Quality of Corporate Governance in BHS and its Impact on Key Stakeholders

Info: 7628 words (31 pages) Dissertation

Published: 30th Nov 2021

Tagged: StakeholdersCorporate Governance

TABLE OF CONTENTS

Part 1 Project Objectives and Overall Research Approach

1.1 Reason for selecting topic

1.2 Reason for selecting company

1.3 Research Objectives

1.4 Overall research approach

Part 2 Information Gathering and Accounting/Business Techniques

2.1 Types of data sources

2.2 Sources of information

2.3 Limitations of information gathering

2.4 Ethical issues

2.5 Accounting and business techniques and limitations of model

2.6 Corporate governance

Part 3 Results, Analysis, Conclusion and Recommendation

3.1 Assess the quality of corporate governance in BHS

3.2 Assess the impact of corporate governance on key stakeholders of BHS

3.3 Pension fund deficit of BHS

3.4 Conclusion

3.5 Recommendation

PART 1 – Project objectives and overall research approach

Reason for selecting topic

I have chosen the topic of analysing the quality of a company’s corporate governance because, although compliance with the code of conduct is voluntary, I feel very strongly that corporate governance is an integral component in any public limited company at today’s day and age as it provides guidance on director conduct and gives reassurance to shareholders and other stakeholders that there are principles in place where the directors will act in the shareholders and stakeholders best interest rather than their own.

This may be achieved by imposing a sense of accountability towards all stakeholders or linking reward with performance to ensure that work is done to promote the company’s financial position.

Reason for selecting the Company

The reason for selecting BHS to analyse its quality of corporate governance is that on April 25th 2016 the BHS chain had entered administration due to its inability to make £60 million vital to protect its future succession. Hence a contributing factor of the downfall of BHS I very much consider is the negligence of upstanding corporate governance principles within the company.

Research Questions

The failure to meet recommended corporate governance standards I believe contributed to the downfall of the retail giant BHS. Each of the following issues will be further discussed in detail within Part 3 of this project:

- To assess to what extent BHS had been applying key elements of the UK Combined Code of Corporate Governance of 2014.

- To consider who the key stakeholders for BHS were and how they were affected by the level of corporate governance maintained by BHS.

- To investigate the issues relating to the failure of duties towards employee pension funds.

- The evaluation unsuitability of the sale of BHS by Sir Philip Green to Dominic Chappell.

- To analyse the valuation of Sir Philip Green’s payout to himself and his family members consisting of substantial dividends and payouts from BHS.

Research Objectives

- To assess the quality of corporate governance in BHS

- To identify BHS stakeholders

- To assess the impact of corporate governance policies on BHS.

PART 2 – Information gathering and accounting / business techniques

2.1 Types of Data Sources

Within this report I have used secondary data sources as this is easily accessible using the internet which helps provide information from a variety of sources, both governmental and social whereas primary data would have been more difficult to obtain considering the company went into administration over a year ago.

2.2 Sources of Information

Data sources used includes the Internet, BHS annual reports from Companies House, analysts’ reports, financial press and consumer journals.

2.3 Limitations of Information Gathering

Limitations faced during information gathering includes biased opinions of news articles which may have exaggerated the supposedly villainous image portrayed of Sir Philip such as ‘Philip Green’s yacht is christened the ‘BHS Destroyer’’ (Hunter, M. 2016) which implied that the £100 million worth of yacht that Sir Philip Green was spending time on during the administration of BHS was funded by the money he had allegedly removed from BHS for himself. Upon research counter arguments do arise such as ‘pension trustees and politicians have hailed Sir Philip Green’s decision to contribute £363 million to the BHS pension fund’ (Yeomans, J. 2017) so there was quite a lot of sorting between facts and opinions during the information gathering process.

An additional limitation of the information gathering process was that the information of a secondary nature was more difficult to obtain at times and quite subjective in nature for example when researching the gross and net profit margin for BHS in the years running up to its administration is took some time to locate the relevant documents from Companies House regarding the profits and turnover.

The subjective nature of the information gathered comes about as many news articles have not hesitated to paint Sir Philip Green the villain with headlines such as ‘Sir Philip Green: From ‘king of the High Street’ to ‘unacceptable face of capitalism’ (Crighton, B. and Barnes, H. 2016) which implicates the erroneous actions of Sir Philip Green to have caused the administration of BHS but many of these news articles do not portray additional factors contributing to the downfall of the company to give a balanced argument. Hence this was causative to the gathering of unbiased information and I had to do further research to gather all the full facts of the case which added to the time constraint on this project.

2.4 Ethical Issues

As secondary data has been used the primary ethical consideration is that there should be no plagiarism. As a result I have cited both in-text and provided a complete reference list at the end.

2.5 Accounting and Business Techniques

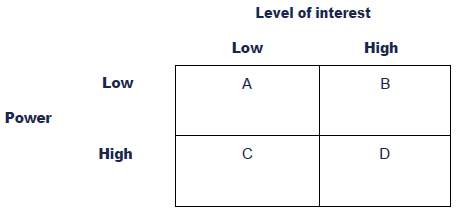

Within this project I have used Mendelow’s matrix (Mendelow, A. 1991) for stakeholder mapping and analysis, used to identify how do deal with stakeholders depending on how much power they hold over the company and how much interest they invest in the company.

A stakeholder is an individual that can be affected by the company, affect the company themselves or they may be capable of both.

Primary stakeholders are those who are directly affected by the decisions and actions taken by the company such as employees, suppliers and customers.

Secondary stakeholders are those who are indirectly affected by the decisions and actions taken by the company such as members of the public, unions, communities and the press.

Connected stakeholders are those who have a contractual relationship, written or verbal, with a company. Examples include suppliers, customers, financial providers and shareholders.

The above is a diagram (Kaplan Financial Knowledge Bank) of Mendelow’s matrix, of which each sector I will explain in turn.

‘A’ refer to those stakeholders who have low power in the company and hold little interest for it. These stakeholders require minimal effort from the company as they are the least important stakeholders for them to consider due to the stakeholders minimal impact.

‘B’ refers to those stakeholders with high interest and low power. The company should aim to keep those of this category informed of proposed decisions and actions relevant to these stakeholders, this would include people such as employees, community groups and environmental groups.

‘C’ refers to those stakeholders with high power and low interest. The company should aim to keep these stakeholders satisfied by meeting their needs, this would include stakeholders such as the government. This group of stakeholders have the potential to become key players in accordance with Mendelow’s matrix hence it would be wise for the company to ensure that their needs are satisifed.

‘D’ refers to those stakeholders with high power and high interest in the company, they can also be referred to as key players in the company and can be considered as the most important stakeholder group so they need to be closely managed with the company ensuring that their corporate strategy fits around the requirements of this group of stakeholders. This category would include stakeholders such as company customers and investor.

Limitations of Models

Mendelow’s matrix can be of limited use due to it only factoring the power and interest a stakeholder may have. In actual fact there are many more factors that can influence or be influenced by the stakeholders such as the level of responsibility the company has towards different influences such as social, legal and environmental responsibility which, amongst other factors have not been taken into account using this model. Additionally the company must consider how much of the stakeholders support they require and so treat them accordingly to ensure their continued support.

The level of power and interest placed upon a stakeholder may be subjective to the opinion of those carrying out the stakeholder analysis, for example the general public would generally be placed in the low level, low power sector of Mendelow’s matrix wand whilst individuals do not have much power as they are one source of turnover and little interest due to the abundance of high street stores available, if one looks at the impact a collective of individuals may have on BHS, such as a large population of a particular store of BHS, then one may be able to surmise that together they do hold the power to have the particular store closed down if custom does not lead to the required turnover to keep the store up and running. Therefore it may be deduced that the matrix may be slightly misleading in that it does not lend to all eventualities of factors affecting stakeholder rankings and does not fully reflect how each stakeholder should be dealt with by the company as it does not consider all relevant factors on what affects how a company treats its stakeholders.

2.6 Corporate Governance

Corporate governance refers to ‘exercise of power over and responsibility for corporate entities… recommended code of best practice based on fundamental principles of accountability, transparency and linkage of rewards to performance.’ (Wood, F. 2005). Thus the UK corporate governance code endows guidance to aid the application of the quoted definition of corporate governance within a company enabling them to act in the best interest of all relevant stakeholders. Corporate governance is a voluntary concept in most cases although it is a requirement to disclose compliance with corporate governance guidelines if a company is registered on the stock exchange, non-compliance must be explained to shareholders with an appropriate reason.

The combined code was published on the FRC website on June 2008 and has since been updated quite regularly, this reflects the dynamic nature of corporate governance and its adaptability to the continuously transforming social, legal and economic environment. This therefore emphasises the importance of following the principles of corporate governance as it will aid companies to cope with the continuously changing environment and continue providing for all stakeholders appropriately. This is done by the combined code outlining the responsibilities for board members, how their performance is measured and rewarded as well as setting out the prescribed relationship between the board and the company shareholders.

PART 3 – Results, Analysis, Conclusions and Recommendations

3.1 Assess the quality of corporate governance in BHS

One of the key factors of corporate governance is that of accountability. This refers to being accountable to the relevant stakeholders who would be affected or would affect the company. With regards to BHS this includes disclosure requirements by law within financial reporting of a company as well as accounting to those affected by BHS’s decisions and actions. Whilst the company seemed to have complied with law regulations on disclosures of expense within the financial statement it has not been clearly just how much of this has been pocketed by Sir Philip Green as he has used various methods to make personal gains using BHS including the use of sale-and-leaseback deals and the issue on bonds, all of which will be further discussed.

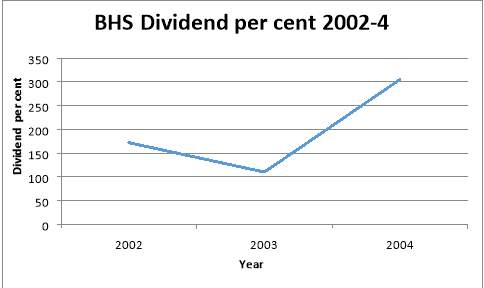

| YEAR | DIVIDENDS PER CENT |

| 2002 | 172 |

| 2003 | 110 |

| 2004 | 305 |

(BHS Company Accounts, 2016-17)

The above table and line graph illustrates the sharp increase in dividends per cent paid by BHS Ltd in the period 2002-4. BHS Ltd paid out £414 million in total dividends during this period despite the fact that its profit after tax rounded up to £208 million which is significantly less than the dividend payout which puts into question as to whether it was ideal to give out such a large dividends when so obviously BHS Ltd would not be able to support this type of behaviour long term seeing as the dividend paid out was just about double of the profit after tax received by BHS in this period. The £414 million dividends paid by BHS Ltd was essentially paid out by the parent company, the BHS group who themselves paid out dividends of £423 million during the 2002-4 period and this quantity includes the £414 million dividend payout for BHS Ltd. Of this £423 million paid out by BHS Group it is reported that Sir Philip Green and his family received £307 million (Taveta Investment Ltd comments oral evidence transcript 2016). The removal of this money from BHS to Sir Philip Green and his family lead to a lack in funds for BHS to reinvest in itself for growth and maintenance and also endangered the pension fund provided by BHS as the money in the scheme decreased as the dividends out increased.

As owner of BHS, Sir Philip Green had a fiduciary duty to act accountably towards those affected by his decisions and actions for the company, in particular his employees and those relying on the BHS pension scheme but due to him taking money out of the company to increase his personal wealth he failed to nurture BHS as a leading home department store and instead caused the redundancy of over 11,000 employees and put to risk the future of 20,000 individuals who partook in the BHS pension scheme. The sale to Dominic Chappell was further detrimental to this situation as he managed to further increase the deficit.

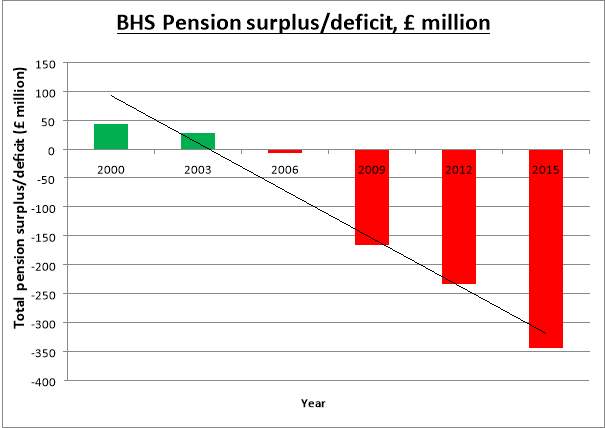

As shown by graph above which I have constructed (Parliamentary BHS pension fund minutes, 2016), when Sir Philip Green first acquired BHS in the year 2000 the BHS pension fund had been in a surplus of £43 million which did not remain the case as from then onwards there is shown a drastic decrease following the 2002-4 period as previously described detailing the systematic withdrawal of money from BHS as dividends. This continuous withdrawal from the pension fund was unsustainable as the fund was not being replenished after being reduced. The linear tread line constructed on the graph illustrates the dire reduction of funds from BHS of a negative relationship between the increasing years and decreasing funds and this correlates with the increase in dividends by BHS which will be further discussed below.

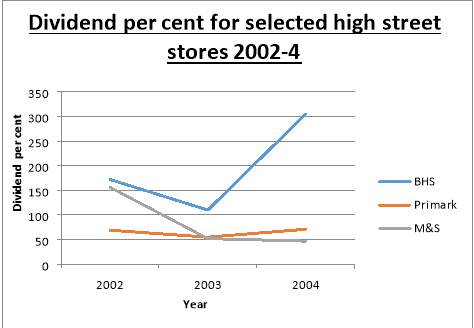

| Dividend per cent for selected high street stores 2002-4 | |||

| YEAR | BHS | Primark | M&S |

| 2002 | 172 | 69 | 156 |

| 2003 | 110 | 55 | 52 |

| 2004 | 305 | 71 | 47 |

(BHS Company Accounts, 2016-17)

As previously mentioned, BHS had significantly increased their dividend payout in 2002-4 of which most of this went towards Sir Philip Green and his family and in order to assess the suitability of the significant dividend increase I have created the above table to compare the dividend per cent between BHS to similar companies as a yardstick. Upon review of the graph I created using the information from the BHS company accounts it is obvious that whilst Primark and M&S had a decreasing or relatively constant dividend per cent value over the period 2002-4, BHS had a dividend per cent significantly higher yet and increasing also. The increase of the BHS dividends therefore seem highly irregular when compared to other companies in the same industry, for example Primark shows a percentage increase of 2.89% in dividend per cent from 2002 to 2004 and M&S shows a percentage decrease of 69.87%. The minimal increase for Primark and large decrease for M&S contrasts largely with the 77.33% increase in dividend per cent from 2002 to 2004, it possibly suggests that economic conditions at the time may not have been particularly favourable causing the companies in this industry to limit their dividend increase such as that done by Primark or to simply decrease it such as that done by M&S which then brings into question why BHS had been significantly increasing their dividend payouts.

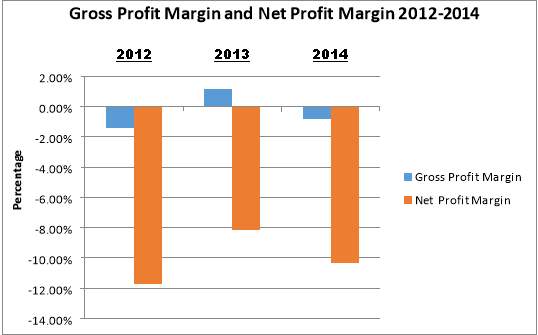

The suggested economic downturn is illustrated through the profits shown for BHS from 2012-2014 where they have been consistent in making a loss as shown by their statement of profit/loss on Companies House accounts. In the following table I have calculated the gross profit margin and net profit margin for BHS for the years 2012-2014.

| Year | 2012 | 2013 | 2014 |

| Sales £ | 699769000 | 675653000 | 668037000 |

| Cost of Sales £ | 709602000 | 667999000 | 673666000 |

| Gross Profit/Loss £ | -9833000 | 7654000 | -5629000 |

| Gross Profit Margin | -1.41% | 1.13% | -0.84% |

| Net Profit/Loss £ | -82118000 | -55290000 | -69080000 |

| Net Profit Margin | -11.74% | -8.18% | -10.34% |

(Companies House Annual report and FS: 2012, 2013, 2014)

As exemplified by the Gross Profit Margin and Net Profit Margin in 2012-2014 graph I have assembled using the Companies House Annual report and financial statements, BHS has been running into a loss with regards to their net profit margin in the years running up to its administration, namely 2012-2014. This further raises the question that if the company was performing so poorly surely it should have been decided by its directors and shareholders that there is a change required in the business model and process used by BHS as it does not seem to be successful in that climate and so for the sake of BHS’s going concern decisions and actions needed to be taken in order to ensure the company’s survival.

Additionally, the position of BHS was affected by the drop in their market share from 2.3% in 2000 down to 1.4% in 2016 (Fuller, C. 2016). The decreasing market share of BHS may have affected the corporate governance of the company due to its negative impact on the profitability of BHS as shown by the graph I constructed on the net profit margin of 2012-14 which portray an ongoing loss and so the owners of the company may have felt the need to take drastic action to recover the losses and ensure the continuity of BHS but this may have been done with little or no consideration for all stakeholders, mainly only the shareholders and directors were considered who wanted to ensure a lucrative return for themselves.

It can be suggested that increased competition or a decrease in market share can weaken the quality of corporate governance to a degree. Whilst these factors can help overcome the agency problem by promoting the shareholder and director relationship as they would work to improve the company’s financial position to avoid bankruptcy and losses of jobs although due to this fear of liquidation this may have led to a reduction in quality of corporate governance as the strategy adopted by the directors may not have considered the best interest of all the stakeholders but instead just those of the shareholders and directors.

This is clearly illustrated in the case of BHS as it can be seen that to increase their wealth, shareholders and directors of BHS colluded to maintain a high level of dividends, during a time when there was economic stress and also a question mark on the company’s going concern, by using money from the company’s pension fund scheme amongst other sources in order to maintain their wealth regardless of the consequences on other stakeholders which turned out to be disastrous as indicated by the administration of the company, a loss of 11,000 jobs and 20,000 being affected by the extreme pension fund deficit.

Despite the implied economic challenges, BHS shows to have vastly increased their dividend per cent from 2002 to 2004 when it might have suited them better to follow the footsteps of other similar companies in the industry for the sake of sustainability for BHS as retaining funds within the company rather than taking them out in the form of dividends may have supported the maintenance and growth of BHS.

Another key element of corporate governance is sustainability which refers to ensuring the continuity and growth of the business by making decisions and acting on them with the intention of keeping the business afloat and successful enough to survive in the economic conditions as a going concern. One of the main ways of ensuring sustainability is to avoid the depletion of the business and financial resources the organisation has in order to be able to continue providing for the organisation’s maintenance and growth. Unfortunately for BHS the actions of the shareholders and directors were almost parasitic in nature in that they benefited by deriving money at the expense of the BHS pension fund users as well as other sources such as issuing bonds from BHS funds. By continuously withdrawing money from the pension fund, this created an extremely large deficit of £571 million which in turn became a major factor in the downfall of BHS as such a large liability became a burden in that the £571 million deficit outweighed the assets owned by them hence this was detrimental to the going concern of BHS.

A further element of corporate governance is responsiveness which refers to serving the company in the best interests of stakeholders within a suitable timeframe so that they can make timely decisions and take actions accordingly relying on current information that is not out of date to aid them. In terms of BHS stakeholders such as shareholders they were not provided with information relevant to going concern of the company, namely they were ill informed of the deterioration of BHS hence the administration of BHS may have come as a surprise to them as many may have dropped their shareholding with the company had they previously known about the precarious situation BHS has been facing.

In addition to shareholders, users of the BHS pension fund also had their future jeopardised as BHS did not serve in the best interest of the members of the BHS pension scheme as shown by the £571 million deficit created in the pension fund in order to help maintain a lucrative dividend payouts for the shareholders, mainly the £400 million paid in dividends to Sir Philip Green (Karasin, E. 2016). This unsustainable course of action of the withdrawal from pension funds with no replenishment contributed to the eventual demise of BHS into bankruptcy leading to the loss of 11,000 jobs and the pension of 20,000 individuals endangered.

Within the BHS report released it is mentioned that the ‘pattern of transactions between Green family companies which brought into question their corporate governance and the role of their directors.’ (Parliamentary Taveta Corporate Governance, 2016). Corporate governance provides guidelines on how to balance the relationship between the company and its various stakeholders but this was disregarded by the Green family who carried out inter-company transactions for their own personal gain to receive profit and tax advantages. This is illustrated by the complexity of the ownership of BHS with the Taveta Group as its parent company of which Sir Philip Green’s wife is the definitive owner, this gives rise to a conflict of interest as it can give way to running the company for personal gain and this is what was unfortunately carried out by the Green family who made sale-and-leaseback deals between Carmen Properties which was primarily registered to Lady Green and BHS producing a sizeable profit between the transactions for the Green family. The inter-company dealings between Sir Philip Green’s BHS and Lady Green’s Tacomer Ltd was not limited to sale-and-leaseback deals as shown by the bonds issued by BHS for Tacomer Ltd worth £19.5 million with 8 per cent interest p.a. to Lady Green’s Tacomer Ltd, this realised a return of £9,475,000 for Lady Green again showing the personal gains the Green’s attained by their inter-company transactions which also included tax advantages. (BHS Company Accounts, 2016-17)

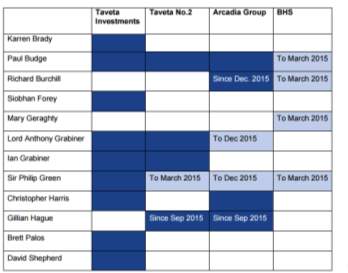

Within the guidance of corporate governance it is indicated that a company’s board composition should be set up in such a way that it does not give rise to conflict of interest, ensuring that the board always work and make decisions in the best interest of the company and consider all the stakeholders rather than themselves or family members.

(BHS Company Accounts, 2016-17)

The above table shows company directors of the business owned amongst the Green family and immediately one can see that there are major conflicts of interests as at least seven of these directors have interests in more than one company in the same group and this may have weakened the strength of the corporate governance as being director of more than one company in the same group may give rise to the opportunity of working for and making decisions for one’s own best interests resulting in personal gain rather than working in the best interest of the company and the stakeholders and so in a situation such as this it is imperative to have strong corporate governance so as to overcome the self-interest risks posed to the directors.

Chair: Is good corporate governance a priority for you in your business?

Sir Philip Green: Absolutely. (HC 55, 2016)

Above is an excerpt from oral evidence gathered at the House of Commons illustrating Sir Philip Green’s supposed commitment to the application of corporate governance within his business practices which includes BHS. One would assume that with a directorial layout such as this present there would be a high level of corporate governance present to overcome the conflict of interest issues and in addition to Sir Philip Green’s comment quoted above one would feel assured that strong corporate governance is being upheld but regrettably this was not the case as illustrated by the pension fund deficit of £571 million caused, the vast profit received by the Green family in the form of dividend, loan deals and inter-company transactions and the eventual diminishing of BHS. The Green family did not act in good faith of their respective companies as is shown by the unsustainable withdrawal of money from the BHS pension fund scheme, they did not consider the possible long term consequences of their actions which proved to be the administration of BHS along with the redundancy of 11,000 jobs and jeopardising 20,000 pensions and furthermore they did not strive to maintain a respectable standard of professional behaviour whilst carrying out their business as shown by Sir Philip Green having bought BHS for £200 million then went on to sell it for £1 which reflects the impact his actions have had on BHS.

Linking back to the corporate governance definition quoted within Part 2 of this project, in terms of accountability there has been a clear lack of responsibility shown on Sir Philip Green’s part and that of Dominic Chappell as Sir Philip Green, having bought BHS for £200 million in the year 2000 (Martin, B. 2016) ended up selling it for £1 to Dominic Chappell who purchased it via his consortium, Retail Acquisitions of which he was the 90% owner of, upon further consideration of an additional cash injection. Instead of going further with the assurance he had given to inject new capital into BHS, Chappell ended up extracting £1,789,250 in the first three months of acquisition which contributed to the total of £2,627,643 removed from BHS by Chappell during his 13 month control over the company before its administration.

These actions taken by Dominic Chappell depict a severe lack of commitment towards the principles of corporate governance as he took no regard to his accountability towards BHS and its stakeholders as well as not upholding the principle of linking rewards with performance as shown by the removal of over £1 million within his first three months of ownership when in fact BHS would have highly benefited from the cash injection to keep it afloat and help it survive. Hence had the principles of corporate governance been upheld in this instance then maybe BHS may have had a chance to continue as a going concern rather than have to enter administration.

3.2 Assess the impact on key stakeholders of BHS

Firstly I will identify the key stakeholders of BHS, classify them as primary, secondary or connected then apply Mendelow’s matrix to analyse whether BHS treated those particular stakeholders appropriately and sufficiently.

One of the major stakeholders for BHS were the shareholders, those who own a stake within BHS. They are primary, connected stakeholders who identify as ‘key players’ in Mendelow’s matrix. They have significant influence and have the power to drive forward or stop company plans depending on how their attitude towards it is. As key players BHS should have been looking after the shareholders’ best interests, mainly ensuring satisfactory dividend payouts and surety for the continuity of BHS. Whilst the company did maintain high levels of dividend, this unsustainable plan of action of taking increasingly large amounts of money from the company especially during times of economic downturn such as the great recession during 2008 to 2013 when it would have been wise to retain company wealth to ensure the survival and growth of the company did in fact contribute to the downfall of BHS as by the time its administration came around it was due to the company not being able to uphold itself with its funds. The failure of the company had a major impact on the shareholders of BHS as they lost their shares within BHS hence losing the worth of the shares and the future dividends they were expecting to receive had the company not gone bust.

Another group of important stakeholders for the BHS were the employees of the company, those who work for BHS. They are primary, connected stakeholders of BHS who identify under the ‘keep informed’ category of Mendelow’s Matrix where they have a high interest in the company as they need the continuity and stability of the company to ensure job safety, although as individuals they do not have much power to change the system themselves. In accordance with Herzberg’s motivation theory, job security comes under hygiene factors meaning that its presence will prevent dissatisfaction but this doesn’t particularly mean it is a motivation driver for the employee, thus job security is a minimum requirement before the employee could go on looking for motivation within the job. BHS should have ideally taken action to keep the company afloat to survive, enabling the employees to have a sense of job security, but failing this the company should have at least kept the employees informed of the detrimental health of the company so that the administration and liquidation of the company leading to their redundancy should not have come as a total surprise to them. The failure of BHS led to a redundancy of around 11,000 jobs and the closure of 164 BHS stores in the UK which caused a national outcry as this failure was caused by negligence in investing and maintaining the company hence threatening the sustainability and survival of the company.

An additional group of stakeholders affected by the actions of BHS includes the users of the BHS pension scheme who also classify as primary stakeholders and identify under the ‘keep informed’ category regarding Mendelow’s Matrix as they didn’t have much power in being able to influence the company’s decisions and actions but do hold quite an interest as they rely on the survival and growth of BHS to support its pension fund to be able to provide to those who have enrolled in it and therefore depend on its presence. The consistent withdrawal of money from the BHS pension fund by Sir Philip Green contributed to the failure of the company due to little funds left to maintain and grow BHS and also resulted in the jeopardising of 20,000 individuals who were part of the BHS pension scheme. The BHS pension scheme holders should have ideally been informed of the detrimental health of the company and the possibility that their pension may be placed in danger due to lack of funds, this way they would not have been taken by surprise and there would not have been that much of a national outcry towards the supposed injustice done towards them.

The general public are another group of stakeholders affected by the administration of BHS. They classify as secondary stakeholders under the ‘minimal effort’ category of Mendelow’s Matrix as they have little power to influence the strategic decisions of BHS and have little interest in the choices faced and decisions taken by the company as BHS is one of many high street retailers of the same industry available to the public to choose and shop from hence they would not have an exclusive interest for BHS. The impact of the closure of BHS on the general public is not only that they have lost a major high street retailer to shop from, but furthermore it was quite a big hit to public morale in terms if the instability of the current economic climate being unable to support the retail giant BHS from liquidation then this may reflect what can happen to any high street business hence causing insecurity amongst many individuals regarding their businesses.

3.3 Pension Fund Deficit

The £571 million pension deficit that was measured during a buyout evaluation of BHS (Butler, S. 2016) was created by continuous withdrawal of the funds as per the decision of the shareholders to increase dividends by diverting money from the BHS pension fund to dividends in order to line the pockets of the shareholders. Thus, upon consideration, due to the selfish and greedy actions of said shareholders they neglected to treat the company in a sustainable manner and instead withdrew company funds without reimbursing it and without consideration of the effect these actions would have upon those people who depend on these funds for their pension. Money via dividends was taken out of BHS year after year whilst under the ownership of Sir Philip Green for the shareholders own benefit regardless of the effect it may have. As it turns out the effects were disastrous as the extremely large pension deficit was a major contributing factor in the administration and liquidation of BHS which then further put into jeopardy the stability and safety on the BHS pension scheme users. Additional effects of the creation of the pension fund deficit includes the closure of the pension fund to new members in 2005 and stopping new accruals for the members already present in 2009. (Dakers, M. 2016) This would have been detrimental for those who wanted to join the pension scheme for their future security as well as those who were already affiliated with it as their future pension was put at risk by the stoppage of new accruals.

Following extensive media coverage, the failure of BHS and the further negative press received by Sir Philip Green regarding his knighthood, the correct ethical and moral behaviour that was failed to be observed and acted on as well as the high-profile inquiry triggered by Parliament, Sir Philip Green then agreed to pay up to £363 million back into the BHS pension fund scheme in an attempt to make a deal with the pension regulators as explained by The Telegraph as Sir Philip Green putting in £363 million into the BHS pension fund ‘after threats to strip his knighthood’ (The Telegraph, Yeomans J, Feb 2017) Despite having received over £580 million from the company in the form of ‘dividends, rental payments and interest on loans to help fund a lavish lifestyle’ (Butler, S. 2016) the Green family paid the sum of £363 million as a settlement with the pension regulators as this led to a halt in the enforcement action antagonistic towards the image and lifestyle of Sir Philip Green and his family.

3.4 Conclusion

Sound corporate governance is required to ensure that the company is run by balancing the needs and requirements of the many stakeholders involved, this is done by considering all stakeholders involved thus addressing and reflecting this with company decisions, actions and policies. The attainment of good corporate governance can be a difficult goal due to the requirement of well-meaning people to bring about their knowledge, expertise and experience to contribute to company decisions, actions and policy making, the problem being that not all people would possess the good intention required to achieve this.

Throughout the research I have carried out for this project I have come across a number of factors which have led me to believe that there has been a complete lack of application of the concept of corporate governance with regards to BHS such as the exercise of power for the gain of shareholders and directors as shown by over £400 million extracted by Sir Philip Green and over £2 million removed by Dominic Chappell from BHS for personal gain, little accountability shown towards stakeholders of BHS as portrayed by the removal of £571 million from the BHS pension fund scheme for shareholder personal gain hence jeopardising the pension of 20,000 as well as laying 11,000 jobs on the line which were then lost due to these selfish actions robbing BHS of its going concern status. Moreover, there has been a total disregard for the linkage of rewards to performance as despite BHS having run a loss for its net profit margin in the years running up to its administration, there was still a continuation of money withdrawn from the company to provide lucrative dividends to shareholders and rewards to directors when in fact action was required to turn the company around away from its negative profit margins, but due to the selfish actions taken this led to the downfall of BHS along with 11,000 jobs.

The weak corporate governance structure that was present in BHS gave way to damaging and devastating effects on the stakeholders of BHS. Due to lack of due diligence towards the stakeholders, the decisions and actions taken by the directors of the company proved to be so damaging so as to result in major job loss for BHS employees, a threat over the pension of 20,000 individuals and a high street retailer off the streets which disturbed or distressed the employees of BHS and possibly some members of the public. Furthermore, the impact of the frail corporate governance of BHS caused a national outcry for many reasons including the high job loss, the pension scheme put in risk and the fact that the BHS pension fund which was in surplus when purchased by Sir Philip Green in 2000 fast turned into a deficit, coinciding with the high level of dividends given out to the Green family.

The result of the frail corporate governance was that it was a contributor to the administration of BHS in that if the best interests of all stakeholders were taken into account then possibly money would not have been withdrawn from the BHS pension scheme and it would not have run the company out of funds for growth and reinvestment which it so desperately needed to keep up with the times and compete with other high street retailers such as Primark and M&S.

3.5 Recommendations

In order to have avoided this devastating consequence of the administration of a major high street retailer the principles of corporate governance should have been adhered to, namely the company should have run balancing the interest of its range of stakeholders with the directors acting with due diligence along with skills and professionalism.

To achieve this it may be recommended that the application of sound corporate governance become compulsory rather than remain voluntary so that each and every company will have to regard all stakeholders and act in the stakeholders best interest rather than their own, with tighter corporate governance directors will have less of an opportunity to take advantage of a self-interest risk as they are to be working in the best interest of the company and its stakeholder.

Additionally, continual development training should be instituted to include elements of corporate governance such as accountability, transparency and sustainability to maintain the company as a going concern to avoid it getting into the state of administration. By implementing this into training it would become the norm to follow the corporate governance guidelines and principles rather than opt out of participating in this voluntary concept.

Furthermore, by strictly linking reward to performance such as not allowing the directors’ bonus to go through until the company has done its duties to other stakeholders such as it needs to be sure that company dividends are paid out first if the company is running at a profit before directors can reward themselves.

These changes can be made by reforming company law and possibly the government could adopt a scheme whereby they could reward high quality corporate governance with a highly ethical status or possibly grants of some sort as this would also motivate company directors to work within the guidelines of corporate governance and thus work in the best interest of others too.

As extra security for those who use company pension schemes it would greatly appeal to them if they were offered a secure pension fund from the government rather than their employer so that if the employer hits bankruptcy the employees will not have their pensions jeopardised which was the case with BHS where 20,000 pension scheme users had their pensions endangered due to the incredible pension fund deficit created.

In the case of BHS they should have been keeping up with the times to compete with the newer high street stores such as Primark but instead they kept the same departmental layout with little updates and so BHS was not moving fast enough when compared to other high street stores and so it would not have been able to survive in the fast changing climate that has been as of late. To prevent itself from becoming out of date they could have ensured participation which is another element of corporate governance, by making sure that the organisation is well informed and organised by joint participation of a range of stakeholders such as directors and employees BHS would have been able to respond to the environmental changes more effectively giving it a fighting chance to remain a going concern by possibly bringing in profit unlike the loss making that in fact did occur 2012-14 in net profit margin.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Corporate Governance"

Corporate Governance is a term used to describe the way in which a corporation is governed and how operations are controlled. Corporate Governance covers the processes and procedures that employees must follow during business operations.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: