/quotas and the investment required to operate the business.

1) Commodities

1.1 Assessment

Foreign direct investment can’t be done without a joint venture with the government as this sector has restrictions. Producing commodities require a lot of Capital as Tangible fixed assets (land, building and/or machinery) are necessary in the Business. This activity also requires enough fund to support the working capital. In Brazil, starting business is very difficult because of time consuming. Brazil is also consider of one of the worst to get construction permit (rank 170th in 2017) and to register property (rank 131th). Commodity business has a high requirement of properties and constructions permit to growth. The risk is very high in this industry because of the cost of asset. Commodity prices are volatile and can be hardly control even with SWAP. Because of the level of investment to run a company in the commodity industry, there is not many competitors.

1.2 Recommendations

The best entry mode for a foreign investor in the commodities industry is the foreign indirect investment by buying a participation from a Brazilian company. The investment is even more liquid if the participation is done though the financial market. The cost in this type of investment is related to the amount invested and can be flexible. The risk taken is low and depend of the price share. The best approaches in this market is to be a fast follower as it takes lot of time for a company to even start the business and because producing commodities is standard. The small number of competitor is an advantage because it increases the power of negotiation with clients.

2) Technology

2.1 Assessment

This sector does not have restrictions, investment can be done through Foreign indirect investment or FDI. Developing technology does not involve high investment and most of the asset are intangible. As mentioned before, Brazil bureaucracy slow down creation of business, it is time consuming but developing technology does not require large properties. Intellectual property can be risky in Brazil because of the rules of the law. For the last 6 years, Brazil were ranked at around the 100th country in the world for the rules of law according to (“Euromonitor International - Analysis,” n.d.). It can scare people to do research and develop new products. Financially, the risk in the industry of technology is low because investments are usually low. There is no need of minimum capital for a Limited liability company (Ltda)and it require a minimum of only one owner. Nevertheless, the ease to access in this market increase the risk of competition from new entrant.

2.2 Recommendations

The best solution for a foreign investor in the technology industry is the foreign indirect investment. Nevertheless, because of the time consuming at the creation. I would advise the creation a foreign branch to be more flexible with the growth of the business. In technology industry, the best approaches in this market is to be the pioneer, people usually identify the first product as the key product and it gives advance to the competition. In term of intellectual property, it is important to register intellectual property to the World Intellectual Property Organisation (WIPO). Brazilian government supports investment the technology industry and will keep supporting it as it is one of the key for the Brazil improvement and development. It is good for small local business but it can be dangerous for foreign investors. They must be aware of the situation and be careful in their choice of innovation.

V. REFERENCES

Authers, J., 2016. Demographics and markets: The effects of ageing [WWW Document]. Financ. Times. URL https://www.ft.com/content/df61dc42-99fa-11e6-8f9b-70e3cabccfae (accessed 10.21.17).

Brazil and the IMF [WWW Document], n.d. . IMF. URL http://www.imf.org/en/Countries/BRA (accessed 10.21.17).

Brazil Assumes Control of Chilean, Uruguayan, and Peruvian Bases in Haiti [WWW Document], n.d. . Dialogo Am. URL https://dialogo-americas.com/en/articles/brazil-assumes-control-chilean-uruguayan-and-peruvian-bases-haiti (accessed 10.21.17).

Brazil Map, Map of Brazil [WWW Document], 2013. URL https://www.mapsofworld.com/brazil/ (accessed 10.27.17).

Brazil mining flood could devastate environment for years, 2015. . Reuters. Brazil’s macro economy, past and present [WWW Document], n.d. . Rabobank. URL https://economics.rabobank.com/publications/2014/january/brazils-macro-economy-past-and-present/ (accessed 10.13.17).

Corporate taxation | Deloitte Brazil | Doing Business in Brazil [WWW Document], n.d. . Deloitte. URL https://www2.deloitte.com/br/en/pages/doing-business-brazil/articles/corporate-taxation.html (accessed 10.12.17).

Doing Business in Brazil - World Bank Group [WWW Document], n.d. URL http://www.doingbusiness.org/data/exploreeconomies/brazil (accessed 10.22.17a).

Doing Business in Brazil - World Bank Group [WWW Document], n.d. URL http://www.doingbusiness.org/data/exploreeconomies/brazil (accessed 10.22.17b).

Economic Development - Oxford Reference [WWW Document], n.d. URL http://www.oxfordreference.com/view/10.1093/oi/authority.20110803095741341 (accessed 10.05.17).

Emerging markets to be hot commodity in 2018?, n.d. . BRICS Post. Euromonitor International - Analysis [WWW Document], 2017. URL http://www.portal.euromonitor.com/portal/analysis/tab (accessed 10.27.17).

Euromonitor International - Analysis [WWW Document], n.d. URL http://www.portal.euromonitor.com/portal/analysis/contentlink (accessed 10.08.17a).

Euromonitor International - Analysis [WWW Document], n.d. URL http://www.portal.euromonitor.com/portal/analysis/tab (accessed 09.27.17b).

Foreign direct investment - Oxford Reference [WWW Document], n.d. URL http://www.oxfordreference.com/view/10.1093/oi/authority.20110803095828362 (accessed 10.23.17).

Foreign direct investment, net inflows (BoP, current US$) | Data [WWW Document], n.d. URL https://data.worldbank.org/indicator/BX.KLT.DINV.CD.WD (accessed 11.5.17).

Globalization - Oxford Reference [WWW Document], n.d. URL http://www.oxfordreference.com/view/10.1093/oi/authority.20110803095855259 (accessed 10.11.17).

Information and communication technology (ICT) - Access to computers from home - OECD Data [WWW Document], n.d. . theOECD. URL http://data.oecd.org/ict/access-to-computers-from-home.htm (accessed 10.15.17).

Kuepper, J., n.d. Globalization and Its Impact on Economic Growth [WWW Document]. The Balance. URL https://www.thebalance.com/globalization-and-its-impact-on-economic-growth-1978843 (accessed 10.16.17).

Limitation of Foreign Participation in Brazilian Companies [WWW Document], n.d. . Braz. Bus. URL http://thebrazilbusiness.com/article/limitation-of-foreign-participation-in-brazilian-companies (accessed 10.14.17).

Mari, A., n.d. Growth predicted for IT investments in Brazil [WWW Document]. ZDNet. URL http://www.zdnet.com/article/growth-predicted-for-it-investments-in-brazil/ (accessed 10.27.17).

Overview [WWW Document], n.d. . World Bank. URL http://www.worldbank.org/en/country/brazil/overview (accessed 11.5.17).

PricewaterhouseCoopers, n.d. Global Economy Watch - Projections [WWW Document]. PwC. URL https://www.pwc.com/gx/en/issues/economy/global-economy-watch/projections.html (accessed 10.21.17).

Standard & Poor’s | Americas [WWW Document], n.d. URL https://standardandpoors.com/en_US/web/guest/article/-/view/type/HTML/id/1930257 (accessed 10.21.17).

Statista, 2017, 2017. Brazil - share of economic sectors in the gross domestic product 2006-2016 | Statistic [WWW Document]. Statista. URL https://www.statista.com/statistics/254407/share-of-economic-sectors-in-the-gdp-in-brazil/ (accessed 10.28.17).

SWOT analysis, 2009. . The Economist. The Atlas of Economic Complexity by @HarvardCID [WWW Document], n.d. URL http://atlas.cid.harvard.edu/explore/stack/?country=32&partner=undefined&product=undefined&productClass=HS&startYear=2000&target=Product&tradeDirection=import&year=2016 (accessed 10.77.17a).

The Atlas of Economic Complexity by @HarvardCID [WWW Document], n.d. URL http://atlas.cid.harvard.edu/explore/stack/?country=32&partner=undefined&product=undefined&productClass=HS&startYear=2000&target=Product&year=2016 (accessed 10.21.17b).

The Brazil – Russia Double Tax Treaty | KPMG | BR [WWW Document], 2017. . KPMG. URL https://home.kpmg.com/br/en/home/insights/2017/08/the-brazil-russia-double-tax-treaty.html (accessed 110.17.17).

The World Factbook — Central Intelligence Agency [WWW Document], 2017. URL https://www.cia.gov/library/publications/the-world-factbook/geos/br.html (accessed 10.05.17).

The World Factbook — Central Intelligence Agency [WWW Document], n.d. URL https://www.cia.gov/library/publications/the-world-factbook/geos/br.html (accessed 10.05.17).

Troops raid Rio slums in crime crackdown, 2017. . BBC News.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "PESTLE"

PESTLE, or PESTEL, is a framework used in strategic analysis to analyse the impact of external factors on a business in terms of market growth or decline, potential, and operational direction. An extension of the PEST analysis (political, economic, sociological, and technological) model, it adds legal and environmental.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: