Financial Predictions for the Body Shop

Info: 9556 words (38 pages) Dissertation

Published: 16th Dec 2019

Methodology

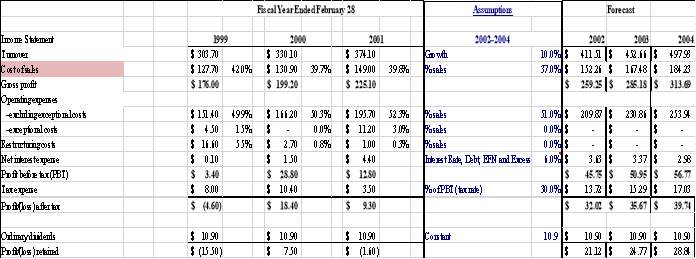

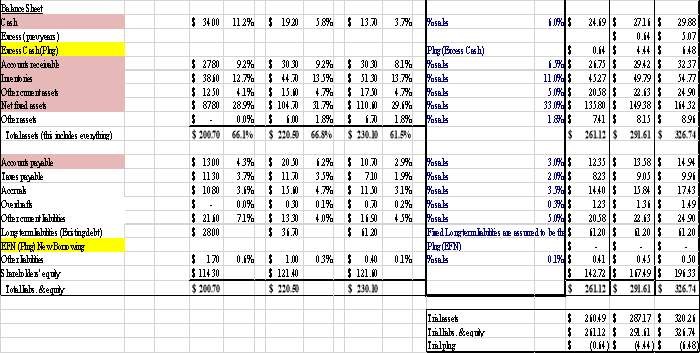

To assist in generating the forecast for the years 2002-2004 we used the percentage of sales method to establish our assumptions. The percentage of sales method is used to create a forecast for all accounts on the income statement and balance sheet tied to sales to get an idea of what the future performance of the firm may look like. Forecasting helps the firm determine whether they will need external financing to fund increases in assets or decreases in liabilities that change with sales. The percentage of sales methods usefulness in each case will likely depend upon the judgement of the people making the assumptions. Some analysts may choose to carry over the same percentage as last year and some may try to follow a trend. This technique is extremely useful in creating timely, accurate forecasts, but it is not without its drawbacks. Assets and liabilities that change with sales will likely not be the same percentage of sales from the year before and may not even follow the trend the analyst is observing. To try and dilute this problem in our analysis, we made the assumed financial statement variables the average of what we assumed them to be through the three-year forecasted period. Using the average will give us more accurate numbers overall rather than using the forecasted number for the next year for all three years, which would give us inaccurate numbers the last two years. The balance sheet contains most of the accounts tied to sales, the balance variables with the largest percentages of sales and therefore, greater importance in our analysis, include cash, accounts receivable, inventory, and net fixed assets. The level of cash as a percentage of sales mainly depends on your goals as a company, a company like The Body Shop who wishes to lower product and inventory costs will carry a larger cash percentage relative to sales so that it can pay suppliers sooner or buy more in bulk. Holding too much cash can be as risky or possibly even more than not having enough. By having too much cash as a percentage of sales than required you risk taking out interest expense laden debt to cover the unnecessarily high required cash balance. It is also possible that Inflation could reduce your company’s purchasing power. By having an adequate amount of cash on hand you are also making sure your company is prepared for any unexpected incidences such as, slow turnover in accounts receivables, large unexpected costs, economic downturns as well as cyclical sales.

Accounts tied to sales

Net Interest Expense=(IRLTL+EFN)-(IR( EC Plug+EC previous years)

Now I will begin discussing the main accounts tied to sales that form the basis of our assumptions to achieve a growing cash balance through operations, resulting in the many benefits discussed in the assumptions and results sections. First, cost of goods sold is the amount paid by The Body Shop for the wide array of all-natural products sold at all its stores nationwide. This is subtracted from sales to get our gross profit. Subtracted from gross profit is our next variable tied to sales; operating expenses.

Operating expenses are the costs associated with the retail stores, managing them, administrating, any expense associated with keeping the retail stores open and selling all-natural Body Shop products. After we subtract the operating expenses from gross profit we pay net interest expense, taxes and dividends to finally get our addition to retained earning which will increase our shareholders equity. Net interest expense is the cost associated with taking out long term debt minus the interest income of excess cash. The more interest laden debt we take out the more interest expense is taken from our income, resulting in lower profit margins. Profit margin increasing is essential to the success of The Body Shop and using debt to grow is not a good long-term strategy. Shareholders equity is made up of the total amount of stock times the price of the stock as well as the cumulative additions to retained earnings over the years. The yearly addition to retained earnings is income that remains after everything is finally paid off for the year, including all expenses, taxes, interest and dividends. Each year addition to retained is added to shareholders equity, that it why shareholders equity increases each forecasted year.

Accounts receivable represents uncollected sales revenue, the faster it is collected the more cash The Body Shop will have on hand. A more generous accounts receivable collection period may increase demand, but this increases the need for cash to fund operations because increasingly more revenue relative to sales will be tied up in receivables, unable to fund investment or buy products more in bulk or pay a supplier sooner. This will result in increasing need for debt which will not be healthy for the future performance of The Body Shop. Inventory is another account tied to sales. Inventories is the largest as a percentage of sales of all the current assets, this makes it extremely important to optimize if the goals of The Body Shop are to be achieved. Inventory has been increasing each year as a percentage of sales as well as a total balance, this is because of the addition of various products of which many were left unsold. Inventory can also represent the amount of unsold goods left over each year and these unsold goods do not just disappear. The Body Shop pays cash just to hold these products. To optimize inventory, we must cut obsolete stock as well as implement focused product strategies, as suggested by Mr. Gournay. Other current assets are all current assets that do not include cash, accounts receivable or inventory. It is considered a current asset because it is presumed it can be converted to cash within one year.

Now I will discuss net fixed assets and its relationship with sales. Net fixed assets are tricky because usually you cannot increase fixed assets exactly proportionate to sales, but we still use percentage of sales to measure it and I will explain why. Increasing net fixed assets represents investing in a new store or increasing investment in already existing stores. These investments have a set price regardless of sales, so for example, if sales increase 1% and we can only increase fixed assets 2% due to set price of fixed assets, we must increase net fixed assets the 2% to fund the 1% increase in sales.

Next, I will be discussing the liabilities tied to sales. Liabilities are obligations that must be paid in the future because of a benefit, in the form of service or product, you have already received. The first of these I will discuss is accounts payable. Accounts payable typically represents the amount owed at the end of the year to suppliers. As accounts payable as a percentage of sales increases, the more benefits, such as cash or inventory, you are receiving without paying, meaning there will be an increasing excess cash balance, but this is not the healthy way to go about achieving excess cash through operations. Whereas when accounts payable as a percentage of sales decreases, your excess cash decreases because you are paying off more of your balance with your suppliers than the previous years, which is increasing the outflow of cash. The last of the liabilities I will discuss is the EFN plug and long-term liabilities. Long term liabilities would increase if there were a need for external financing but according to my assumptions and recommendations, external financing will not be necessary. Regardless of the forecasted lack of need for external financing, there is a chance it may be necessary, so I will discuss EFN briefly before the below paragraphs go into further detail. EFN is the difference between trial assets and trial liabilities. Trial assets is the sum of total assets for the projected year, minus excess cash. and trial liabilities is the sum of total liabilities for the projected year, minus the EFN. EFN is not projected for the next three forecasted years mainly because of the decreases in assumed decreases in cost of goods sold and operating expenses as percentages of sales due to increasing cash balances through operations and increased efficiency in stores.

Explanation and Implications of EFN

EFN=New TA- New TL&E Surplus of Cash

EFN=New TA – New TL&E Shortage of Cash

The next paragraphs will be the more detailed explanation of EFN that was mentioned above as well as the Implications of needing external financing instead of achieving excess cash through operations. EFN stands for external financing needed. It is the difference between the new pro forma trial assets and the pro forma trial liabilities found by adjusting the assets and liabilities with the percentage of sales method. A larger balance in pro forma trial assets represent a projected use of cash or EFN. If pro forma trial liabilities are larger, that represents a projected source of cash or excess cash. When use of cash exceeds the source of cash then there is a shortage of cash, meaning there is a need for external financing. If the resulting trial plug from the difference between trial assets and liabilities is negative, that represents excess cash because the projected liabilities are larger than the projected assets. If trial plug is positive, then external finance is needed because the trial assets are larger than the liabilities. The EFN and excess cash were entered in the excel sheet using an IF statement depending on whether the trial plug was found to be negative or positive so that the appropriate amount would display in either excess cash or EFN. The worksheet is all tied together so if you would like to experiment with other assumptions or recommendations, to measure excess cash or EFN. the power is all yours. The impact of the sales growth rate on external financing needed was very interesting to me as I experimented with different reasonable numbers. It may seem like common sense to infer that an increasing sales growth rate would increase the amount of excess cash because usually profit margin increases come along with sales growth increases. In our model it was seen that as sales growth decreased our excess cash increased. The reasoning behind this is because we spent less on increasing our assets relative to how liabilities increased. This is not a problem, this can be healthy for The Body Shop because the increase in new stores, the majority of the increase in assets, did not help the firm, so we should focus on other paths to success rather than leveraging another large increase in inefficient assets.

Calculating pro formas

The first of the pro forma statements I will be discussing the creation of is the income statement. The pro forma income statement is used to estimate the sales and eventual earnings for the firm in the upcoming years so that it may accurately portray the future performance of the company for use by internal managers, investors, creditors and other parties interested in the future performance. These parties must have an accurate idea of the future performance so that they can make the most effective and informed decisions regarding the financing or direction of the firm. The pro forma income statement is connected to the next statement we will be discussing, complicating the circularity issue I will discuss at the end of this section. The next pro forma statement is the balance sheet. It is connected to the pro forma income state through the addition to retained earnings being added to stockholders’ equity, increasing the liabilities and equity side of the trial plug equation, increasing the likelihood of achieving excess cash. The pro forma balance sheet breaks down by account how The Body Shops assets and liabilities will react to the changes in sales. This is extremely important so that the firm can determine how much external funding, if any, is needed to fund the increase in assets or the planned decreasing of liabilities. The pro forma balance sheet is where the majority of assumptions that act basically as recommendations are because there are more accounts that are tied to sales that can be changed to optimize the cash balance, and untimely the future performance of The Body Shop. To sum it up, the pro forma income statement has the most impactful variables in determining if EFN is needed or excess cash will be achieved because of their percentages relative to sales. The pro forma balance sheet holds the majority of assumptions and provides the most variety of assumptions that can be reasonably changed to aim to achieve a goal, such as growing the cash balance through operations cash flow and not interest ridden debt.

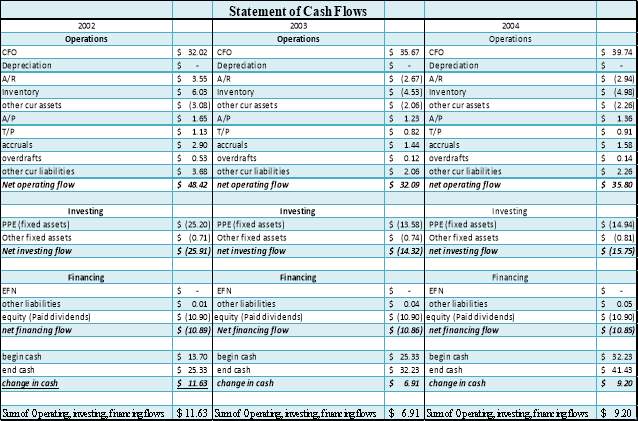

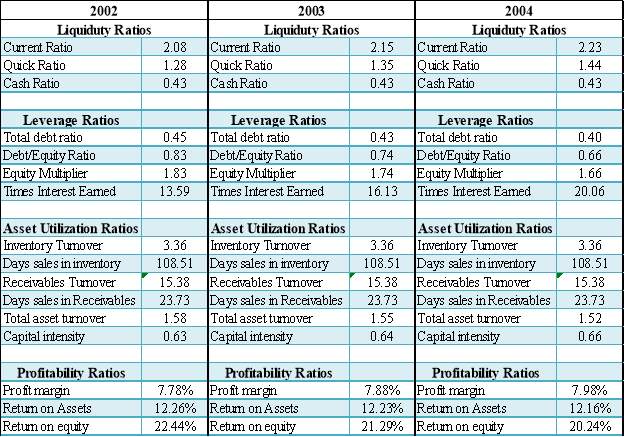

The next pro forma statements I will be discussing are the pro forma statement of cash flows as well as the pro forma ratio analysis. I will start with the pro forma ratio analysis because it is tied to the pro forma income statement as well as the balance sheet, which we just discussed in the above paragraph. The ratios are broken into four categories that each represent a different purpose. The first category is liquidity ratios which help to measure the amount of current assets or possibly just cash relative to the amount of current liabilities, these ratios could be used to help creditors determine if The Body Shop is able to pay off its current debt and possibly take on more if necessary. The leverage ratios measure the amount of debt relative to equity, this helps parties interested determine how exactly the firm is funding its operations, either mostly through debt or equity or balanced. The asset utilization ratios help investors and managers as well as creditors see how well the assets the invested or lent funds paid for are generating funds. These parties want asset utilization to be healthy because their investments are worthless if the assets bought with their funds cannot generate funds. The last category of the ratio analysis is profitability ratios. These ratios help measure the, you may have guessed it, profitability of the firm. This is useful information to many parties, especially managers, investors and creditors. Profit margin, and the underlying profit margin trend direction, is probably the most important because it is a major metric, one of the first analyzed, when determining the financial health of a firm. This is because of its importance in the cash flow distribution of the firm and a good guide in guessing if it will be able to survive into the future. A firm cannot survive with negative or constantly decreasing profit margins, it must always be a focus in optimizing a firms’ performance. Next up for discussion is the pro forma cash flow statement. This statement is used to get a breakdown of the actual cash flow of the firm. This is arguably the most important statement because accumulating cash is the top priority of businesses, maybe not for a passionate all-natural product producer like The Body Shop, but for the vast majority of businesses it is, therefore, that reputation is earned. The pro forma cash flow statement shows the changes in each account that affects cash. A positive number reflects a cash inflow or more cash came in from this account than went out, and a negative number means the opposite. For example, if accounts receivable is a positive number that indicates more receivables were collected than were received or a cash inflow from accounts receivable. This statement is extremely important to watch change as the assumptions that were reasonably changed so that we can see the detailed effects on the cash account. We want the cash account to grow through positive operations cash flows and not through large positive financing flows which would indicate either large amounts of debt have been taken out or stock has been issued. This distinction between growing through operations and not through financing will be much further expanded on in the assumptions and results sections but I will briefly discuss it. We want operating flows to be high and financing to be low so that interest expense is minimal and profit margin can grow healthily and the future performance of the nation’s premier all-natural body products producer is bright once again.

Circularity Issue

Circularity Issue

EFN>0=Shortage[DE]

EFN<0=Surplus[DEEC]

∆Addition to RE=∆ S.H. Equity

∆TL&E = ∆EFN

∆Debt ∆E.C =∆ Interest

∆Equity =∆ Dividend

∆ Dividend

∆ Interest

∆ Addition to RE

=

The last subject I will be discussing is the circularity problem and why exactly It arises.

Circularity is the problem that arises when producing pro formas. It is when we must recalculate all equations in the pro forma numerous times until all numeric conditions are met. Circularity is because of net interest expenses relationship with EFN and excess cash. When net interest expense changes, this changes the net income which changes the after-tax earnings. The after-tax earnings effect the retained earnings which would then change the shareholders equity. Ultimately this leads to changes in the trial figures which changes the EFN and excess cash. The process is recalculated repeatedly until balanced. It is called iterations. Excel can be used to make the process easier and remove the chance of error by using the iteration function to do this automatically.

Assumptions

The assumptions made by myself regarding variables in the future financial performance of The Body Shop reflect similar goals to the proposed strategy by Mr. Gournay “To enhance The Body Shop Brand through a focused product strategy and increased investment in stores; to achieve operational efficiencies in our supply chain by reducing product and inventory costs; and to reinforce our stakeholder culture”. My assumptions are also based on the ideas that we would like to enhance the Body Shop brand, create a focused product strategy, achieve operational efficiencies and reinforce stakeholder culture. Through analysis and research, I believe growing the cash account is the main factor in achieving the goals of The Body Shop. Growing the cash balance will help lower product costs by having the ability to pay suppliers sooner, defend from large unexpected costs, provide cushion during economic downturns, finance investments in stores and new natural products as well as lowering the cost of debt because creditors will have more confidence in The Body Shops ability to pay back debt. I also discovered an excess cash balance at the end of the year, instead of needing external financing, will be key to growing the cash balance. excess cash or external financing needed (EFN) mean respectively, The Body Shop has either more or less cash than you need to spend on assets and liabilities that change based on sales projections. Achieving an excess cash balance will come with a lot of other extremely positive results regarding the future performance of The Body Shop. For example, to achieve excess cash, instead of needing external financing, we may attempt to increase profit margin or increase operating cash flows. Increasing profit margin will help achieve excess cash or less external financing needed because the cash that is not paid out in dividends will go to the cash balance to help pay for increases in assets or decreases in liabilities instead of using debt to fund these changes. The amount of excess cash or EFN is tied to all variables on the future financial statements but some much more than others. The two-main assumption that will form the basis of our decision making regarding other financial statement variables are sales growth and operating expenses. The secondary variables I have identified that affect excess cash, EFN and ultimately the cash balance the most dramatically, are accounts receivable, inventories, other current assets, cost of goods sold, net fixed assets, and accounts payable. I have made significant changes in the assumptions about the main and secondary variables and the following paragraphs will go into detail on how I made the decisions that will ultimately most dramatically affect the cash balance and achieving The Body Shops other main goals.

Sales Growth

To begin explaining my assumptions, I will begin with one of the most essential; sales growth. Sales growth was a strength of The Body Shop during the early to middle 1990s but then significantly decreased to 8% by the late 1990s due to intense competition, opening inefficient stores as well as drifting away from creating natural products that made The Body Shop one of the most recognizable and successful natural product producers in the nation. The product innovation that had previously done extremely well at bringing the right products to the market at the right time started to falter in the late 1990s and the reactions to this, as well as their consequences, can be seen in the financial statements. Due to the massive decrease in sales growth, big decisions had to be made, investments in opening new stores were increased, restructuring costs were incurred, and inventory was increased with a variety of new products. The Body Shop hoped this would spur sales growth but instead the investments in opening inefficient stores and selling more products that were unsuccessful lead to a massive decrease in profit margin and ultimately the financial success of The Body Shop. I have assumed the sales growth in my model to be 10% and the reasons for that are as follows. Just a quick reminder that 10% reflects the average growth of the three-year forecasted period. The first reason I chose 10% is because it is about a 1% decrease in the average over the last three years. The average growth of retail stores in the late 1990 to early 2000s fell from 10% to 5% and the projections are not showing increases in the near future. Because of this decrease in average retail sales growth, I believe there will be a slight decrease in sales growth, but not as dramatic as it would be had we not analyzed The Body Shops situation and come up with recommendations to improve the financial performance. Sales growth will only fall 1%, rather than closer to industry average, because of the planned increased investment in stores that will increase the efficiency of these stores, lowering operating costs, as well as increased efficiency regarding inventory and product costs because of bringing the right natural products to the market at the right time.

Operating Expenses

The second main variable I will be discussing, which will be essential in determining assumptions regarding the secondary variables, is operating expenses. Operating expenses as a balance and as a percentage of sales increased between 1999 and 2000 as well as between 2000 and 2001. The increase between 2000 and 2001 was far more dramatic and had much larger consequences, such as a 20%+ decrease in profit margin, then the previous increase. This was due to decisions to open inefficient stores as well as creating products that did not do well. Because I plan on recommending that no stores be opened during the first forecasted period, but instead invest in existing inefficient stores, I have made the operating expenses assumption 51%, from 52.3%. I assumed this decrease from the previous period so that the increase in operating expenses between 2001 and 2002 is minimal while allowing for larger increases in the following years because of potential changes in the future performance of The Body Shop.

Accounts Receivable

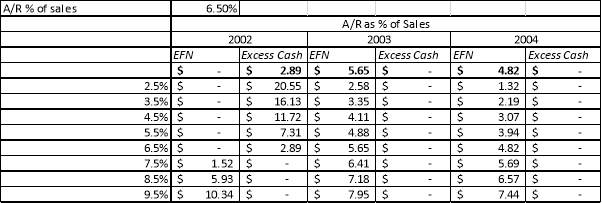

Now, the first of the secondary variables I will discuss is accounts receivable. The accounts receivable balance increased from 27.80 to 30.30 between 1999 and 2000 but between 2000 and 2001, remained the same at 30.30. I believe accounts receivable will remain around the same balance for the next three years, but I have it projected to decrease in year 2001 because I believe The Body Shop will collect more receivables than average due to an increased need to grow the cash balance to help achieve the goals of lowering product costs and increased investment in stores. Because Sales have increased, and I believe the accounts receivables balance will remain relatively steady, the percentage of sales assumption I assigned to accounts receivable is significantly lower than the previous year. The assumption reflecting the average of the three forecasted years also lends to the significant decrease. As accounts receivable as a percentage of sales decreases, the amount of excess cash increases, and EFN decreases, this is because the cash balance is being increased by more sales being in cash, rather than in receivables, an increase in accounts receivable is a use of cash and requires more funding. Below is a sensitivity analysis to help visualize this relationship.

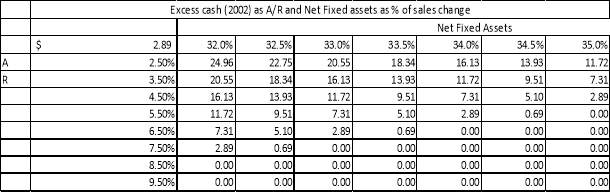

Even when accounts receivable as a percentage of sales is reduced and net fixed assets as a percentage of sales is increased, because of the increased investment in stores, excess cash in 2002 in achieved and EFN in the next years in much lower than it would have been without the decrease in accounts receivable as a percentage of sales. Below is a sensitivity analysis which will help visualize this relationship.

Inventory

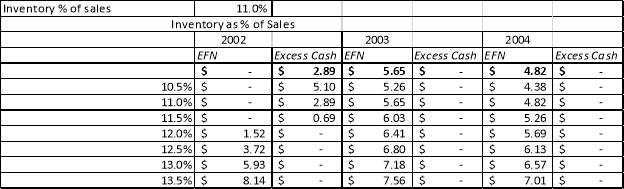

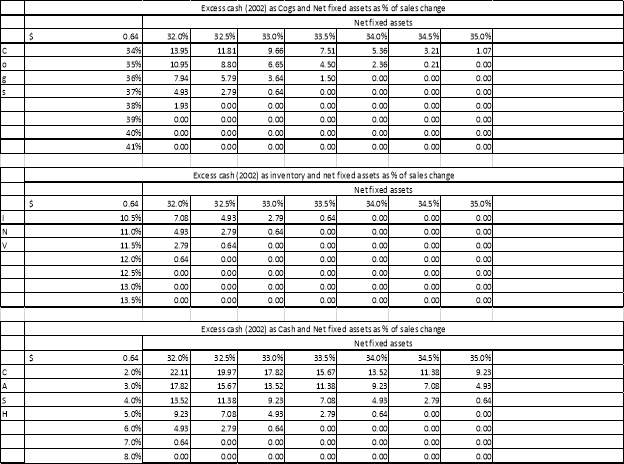

Secondly, I will discuss my decision making regarding the inventory as a percentage of sales assumption. Inventory as a total balance and as a percentage of sales increased between 1999 and 2001. Because of the goals in mind for The Body Shop, such as reducing inventory costs, I have chosen to assume that inventory as a percentage of sales will decrease from 13.7% in 2001 to 11% in 2002. As stated before this 11% figure represents what I believe will be the average through the three-year forecasted period. I believe inventory will be reduced because The Body Shop will implement a more specific, targeted product strategy that will require carrying a narrower variety of products. Mrs. Roddick indicated that she would like the right products going to market, not just regular products, as has been occurring recently, indicating to me a reduction in inventory will be incoming. Reducing inventory costs will also help grow the cash account, aiding our other goals of reducing product costs and increasing investment in stores. It will also help boost profit margin because less costs will be taken out of net income due to inventory carrying costs. In my analysis I have confirmed that the levels of inventory as a percentage of sales have a significant impact on whether The Body Shop will need external financing or will achieve an excess cash balance at the end of the year. As Inventory as a percentage of sales decreases, the amount of excess cash increases or EFN decreases. Below is a sensitivity analysis to help visualize this relationship.

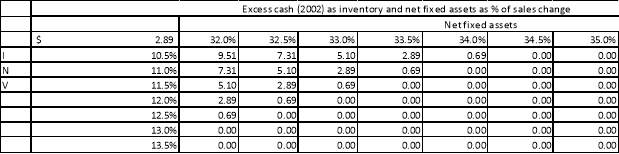

Similarly, to accounts receivable, as inventory as a percentage of sales is decreased and net fixed assets as a percentage of sales are increased, excess cash can be achieved and EFN can be reduced from what it potentially would be without the proper goals in mind. We can see that in the sensitivity analysis below that inventory does not affect excess cash or EFN as dramatically as accounts receivables does. Therefore, I believe that making sure that accounts receivable as a percentage of sales decreases should be a higher priority than reducing inventory as a percentage of sales.

Other Current Assets

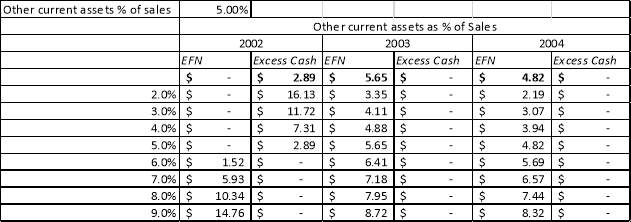

The next variables assumption I will be discussing my decision making for is other current assets. Other current assets increased from 4.1% in 1999 to 4.7% in 2000 and remained the same from 2000 to 2001. Because other current assets, as a percentage of sales and total balance, has risen the last three years and part of our goals include increased investment in stores, I have assumed that other current assets will rise to an average of 5% over the next three-year forecasted periods. Because assets are a use of cash this will work slightly against my recommendation that The Body Shop should work to achieve excess cash and reduce the amount of EFN. That is not a major problem because of the offsetting effects reducing other variables as percentages of sales, such as accounts receivable and inventory, will have on The Body Shops need or lack thereof external financing. Not only are the effects offsetting, increased investment in stores and product strategies is a goal of The Body Shop and increasing the assumption for other current assets as a percentage of sales reflects those goals. The following sensitivity analysis helps to visualize the relationship between other current assets and excess cash.

Cost of Goods Sold

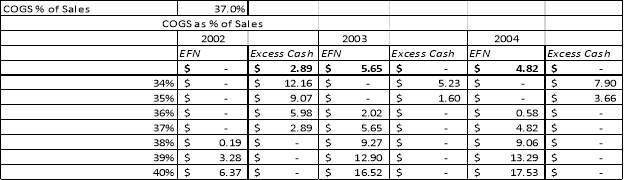

Fourthly, I will be discussing my decision making regarding the assumptions made for cost of goods sold or otherwise known as cogs. Between years 1999 and 2000 cogs decreased from 42% to 39.7% but between 2000 and 2001 has increased slightly from 39.7% to 39.8%. This is a positive trend for something that is a primarily goal of The Body Shop, to reduce product costs. I would like it to continue down that route, so I have suggested growing the cash balance to give The Body Shop the ability to buy products sooner or in larger quantities to reduce product costs, otherwise known as cost of goods sold. Because I believe The Body Shop will achieve the goal of reducing cogs as a percentage of sales, I have chosen to assume that the average cost of goods sold will decrease from an average of 40.5% between 1999 to 2001 to an average of 37% between the three-year forecasted period of 2002-2004. This decrease will have the most significant impact out of all seven main variables on the amount of excess cash or external financing needed, as the below sensitivity analysis will help show.

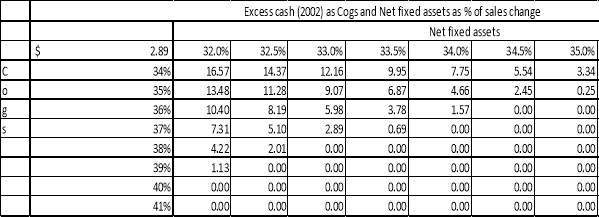

Oddly, when cogs as a percentage of sales is combined with an increase in net fixed assets as a percentage of sales, it does not have the most significant impact on excess cash or EFN compared to other variables that will decrease as net fixed assets increases, such as accounts receivable. The relationship between decreasing cogs and increasing net fixed assets in shown below in a sensitivity analysis. Cogs is the second most impactful variable in achieving an excess cash balance or needing external financing and because of this, it should be a priority to achieve the forecasted assumption if the main goals of the Body Shop are to be achieved.

Net Fixed Assets

The next variable I will be discussing is net fixed assets. Net fixed assets as a total balance has increased between 1999 and 2000, as well as 2000 and 2001. it increases a percentage of sales between 1999 and 2000 but decreases between 2000 and 2001. Due to the goals of The Body Shop, that include increased investment in stores, I have decided to increase the net fixed assets as a percentage of sales from an average of 30% between 1999 and 2001 to 33% between the three-year forecasted period of 2002-2004. This increase will dramatically increase the total balance of net fixed assets almost 30% but I believe this investment is necessary as well as attainable, even while working to achieve our goal of growing the cash balance. By looking at the previous sensitivity analyses we can see that altering other secondary variable assumptions along with increasing investment in net fixed assets will allow us to achieve an excess balance in the upcoming year as well as reduced need for external financing. The cash flow statement also shows a growing cash balance despite these levels of investment in stores. Increased investment in stores can have great effects outside of the financial performance of the company. The Body Shop brand image that is portrayed out to the public, the nation’s premier natural body products producer will be improved and ultimately lead to increased demand. This increased demand will lead to eventual increases in sales growth and that is reflected in my assumptions regarding sales growth. Because net fixed assets increase as a percentage of sales, as well as a total balance, it is a cash outflow, meaning as it is increased, excess cash will decrease, and the amount of external financing needed will increase. This relationship between net fixed assets, excess cash and EFN is reflected in a sensitivity analysis below.

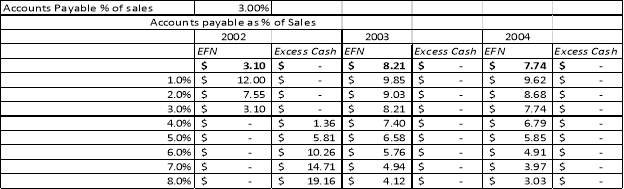

Accounts Payable

Now I will be discussing the decision process regarding accounts payable. Accounts payable increases as a balance and as a percentage of sales between 1999 and 2000 but between 2000 and 2001 the balance as well as the percentage of sales decreased. Because accounts payable is a liability, the balance or percentage of sales increasing is a source of cash, meaning excess cash increases and EFN will decrease. Accounts payable was an average of about 4.5% between 1999 and 2000, but I have assumed that accounts payable will be an average of 3% through the three-year forecasted period because main goals of The Body Shop include reducing product and inventory costs and reducing accounts payable as a percentage of sales will aid in achieving these goals. Because inventory is reduced, payment to suppliers, or accounts payable, will be reduced. Also, if the cash balance is grown and the goal to pay suppliers sooner is achieved this will reduce accounts payables total balance and as a percentage of sales because less payments to suppliers will be outstanding relative to sales. The relationship between accounts payable and excess cash as well as EFN is reflected below in a sensitivity analysis.

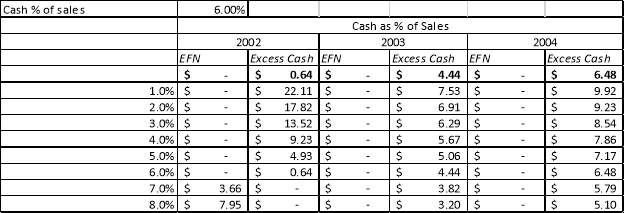

Cash

Last but certainly not least, I will be discussing my assumption regarding the cash account. The cash account is the most important of the secondary variables because it is the account where increasing the balance is a goal of The Body Shop due to all the effects of a growing, healthy cash account. These benefits include cutting product costs, cutting inventory carrying costs, protecting from economic uncertainty and lower the cost of debt. The problem with growing the cash account is it is so easy! All you must do is put cash at the highest percentage of sales possible! Just kidding, I wish it was that easy, the problem with making cash a large percentage of sales is that no matter what level of sales you attain, you will require a certain percentage of those sales in cash, and if sales are much lower than expected, a large amount of EFN may be required to cover the required cash in the cash account, resulting in interest expenses that could have been avoided. Because there must be a proper balance between achieving the goals of The Body Shop, which requires a growing cash account, I have chosen to assume that the cash balance will increase from 3.7% to 6.0%. around 6.8% is the average of the three-year period between 1999 and 2001 and I believe that this average will remain around the same average because during the last three forecasted years there were attempts to increase investment, as there will be during the next three-year forecasted period as well as attempts to increase excess cash and reduce EFN which will contribute to the decision to reduce the cash account as a percentage of sales. The following sensitivity analysis shows the relationship between cash, EFN and excess cash. We can see that as more cash as a percentage of sales is required, more EFN is required to cover the amount we must have in the cash account.

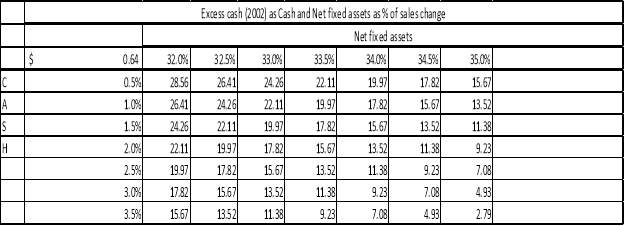

The next sensitivity analysis will show the relationship between decreasing cash as a percentage of sales along with an increase in net fixed assets as a percentage of sales to help visualize how these variables affect the level of excess cash.

Results

The significance of the results I have received through my analysis can be subjective, individuals can see the same trend or pattern and come up with completely different conclusions based on factors that may or may not be conscience to the analyzer. In my individual opinion, the results I have gathered are significant because I have utilized reasonable assumptions that are not too far off from the average but still reflect the potential for high growth and a resurgence in popularity due to the courses of action I will later recommend in this section. The results I have gathered in this analysis are based off a collection of market research, history of the firm, sensitivity analyses, trends in the pro forma financial statements, the cash flow statement and the financial ratios. In this section I will discuss how each collection of information and data has shaped my recommendations to help The Body Shop once again be the nation’s premier natural body product retailer and producer. Before that I would like to lay out again the main goals of The Body Shop Mr. Gournay has suggested, as well as one I added, so that we may fully appreciate the results. First, it was suggested that The Body Shop would like to improve its brand image using a focused product strategy and increase investment in stores. As we saw between 2000 and 2001, operating expenses sharply rose due to investment in opening new stores, this is not what I recommend for our current goal of increased investment in stores, but rather increase investment in the inefficient stores that are already open. This strategy will help improve brand image as well as bring operating expenses as a percentage of sales down because sales will be made more efficiently due to less operating expenses needed per every $1 of sales. The focused product strategy is also essential because The Body Shop has been increasing its inventory with a variety of new products, but they are not popular with the consumers, leading to a larger and larger percentage of sales each year being held in inventory, also known as unsold goods. The increase in inventory, or unsold goods, is a worrying statistic for a brand such as The Body Shop who is known for producing popular, high quality all-natural body products that people love. A focused product strategy will also potentially improve sales growth if utilized correctly as well as improve brand image. The results in my analysis reflect these goals of investment in inefficient stores as well as utilizing a focused product strategy. The next goals Mr. Gournay has stated as a priority to the success of The Body Shop were to lower product costs as well as inventory costs. I have already discussed reducing inventory costs in regard to a focused product strategy, that, I believe through my analysis, is the best way but not the only way. We could reduce inventory costs by discontinuing obsolete stock, something that may help the brand image as well. I agree with Mr. Gournay that lowering product costs should be a major priority of The Body Shop, lowering product costs is almost always a good goal to aim for if financial performance is unsatisfactory. I believe lowering product costs can be achieved within the three-year forecasted period because based on my results, the cash account will be growing (through operations, not by debt), enabling The Body Shop to buy more in bulk and pay suppliers sooner, which will reduce the cost of products. The cash account growing through operations and not by interest ridden debt will be extremely beneficial to the success of The Body Shop, not only will it lower product costs, it will lower the cost of debt, it will increase profit margin, it will increase the image of The Body Shop to investors, increase ability to invest without needing financing, protect from cyclical sales, economic downturns as well as large unexpected costs. All these benefits just from trying to achieve one goal? I know, it’s incredible, and it is truly possible, just look at my results, the following sensitivity analyses, ratios and cash flow balances will show how growing the cash account should be have the highest priority if the main goals of the body shop are to be achieved.

We can see in these sensitivity analyses that excess cash is the largest when the cash account as a percentage of sales is decreased even as net fixed assets as a percentage of sales is increased compared to inventory and cogs. This tells me that the cash account is the account we should aim to grow because it will have the largest effects on achieving excess cash, a main factor in trying to healthily improve the financial success of The Body Shop. Excess cash is reacting stronger to decreases in cash as percentage of sales because the cash you do not require in your cash account to fulfill the forecasted percentage of sales, gets labeled as excess cash, it does not indicate that the cash account will grow faster if the cash account as a percentage of sales is reduced. This does not mean it is insignificant though, this helped serve me as a guide to determine the proper levels of what should be required in the cash account to achieve goals such as lowering product costs and increased investment in inefficient stores. I determined the proper levels of the cash account and net fixed assets to be 6% and 33% respectively because If you follow those numbers to where they meet in the sensitivity analysis, it is the lowest amount of excess cash possible. I chose to aim to achieve this because I would like to show creditors, suppliers, and investors that we are increasing our cash as a percentage of sales significantly, which indicates to them we will have more cash and if the store investments as well as focused product strategy succeed then we will not need external financing to attain cash as 6% of sales.

Next, I will describe my results and recommendations based on the pro forma cash flow statement. The cash flow statement also indicates to me that growing the cash account through operations, not debt, will be key in achieving the goals of The Body Shop. Analyzing the pro forma statement of cash flows, we can see that the ending cash balance is growing each year while EFN remains at 0. The cash balance is growing due to cash flows from operations, not from external financing which has interest payments associated with it, reducing profit margin at a time when increasing profit margin is essential to improve the future performance of The Body Shop. Other goals of the body shop being realized that are reflected in the cash flow statement can be seen in inventory and net fixed assets. Inventory has a positive cash flow balance meaning we have decreased inventory, the decrease in inventory will be coming from the focused product strategy that involves cutting obsolete products as well as innovating new all-natural products while bringing them to market at the proper time. For net fixed assets we can see a large negative balance in 2002, meaning a cash outflow, this is due to the increased investment in inefficient stores. I believe this trend of investment in inefficient stores will slow after the first year, consequently the next two years have a lesser outflow of cash in the net fixed assets account. The cash flow statement also reflects the increasing frequency of payment with accounts payable and other current liabilities. The frequency should be increased because The Body Shop may receive reduced product costs due to the supplier receiving the payment quicker. The balances in accounts payable and other current liabilities are becoming smaller and smaller each year due to lesser liabilities being left unpaid compared to the previous year. The cash flow statement is very useful in looking at the big picture of where the firm is headed. The trends in the pro forma cash flow look very positive, a growing cash balance, strong operating flows, decreasing financing flows and steady investment flows in the last two forecasted periods. As previously discussed, a growing cash balance comes with many benefits and achieving a growing cash balance will only be achieved through other positive changes in the performance of The Body Shop. That is why it is such a great goal, it is tied to almost everything in the financial statements and all those variables must be optimized in the best way to achieve a growing cash balance through operations cash flow and not from interest laden debt. The specific accounts which reflect the goals of The Body Shop as well as the big picture can be seen in the pro forma statement of cash flows below.

Ratios are another great way to help measure the performance of The Body Shop. There are several categories of ratios that are used for different purposes in analysis of a firm. First there is the liquidity ratios which creditors usually use to help them determine if the firm is able to pay their current liabilities. Ideally the higher the better because that indicates how much assets you have relative to $1 in liabilities. The Body Shops current and quick ratios are growing each year, this reflects some of the goals of The Body Shop which include reducing the cost of debt as well as reducing the need for debt because we are growing our assets faster than liabilities, meaning we should be achieving excess cash balances and not using interest ridden external financing to fund the asset growth. The next category measures the leverage, or debt level relative to assets or equity. The total debt and debt to equity ratios are decreasing each year, exactly what we want. The total debt ratio decreasing indicates that less and less asset growth is being funded by debt each year, reflecting the goal to increase investment through operations cash flow and not debt. The debt to equity ratio measures how much debt you hold relative to the level of stockholders’ equity, it is positive to see debt to equity decrease each year because the higher the level of debt to equity, the higher the risk creditors associate with The Body Shop, raising the cost of debt. Times interest earned increasing each year is also a great reflection of the goals that Mr. Gournay and myself have set out to improve the future performance of The Body Shop. Times interest earned is earnings before interest and taxes, or EBIT, divided by interest expense. The larger the number the better, the number indicates how many times you could have paid interest expense with the EBIT. This growing each year indicates either a growing EBIT or a decreasing interest expense, both very positive for performance The Body Shop. Next, I will discuss the asset utilization category of the ratios section. Most ratios in this section remained the same over the three-year forecasted period, this is because as sales and cost of goods sold increase proportionally, so do inventory and receivables, the changes in these variables must be proportionate for the numbers in both the turnover and days ratios to remain the same for the three forecasted years. The two that did not remain the same, total asset turnover and capital intensity are opposites of each other, therefore one is increasing and the other is decreasing. Total asset turnover is sales divided by assets while capital intensity is assets divided by sales. Total asset turnover is decreasing each year while capital intensity is increasing, this indicates that sales are growing faster than assets, this is a very good sign, we definitely want sales to grow faster than assets because if it were the other way around, that would mean the efficiency of our assets is decreasing, exactly the opposite of what we want to do; increase efficiency with investment. The last category of ratios are the profitability ratios. The one I would like to discuss because of its importance and relevance to the goals of The Body Shop is profit margin. Profit margin is the percentage of sales that eventually makes its way to become profit. Profit margin may not be the 20%+ margins of the past but 8% is a healthy margin and an increasing profit margin is an extremely positive sign. Increasing profit margins show me that my assumptions which basically act as recommendations as well as non-assumption related recommendations are taking The Body Shop in the right direction. The following ratio analysis will help visualize what I have described in the above paragraph.

Last but certainly not least, I would like to discuss the results of my EFN and excess cash analysis in the pro forma balance sheet that is linked to the pro forma income statement. I used these statements to analyze how changing each assumption changes the cash balance and ultimately the EFN and determine what mix of reasonable assumptions, based on the goals of The Body Shop, will provide long term success. Sensitivity analyses helped me to visualize the wide possible range of effects and determine the most responsive individual pro forma income statement and balance sheet assumptions on excess cash and EFN alone as well as with an increase in net fixed assets as a percentage of sales. I feel these proformas accurately reflect the future possibilities regarding EFN and excess cash because the assumptions are extremely reasonable and not far from the averages. You may possibly be thinking it is irresponsible to make assumptions that reflect the ideal situation but that is just not the case here. It is not just the ideal situation, it is extremely attainable. If we remember from the assumptions section, I have assumed sales growth to be 10%, lower than the average over the last three years. Despite this, we can still earn excess cash and grow the cash balance through operations, achieving all the great benefits that come along with it, by optimizing our assumption variables such as accounts receivable or inventory to more reflect the current goals of The Body Shop to enhance future performance. Below this, the pro forma income statement will come first, and then the balance sheet.

To end this section, I would like to go through a rundown of exactly what I have recommended for The Body Shop to achieve the goals laid out earlier in this section. I consider my assumptions recommendations as well because they are based off trying to achieve the goals laid out by Mr. Gournay and myself but are realistic and grounded in analysis and facts. The assumptions section will contain how and why I chose those assumptions (also recommendations) and below will contain how and why I chose the non-assumption recommendations. The first recommendations made, due to the goals of improving brand image and reducing inventory costs, is to utilize a focused product strategy. The focused product strategy is necessary because The Body Shop in recent years has flopped trying to produce new products and bring them to market. A focused product strategy that includes market research, studying the competition, timing the market, determining sales cycles and other factors all will be essential in achieving the goals of The Body Shop. A focused product strategy will help make inventory costs more efficient due to less poor performing or obsolete products in the inventory balance. The next recommendation was to increase investment in stores, but not in opening new stores, investing in already existing inefficient stores. This recommendation is due to the goal of improving brand awareness and store efficiency. The inefficient stores really hurt The Body Shops success in the last year, net income decreased from $7.50 in 2000 to -$1.60 in 2001 because of the massive increase in operating costs that did not lead to significant increases in sales growth, brand awareness or brand image. I believe improving the efficiency of stores is a must before even considering opening new stores. What is the point of opening inefficient stores? I believe through educated trial and error investing into stores The Body Shop will discover what exactly needs to be improved in each store to increase efficiency and ultimately brand image. It will most likely be different for every store because they are located in a diverse array of local markets with unique buying criteria and other characteristics. The next recommendations come from the goal to lower product costs. Lowering product costs is technically a recommendation but I would like to discuss what recommendations I will make to achieve the main recommendation; lowering product costs. The Body Shop should aim to purchase supplies more in bulk as well as paying supplier sooner because of the resulting decrease in product costs. Buying in bulk reduces per unit prices and paying sooner rather than later allows the supplier to lose less value to the time value of money, effectively allowing them to decrease price. The most essential recommendation that I have mentioned throughout this analysis, which has an amazing amount of benefits outside of the main goals of The Body Shop, is growing the cash balance through operations, not by debt, and aiming for excess cash instead of needing external financing is key to this. We can always grow the cash account by taking more and more debt but that defeats the purpose of this analysis. Our purpose is to improve the financial future of The Body Shop and growing the cash account with debt, or an increase in need for external financing, will incur increasing interest expense and significantly lower profit margin. Growing the cash account through operations comes with a lot of significant changes in the assumptions about The Body Shops financial statement variables. To achieve this, we will have to collect receivables quicker, significantly reduce inventory by getting rid of obsolete stock and committing to a focused product strategy, reduce operating expenses as a percentage of sales by making stores more efficient through investment and reduce product costs by paying supplier sooner and buying from them in greater bulk for a better price. This is an ambitious plan but I believe it is perfect for The Body Shop because the leadership is truly dedicated to creating all-natural products that people truly love, and will do anything to make sure that this plan brings back the great Body Shop of old that achieved profit margins of 20%+ because they had products and a brand that people truly loved.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business Analysis"

Business Analysis is a research discipline that looks to identify business needs and recommend solutions to problems within a business. Providing solutions to identified problems enables change management and may include changes to things such as systems, process, organisational structure etc.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: