Blockchain in Banking: A State of the Art Analysis

Info: 55386 words (222 pages) Dissertation

Published: 10th Dec 2019

Tagged: Finance

Abstract

By eliminating the need for a central intermediary, blockchain technology proposes a new way to store and transfer value within a network. And as central financial intermediary, the banking industry offers a broad range of potential applications for blockchain technology. The purpose of this study is the exploration of the possible applications of blockchain technology in the field of commercial banking, the derivation of potential operational and strategic implications of such applications, as well as the uncovering of hurdles that currently stand in the way of a wider-scale implementation of blockchain technology. The exploratory research design is based on a thorough literature review on the topic of blockchain in banking as well as on expert interviews with dedicated blockchain professionals. The research methodology resulted in the identification of three particularly relevant use cases of blockchain technology in commercial banking: cross-border payments, trade finance, and know-your-customer applications. Applying blockchain technology within these areas can allow commercial banks to reduce both process complexity and cost, as well as increase inherent security and transparency. Furthermore, blockchain will allow banks to unlock additional strategic opportunities within these three application areas. But before blockchain technology can be implemented in the context of these use cases, significant hurdles remain yet to be overcome. Technological issues, the lack of a common standard, regulatory uncertainty and cultural hurdles of organisations so far prevent the application of blockchain technology in commercial banks on a wider scale. But the common assessment of the experts interviewed over the course of this study indicates that these remaining hurdles will be resolved in the near future. Blockchain technology will then offer banks an opportunity to strengthen their positioning within an increasingly competitive environment.

Keywords: Blockchain, blockchain technology, commercial banking, banking, strategic implications, operational implications, hurdles, Ripple, Skuchain, SecureKey

Table of Contents

2.1 A Short History of the Blockchain Technology

2.3.1 The Blockchain Lifecycle

2.3.2.1 The Proof-of-Work Mechanism

2.3.2.2 The Proof-of-Stake Mechanism

2.6 Possible Areas of Application for Blockchains

2.6.3 ValueWeb and Smart Contracts

3. A Short Overview of the Banking Industry

5. The Impact of Blockchain on the Commercial Banking Industry

5.1 Forces of Change in the Banking Industry

5.2 What Are the Pressing Use Cases of Blockchain in Commercial Banking?

5.2.1 Use Case: Cross-Border Payments

5.2.1.2 Blockchain-Based Solution: Ripple

5.2.1.2.2 Operational and Strategic Implications

5.2.2.2 Blockchain-Based Solution: Skuchain

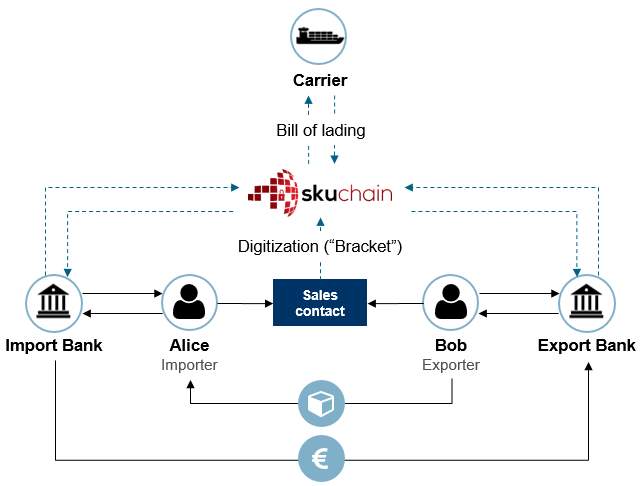

5.2.2.2.2 Operational and Strategic Implications

5.2.3 Use Case: Know Your Customer

5.2.3.2 Blockchain-Based Solution: SecureKey

5.2.3.2.2 Operational and Strategic Implications

6. Hurdles to the Implementation of Blockchain

Appendix A: Analysis of Blockchain Studies

Appendix A.1: Use Cases Mentioned Per Study

Appendix A.2: Use Case Reclassification

Appendix B: Interview Questionnaire

AML……………………………………………Anti-money laundering

BaFin………………………Bundesanstalt für Finanzdienstleistungsaufsicht

BBO………………………………………Blockchain Based Obligation

CBA…………………………………Correspondent Banking Agreement

CCICADA..Command, Control & Interoperability Center for Advanced Data Analysis

dApp………………………………………………Decentralised App

DIACC……………………….Digital ID & Authentication Council of Canada

DLT……………………………………..Distributed Ledger Technology

DNS………………………………………….Deferred Net Settlement

ECB…………………………………………..European Central Bank

Fintech………………………………………….Financial Technology

FX………………………………………………..Foreign Exchange

GPSG………………………………….Global Payments Steering Group

IaaS…………………………………………….Identity-as-a-Service

ILP………………………………………………Interledger Protocol

KYC…………………………………………….Know your customer

LOC…………………………………………………Letter of Credit

MEP………………………………..Member of the European Parliament

PoC………………………………………………..Proof-of-Concept

PSD2…………………………………….Payment Services Directive 2

RTGS………………………………………Real-time gross settlement

SWIFT…………..Society for Worldwide Interbank Financial Telecommunication

List of Figures

Figure 1: Global Google Trend Graph for the keyword ‘Blockchain’ (May 2017)

Figure 4: Input and output of a hashing algorithm (adapted from Brennan and Lunn (2016, p. 20))

Figure 5: Structure of a block and linkage to previous blocks (adapted from Andersen (2016, p. 2))

Figure 6: Determining the applicability of blockchain (Suichies, 2015)

Figure 7: Use case identification from literature analysis

Figure 8: Investments (M&A and VC) and deal volume in the global Fintech sphere (KPMG, 2017, p. 9)

Figure 9: Current international payment infrastructure (Bauerle, 2017)

Figure 10: Two modes of operation for Ripple transactions (Ripple, 2017b)

Figure 11: The two components of the Ripple network (Ripple, 2016a, p. 2)

Figure 12: Ripple Cost Reduction Potential (Ripple, 2016b, p. 9)

Figure 16: Estimated savings due to digital identity solution (Schneider et al., 2016, p. 75 f.)

List of Tables

Table 1: Parameters defining a consensus mechanism (adapted from Seibold and Samman, 2016)

Table 2: Properties of smart contracts (Morrison, 2016, p. 5)

1. Introduction

A new industrial revolution is underway. Just as the discovery of steam power and mechanized production, of electricity and mass production, and the introduction of information technology have each facilitated a fundamental shift in global economic and social conditions, the rapid increase in speed of development and diffusion of new technologies in almost every sector in recent years is carrying an equal promise of transformation for today’s society (Schwab, 2016, p. 6 ff.).

Among these technological megatrends is the blockchain[1], a distributed ledger that allows for secure processing and immutable recording of transactions in a network without the need for a trusted third-party. By representing a “[…] radically new approach[es] that revolutionize[s] the way in which individuals and institutions engage and collaborate” (Schwab, 2016, p. 19), this technology is at the heart of this fourth industrial revolution.

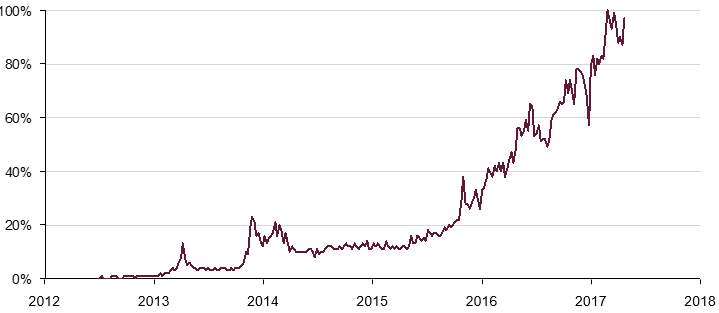

Even though it was originally introduced in 2008 with the development of the cryptocurrency Bitcoin, blockchain technology has only started to spark the interest of a wider audience in recent years, as is demonstrated by the stark increase in Google search queries depicted in figure 1.

Figure 1: Global Google Trend Graph for the keyword ‘Blockchain’ (May 2017)

This increasing interest in blockchain technology has furthermore materialised itself in significant investments into blockchain-related start-ups. In 2016 alone, an estimated amount of US $550 million has been invested into the blockchain sphere (CB Insights, 2017).

Financial services, especially the banking industry, is among the sectors on which blockchain technology is expected to have the most profound impact, as it is an industry that is characterised by complex process structures that are largely based on intermediation (Liesenjohann, Matten and Terlau, 2016, p. 54 ff.; Tapscott and Tapscott, 2016a).

1.1 Problem Discussion

“Banking is necessary, banks are not!” – Bill Gates

Bill Gates spoke these famous words in 1994 (Filkorn, 2016). But almost thirty years later, the traditional banking model is still in place. And while the digitalisation has not only transformed a wide range of industries but society as a whole, banks have been surprisingly un-innovative (Filkorn, 2016) – merely adjusting their service offerings and infrastructure in an incremental manner (Doyle and Quigley, 2014, p. 1). Banks simply did not feel the pressure to adjust or to reinvent their businesses, be it because strict regulations made it difficult for disruptors to enter the banking industry, because banking customers have always been notoriously loyal or, most importantly, because, as “keepers of trust” (Batlin et al., 2016, p. 12), banks have always been important facilitators of the flows of value within the global economy (Ruttmann and Mohr, 2016).

But advancements in technology and changes in regulation, such as the introduction of the PSD2 directive in Europe, are increasingly threatening this historical monopoly of traditional banks (Kruta, 2017). As a result, the incumbent players’ margins on their traditional service offerings have been shrinking, while, at the same time, customers are demanding increasingly personalised offerings and value-added services (Brereton et al., 2014; Doyle and Quigley, 2014). The lack of digital innovation in banking is putting incumbents at risk, as industry experts, such as former Barclays CEO Antony Jenkins, are predicting the dawning of the Uber moment of banking – a technology-driven, fundamental disruption across the entire industry (Williams-Grut, 2017).

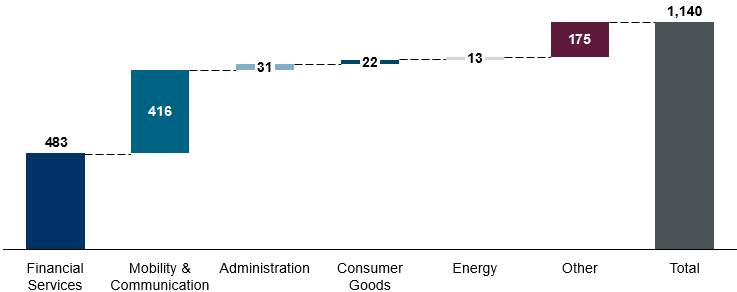

Among the technologies driving this change is blockchain, a potential paradigm shift that threatens to render irrelevant the traditional function of banks as “keepers of lists” (Brennan and Lunn, 2016, p. 9; Lehman, 2016). As is depicted in figure 2, this large disruption potential is what attracts a large part of the overall development efforts of start-ups within the blockchain sphere: More than 50 per cent of all ventures that base their business models on blockchain technology are currently focusing on the financial services sector.

Figure 2: Total number of blockchain-related start-ups per sector (adapted from Kirsch and Voß (2016, p. 12))

But while the blockchain somewhat poses a risk to the traditional functions and offerings of banks, it may also be the tool empowering banks to perform the much-needed reformation of their complex, inefficient and expensive structures as well as their endangered business models (Lehman, 2016).

1.2 Objective of the Study

As has been outlined above, the financial services industry is often quoted as one of the most promising areas of application for blockchain technology, with potential use cases being researched in commercial banking, investment banking and capital markets as well as in the insurance industry.

This exploratory study aims to provide a comprehensive overview of the application of blockchain technology in commercial banking. More specifically, the following three research questions shall be addressed over the course of this study:

RQ1: What are the possible applications of blockchain technology in commercial banking?

RQ2: What are the operational and strategic implications that arise from the implementation of blockchain in commercial banking?

RQ3: What are the challenges for the implementation of blockchain technology in commercial banking?

Answers to these research questions will be based on an in-depth review of current literature on blockchain in commercial banking, as well as on the insights gained over the course of several interviews with blockchain experts from various backgrounds. A more comprehensive description of the research methodology shall be given in the fourth chapter of this thesis.

2. Technological Background

The ability to own and to transfer assets via transactions is at the heart of economic value creation. And to keep track of these business agreements, market participants have always relied on ledgers. But to make sure that these ledgers remain accurate and are not being tampered with by fraudulent market participants, most business networks rely on central, trusted parties, such as banks or other intermediaries, to oversee these business ledgers and to validate each transaction that is taking place within the network (Brakeville and Perepa, 2016).

This need for an intermediary has become even more important in the modern age, as assets have increasingly been digitalised and central third parties are required to make sure that a digital asset is not duplicated and spent more than once by the same party (Thompson, 2016a). But while the use of such a central intermediary brings the major benefit of introducing trust into the system, it also comes with certain limitations, such as the introduction of bottlenecks into the network, leading to a slowdown in transaction processing speed and an overall lack of transparency (Brakeville and Perepa, 2016).

But as will be presented in the following chapters, blockchain technology offers a solution to these issues by introducing a shared, incorruptible ledger whose integrity can be ensured without the need for a central intermediary.

2.1 A Short History of the Blockchain Technology

When an unknown scientist under the pseudonym Satoshi Nakamoto published his white paper about Bitcoin – a “purely peer-to-peer version of electronic cash” (Nakamoto, 2008, p. 1) – in 2008, it was not the cryptocurrency itself but its underlying mechanism, known today as the blockchain, that was considered revolutionary (Thompson, 2016a). But overall awareness of the blockchain technology remained rather limited, as Bitcoin itself was not yet widely known.

Starting in the year 2012, increasing activity surrounding Bitcoin could be observed, as the cryptocurrency’s market capitalization grew and start-ups in the field of payments and coin wallets started to emerge. But still, Bitcoin and the underlying blockchain remained subject to a general scepticism, being associated mainly with the financing of rather sketchy online activities and other misconceptions (McKinsey & Company, 2015a, p. 5). Nonetheless, by the year 2014, over 80 uses of blockchains had been reported (Grant, 2016). Slowly, the initial scepticism gave way to the increasing efforts of tech enthusiasts around the world who, under the keyword Blockchain 2.0, explored uses of the blockchain technology outside the domain of cryptocurrencies (Yerdon, 2016). By detaching the enabling technology from its initial exclusive use for cryptocurrencies, blockchain became a possible application for any situation in which “validation of trust, proof of ownership, or a record of an event are required” (NewsBTC, 2016).

Following the rise in interest within the start-up sphere as well as among industry incumbents, the recent years have been characterised by the emergence of blockchain consortia making a joint effort to bring blockchain technology into practice (McKinsey & Company, 2015a, p. 5).

2.2 What the Blockchain Is

In its essence, a blockchain is a shared – or distributed – database capable of processing and recording all transactions taking place within a network on a peer-to-peer basis, eliminating the traditional need for a third party to record and verify single transactions, and creating an immutable transaction history (Finextra Research, 2016, p. 6; Howard, 2015).

While the blockchain has been first introduced as the technological foundation of the cryptocurrency Bitcoin (Gupta, 2017), significant efforts have since been put into the development of alternative blockchain protocols, such as Ethereum or Ripple. And while certain differences exist between these protocols, all blockchains share certain key characteristics.

First of all, a blockchain is distributed, meaning it is being stored on all devices connected to the network simultaneously. It thus distributes information evenly to all parties, i.e. every network participant has visibility over the entire database (Mainelli, 2017). As such, a blockchain can be described as a system of “collective book keeping” (Burelli et al., 2015, p. 6), capable of establishing a network for value exchange that is, as opposed to the centralized network structures that are currently mainly used within the global economy, not dependent upon the supervision by a trusted intermediary and, thus, allows for direct peer-to-peer communication (Mainelli, 2017; Sproul et al., 2016, p. 7).

Moreover, consensus mechanisms are at the heart of every blockchain, and while many different consensus mechanisms have been developed over time, they always serve the same purpose. In simplified terms, consensus mechanisms comprise a set of rules and procedures that allow the system as a whole to agree on which transactions are valid and will be executed, thus establishing a single version of the truth across the network (Andersen, 2016, p. 4; Brakeville and Perepa, 2016; Brown, 2016; Seibold and Samman, 2016).

A blockchain furthermore assigns a cryptographic identity to each member of the network. Every network participant possesses a public key, which is essentially his or her address that is visible to every other network member, as well as a private key that is used to digitally sign each transaction commissioned by this party. Cryptographic mechanisms make it practically impossible to decrypt the identity of a transacting party based on a public key (Sproul et al., 2016, p. 7). This mechanism allows for pseudonymity of network participants while, at the same time, keeping the transaction history visible to everyone (Mainelli, 2017; Plansky, O’Donnell and Richards, 2016).

The fourth important characteristic of a blockchain is its immutability. Due to the blockchain’s architectural design – linking each new block of transaction data to the existing history of the entire network – the content of any of the previous blocks in the chain cannot be changed without the rest of the network noticing and, thus, rejecting such an attempt to tamper with the transaction history (Brunner et al., 2017, p. 43; Tapscott and Tapscott, 2017).

And lastly, as a digital system, a blockchain is programmable, meaning users may embed a certain computational logic within the network. This allows for the automated execution of transactions or other actions based on the occurrence of predefined trigger events (Iansiti and Lakhani, 2017, p. 70; Mainelli, 2017).

Besides these overarching common features, many differences can exist between blockchain protocols – most prominently regarding which consensus mechanism they employ and regarding the question who is granted access to the blockchain network. The following chapter will first provide a basic description of the block creation process on the Bitcoin blockchain, after which an overview of two of the most prominent examples of consensus mechanisms will be given. Finally, possible differences in terms of accessibility of the respective network will be presented.

2.3 How the Blockchain Works

2.3.1 The Blockchain Lifecycle

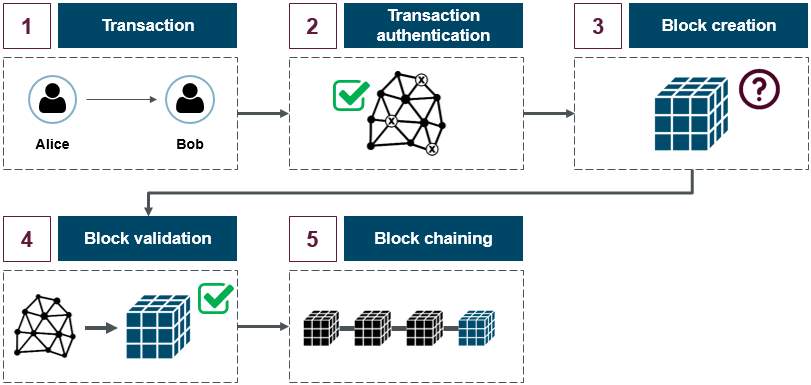

The blockchain’s name essentially describes the workings of the underlying technology. A blockchain consists of a chain of data blocks containing the entire history of transactions that have taken place among all members of the network since its initiation. The chain is continuously expanded by new blocks containing the data of recent transactions that have occurred within the network.

A single block can be compared to a page within a ledger, and its creation and connection to the existing chain of blocks always follow the same process, as is depicted in figure 3[2]. First, a transaction is created by a participant of the blockchain network. This transaction, as well as a cryptographically secured digital signature of the sender proving the transaction’s authenticity, is then broadcasted to the entire network of users (nodes). Subsequently, the nodes will verify the authenticity of this transaction by decrypting the digital signature of the sender, after which it is pooled together with other recent transactions into a block of data. This block of recent transactions is then again transmitted to the (validating) nodes in the network, which are now required to validate the block. This process requires the implementation of a specific consensus mechanism in the blockchain protocol, a concept that shall be explained in detail in the following chapter. Once the block has been validated, it is added to the existing chain of blocks. With the chaining of subsequent blocks to this block, all the transactions contained within this block become a permanent part of the distributed ledger. Continuous updating of the entire chain enables each node within the network to validate, at any point in time, the status of the blockchain (Seibold and Samman, 2016; Thompson, 2016a; Burelli et al., 2015; Frøystad and Holm, 2015).

Figure 3: Block creation process (adapted from Sproul et al. (2016, p. 4 f.) and Burelli et al. (2015, p. 8))

As was indicated above, one of the key aspects of a specific blockchain’s workings is the consensus mechanism it employs to verify transactions within its network. Various approaches to such a consensus mechanism have been developed, and the two most prominent protocols shall be presented in the following: the proof-of-work and the proof-of-stake mechanism.

2.3.2 Consensus Mechanisms

It is only after a formal approval that a transaction will be executed on a blockchain. But the absence of a traditional middleman to verify and approve transactions within a blockchain network requires the introduction of a new mechanism that allows for a reliable verification within an anonymous environment. As any node within a blockchain network can create a new block of transaction data, the network needs a mechanism that decides which block should eventually become part of the unique existing blockchain.

This role is taken up by a so-called consensus mechanism (Narayanan et al., 2016, p. 56 ff.). In the absence of trust between transaction partners, such a mechanism is defined by certain parameters, as depicted in table 1, allowing it to replace the usually required middleman to clear transactions and ensure a reliable transaction environment.

| Parameter | Explanation |

| Decentralized governance | A single central authority cannot provide transaction finality. |

| Quorum structure | Nodes exchange messages in predefined ways, which may include stages or tiers. |

| Authentication | It provides means to verify the participants’ identities. |

| Integrity | It enforces the validation of the transaction integrity (e.g., mathematically through cryptography). |

| Nonrepudiation | It provides means to verify that the supposed sender has really sent the message. |

| Privacy | It helps ensure that only the intended recipient can read the message. |

| Fault tolerance | The network operates efficiently and quickly, even if some nodes or servers fail or are slow. |

| Performance | It considers throughput, liveness, scalability, and latency. |

Table 1: Parameters defining a consensus mechanism (adapted from Seibold and Samman, 2016)

Based on these parameters, many different consensus mechanisms have been developed over time. And while all of them work towards the same goal of ensuring a trustless and secure transaction environment by establishing a single version of the truth, each alternative features “varying degrees of speed, cost, scalability, privacy and network security […]” (Blockchain Technologies, 2016). In the following, the focus will be laid on two substantially different consensus protocols: Bitcoin’s proof-of-work protocol and the proof-of-stake protocol.

2.3.2.1 The Proof-of-Work Mechanism

The proof-of-work protocol, even though already having been developed in its essence in 1999, is one of the most widely used consensus mechanism today (Seibold and Samman, 2016, p. 5). Within the Bitcoin blockchain, this mechanism, also known as mining, serves two main purposes. First of all, it prevents network participants from tampering with the transaction data on the blockchain, thus allowing for trustless consensus among network participants and ensuring security (Bulkin, 2016), while secondly creating new Bitcoins (Blockchain Technologies, 2016).

A proof-of-work protocol requires network nodes, also known as miners, to run complex mathematical computations to validate the pool of recent transactions within the proposed block. This ensures that the validating nodes have invested significant resources in the form of processing power, bandwidth and electricity to verify transactions, a process for which they are compensated in return (Bheemaiah, 2015).

The mathematical computations performed by the nodes transform certain pieces of data into a unique and seemingly random sequence of letters and numbers known as a hash, as is depicted in figure 4. While it is easy to transform data into a hash by applying a certain hashing algorithm, it is practically impossible to backwards-translate a hash into the original data, and any minor change of inputs will furthermore result in an entirely different hash (CoinDesk, 2014).

Figure 4: Input and output of a hashing algorithm (adapted from Brennan and Lunn (2016, p. 20))

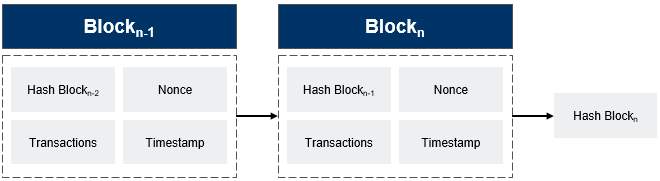

Within the proof-of-work-mechanism, a block hash is created by applying the SHA-256 algorithm to distinct pieces of data, among which are the hash of the previous block on the chain, a binary hashing of all the transactions pooled in the current block (also known as the Merkle Root), a timestamp of the hashing, and the nonce, a random number that is varied constantly (CryptoCompare, 2016).

Miners put these pieces of data through the hashing algorithm and compare the resulting hash with a certain arbitrary condition set by the network, also known as target. As hashes are one-way functions, it is practically impossible to find an acceptable hash value just by looking at the current target. Random guessing is the only possibility for a miner to hunt for a solution to the target, and thus large computing power is required to be able to compete for the discovery of a solution with other miners in the network (Krawisz, 2013).

Should the computed hash comply with the target, the miner has solved the mathematical problem, proof-of-work has been generated, the block is linked to the local copy of the blockchain, as is depicted in figure 5, and propagated to the entire network. For this, the successful miner is rewarded with Bitcoins, thus incentivizing the provision of computing power for the validation of transactions (CoinDesk, 2014).

Figure 5: Structure of a block and linkage to previous blocks (adapted from Andersen (2016, p. 2))

Three factors relating to this proof-of-work mechanism add to the security of the Bitcoin blockchain: First of all, it is not possible to predict which miner will find the solution to the target, consequently making it impossible to predict which block will be added to the blockchain at any point in time (The Economist, 2015a). Furthermore, the hash of each block on the blockchain includes the respective hash of its preceding block. As a hash value changes entirely when making even the slightest change to the input data, manipulating a certain transaction within a previous block on the blockchain would require the recalculation of the hash of that respective block and of those of all the consecutive blocks on the chain. Considering the effort needed to find the solution to a single block, such a manipulation becomes practically unfeasible (Acheson, 2016; The Economist, 2015a). And third, potential double-spending by network participants is prohibited by the proof-of-work mechanism. When mining, nodes always built on the longest existing version of the blockchain. Thus, while a miner might be engaged in the manipulation of a historic block of the chain, the chain is continuously expanded by other miners. Thus, to force the network to accept the manipulated version of the blockchain, a miner would have to lengthen the chain quicker than the other nodes in the network were lengthening it originally. This would require the malevolent attacker to control more than 50 per cent of the computing power within the network – which should be practically impossible and/or completely uneconomical (Gervais et al., 2016; The Economist, 2015a). As a consequence, the proof-of-work mechanism enables the network to achieve consensus in the absence of trust by making it prohibitively expensive to try to manipulate the blockchain (Krawisz, 2013).

The question that remains to be answered is how this mechanism leads to a unique chain that is characterised by consensus across the network. As Krawisz (2013) puts it, “the ability to generate blocks is a show of computational strength, which is just what the Bitcoin network needs to help verify all the transactions. But it is also a show of community spirit because by agreeing to enter the contest for the next block, they show themselves to be willing to respect the interests of the community rather than manipulate the block chain for self-interested purposes.”. Put otherwise, as it is assumed that most the network participants are honest, when in doubt, the longest blockchain will always be the ‘correct’ blockchain. This chain enjoys the consent of all nodes, as a manipulated blockchain will never be able to outpace the honest chain (Karame and Androulaki, 2016, p. 66).

The proof-of-work mechanism suffers from certain limitations. Most importantly, as has been described earlier, a proof-of-work protocol requires the input of significant computational effort and, thus, resources to verify transactions. As O’Dwyer and Malone (2014) have shown, the annual power consumption required for the entire Bitcoin mining operations can be compared to Ireland’s average annual electricity consumption. Depending on the availability of respective mining hardware, mining can become an uneconomical venture for nodes, as electricity costs can outweigh the reward for mining (Stieben, 2013) and moreover raises ecological questions (BitFury Group, 2015). Furthermore, the fact that the amount of computing power required to be able to sustain a profitable mining activity is prohibitively expensive for the average person favours the concentration of computing power on singular nodes. This, in turn, yields the danger of a 51 per cent attack and contradicts the blockchain’s idea of decentralisation (Manning, 2016).

Finally, a question that remains to be answered is what happens to a proof-of-work system once all units of its underlying cryptocurrency have been mined. Since miners only perform the work necessary to validate transactions out of the economic incentive of being rewarded for this work with Bitcoins, the finite supply of Bitcoins might lead to transaction validation activity breaking down once this supply runs out. While some authors predict that transaction fees will continue to provide sufficient incentive for mining activities to be upheld, it remains to be seen whether the cost of the validation activity will be sufficiently low in the future to be covered by the small transaction fees received by miners on the Bitcoin blockchain (Faggart, 2015).

2.3.2.2 The Proof-of-Stake Mechanism

Due to the disadvantages of a proof-of-work mechanism (especially the environmental impact due to the high energy consumption), proof-of-stake was first proposed as an alternative consensus mechanism in 2012 (Seibold and Samman, 2016, p. 7) and offers a completely different approach to the computing power-based proof-of-work mechanism. Within a proof-of-stake consensus mechanism, a node’s ability to add blocks to the blockchain is directly related to its respective ownership stake in the cryptocurrency. Thus, a node that possesses five times more coins than another node would be able to validate five times more blocks than the other (Manning, 2016). In other words, block validation is made easier for those nodes that own a larger stake in the network, the motivation behind this being to give more power to those network participants that have the “strongest incentive to be good stewards of the system” (Narayanan et al., 2016, p. 233). Thus, in a sense, a proof-of-work mechanism seeks to guarantee validity by requiring a high input of work, while a proof-of-stake mechanism seeks to guarantee validity by requiring validators to invest in a stake as collateral.

The general process of block validation under a proof-of-stake mechanism can be described as follows. A certain number of currency holders decides to place their coins within a proof-of-stake mechanism and thus become validators. The algorithm then chooses one of these nodes to become the validator for the next block based on a weighting that is dependent on their respective deposit size. Thus, a node with ten coins will be ten times as likely to be chosen as validator than a node with one coin (Github, 2016; Narayanan et al., 2016, p. 231 ff.).

In addition to the proof-of-work and proof-of-stake protocols, a wide range of other consensus mechanisms has been developed (Seibold and Samman, 2016). But as each consensus mechanism has its unique advantages and shortcomings, it is important to note that the choice of a consensus mechanism is very much dependent on the architecture and purpose of the blockchain in question (Liesenjohann, Matten and Terlau, 2016, p. 15). To illustrate these potential differences in architecture and purpose, a short overview of the different types of blockchains regarding accessibility will be given in the following.

2.4 Types of Blockchains

In addition to the respective consensus mechanism that they employ, blockchain networks can also differ in terms of their accessibility for potential users. It has by now become common practice to distinguish between three main types of blockchains: public, private and consortium blockchains (Liesenjohann, Matten and Terlau, 2016, p. 15).

2.4.1 Public Blockchains

A public, or unpermissioned, blockchain is, as its name suggests, accessible by any willing participant around the world. As soon as a node has accessed the network, it can engage in transactions and take part in the validation and consensus process. In general, public blockchains can be “considered to be fully decentralized” (Buterin, 2015) and are consequently fully transparent and open networks (Winters, 2016). To this day, the Bitcoin blockchain is probably still the most well-known example of a public blockchain, as anyone is free to participate if he or she can run the required software.

2.4.2 Private Blockchains

On a fully private, or permissioned, blockchain, the participation of nodes requires a central authority’s permission. This gatekeeper enacts control over who is allowed to engage in transactions, to validate transactions and to gain insight into the transaction history within the network (Winters, 2016).

As such, a private blockchain relies on the interposition of a central middleman. Since the core feature of the original Bitcoin blockchain was the abolishment of such a central authority, blockchain enthusiasts are having heated discussions over whether such a setup does or does not defeat the essential purpose of a blockchain (Interview #1, p. XLI) (Winters, 2016). But aside from this discussion, a private blockchain offers the benefit of being able to process transactions more efficiently and, thus, quicker than an unpermissioned blockchain (Thompson, 2016b). Furthermore, as Buterin (2015) points out, the central authority can make quick changes to the blockchain’s parameters, a functionality that may be crucial in certain fields of application, such as national land registries. Moreover, transactions on a private blockchain are cheaper than on a public blockchain, as they needn’t be verified by thousands of nodes, but only a few participating nodes (Brennan and Lunn, 2016, p. 44 f.).

2.4.3 Consortium Blockchains

A consortium blockchain differs from a public blockchain in the sense that a certain consortium of network participants decides over which node is allowed to approve which transactions, while the read access may lie anywhere on the spectrum from entirely public to private and will depend on the ultimate goal of the respective blockchain (Winters, 2016). Thus, a consortium blockchain “may be considered ‘partially decentralized’” (Buterin, 2015).

This type of blockchain offers especially interesting possibilities to organisational users as a means of collaboration, as it offers the same benefits of private blockchains – for example transaction efficiency and privacy – while distributing power between multiple network participants (Thompson, 2016b).

2.5 Benefits of a Blockchain

After having provided an overview of the conceptual and technological foundations of a blockchain in the previous chapters, a question that remains unanswered is which benefits the implementation of a blockchain architecture offers over traditional, centralised network and database structures.

As has been described earlier, blockchains allow for the disintermediation of transaction processing systems, thus enabling trustless, direct peer-to-peer transactions between parties. As such, a blockchain offers certain key advantages of traditional network structures that rely on intermediation by a trusted third party.

First and foremost, blockchains possess the potential to increase the speed at which transactions are carried out. By establishing direct peer-to-peer connections between network participants, the overall transaction processing time can be significantly cut by not having to transact through central third parties anymore (Underwood, 2016, p. 15).

Furthermore, blockchains bear the promise to reduce the overall cost inherent to a transaction processing system, as disintermediation also eliminates the cost associated with having to work through an intermediary (Plansky, O’Donnell and Richards, 2016). But a blockchain also allows for cost savings via the simplification of business processes and the automation of certain tasks (Nomura Research Institute, 2016, p. 65). Network participants are furthermore able to mutualise the infrastructure cost of a blockchain network (van Steenis et al., 2016, p. 9)., as all nodes “[…] provide the required computing power and data storage capacity.” (Interview #3, p. XLIX f.).

Moreover, the distributed character of a blockchain enables all nodes to gain full insight into the transaction history within the network. In an age where certain actors within business ecosystems have gained a competitive edge by building on information asymmetries, this increase in transparency can boost competition by levelling the playing field regarding the symmetrical distribution of information within industries. It can furthermore increase efficiencies by reducing the need for risk-hedging, thus allowing for more pricing accuracy and making regulatory compliance easier (McWaters et al., 2016, p. 24 ff.). In addition, it is not unreasonable to believe that organisations will be rewarded for such an increase in transparency with higher trust by stakeholders (Tapscott and Tapscott, 2016b, p. 30).

In addition to establishing more transparency, a blockchain can furthermore enhance the overall data quality within a network. Organisations today often still rely on outdated legacy systems and processes “to manage and repair unclear, inaccurate reference data […].” (Parker, 2016). A blockchain can solve this issue by “remov[ing] the need to reconcile multiple copies of data […].” (Parker, 2016). This eliminates potential discrepancies between separate databases and greatly enhances overall data accuracy and quality (Kasolowsky et al., 2016, p. 3 f.).

One of the key selling points of the blockchain technology is furthermore the security it offers due to its distributed nature and its inherent consensus mechanism that make it virtually tamper-proof. As there is no central party with controlling power over the network, a blockchain’s history cannot be changed without overwriting it on all nodes connected to the network simultaneously. This would require an attacker to possess at least 51 per cent of the computing power of the entire network – rendering every hacking attempt uneconomical (The Economist, 2015b). Furthermore, due to the distributed nature of the blockchain, there is no “central point of failure” (Interview #3, p. L), as is the case in centralised networks that rely on an intermediary, thus greatly increasing the resilience of the overall network (Brennan and Lunn, 2016, p. 8; McKinsey & Company, 2015a, p. 6).

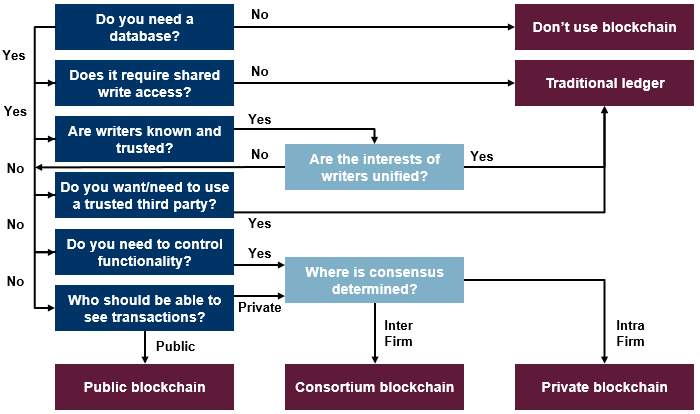

Overall, the blockchain offers certain key advantages over traditional, centralised databases and transaction systems. But as two of the interviewees for this study put it, this does not mean that blockchain technology is fit to replace centralised systems in every scenario (Interview #2, p. XLV; Interview #4, p. LVII). In the current blockchain hype, many use cases of blockchain appear to be a “solution searching for a problem” (Brennan and Lunn, 2016, p. 4). As one interviewee noted, to avoid wasting time and resources on the development of irrelevant blockchain use cases, starting by analysing a situation with a decision tree is a good starting point to identify worthwhile blockchain opportunities (Interview #4, p. LVII).

According to such a decision tree, as is presented in figure 6, a blockchain platform makes sense for business applications only under the condition that a database is needed, this database requires shared write access, will be accessed by unknown parties with contrasting interests and shall not rely on an intermediary to ensure system integrity (Brennan and Lunn, 2016, p. 45 f.).

Figure 6: Determining the applicability of blockchain (Suichies, 2015)

2.6 Possible Areas of Application for Blockchains

As an “immutable, unhackable distributed database of digital assets” (Kirkland and Tapscott, 2016), blockchain has already been dubbed the “biggest innovation in computer science” (Kirkland and Tapscott, 2016). And while the blockchain was first developed and applied in the context of the cryptocurrency Bitcoin, it offers many more potential areas of application. In essence, “[Blockchain] is to Bitcoin, what the internet is to email. A big electronic system, on top of which you can build applications. Currency is just one.” (Financial Times, 2015).

The quest for applications beyond cryptocurrencies, also dubbed Blockchain 2.0, has led to the development of new blockchain protocols, such as Ethereum or Hyperledger, which allow users to build custom applications based on an underlying blockchain. Blockchain 2.0 now enables not only the transfer of digital currency, but “to register and transfer any digital asset besides bitcoins.” (NewsBTC, 2016). This feature carries profound implications for the applicability of blockchain for a wide range of use cases, as it enables the representation of physical assets on the blockchain, a process also known as tokenization of assets (FINRA, 2017, p. 3; Evans et al., 2016).

Following the comprehensive classification of potential areas of application of blockchain technology by Frøystad and Holm (2015), a short, non-exhaustive overview over current and possible future fields of application of blockchains will be given in the following chapters.

2.6.1 Cryptocurrencies

In the following, a cryptocurrency, or digital currency, will be defined as follows:

“A cryptocurrency is a digital representation of value that is neither issued by a central bank or public authority nor necessarily attached to a fiat currency, but is accepted by two or more parties as a means of exchange and can be transferred, stored or traded electronically.” (Frøystad and Holm, 2015, p. 18)

Blockchain has been at the heart of a new wave of cryptocurrencies since the development of the Bitcoin protocol by Satoshi Nakamoto in 2008. And cryptocurrencies are on the rise. As of May 2017, Bitcoin alone boasted a market capitalisation of more than US $31 billion (Coinmarketcap, 2017). But why is it that these new digital currencies seem to be so much more successful than any other concept of digital money before them?

Concepts of digital currencies have been developed as early as the 1980s, but have faced various major issues that have prevented them from being implemented and utilised on a larger scale. One of these issues has always been the so-called double-spend problem: how does one prevent an actor from simply copying a purely digital form of money, and consequently being able to spend it more than once (NewsBTC, 2016)?

This is where the blockchain steps in as one of the main building blocks of a free-floating and secure digital currency. As an immutable digital ledger, it registers the entire transaction history within the network. Trying to spend the identical currency unit twice would contradict the recorded history on the blockchain, and the transaction would be consequently be refused by the other nodes within the network (Narayanan et al., 2016, p. 69).

While cryptocurrencies offer valuable benefits over traditional currencies, significant challenges remain to be addressed: not only are they currently still subject to high fluctuations in value, but also is their risk of inflation or deflation not controllable. Furthermore, due to a lack of a regulating entity, there is no way of implementing monetary policies based on a cryptocurrency (Frøystad and Holm, 2015, p. 18). But regardless of these issues, regulators increasingly concern themselves with providing a legal framework for the use of digital currencies:

“It is too early to assess the possible impact of the forthcoming EU legislation on virtual currencies, but there is little doubt that it will be profound. Whether it will affect the growth of the emerging virtual currency industry, or provide it with a more stable regulatory framework, thus increasing its acceptance as money and eventually allowing it to become mainstream, is an open question.” (Scheinert, 2016, p. 10)

2.6.2 Value-Registry

It is essential for an owner of any kind of property to be able to prove his legal claim towards his asset. Nowadays, various kinds of physical and digital ownership records are used to protect property rights, to resolve disputes, to allow for the transfer of ownership and to prevent fraud. But any common method of recording relies on a trusted third party to ensure its integrity (Mizrahi, 2015, p. 1).

While the blockchain technology’s original application as facilitator of the Bitcoin currency solely involved the registry and transaction-processing of a purely digital asset, solutions are now emerging that provide users with a proof of ownership of any kind of digital or physical asset via registry on a blockchain, thus eliminating the need for a trusted intermediary for the management of ownership records.

Such a registry of assets other than cryptocurrencies offers various potential uses. It would provide the creators of intellectual property with a means to ensure that they receive the appropriate remuneration for the value they create. In this domain, the start-up Ascribe offers a potential solution to the issue of piracy within the digital sphere. It allows artists to create an unequivocal, trackable and verifiable proof of ownership for their creations and gives them full control over who gets to experience their works of art. Unique pieces of art can be furthermore be transferred from one owner to another, just as Bitcoins (Tapscott and Tapscott, 2016a).

Another breakthrough application of blockchain that falls within the value-registry sphere is the validation of existence and possession of physical documents. A system securing and proving the authenticity of documents or other types of data, as is currently offered by the blockchain start-up Factom, enables users to eliminate certain risks associated with the handling of large amounts of physical documentation, such as risk of loss, deterioration, information leakage, etc. (Frøystad and Holm, 2015, p. 21).

But the blockchain offers more opportunities than a mere reduction of risks and costs. By providing land-owners with a tool to unmistakably secure their property claim, homeowners can protect themselves against misappropriation by governments in politically unstable regions (Tapscott and Tapscott, 2016b, p. 40 f.). Furthermore, real estate transactions are often tedious and take a long time to complete, thus significantly delaying the actual transfer of ownership. A blockchain can help to speed up such transactions, while eliminating the risks involved in manual registration, such as registering property with incomplete or wrong information (Lantmäteriet, ChromaWay and Kairos Future, 2016, p. 26). Blockchain-based land registry systems are currently being considered by a multitude of countries, including Honduras and Georgia, and a public-private collaboration in Sweden is planning to start testing its registry in March 2017 (Rizzo, 2017).

2.6.3 ValueWeb and Smart Contracts

The ValueWeb (Skinner, 2016), also known as Internet of Value, refers to an evolutionary transformation of the internet by a number of emerging technologies, amongst which blockchain is one of the key drivers (Frøystad and Holm, 2015, p. 26). In its essence, the ValueWeb allows for the creation of markets for any asset there is, allowing individuals to monetize whatever they “own, think or do, or can influence others to do” (Undheim, 2014).

An essential role within such this ValueWeb is played by so-called smart contracts, which allow users to “exchange money, property, shares, or anything of value in a transparent, conflict-free way while avoiding the services of a middleman” (BlockGeeks, 2016). In this sense, they expand the use of the blockchain protocol from being a mere ledger for financial transactions to storing and automatically executing any agreement between multiple parties (IDRBT, 2017, p. 7).

Just as regular contracts, smart contracts encompass all details of a contractual agreement between multiple parties, but in contrast to the traditional paper-based contract do not require a third-party intermediary to ensure the enforcement of the agreement. As such, smart contracts are self-verifying, self-executing and tamper resistant (SmartContract, 2017). Smart contracts thus possess the potential of making the formation of contracts as well as their enforcement “more efficient, cost-effective, and transparent” (Frøystad and Holm, 2015, p. 30) and can be especially of high value “in industries where accurate monitoring and execution of high-value contracts is critical […].” (SmartContract, 2017). A comprehensive comparison between blockchain-based smart contracts and traditional paper-based contracts is given in table 2.

| Parameter | Traditional Contracts | Smart Contracts |

| Settlement time | 1-3 Days | Minutes |

| Remittance | Manual | Automatic |

| Escrow | Necessary | Possibly unnecessary |

| Cost | High | Low |

| Form | Physical (wet signature) | Virtual (digital signature) |

| Enforcement | Lawyers necessary | Lawyers possibly unnecessary |

Table 2: Properties of smart contracts (Morrison, 2016, p. 5)

The lifecycle of a smart contract always follows four distinct steps. First, smart contracts are coded by translating all desired contractual parameters into the respective programming language, after which the contract is encrypted and sent out to the other nodes within the blockchain network, just as would be the case with a regular transaction on the blockchain. Next, a certain triggering event, which has been precisely defined in the contract parameters, occurs. This event can either be a specific transaction taking place within the network, or the receipt of certain information. Following this triggering event, the contract is executed, and value is transferred as defined in the contract. Finally, settlement takes place in whichever form has been specified within the contract (Frøystad and Holm, 2015, p. 31). Thus, in simplified terms, a smart contract can be compared to a physical vending machine. After the buyer has inserted a coin, the machine automatically enforces the buying agreement between the owner of the machine and the buyer (Narayanan et al., 2016, p. 286 f.)

Due to their very general nature, smart contracts based on blockchains possess the potential to reinvent business processes in various industries (Sproul et al., 2016, p. 6): Smart contracts could be applied by a governing authority to establish a tamper-resistant voting system, and/or induce more people to participate in a vote, as the hassle of having to line up in front of voting offices is alleviated (BlockGeeks, 2016). Smart contracts could furthermore be used to replace intermediary services, such as Airbnb or Uber, by introducing what is known as a decentralised app (dApp) (Tapscott and Tapscott, 2016b, p. 336): a “completely open-source application that operates autonomously, and with no entity controlling the majority of its tokens” (Voshmgir, 2016b, p. 6). Before the introduction of blockchain technology, the bulk of computing power used to lie mainly in the hands of centralised organisations. But now, dApps offer users the opportunity to directly code and upload an application onto a shared computing space, the blockchain, where it will function as it was meant to without any central power controlling it (Tapscott and Tapscott, 2016b, p. 297 ff.).

As has been outlined in the previous chapters, blockchain technology can be applied to a wide range of contexts and for a variety of purposes, from replacing fiat currencies with digital cryptocurrencies, over serving as a digital asset registry, up to enabling the vision of an internet of value – thus not representing “[…] only a replacement of current systems, but […] something that makes possible entirely new things.” (Interview #3, p. LI).

But while use cases for blockchain technology can be found across many economic sectors, financial services have early on been identified as a key area of application. As central financial intermediaries, banks have been fulfilling a wide range of important functions within the global economy for a long time. The following chapter shall provide a brief overview over these functions, before a deep-dive into the possible applications of blockchain in banking as well as into their strategic and operational implications for banks will be given.

3. A Short Overview of the Banking Industry

As central financial intermediaries, banks serve a critical purpose in the worldwide economy. They are the balancing force between financing needs of individuals, corporations or states on the one hand, and investing needs of these actors on the other hand (Berger, Molyneux and Wilson, 2012).

Blockchain use cases can be found across the entire range of different banking services. As the focus of this thesis will be laid on blockchain applications in commercial banking, the following chapters will provide a simplified conceptual classification of the three main types of banks that are active in most modern economies: commercial banks, investment banks, and central banks.

3.1 Commercial Banks

Commercial banking comprises mainly of those parts of the banking business that the greater public will, in general, associate with the term banking.

A commercial bank’s role is threefold. First, it accepts funds from depositors and, in turn, uses these funds to provide a range of financial services, such as giving out loans to customers. It is this critical function of financial intermediation that enables individuals and corporations to engage in economic activities.

Second, commercial banks provide security and convenience to their clients. In the simplest form, banks can be seen as a “safe haven for the depositor’s funds” (Berger, Molyneux and Wilson, 2012, p. 1) that, by enabling customers to handle transactions via, for example, debit cards, eliminate the safety risk of having to hold large amounts of cash on hand.

This idea is furthermore linked to the third major function of commercial banks, which is the operation of the payment system by issuing checks, debit and credit cards as well as arranging wire transfers, all of the time making sure that the correct accounts are credited and debited in a timely manner (Casu, Girardone and Molyneux, 2008, p. 25 ff.). As such, these banks facilitate commercial transactions between buyers and sellers of goods and services by practically “lending their reputation and credibility to the transaction” (Simpson, 2015).

3.2 Investment Banks

While commercial banking mainly refers to deposits and lending activities, investment banking focuses on offering specialised services relating to financial markets to corporate clients. The main role of investment banks is helping companies to raise money, i.e. advising them on whether and how to raise equity or debt (Casu, Girardone and Molyneux, 2008, p. 69).

But investment banks also engage in activities on financial markets themselves. Not only do they regularly engage in the trading of financial securities on their own behalf, hoping to make a profit by buying low and selling high, but often they also act as market makers on financial markets, a key facilitating function in which they buy and sell large amounts of securities according to the market’s supply and demand fluctuations, thus keeping financial markets liquid (Investopedia, n.d.).

Further activities encompass the creation of new financial products for specific clients or general investors by combining existing financial instruments, acting as research agents for clients and offering mergers and acquisitions-related services (Pritchard, 2015).

3.3 Central Banks

While commercial and investment banks are (mainly) for-profit institutions, central banks don’t operate with the goal of generating a profit. In a simplified sense, a central bank’s most prominent function is to control the money supply by either injecting the market with liquidity, essentially by ‘printing money’, or by reducing the available amount of the respective currency by absorbing funds. Adjusting the overall money supply via these practices, an activity that is also known as the monetary policy of a central bank, directly influences the level of inflation within a market and is thus performed cautiously to attain a certain target inflation level (Heakal, 2015).

This macroeconomic responsibility is complimented by the microeconomic responsibility of acting as the “lender of last resort” (Heakal, 2015; Berger, Molyneux and Wilson, 2012, p. 23): By lending money to commercial banks, a central bank ensures that solvent banks do not become the victims of short-term liquidity crises – a circumstance that could otherwise potentially destabilize an entire economy (Deutsche Bundesbank, n.d.). As such, central banks are essentially the backbone of a nation’s banking system, put in place to prevent it from failing (Heakal, 2015).

By engaging in these macro- and microeconomic activities, a central bank pursues its overall goals of stabilising a currency, keeping unemployment low, and preventing inflation (Amadeo, 2016).

4. Research Methodology

As has been outlined earlier, the purpose of this exploratory analysis is to identify the currently most relevant use cases of blockchain technology in commercial banking, to determine the respective operational and strategic implications of these use cases for banks, as well as to give an overview over the current hurdles standing in the way of a wider adoption of blockchain technology.

These research questions are analysed via a two-pronged research methodology well-suited for exploratory studies (Saunders, Lewis and Thornhill, 2009, p. 140): an in-depth literature review on the one hand, and expert interviews on the other hand, both of which shall be further described in the following.

4.1 Literature Review

As blockchain offers a wide range of possible applications in commercial banking, an in-depth literature review has been conducted to identify those use cases that are currently deemed the most relevant and pressing in practice.

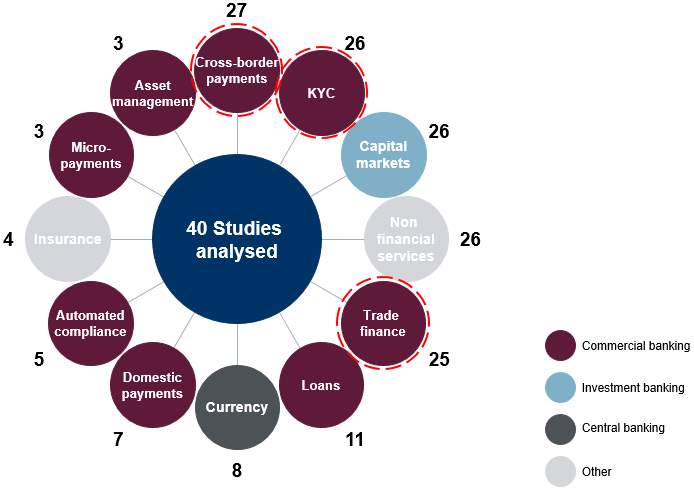

A total of 39 recent studies on blockchain technology in banking have been collected and analysed over the course of this study (see Appendix A). These studies have been analysed as per the following scheme, the results of which are depicted in figure 7: First, all use cases mentioned as relevant within each of the respective studies have been collected. In a next step, these use cases were sorted into four main categories per the following classification: 1) commercial banking, 2) investment banking, 3) central banking, and 4) other. Next, the use cases that have been categorised as belonging to the realm of commercial banking were standardised to eliminate discrepancies in terminology between different authors.

This standardisation resulted in the classification of all commercial banking blockchain applications into eight distinct use cases: 1) Cross-border payments, 2) Automated compliance, 3) Loans, 4) Domestic payments, 5) Know your customer (KYC), 6) Micropayments, 7) Trade finance and 8) Asset management. Following this process of standardisation, the studies could then be collectively screened for the most-mentioned use cases of blockchain technology in commercial banking. This evaluation of recently published literature on blockchain in banking resulted in the selection of three distinct blockchain use cases for further analysis within the scope of this thesis: cross-border payments, trade finance, and KYC.

Each of these use cases was then analysed following the same pattern. First, the current situation within these fields of application was researched to identify the underlying problem that blockchain could help to solve. In a next step, current blockchain-based solutions for these fields of application were identified. From the resulting list of start-ups and technologies, one specific example was selected to demonstrate a possible technological solution incorporating blockchain technology for the specific use case. This selection was based partly on the availability of detailed information regarding the technical workings of the solution, and partly on the density of the recent news flow regarding practical initiatives of this start-up and its partnerships with banks. Following the presentation of the technological solution, each use case was then analysed regarding its specific operational and strategic implications for commercial banks.

Figure 7: Use case identification from literature analysis

4.2 Expert Interviews

In addition to the literature review and analysis, interviews with dedicated blockchain experts have been conducted over the course of this study. The interview methodology followed a semi-structured approach, with an overarching interview template (see Appendix B)forming the basis of each interview, but allowing for deviations to occur naturally as the respective discussions evolved (Saunders, Lewis and Thornhill, 2009, p. 320).

The contact to relevant interviewees was established via personal networking in three cases, and via LinkedIn in another case. To provide a holistic perspective on the topic, these experts were selected to include members of different stakeholder groups and to represent each of the three selected use cases:

- Interview #1: Blockchain consultant specialising in payments; former member of the innovation lab of a global payments provider

- Interview #2: Generalist blockchain consultant at a global consulting firm

- Interview #3: CEO of a global digital identity institution; board member of a European Fintech advisory group

- Interview #4: Blockchain consultant specialising in real economy and trade applications; former managing director of multiple European electronics companies

The interviews served a twofold purpose: on the one hand, they allowed for validation of the results of the literature review, and, on the other hand, served to ensure that the results presented in this thesis are up-to-date and based on practical insights. Three of the interviews were conducted per telephone, and one was conducted via video conferencing.

4.3 Methodology Discussion

The research methodology employed in this study does not come without limitations. To ensure the actuality of the insights gathered, but also due to the general lack of coverage of the topic within academic research, the literature review and the establishment of the state of the art was based primarily on grey literature in the form of studies and reports issued by corporations, research institutions, and government institutions. As these primary literature sources are not indexed in any central research database, the search for relevant literature was limited to the utilisation of common web search engines. Thus, it is difficult to estimate whether the sample of 39 studies analysed within the scope of this thesis adequately represents the unknown number of all studies on the topic of blockchain in banking. But as the analysis of 39 reports has yielded a rather unambiguous result regarding relevant use cases, it can be assumed that a larger sample would have likely resulted in similar findings.

Furthermore, a limiting factor in the identification of relevant blockchain use cases is the fact that different authors tend to utilise very different terminologies within their respective publications. To make the sample of studies comparable it was thus necessary to standardise the terminology of the use cases, which may have led to the distortion of the findings in some way. But as the use cases are, most of the times, described in a detailed manner in each study, it was possible to match associated use cases based on the described processes and applications.

And lastly, as this study focuses only on relevant use cases of blockchain technology in commercial banking, it was necessary to classify the overall banking use cases as belonging to the realm of either commercial banking, investment banking, central banking, or other sectors. But as use cases of blockchain technology often involve a wide range of different stakeholders, this distinction cannot always be clearly drawn.

A similar assessment of methodology limitations can be applied to the interviews performed over the course of this study. The lack of standardisation of a semi-structured interview may result in less reliable data than structured interviews, and the results may suffer from an interviewer bias due to the interviewer potentially influencing responses via the use of specific tone of voice or non-verbal behaviour (Saunders, Lewis and Thornhill, 2009, p. 326 ff.). Thus, in an effort to ensure a high level of data quality and unbiased answers, the focus was laid on the use of open questions (Saunders, Lewis and Thornhill, 2009, p. 332).

Next to potential data quality issues within the experts’ responses, the selection of the interviewees themselves can be a limiting factor in terms of research design. As the blockchain technology is currently being explored by a wide range of different stakeholders who may not necessarily have the same opinion on relevant topics, insights may differ depending on the selection of interviewees. Thus, to base the study’s findings on a range of different viewpoints, the interviewees for this study were selected to represent multiple different stakeholder groups. Nevertheless, both a larger sample of interviewees, as well as the inclusion of interviewees from other professional areas, might have yielded different results. But the fact that the overall insights gained from the conducted interviews were in no case contradictory to each other increases confidence in overall data reliability.

5. The Impact of Blockchain on the Commercial Banking Industry

As the blockchain technology carries the promise of transforming the way value is stored and transferred, the financial services sector is naturally the first that comes to mind when considering potential applications of this technology. And indeed, use cases for blockchain are currently being explored in the insurance industry, in capital markets and investment banks, as well as in commercial banks. And even central banks, such as the Bank of England, are researching the potential adoption of a blockchain-based cryptocurrency (Liesenjohann, Matten and Terlau, 2016, p. 18).

The focus of this study will be the analysis of potential applications and their strategic and operational implications within the commercial banking industry. The following chapters will therefore be dedicated to the assessment of the importance of blockchain technology given the overall forces driving change in the commercial banking sector, after which a detailed analysis of the three currently most relevant use cases of blockchain in commercial banking will be conducted.

5.1 Forces of Change in the Banking Industry

A lot has changed since the beginning of the digital revolution in the middle of the last century. The so-called third industrial revolution, which brought us the introduction of the personal computer, the internet, and information technology, enabled the emergence of a wide range of new business models, disrupting entire industries (Schwab, 2016, p. 7).

When it was acquired for US$ 22 billion by Facebook in 2014 (Frier, 2014), WhatsApp had already amassed a user base of 465 million people in the five years since its founding in 2009 (Statista, 2017). Suddenly, it was possible for a start-up with just 55 employees to compete with and to effectively disrupt the business models of established companies – organisations that employed tens of thousands of people and had been in the business for decades (Perrault, 2016). It is this disruption of established businesses by the likes of WhatsApp, Uber, Airbnb and other digital ventures, by which the process of creative destruction, which essentially describes the ongoing revolution of any economy from within (Schumpeter, 1942, p. 83), manifests itself in the current age (Gans, 2016; Frey and Osborne, 2015).

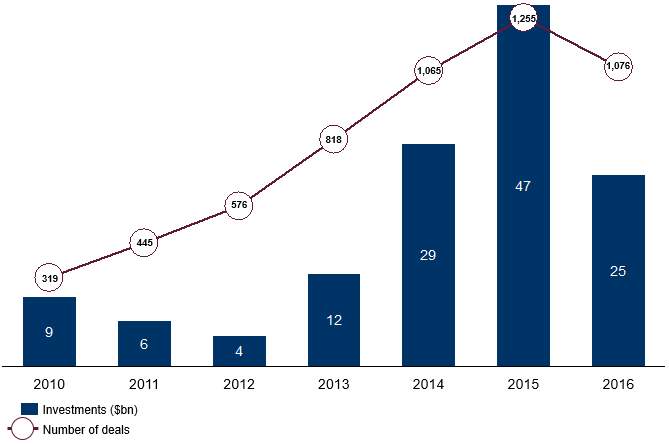

Banks have been operating in a difficult market environment over the past years. Market conditions such as low interest rates, a reduction of overall debt levels and increased pressure from regulators have shrunken revenues (CGI Group, 2016, p. 2; Doyle and Quigley, 2014), and with overall investments into Fintechs around the world having grown tremendously over the recent years, as is demonstrated in figure 8, the banking industry ranks among the primary candidates of sectors ripe for a fundamental disruption. And while changing customer needs, as well as regulatory influences, are also among the factors that drive the reshaping of the banking industries, technological advancement is at the heart of the disruption process (Brereton et al., 2014, p. 6).

Figure 8: Investments (M&A and VC) and deal volume in the global Fintech sphere (KPMG, 2017, p. 9)

Amongst the uprising technologies that are currently working on reshaping the banking industry as we know it, blockchain technology is probably one of the most talked about. By introducing an immutable and, thus, trustless shared ledger of transactions to all kinds of (business) networks, blockchains could, in theory, “[…] threaten a central provider, such as a bank […].” (Interview #2, p. XLV) by reducing the reliance on banks as financial intermediaries within the traditional “hub and spoke model” (IDRBT, 2017, p. 10), and making room for entirely new business models in the financial services industry (Haycock and Richmond, 2015, p. 62 ff.).

But while the definite impact of the blockchain technology on banking as we know it remains a matter of speculation as of today, practitioners are extending their understanding of potential applications of blockchain technology in banking on a daily basis. A wide range of use cases has so far already been conceptualised, and Fintechs, as well as established banks, are working on the goal of developing blockchain-based banking applications beyond the proof-of-concept (PoC) phase. And the current projections of an annual blockchain-enabled cost savings potential for banks of around US $20 billion per annum by 2022 in back-office processes alone (Belinky, Rennick and Veitch, 2015, p. 15) may serve as an explanation for these increased development efforts.

5.2 What Are the Pressing Use Cases of Blockchain in Commercial Banking?

As has been outlined earlier, blockchain is one of the technologies that are currently discussed to carry a large potential to transform the entire financial services industry. But while blockchain technology might seem applicable in a wide range of use cases, all the interviewees for this study pointed out that many of these potential applications are ‘solutions in search of a problem’, as other currently available technologies could also be used to implement certain use cases (Interview #1, p. XLI; Interview #2, p. XLV; Interview #3, p. LI; Interview #4, p. LVII).

Thus, to assess the impact of blockchain on commercial banks, it is important to lay the focus of the analysis on the pressing and most realistic use cases. Over the course of the literature review and the expert interviews, the three distinct use cases cross-border payments, trade finance and KYC have been identified as the most relevant areas of application of blockchain technology in commercial banks.

5.2.1 Use Case: Cross-Border Payments

When considering the significant technological advancements made in all areas of our modern society within the past 30 years, it is difficult to believe that an integral service to our everyday life, banking, still largely relies on IT structures that date back as far as 40 years. While other sectors, such as the media industry, have radically transformed their organisations as well as their products and services with uprising of digital technology (Ito, Narula and Ali, 2017), commercial banks have not made essential changes to their servicing structure since the 1970s (Haycock and Richmond, 2015; Heidmann, 2010). As one interviewee pointed out, “[…] banks are currently mostly operating on quite the old systems, rely on bloated structures and still often have processes in place that are largely dependent on a lot of manual work” (Interview #1, p. XXXVIII).

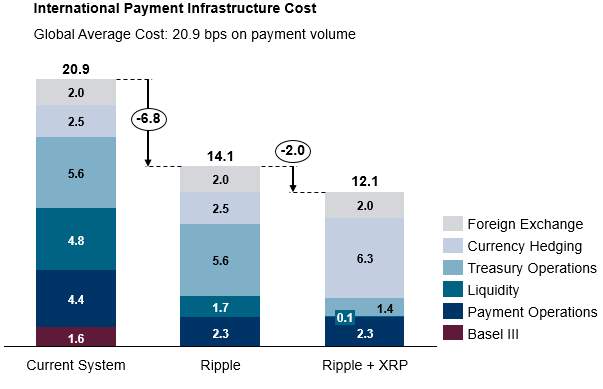

This issue of antiquated IT structures in financial services is especially visible within the field of cross-border payments (Interview #1, p. XXXVIII), which are an integral part of a bank’s service portfolio and which total up to US $155 trillion each year (Leising, 2016). These payments are currently directed through a complex network of intermediaries, a system also known as correspondent banking, taking up a lot of time (in most cases three to five days), introducing many risks into the process of sending money from one party to another across country borders, and entailing high costs for banks and their clients (Bauerle, 2017).

As one of the blockchain’s main strengths lies in the disintermediation of networks, and, with it, the establishing of direct peer-to-peer connections for value exchange, cross-border interbank payments appear to be a very promising use case in which blockchain has the potential to benefit both banks and their customers. But before the blockchain solution to correspondent banking is introduced, an overview of the current correspondent banking system and its pain points shall be given in the following.

5.2.1.1 Current Situation

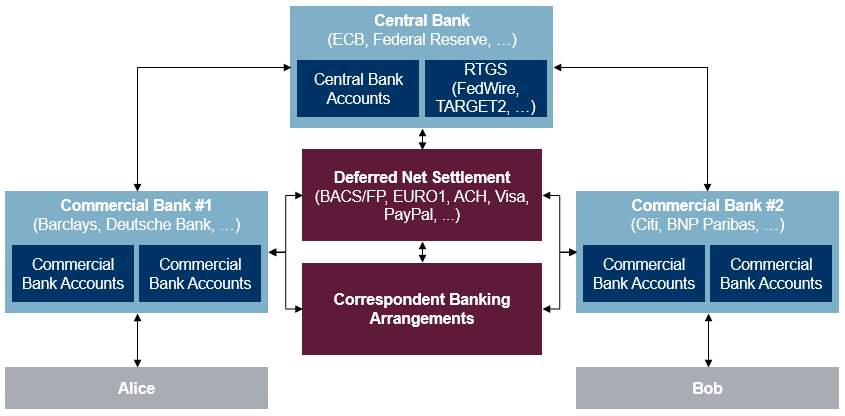

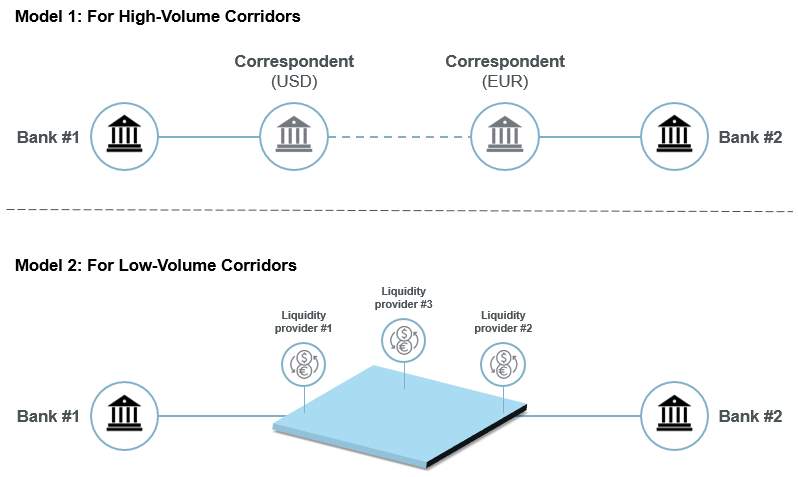

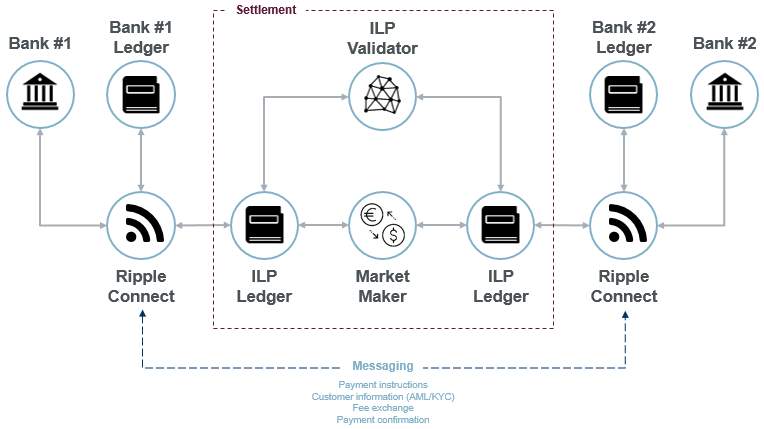

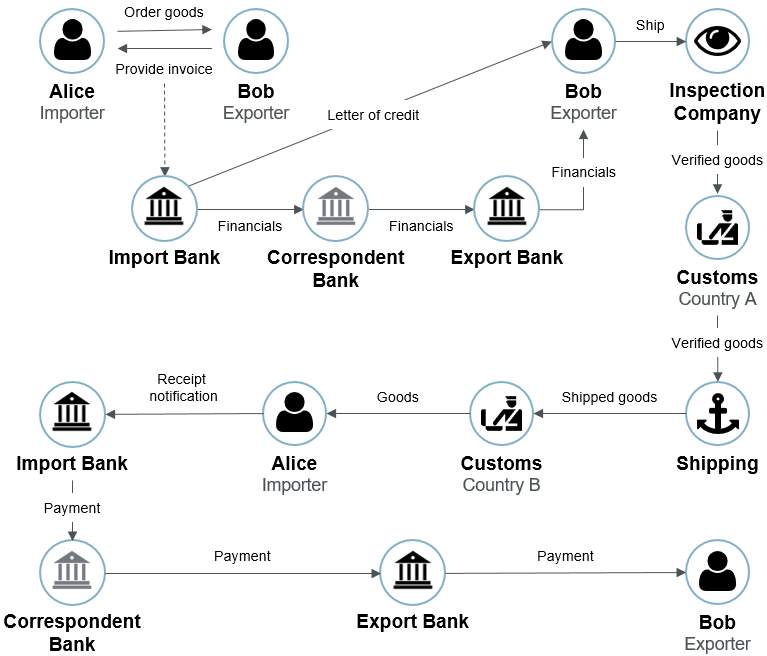

As is depicted in figure 9, a transfer of funds between two customers of different banks, Alice and Bob, is currently processed by the inclusion of a variety of parties other than the two commercial banks at which Alice and Bob hold their respective client accounts.

Alice, a customer of bank #1, would like to transfer US $10 into Bob’s bank account. But Bob lives in another country and does not own a bank account within the same bank that Alice does. To process such an interbank transaction, Alice’s and Bob’s banks may enter one of the following transaction relationships: the simplest relationship currently possible would be the transfer via a so-called Correspondent Banking Agreement (CBA) (Committee on Payments and Market Infrastructures, 2016, p. 9 f.; Brown, 2013). In the basic scenario, the two banks would be directly connected to each other via such an agreement, allowing for the flow of funds from one entity to the other. In a more complex scenario, the banks could be indirectly connected via CBAs with other banks, thus creating the need to direct the funds through a network of intermediary banks that are unrelated to the transaction.

It is easy to imagine that this system can, depending on the relationship of the two banks, in practice quickly become highly complex (Brown, 2013). In its essence, the SWIFT system is a vehicle enabling banks to engage exactly in such transactions. But it is a common misconception that the SWIFT network is a direct payment transferring vehicle (Brown, 2013). SWIFT in fact only allows banks that are members of its international network to exchange payment orders with each other, which are essentially messages indicating a payment to a specific account. Banks are then obliged to settle these payments through the respective correspondent accounts that they hold with each other (SWIFT, 2017a).

While, in theory, the above-described transaction process, involving banks holding accounts with each other, seems perfectly viable, there is a major liquidity issue inherent to it. If a bank would want to be able to transfer its customers’ funds to any other bank around the world at any given time via such CBAs, it would need to hold large sums of funds tied up in correspondent accounts (also known as nostro and vostro accounts) at all the respective correspondent banks (Summers, 1994, p. 22). Thus, a solution to this system might be for the two banks in our example to gather all the international money transfers that have been demanded by customers to another bank on a given day and to just settle the net balance with the other bank at the end of the day (Brown, 2013).